Alliant Energy Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alliant Energy Bundle

Alliant Energy operates within a complex utility sector, facing significant pressure from established competitors and the ever-present threat of new entrants. Understanding the bargaining power of both their suppliers and customers is crucial for strategic planning.

The complete report reveals the real forces shaping Alliant Energy’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

For regulated utilities like Alliant Energy, a concentrated supplier base for essential resources such as natural gas, coal, and renewable energy components can significantly amplify supplier bargaining power. If there are few providers for specialized technologies or fuel sources, these suppliers can dictate terms, impacting Alliant's operational costs. For instance, in 2024, the global supply chain for critical minerals used in battery storage, like lithium and cobalt, experienced price volatility due to geopolitical factors and concentrated mining operations, directly affecting the cost of renewable energy infrastructure.

Switching costs represent a significant factor in the bargaining power of suppliers for Alliant Energy. The expense and complexity associated with changing fuel sources or technology providers, encompassing infrastructure upgrades, regulatory hurdles, and staff re-training, can effectively lock the company into existing supplier relationships. This makes it harder for Alliant Energy to negotiate favorable terms.

For instance, transitioning to new generation technologies often requires substantial capital investment and lengthy approval processes. However, Alliant Energy's strategic push towards a diversified energy portfolio, heavily featuring renewable sources like solar and wind, is designed to mitigate this supplier power over the long term by reducing dependence on any single fuel source or technology vendor.

The cost of essential inputs, such as natural gas and materials for upgrading its electricity grid, significantly influences Alliant Energy's operational expenses and the rates it can charge its customers. For instance, in 2023, Alliant Energy reported that fuel and purchased power costs were a substantial portion of its operating expenses.

Any volatility in these commodity prices or disruptions in the supply chain can directly affect the company's profitability. However, Alliant Energy's capacity to pass these increased costs onto consumers through regulated rate adjustments, as demonstrated by approved rate increases in Iowa and Wisconsin during 2023 and early 2024, helps to buffer the impact of supplier power.

Supplier's Ability to Forward Integrate

The threat of suppliers forward integrating, meaning they start offering utility services themselves, is a potential concern. For instance, a company supplying advanced energy storage technology could theoretically begin providing grid management services. This would directly compete with Alliant Energy and significantly boost the supplier's leverage.

However, the utility sector, particularly in Iowa and Wisconsin where Alliant Energy operates, is heavily regulated. These regulations create substantial barriers to entry for new service providers, making it difficult for suppliers to successfully integrate forward. Alliant Energy's existing infrastructure and long-standing relationships with regulatory bodies offer a robust defense against this specific threat.

In 2023, Alliant Energy invested $3.5 billion in capital expenditures, with a significant portion directed towards grid modernization and renewable energy projects. This substantial investment in their own infrastructure and capabilities further solidifies their position and makes it harder for potential suppliers to disrupt their operations through forward integration.

The bargaining power of suppliers is generally moderate. While certain specialized components or services might be concentrated among a few providers, Alliant Energy's scale and diversified supplier base mitigate extreme dependence. The high capital intensity and regulatory hurdles inherent in the utility industry also limit the likelihood of suppliers successfully entering the market by offering integrated services.

Uniqueness of Supplier Products/Services

Suppliers providing highly specialized or proprietary technologies for renewable energy generation, grid modernization, or energy storage can exert greater bargaining power. Alliant Energy's strategic focus on these advanced areas necessitates a growing dependence on such unique inputs.

The company's ongoing partnerships and substantial long-term investment commitments in renewable energy projects underscore a continuous demand for these distinctive products and services. For instance, in 2024, Alliant Energy announced plans to invest significantly in solar and wind power expansion, requiring specialized equipment and expertise.

- Renewable Energy Technologies: Suppliers of advanced solar panel manufacturing or wind turbine components with unique efficiency enhancements hold leverage.

- Grid Modernization Solutions: Providers of proprietary smart grid software or advanced energy management systems are crucial.

- Energy Storage Innovations: Companies with patented battery technologies or unique grid-scale storage solutions possess considerable influence.

Suppliers of specialized renewable energy components and grid modernization technologies hold significant bargaining power over Alliant Energy. This is due to the concentrated nature of these advanced markets and the high switching costs associated with integrating new technologies. For example, in 2024, the demand for advanced battery storage systems, critical for grid stability, outstripped supply for certain high-performance components, allowing suppliers to command higher prices.

Alliant Energy's strategic investments in renewable energy projects, such as its 2024 plans for significant solar and wind expansion, create a sustained demand for specialized equipment and expertise. This reliance on niche suppliers for cutting-edge solutions amplifies their leverage in negotiations, impacting project costs and timelines.

The bargaining power of suppliers for Alliant Energy is generally moderate, influenced by the company's scale and regulatory environment. However, for critical inputs like natural gas and specialized renewable energy components, supplier power can be higher due to market concentration and the difficulty of finding alternative sources. Alliant's ability to pass on fuel cost increases through regulated rates, as seen in 2023 and early 2024 rate adjustments in Iowa and Wisconsin, partially offsets this supplier leverage.

| Supplier Category | Key Factors Influencing Bargaining Power | Impact on Alliant Energy |

|---|---|---|

| Natural Gas & Coal | Market price volatility, availability of extraction sites, transportation infrastructure. | Directly impacts operating expenses; regulated rates allow cost pass-through. |

| Renewable Energy Components (Solar, Wind) | Concentration of manufacturers, proprietary technology, supply chain disruptions. | Higher costs for new projects; strategic diversification aims to reduce dependence. |

| Grid Modernization & Energy Storage | Intellectual property, specialized manufacturing capabilities, integration complexity. | Can lead to higher capital expenditures for infrastructure upgrades. |

| Maintenance & Specialized Services | Availability of skilled labor, unique technical expertise. | Can influence operational efficiency and repair costs. |

What is included in the product

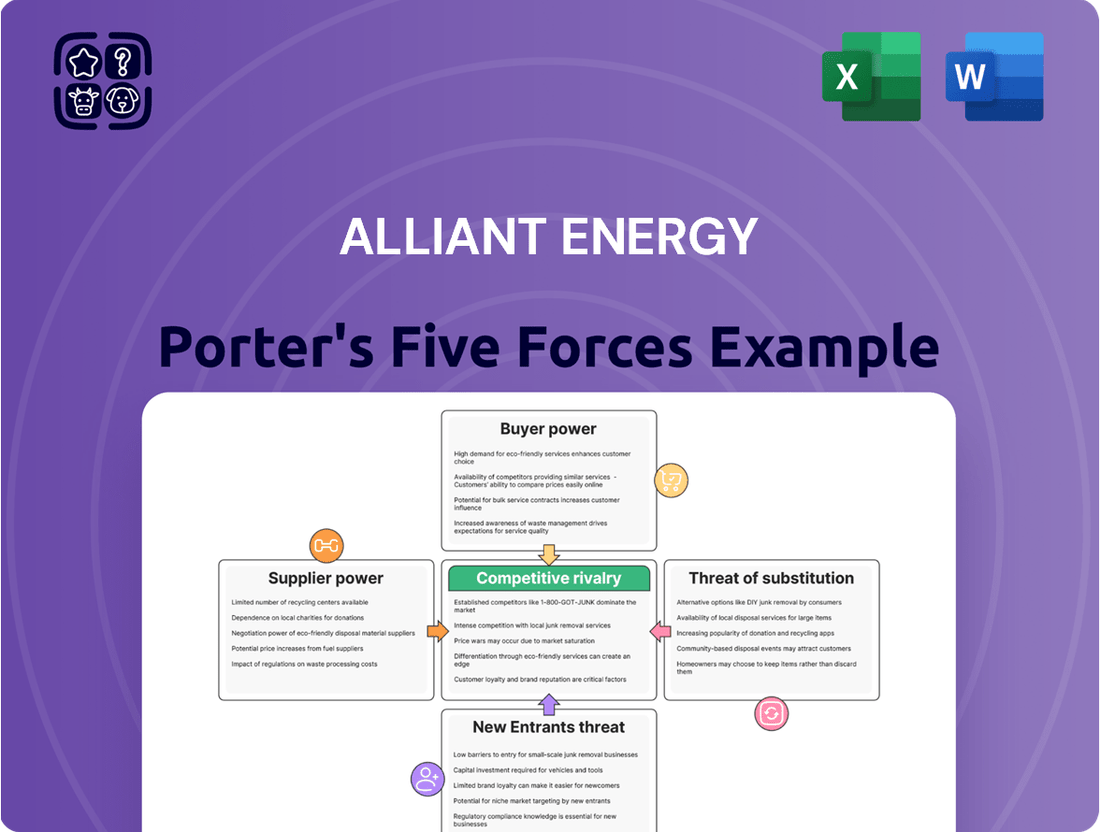

Uncovers the competitive landscape for Alliant Energy by analyzing the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the utility sector.

Instantly visualize Alliant Energy's competitive landscape with a dynamic, interactive dashboard that highlights key pressures and opportunities.

Customers Bargaining Power

Alliant Energy operates in regulated markets in Iowa and Wisconsin, which significantly limits customer bargaining power. Residential and small business customers generally have no alternative providers for their electricity and natural gas, preventing them from switching to gain better terms.

State Public Utility Commissions, such as the Iowa Utilities Board and the Public Service Commission of Wisconsin, play a crucial role. They set rates and service standards, effectively acting as the primary arbiter of customer interests in these regulated environments, rather than individual customer actions.

While individual customers typically wield little direct power over utility pricing, their collective price sensitivity is a significant factor managed through regulatory oversight. For instance, Alliant Energy's proposed rate adjustments in Iowa and Wisconsin for 2024 and 2025 underwent scrutiny by regulatory bodies, highlighting the importance of customer affordability in these approval processes.

Large industrial and commercial clients, particularly those with substantial energy demands like data centers, can wield considerable bargaining power. This is often due to their sheer volume of consumption and the potential for them to either generate their own power or negotiate more favorable pricing structures. For instance, in 2023, Alliant Energy reported serving a growing number of large commercial and industrial customers, highlighting the importance of these relationships.

Availability of Substitutes for Customers

The availability of substitutes for customers significantly influences their bargaining power. While direct utility competitors are scarce, customers can exert pressure if viable alternatives exist, such as rooftop solar installations for electricity or different heating systems replacing natural gas.

However, for most residential and commercial customers within Alliant Energy's service areas in Iowa and Wisconsin, the expense and practicality of these substitutes remain substantial barriers. This high cost and limited feasibility cap the widespread adoption of alternatives, thereby constraining the bargaining power customers can wield through substitute options. For instance, while solar adoption is growing, it still represents a small fraction of the overall energy consumption for the majority of Alliant's customer base.

- Limited Direct Competition: Traditional utility providers like Alliant Energy face few direct competitors for their core services.

- Emerging Substitutes: Rooftop solar and alternative heating sources offer potential alternatives, empowering some customers.

- Cost and Feasibility Barriers: The high initial investment and ongoing maintenance for substitutes limit their widespread adoption by most customers.

- Constrained Bargaining Power: Due to the practical and financial hurdles of alternatives, customers' bargaining power through substitution remains relatively low for the majority.

Customer Information and Transparency

Increased transparency, driven by regulatory filings and public forums, empowers customers to scrutinize and contest proposed rate hikes or service standards. Alliant Energy's commitment to transparency is evident in its readily available annual reports and SEC filings, which detail financial health and operational strategies, fostering a more informed customer base.

This enhanced visibility allows customer advocacy groups to effectively challenge utility pricing and performance. For instance, in 2023, Alliant Energy reported revenues of $4.7 billion, with a significant portion subject to regulatory oversight, making customer input crucial in rate-setting processes.

- Regulatory Filings: Publicly accessible documents detailing operational costs and investment plans.

- Public Hearings: Forums where customers can directly voice concerns about proposed rate changes.

- Annual Reports & SEC Filings: Provide financial performance data and strategic outlooks.

- Customer Advocacy: Organized groups leverage information to negotiate better terms and service.

Alliant Energy's customer bargaining power is generally low due to the regulated nature of its service territories in Iowa and Wisconsin. Most residential and small business customers have no alternative providers, meaning they cannot switch to negotiate better terms. State Public Utility Commissions, like the Iowa Utilities Board and the Public Service Commission of Wisconsin, set rates and standards, acting as the primary voice for customer interests rather than individual customer actions.

While individual customers have limited direct power, their collective price sensitivity is a key consideration in regulatory approvals. For example, Alliant Energy's proposed rate adjustments for 2024 and 2025 in these states faced regulatory scrutiny, emphasizing customer affordability. Large industrial clients, however, can exert more influence due to their high energy consumption and potential for self-generation or alternative supply contracts, a factor Alliant Energy actively manages given its growing base of such customers.

| Factor | Impact on Alliant Energy | Evidence/Data |

|---|---|---|

| Limited Direct Competition | Lowers customer bargaining power | Core services in regulated markets |

| Emerging Substitutes (e.g., Solar) | Slightly increases bargaining power for some | Small but growing adoption rates, still high cost for most |

| Regulatory Oversight | Mitigates customer bargaining power through rate setting | Rate adjustment approvals by Iowa Utilities Board and WI PSC |

| Large Industrial Customers | Higher bargaining power due to volume | Alliant Energy serves a growing number of these clients |

| Price Sensitivity | Influences regulatory decisions | Scrutiny of 2024-2025 rate proposals |

Full Version Awaits

Alliant Energy Porter's Five Forces Analysis

This preview showcases the complete Alliant Energy Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the industry. You're looking at the actual document; once your purchase is complete, you'll receive instant access to this exact, professionally formatted file. This comprehensive analysis is ready for immediate use, providing valuable strategic insights without any placeholders or surprises.

Rivalry Among Competitors

Alliant Energy enjoys a regulated monopoly in its Iowa and Wisconsin service territories, meaning direct competition from other utilities entering these specific geographic areas is virtually nonexistent. This structure significantly dampens traditional competitive rivalry, as customers have no alternative providers for their essential electric and natural gas needs within these defined regions.

Instead of battling rivals, Alliant Energy's focus within these monopolies is on operational efficiency and demonstrating prudent investment to its regulators. For instance, in 2023, Alliant Energy reported approximately $7.1 billion in operating revenue, a figure influenced by regulatory approvals of its capital expenditures and operational costs, rather than market share battles.

While direct competition within the traditional utility sector might be limited for Alliant Energy, the landscape is significantly shaped by indirect rivals. These are the alternative energy solutions and technologies that customers can increasingly choose to adopt. Think about rooftop solar panels or advanced energy efficiency programs; these directly reduce a customer's reliance on traditional utility-provided electricity.

Alliant Energy is actively addressing this by investing in renewable energy sources and modernizing its grid infrastructure. For instance, in 2023, Alliant Energy continued its significant investments in clean energy, aiming to retire coal-fired generation and increase its renewable energy portfolio. This strategy is designed to not only meet regulatory requirements but also to integrate these emerging alternatives, ensuring Alliant remains a central and competitive player in the evolving energy supply chain.

Competitive rivalry in regulated utilities like Alliant Energy is largely shaped by the regulatory environment, particularly through rate cases. These proceedings involve intensive scrutiny of proposed rates and investment plans by regulatory bodies and stakeholders.

Alliant Energy's track record, including securing favorable outcomes in recent Iowa and Wisconsin rate cases, highlights its effectiveness in navigating these complex regulatory processes. For example, in 2023, Alliant Energy received approval for a $120 million electric rate increase in Wisconsin, demonstrating its ability to achieve its requested returns.

Competition for Load Growth and Economic Development

Alliant Energy faces significant rivalry from other regions and utilities vying for new businesses that drive energy demand. This competition is crucial for load growth and overall economic development. For instance, Alliant Energy has been actively pursuing agreements for data center developments in Iowa and Wisconsin, directly competing for these energy-intensive industries.

- Competition for Load Growth: Utilities like Alliant Energy compete to attract businesses that increase electricity consumption, a key metric for growth.

- Economic Development Focus: Securing new industrial customers is a primary strategy, directly impacting revenue and operational scale.

- Data Center Investments: Alliant Energy's efforts to attract data centers, such as those in Iowa, illustrate a direct competition for high-demand users.

- Regional Utility Rivalry: The company competes with other utilities in neighboring states for the same industrial investment dollars.

Industry Consolidation and M&A Activity

The utility sector, while not directly characterized by Alliant Energy's holding company structure, sees significant merger and acquisition (M&A) activity. This consolidation reshapes the competitive environment across the nation.

Large power generation companies, especially those with substantial natural gas capacity, are actively engaging in mergers and acquisitions. This trend highlights a sector where companies are strategically pursuing growth and aiming to strengthen their market standing. For instance, in 2024, the energy sector continued to witness substantial M&A deals, with several utility companies involved in significant transactions aimed at portfolio optimization and scale.

- Increased Consolidation: The utility industry is experiencing a wave of M&A, leading to fewer, larger players.

- Natural Gas Focus: Acquisitions of natural gas assets are particularly prevalent as companies adapt to energy market shifts.

- Competitive Landscape Shift: These deals can alter market share and introduce new competitive dynamics for companies like Alliant Energy.

- 2024 M&A Trends: Significant transactions in 2024 indicate a strong drive towards consolidation and strategic asset acquisition within the power generation space.

Direct competitive rivalry for Alliant Energy within its core Iowa and Wisconsin service territories is minimal due to its regulated monopoly status. Instead, competition manifests indirectly through alternative energy solutions like rooftop solar, and more directly through the pursuit of new, energy-intensive business customers, such as data centers, where it competes with other regional utilities for load growth.

The broader utility sector is also experiencing significant consolidation through mergers and acquisitions, particularly involving natural gas assets, which reshapes the competitive landscape nationwide. Alliant Energy's ability to secure favorable rate case outcomes, like the 2023 Wisconsin electric rate increase of $120 million, demonstrates its effectiveness in navigating regulatory processes rather than direct market competition.

| Competitive Factor | Description | Alliant Energy's Position/Actions |

|---|---|---|

| Regulated Monopoly | Limited direct competition within service territories. | Focus on operational efficiency and regulatory compliance. |

| Indirect Competition | Alternative energy sources (e.g., solar). | Investing in renewables and grid modernization. |

| Competition for Load Growth | Attracting energy-intensive businesses. | Actively pursuing data center development in Iowa and Wisconsin. |

| Industry Consolidation | M&A activity among utilities. | Adapting to a landscape with fewer, larger players. |

SSubstitutes Threaten

The rise of distributed generation, especially rooftop solar, presents a significant threat to Alliant Energy. As more customers install solar panels, they become less dependent on the traditional utility grid for their electricity needs. This trend directly impacts Alliant Energy's customer base and revenue streams.

In 2023, the U.S. saw a record 6.7 gigawatts of new solar capacity installed, with residential solar leading the charge. This growing adoption means fewer customers may purchase electricity directly from utilities like Alliant Energy, impacting their sales volumes.

Alliant Energy is proactively addressing this threat by investing in its own renewable energy projects, including large-scale solar farms. For instance, in 2024, they are continuing to develop projects like the approximately 200-megawatt solar facility in Wisconsin, aiming to offer competitive renewable energy options and retain customers by integrating these resources into their service offerings.

Improvements in energy efficiency across appliances, buildings, and industrial processes are a significant threat, as they directly reduce the overall demand for electricity and natural gas. For instance, by 2024, advancements in smart home technology and LED lighting have made significant inroads into lowering household energy consumption. This trend can diminish the need for Alliant Energy's core services.

Alliant Energy actively addresses this threat by offering various energy conservation programs and providing customers with information to manage their energy usage more effectively. These initiatives aim to strike a balance between helping customers save energy, which aligns with broader societal goals, and ensuring the company's continued revenue streams and operational stability.

For natural gas services, potential substitutes include electric heating, such as heat pumps, as well as propane and geothermal systems. These alternatives, while often carrying higher initial investment, can offer long-term operational cost savings or appeal to customers prioritizing environmental sustainability, potentially driving adoption away from natural gas.

In 2023, residential electricity prices averaged around $0.16 per kilowatt-hour nationally, while natural gas prices fluctuated but remained competitive for many. However, the increasing efficiency and declining costs of heat pump technology, with many models now achieving high Seasonal Energy Efficiency Ratios (SEER) and Heating Seasonal Performance Factors (HSPF), present a growing threat.

Alliant Energy's strategic advantage lies in its diversified energy portfolio, which includes both electric and natural gas utility services. This diversification allows the company to mitigate the risk of a significant customer shift towards alternative heating and cooling sources in one segment by potentially capturing that demand in another, thereby maintaining overall customer engagement and revenue streams.

Battery Storage Technologies

The increasing sophistication and affordability of battery storage technologies present a significant threat to traditional utility models like Alliant Energy. Customers can now store electricity generated from various sources, including their own solar panels, and deploy it during peak demand periods or power outages. This capability directly reduces their dependence on the utility for electricity supply.

Alliant Energy is actively engaging with this evolving landscape by investing in its own battery storage projects. These initiatives are twofold: they aim to mitigate the threat by offering storage solutions as part of their service, and they also represent an opportunity to enhance grid stability and reliability. For instance, in 2023, Alliant Energy announced plans for several battery storage projects, including a 100-megawatt facility in Wisconsin, signaling a proactive approach to integrating this substitute technology.

- Growing Adoption: Residential and commercial battery storage systems are becoming more accessible, with market growth projected to continue.

- Reduced Grid Reliance: Customers can increasingly meet their own energy needs using stored power, diminishing the volume of electricity purchased from utilities.

- Grid Services Potential: Battery storage can offer ancillary services to the grid, such as frequency regulation, creating a dual role as both a substitute and a grid asset.

- Alliant's Investment: Alliant Energy is strategically investing in battery storage, recognizing its dual nature as a competitive threat and a valuable grid enhancement tool.

Fuel Switching (Industrial/Commercial)

Large industrial and commercial clients, especially those with significant energy needs, can shift between different fuel sources like natural gas and electricity. This capability introduces a substitution threat, particularly in markets where energy prices fluctuate. For instance, a manufacturing plant might adjust its operational fuel based on the prevailing cost of natural gas versus electricity.

Alliant Energy actively works to secure and keep large customers, such as data centers, by offering dependable and economical energy solutions. Their strategy focuses on meeting client needs irrespective of the primary fuel used, ensuring flexibility and cost-competitiveness.

In 2024, the energy landscape saw continued volatility, with natural gas prices experiencing fluctuations. For example, in early 2024, natural gas spot prices at major hubs like Henry Hub saw periods of decline, making it a more attractive option for some industrial users compared to electricity, which can be influenced by renewable energy mandates and grid modernization costs. This dynamic directly impacts the threat of fuel switching.

Key considerations for Alliant Energy regarding fuel switching include:

- Customer Flexibility: The ability of large industrial users to adapt their energy consumption based on price signals from different fuel sources.

- Price Volatility: Fluctuations in the cost of natural gas and electricity directly influence the attractiveness of switching.

- Infrastructure Investment: The capital required by customers to modify their facilities to switch between fuel types.

- Regulatory Environment: Policies that might favor or disincentivize the use of specific fuel sources can impact switching decisions.

The threat of substitutes for Alliant Energy is multifaceted, encompassing distributed generation like rooftop solar, energy efficiency improvements, alternative heating sources, battery storage, and fuel switching by large industrial clients. These substitutes directly challenge the company's traditional revenue models by reducing reliance on its grid-supplied electricity and natural gas.

In 2023, the residential solar market continued its strong growth, with new installations contributing to a reduced demand for utility-provided electricity. Similarly, advancements in energy-efficient appliances and smart home technology further dampen overall energy consumption. For natural gas, the increasing efficiency and affordability of electric heat pumps present a growing alternative, especially as electricity generation increasingly incorporates renewables.

Battery storage technologies are also evolving rapidly, allowing customers to store self-generated power, thereby decreasing their dependence on the utility. Furthermore, large industrial customers retain the flexibility to switch between natural gas and electricity based on price fluctuations, a dynamic influenced by market conditions like the volatility observed in natural gas prices throughout early 2024.

Alliant Energy is actively responding by investing in renewable energy projects, energy conservation programs, and battery storage solutions. These strategies aim to integrate these evolving technologies into their service offerings, thereby mitigating the threat of substitutes while also capitalizing on new market opportunities.

Entrants Threaten

The utility sector, particularly for regulated electricity and natural gas, demands colossal capital outlays for essential infrastructure like power plants, transmission lines, and distribution networks. This creates a substantial hurdle for any new company looking to enter the market.

For instance, Alliant Energy's significant investment plans, projected to be in the billions of dollars for initiatives such as grid modernization and expanding renewable energy sources, underscore just how high these initial capital requirements are, effectively deterring potential new entrants.

New entrants into the utility sector, like Alliant Energy, confront significant regulatory obstacles. Obtaining necessary licenses, permits, and rate approvals from state commissions in Iowa and Wisconsin is a complex and time-consuming process. This rigorous oversight, while ensuring service reliability, acts as a substantial barrier to entry, effectively limiting new competition.

Alliant Energy benefits from its existing, extensive infrastructure for electricity and natural gas distribution across its service territories, representing a significant barrier to entry. Building a comparable network from scratch would be prohibitively expensive and time-consuming for any new entrant, making it difficult to compete on scale. In 2023, Alliant Energy reported capital expenditures of $2.2 billion, a portion of which was directed towards maintaining and expanding its robust distribution systems.

Brand Loyalty and Customer Inertia

Even in regulated utility markets where customer choice is restricted, a significant inertia exists against switching providers. This customer inertia means that even if new competitors were to enter, convincing existing customers to change would be a substantial hurdle. Alliant Energy benefits from this, as its established reputation and consistent service delivery foster a deep-seated trust that new entrants would find difficult to replicate in the short to medium term.

Alliant Energy's long history and active involvement in the communities it serves are key drivers of its strong brand loyalty. This focus on community engagement, coupled with a proven track record of reliable service, cultivates a level of customer trust that acts as a significant barrier to new entrants. For instance, in 2023, Alliant Energy reported customer satisfaction scores that consistently ranked high within the utility sector, underscoring the effectiveness of their community-focused approach.

- Brand Loyalty: Alliant Energy's established presence and community focus foster strong customer loyalty.

- Customer Inertia: Existing customers are generally reluctant to switch utility providers, even if alternatives exist.

- Trust Factor: Decades of reliable service build trust, making it challenging for new entrants to gain market share.

- Community Engagement: Investments in local communities enhance Alliant's reputation and customer retention.

Government Policy and Support for Incumbents

Government policies and regulations frequently bolster incumbent utility providers like Alliant Energy, aiming to maintain the stability and reliability of essential services. This regulatory environment can erect significant barriers for potential new entrants seeking to disrupt the established market. For instance, in 2024, continued regulatory oversight by state Public Utility Commissions (PUCs) across Alliant Energy's service territories, such as Wisconsin and Iowa, often involves lengthy approval processes for new infrastructure projects, which established players are better equipped to navigate.

Furthermore, government support programs, while ostensibly promoting innovation, can inadvertently reinforce the dominance of existing utilities. The Department of Energy's loan guarantee programs for clean energy initiatives, for example, are often directed towards established utilities undertaking large-scale projects, providing them with crucial financial backing and market access. In 2024, such programs continue to be a significant avenue for financing renewable energy development, with utilities like Alliant Energy leveraging these opportunities to expand their clean energy portfolios, thereby strengthening their competitive position against potential new market entrants.

- Regulatory Hurdles: State PUCs across Alliant Energy's operational areas (e.g., Wisconsin, Iowa) impose complex approval processes for new utility projects, favoring incumbents with established relationships and expertise.

- Government Financing: Programs like the DOE's loan guarantees in 2024 provide substantial financial advantages to established utilities for clean energy investments, making it harder for new entrants to compete on capital availability.

- Established Infrastructure: Incumbents benefit from existing, often government-sanctioned, infrastructure, which new entrants would need to replicate at considerable cost and regulatory scrutiny.

The threat of new entrants for Alliant Energy is considerably low, primarily due to the immense capital required for infrastructure development and the stringent regulatory environment. Building new power plants, transmission lines, and distribution networks demands billions, a barrier that deters most potential competitors. For example, Alliant Energy's 2024 capital expenditure forecast includes significant investments in grid modernization and renewable energy projects, highlighting the scale of investment needed.

Regulatory hurdles also play a crucial role in limiting new entrants. Obtaining necessary licenses and permits from state commissions in Iowa and Wisconsin is a complex, time-consuming process that established players like Alliant Energy are better equipped to navigate. This rigorous oversight, combined with customer inertia and strong brand loyalty built through community engagement, makes it exceedingly difficult for newcomers to gain a foothold.

| Barrier Type | Description | Impact on New Entrants | Alliant Energy Example (2023-2024 Data) |

|---|---|---|---|

| Capital Requirements | High cost of building power generation, transmission, and distribution infrastructure. | Very High - deterring most new entrants due to financial scale. | Billions in planned investments for grid modernization and renewables. |

| Regulatory Hurdles | Complex licensing, permits, and rate approvals from state commissions. | High - lengthy and intricate processes favor incumbents. | Navigating PUC approvals in Iowa and Wisconsin for new projects. |

| Customer Inertia & Brand Loyalty | Customer reluctance to switch and trust built through reliable service and community involvement. | High - difficult for new entrants to attract existing customers. | Consistent high customer satisfaction scores in 2023; active community programs. |

| Economies of Scale | Existing extensive infrastructure provides cost advantages. | High - difficult to match operational efficiency and cost structure. | $2.2 billion in 2023 capital expenditures supporting existing distribution systems. |

Porter's Five Forces Analysis Data Sources

Our Alliant Energy Porter's Five Forces analysis is built upon a foundation of diverse and reliable data sources, including company annual reports, regulatory filings from entities like the SEC, and industry-specific publications. This ensures a comprehensive understanding of the competitive landscape.