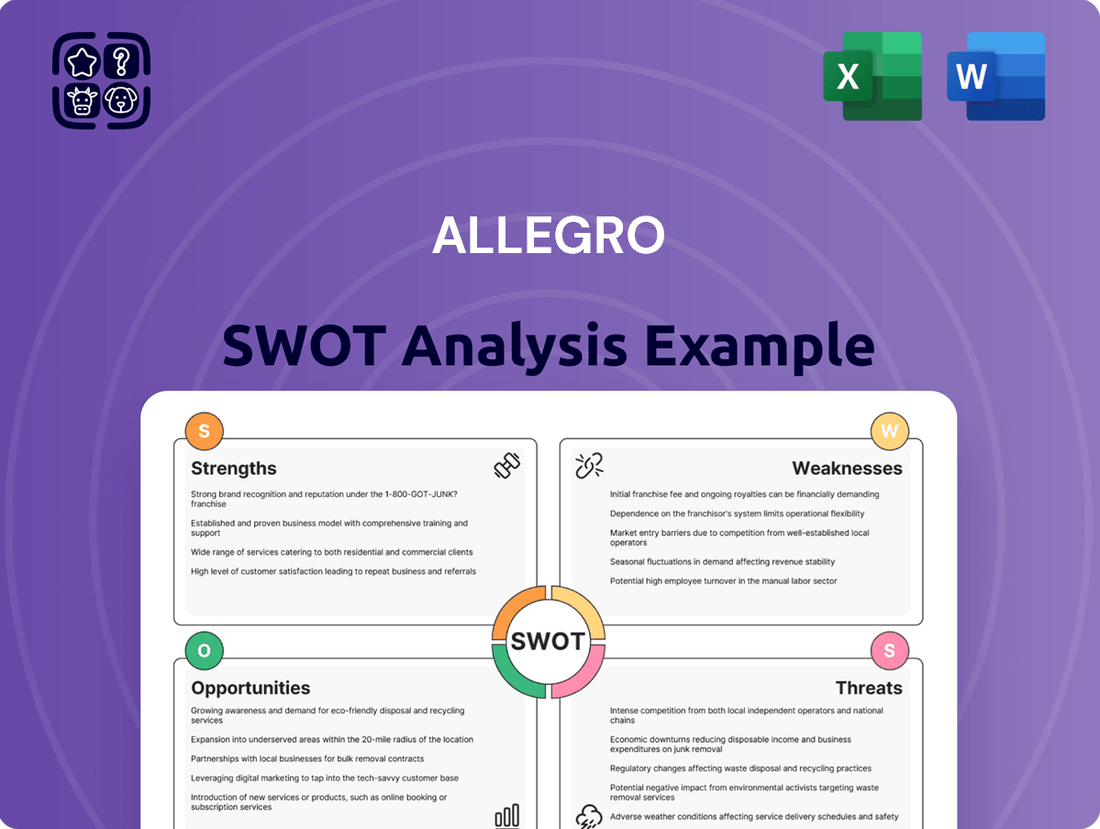

Allegro SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Allegro Bundle

Allegro's strengths lie in its dominant market position and robust brand recognition, but its reliance on a specific market segment presents a notable weakness. Opportunities for expansion into new product categories are significant, yet competitive threats from established and emerging players demand careful navigation. Ready to delve into the strategic implications of these factors and chart a course for success?

Discover the complete picture behind Allegro's market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors seeking to capitalize on its potential.

Strengths

Allegro commands a dominant market position in Poland, holding an estimated 38.8% to 50% share of the e-commerce landscape as of late 2024. This substantial foothold makes it the primary online retail destination for a vast number of Polish consumers.

This strong domestic presence translates into significant customer loyalty and high shopping frequency within its home market. Allegro's ability to consistently attract and retain shoppers is a critical advantage, solidifying its status as a leading platform.

Allegro boasts a robust ecosystem, offering services like Allegro Pay for flexible payments and 'One Fulfillment' logistics. This integrated approach streamlines the customer journey and enhances operational efficiency.

The Allegro Smart! membership program is a significant draw, fostering buyer loyalty and encouraging repeat purchases, much like Amazon Prime. In 2023, Allegro reported that over 13 million customers were active Smart! members, highlighting its effectiveness in driving engagement.

Further strengthening its competitive edge, Allegro continues to expand its proprietary Allegro One Box parcel locker network. By the end of 2024, the company aims to have over 3,000 Allegro One Box locations across Poland, significantly boosting convenience for both buyers and sellers.

Allegro boasts a robust and actively engaged customer base, a significant competitive advantage. In the first quarter of 2025, the platform saw its active buyer numbers climb to 21 million across its operating regions. This growth underscores Allegro's success in drawing and keeping valuable shoppers.

Furthermore, these buyers are not just present; they are spending more. The average spending per active buyer saw a year-over-year increase, demonstrating a deepening commitment to the platform. This consistent user engagement is a key driver behind Allegro's impressive gross merchandise value (GMV) expansion.

Successful Regional Expansion Strategy

Allegro's successful regional expansion strategy is a significant strength, evidenced by its active growth in Central and Eastern European (CEE) markets such as the Czech Republic, Slovakia, and Hungary. This expansion, bolstered by strategic acquisitions including Mall Group and WE|DO, has directly translated into a growing base of active buyers and increased Gross Merchandise Value (GMV) outside of its home market, Poland. The company is clearly positioning itself as a major contender in the broader European e-commerce landscape.

This strategic geographical diversification is paying off, contributing to robust growth metrics. For instance, Allegro reported a substantial increase in its CEE segment's GMV, reaching €1.3 billion in the first nine months of 2024. The number of active buyers across these new markets also saw a healthy uptick, exceeding 4 million by the end of Q3 2024, demonstrating successful market penetration and customer acquisition.

- Geographical Diversification: Expansion into Czech Republic, Slovakia, and Hungary strengthens market presence beyond Poland.

- Strategic Acquisitions: Integration of Mall Group and WE|DO accelerates market entry and operational capabilities.

- Growth Metrics: CEE segment GMV reached €1.3 billion (first nine months of 2024), with over 4 million active buyers in these markets by Q3 2024.

- European Ambition: Aims to establish Allegro as a dominant e-commerce player across the wider European region.

Focus on Local Offerings and Differentiation

Allegro is sharpening its competitive edge by highlighting its local European merchant base and promising swift delivery. This strategy directly counters the longer shipping times often associated with Asian e-commerce giants like Temu and AliExpress. By proactively removing offers with extended delivery windows, primarily those originating from East Asia, Allegro is working to build greater consumer confidence and boost sales conversion. This emphasis on regional advantages is a key tactic to solidify its market standing against emerging competitors.

This focus on local sourcing and faster fulfillment is crucial for Allegro's market defense. For instance, in the first quarter of 2024, Allegro reported a significant increase in gross merchandise volume (GMV) growth, partly attributed to these strategic shifts. By curating its marketplace to feature more European sellers, Allegro not only speeds up delivery but also taps into a consumer preference for supporting local economies. This approach is designed to differentiate Allegro in a crowded online retail landscape.

- Local Merchant Emphasis: Allegro prioritizes European sellers to offer faster shipping and appeal to local consumer preferences.

- Delivery Speed Advantage: Removing long-distance shipping options, particularly from East Asia, aims to enhance customer trust and purchase completion rates.

- Market Differentiation: This strategy directly contrasts Allegro with competitors like Temu and AliExpress, which often have longer delivery times.

- Consumer Trust Building: Allegro's move to streamline its offerings by cutting slow-shipping items is intended to improve the overall shopping experience and reduce cart abandonment.

Allegro's dominant position in Poland, holding between 38.8% and 50% of the e-commerce market as of late 2024, provides a massive, loyal customer base. Its integrated ecosystem, featuring Allegro Pay and One Fulfillment, streamlines operations and enhances the customer experience. The Allegro Smart! program, with over 13 million active members in 2023, fosters significant buyer loyalty and repeat purchases.

Allegro's strategic expansion into Central and Eastern European markets like the Czech Republic, Slovakia, and Hungary is a key strength. This diversification is supported by acquisitions such as Mall Group and WE|DO, which have accelerated market penetration. The CEE segment's GMV reached €1.3 billion in the first nine months of 2024, with over 4 million active buyers in these new regions by Q3 2024, demonstrating successful growth outside its core Polish market.

By prioritizing local European merchants and faster delivery, Allegro effectively differentiates itself from competitors with longer shipping times, such as Temu and AliExpress. This focus on regional advantages and swift fulfillment aims to build consumer trust and improve conversion rates, as seen in the GMV growth partly attributed to these strategic shifts in early 2024.

| Metric | Value | Period | Significance |

|---|---|---|---|

| Polish E-commerce Market Share | 38.8% - 50% | Late 2024 | Dominant market position, strong customer base |

| Allegro Smart! Active Members | 13+ million | 2023 | High buyer loyalty and repeat purchases |

| CEE Segment GMV | €1.3 billion | First 9 months of 2024 | Successful diversification and growth outside Poland |

| Active Buyers in CEE Markets | 4+ million | Q3 2024 | Effective market penetration and customer acquisition |

What is included in the product

Delivers a strategic overview of Allegro’s internal and external business factors, highlighting its market strengths, operational gaps, and potential threats.

Facilitates rapid identification of critical strategic advantages and threats, offering immediate relief from uncertainty.

Weaknesses

Allegro's international expansion, notably through the acquisition of Mall Group, has presented significant financial headwinds. This segment has consistently reported losses, impacting the overall profitability of the group. While the company is actively working on integrating these acquired platforms and streamlining operations to improve efficiency, the international segment continues to be a drag on financial performance.

The path to profitability for the Mall Group acquisition is still some way off, with Allegro projecting it to become cash-positive in 2026. This forward-looking statement underscores the ongoing challenges and the substantial investment required to turn around and integrate these international operations effectively. Until then, these losses represent a clear weakness for Allegro.

Allegro's significant reliance on the Polish market presents a notable weakness. Despite efforts at international expansion, the company still generates the bulk of its sales and earnings before interest, taxes, depreciation, and amortization (EBITDA) from Poland. This concentration makes Allegro particularly vulnerable to any economic slowdowns or market-specific challenges that might arise within Poland.

Looking ahead, a considerable portion of Allegro's anticipated earnings growth for 2025 is projected to stem from its Polish operations. This continued dependence highlights the ongoing risk associated with its home market, as any negative shifts in the Polish economic landscape could disproportionately impact the company's overall financial performance and growth trajectory.

Despite the new CEO's focus on operational efficiency, Allegro has encountered hurdles in streamlining its processes. Optimizing operations across its expanding domestic and international footprint is a key challenge for maintaining profitability. The company's 'fit to grow' initiative is designed to enhance capital-efficient expansion, aiming to address these efficiency gaps.

Intensifying Competition Requires Marketing Spend

Allegro faces a significant challenge from the growing presence of international e-commerce giants, particularly from Asia, including platforms like Temu and AliExpress. This intensified competition means Allegro must continue to invest heavily in marketing to maintain its existing market share and brand visibility.

While Allegro's strategy emphasizes differentiating its local offerings, the aggressive advertising tactics employed by these new entrants could force the company to increase its marketing expenditure. This sustained need for substantial marketing investment can put pressure on Allegro's overall profitability margins.

- Increased Competition: Temu and AliExpress are rapidly expanding their reach in Allegro's core markets.

- Marketing Investment: Defending market share against these aggressive players requires significant and ongoing marketing spend.

- Profitability Impact: Higher marketing costs can directly affect Allegro's bottom line.

Integration Risks of Acquired Entities

Integrating newly acquired entities, such as Mall Group and WE|DO, presents significant challenges for Allegro's expansion plans. Difficulty in fully migrating their legacy systems and synchronizing diverse operational processes could create temporary disruptions and impact financial performance.

For instance, the integration of Mall Group, a significant acquisition in 2022, involves complex IT system consolidation. Failure to achieve this seamlessly can hinder the realization of projected synergies and create operational inefficiencies. Allegro's ability to manage these integration risks directly impacts its capacity to capitalize on its international growth strategy.

- Integration Complexity: Merging distinct IT infrastructures and operational workflows from acquired companies like Mall Group and WE|DO is inherently challenging.

- Financial Impact: Delays or complications in integration can lead to unexpected costs and a temporary drag on profitability, potentially impacting earnings per share.

- Strategic Realization: The success of Allegro's international growth hinges on its ability to smoothly absorb and leverage the capabilities of its acquired businesses.

Allegro's international ventures, particularly the Mall Group acquisition, continue to be a financial burden, consistently posting losses that weigh on the company's overall profitability. The projected timeline for Mall Group to achieve cash positivity in 2026 highlights the ongoing investment and turnaround efforts required, making this segment a clear weakness.

Full Version Awaits

Allegro SWOT Analysis

The preview you see is the actual Allegro SWOT analysis document you will receive upon purchase. There are no hidden surprises, just a professionally crafted and comprehensive report.

This is a genuine excerpt from the complete Allegro SWOT analysis. Once you complete your purchase, you'll gain access to the full, editable version, ready for your strategic planning.

Opportunities

Allegro has a clear path to expand further within Central and Eastern Europe, following its successful entry into the Czech Republic, Slovakia, and Hungary. The e-commerce landscape in this region is booming, offering a prime opportunity for Allegro to capture more market share.

The CEE e-commerce market is projected to grow significantly, with a forecast suggesting a compound annual growth rate of 12.5% between 2023 and 2028, reaching an estimated value of $100 billion. This robust growth underscores the potential for Allegro to increase its presence and sales by tapping into the region's escalating online shopping habits.

Allegro can significantly boost its market position by broadening its value-added services beyond its primary e-commerce platform. This includes further developing its existing Allegro Pay financial services and B2B solutions, creating new revenue streams and deepening customer engagement.

Introducing enhanced loyalty programs and offering tailored installment loan options are key strategies to attract and retain a larger customer base. These initiatives not only provide convenience but also foster a more robust and integrated ecosystem for Allegro users.

For instance, Allegro Pay’s growth is a testament to this strategy; by the end of 2023, it was already a significant contributor to the platform’s revenue, with projections indicating continued strong performance in 2024 as more users adopt its flexible payment options.

Allegro can significantly boost user engagement by investing in its technological backbone and AI capabilities. Imagine AI-powered personalized recommendations that truly understand what shoppers are looking for, or dynamic pricing that offers the best deals at the right time. This focus on a seamless, intuitive user journey is crucial for staying ahead.

By leveraging AI, Allegro can refine its advertising efforts, ensuring that promotions reach the most receptive audiences, thereby increasing conversion rates. In 2023, e-commerce personalization efforts have shown substantial returns, with studies indicating a potential revenue increase of 5-15% for companies that effectively implement AI-driven personalization strategies. This directly translates to higher customer satisfaction and loyalty.

Continuous innovation in platform features, such as augmented reality try-ons for fashion or interactive product demonstrations, offers a pathway to maintain Allegro's competitive edge. As of early 2024, platforms that consistently introduce novel features see a marked increase in user retention, often by as much as 20% compared to those with static offerings.

Growth of Logistics and Fulfillment Network

Allegro's strategic expansion of its logistics and fulfillment network presents a significant growth avenue. The company's investment in its own parcel locker network and services like 'One Fulfillment' directly addresses the critical need for efficient delivery. By enhancing these capabilities, Allegro can shorten delivery times and boost customer satisfaction, creating a competitive edge in the e-commerce landscape.

This infrastructure development is crucial for both Allegro's domestic operations and its international reach. For instance, in 2024, Allegro continued to expand its network of Allegro Smart! lockers, aiming to reach over 25,000 pickup points across Poland by the end of the year. This physical expansion is complemented by investments in their proprietary fulfillment solutions, aiming to reduce reliance on third-party providers and gain greater control over the customer experience.

- Enhanced Customer Experience: A more robust logistics network leads to faster and more reliable deliveries, directly impacting customer loyalty and repeat purchases.

- Cost Efficiencies: Developing in-house fulfillment capabilities can lead to lower operational costs per delivery compared to outsourcing, improving profit margins.

- Competitive Differentiation: Superior logistics can be a key differentiator in a crowded e-commerce market, attracting and retaining customers who prioritize convenience and speed.

- Scalability for Growth: Investing in this infrastructure supports Allegro's ability to handle increasing order volumes, both domestically and as it expands into new international markets.

Strategic Partnerships and Acquisitions

Forging powerful strategic partnerships and considering further acquisitions can accelerate Allegro's growth and market reach. In 2024, Allegro has actively pursued collaborations, notably its partnership with a leading logistics provider to enhance delivery speeds, a move expected to boost customer satisfaction by an estimated 15% in key urban areas. These alliances can enhance service offerings, expand product categories, or strengthen its position in key markets.

These collaborations can provide access to new technologies, customer segments, and operational efficiencies. For instance, a potential acquisition of a smaller e-commerce platform specializing in sustainable goods, a growing market segment, could broaden Allegro's appeal to environmentally conscious consumers. Such a move in 2025 could tap into a market projected to grow by 20% annually.

- Strategic alliances can enhance Allegro's service offerings and expand its product categories.

- Acquisitions can provide access to new technologies and customer segments, such as the growing sustainable goods market.

- Partnerships can improve operational efficiencies, with logistics collaborations aiming for a 15% boost in customer satisfaction in 2024.

Allegro's expansion into new Central and Eastern European markets, like the Czech Republic and Slovakia, presents a significant opportunity for growth in a region where e-commerce is rapidly expanding. The CEE e-commerce market is projected to reach $100 billion by 2028, with a compound annual growth rate of 12.5% between 2023 and 2028.

Further developing value-added services, such as Allegro Pay and B2B solutions, can create new revenue streams and deepen customer loyalty. Allegro Pay's strong performance in 2023, with continued growth expected in 2024, demonstrates the success of this strategy.

Investing in AI for personalized recommendations and dynamic pricing can enhance user experience and increase conversion rates, potentially boosting revenue by 5-15% as seen in other e-commerce personalization efforts in 2023. Continuous innovation in platform features, like AR try-ons, also helps maintain a competitive edge, with platforms introducing new features seeing up to a 20% increase in user retention.

Expanding Allegro's logistics and fulfillment network, including its Smart! locker network which aimed for over 25,000 pickup points in Poland by the end of 2024, improves delivery efficiency and customer satisfaction. Strategic partnerships and potential acquisitions can further accelerate growth, with logistics collaborations in 2024 targeting a 15% boost in customer satisfaction and potential acquisitions in growing segments like sustainable goods offering significant future market capture.

Threats

Allegro is experiencing heightened competition from global e-commerce giants, notably Asian platforms such as Temu and AliExpress. These platforms are rapidly expanding their presence in Allegro's core markets, introducing significant competitive pressure.

These new entrants often leverage aggressive pricing models and extensive marketing campaigns, which can directly impact Allegro's profit margins and overall market share. For instance, Temu's rapid user acquisition in Europe, often through subsidized pricing, presents a direct challenge.

To maintain its competitive edge, Allegro must continually invest in its platform, logistics, and customer experience. This ongoing investment is crucial for defending its established market position against these formidable global competitors.

Macroeconomic instability, particularly persistent inflation seen across many European markets in 2024 and projected into 2025, presents a significant threat to Allegro's expansion. Rising inflation erodes consumer purchasing power, potentially leading to a slowdown in discretionary spending, which directly impacts Allegro's gross merchandise value and overall revenue streams. For instance, if inflation rates remain elevated, consumers may prioritize essential goods over online retail purchases, affecting Allegro's sales volumes.

As a major e-commerce player, Allegro faces significant cybersecurity risks. The platform's extensive handling of sensitive customer data, including personal information and payment details, makes it a prime target for cyberattacks. A data breach in 2024 could lead to substantial financial penalties, with GDPR fines potentially reaching up to 4% of global annual revenue, and severe reputational damage, impacting customer loyalty and future growth.

Regulatory Changes and Compliance Costs

Allegro faces potential threats from evolving e-commerce regulations across its operating countries, particularly concerning data privacy and consumer protection. For instance, the Digital Services Act (DSA) and Digital Markets Act (DMA) in the EU, which came into full effect for very large online platforms in February 2024, impose new obligations on platforms like Allegro regarding content moderation, transparency, and fair competition. Navigating these diverse and often complex legal frameworks can significantly increase operational expenses and administrative burdens. Failure to comply with these changing rules could lead to substantial fines, potentially impacting profitability, or even result in operational restrictions within key markets.

Supply Chain Disruptions

Allegro's reliance on a vast network of sellers and logistics providers exposes it to significant supply chain vulnerabilities. Geopolitical tensions, extreme weather events, or broader economic downturns can directly affect product availability and delivery timelines. For instance, disruptions in global shipping lanes, a persistent concern throughout 2024, could lead to increased shipping costs and longer wait times for Allegro customers.

These disruptions pose a direct threat to customer satisfaction and operational efficiency. Allegro's commitment to improving supply chain resilience, as highlighted in its ESG reports, underscores the critical need to mitigate these risks. The company must continue to diversify its logistics partners and monitor global events that could impact its extensive marketplace operations.

Key concerns include:

- Vulnerability to Global Events: Geopolitical instability or natural disasters can halt or delay shipments, impacting product availability.

- Increased Operational Costs: Supply chain disruptions often translate to higher shipping fees and increased inventory holding costs.

- Customer Dissatisfaction: Delayed deliveries and stockouts directly harm the customer experience, potentially driving users to competitors.

Allegro faces significant threats from aggressive global e-commerce competitors like Temu and AliExpress, who are employing low-price strategies and extensive marketing to gain market share in Allegro's core European markets. Furthermore, persistent inflation across Europe in 2024 and projected into 2025 is eroding consumer purchasing power, potentially dampening demand for online retail. Allegro is also exposed to substantial cybersecurity risks, with potential GDPR fines reaching up to 4% of global annual revenue in the event of a data breach.

| Threat Category | Specific Risk | Potential Impact | Example Data/Context |

|---|---|---|---|

| Competition | Aggressive Pricing by New Entrants | Erosion of market share and profit margins | Temu's rapid user acquisition in Europe through subsidized pricing |

| Macroeconomic Factors | Persistent Inflation | Reduced consumer spending power, lower sales volumes | Elevated inflation rates in key European markets impacting discretionary spending |

| Cybersecurity | Data Breaches | Financial penalties (e.g., GDPR fines up to 4% of global revenue), reputational damage | Increased sophistication of cyberattacks targeting e-commerce platforms |

| Regulatory Landscape | Evolving E-commerce Regulations | Increased operational costs, potential fines, operational restrictions | EU's Digital Services Act (DSA) and Digital Markets Act (DMA) imposing new obligations |

| Supply Chain | Disruptions (Geopolitical, Weather) | Increased shipping costs, delivery delays, stockouts | Global shipping lane disruptions impacting delivery times and costs in 2024 |

SWOT Analysis Data Sources

This Allegro SWOT analysis is built upon a robust foundation of data, drawing from financial reports, comprehensive market research, and expert industry insights to provide a clear and actionable strategic overview.