Allegro Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Allegro Bundle

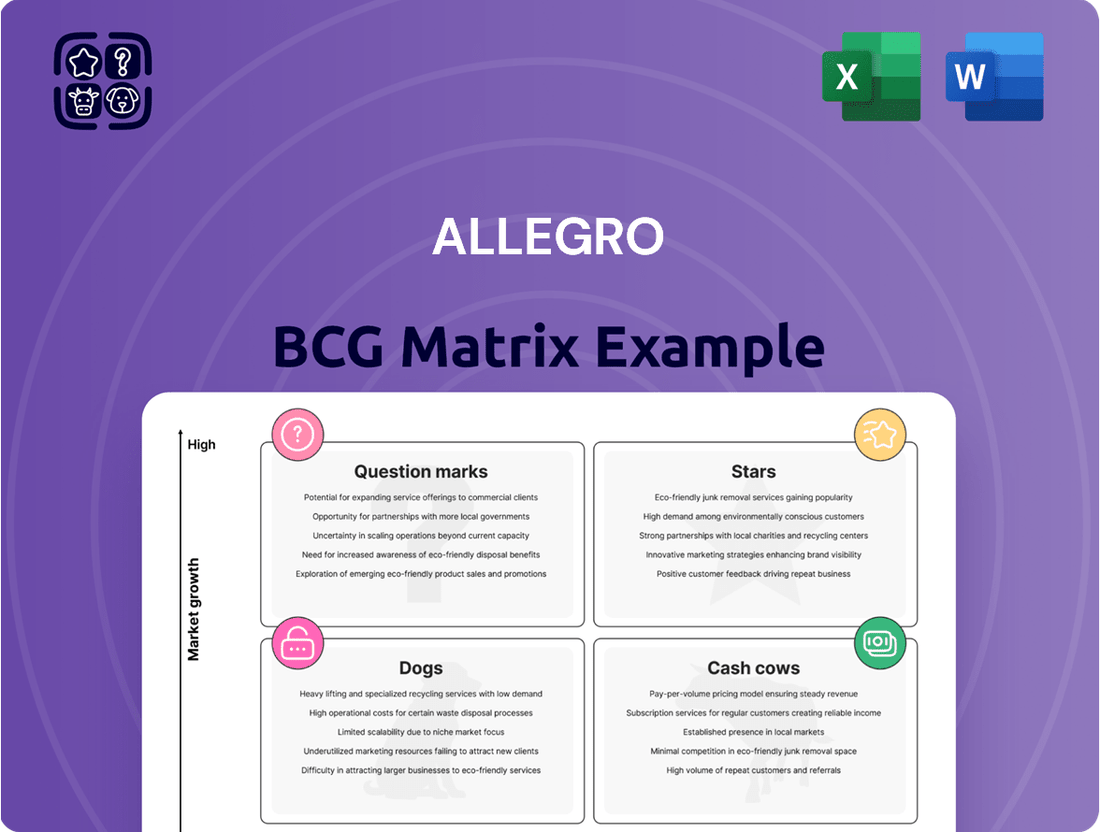

Understanding where a company's products sit within the BCG Matrix—Stars, Cash Cows, Dogs, or Question Marks—is crucial for strategic decision-making. This initial glimpse offers a foundational understanding of market position and growth potential. Purchase the full BCG Matrix for a comprehensive analysis, including detailed quadrant breakdowns and actionable strategies to optimize your product portfolio and drive future success.

Stars

Allegro's core Polish e-commerce platform is a true market leader, demonstrating robust growth. By the close of 2024, it held an impressive 38.8% share of the Polish retail e-commerce market, as reported by Euromonitor International. This dominance is further solidified by its gross merchandise volume (GMV) growth, which outpaces the overall Polish retail sales, underscoring its strong domestic performance.

The Allegro Smart! loyalty program is a significant factor in keeping customers engaged and encouraging them to buy more often, both in Poland and in other countries. As of the first quarter of 2024, this program boasts over 6 million users in Poland and more than 520,000 users internationally.

This widespread adoption translates into strong customer loyalty, which in turn has a substantial positive impact on Allegro's overall gross merchandise value (GMV). The program's success highlights its effectiveness in driving repeat business and increasing customer lifetime value.

Allegro Pay, Allegro's fintech division, is a significant growth driver, boasting over 2 million active users by Q1 2025. This rapid adoption is fueling substantial transaction volumes, with PLN 2.8 billion financed in the first quarter of 2025 alone. The platform's ability to finance a considerable percentage of gross merchandise value (GMV) underscores its strategic importance in enhancing buyer convenience and transaction security.

Growth in Advertising Revenue

Allegro is strategically developing advertising as a key growth area. This initiative is proving successful, as evidenced by the substantial increase in advertising revenue within its Polish operations.

The company's ability to monetize its extensive user base and leverage data for advertising purposes is a significant driver of this growth. In 2023, Allegro's advertising revenue saw a remarkable rise, contributing to its overall financial performance.

- Advertising revenue growth: Allegro's advertising segment experienced a significant year-on-year increase in 2023.

- Leveraging user base: The company effectively utilizes its large customer base and data insights to drive advertising monetization.

- High-margin revenue: Advertising contributes high-margin revenue, enhancing overall profitability.

- Strategic focus: Advertising is a core component of Allegro's strategy to build new growth engines.

Managed Delivery Methods (Allegro One Box, Allegro Delivery)

Allegro's investment in proprietary delivery methods like Allegro One Box and Allegro Delivery signifies a strategic push for logistical control and improved customer satisfaction. This initiative aims to streamline operations and potentially lower delivery expenses.

The significant 118% year-over-year growth in Allegro One Box volumes during 2024 underscores robust customer engagement and highlights the substantial potential for future operational efficiencies derived from these owned delivery channels.

- Allegro One Box Growth: Witnessed a remarkable 118% year-over-year increase in volumes for 2024.

- Strategic Logistics Investment: Allegro is actively building its own delivery infrastructure.

- Customer Experience Focus: Enhancing delivery options aims to directly benefit the end-user.

- Efficiency Gains: The expansion of owned delivery methods is expected to yield cost reductions and operational improvements.

Stars in the Allegro BCG Matrix represent business units with high market share in high-growth markets. Allegro's core Polish e-commerce platform fits this description, demonstrating strong growth and market leadership. Its significant share of the Polish e-commerce market, coupled with its continuous expansion, positions it firmly as a Star.

The Allegro Smart! loyalty program and Allegro Pay fintech division are key contributors to this Star status, driving customer engagement and transaction volumes. These initiatives are not only solidifying Allegro's market position but also fueling its growth in a dynamic market environment.

Allegro's strategic investments in advertising and proprietary delivery methods further reinforce its Star classification by creating new revenue streams and enhancing operational efficiency. These developments are crucial for maintaining its competitive edge and capitalizing on market opportunities.

| Business Unit | Market Share (Poland) | Market Growth | BCG Category |

|---|---|---|---|

| Core E-commerce Platform | 38.8% (2024) | High | Star |

| Allegro Smart! Program | 6M+ users (Poland, Q1 2024) | High | Star |

| Allegro Pay | 2M+ active users (Q1 2025) | High | Star |

What is included in the product

The Allegro BCG Matrix categorizes products by market share and growth, guiding investment decisions.

Visualize your portfolio's health with a clear, quadrant-based Allegro BCG Matrix.

Cash Cows

Allegro's established Polish e-commerce operations are a classic Cash Cow. As the largest e-commerce platform of Polish origin, it commands a significant market share, consistently generating substantial cash flow.

This mature market position translates into high profit margins. Allegro benefits from established competitive advantages and a large, loyal customer base, allowing it to leverage its scale effectively.

In 2023, Allegro reported net revenue of PLN 11.1 billion, a testament to its strong performance in its core Polish market.

Allegro's Polish market boasts 15.1 million active buyers as of Q1 2025, a substantial and consistent customer base. This high engagement ensures steady revenue streams with minimal incremental marketing spend, solidifying its Cash Cow status.

The increasing average spend per buyer further bolsters Allegro's Polish operations. This trend means that even without aggressive promotional pushes, revenue continues to grow organically, reinforcing the platform's profitability and stability.

Allegro is a dominant force in Poland's e-commerce landscape, enjoying the status of the premier online shopping destination for millions of consumers. Established in 1999, its long-standing presence has cultivated deep brand recognition and unwavering consumer trust. This established reputation significantly lowers the necessity for substantial marketing expenditures to defend its market share.

Robust Financial Health and Free Cash Flow

Allegro exhibits robust financial health, underscored by a manageable debt-to-equity ratio. In 2024, the company's free cash flow generation remained strong, providing ample resources for strategic initiatives and shareholder distributions.

- Strong Free Cash Flow: Allegro consistently generates substantial free cash flow, a key indicator of its cash cow status.

- Financial Stability: A well-managed debt structure supports its operational flexibility and investment capacity.

- Funding Capabilities: The company can readily fund internal growth, debt obligations, and potential dividend payouts.

Leveraging Existing Infrastructure and Merchant Network

Allegro's existing infrastructure and vast merchant network are key to its Cash Cow status. With over 163,000 merchants on its platform in Poland, Allegro benefits from an established ecosystem that efficiently handles transactions. This scale significantly reduces the need for substantial new capital expenditures to sustain current operations.

This robust infrastructure allows Allegro to generate strong, consistent cash flows. The company's ability to leverage its existing network minimizes incremental costs, thereby maximizing profitability from its core e-commerce operations.

- Established Merchant Network: Over 163,000 merchants in Poland provide a broad base for transactions.

- Efficient Transaction Facilitation: Well-developed platform infrastructure ensures smooth operations.

- Minimized Investment Needs: Existing assets require limited new capital for maintenance, boosting cash flow.

- Strong Cash Generation: The mature e-commerce operations are highly profitable and self-sustaining.

Allegro's Polish e-commerce operations are a prime example of a Cash Cow within the BCG Matrix. Its dominant market position and extensive customer base, with 15.1 million active buyers in Q1 2025, generate consistent and substantial free cash flow. This maturity means high profit margins, as seen in the PLN 11.1 billion net revenue reported for 2023, with minimal need for significant new investment to maintain its standing.

| Metric | Value | Significance |

|---|---|---|

| Active Buyers (Q1 2025) | 15.1 million | Demonstrates a large, engaged customer base ensuring steady revenue. |

| Net Revenue (2023) | PLN 11.1 billion | Highlights strong financial performance in its core market. |

| Merchants on Platform (Poland) | Over 163,000 | Indicates a robust ecosystem reducing operational costs and capital needs. |

What You’re Viewing Is Included

Allegro BCG Matrix

The BCG Matrix document you are previewing is the identical, fully-formatted report you will receive immediately after purchase. This means no watermarks, no demo content, and no hidden surprises – just a professional, analysis-ready tool designed to provide strategic clarity for your business.

Dogs

The Legacy Mall Group, positioned as a potential Dog in the Allegro BCG Matrix, has experienced a notable downturn. Its Gross Merchandise Volume (GMV) and revenue have seen significant contraction, reflecting a diminished market presence within a stagnant or shrinking sector. This segment's performance is a clear indicator of its status as a drag on the company's overall financial health.

Certain international operations within Allegro, notably the legacy Mall segment, are currently showing adjusted EBITDA losses. This cash burn without sufficient returns clearly positions these units as 'dogs' in the BCG matrix, despite the company's overall growth trajectory.

Allegro's decision to remove products with extended shipping times, particularly those originating from East Asia, from its international platforms strongly suggests these items were classified as 'dogs' within the BCG matrix. This strategic move indicates these products likely held a low market share and negatively impacted customer satisfaction and profitability.

Underperforming Acquired Businesses Not Fully Integrated

Acquired businesses, especially those operating internationally, that remain poorly integrated and consistently underperform or generate losses are classified as Dogs in the BCG Matrix. These entities are essentially draining company resources without contributing to overall profitability.

For example, if a company acquired a foreign tech firm in 2023 for $50 million and by mid-2024 it’s still showing a net loss of $5 million annually with no clear path to improvement, it would be a prime candidate for the Dog quadrant. Such situations highlight the challenges of post-acquisition integration and market adaptation.

- Underperforming International Acquisitions: Businesses bought overseas that haven't been successfully merged into the parent company's operations, leading to persistent financial deficits.

- Resource Drain: These units consume capital and management attention without generating commensurate returns, negatively impacting overall financial health.

- Integration Challenges: Difficulties in aligning systems, cultures, and market strategies post-acquisition are common reasons for these businesses becoming Dogs.

- Potential Divestment: Often, the strategic recommendation for Dog businesses is divestment or liquidation to reallocate resources to more promising ventures.

Specific, Niche Product Categories with Stagnant Demand

Within Allegro's extensive marketplace, certain niche product categories might exhibit stagnant demand. These segments, characterized by low market share and limited growth prospects, would be classified as 'dogs' in the BCG matrix. Such categories typically contribute little to overall revenue and profitability, representing areas where Allegro might need to re-evaluate its strategy.

While specific financial data for these niche categories isn't publicly disclosed, it's a common challenge for large e-commerce platforms to manage underperforming segments. For instance, in 2024, the broader e-commerce market saw growth, but specialized areas like vintage electronics or certain artisanal crafts might not have kept pace.

- Stagnant Demand: Categories with declining or flat sales trends.

- Low Market Share: Products that capture a small percentage of their respective niche markets.

- Minimal Profitability: Segments that generate very low revenue and profit margins.

- Strategic Re-evaluation: Potential for divestment, reduced investment, or strategic repositioning.

Dogs in the Allegro BCG Matrix represent business units or product categories with low market share in slow-growing or declining industries. These segments typically consume resources without generating significant returns, often leading to cash drains. For instance, Allegro's legacy Mall segment, experiencing GMV contraction and adjusted EBITDA losses, exemplifies a Dog. Similarly, poorly integrated international acquisitions that consistently underperform also fall into this category, highlighting integration challenges and potential divestment needs.

| Segment/Category | Market Share | Industry Growth | Profitability | Allegro BCG Classification |

|---|---|---|---|---|

| Legacy Mall Segment | Low | Stagnant/Declining | EBITDA Loss | Dog |

| Underperforming International Acquisitions | Low | Varies | Net Loss | Dog |

| Niche Product Categories (e.g., vintage electronics) | Low | Stagnant | Minimal | Dog |

Question Marks

Allegro's recent expansions into Czechia, Slovakia, and Hungary represent strategic moves into burgeoning e-commerce landscapes. While these markets offer significant growth potential, Allegro's presence is still nascent, leading to a smaller market share compared to its established dominance in Poland.

Despite their current investment phase, these new marketplaces are demonstrating robust performance. In Q1 2025, for instance, they achieved impressive Gross Merchandise Value (GMV) and revenue growth, reportedly around 80% year-over-year. This rapid expansion indicates strong consumer adoption and market penetration, even as the company continues to invest heavily in these regions.

These markets, while consuming cash during this growth phase, exhibit the characteristics of potential future stars within Allegro's portfolio. The high growth rates suggest they are on a trajectory to capture substantial market share, mirroring Allegro's success in other European countries.

Allegro's ambitious expansion of its delivery network, including Allegro One Box parcel lockers, into new European markets presents a classic "question mark" scenario within the BCG matrix. These ventures tap into high-growth potential as e-commerce continues its upward trajectory across the continent, but they demand substantial capital outlay for infrastructure and market penetration.

As of early 2024, Allegro's direct control and market share over its managed delivery solutions outside of its home market, Poland, are still nascent. For instance, while Allegro One Box is operational in countries like the Czech Republic and Slovakia, these operations are in their early stages, meaning their contribution to overall delivery volume is minimal compared to established players or even Allegro's Polish operations. This low current market share, coupled with the significant investment required for further international rollout, firmly places these initiatives in the question mark category, requiring careful monitoring and strategic decision-making regarding future investment.

Allegro's strategic focus on developing new products and services, particularly AI-driven solutions for enhanced recommendations and targeted advertisements, positions it for future growth. These initiatives are currently in their nascent stages, facing low market penetration but holding significant potential within the rapidly expanding AI sector.

The company's commitment to substantial investment in research and development, alongside robust marketing efforts, is crucial for these AI solutions to capture market share and achieve widespread adoption. For instance, the global AI market was valued at approximately $200 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 37% from 2024 to 2030, indicating a fertile ground for Allegro's ventures.

Expansion into New Geographic Markets (e.g., Slovenia, Croatia)

Allegro's strategic move into Slovenia and Croatia positions these ventures as potential Stars or Question Marks within its BCG matrix. These markets offer significant growth opportunities, as evidenced by the increasing e-commerce penetration in Central and Eastern Europe. For instance, e-commerce sales in Croatia were projected to reach approximately $1.5 billion in 2024, indicating a fertile ground for expansion.

These new geographic markets represent a substantial investment, requiring considerable upfront capital for platform development, marketing, and establishing local operations. This aligns with the characteristics of Question Marks, where substantial investment is needed to capture potential future market leadership. The success hinges on Allegro’s ability to adapt its existing model to local consumer preferences and competitive landscapes.

- Market Entry: Allegro's expansion into Slovenia and Croatia signifies entry into markets with nascent e-commerce ecosystems and lower existing competition compared to its core markets.

- Growth Potential: These countries present an opportunity for high revenue growth, driven by increasing internet access and digital payment adoption.

- Investment & Risk: Initial investment will be high, characteristic of Question Marks, with the potential for significant returns if market share is successfully captured, but also carrying the risk of underperformance.

- Strategic Importance: This expansion diversifies Allegro's geographic footprint and taps into the broader European growth narrative, potentially leading to future Stars if market dominance is achieved.

Allegro Cash (New Cashback Deposit Account)

Allegro Cash, a new cashback deposit account, is currently in its testing phase, making it a question mark in the Allegro BCG Matrix. Its future success hinges on its ability to gain traction within Allegro's established customer base and demonstrate a clear path to profitability.

The account's potential is significant, given Allegro's substantial user numbers, which stood at over 140 million active users across its platforms in 2023, according to company reports. However, market adoption and the account's ability to generate sustainable revenue streams remain unproven, characteristic of a question mark product.

- Market Potential: Leverages Allegro's large existing user base for initial customer acquisition.

- Uncertainty: Profitability and market acceptance are yet to be definitively established.

- Strategic Importance: Represents Allegro's expansion into the financial services sector, aiming to deepen customer engagement.

- Investment Decision: Requires careful monitoring of adoption rates and revenue generation to determine future investment or divestment.

Question Marks represent ventures with high growth potential but currently low market share. Allegro's expansion into new markets like Slovenia and Croatia, along with new product initiatives such as Allegro Cash and AI-driven services, fall into this category. These areas demand significant investment to capture future market leadership but carry inherent risks regarding adoption and profitability.

The success of these question marks hinges on Allegro's ability to adapt its strategies to diverse local markets and consumer preferences, while effectively leveraging its existing user base and technological advancements. For instance, the global AI market's projected 37% CAGR from 2024 to 2030 highlights the significant upside for Allegro's AI ventures, provided they can achieve market penetration.

Allegro's investment in its delivery network, including parcel lockers in new European countries, also exemplifies a question mark. While the e-commerce sector offers robust growth, these logistical expansions require substantial capital for infrastructure and market entry, with their ultimate market share and profitability yet to be determined.

The company's Q1 2025 performance in new markets like Czechia and Hungary, showing around 80% GMV and revenue growth, demonstrates the potential of these question marks to evolve into Stars. This rapid growth, however, is occurring during a heavy investment phase, underscoring the capital-intensive nature of these emerging ventures.

| Initiative | Market Share (Current) | Growth Potential | Investment Required | BCG Category |

| Slovenia/Croatia Expansion | Nascent | High | Substantial | Question Mark |

| Allegro Cash | Unproven | High (Leveraging User Base) | Moderate | Question Mark |

| AI-driven Services | Low | Very High (Global AI Market Growth) | High (R&D, Marketing) | Question Mark |

| International Delivery Network | Nascent | High (E-commerce Growth) | Substantial (Infrastructure) | Question Mark |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, customer feedback, and competitive intelligence, to accurately position each business unit.