Allegro Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Allegro Bundle

Allegro's competitive landscape is shaped by powerful buyer bargaining power and the constant threat of new entrants, influencing pricing and market accessibility.

The full Porter's Five Forces Analysis dives deep into Allegro's industry, revealing the true intensity of each force and uncovering hidden strategic opportunities.

Ready to gain a comprehensive understanding of Allegro's market position? Unlock the complete analysis to equip yourself with actionable insights for strategic advantage.

Suppliers Bargaining Power

Allegro's fragmented seller base significantly weakens supplier bargaining power. With millions of individual sellers offering their goods on the platform, no single seller can exert substantial influence over Allegro's terms. This dispersal of suppliers means Allegro can easily substitute one seller for another, further diminishing any individual seller's leverage.

The platform's dominant position in Poland, evidenced by its 15.1 million active buyers in Q4 2024, makes it a highly desirable sales channel. This strong buyer attraction means sellers are eager to access Allegro's customer base, which inherently reduces their ability to negotiate favorable terms or dictate platform policies.

Allegro's strategic investment in its proprietary logistics network, including 'One Fulfillment' and 'Allegro One Boxes,' significantly diminishes its reliance on external suppliers for storage, packaging, and delivery.

This internal development grants Allegro greater command over delivery efficiency and associated expenses, directly weakening the bargaining power of third-party logistics providers.

By the close of 2025, Allegro's automated parcel machines (APMs) are projected to offer a cost advantage, becoming more economical per parcel than its priciest logistics partner.

Allegro's strategic move to consolidate payment processing under its Allegro Finance division significantly impacts supplier bargaining power. By centralizing operations and reducing reliance on external payment processors, Allegro aims to streamline backend processes for sellers and achieve cost efficiencies. This consolidation positions Allegro Finance as a major player in the Polish online payments market, thereby enhancing Allegro's leverage over remaining independent payment providers.

Standardized Platform Services

Allegro's provision of standardized platform services, such as promotional tools and sales management support, reduces the bargaining power of suppliers. These standardized offerings simplify operations for sellers but also constrain their ability to negotiate highly customized terms. This uniformity limits suppliers' leverage, as they are integrated into a pre-defined operational framework.

The platform's simplified fee structure, with sales commission as the sole mandatory charge, further streamlines merchant operations. This clarity, while beneficial for sellers, establishes a predictable cost structure that suppliers must accept, thereby diminishing their capacity to negotiate unique or preferential fee arrangements.

- Standardized Tools: Allegro offers uniform promotional and sales management features, limiting supplier customization demands.

- Simplified Fee Structure: A single, mandatory sales commission fee provides a clear, non-negotiable cost for suppliers.

- Reduced Supplier Leverage: The standardized nature of services and fees inherently weakens suppliers' bargaining power.

Importance of Brand Partnerships

While many individual sellers on Allegro might have limited bargaining power, major, well-established brands or those offering truly unique, in-demand products can wield considerable influence. These prominent players are crucial for Allegro's diverse marketplace, attracting a broad customer base and driving sales volume.

Allegro actively cultivates these relationships. For instance, in 2023, Allegro reported a significant increase in Gross Merchandise Volume (GMV) driven by its key partner programs, which offer enhanced visibility and promotional support. These programs acknowledge the substantial contribution of top brands to the platform's overall success.

- Brand Partnerships Drive GMV: Allegro's strategic focus on key brand partners directly correlates with increased Gross Merchandise Volume, as seen in its 2023 performance reports.

- Unique Offerings as Leverage: Sellers providing exclusive or highly sought-after products gain enhanced bargaining power due to their ability to attract and retain customers.

- Platform Dependence on Brands: The platform's ability to offer a wide and appealing selection relies heavily on the participation and cooperation of major brands.

- Targeted Support for Key Sellers: Allegro implements specific programs and provides tailored support to its most important brand partners to foster loyalty and mutual growth.

Allegro's bargaining power with suppliers is generally low due to its fragmented seller base and the platform's dominance in the Polish market. This means individual sellers have limited leverage, as Allegro can easily replace them and sellers are eager to access its large customer pool. However, major brands with unique offerings can exert significant influence, driving GMV and necessitating tailored support from Allegro.

| Factor | Impact on Supplier Bargaining Power | Allegro's Position (as of 2024/2025) |

|---|---|---|

| Seller Base Fragmentation | Weakens power | Millions of individual sellers limit individual leverage. |

| Market Dominance (Poland) | Weakens power | 15.1 million active buyers (Q4 2024) make Allegro a sought-after channel. |

| Proprietary Logistics | Weakens power | Investments in 'One Fulfillment' and 'Allegro One Boxes' reduce reliance on external providers. APMs projected to be more economical per parcel than pricest logistics partners by end of 2025. |

| Consolidated Payment Processing | Weakens power | Allegro Finance centralizes operations, enhancing leverage over independent providers. |

| Standardized Platform Services & Fees | Weakens power | Uniform tools and a simple commission structure limit negotiation. |

| Key Brand Partnerships | Strengthens power (for key brands) | Major brands drive GMV (e.g., increased GMV in 2023 driven by key partner programs) and require tailored support. |

What is included in the product

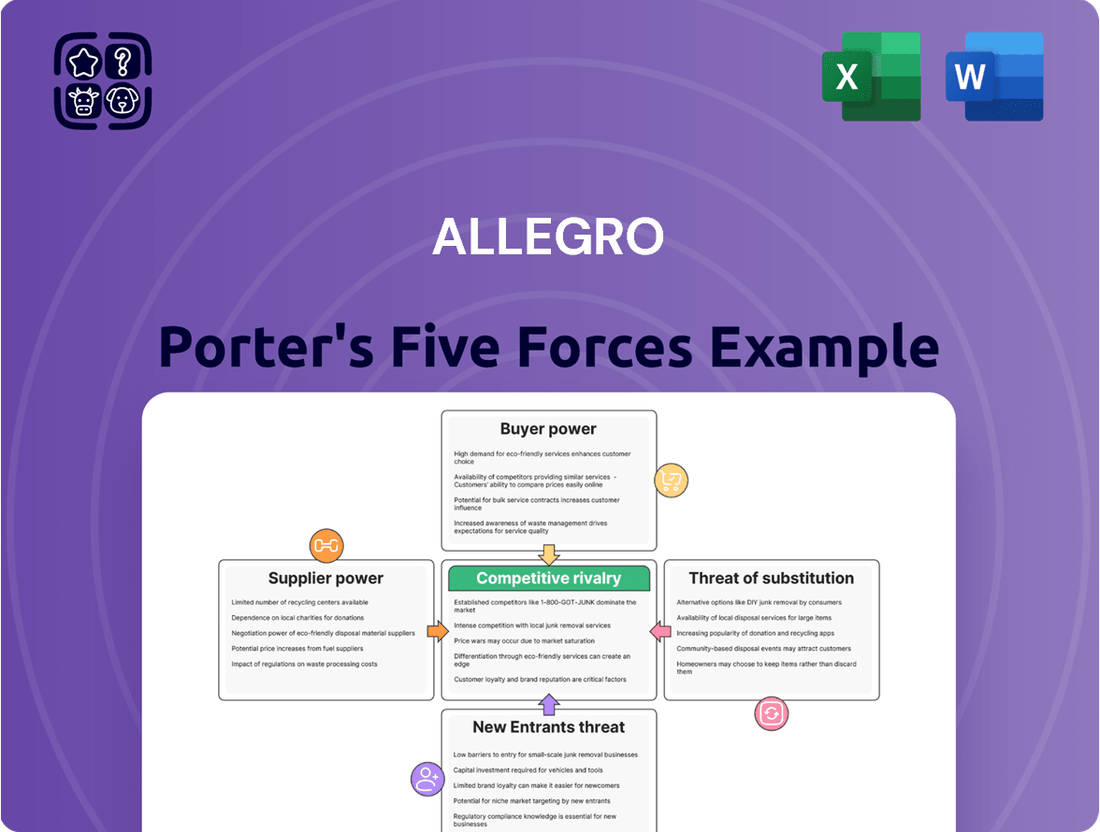

Analyzes the five competitive forces impacting Allegro, including the threat of new entrants, bargaining power of buyers and suppliers, threat of substitutes, and intensity of rivalry.

Quickly identify and address competitive threats with a visual representation of each force, making strategic planning more intuitive.

Customers Bargaining Power

Allegro's substantial customer base, reaching 15.1 million active buyers in Poland by Q4 2024 and 21 million across its entire operational area by Q1 2025, significantly dilutes individual customer bargaining power. This vast network creates a network effect, making it more attractive for sellers to be on the platform.

The 'Allegro Smart!' loyalty program, boasting over 7 million subscribers in Poland as of Q4 2024, further solidifies customer loyalty. By offering benefits such as free deliveries, Allegro incentivizes repeat business and reduces the likelihood of customers switching to competitors based on price alone.

Allegro's impressive product selection, boasting over 200 million offers in 2024 across diverse categories like electronics, fashion, and home goods, significantly bolsters customer bargaining power. This sheer volume of choices makes Allegro a highly convenient, go-to destination for a wide array of needs.

With such a comprehensive inventory, customers are less inclined to seek out alternative platforms simply for product availability, as Allegro effectively consolidates a vast marketplace. This extensive variety directly translates to greater choice and, consequently, increased leverage for the consumer when making purchasing decisions.

Polish consumers demonstrate significant price sensitivity, a trait amplified by the highly competitive nature of the e-commerce landscape. This sensitivity directly translates into increased bargaining power for buyers.

The proliferation of price comparison tools and the ease with which customers can vet offerings on Allegro and across rival platforms empower them to seek the best deals. This transparency forces sellers to maintain competitive pricing strategies, a cornerstone of Allegro's appeal.

In 2023, for instance, inflation in Poland hovered around 11.6%, further intensifying consumer focus on value and price. Allegro's success hinges on its ability to facilitate these price-conscious transactions, making it a critical factor in its market position.

Integrated Financial Services

Allegro's integrated financial services, particularly Allegro Pay, directly impact customer bargaining power. With over 2.2 million users and financing nearly 17% of Allegro's Gross Merchandise Value (GMV) in Q1 2025, Allegro Pay offers convenient payment options.

This accessibility can reduce a customer's immediate need to seek alternative, potentially cheaper, financing, thereby slightly diminishing their leverage to demand lower prices. The ease of use and integrated nature of Allegro Pay fosters loyalty, making customers less likely to switch for minor price differences.

- Allegro Pay User Base: Exceeding 2.2 million users as of Q1 2025.

- GMV Financed by Allegro Pay: Accounted for approximately 17% of total GMV in Q1 2025.

- Impact on Bargaining Power: Enhanced payment flexibility can reduce customer price sensitivity.

- Customer Loyalty: Integrated financial services contribute to increased customer retention.

Low Switching Costs for Buyers

While Allegro has cultivated a robust ecosystem, the costs for individual buyers to switch to competing e-commerce platforms remain quite low. This ease of transition significantly influences customer bargaining power.

The expanding landscape of cross-border e-commerce and the presence of numerous major online marketplaces empower consumers. They can readily compare prices, product assortments, and service quality across different platforms, seeking the most advantageous deals. For instance, in 2024, the average e-commerce user in Poland browsed at least 3.5 different online stores before making a purchase, highlighting the ease of comparison.

- Low Buyer Switching Costs: Buyers face minimal financial or effort barriers when moving between e-commerce platforms.

- Increased Competition: The proliferation of online marketplaces, including international ones, provides abundant alternatives for consumers.

- Price Sensitivity: Customers actively seek better pricing and value, readily shifting their loyalty to platforms offering superior deals or wider selections.

- Information Accessibility: Online tools and comparison sites make it simple for buyers to research and identify the best offers available across the market.

Allegro's vast customer base, with 15.1 million active Polish buyers in Q4 2024, inherently limits individual bargaining power. The loyalty program, boasting over 7 million subscribers by Q4 2024, further solidifies customer retention by offering benefits like free delivery, reducing price sensitivity.

The sheer volume of over 200 million offers available on Allegro in 2024 empowers customers by providing extensive choice and facilitating easy price comparisons across numerous sellers. This abundance of options, coupled with a highly competitive e-commerce market where Polish consumers are price-sensitive, significantly enhances their bargaining leverage.

Allegro Pay, used by over 2.2 million customers in Q1 2025 and financing 17% of GMV, offers payment flexibility that can slightly reduce immediate price-driven bargaining power. However, the low switching costs for buyers to move between the numerous online marketplaces, including cross-border options, maintain strong customer leverage in seeking the best deals.

| Metric | Value | Impact on Bargaining Power |

| Active Buyers (Poland, Q4 2024) | 15.1 million | Dilutes individual power |

| Allegro Smart! Subscribers (Q4 2024) | >7 million | Increases loyalty, reduces price sensitivity |

| Total Offers (2024) | >200 million | Enhances choice, facilitates price comparison |

| Allegro Pay Users (Q1 2025) | >2.2 million | Offers payment flexibility |

| GMV Financed by Allegro Pay (Q1 2025) | ~17% | Can reduce immediate price-driven leverage |

| Buyer Switching Costs | Low | Maintains strong customer leverage |

Full Version Awaits

Allegro Porter's Five Forces Analysis

This preview displays the comprehensive Allegro Porter's Five Forces analysis you will receive upon purchase, offering a complete and professionally formatted document. You're looking at the actual analysis, ensuring no discrepancies between the preview and the final deliverable. Once your purchase is complete, you'll gain instant access to this exact, ready-to-use file for your strategic planning needs.

Rivalry Among Competitors

Allegro's formidable presence in Poland, holding an estimated 45%-50% market share in 2024, intensifies competitive rivalry. Other e-commerce players are constantly striving to chip away at this dominance, leading to aggressive strategies and price wars. This battle for market share is further fueled by Allegro's growth, which consistently outpaces the broader retail sales expansion in the country.

The Polish e-commerce arena has become a battleground with the arrival of global powerhouses. Amazon's official entry in March 2021 marked a significant shift, bringing its vast resources and established logistics network.

Further intensifying this competition are Chinese e-commerce platforms such as Temu and Shein. These players are rapidly gaining traction, leveraging aggressive pricing strategies and extensive product selections.

This influx of international giants directly challenges Allegro's long-standing market leadership. Their substantial financial backing, sophisticated operational capabilities, and diverse offerings put considerable pressure on local players to innovate and adapt.

Allegro contends with robust local rivals such as OLX and Ceneo, which command significant user bases within particular market niches or for price-sensitive consumers. These platforms often benefit from established brand recognition and tailored offerings for the Polish market.

The competitive landscape is further intensified by new entrants like Kaufland Poland, which strategically entered the market in August 2024. By leveraging its existing physical retail footprint, Kaufland Poland can swiftly acquire market share and customer loyalty, directly challenging Allegro's dominance.

Investment in Logistics and Financial Services

Allegro's significant investments in its logistics infrastructure, such as Allegro One Boxes and One Fulfillment, alongside its financial services like Allegro Pay, create a strong competitive advantage. These integrated offerings are designed to elevate the customer journey by speeding up deliveries and providing adaptable payment options, compelling rivals to make comparable infrastructure investments.

This strategic integration forces competitors to allocate substantial capital towards developing their own logistics and financial service capabilities to remain competitive. For instance, in 2024, the e-commerce logistics market continued to see aggressive expansion, with major players investing billions globally to enhance last-mile delivery and fulfillment efficiency, directly pressured by Allegro's model.

- Logistics Investment: Allegro's expansion of its Allegro One network, including an increase in the number of pickup points and fulfillment centers, directly challenges competitors to match its delivery speed and convenience.

- Financial Services Integration: The success of Allegro Pay, offering buy-now-pay-later and other flexible payment options, pushes competitors to develop or partner for similar financial solutions to avoid losing customers to enhanced purchasing power.

- Customer Experience Enhancement: By seamlessly blending logistics and financial services, Allegro elevates the overall customer experience, setting a higher benchmark that rivals must strive to meet through their own service development.

- Market Pressure: Allegro's integrated approach creates a barrier to entry and intensifies rivalry, compelling competitors to invest heavily in technology and infrastructure to offer comparable end-to-end solutions.

Market Growth and Innovation Pace

The Polish e-commerce landscape is experiencing robust expansion, with forecasts suggesting a 10-15% growth rate for 2025. This vibrant market expansion acts as a magnet for new entrants and compels established players to continuously enhance their offerings.

This dynamic environment fuels intense competitive rivalry as companies strive to capture market share through innovation.

- Rapid Market Growth: Projected 10-15% growth in Polish e-commerce for 2025.

- Attracting New Players: High growth incentivizes new businesses to enter the market.

- Innovation Drivers: Focus on mobile commerce, social commerce, and AI integration.

- Intensified Rivalry: Constant need for differentiation and improved customer experience.

Allegro's dominant 45%-50% market share in Poland as of 2024 fuels intense competition, as rivals like Amazon, Temu, and Shein aggressively vie for customers. Local players such as OLX and Ceneo also present significant challenges, particularly with niche offerings and price-sensitive segments. The recent market entry of Kaufland Poland in August 2024 further escalates this rivalry, leveraging its physical store presence to capture market share.

| Competitor | Market Entry/Activity | Competitive Strategy |

|---|---|---|

| Amazon | Official entry March 2021 | Vast resources, established logistics |

| Temu & Shein | Rapidly gaining traction | Aggressive pricing, extensive product selection |

| OLX & Ceneo | Established local presence | Niche markets, price-sensitive consumers |

| Kaufland Poland | Entry August 2024 | Leveraging physical retail footprint |

SSubstitutes Threaten

Despite the continued rise of e-commerce, traditional brick-and-mortar retail stores persist as a viable substitute for online purchasing, especially for items like home furnishings and gardening supplies. Consumers still value the ability to physically examine products before buying and appreciate the immediate availability and personal interaction that physical stores provide. For instance, in 2024, while online retail sales continued to grow, physical stores still accounted for a substantial portion of total retail revenue, demonstrating their enduring appeal.

Many brands are now channeling significant investment into their own direct-to-consumer (DTC) e-commerce websites. This strategy allows them to bypass traditional marketplaces and engage customers directly, creating a powerful substitute channel.

These DTC platforms offer unique advantages, such as exclusive product lines and tailored brand experiences, fostering a direct connection with consumers. For instance, in 2024, the global DTC e-commerce market was projected to reach $323 billion, demonstrating its growing importance as an alternative to third-party platforms.

Specialized online retailers present a significant threat of substitution for general marketplaces like Allegro. For instance, in 2024, the European online fashion market, dominated by players like Zalando, saw continued growth, with Zalando reporting a revenue of approximately €4.1 billion for 2023, showcasing the appeal of niche expertise.

These focused platforms often cultivate a loyal customer base by offering a curated selection and a more personalized shopping journey, which can be difficult for broad-based marketplaces to replicate across all product categories. This deep specialization allows them to cater to specific consumer needs and preferences more effectively.

Social Commerce and Emerging Channels

The increasing prevalence of social commerce, allowing direct purchases within platforms like TikTok and Instagram, poses a significant threat of substitutes. This model capitalizes on influencer marketing and user-generated content, providing a frictionless path to purchase that bypasses traditional e-commerce sites. For instance, TikTok's e-commerce ventures have seen substantial growth, with projections indicating a significant increase in its share of the global social commerce market in the coming years.

These emerging channels offer an alternative shopping experience, often driven by impulse and trend-following, which can divert customer attention and spending from established players. The seamless integration of discovery and transaction within social feeds creates a compelling substitute for more deliberate online shopping journeys. By 2024, social commerce is expected to represent a notable percentage of total e-commerce sales globally, highlighting its growing competitive influence.

- Social Commerce Growth: Platforms like TikTok and Instagram are increasingly facilitating direct in-app purchases.

- Influencer and UGC Impact: These channels leverage trusted influencers and user content to drive sales.

- Seamless Experience: Customers can buy without leaving their preferred social media applications.

- Market Share: Social commerce is projected to capture a growing segment of the overall e-commerce market by 2024.

Subscription Services and Local Delivery Apps

For certain goods, especially groceries and everyday household items, subscription box services and local rapid-delivery applications present a significant threat of substitution. These alternatives focus on delivering specific items conveniently and quickly, offering a different value proposition compared to a broad marketplace model.

These services can siphon off demand for regularly purchased items, impacting Allegro Porter's overall transaction volume. For instance, the grocery delivery market in Poland saw substantial growth, with platforms like Glovo and Wolt expanding their offerings, making it easier for consumers to bypass traditional marketplaces for their immediate needs. In 2023, the e-grocery market in Poland was estimated to be worth over PLN 10 billion, indicating a strong consumer shift towards convenient delivery options.

- Convenience Factor: Subscription services and local apps offer unparalleled convenience for recurring purchases, directly competing with Allegro Porter's broader selection.

- Speed of Delivery: Quick-delivery apps can fulfill immediate needs faster than traditional e-commerce models, appealing to consumers seeking instant gratification.

- Market Share Erosion: The increasing popularity of these specialized services can lead to a gradual erosion of Allegro Porter's market share for frequently bought goods.

- Consumer Behavior Shift: A growing segment of consumers is prioritizing speed and ease for specific purchases, potentially altering long-term shopping habits.

The threat of substitutes for Allegro is multifaceted, encompassing traditional retail, direct-to-consumer (DTC) channels, specialized online retailers, social commerce, and convenience-focused delivery services. Each of these alternatives offers a distinct value proposition that can divert consumer spending and attention away from Allegro's platform.

For example, while e-commerce continues its upward trajectory, physical stores remain relevant, particularly for experiential purchases. In 2024, brick-and-mortar sales still represented a significant portion of total retail revenue, underscoring their enduring appeal. Simultaneously, the global DTC e-commerce market was projected to reach $323 billion in 2024, highlighting brands' efforts to bypass intermediaries.

Specialized online retailers, such as Zalando in the fashion sector, which reported approximately €4.1 billion in revenue for 2023, offer curated selections and personalized experiences that can be more appealing than broad marketplaces. Furthermore, social commerce, driven by platforms like TikTok and Instagram, provides a frictionless path to purchase, with its share of global e-commerce sales expected to grow notably by 2024.

Finally, subscription boxes and rapid-delivery apps cater to the demand for convenience, especially for groceries and household staples. The Polish e-grocery market, valued at over PLN 10 billion in 2023, demonstrates a clear consumer shift towards these convenient alternatives, impacting Allegro's transaction volume for everyday items.

| Substitute Channel | Key Characteristics | 2024 Relevance/Data Point |

|---|---|---|

| Traditional Retail | Physical examination, immediate availability, personal interaction | Significant portion of total retail revenue |

| Direct-to-Consumer (DTC) | Exclusive products, tailored brand experiences | Global market projected to reach $323 billion |

| Specialized Online Retailers | Curated selection, niche expertise, personalized journey | Zalando's 2023 revenue: ~€4.1 billion |

| Social Commerce | Influencer marketing, user-generated content, in-app purchases | Growing share of global e-commerce sales |

| Convenience Delivery Services | Speed, convenience for recurring purchases | Polish e-grocery market > PLN 10 billion (2023) |

Entrants Threaten

Building a competitive e-commerce platform similar to Allegro demands significant upfront capital. This includes investing heavily in sophisticated technology, establishing a widespread and efficient logistics network, and developing secure payment processing capabilities. For instance, in 2023, Allegro continued to expand its network of Allegro One Boxes, a key component of its logistics infrastructure, further solidifying its competitive advantage.

Allegro's existing infrastructure, such as its extensive parcel locker network and its 'One Fulfillment' service, presents a formidable hurdle for potential new entrants. These established assets represent a substantial barrier to entry, requiring new players to commit immense financial resources to replicate or even approach Allegro's operational scale and efficiency.

Allegro benefits from powerful network effects, a significant barrier for new entrants. With 21 million active buyers across its markets as of Q1 2025, the platform becomes highly attractive to sellers. This large buyer base, in turn, draws in more sellers, who in 2024 numbered over 135,000 active participants, offering a vast product selection.

This creates a self-reinforcing cycle: more buyers attract more sellers, and more sellers with diverse offerings attract even more buyers. Replicating this established ecosystem, with its critical mass of both buyers and sellers, presents a substantial challenge for any new competitor attempting to enter the market.

Allegro's formidable brand recognition, honed over two decades as Poland's e-commerce leader, presents a significant barrier to new entrants. A 2024 report indicated that 86% of Polish consumers recognize the Allegro brand, a testament to its deep market penetration and established trust.

The Allegro Smart! loyalty program further solidifies this advantage by fostering strong customer relationships and repeat business. New competitors must invest heavily in marketing and customer acquisition to even begin to rival Allegro's established brand affinity and loyalty, a task that is exceptionally difficult and costly.

Regulatory and Compliance Hurdles

The e-commerce landscape is heavily influenced by stringent and ever-changing regulatory frameworks. For instance, the General Data Protection Regulation (GDPR) in the EU mandates robust data protection measures, requiring significant investment in compliance infrastructure and ongoing legal counsel. This complexity acts as a deterrent for potential new entrants who may lack the resources to navigate these requirements effectively.

Tax and customs regulations, such as DAC7 which mandates reporting for digital platform operators, add another layer of complexity and cost. Adapting to these rules necessitates specialized software and dedicated personnel, creating a substantial financial barrier. These compliance costs can easily run into tens of thousands of euros annually, making it challenging for smaller startups to compete with established players.

The cumulative effect of these regulatory and compliance hurdles significantly raises the cost of entry for new businesses in the e-commerce sector. This can limit the number of new players entering the market, thereby reducing competitive pressure.

- GDPR compliance: Significant investment in data security and privacy protocols.

- DAC7 reporting: Increased administrative burden and potential penalties for non-compliance.

- Evolving tax laws: Constant need for adaptation to new VAT and customs regulations across different markets.

- Compliance costs: Can represent a substantial percentage of initial operating budgets for new entrants.

Intense Competition from Established Players

The threat of new entrants in the Polish e-commerce landscape is significantly tempered by the sheer dominance of established players. Allegro, a household name, commands a substantial market share, making it incredibly difficult for newcomers to gain traction. For instance, in 2023, Allegro's gross merchandise value (GMV) reached PLN 45.9 billion, highlighting its entrenched position.

New entrants face the daunting task of not only building brand recognition but also overcoming the loyalty and trust that consumers have placed in existing platforms. Global giants like Amazon are also expanding their presence in Poland, further intensifying the competitive environment. In 2024, Amazon continued its aggressive expansion, investing in logistics and marketing to capture a larger slice of the Polish online retail market.

This intense competition means that any new entrant must possess substantial capital, innovative strategies, and a clear value proposition to even stand a chance. The barriers to entry are high, requiring significant investment in technology, marketing, and logistics to compete effectively with players who have years of operational experience and established customer bases.

- Market Saturation: The Polish e-commerce market is already crowded, with consumers having multiple established options.

- Brand Loyalty: Allegro, in particular, benefits from strong brand recognition and customer loyalty built over many years.

- Capital Requirements: New entrants need significant financial resources to compete on price, selection, and marketing against established giants.

- Logistical Infrastructure: Building a robust and efficient delivery network is a major hurdle that existing players have already overcome.

The threat of new entrants to Allegro's market is significantly reduced by substantial capital requirements. Building a competitive e-commerce platform demands massive investment in technology, logistics, and secure payment systems. For example, Allegro's continued investment in its Allegro One Boxes in 2023 underscored the scale of infrastructure needed.

Established players like Allegro benefit from strong network effects, where a large buyer base attracts more sellers, creating a self-reinforcing cycle. With 21 million active buyers and over 135,000 active sellers in 2024, replicating this critical mass is a major challenge for newcomers.

Regulatory hurdles, including GDPR and DAC7 reporting, add significant compliance costs, estimated to be tens of thousands of euros annually, which can deter smaller startups. Furthermore, Allegro's strong brand recognition, with 86% consumer recognition in Poland in 2024, and loyalty programs like Allegro Smart! necessitate extensive marketing investment for new entrants to gain traction.

The Polish e-commerce market is already saturated, with Allegro holding a dominant position, evidenced by its PLN 45.9 billion GMV in 2023. Increased competition from global players like Amazon in 2024 further raises the bar, requiring substantial capital and innovative strategies for any new entrant to succeed.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Allegro leverages data from Allegro's own investor relations disclosures, reputable financial news outlets like Bloomberg and Reuters, and industry-specific market research reports to provide a comprehensive view of the e-commerce landscape.