Allcargo Logistics PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Allcargo Logistics Bundle

Navigate the complex external forces shaping Allcargo Logistics with our expert-crafted PESTEL Analysis. Understand the political, economic, social, technological, environmental, and legal factors influencing its operations and future growth. This comprehensive analysis is your key to unlocking strategic advantages and making informed decisions. Download the full version now for actionable intelligence.

Political factors

The Indian government's commitment to boosting the logistics sector is a major political factor. Initiatives like the National Logistics Policy (NLP) and the PM Gati Shakti National Master Plan are designed to create a more integrated and efficient logistics ecosystem.

These policies focus on developing multimodal infrastructure, leveraging digital technologies, and ultimately reducing logistics costs. The goal is to bring these costs down from the current 13-14% of GDP to a more competitive 8%, thereby enhancing the global competitiveness of Indian exports.

Furthermore, the government's emphasis on data-driven decision-making and inter-ministerial coordination through these plans provides a supportive framework for companies like Allcargo Logistics to operate and grow.

The Union Budget 2024-2025 allocates a significant Rs 11.11 lakh crore towards capital expenditure, with a substantial portion earmarked for infrastructure upgrades, including national highways and port modernization. This focus on enhancing physical connectivity directly supports the logistics industry.

These infrastructure investments are designed to create a more efficient ecosystem for goods movement, aiming to reduce transit times and logistics costs, which are critical for companies like Allcargo Logistics. The development of multimodal logistics parks (MMLPs) is particularly important, as it facilitates seamless integration of different transport modes.

For Allcargo Logistics, a key player in integrated logistics, these government initiatives translate into a more streamlined operational environment. Improved road and port infrastructure means faster turnaround times for shipments and reduced handling complexities, ultimately boosting efficiency and competitiveness.

The Indian government's strong push for Public-Private Partnerships (PPPs) in infrastructure development, particularly for logistics parks, is a significant political factor. This strategy aims to harness private sector efficiency and investment to upgrade and expand the nation's logistics capabilities. For instance, the National Logistics Policy, unveiled in 2022, emphasizes private sector participation in creating integrated logistics infrastructure.

Allcargo Logistics, with its established presence in developing and operating logistics parks, is well-positioned to capitalize on this government initiative. The company's business model aligns directly with the government's objective of fostering collaborative growth in the logistics sector. This partnership approach is expected to accelerate the modernization and expansion of crucial logistics hubs, enhancing overall supply chain efficiency.

Regulatory Reforms and Ease of Doing Business

Recent government initiatives are significantly streamlining the logistics sector, directly benefiting companies like Allcargo Logistics. For instance, the Delhi Logistics and Warehousing Policy 2025 is designed to simplify tax structures, extend the period for assessment findings, and offer more flexible customs duty timelines. This aims to cut down on legal disputes and make compliance less burdensome for businesses. Such reforms are crucial for fostering a more stable and welcoming operational landscape for logistics providers.

These regulatory adjustments are expected to boost operational efficiency and predictability. Initiatives like Bharat Trade Net, which focuses on digital trade facilitation, are further enhancing these efforts. By simplifying processes and embracing digital solutions, the government is actively working to reduce the overall cost of doing business and improve the speed of trade, which is particularly advantageous for a company managing complex supply chains.

The impact of these changes can be seen in the broader economic outlook. For example, the Union Budget 2024-25 continued to emphasize infrastructure development and ease of doing business, with a projected capital expenditure of ₹11.11 lakh crore, a substantial increase from previous years. This focus on infrastructure directly supports logistics operations by improving connectivity and reducing transit times.

- Simplified Tax Laws: Reforms aim to reduce the complexity and compliance burden associated with tax regulations.

- Extended Assessment Timelines: Providing businesses with more time for tax assessments can reduce pressure and improve accuracy.

- Relaxed Customs Duty Timelines: This can improve cash flow and reduce the administrative burden for import/export operations.

- Digital Trade Facilitation: Initiatives like Bharat Trade Net enhance efficiency and transparency in cross-border trade.

Geopolitical Stability and Trade Agreements

Geopolitical stability significantly impacts global trade, a key driver for logistics companies like Allcargo Logistics. While ongoing geopolitical tensions can create volatility, initiatives aimed at strengthening supply chains offer potential upside. For instance, the proposed India-Middle East-Europe Economic Corridor (IMEEC), a project discussed in 2023 and continuing into 2024, aims to create a new trade route, potentially boosting international trade volumes and creating new avenues for logistics providers.

A stable political climate is crucial for attracting foreign direct investment (FDI) and fostering the growth of logistics infrastructure and services. Allcargo Logistics closely monitors these geopolitical developments, recognizing that improvements in global trade outlook and increased FDI can directly translate into higher demand for its services, supporting a recovery in global trade volumes. For example, India's FDI inflows reached $71 billion in 2023, indicating a positive trend in investment that benefits the logistics sector.

- Geopolitical Uncertainty: Ongoing global conflicts and trade disputes can disrupt supply chains and reduce overall trade activity.

- Trade Facilitation Efforts: Projects like the India-Middle East-Europe Economic Corridor (IMEEC) aim to streamline trade and create new routes, potentially benefiting logistics firms.

- FDI Impact: Political stability encourages foreign investment, which can lead to infrastructure development and increased demand for logistics services.

- Allcargo's Monitoring: The company actively tracks these trends to anticipate shifts in global trade volumes and identify new growth opportunities.

Government policies are actively reshaping India's logistics landscape, with initiatives like the National Logistics Policy and PM Gati Shakti Master Plan aiming to reduce costs from 13-14% to 8% of GDP by 2030. The Union Budget 2024-25's substantial capital expenditure of Rs 11.11 lakh crore, particularly for infrastructure, directly supports Allcargo Logistics by improving connectivity and operational efficiency. Furthermore, the government's push for Public-Private Partnerships in logistics infrastructure development, as highlighted by the National Logistics Policy, positions companies like Allcargo to leverage these collaborative growth opportunities.

Recent policy reforms, such as the Delhi Logistics and Warehousing Policy 2025, are simplifying tax structures and customs duty timelines, reducing compliance burdens and legal disputes for logistics providers. Digital trade facilitation initiatives like Bharat Trade Net are also enhancing efficiency and transparency. These measures are crucial for creating a more stable and predictable operational environment, directly benefiting Allcargo Logistics' complex supply chain operations.

Geopolitical stability remains a key consideration, with projects like the India-Middle East-Europe Economic Corridor (IMEEC) potentially opening new trade routes and boosting volumes for logistics firms. India's strong FDI inflows, reaching $71 billion in 2023, underscore a positive investment climate that benefits the logistics sector. Allcargo Logistics closely monitors these global trends to anticipate shifts and identify growth opportunities in international trade.

What is included in the product

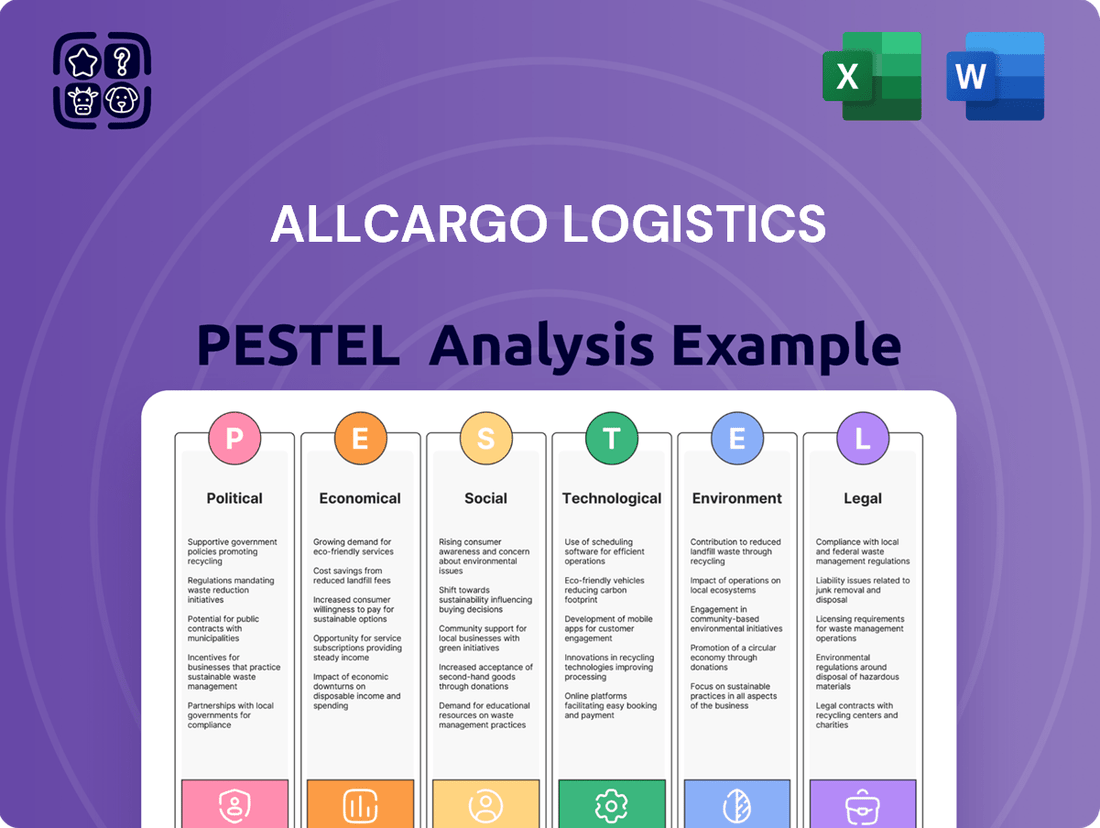

This PESTLE analysis examines the external macro-environmental factors influencing Allcargo Logistics across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights into market dynamics and regulatory landscapes, aiding strategic decision-making for stakeholders.

This PESTLE analysis for Allcargo Logistics acts as a pain point reliever by providing a clear, summarized version of external factors for easy referencing during strategic planning sessions.

It helps support discussions on external risks and market positioning, offering a concise framework that can be readily dropped into presentations or used for group alignment.

Economic factors

The global logistics market is on a strong upward trajectory, expected to grow from approximately USD 3,931.8 billion in 2024 to USD 5,951.0 billion by 2030, showcasing robust expansion. This significant market size offers substantial opportunities for companies like Allcargo Logistics.

India's logistics sector, a vital component of its economy, is also projected for considerable growth in 2025. This expansion is fueled by rising consumer demand and significant infrastructure investments, creating a favorable environment for Allcargo Logistics to capitalize on increased business volumes.

The e-commerce sector is experiencing a remarkable expansion, with global online sales projected to hit $7.4 trillion by 2025. This significant growth directly fuels a heightened demand for robust logistics and warehousing capabilities. Companies like Allcargo Logistics are well-positioned to capitalize on this trend by providing integrated supply chain solutions essential for the modern online retail environment.

The Indian industrial and logistics sector has experienced a robust inflow of private equity, demonstrating a compound annual growth rate of 20% between 2019 and 2024. This significant investment, with foreign investors being key contributors, underscores a strong belief in the sector's future growth prospects.

This favorable investment climate directly benefits Allcargo Logistics, providing the necessary capital to fuel its strategic expansion of logistics parks and the crucial modernization of its existing infrastructure. Such capital expenditure is vital for enhancing operational efficiency and competitiveness.

Logistics Cost Reduction Initiatives

The Indian government's National Logistics Policy, launched in 2022, targets a substantial reduction in logistics costs, aiming to bring them down from the current 13-14% of GDP to below 8% by 2030. This initiative is a significant economic factor that directly impacts companies like Allcargo Logistics. By lowering these costs, India's products become more competitive globally, a direct benefit for exporters and importers alike.

For logistics providers such as Allcargo Logistics, these cost reductions translate into improved profit margins and the ability to offer more competitive pricing. This enhanced efficiency can be a powerful tool for attracting new clients and expanding market share. For instance, if Allcargo can optimize its operations to benefit from these policy-driven efficiencies, it could lead to a more attractive service offering compared to competitors.

- Reduced GDP Percentage: Aim to decrease logistics costs from 13-14% of India's GDP to under 8% by 2030.

- Global Competitiveness: Lower costs enhance the competitiveness of Indian goods in international markets.

- Profitability Boost: Logistics companies can see improved profit margins due to operational efficiencies.

- Pricing Advantage: Allcargo Logistics can leverage these gains to offer more competitive pricing and secure new business opportunities.

Company Financial Performance

Allcargo Logistics demonstrated robust top-line growth in FY25, with consolidated revenue reaching Rs 16,021.53 crore, a significant 23.54% increase year-on-year. This strong performance was further evidenced by a 18% year-on-year jump in consolidated revenue to Rs 3,952 crore in Q4FY25.

Despite a net loss in the March 2025 quarter, the company's operational segments showcased promising trends. The contract logistics division was a standout performer, achieving an impressive 48% growth. Additionally, the express business reported improvements in both revenue and EBITDA, signaling effective operational strategies and focused growth initiatives.

- FY25 Consolidated Revenue: Rs 16,021.53 crore (up 23.54% YoY)

- Q4FY25 Consolidated Revenue: Rs 3,952 crore (up 18% YoY)

- Contract Logistics Growth: 48%

- Express Business: Revenue and EBITDA improvements

India's economic growth is a significant tailwind for Allcargo Logistics. The nation's GDP is projected to grow by over 6.5% in FY25, driving increased trade volumes and demand for logistics services. Furthermore, inflation, while a concern, is expected to moderate, potentially leading to lower interest rates which can reduce borrowing costs for infrastructure development and expansion projects.

| Economic Factor | Projection/Data (2024-2025) | Impact on Allcargo Logistics |

| India GDP Growth | Over 6.5% (FY25) | Increased trade volumes, higher demand for logistics |

| Inflation | Moderating trend | Potential for lower borrowing costs, improved consumer spending |

| Interest Rates | Expected to stabilize or decrease | Reduced capital expenditure costs, enhanced investment attractiveness |

What You See Is What You Get

Allcargo Logistics PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, detailing the Allcargo Logistics PESTLE Analysis.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, offering a comprehensive look at the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Allcargo Logistics.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights into the external landscape for Allcargo Logistics.

Sociological factors

Consumers, fueled by the rapid growth of e-commerce and quick commerce, now expect near-instantaneous delivery. This shift means services that used to be considered premium, like same-day or even same-hour delivery, are becoming the norm, especially in urban centers. For instance, the quick commerce market in India, a key area for logistics, saw significant expansion in 2024, with companies aiming for delivery times under 30 minutes.

This escalating demand for speed puts immense pressure on logistics providers like Allcargo Logistics to optimize their last-mile operations and warehouse networks. Companies are investing heavily in technology and infrastructure to reduce transit times, from advanced route planning software to strategically located micro-fulfillment centers. Reports from 2024 indicated a substantial increase in venture capital funding for logistics tech startups focused on last-mile efficiency.

Consequently, Allcargo Logistics needs to continuously innovate its service portfolio to align with these evolving consumer expectations. This involves not only adapting existing services but also exploring new models that prioritize speed and convenience, potentially through partnerships or direct investment in faster delivery capabilities. The company’s ability to meet these demands will be a critical differentiator in the competitive logistics landscape of 2025.

The logistics sector, including companies like Allcargo Logistics, is grappling with persistent workforce shortages, particularly for essential roles like truck drivers and warehouse staff. This scarcity has driven up wages, with reports indicating a significant increase in driver compensation in many regions during 2024. Addressing this requires sustained investment in training to ensure employees possess up-to-date digital, operational, and safety competencies.

Allcargo Logistics actively invests in comprehensive training and development programs, coupled with a strong focus on employee well-being. This strategy aims to attract and retain talent, mitigating the impact of labor market dynamics and ensuring a skilled workforce capable of meeting evolving industry demands.

Rapid urbanization, particularly in emerging economies, significantly boosts demand for freight movement within cities. This necessitates efficient urban logistics and warehousing solutions, influencing the strategic placement and design of logistics hubs and distribution centers to manage increased last-mile delivery volumes. For instance, India's urban population is projected to reach 675 million by 2035, a substantial increase that will strain existing infrastructure.

Allcargo Logistics must adapt by developing infrastructure tailored to serve these expanding urban areas, including innovative solutions for traffic decongestion and more localized warehousing. The company's 2024-2025 strategy likely involves investing in smaller, strategically located urban fulfillment centers to reduce transit times and operational costs associated with dense city environments.

Increased Focus on MSME Inclusion

Government policies in 2024 and 2025 are increasingly focused on integrating Micro, Small, and Medium Enterprises (MSMEs) into the national logistics framework. This includes initiatives to improve their access to credit and streamline digital processes for onboarding, aiming to boost their participation in supply chains.

This growing emphasis on MSME inclusion presents a significant opportunity for integrated logistics providers like Allcargo Logistics. By catering to this expanding segment, the company can broaden its client base and tap into new revenue streams, particularly as these businesses grow and require more sophisticated logistics solutions.

- Government Support for MSMEs: As of early 2025, several government schemes offer subsidized loans and digital platforms to facilitate MSME entry into formal logistics networks.

- Market Expansion: The MSME sector, a vital contributor to India's GDP, represents a substantial, often underserved, market for logistics services.

- Strategic Partnerships: Allcargo Logistics can develop specialized service packages, potentially including last-mile delivery solutions and warehousing, designed to meet the unique needs of MSMEs.

- Digital Integration: Offering user-friendly digital portals for booking, tracking, and payment can significantly lower barriers to entry for smaller businesses.

Workforce Diversity and Safety Standards

The logistics industry is experiencing a significant push towards greater workforce diversity and stricter safety standards. This is driven by a growing recognition that varied perspectives enhance innovation and that employee well-being is paramount for operational continuity. Allcargo Logistics, like its peers, is investing in comprehensive training and rigorous safety protocols to safeguard its employees and uphold its operational integrity.

For instance, a 2024 report indicated that companies with diverse leadership teams are 35% more likely to achieve above-average financial returns. In parallel, the International Labour Organization reported in 2023 that improved safety measures can reduce workplace accidents by up to 20%. Allcargo Logistics' commitment in these areas is therefore crucial for attracting and retaining top talent, as well as ensuring responsible and sustainable business practices.

- Diversity Initiatives: Allcargo Logistics is enhancing recruitment strategies to attract a broader range of candidates, focusing on gender, age, and background representation.

- Safety Training: The company is expanding its safety training modules, incorporating advanced techniques for handling hazardous materials and operating heavy machinery, with a target of 95% employee completion rates by end of 2025.

- Compliance and Standards: Adherence to global safety benchmarks, such as ISO 45001 for occupational health and safety, is being reinforced across all operational sites.

- Employee Well-being Programs: Introduction of mental health support and ergonomic assessments aims to create a more supportive and safe working environment, contributing to a projected 15% reduction in reported minor injuries by 2025.

Societal trends are significantly reshaping the logistics landscape, with a growing emphasis on sustainability and ethical business practices. Consumers and business partners alike are increasingly scrutinizing companies' environmental impact and social responsibility, influencing purchasing decisions and investment strategies. Allcargo Logistics must therefore integrate robust ESG (Environmental, Social, and Governance) principles into its operations to maintain its competitive edge and stakeholder trust.

Technological factors

The Indian logistics sector is rapidly embracing digital transformation, with AI and ML becoming central to operations. This integration allows for sophisticated predictive analytics, more accurate demand forecasting, and optimized routing, all of which directly impact efficiency and cost reduction. For instance, AI-powered route optimization can reduce fuel consumption by up to 15% in complex urban environments.

Allcargo Logistics is actively pursuing digitalization, placing a strong emphasis on data security throughout its operations. This strategic focus is crucial as the company leverages technology to enhance its service offerings and streamline its supply chain management, aiming to stay ahead in a competitive and increasingly tech-dependent market.

The Internet of Things (IoT) is fundamentally reshaping logistics by offering unprecedented real-time visibility across the supply chain. This technology enables the precise tracking of shipments, continuous monitoring of critical conditions such as temperature and humidity, and the proactive identification and resolution of potential disruptions. For instance, by 2024, the global IoT market in logistics is projected to reach over $75 billion, underscoring its growing importance.

This enhanced transparency directly translates to more efficient inventory management, reducing waste and improving stock accuracy. Furthermore, IoT implementation bolsters supply chain resilience by providing immediate alerts for deviations, allowing for swift corrective actions. Allcargo Logistics can significantly benefit from adopting IoT solutions to gain tighter control over its operations and boost overall efficiency, potentially seeing a reduction in transit times by up to 15% according to industry reports.

Automation and robotics are increasingly vital for warehouse operations, boosting productivity and efficiency while helping to overcome labor shortages. By 2025, it's projected that around 25% of warehouse tasks could be automated, significantly streamlining processes.

This trend offers Allcargo Logistics a prime opportunity to invest in advanced technologies for a competitive edge. Enhanced throughput and operational efficiency are direct benefits of integrating these systems, allowing for quicker order fulfillment and reduced errors.

Adoption of Digital Twins and Blockchain

The logistics industry is beginning to embrace digital twins, which are virtual replicas of physical assets like warehouses. These digital models allow for real-time simulation of operations, helping companies like Allcargo Logistics identify potential bottlenecks and optimize workflows before physical implementation. For instance, a simulated warehouse environment can test different inventory management strategies to find the most efficient layout and process flow.

Blockchain technology is also making inroads into warehouse management, offering enhanced security and transparency. By creating an immutable ledger for transactions and data, blockchain reduces the risk of fraud and errors in supply chain operations. This technology can streamline processes such as customs clearance and proof of delivery, increasing overall efficiency and trust among partners.

The adoption of these technologies is expected to drive significant improvements in operational efficiency and cost reduction within the logistics sector. By 2025, the global market for digital twins in manufacturing and logistics is projected to reach billions of dollars, indicating a strong trend towards virtualized and data-driven operations. Blockchain in supply chain management is also anticipated to see substantial growth, with estimates suggesting a market value in the tens of billions by the mid-2020s.

- Digital Twins: Virtual models of warehouses for process simulation and optimization.

- Blockchain: Enhancing security, efficiency, and accuracy in warehouse transactions and data management.

- Market Growth: Digital twin market in logistics projected for significant expansion by 2025.

- Blockchain Impact: Expected to boost transparency and reduce errors in supply chain operations.

Technology-driven Last-Mile Delivery Innovations

The surge in quick commerce is compelling logistics firms like Allcargo Logistics to innovate rapidly in last-mile delivery. This includes adopting automated warehousing solutions and AI for personalized customer experiences, aiming to shave precious minutes off delivery times. For instance, the global last-mile delivery market is projected to reach $347.1 billion by 2030, a significant jump from its 2022 valuation, highlighting the immense growth and investment in this sector.

These technological advancements are crucial for Allcargo Logistics to maintain a competitive edge. Investment in technology platforms for real-time fleet monitoring, sophisticated stock forecasting, and optimized last-mile delivery routes are becoming standard. By integrating these, Allcargo can significantly boost the efficiency and speed of its express logistics operations.

- Automated Warehousing: Enhancing sorting and dispatch speeds, potentially reducing order fulfillment times by up to 30%.

- AI-driven Personalization: Improving customer engagement and delivery slot accuracy, leading to higher satisfaction rates.

- Fleet Monitoring & Optimization: Real-time tracking and route planning can cut delivery times by 10-15% and reduce fuel costs.

- Stock Forecasting: Predictive analytics minimize stockouts and overstocking, ensuring faster dispatch of goods.

Technological advancements are profoundly reshaping the logistics landscape, with AI and IoT driving efficiency. By 2025, automation is expected to handle a significant portion of warehouse tasks, boosting productivity. Allcargo Logistics' focus on digitalization, including data security, positions it to leverage these innovations for competitive advantage.

| Technology | Impact | Projected Growth/Adoption (by 2025) |

|---|---|---|

| AI/ML | Optimized routing, demand forecasting, predictive analytics | Integral to operations; fuel savings up to 15% |

| IoT | Real-time visibility, condition monitoring, supply chain resilience | Global market projected over $75 billion |

| Automation/Robotics | Increased warehouse productivity, overcoming labor shortages | Up to 25% of warehouse tasks automated |

| Digital Twins | Process simulation, bottleneck identification, workflow optimization | Market projected in billions of dollars |

| Blockchain | Enhanced security, transparency, fraud reduction in transactions | Market value in tens of billions |

Legal factors

The National Logistics Policy (NLP), introduced in 2022, establishes a robust legal and regulatory backbone for India's logistics sector, aiming to cut logistics costs from the current 13-14% of GDP to below 10% by 2030. This policy champions digitalization and multimodal transport, directly influencing Allcargo Logistics by simplifying compliance and paving the way for more integrated and efficient supply chain solutions.

Key regulatory frameworks under the NLP, such as the Unified Logistics Interface Platform (ULIP), are designed to reduce paperwork and improve transparency, creating a more conducive environment for logistics providers like Allcargo. By addressing existing bottlenecks and promoting inter-state movement of goods, these legal changes are expected to boost operational efficiency and potentially expand market access for the company.

Government budgets, like the anticipated Union Budget 2025, are expected to introduce measures aimed at simplifying tax laws and expediting customs duty processes. These reforms are vital for logistics companies like Allcargo, particularly those engaged in bulk imports and international trade, as they can substantially lower compliance costs and streamline operations.

Adapting to these evolving tax and customs regulations is paramount for Allcargo Logistics to optimize its financial performance. For instance, a reduction in customs clearance times, even by a few days, can unlock significant working capital, as evidenced by the logistics sector's reliance on efficient cash flow. The government's focus on digitalizing customs procedures, a trend likely to be amplified in 2025, further underscores the need for technological integration within Allcargo's compliance framework.

Global and domestic environmental regulations are tightening, impacting logistics. For instance, the EU Emissions Trading Scheme (EU ETS) now includes maritime shipping, forcing companies to account for carbon emissions. In India, the Ecomark Rules 2024 are pushing for better waste management and eco-friendly product standards.

Allcargo Logistics must navigate these evolving environmental compliance requirements across its international and domestic operations. This means adhering to stricter emission standards for its fleet and implementing robust waste management protocols to minimize its ecological footprint and avoid potential penalties.

Labor Laws and Workforce Safety Standards

The logistics industry, including Allcargo Logistics, must navigate a complex web of labor laws. These regulations cover everything from minimum wage requirements and working hours to ensuring a safe working environment for all employees. In 2024, many regions are seeing increased scrutiny on fair employment practices and the rights of gig economy workers, which could impact staffing models.

Workforce safety standards are paramount in logistics due to the inherent risks involved in handling goods and operating vehicles. Compliance with occupational safety and health administration (OSHA) or equivalent bodies' guidelines is non-negotiable. For instance, in 2023, transportation and warehousing sectors continued to report significant injury rates, underscoring the need for rigorous safety protocols and continuous training to mitigate risks and prevent accidents.

- Adherence to minimum wage laws and overtime regulations is critical, with potential adjustments in 2024 impacting labor costs.

- Robust safety training programs are essential to reduce workplace accidents, which in the transportation and warehousing sector saw a notable injury incidence rate in recent years.

- Compliance with regulations regarding driver hours of service and rest periods directly affects operational efficiency and driver retention.

- The evolving legal landscape around employee classification, particularly for contract drivers, presents compliance challenges and potential cost implications.

Local and State-Specific Policies

Local and state-specific policies significantly shape Allcargo Logistics' operational landscape. For instance, the Delhi Logistics and Warehousing Policy 2025 aims to foster efficiency by permitting 24x7 operations in logistics parks, necessitating amendments to existing local legislation. This policy also focuses on streamlining the licensing process for warehouse operators.

Allcargo Logistics must actively monitor and adapt to these evolving regional regulations to ensure compliance and capitalize on opportunities presented by localized policy shifts, particularly concerning its logistics park developments and day-to-day operations within these specific jurisdictions.

- Delhi Logistics and Warehousing Policy 2025: Enables 24x7 operations in logistics parks.

- License Simplification: Aims to reduce red tape for warehouse operators.

- Compliance Requirement: Allcargo Logistics must adhere to these localized rules for its parks.

- Operational Impact: Policy changes can directly affect efficiency and cost of operations.

The National Logistics Policy (NLP) of 2022 is a cornerstone, aiming to reduce India's logistics costs from 13-14% of GDP to under 10% by 2030, directly benefiting Allcargo by streamlining operations through digitalization and multimodal transport initiatives.

Government budgets, such as the anticipated Union Budget 2025, are expected to further simplify tax laws and customs procedures, crucial for Allcargo's international trade operations by lowering compliance burdens and improving cash flow.

Environmental regulations are increasingly stringent; the EU ETS now covers maritime shipping, and India's Ecomark Rules 2024 push for eco-friendly standards, requiring Allcargo to manage its fleet emissions and waste disposal carefully.

Labor laws, particularly concerning gig workers and fair employment practices, are under closer scrutiny in 2024, impacting Allcargo's staffing models and operational costs.

Environmental factors

The logistics sector, including major players like Allcargo Logistics, is witnessing a significant shift towards green logistics. This means a concerted effort to reduce environmental impact through practices like optimizing delivery routes to save fuel and emissions. For instance, by 2024, many companies are aiming to incorporate a substantial percentage of electric vehicles (EVs) into their last-mile delivery fleets, a trend Allcargo is likely to follow to meet evolving sustainability standards.

Beyond fleet management, the focus on sustainability extends to infrastructure. Allcargo Logistics, like its peers, is exploring and implementing renewable energy sources for its warehouses and distribution centers. This could involve solar panel installations or other green energy solutions, aiming to power operations with cleaner energy. Such initiatives are not just about environmental responsibility but also about long-term cost savings and compliance with increasingly stringent environmental regulations expected to be in place by 2025.

The global push for sustainability is significantly impacting logistics operations, with a notable trend towards adopting renewable energy sources like solar power for warehouses and distribution centers. This shift is driven by a dual benefit: reducing carbon emissions and achieving lower energy costs, thereby fostering a more sustainable and cost-effective supply chain. For instance, India has set an ambitious target to increase the use of renewable energy in its major ports to 60% by 2030, a move that will likely influence logistics providers like Allcargo Logistics.

Environmental concerns are increasingly driving policy, with a strong push for reduced carbon footprints in the logistics sector. This collaborative effort between public and private entities aims to curb emissions from transportation and warehousing activities.

Key regulations are already in place, such as the EU Emissions Trading System (ETS) for maritime shipping, which began covering maritime transport emissions in 2024, and India's Ecomark Rules, which encourage environmentally friendly products and services. These frameworks necessitate substantial cuts in greenhouse gas output.

Allcargo Logistics needs to embed these emission reduction targets directly into its core operational planning. For instance, by 2025, the International Maritime Organization (IMO) aims to have greenhouse gas emissions from international shipping at least 20% lower than in 2008, a benchmark Allcargo will need to align with for its sea freight operations.

Sustainable Packaging and Waste Management

Allcargo Logistics is increasingly prioritizing sustainable packaging and waste management. This focus aligns with global trends where companies are adopting recyclable materials and optimizing packaging to minimize their environmental footprint, contributing to circular economy principles within their logistics. For instance, the global sustainable packaging market was valued at approximately USD 270 billion in 2023 and is projected to reach over USD 400 billion by 2030, indicating a significant shift towards eco-friendly solutions.

These initiatives can bolster Allcargo Logistics' environmental, social, and governance (ESG) profile, appealing to environmentally conscious investors and customers. By implementing innovative waste reduction strategies and promoting the use of biodegradable or reusable packaging across its operations, the company can differentiate itself in a competitive market.

- Reduced Environmental Impact: Utilizing recyclable and biodegradable packaging materials directly cuts down on landfill waste and pollution.

- Circular Economy Integration: Promoting reusable packaging and closed-loop systems within logistics enhances resource efficiency.

- Enhanced Brand Reputation: Demonstrating a commitment to sustainability can improve customer loyalty and attract environmentally aware stakeholders.

- Operational Cost Savings: Optimized packaging can lead to reduced material usage and lower transportation costs due to lighter loads.

Development of Green Infrastructure and Corridors

Government policies are increasingly focused on developing green infrastructure and corridors to enhance sustainability. For instance, urban planning initiatives are actively promoting the creation of green freight corridors, which can streamline logistics while minimizing environmental impact. These policies aim to foster a cleaner and more resilient logistics ecosystem, directly supporting companies like Allcargo Logistics in their sustainability objectives.

The push towards greener transportation solutions is evident in the promotion of electric and compressed natural gas (CNG) vehicles, particularly for last-mile deliveries. This strategic shift is designed to significantly improve urban air quality and reduce congestion. By encouraging the adoption of these cleaner alternatives, governments are paving the way for a more environmentally conscious logistics sector.

- Government Investment: India's National Green Hydrogen Mission, launched in January 2023 with an outlay of ₹19,744 crore, signals a significant commitment to green energy, which can influence the future of logistics infrastructure.

- Urban Mobility Initiatives: Cities globally are investing in public transport and dedicated freight lanes, with examples like London's Ultra Low Emission Zone (ULEZ) impacting commercial vehicle operations and encouraging cleaner fleets.

- Logistics Sector Alignment: Allcargo Logistics can leverage these developments by integrating electric and CNG fleets, optimizing routes through green corridors, and potentially benefiting from incentives for sustainable operations, aligning with a projected 15% growth in India's logistics sector by 2025.

Environmental regulations are increasingly shaping the logistics landscape, pushing companies like Allcargo Logistics towards greener operations. This includes stricter emission standards for shipping, with the EU ETS impacting maritime transport from 2024, and a global push for reduced greenhouse gas emissions, aiming for a 20% reduction in international shipping by 2025 compared to 2008 levels.

Allcargo Logistics is actively integrating sustainable practices, from optimizing delivery routes to reduce fuel consumption and emissions to adopting renewable energy sources for its facilities. The company is also focusing on sustainable packaging, with the global market projected to exceed USD 400 billion by 2030, reflecting a significant industry-wide shift.

Government initiatives, such as India's National Green Hydrogen Mission with a ₹19,744 crore outlay, underscore a commitment to green energy that will influence logistics infrastructure. Furthermore, the promotion of electric and CNG vehicles for last-mile delivery is improving urban air quality and aligning with a projected 15% growth in India's logistics sector by 2025.

| Factor | Impact on Allcargo Logistics | Key Data/Trend |

| Emissions Regulations | Necessitates reduction in GHG output from shipping and road transport. | EU ETS for maritime shipping from 2024; IMO target of 20% GHG reduction by 2025. |

| Renewable Energy Adoption | Drives investment in solar and other green energy for warehouses. | India's ports target 60% renewable energy by 2030. |

| Sustainable Packaging | Encourages use of recyclable and biodegradable materials. | Global sustainable packaging market to exceed USD 400 billion by 2030. |

| Green Infrastructure | Promotes electric/CNG vehicles and green freight corridors. | India's logistics sector projected to grow 15% by 2025; National Green Hydrogen Mission outlay ₹19,744 crore. |

PESTLE Analysis Data Sources

Our Allcargo Logistics PESTLE Analysis draws upon a comprehensive blend of data from reputable sources including government publications, international economic bodies like the World Bank and IMF, and leading logistics industry reports. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.