Allcargo Logistics Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Allcargo Logistics Bundle

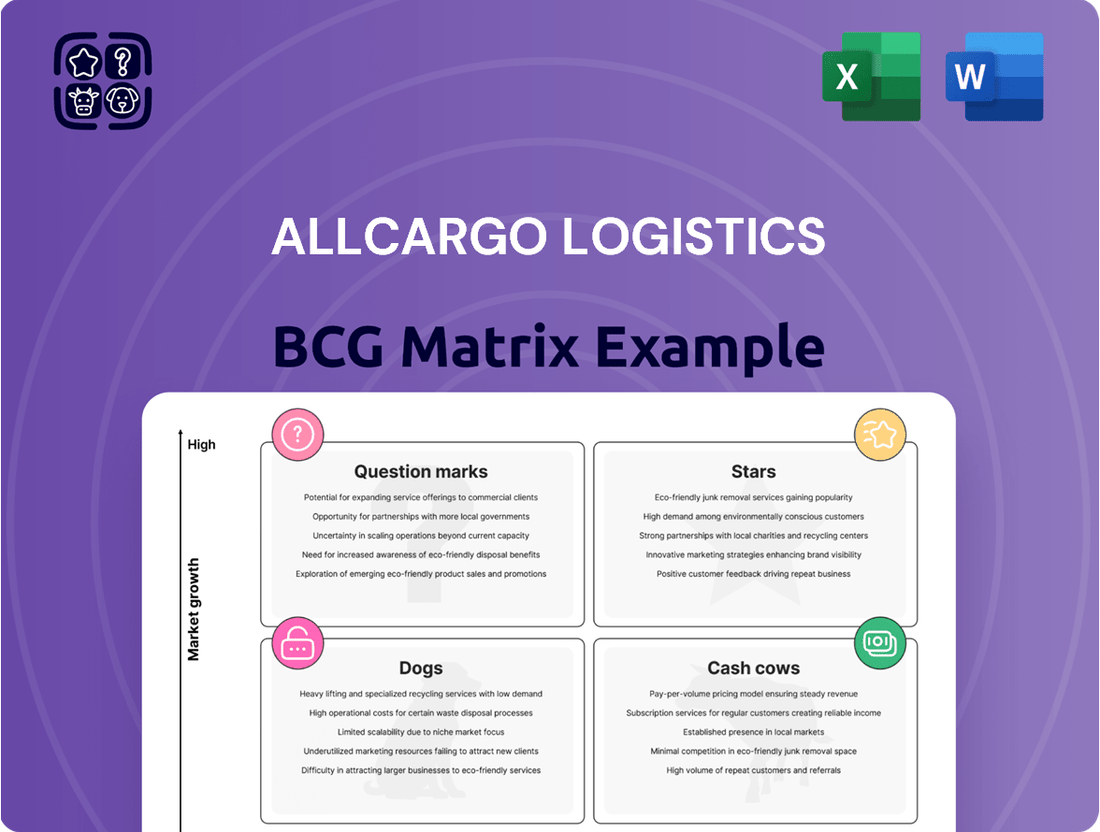

Curious about Allcargo Logistics' strategic positioning? Our BCG Matrix preview offers a glimpse into their market performance, highlighting areas of strength and potential challenges.

Don't miss out on the full picture; purchase the complete BCG Matrix report to unlock detailed quadrant placements, understand the dynamics of their business units, and gain actionable insights for future growth and investment decisions.

Stars

Allcargo's contract logistics business is a star performer, demonstrating robust expansion. In Q3 FY25, this segment achieved an impressive 62% quarter-on-quarter external revenue growth. This surge is a direct result of successfully onboarding new clients and deepening relationships with existing ones, leading to increased business volume.

The strategic move to acquire the remaining stake in ASCPL in March 2023 further solidifies Allcargo's dominance in this lucrative sector. This consolidation is key to capitalizing on the ongoing high-growth trajectory of the contract logistics market.

The Express Business, operating as Gati Express Supply Chain (GESCPL) under Allcargo Logistics, demonstrates strong growth potential. In Q3 FY25, it achieved its highest quarterly volume ever, alongside a 3.8% increase in external revenue compared to the previous year's same quarter. This upward trajectory is further bolstered by its integration with the ONDC Network in June 2025, a move designed to expand its customer base and capture a larger share of the burgeoning Indian e-commerce logistics market.

Allcargo Logistics' Air Freight Services are clearly positioned as a Star in its BCG Matrix. The company experienced a remarkable 30% year-over-year increase in air freight volumes for FY25, reaching 33.63 million kilos. This robust growth, particularly the 51% surge in Q4 FY25 compared to the prior year's fourth quarter, highlights its strong market presence in a rapidly expanding sector.

International Supply Chain (ISC) Segment

The International Supply Chain (ISC) segment demonstrated robust performance in Q3 FY25, with revenue climbing 30.2% to INR 35,443.4 million from INR 27,213.7 million in the prior year period. This growth was supported by increased volumes in both Less than Container Load (LCL) and Full Container Load (FCL) services.

Despite navigating global geopolitical uncertainties that introduced some market volatility, the ISC segment continues to hold a strong market position. The segment is anticipated to see a recovery, playing a crucial role in Allcargo Logistics' overall revenue generation.

- Revenue Growth: 30.2% increase in Q3 FY25.

- Key Drivers: Growth in LCL and FCL volumes.

- Market Position: Strong, despite geopolitical headwinds.

- Future Outlook: Expected recovery and significant revenue contribution.

Development of Logistics Parks

Allcargo Logistics' strategic investments in developing multimodal logistics parks, exemplified by its partnership with HORCL for the Farrukhnagar, Haryana facility, represent a significant 'Star' in its BCG matrix. These parks are crucial for bolstering freight connectivity across India and are expected to stimulate new industrial growth zones. For instance, the Farrukhnagar park is designed to handle a substantial volume of cargo, aiming to streamline supply chains and reduce logistics costs, a key driver for economic development.

The development of these parks aligns with India's national logistics policy, which targets a reduction in logistics costs to 8-10% of GDP by 2030, down from the current estimated 13-14%. This initiative is poised to capitalize on the anticipated 10-12% compound annual growth rate (CAGR) of the Indian logistics sector over the next five years. The strategic placement and integrated infrastructure of these parks are set to enhance efficiency and create a competitive advantage for businesses operating within their vicinity.

- Strategic Investment: Development of multimodal logistics parks like the Farrukhnagar facility.

- Growth Potential: Designed to enhance freight connectivity and foster new industrial zones.

- Market Alignment: Supports India's goal to reduce logistics costs to 8-10% of GDP by 2030.

- Sector Growth: Leverages the projected 10-12% CAGR of the Indian logistics sector.

Allcargo's contract logistics segment is a clear star, showing impressive 62% quarter-on-quarter external revenue growth in Q3 FY25 due to new client acquisitions and expanded business with existing ones. The acquisition of the remaining stake in ASCPL in March 2023 further solidifies its leading position in this high-growth market.

| Business Segment | Q3 FY25 Performance Highlights | Key Growth Drivers |

|---|---|---|

| Contract Logistics | 62% QoQ external revenue growth | New client onboarding, deepening existing relationships |

| Express Business (GESCPL) | Highest quarterly volume ever, 3.8% YoY revenue increase | Integration with ONDC Network, e-commerce logistics expansion |

| Air Freight Services | 30% YoY volume increase in FY25, 51% surge in Q4 FY25 | Strong market presence in a growing sector |

| International Supply Chain (ISC) | 30.2% revenue growth in Q3 FY25 (INR 35,443.4 million) | Increased LCL and FCL volumes, navigating geopolitical factors |

| Multimodal Logistics Parks | Strategic development (e.g., Farrukhnagar facility) | Enhancing freight connectivity, aligning with national logistics policy |

What is included in the product

The Allcargo Logistics BCG Matrix offers a tailored analysis of its diverse business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

This framework provides strategic insights, highlighting which units to invest in, hold, or divest based on market growth and share.

The Allcargo Logistics BCG Matrix provides a clear, one-page overview, simplifying complex portfolio analysis for strategic decision-making.

Cash Cows

Allcargo Logistics' Less than Container Load (LCL) consolidation business, known globally as ECU Worldwide, is a prime example of a Cash Cow. This segment boasts an impressive footprint, operating in over 160 countries and solidifying its position as a worldwide leader in LCL services.

Despite a modest 1% volume growth in LCL during FY25, the business's established market dominance and vast international network ensure consistent cash generation. This stability is characteristic of a mature market where Allcargo has a strong, defensible position.

Allcargo Logistics' Container Freight Station (CFS) operations represent a stable, cash-generating segment. These facilities are crucial for consolidating and de-consolidating Less than Container Load (LCL) shipments, a vital link in the global supply chain. While the overall logistics market might see fluctuations, the necessity of CFS services ensures a steady demand.

In the fiscal year 2023-24, Allcargo Logistics reported a consolidated revenue of INR 12,138 crore. Within this, the CFS and Inland Container Depot (ICD) segment contributes significantly to the company's operational stability, often acting as a reliable cash cow due to the continuous flow of import and export cargo.

Allcargo Logistics has strategically developed several Grade A logistics parks situated in crucial consumption centers. Approximately 80% of its warehousing space is already pre-leased, with nearly 1.5 million square feet actively generating income.

These mature, income-producing assets are strong candidates for Allcargo's Cash Cows, as they are established and contribute stable, predictable cash flows to the business.

Project and Engineering Solutions

Allcargo Logistics' Project and Engineering Solutions segment is a specialized area focusing on the intricate handling of oversized and heavy cargo. This niche requires significant expertise and dedicated, specialized equipment, setting it apart from general logistics operations.

While specific recent growth figures for this segment aren't always prominently detailed, its nature as a high-value, project-based service strongly indicates a stable and profitable business. These operations typically command higher margins due to the complexity and specialized resources involved, making it a consistent contributor to Allcargo's overall profitability.

- Niche Expertise: Focuses on complex, oversized, and heavy cargo requiring specialized handling.

- High-Margin Business: The specialized nature and project-based approach typically yield strong profitability.

- Stable Contribution: Consistently adds to the company's financial performance through its unique service offering.

- Strategic Importance: Underscores Allcargo's capability in handling challenging and high-value logistics projects.

Established Global Network

Allcargo Logistics' established global network, largely powered by its ECU Worldwide subsidiary, acts as a significant cash cow. This extensive infrastructure, boasting over 300 offices across more than 160 countries, generates a steady revenue stream and underpins the company's operational efficiency.

This mature network is a core strength, providing a reliable source of income that can be reinvested into other strategic areas of the business. Its widespread presence allows for seamless logistics solutions, solidifying its position as a stable performer within the BCG matrix.

- Global Reach: Over 300 offices in more than 160 countries.

- Revenue Generation: ECU Worldwide subsidiary contributes consistent income.

- Operational Efficiency: Facilitates smooth and cost-effective logistics.

- Competitive Advantage: Mature network supports other business ventures.

Allcargo Logistics' ECU Worldwide, the global LCL consolidation arm, is a quintessential cash cow. Operating in over 160 countries, its extensive network and market leadership ensure consistent cash generation, even with modest volume growth. This segment benefits from a mature market position, providing stable financial returns.

The Container Freight Station (CFS) and Inland Container Depot (ICD) operations also function as cash cows, vital for LCL handling and cargo movement. These facilities are essential infrastructure, guaranteeing steady demand and contributing reliably to Allcargo's financial stability, as seen in the company's consolidated revenue of INR 12,138 crore in FY23-24.

Furthermore, Allcargo's strategically located Grade A logistics parks, with approximately 80% of warehousing pre-leased and 1.5 million square feet generating income, represent mature, income-producing assets. These parks are strong cash cow candidates, delivering predictable and stable cash flows.

The Project and Engineering Solutions segment, while niche, is a high-margin business due to its specialized nature in handling oversized and heavy cargo. This expertise and dedicated equipment lead to consistent profitability, making it a stable contributor to Allcargo's overall financial performance.

| Business Segment | BCG Matrix Category | Key Characteristics | Financial Contribution (Illustrative) |

|---|---|---|---|

| ECU Worldwide (LCL Consolidation) | Cash Cow | Global leader, extensive network (>160 countries), mature market | Consistent revenue, stable cash flow |

| CFS & ICD Operations | Cash Cow | Essential for LCL handling, stable demand, crucial infrastructure | Reliable income stream, supports overall stability |

| Logistics Parks (Pre-leased Warehousing) | Cash Cow | Mature assets, income-generating, predictable cash flows | Stable, recurring revenue from leased space |

| Project & Engineering Solutions | Cash Cow | Niche expertise, high-margin, specialized handling | Consistent profitability, stable contribution |

What You See Is What You Get

Allcargo Logistics BCG Matrix

The Allcargo Logistics BCG Matrix you are previewing is the exact, fully formatted report you will receive upon purchase. This comprehensive analysis, designed for strategic clarity, contains no watermarks or demo content, ensuring you get a professional and ready-to-use document. You can confidently use this preview as a direct representation of the valuable insights you'll unlock for your business planning and decision-making.

Dogs

Allcargo Logistics' Contract Logistics division, despite achieving a 12% revenue increase in Q4 FY25, is showing signs of being a 'Dog' in the BCG matrix. This is primarily due to its EBITDA growth being capped at a modest 2% for the same quarter.

The core issue lies in underutilized operational capacity within this segment. This means the infrastructure and resources are not being used to their full potential, leading to a drag on profitability.

For instance, if a warehouse has a capacity to handle 1000 shipments but is only processing 600, the fixed costs associated with that unused 40% capacity directly impact the EBITDA margin.

This situation requires strategic intervention to either boost demand to fill the capacity or to right-size the operations to match current demand levels, thereby improving the segment's financial performance.

In the fourth quarter of fiscal year 2025, Allcargo Logistics observed a 3% decrease in Less than Container Load (LCL) volumes when compared to the same period in fiscal year 2024. While Full Container Load (FCL) volumes showed overall growth, specific regions such as China, Vietnam, and Mexico experienced marginal declines as of July 2024.

These particular segments within the Multimodal Transport Operator (MTO) business, marked by contracting volumes, could be categorized as dogs. This designation applies if they persistently underperform, consuming resources without a clear path to recovery, thereby impacting overall operational efficiency.

While Allcargo Logistics is actively developing modern, Grade A logistics parks, it's possible that some legacy or less efficient warehousing facilities remain. These older sites might not align with today's stringent market demands for speed and advanced technology, potentially hindering optimal operational flow and customer satisfaction.

These underperforming assets could represent a drag on capital, tying up resources without generating the robust returns expected from contemporary logistics infrastructure. For instance, if a facility has low occupancy rates or requires significant ongoing maintenance, its contribution to overall profitability could be diminished, especially when compared to newer, more efficient counterparts.

Any Businesses with Persistent Negative PAT or Low Profitability

Allcargo Logistics has experienced persistent negative PAT, indicating areas of significant concern within its portfolio. For instance, the company reported a net loss of Rs 7.52 crore for Q1 FY25 and a consolidated net loss of Rs 12.59 crore in Q4 FY25. This trend points to an overall decline in net profit for FY25, suggesting that certain business units are not only unprofitable but may also be draining resources.

These underperforming segments, if they represent a substantial portion of the consolidated losses, would be categorized as Dogs in the BCG Matrix. Such units typically have low market share and low growth prospects, making them candidates for divestment or a complete overhaul to improve profitability.

Identifying the specific business units responsible for these losses is crucial for strategic decision-making. The consolidated losses suggest that these Dogs are impacting the overall financial health of Allcargo Logistics.

Key financial indicators for these underperforming units would include:

- Persistent Net Losses: Consistent negative Profit After Tax (PAT).

- Low Revenue Growth: Minimal or declining sales in their respective markets.

- High Operating Costs: Expenses that outweigh the revenue generated.

- Negative Cash Flow: Units that consume more cash than they produce.

Segments with High Interest Costs Relative to Revenue

Allcargo Logistics experienced a significant 31.29% increase in interest costs for the nine months ending June 2024, signaling an expansion in its debt. This heightened financial burden can place pressure on business segments that are heavily leveraged.

When a segment's revenue generation falls short of covering its substantial interest expenses, it can be categorized as a cash dog. These segments consume more resources than they produce, potentially hindering the company's overall financial performance.

- Increased Borrowings: The 31.29% rise in interest costs for the nine-month period ending June 2024 points to a greater reliance on borrowed funds by Allcargo Logistics.

- Leverage Risk: Segments with high debt levels are particularly vulnerable if their revenue streams are insufficient to service these growing finance costs.

- Financial Drain: Such underperforming, highly leveraged segments can act as a drag on the company's financial health, diverting capital that could be used for growth or investment elsewhere.

Allcargo Logistics' Contract Logistics division, despite a 12% revenue increase in Q4 FY25, shows 'Dog' characteristics due to a mere 2% EBITDA growth, indicating underutilized capacity. Similarly, certain LCL segments within the MTO business, experiencing volume declines as of July 2024, also fit the 'Dog' profile if they remain underperformers. Persistent net losses, such as the Rs 7.52 crore loss in Q1 FY25 and Rs 12.59 crore in Q4 FY25, further highlight these 'Dog' segments that are draining resources and impacting overall financial health.

| Segment/Indicator | Q4 FY25 Performance | Analysis |

|---|---|---|

| Contract Logistics | +12% Revenue, +2% EBITDA | Low EBITDA growth suggests underutilized capacity, a 'Dog' trait. |

| LCL Volumes (Specific Regions) | -3% YoY (as of July 2024) | Declining volumes in regions like China, Vietnam, Mexico point to potential 'Dogs'. |

| Consolidated PAT | Net Loss of Rs 12.59 crore (Q4 FY25) | Persistent losses indicate 'Dog' segments are impacting overall profitability. |

| Interest Costs | +31.29% (9 months ending June 2024) | Increased debt burden on underperforming, highly leveraged segments can create 'Cash Dogs'. |

Question Marks

Allcargo Gati's integration with the Open Network for Digital Commerce (ONDC) Network in June 2025 positions it within a rapidly expanding digital marketplace. This move aims to unlock significant growth by providing broader market access and more efficient logistics solutions for businesses.

While the ONDC network itself shows strong growth potential, Allcargo Gati's current market share and profitability within this nascent ecosystem are still being established. This makes its position within the BCG matrix a classic 'Question Mark,' requiring careful monitoring and strategic investment to capitalize on its future promise.

Allcargo Logistics' expansion into new geographies, like acquiring the remaining stake in Fair Trade in Germany, signals a strategic move to deepen its presence in key European markets for its FCL and LCL services. This acquisition, completed in early 2024, aims to bolster its European network and capture a larger share of the regional freight forwarding market.

These ventures are characteristic of question marks in the BCG matrix, as they represent significant investment for future growth but carry inherent uncertainty regarding their immediate profitability and market acceptance. The success of these expansions will depend on effective integration and Allcargo's ability to compete against established players in these new territories.

Allcargo Gati's Phase II infrastructure expansion at eight key locations, slated for completion by Q2 FY2026, represents a substantial investment in future growth. This strategic move, coupled with an ERP system upgrade, aims to boost operational efficiency and service quality. The classification of these investments as '?' reflects their long-term, uncertain payoff, with potential impacts on market share and profitability yet to be realized.

Leveraging Data Science for Cost Efficiencies

Allcargo Gati's strategic focus on data science for optimizing line haul costs represents a significant investment in operational efficiency. This initiative is designed to reduce the expenses associated with transporting goods between major hubs, a critical component of logistics operations. While the potential for substantial cost savings is evident, the long-term impact on market share and profitability is still unfolding.

The company's investment in data analytics for cost reduction positions it to potentially gain a competitive edge. However, the full realization of these benefits and their translation into market dominance or significantly improved profit margins are yet to be fully demonstrated. This makes the data science initiative a classic 'Question Mark' in the BCG matrix context.

- Cost Efficiency Focus: Allcargo Gati is actively employing data science to cut down on line haul expenses.

- Potential Returns: This operational optimization strategy holds promise for high returns and a stronger competitive position.

- Early Stage Impact: The full effects on market share and profitability are still developing, classifying it as a 'Question Mark'.

- Data-Driven Operations: In 2024, the logistics sector saw increased adoption of AI and data analytics, with companies reporting an average of 5-10% reduction in operational costs through such technologies.

Future Logistics Park Developments Beyond Initial Phase

Allcargo Logistics is strategically expanding its footprint beyond its current operational phase. The company has outlined plans to develop an additional 3 million square feet of logistics facilities, signaling a substantial commitment to future growth within India's burgeoning logistics sector.

These upcoming projects represent significant potential, tapping into the ongoing expansion of the Indian logistics market. However, the successful execution, market acceptance, and ultimate financial success of these new ventures remain subject to various market dynamics and operational efficiencies.

- Future Expansion: Allcargo plans to add 3 million square feet of logistics space.

- Market Opportunity: This expansion targets the growing Indian logistics market.

- Uncertainty: Profitability and market adoption of these future projects are still to be determined.

- Strategic Growth: These developments are key to Allcargo's long-term strategy.

Allcargo Gati's integration with ONDC and its infrastructure expansion projects are prime examples of 'Question Marks' in the BCG matrix. These initiatives represent significant investments aimed at capturing future market share and profitability, but their immediate success and market impact are still uncertain.

The company's strategic moves, such as expanding into new geographies like Germany and investing in data science for cost optimization, also fall into this category. While these actions signal a proactive approach to growth, their ultimate contribution to Allcargo's market position and financial performance is yet to be fully realized.

The development of 3 million square feet of new logistics facilities in India further underscores this 'Question Mark' status. These ventures require substantial capital and are subject to market dynamics, making their future returns and competitive standing a subject of ongoing evaluation.

| Initiative | Description | BCG Matrix Classification | Key Data Point (2024/2025) | Strategic Implication |

|---|---|---|---|---|

| ONDC Integration (Allcargo Gati) | Connecting to the Open Network for Digital Commerce | Question Mark | ONDC network growth projected to reach over 2 million transactions by end of 2025. | Potential for expanded market access, but current market share within ONDC is nascent. |

| European Expansion (Fair Trade Acquisition) | Acquiring remaining stake in Fair Trade in Germany | Question Mark | Allcargo completed acquisition of remaining stake in Fair Trade in early 2024. | Aims to strengthen European network, but success depends on integration and competition. |

| Infrastructure Expansion (India) | Developing 3 million sq ft of logistics facilities | Question Mark | Indian logistics market expected to grow at a CAGR of 9-10% through 2027. | Taps into a growing market, but profitability and adoption of new facilities are uncertain. |

| Data Science for Cost Optimization | Using data analytics to reduce line haul costs | Question Mark | Logistics firms using AI/data analytics reported 5-10% operational cost reduction in 2024. | Potential for competitive edge, but full impact on market share and profit margins is developing. |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.