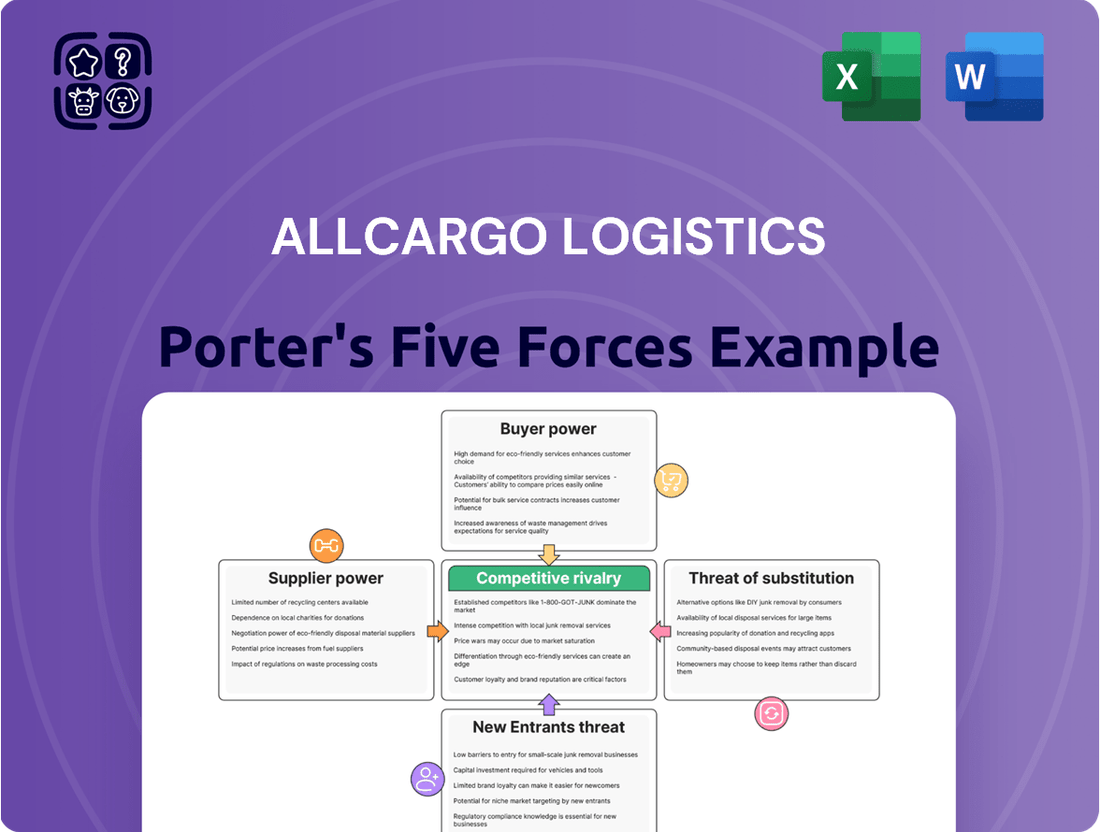

Allcargo Logistics Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Allcargo Logistics Bundle

Allcargo Logistics navigates a competitive landscape shaped by supplier power, buyer bargaining, and the constant threat of new entrants. Understanding these forces is crucial for any stakeholder looking to grasp their market position.

The complete report reveals the real forces shaping Allcargo Logistics’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Allcargo Logistics depends on a select group of specialized service providers for crucial elements of its operations, like unique transport equipment or advanced warehouse management systems. When the pool of suppliers for essential services is small, their ability to negotiate terms and prices significantly increases.

This concentration of power among a few specialized providers can translate into higher operational costs or less favorable contract conditions for Allcargo. This dynamic is especially pronounced in areas demanding substantial capital investment and specialized technical know-how, such as bespoke cold chain logistics or advanced tracking technologies.

The logistics sector's growing reliance on advanced software for tracking, route optimization, and warehouse management means companies like Allcargo Logistics are increasingly dependent on technology providers. This dependency can grant significant leverage to these software suppliers, especially if only a few dominate the market for critical solutions.

For instance, the global logistics software market was valued at approximately USD 14.5 billion in 2023 and is projected to grow significantly. If Allcargo Logistics utilizes specialized or proprietary software, the cost and complexity of switching to an alternative provider could be substantial, thereby increasing the bargaining power of its current technology partners.

Suppliers of fuel and labor wield substantial bargaining power over Allcargo Logistics. The critical need for fuel in transportation and skilled labor in warehousing and delivery makes these inputs essential, amplifying supplier leverage. For instance, global crude oil prices, a key determinant of fuel costs, saw significant volatility in early 2024, impacting operational expenses across the logistics sector.

Rising fuel prices directly inflate Allcargo's transportation expenses, a core cost driver. Similarly, escalating labor costs, influenced by the demand for qualified logistics professionals and potential union negotiations, can compress profit margins. In 2024, reports indicated a general upward trend in wages for skilled warehouse staff and drivers in several key markets where Allcargo operates, adding to these pressures.

Infrastructure and Port Service Providers' Influence

Allcargo Logistics' reliance on critical infrastructure, including port authorities and railway networks, grants significant leverage to these service providers. In 2024, the ongoing development and capacity expansion at major Indian ports, while beneficial, also mean that port operators can command higher service fees due to demand. Limited competition in certain regions for specialized port handling equipment further amplifies this power.

The bargaining power of infrastructure and port service providers directly impacts Allcargo's cost structure. For instance, increased port handling charges or railway freight rates, which saw an average increase of 5-7% across several key Indian routes in early 2024 due to fuel price adjustments and infrastructure development surcharges, can squeeze Allcargo's profit margins. This is particularly true for their Container Freight Station (CFS) operations, which are intrinsically linked to efficient port throughput.

- Port Authority Fees: Increases in vessel-related charges and cargo handling fees by port authorities can directly inflate Allcargo's operational expenses.

- Railway Tariffs: Fluctuations in railway freight rates, influenced by government policies and operational costs, impact the cost-effectiveness of Allcargo's multimodal transport solutions.

- Infrastructure Availability: In areas with limited road or rail connectivity, the few available providers can dictate terms, increasing costs for Allcargo's land-based logistics.

Availability and Quality of Logistics Equipment Suppliers

The availability and quality of essential logistics equipment, like containers and specialized vehicles, directly impact Allcargo Logistics' operational efficiency. If there's a limited pool of high-quality suppliers or if specific equipment is patented, these suppliers gain considerable leverage. This can translate into higher purchasing expenses and extended delivery schedules for Allcargo.

For instance, in 2024, the global shortage of shipping containers, exacerbated by supply chain disruptions, led to significant price hikes. Companies like Allcargo faced increased costs for container leasing and procurement, impacting their overall profitability. The reliance on a few key manufacturers for specialized heavy-lift vehicles also presents a similar challenge, allowing those suppliers to dictate terms.

- Limited Supplier Base: A concentrated market for specialized logistics equipment grants suppliers greater pricing power.

- Quality and Reliability: High-quality, dependable equipment is critical; suppliers offering superior products can command premium prices.

- Proprietary Technology: Exclusive or patented equipment designs reduce alternative options for logistics providers like Allcargo.

- Impact on Costs: Supplier power can directly inflate procurement costs and affect the overall cost structure for Allcargo Logistics.

Suppliers of specialized equipment and technology hold significant bargaining power over Allcargo Logistics due to limited alternatives and high switching costs. In 2024, the ongoing demand for advanced tracking and warehouse management software, coupled with the market dominance of a few providers, allowed these suppliers to influence pricing and contract terms. This dependency on proprietary solutions means Allcargo faces potential cost escalations and less favorable conditions, directly impacting operational expenses.

Fuel and labor suppliers also exert considerable influence. Volatile crude oil prices in early 2024 directly increased Allcargo's transportation costs. Similarly, rising wages for skilled logistics personnel in key operating regions in 2024 put upward pressure on labor expenses, potentially squeezing profit margins. The critical nature of these inputs amplifies their leverage.

Infrastructure providers, particularly port authorities and railway networks, possess substantial bargaining power. In 2024, increased demand and ongoing development at major Indian ports led to higher service fees. Limited competition for specialized port handling equipment further consolidates this power, directly impacting Allcargo's cost structure through higher handling charges and freight rates, especially affecting their Container Freight Station (CFS) operations.

| Supplier Category | Key Factors Influencing Power | Impact on Allcargo Logistics (2024) | Example Data/Trend |

|---|---|---|---|

| Specialized Equipment & Technology | Limited supplier base, proprietary technology, high switching costs | Increased procurement costs, potential for unfavorable contract terms | Global logistics software market valued at approx. USD 14.5 billion in 2023, with growth projected. |

| Fuel | Volatility in crude oil prices, essential input for transportation | Direct increase in transportation expenses, impacting overall operational costs | Significant volatility observed in global crude oil prices in early 2024. |

| Labor | Demand for skilled logistics professionals, potential union influence | Escalating wages, pressure on profit margins | Upward trend in wages for skilled warehouse staff and drivers reported in key markets in 2024. |

| Infrastructure (Ports, Railways) | Limited competition, capacity expansion, government policies | Higher service fees and freight rates, impacting cost structure | Average increase of 5-7% in railway freight rates on key Indian routes in early 2024. |

What is included in the product

This Porter's Five Forces analysis for Allcargo Logistics dissects the competitive intensity, buyer and supplier power, threat of new entrants and substitutes within the logistics sector.

Instantly identify and mitigate competitive threats with a dynamic Porter's Five Forces analysis, tailored to Allcargo Logistics' unique market position.

Customers Bargaining Power

Allcargo Logistics serves a wide array of businesses, including major corporations that represent significant logistics volumes. These large clients wield considerable bargaining power due to the substantial value of their business, often dictating terms and pricing.

Industry consolidation among Allcargo's customer base further strengthens their negotiating position. For instance, if a sector sees major players merging, the combined entity can leverage its increased scale to demand more favorable rates and enhanced service offerings from logistics partners.

In 2023, the global logistics market saw continued consolidation, with several notable mergers and acquisitions impacting customer concentration. This trend directly translates to increased bargaining power for these larger, consolidated entities when engaging with providers like Allcargo, pushing for competitive pricing and tailored solutions.

For many standardized logistics services, customers often find it quite easy and inexpensive to switch from one provider to another. This is a significant factor impacting Allcargo Logistics. If their services are seen as largely the same as what competitors offer, clients can readily move to a company that provides similar services for less money or with better deals. For instance, in the less specialized freight forwarding market, a company might only need to compare rates and transit times, making a switch straightforward.

Customers' ability to integrate logistics in-house significantly impacts their bargaining power. Large clients, especially those with substantial or intricate supply chains, can choose to build their own logistics operations instead of relying on external companies like Allcargo. This potential for backward integration provides them with considerable leverage, as it poses a genuine risk of losing their business altogether. For instance, Amazon's substantial investments in its own logistics network serve as a prime example of this growing trend, demonstrating a clear alternative to third-party providers.

Availability of Multiple Logistics Service Providers

The Indian logistics sector is a vibrant and competitive landscape, boasting a multitude of domestic and international service providers. This sheer volume of choice empowers customers, allowing them to readily compare offerings and negotiate terms based on factors like cost, service quality, and dependability. For a company like Allcargo Logistics, this means a constant need to innovate and differentiate its services to maintain a competitive edge and secure customer loyalty.

The bargaining power of customers is significantly amplified by the availability of numerous logistics service providers. In 2024, the Indian logistics market is projected to reach approximately $330 billion, a substantial increase driven by e-commerce growth and government initiatives like Gati Shakti. This expansion has attracted a large number of players, from established giants to agile startups, creating a buyer's market.

- Customer Choice: The presence of many logistics companies means customers can easily switch providers, putting pressure on pricing and service levels.

- Price Sensitivity: With abundant options, customers can shop around, forcing providers to offer competitive rates to win business.

- Service Differentiation: Companies like Allcargo must focus on unique selling propositions beyond price, such as specialized services, technology integration, or superior customer support, to retain clients.

- Market Dynamics: The ongoing growth and fragmentation of the Indian logistics market in 2024 underscore the sustained high bargaining power of customers.

Transparency and Information Availability

The logistics industry, including players like Allcargo Logistics, is experiencing a significant shift towards greater transparency. Digital platforms and readily available industry data now allow customers to easily compare pricing and service offerings across multiple providers. This increased access to information empowers customers, enabling them to negotiate more effectively and secure better deals.

This reduction in information asymmetry directly strengthens the customer's bargaining position. For instance, a recent industry report indicated that over 70% of B2B buyers now conduct extensive online research before engaging with a logistics provider, highlighting the impact of readily available data. Consequently, Allcargo Logistics must remain competitive not only on service quality but also on transparent and attractive pricing to retain and attract clients.

- Increased Information Access: Digital platforms provide customers with easy access to pricing and service details from various logistics companies.

- Informed Decision-Making: Customers can now make more informed choices due to the availability of comprehensive data on logistics providers.

- Enhanced Negotiation Power: Transparency allows customers to leverage comparative information to negotiate better terms and pricing with Allcargo.

- Reduced Information Asymmetry: The gap in knowledge between Allcargo and its customers is narrowing, shifting the power balance.

The bargaining power of customers for Allcargo Logistics is significant, driven by market fragmentation and the availability of numerous alternative providers. In 2024, the Indian logistics sector's projected growth to $330 billion has intensified competition, empowering customers to demand better pricing and service. This competitive landscape means Allcargo must continuously innovate and offer differentiated services to retain its client base.

| Factor | Impact on Allcargo Logistics | Customer Leverage |

|---|---|---|

| Market Fragmentation | High number of competitors | Easy switching, price comparison |

| Customer Consolidation | Large clients have more volume | Dictate terms, demand discounts |

| In-house Logistics Capability | Threat of backward integration | Leverage to negotiate or insource |

| Information Transparency | Easy access to pricing data | Stronger negotiation position |

Preview the Actual Deliverable

Allcargo Logistics Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. The Allcargo Logistics Porter's Five Forces Analysis meticulously details the competitive landscape, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitute products, and the intensity of rivalry within the logistics sector. This comprehensive report provides actionable insights into the strategic positioning and potential challenges faced by Allcargo Logistics.

Rivalry Among Competitors

The Indian logistics landscape is a bustling arena, characterized by a significant number of both domestic and international companies. This fragmentation means Allcargo Logistics is constantly navigating a highly competitive environment, where market share is fiercely contested.

Allcargo Logistics contends with established global logistics powerhouses, many of whom have a strong presence in India. Alongside these giants, a dynamic and growing cohort of local Indian logistics providers are also vying for business, further intensifying the rivalry.

This crowded market directly impacts pricing strategies and the need for distinct service offerings. With so many players competing for the same customers, there’s continuous pressure to offer competitive rates and innovative solutions to stand out.

The Indian logistics sector is booming, with projections indicating it will reach USD 357.3 billion by 2030, growing at a compound annual growth rate of 7.7% from 2025 to 2030. This robust expansion acts like a magnet, drawing in new companies and investors, which naturally heats up the competitive landscape.

While this growth presents a fertile ground for opportunities, it also means established companies like Allcargo Logistics face a constant challenge. They must remain agile, innovating and scaling their operations to stay ahead of both aggressive new entrants and the expansion efforts of existing rivals.

Logistics services are highly susceptible to commoditization, meaning customers often prioritize price above all else. This intense price sensitivity puts significant pressure on companies like Allcargo Logistics, forcing them to operate with very tight profit margins. For instance, in the competitive Indian logistics market, freight rates can fluctuate significantly based on demand and fuel prices, directly impacting revenue per tonne-kilometer.

The constant need to be cost-efficient is paramount. Allcargo must actively manage its operational expenses, from fuel consumption and fleet maintenance to warehousing and labor costs, to remain competitive. Failure to control these costs can quickly erode profitability, making it difficult to reinvest in crucial areas like technology upgrades or service expansion, which are vital for long-term growth.

Diversified Service Offerings and Integrated Solutions

Allcargo Logistics boasts a wide array of services, encompassing Multimodal Transport Operations (MTO), Container Freight Stations (CFS), project and engineering solutions, contract logistics, and the development of logistics parks. This broad service spectrum allows them to absorb pressure from rivals in any single niche. However, it also positions them against numerous specialized competitors in each of these distinct service areas.

The competitive landscape is intensifying as rivals also broaden their service portfolios, aiming to offer integrated solutions that mirror Allcargo's approach. This trend fuels a more comprehensive and cross-segment rivalry, where companies compete not just on individual services but on the ability to provide end-to-end logistics management.

- Diversified Offerings: Allcargo provides MTO, CFS, project logistics, contract logistics, and logistics parks, reducing reliance on any single segment.

- Specialized Competition: This diversification means Allcargo faces specialized competitors in each of its service areas.

- Integrated Solutions Rivalry: Competitors are expanding their own service offerings, leading to increased competition on integrated logistics solutions.

- Market Dynamics: As of early 2024, the logistics sector continues to see consolidation and service expansion as key competitive strategies.

Technological Advancements and Digital Transformation

The logistics sector is rapidly embracing digital tools like AI, IoT, and blockchain, fundamentally reshaping operations. Companies prioritizing these technologies, such as those investing in advanced route optimization software or real-time tracking systems, are significantly improving efficiency and customer service. For instance, by mid-2024, many global logistics providers reported enhanced supply chain visibility through IoT deployments, leading to an average reduction in delivery times by 10-15%.

Allcargo Logistics faces intense pressure to integrate similar innovations to maintain its competitive standing. Those lagging in technological adoption, perhaps still relying on manual processes or outdated tracking methods, are increasingly vulnerable to losing market share to more agile, tech-savvy competitors. In 2024, the market share gains for logistics firms with robust digital platforms were notably higher compared to their less digitized counterparts.

- AI-powered route optimization can reduce fuel consumption by up to 20%.

- IoT sensors provide real-time cargo condition monitoring, minimizing spoilage and damage.

- Blockchain enhances transparency and security in freight documentation, reducing disputes.

- Digital platforms improve customer engagement and offer predictive analytics for demand forecasting.

Competitive rivalry within the Indian logistics sector is fierce, driven by a large number of players, including global giants and agile domestic firms. Allcargo Logistics must navigate this crowded market, where price sensitivity and the constant need for cost efficiency are paramount. The sector’s projected growth to USD 357.3 billion by 2030 further attracts new entrants, intensifying competition.

Allcargo's diversified service portfolio, from MTO to logistics parks, offers a buffer against niche competitors but also exposes it to rivals expanding into integrated solutions. The rapid adoption of digital technologies like AI and IoT by competitors in 2024 has created a significant advantage for tech-savvy firms, impacting market share gains.

| Aspect | Allcargo Logistics' Position | Competitive Impact |

|---|---|---|

| Number of Competitors | High (Global & Domestic) | Intense pressure on pricing and service differentiation. |

| Price Sensitivity | High | Forces tight profit margins and focus on operational efficiency. |

| Service Diversification | Broad (MTO, CFS, Projects, Contract Logistics, Parks) | Reduces reliance on single segments but faces specialized rivals and integrated solution competition. |

| Technological Adoption (2024) | Needs to keep pace | Firms with advanced digital platforms see higher market share gains. |

SSubstitutes Threaten

Large enterprises, particularly in manufacturing, retail, and e-commerce, possess the financial muscle and operational scale to establish their own in-house logistics capabilities. This directly substitutes the need for external providers like Allcargo Logistics.

Companies with substantial and predictable shipping volumes can find it economically viable to build and manage their own logistics networks. For instance, major retailers in 2024 are increasingly investing in their own fleet and warehousing to streamline delivery, especially for last-mile operations, aiming for cost efficiencies and enhanced supply chain control.

The increasing prevalence of digital platforms, especially within e-commerce, empowers manufacturers and sellers to bypass traditional logistics providers and ship directly to end consumers. Platforms such as Alibaba and Etsy now offer integrated logistics, streamlining vendor-to-consumer shipping and lessening the dependence on conventional logistics firms for specific product categories.

The rise of alternative transportation methods presents a nuanced threat to Allcargo Logistics. While not a direct replacement for their end-to-end solutions, these alternatives are becoming increasingly viable for specific segments of the logistics market, particularly in last-mile deliveries within urban environments.

For example, the adoption of drones and electric bicycles for delivering smaller parcels in cities is accelerating. In 2024, reports indicated a significant increase in pilot programs and commercial rollouts for drone delivery services in several major metropolitan areas globally, aiming for faster and more environmentally friendly transit compared to traditional vans.

Shift to Localized Supply Chains and Nearshoring

The increasing trend towards localized supply chains and nearshoring presents a significant threat of substitutes for Allcargo Logistics. As companies prioritize resilience and reduce reliance on distant manufacturing hubs, the demand for extensive international freight forwarding and multimodal transport services could diminish. This strategic shift, accelerated by recent global disruptions, directly impacts the core business of logistics providers operating on a global scale.

This move away from long-haul transportation means that alternative, shorter-distance logistics solutions become more attractive. For instance, a European company shifting production from Asia to Eastern Europe would utilize regional trucking and rail networks, bypassing the need for the deep-sea shipping and air cargo services that form a substantial part of Allcargo's operations. This substitution directly erodes the market share for global logistics players.

- Reduced Demand for Global Freight: Businesses adopting nearshoring or reshoring may opt for domestic or regional transportation providers, bypassing traditional international logistics chains.

- Shift in Service Needs: The focus shifts from complex, long-distance multimodal solutions to more localized and potentially less integrated transportation services.

- Impact on Allcargo's Core Business: Allcargo's expertise in global supply chain management and multimodal transport faces direct competition from these shorter, localized alternatives.

Standardized Freight Brokering Platforms

The rise of standardized freight brokering platforms presents a significant threat of substitution for Allcargo Logistics. These online marketplaces enable shippers to directly connect with carriers, often bypassing traditional intermediaries for simpler freight requirements.

These platforms, such as Freightos or Convoy, offer enhanced price transparency and foster a competitive bidding environment, particularly impacting Allcargo's less complex freight forwarding services. For instance, the global freight forwarding market, valued at approximately $200 billion in 2023, sees increasing digital penetration, with platforms capturing a growing share of transactional volumes.

- Digital Platforms: Online freight marketplaces are democratizing access to transportation for shippers.

- Price Transparency: These platforms often provide real-time pricing, pressuring traditional service providers.

- Reduced Complexity: For standard, less specialized shipments, the direct connection offered by platforms is a viable alternative.

- Market Share Erosion: The ease of use and cost-effectiveness of these platforms can lead to a gradual erosion of market share for integrated logistics providers on simpler routes.

The threat of substitutes for Allcargo Logistics is multifaceted, stemming from both in-house capabilities and emerging digital solutions. Large enterprises increasingly build their own logistics networks, especially for last-mile delivery, as seen with major retailers in 2024 investing in their own fleets for cost efficiency and greater control. Furthermore, digital platforms are enabling direct shipping from sellers to consumers, bypassing traditional logistics providers, with companies like Alibaba integrating logistics services to streamline this process.

The trend towards localized supply chains also poses a significant substitution threat. As businesses nearshore or reshore production, the demand for extensive international freight forwarding services, a core area for Allcargo, may decline. This shift favors regional transportation networks over global multimodal solutions, impacting Allcargo's business model.

Digital freight brokering platforms represent another key substitute. These online marketplaces connect shippers directly with carriers, offering price transparency and competition, particularly for less complex shipments. The global freight forwarding market, estimated at $200 billion in 2023, is experiencing increased digital penetration, with these platforms capturing a growing share of transactional volumes.

| Threat of Substitutes | Description | Impact on Allcargo Logistics | Example/Data Point |

| In-house Logistics | Large enterprises developing their own logistics capabilities. | Reduces reliance on third-party providers like Allcargo. | Major retailers in 2024 investing in own fleets and warehousing. |

| Digital Platforms | E-commerce platforms offering integrated shipping solutions. | Bypasses traditional logistics providers for direct seller-to-consumer shipments. | Alibaba and Etsy integrating logistics services. |

| Nearshoring/Reshoring | Shift towards localized supply chains. | Decreases demand for international freight forwarding and multimodal transport. | Companies moving production from Asia to Eastern Europe favoring regional networks. |

| Freight Brokering Platforms | Online marketplaces connecting shippers and carriers. | Offers price transparency and competition for standard shipments. | Global freight forwarding market ($200B in 2023) sees increasing digital platform adoption. |

Entrants Threaten

The Indian government's robust push for logistics efficiency, exemplified by the PM Gati Shakti Master Plan, significantly reduces entry barriers. This initiative, coupled with substantial investments in infrastructure like roads, railways, and ports, creates a more accessible landscape for new logistics companies. For instance, the National Highways Authority of India (NHAI) planned to award projects worth approximately ₹1.6 lakh crore in FY2024, a significant increase from the previous year, directly impacting connectivity and operational costs for all players.

The increasing digitalization and accessibility of advanced logistics technologies like AI, IoT, and cloud-based software significantly lower the barrier to entry for new competitors. These advancements allow startups to build efficient operations without the massive upfront investment in physical assets that traditional players like Allcargo Logistics historically required. For instance, the global logistics technology market was valued at approximately $50 billion in 2023 and is projected to grow substantially, indicating a fertile ground for tech-savvy entrants.

New entrants can leverage these readily available technologies to offer specialized or niche services, often with greater agility and lower overheads. This can directly challenge established players by offering competitive pricing or more innovative solutions, as seen with the rise of digital freight forwarders. The ability to scale quickly using cloud infrastructure means a new player can gain market share rapidly, impacting Allcargo's existing market position.

The rapid expansion of e-commerce in India, projected to reach $350 billion by 2030, fuels the threat of new entrants in the logistics sector. This growth is particularly attractive to specialized last-mile delivery and hyperlocal logistics providers, who can leverage technology to offer agile and cost-effective solutions. These new players often have lower overheads and can disrupt established players like Allcargo by focusing on niche market segments or adopting innovative operational models.

Availability of Investment and Funding

The Indian logistics sector's robust growth projections, estimated to reach USD 330 billion by 2027, are a magnet for private equity and venture capital. This substantial funding availability fuels new entrants, allowing them to rapidly scale operations, invest in cutting-edge technology, and challenge established players like Allcargo Logistics.

- Significant Capital Influx: The logistics industry in India is projected to grow at a compound annual growth rate (CAGR) of 8-10% over the next few years, attracting substantial investment.

- Startup Funding: Venture capital and private equity firms have injected billions into Indian logistics startups, empowering them to acquire fleets, develop advanced digital platforms, and offer competitive pricing. For instance, in 2023, logistics tech startups alone secured over $500 million in funding.

- Capacity and Technology Acquisition: This readily available capital enables new companies to quickly build significant capacity and adopt advanced technologies, bridging the gap with incumbents and intensifying competition.

Fragmented Market and Niche Opportunities

The Indian logistics sector, while seeing consolidation, remains notably fragmented. This means that despite the presence of large, established companies, a significant portion of the market is served by smaller, often unorganized, players. This fragmentation itself can lower barriers to entry for new companies looking to establish a foothold.

Furthermore, the increasing specialization within the logistics industry creates opportunities for new entrants. For instance, the demand for cold chain logistics, particularly for pharmaceuticals and perishables, is growing rapidly. In 2023, the Indian cold chain market was valued at approximately USD 15 billion and is projected to grow at a CAGR of over 15% through 2028, indicating a strong demand for specialized services where new, agile players can compete effectively.

- Fragmented Market: The Indian logistics market has a substantial number of smaller, unorganized operators.

- Niche Opportunities: Growing demand for specialized services like cold chain logistics presents entry points.

- Market Growth: The Indian cold chain logistics market was valued around USD 15 billion in 2023.

- Projected Growth: This specialized segment is expected to see a CAGR exceeding 15% through 2028.

The Indian government's infrastructure push, like the PM Gati Shakti Master Plan, significantly lowers entry barriers by improving connectivity and reducing operational costs. This, coupled with the increasing accessibility of advanced logistics technologies, allows new, tech-savvy players to enter the market with lower upfront investments. The rapid growth of e-commerce also fuels the threat, particularly for specialized last-mile delivery providers.

| Factor | Impact on New Entrants | Relevance to Allcargo Logistics |

| Government Initiatives (e.g., PM Gati Shakti) | Reduces barriers through infrastructure development | Improves overall logistics efficiency, potentially benefiting Allcargo but also enabling competitors |

| Technology Adoption (AI, IoT) | Lowers capital expenditure for efficient operations | Requires Allcargo to continuously innovate to maintain its technological edge |

| E-commerce Growth | Creates demand for specialized logistics, attracting niche players | Presents both opportunities for Allcargo to expand services and threats from agile competitors |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Allcargo Logistics is built upon a robust foundation of data, including their annual reports, investor presentations, and industry-specific market research reports.

We also incorporate information from regulatory filings, financial news outlets, and competitor announcements to provide a comprehensive view of the competitive landscape.