Alibaba Pictures Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alibaba Pictures Group Bundle

Uncover the dynamic external forces shaping Alibaba Pictures Group's trajectory. Our PESTLE analysis delves into the political landscape, economic shifts, and technological advancements impacting the entertainment giant. Understand how evolving social trends and regulatory frameworks create both opportunities and challenges.

Gain a competitive advantage by leveraging our expert-crafted PESTLE analysis for Alibaba Pictures Group. This comprehensive breakdown provides actionable intelligence on critical external factors, empowering your strategic decision-making. Invest in clarity and foresight.

Don't get left behind in the rapidly changing entertainment industry. Our detailed PESTLE analysis of Alibaba Pictures Group offers a crucial understanding of the external environment. Download the full report now to equip yourself with the insights needed to navigate and thrive.

Political factors

The Chinese government's stringent censorship and content approval processes directly shape the landscape for Alibaba Pictures. Regulations often steer production towards themes that resonate with national policies and cultural values, potentially limiting creative freedom in storytelling. For instance, the State Administration of Radio, Film and Television (SARFT) regularly issues guidelines that influence content permissible for broadcast and distribution.

Rising geopolitical tensions, especially between China and Western nations, are a significant concern for Alibaba Pictures. These strains can directly impact international co-productions, a key area for content development. For instance, trade disputes and differing regulatory environments can complicate or even halt cross-border collaborations, limiting the company's ability to tap into diverse creative talent and funding sources.

Furthermore, these tensions can restrict the global distribution of Alibaba Pictures' films and television shows. Western markets, in particular, might impose greater scrutiny or outright restrictions on content originating from China due to political sensitivities. This can lead to reduced revenue streams and hinder the company's ambitions for global brand expansion, forcing a more localized approach to market penetration.

Navigating these delicate diplomatic complexities is crucial for Alibaba Pictures' strategic planning. The company must be agile in adapting its content strategy and distribution channels to mitigate the risks associated with an increasingly fragmented global media landscape. For example, focusing on emerging markets or strengthening domestic production capabilities could offer alternative growth avenues.

The Chinese government actively supports its domestic film and television sector through subsidies and favorable policies, a crucial factor for Alibaba Pictures. For instance, in 2023, China's box office revenue reached approximately 54.9 billion yuan (around $7.6 billion USD), showcasing the scale of the industry benefiting from such support.

Alibaba Pictures can leverage these government initiatives, which might include tax breaks or direct funding for specific projects, to enhance its production capabilities and market reach. However, this support also means navigating a landscape where state-backed competitors might receive similar or even greater advantages.

Changes in these governmental programs, which can occur with policy shifts, pose a risk. For example, a reduction in subsidies or a change in criteria for preferential treatment could directly impact Alibaba Pictures' financial planning and competitive positioning within the Chinese market.

Anti-Monopoly Policies

Chinese regulators have been intensifying their focus on anti-monopoly practices among large tech firms, an environment that directly impacts companies within the Alibaba conglomerate. This increased scrutiny, particularly prominent in 2023 and continuing into 2024, aims to foster fairer competition and prevent the concentration of market power.

These anti-monopoly policies carry direct implications for Alibaba Pictures. For instance, in areas like online ticketing or digital content distribution, where Alibaba Pictures holds significant market share, regulators might impose restrictions. This could manifest as requirements for divestitures of certain assets or limitations on expanding into new business segments, thereby shaping the company's growth trajectory.

For Alibaba Pictures, navigating this evolving regulatory landscape is crucial. The company must remain agile, continuously monitoring policy shifts and adapting its business strategies to comply with anti-monopoly directives. This proactive approach is essential for mitigating risks and ensuring sustained operations.

Key areas of regulatory focus often include:

- Market dominance in ticketing platforms: Ensuring fair access for smaller competitors.

- Content distribution exclusivity: Preventing monopolistic control over popular films and shows.

- Data usage and privacy: Adherence to regulations concerning the collection and application of user data.

Cultural and Ideological Control

Beyond direct censorship, the Chinese government actively shapes media through cultural and ideological control, promoting specific narratives and values. This has a direct impact on audience preferences and the commercial success of content, requiring Alibaba Pictures to align its production and distribution strategies with these prevailing national priorities. For instance, state-backed media often receives preferential treatment and wider distribution channels, influencing market share.

Alibaba Pictures must navigate these cultural currents to ensure broad public acceptance and market access. In 2024, a significant portion of the Chinese box office revenue was driven by films that aligned with patriotic or socially responsible themes promoted by the government. This trend underscores the necessity for Alibaba Pictures to invest in content that resonates with these officially sanctioned cultural narratives to maximize its commercial viability.

This ideological alignment is crucial for several reasons:

- Market Access: Content that adheres to government-approved themes often receives more favorable distribution and exhibition opportunities.

- Audience Resonance: Aligning with national values can foster greater audience engagement and loyalty.

- Regulatory Compliance: Proactively incorporating government-endorsed cultural messages helps avoid regulatory hurdles and potential content bans.

- Brand Reputation: Demonstrating cultural sensitivity and alignment can enhance Alibaba Pictures' reputation within China.

Government censorship and content approval processes significantly influence Alibaba Pictures' production and distribution, often favoring themes aligned with national policies and cultural values. Geopolitical tensions, particularly between China and Western nations, can impede international co-productions and global distribution, impacting revenue streams. Chinese regulators' focus on anti-monopoly practices may lead to restrictions on Alibaba Pictures' market dominance in ticketing and content distribution, requiring strategic adaptation.

| Political Factor | Impact on Alibaba Pictures | Supporting Data/Example |

|---|---|---|

| Content Censorship & Approval | Limits creative freedom; steers production towards state-approved themes. | State Administration of Radio, Film and Television (SARFT) regularly issues guidelines. |

| Geopolitical Tensions | Complicates international co-productions and global distribution; potential market access restrictions. | Trade disputes and differing regulatory environments affect cross-border collaborations. |

| Government Subsidies & Support | Provides financial advantages for domestic production but also creates a competitive landscape with state-backed entities. | China's film industry box office reached ~54.9 billion yuan ($7.6 billion USD) in 2023, benefiting from industry support. |

| Anti-Monopoly Regulations | May impose restrictions on market share in ticketing and content distribution; affects expansion. | Increased regulatory focus in 2023-2024 on tech firms' market power. |

| Cultural & Ideological Control | Promotes specific narratives, influencing audience preferences and requiring content alignment for market success. | Films aligning with patriotic or socially responsible themes drove significant box office revenue in 2024. |

What is included in the product

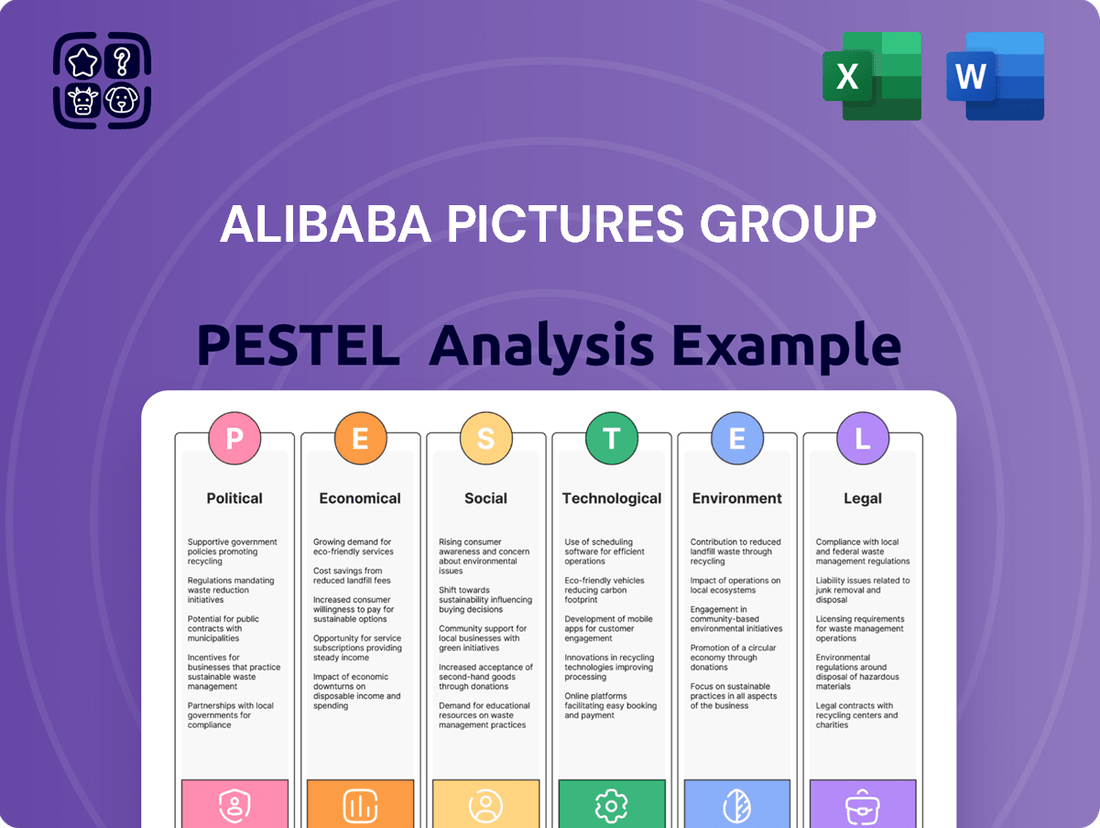

This PESTLE analysis investigates the external macro-environmental influences impacting Alibaba Pictures Group across political, economic, social, technological, environmental, and legal dimensions.

It provides a comprehensive overview of how these factors shape the company's strategic landscape, identifying potential threats and opportunities.

A clear, actionable PESTLE analysis for Alibaba Pictures Group serves as a pain point reliever by highlighting key external forces, enabling proactive strategy development and mitigating potential risks.

Economic factors

China's economic trajectory is a critical driver for Alibaba Pictures. Strong GDP growth, such as the projected 5.0% for 2024 and continued expansion into 2025, directly translates into higher disposable incomes for consumers. This increased purchasing power naturally boosts spending on discretionary items, including movie tickets, streaming subscriptions, and other forms of entertainment that Alibaba Pictures provides. A healthy domestic economy therefore fuels demand for the company's content and distribution services.

Consumer spending habits are a crucial factor for Alibaba Pictures. A notable trend observed through 2024 and into early 2025 is the continued migration of entertainment consumption to digital platforms. This means that while overall entertainment spending might remain robust, the way consumers allocate their budgets is shifting, with a greater proportion directed towards subscription-based streaming services and online video-on-demand.

Alibaba Pictures' revenue streams are directly impacted by these evolving preferences. For instance, the company's ability to monetize its film and television productions depends on aligning with audience demand for specific content types, whether that's feature films, episodic series, or even shorter, bite-sized content suitable for mobile viewing. A willingness to pay for premium content on these platforms is key, and understanding the price sensitivity of different audience segments is paramount.

Data from late 2024 indicated that digital entertainment subscriptions in China continued to grow, with a significant portion of younger demographics favoring on-demand content over traditional theatrical releases for everyday viewing. This highlights the imperative for Alibaba Pictures to adapt its production slate and distribution strategies. Failing to cater to these changing habits, such as a preference for shorter-form content or interactive experiences, could lead to missed revenue opportunities and impact profitability. The company's sustained success hinges on its agility in responding to these dynamic consumer behaviors.

Inflationary pressures are a significant economic factor impacting Alibaba Pictures. Rising costs for talent, equipment, and post-production services directly affect the bottom line. For instance, the Consumer Price Index (CPI) in China, a key market for Alibaba Pictures, saw an increase of 2.8% in 2023, indicating a general rise in expenses across various sectors.

These increased production costs can significantly squeeze profit margins for film and television projects. This necessitates a more strategic approach to resource allocation and potentially higher investment to maintain content quality and output. Companies like Alibaba Pictures must adapt by seeking more efficient production methods or exploring new revenue streams.

To navigate these economic headwinds, Alibaba Pictures requires robust cost management strategies. This could involve negotiating better deals with suppliers, optimizing production workflows, or leveraging technology to reduce operational expenses. Effective cost control is crucial for maintaining profitability in a challenging economic environment.

Advertising Market Fluctuations

The health of the advertising market is a critical factor for Alibaba Pictures, directly influencing revenue from integrated marketing on its content and digital platforms. A slowdown in ad spending, common during economic downturns, can hinder the company's capacity to generate income through brand partnerships and promotional activities.

For instance, global advertising spend growth was projected to moderate in 2024, with some reports indicating a slight dip compared to the robust recovery seen in previous years. This trend highlights the sensitivity of Alibaba Pictures' marketing-related revenue streams to broader economic conditions.

To counter this, Alibaba Pictures' diversified revenue strategy is essential. This approach aims to reduce reliance on any single income source, thereby building resilience against market fluctuations.

- Impact on Integrated Marketing: Reduced advertising expenditure directly affects revenue from brand partnerships and promotions on Alibaba Pictures' platforms.

- Economic Downturns: Periods of economic contraction typically lead to decreased overall advertising budgets.

- Revenue Diversification: A broad revenue base helps mitigate the risk posed by advertising market volatility.

- 2024 Ad Market Trends: Projections for 2024 suggest a potential moderation in global advertising spend growth, underscoring the importance of adaptability.

Investment Climate in Entertainment

The investment climate for the global entertainment sector is experiencing a dynamic shift, directly impacting Alibaba Pictures' ability to fund ambitious projects and embrace new technologies. As of early 2025, venture capital and private equity interest in media and entertainment remain robust, though increasingly focused on companies with proven monetization strategies and strong intellectual property portfolios. This presents both opportunities and challenges for Alibaba Pictures in securing capital for its diverse content pipeline.

Domestically, China's entertainment market continues to be a significant draw for investors, supported by government initiatives aimed at fostering cultural industries. However, regulatory adjustments and evolving consumer preferences can introduce volatility. Internationally, the landscape is characterized by a growing demand for diverse content, yet geopolitical considerations and economic uncertainties in various regions can temper investor enthusiasm.

Securing substantial investment is paramount for Alibaba Pictures to maintain its competitive edge in large-scale content production. The company's ability to attract funding will hinge on demonstrating clear pathways to profitability and innovation in areas like AI-driven content creation and immersive entertainment experiences.

- Global entertainment industry investment: Expected to see continued growth, with a particular emphasis on streaming services and digital content platforms, though economic headwinds may moderate the pace of expansion in 2024-2025.

- Venture Capital (VC) interest: VC funding in entertainment tech and content creation remained strong in 2024, with a notable uptick in investments related to AI and virtual production.

- China's film market recovery: China's box office continued its recovery trajectory through 2024, demonstrating resilience and investor confidence in the domestic market's growth potential.

- Strategic partnerships: Alibaba Pictures is likely to leverage strategic partnerships to de-risk large-scale productions and access diverse capital pools in the current investment climate.

Economic stability and growth in China are foundational for Alibaba Pictures. With China's GDP projected to grow around 5.0% in 2024 and continuing into 2025, this translates to increased consumer spending power, directly benefiting the entertainment sector. A healthy economy means more disposable income for movie tickets and digital content subscriptions, crucial revenue drivers for Alibaba Pictures.

Consumer spending habits are shifting towards digital platforms, with a strong preference for streaming and on-demand content observed through 2024 and into early 2025. This trend necessitates that Alibaba Pictures aligns its production and distribution strategies with these evolving preferences, as data from late 2024 showed continued growth in digital entertainment subscriptions, especially among younger demographics.

Inflationary pressures, evidenced by a 2.8% CPI increase in China in 2023, directly impact Alibaba Pictures' production costs for talent, equipment, and services. This requires robust cost management and potentially higher investment to maintain content quality, making efficient resource allocation critical for profitability.

The advertising market's health is vital for Alibaba Pictures' integrated marketing revenue. Global ad spend growth moderation in 2024, compared to prior recovery years, highlights the sensitivity of these revenue streams to economic conditions, reinforcing the need for Alibaba Pictures' diversified revenue strategy.

| Economic Factor | 2024/2025 Outlook | Impact on Alibaba Pictures |

|---|---|---|

| GDP Growth (China) | Projected ~5.0% for 2024 | Increased consumer spending on entertainment |

| Consumer Spending Shift | Migration to digital/streaming | Need to adapt content and distribution for online platforms |

| Inflation (CPI) | 2.8% in China (2023) | Higher production costs, pressure on profit margins |

| Advertising Spend | Moderating global growth | Potential impact on integrated marketing revenue |

Same Document Delivered

Alibaba Pictures Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This PESTLE analysis of Alibaba Pictures Group delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations. Understanding these elements is crucial for stakeholders to navigate the dynamic landscape of the film and entertainment industry. The detailed breakdown within this report offers actionable insights for strategic planning and risk assessment.

Sociological factors

Consumer tastes in entertainment are in constant flux, with a noticeable surge in demand for diverse content genres, interactive experiences, and the pervasive popularity of short-form video. Alibaba Pictures needs to diligently track these evolving preferences to strategically invest in and create content that truly connects with its audiences, maintaining engagement across its various platforms. For instance, in 2024, the global short-form video market was valued at over $20 billion, highlighting a significant shift in viewing habits.

The pervasive adoption of digital lifestyles, marked by extensive internet and mobile device engagement, fundamentally reshapes content consumption patterns. For Alibaba Pictures, this means catering to an audience accustomed to immediate, accessible entertainment across multiple platforms, influencing demand for both online ticketing and digital content delivery.

In 2024, global mobile internet users are projected to reach over 5.7 billion, highlighting the critical importance of mobile-first strategies for content providers like Alibaba Pictures. This trend underscores the need for seamless user experiences and on-demand access, driving innovation in their digital service offerings to meet evolving consumer expectations.

Social media platforms are crucial for how audiences discover and engage with content, especially for younger viewers. Alibaba Pictures can use platforms like Douyin (TikTok) and Weibo for viral marketing campaigns and direct interaction with fans. For instance, in 2023, Douyin had over 750 million daily active users, providing a massive reach for promotional efforts.

Leveraging these platforms allows Alibaba Pictures to build hype for upcoming films and collect immediate audience sentiment. However, this also means the company must actively manage online conversations and potential backlash. A misstep in a social media campaign could quickly damage a film's reputation, as seen in past industry examples where negative social media trends impacted box office performance.

Demographic Shifts and Urbanization

China's rapid urbanization continues to reshape its consumer landscape, with an increasing portion of the population residing in cities. This trend, coupled with a growing middle class, directly impacts demand for entertainment content. As of 2024, over 65% of China's population lives in urban areas, a figure projected to climb further, creating a larger addressable market for Alibaba Pictures' offerings.

The demographic makeup of China is also undergoing significant shifts. While the middle class expands, contributing to higher disposable incomes and a greater appetite for premium content, the country is also experiencing an aging population. This dual dynamic necessitates a nuanced approach, requiring Alibaba Pictures to develop content appealing to both younger, digitally-native audiences and older demographics with potentially different viewing habits and preferences.

Understanding these population dynamics is crucial for effective market segmentation. Alibaba Pictures must tailor its content creation and distribution strategies to meet the diverse needs and preferences of various demographic segments, whether they are in bustling urban centers or more traditional rural settings.

- Urbanization Rate: China's urbanization rate exceeded 65% in 2024, indicating a substantial urban consumer base.

- Middle Class Growth: The expanding middle class in China, projected to continue its growth through 2025, represents a key demographic for increased spending on entertainment.

- Aging Population: While not a primary focus for all content, the aging demographic presents opportunities for specific content niches and distribution channels.

Cultural Values and Trends

Societal values and evolving cultural trends significantly shape audience reception and content demand. In 2024, a pronounced rise in national pride within China is fueling a strong interest in traditional Chinese narratives and historical themes. This trend directly impacts the appeal of films and series, making culturally resonant storytelling a key driver of commercial success.

Alibaba Pictures Group must skillfully adapt to these cultural currents. Producing content that aligns with a broad Chinese audience's appreciation for their heritage, while also remaining commercially viable, is crucial. For instance, the success of historical dramas or films celebrating Chinese achievements can be directly linked to this growing national sentiment.

- Rising National Pride: Data from late 2023 and early 2024 surveys indicate a significant uptick in nationalistic sentiment among Chinese consumers, particularly younger demographics, influencing entertainment choices.

- Interest in Traditional Narratives: Box office performance of films like the "Creation of the Gods" trilogy, which draws heavily on classic Chinese mythology, demonstrates a substantial audience appetite for traditional stories, with the first installment grossing over $350 million domestically in 2023.

- Cultural Sensitivity: Alibaba Pictures needs to ensure all productions are culturally appropriate to avoid alienating audiences, a lesson reinforced by past instances where cultural missteps led to public backlash and boycotts of certain entertainment products.

Societal values are shifting, with a growing emphasis on diverse content and interactive experiences. Short-form video, valued at over $20 billion globally in 2024, exemplifies this trend. Digital lifestyles are paramount, with over 5.7 billion mobile internet users worldwide in 2024, necessitating mobile-first strategies for platforms like Alibaba Pictures.

Urbanization in China, exceeding 65% in 2024, and a growing middle class present a larger market for entertainment. Simultaneously, rising national pride fuels interest in traditional Chinese narratives. Films drawing on mythology, like the first installment of the "Creation of the Gods" trilogy which grossed over $350 million domestically in 2023, show this demand.

| Sociological Factor | 2024/2025 Relevance | Impact on Alibaba Pictures |

|---|---|---|

| Evolving Consumer Tastes | Surge in diverse genres, interactive content, short-form video popularity (market over $20 billion in 2024) | Requires agile content investment and creation to maintain audience engagement. |

| Digital Lifestyle Adoption | Over 5.7 billion global mobile internet users in 2024 | Necessitates mobile-first strategies and on-demand digital content delivery. |

| Social Media Influence | Platforms like Douyin (750M+ daily active users in 2023) drive discovery and engagement | Offers opportunities for viral marketing but requires active online sentiment management. |

| Urbanization & Middle Class Growth | China's urbanization >65% (2024); growing middle class with higher disposable income | Expands the addressable market and increases demand for premium content. |

| National Pride & Traditional Narratives | Increased interest in historical themes and traditional stories | Creates demand for culturally resonant storytelling, evidenced by successful mythology-based films. |

Technological factors

Artificial intelligence and big data analytics are transforming the entertainment landscape, presenting significant opportunities for Alibaba Pictures. These technologies can be instrumental in enhancing content creation processes, personalizing viewer recommendations, and optimizing marketing campaigns. For instance, AI can aid in script analysis to identify promising narratives and even assist in predicting box office performance, as seen with various AI-powered forecasting tools emerging in the film industry.

Data analytics provides invaluable deep dives into audience behavior, allowing Alibaba Pictures to understand viewing habits, preferences, and engagement patterns more precisely. This understanding is crucial for tailoring content and marketing efforts. By leveraging these advanced technological capabilities, the group can achieve more efficient operational workflows and deliver highly targeted content to its diverse audience base, ultimately driving engagement and revenue.

The relentless advancement of streaming technologies, such as the widespread adoption of 4K and HDR formats, significantly boosts the appeal of Alibaba Pictures' digital content. Improved compression algorithms mean less buffering and higher quality, making platforms like Youku more engaging. This technological leap directly translates to a better user experience, a key factor in subscriber retention.

Alibaba Pictures' commitment to investing in its streaming infrastructure, including adopting cutting-edge codecs like AV1, solidifies its competitive edge. In 2024, the global video streaming market was valued at over $100 billion, and continued innovation in streaming quality is essential to capture market share. A superior viewing experience is not just a perk; it's a fundamental requirement for attracting and keeping viewers in this competitive landscape.

The advancement of virtual reality (VR) and augmented reality (AR) is creating new frontiers for entertainment that go beyond conventional movie watching. Alibaba Pictures can tap into these technologies for VR content creation and interactive narratives, potentially boosting audience engagement and offering fresh revenue streams.

This strategic move into immersive tech is a significant long-term growth opportunity. For instance, the global VR/AR market was projected to reach over $100 billion by 2025, indicating substantial potential for companies like Alibaba Pictures to capture a share through innovative content and experiences.

Blockchain for Rights Management

Blockchain technology presents a significant technological factor for Alibaba Pictures Group, particularly in rights management. Its decentralized and immutable ledger system offers unprecedented transparency and security for intellectual property.

Alibaba Pictures can harness blockchain to combat piracy, a persistent issue in the entertainment industry, and streamline the complex process of content distribution. This technology ensures that rights are clearly defined and verifiable, reducing disputes and enhancing operational efficiency.

Leveraging blockchain can also facilitate fair and automated revenue sharing among all stakeholders, from creators to distributors and platforms. This increased trust and transparency in financial flows can foster stronger relationships within the entertainment ecosystem. For instance, the global digital content creation market was valued at approximately $250 billion in 2024 and is projected to grow, making efficient rights management crucial.

The adoption of blockchain in rights management has the potential to fundamentally alter how content is monetized and protected, offering Alibaba Pictures a competitive edge in the evolving digital media landscape. By 2025, the blockchain in media and entertainment market is expected to reach over $1 billion, highlighting the growing industry adoption.

- Blockchain enables secure and transparent tracking of content usage rights.

- It combats piracy by providing an immutable record of ownership.

- Automated smart contracts can ensure fair and timely revenue distribution.

- This technology enhances trust and efficiency across the entertainment supply chain.

Digital Production and Post-Production Tools

Advances in digital production and post-production tools are reshaping the entertainment landscape. Technologies like sophisticated CGI, immersive virtual production, and collaborative cloud-based editing platforms are dramatically cutting down production costs and timeframes. For Alibaba Pictures, integrating these tools means more efficient workflows and the potential to create higher-quality content. For instance, the adoption of virtual production, which saw significant growth in 2023 and is projected to continue its upward trajectory in 2024-2025, allows for real-time rendering and on-set visualization, reducing the need for extensive post-production work. This technological leap is not just about efficiency; it’s a crucial element for maintaining a competitive edge in a rapidly evolving industry.

The impact of these digital advancements is tangible. By leveraging cloud-based platforms, teams can collaborate seamlessly from different locations, accelerating the post-production process. This was evident in the 2023 film industry where several major productions utilized remote collaboration tools, reportedly saving weeks in their editing schedules. Alibaba Pictures can capitalize on this by enhancing its global reach and talent acquisition, bringing in specialized skills without geographical limitations. Such adoption is key to delivering content that meets the high production value expectations of today's audiences.

- Virtual Production Growth: The virtual production market, valued at approximately $2.5 billion in 2023, is expected to exceed $6 billion by 2028, indicating a strong trend towards its adoption.

- Cloud Collaboration Efficiency: Studies suggest cloud-based editing can reduce post-production timelines by up to 30% for certain projects.

- CGI Advancements: Investments in AI-driven CGI tools are streamlining asset creation, with some studios reporting a 20% reduction in rendering times.

- Cost Savings: Early adopters of advanced digital workflows have seen overall production cost reductions ranging from 10-15% in 2023-2024.

Alibaba Pictures' strategic embrace of AI and big data analytics is pivotal for its future. These technologies are instrumental in personalizing viewer experiences and optimizing content distribution, directly impacting engagement and revenue. For instance, AI-powered recommendation engines, like those used by major streaming services, can increase viewer watch time by up to 20%.

Legal factors

Alibaba Pictures Group operates within a legal landscape where robust intellectual property (IP) protection is paramount. Given the company's substantial investments in creating and distributing films and television shows, the strength and enforcement of IP laws directly impact its revenue and asset security. For instance, the prevalence of digital piracy remains a significant hurdle, potentially eroding profits from content sales and streaming rights.

Navigating the complexities of copyright attribution across various markets and managing intricate licensing agreements for its vast content library are ongoing legal challenges. In 2024, the global film industry continued to grapple with the financial impact of online piracy, with estimates from the U.S. Chamber of Commerce suggesting billions in lost revenue annually, a figure that directly affects companies like Alibaba Pictures.

Alibaba Pictures' extensive digital operations, including ticketing and streaming, mean it handles vast amounts of sensitive user data, making adherence to data privacy and cybersecurity laws critical. China's Personal Information Protection Law (PIPL), effective November 1, 2021, sets strict guidelines for data collection, processing, and storage, necessitating robust security infrastructure and transparent privacy policies.

Failure to comply with PIPL and other evolving data protection regulations can result in substantial fines; for instance, PIPL allows for penalties up to 5% of the previous year's annual turnover or a fixed fine of RMB 1 million, whichever is higher. This legal landscape requires continuous investment in data security technologies and ongoing legal counsel to navigate complex compliance requirements and mitigate risks.

Alibaba Pictures operates within China's increasingly robust anti-monopoly and competition legal framework, which aims to foster a level playing field and prevent excessive market concentration in the entertainment sector. This means regulatory bodies closely watch practices that could stifle competition, such as exclusive content agreements or platform terms that disadvantage rivals.

For instance, the State Administration for Market Regulation (SAMR) has been actively enforcing these laws, as evidenced by significant fines levied against other tech giants for monopolistic behavior in recent years. This scrutiny directly affects Alibaba Pictures' ability to secure exclusive rights for popular films and series, potentially limiting its content acquisition strategies and thus impacting its competitive edge.

The company must navigate these regulations carefully to avoid penalties and ensure its growth strategies, including potential mergers and acquisitions within the film and digital media space, align with government directives on fair competition. Failure to comply could result in substantial financial penalties and operational restrictions, hindering its expansion plans.

Censorship and Content Approval Regulations

Alibaba Pictures operates under China's stringent censorship and content approval regulations, which significantly influence its creative output and distribution strategies. The company must meticulously adhere to national guidelines concerning themes, narratives, and visual content, ensuring all productions meet state-approved standards before reaching the public. This legal landscape directly curtails creative freedom and shapes market access, requiring substantial investment in compliance and adaptation.

Navigating these regulations is a core operational challenge for Alibaba Pictures. For instance, the National Radio and Television Administration (NRTA) regularly updates its directives, impacting everything from historical dramas to modern comedies. Failure to comply can result in delayed releases, content modifications, or outright bans, as seen with certain foreign films facing scrutiny in 2024 and early 2025, impacting potential revenue streams.

- Content Scrutiny: All films and television programs undergo pre-release review by regulatory bodies.

- Thematic Restrictions: Content must avoid politically sensitive topics, historical revisionism, and socially disruptive themes.

- Market Access: Compliance is mandatory for distribution within mainland China, the world's second-largest film market.

- Creative Constraints: These laws necessitate careful scriptwriting and editing to align with government-approved narratives.

International Trade and Investment Laws

Alibaba Pictures Group navigates a complex web of international trade and investment laws when pursuing global ventures. For instance, in 2024, China's Ministry of Commerce reported that foreign investment in the film and television sector, while generally open, still has specific regulations regarding content and distribution channels. These regulations can impact co-production agreements and market entry strategies.

Compliance with import/export regulations for film equipment and intellectual property is critical. Similarly, foreign ownership restrictions in certain markets may limit Alibaba Pictures' direct control over subsidiaries or distribution networks, requiring strategic partnerships or joint ventures. As of early 2025, data privacy laws, such as GDPR and similar regional frameworks, impose strict rules on cross-border data transfers, affecting how Alibaba Pictures manages user data and marketing campaigns internationally.

- Compliance with China's Film Law and related regulations for co-productions and distribution

- Adherence to foreign ownership limitations in key overseas markets, potentially requiring JV structures

- Navigating evolving international data privacy regulations affecting content delivery and user engagement

- Understanding and managing intellectual property rights across different legal jurisdictions

Alibaba Pictures Group operates under China's strict censorship laws, requiring all content to pass pre-release reviews by regulatory bodies like the National Radio and Television Administration (NRTA). These regulations dictate acceptable themes, preventing politically sensitive or socially disruptive narratives, which directly impacts creative freedom and market access. Non-compliance can lead to delays, content modification, or outright bans, as seen with certain film releases facing scrutiny in 2024 and early 2025, affecting revenue potential.

Environmental factors

The global film industry is increasingly prioritizing sustainability, pushing for reduced waste, lower energy use, and a smaller carbon footprint during production. Alibaba Pictures can anticipate greater scrutiny from investors and the public to adopt greener methods, like utilizing renewable energy sources on set and cutting down on material waste.

For instance, the UK film industry's 'Green Film Alliance' reported in early 2024 that sustainable production practices can lead to significant cost savings, with some productions achieving a 15% reduction in overall expenses through waste management and energy efficiency.

Embracing eco-friendly initiatives can bolster Alibaba Pictures' brand image, resonating with environmentally conscious audiences and stakeholders. This alignment with sustainability trends could attract investment and improve public perception.

Alibaba Pictures' digital platforms, including its online ticketing services and streaming operations, are significant consumers of electricity. This consumption directly translates into carbon emissions, a key environmental consideration for the company.

The energy demands of data centers powering these digital services are substantial. In 2023, the global IT sector accounted for an estimated 3.7% of global greenhouse gas emissions, a figure that underscores the environmental footprint of digital operations.

As a digital-first entertainment company, Alibaba Pictures must prioritize energy efficiency within its infrastructure. This involves adopting greener data center practices and exploring renewable energy sources to power its operations, aligning with broader Environmental, Social, and Governance (ESG) goals.

The company's commitment to sustainability necessitates a proactive approach to mitigating the environmental impact of its digital backbone. Investing in energy-efficient technologies and securing renewable energy contracts will be crucial for reducing its carbon footprint moving forward.

Investors are placing a significant emphasis on Environmental, Social, and Governance (ESG) criteria when making investment choices, pushing companies like Alibaba Pictures to highlight their sustainability efforts. For instance, a significant portion of global assets under management, estimated to be over $35 trillion by the end of 2023, are now guided by ESG principles. This trend directly impacts Alibaba Pictures' appeal to a growing investor base and its ability to secure funding, making robust ESG reporting and demonstrable performance paramount for financial stakeholders.

Alibaba Pictures' dedication to environmental stewardship and responsible business practices directly influences its attractiveness to investors and its access to capital markets. Strong ESG performance is increasingly viewed as a proxy for long-term viability and effective risk management. Indeed, research from MSCI in 2024 indicated that companies with high ESG ratings often exhibit lower volatility and better long-term financial returns compared to their peers with lower ratings.

Climate Change Impact on Production

Climate change poses significant operational challenges for Alibaba Pictures' production activities. Extreme weather events, such as typhoons and heavy rainfall, can disrupt filming schedules, damage equipment, and render outdoor locations unusable, as seen in the increased frequency of such events in Asia. For instance, a study by the China Meteorological Administration noted a trend of more intense rainfall in Southern China during the summer months in recent years, directly impacting outdoor shoots. This necessitates robust contingency planning and potentially higher insurance premiums to cover weather-related delays and damages, impacting the overall budget of productions.

Alibaba Pictures must proactively assess and mitigate these climate-related risks to safeguard its investments and maintain operational stability. This includes developing flexible production schedules and identifying alternative, climate-resilient filming locations. Furthermore, the company should explore incorporating climate adaptation strategies into its long-term business planning, recognizing that environmental volatility is a growing factor in the entertainment industry's operational landscape.

The financial implications are substantial; a major weather event could lead to millions in lost production days and increased costs. For example, the average cost of a major film production can easily exceed $100 million, and significant weather delays can add 10-20% to these budgets.

- Increased Production Costs: Extreme weather can lead to extended filming periods and the need for more resilient infrastructure, driving up overall production expenses.

- Schedule Disruptions: Unpredictable weather patterns directly impact shooting timelines, potentially delaying release dates and affecting marketing campaigns.

- Insurance Escalation: The rising frequency and severity of climate-related events are likely to result in higher insurance premiums for film production companies.

- Location Viability: Certain filming locations may become less viable or inaccessible due to climate change impacts like rising sea levels or desertification.

Promotion of Green Themes in Content

Societal demand for content with environmental themes is on the rise, with surveys indicating a significant portion of consumers prefer brands that demonstrate environmental responsibility. Alibaba Pictures can leverage this by weaving green narratives into its productions, potentially attracting a wider audience. For instance, a 2024 report highlighted that 65% of Gen Z consumers are more likely to engage with brands that actively promote sustainability.

Integrating messages about conservation or sustainable living into films and TV shows can not only meet audience expectations but also bolster Alibaba Pictures' brand image. This strategic alignment with growing environmental consciousness can foster stronger consumer loyalty and a positive perception of the company as a forward-thinking, responsible entity in the entertainment sector.

- Growing Consumer Preference: A 2024 Nielsen study found that 73% of global consumers would change their consumption habits to reduce their environmental impact.

- Brand Differentiation: Incorporating green themes offers a unique selling proposition in a crowded market, differentiating Alibaba Pictures from competitors.

- Positive Brand Association: Aligning with environmental causes can create positive sentiment, potentially leading to increased viewership and engagement.

- Market Opportunity: The demand for eco-conscious entertainment presents a clear opportunity for content creation that appeals to a values-driven demographic.

The film industry's increasing focus on sustainability, driven by a desire for reduced waste and lower carbon footprints, presents both challenges and opportunities for Alibaba Pictures. The company faces growing pressure from investors and the public to adopt greener production methods, such as using renewable energy and minimizing material waste during shoots.

Alibaba Pictures' digital operations, including its online ticketing and streaming services, are significant energy consumers, contributing to its carbon footprint. As of 2023, the IT sector globally was responsible for approximately 3.7% of greenhouse gas emissions, highlighting the environmental impact of digital infrastructure. This necessitates a focus on energy efficiency within data centers and the exploration of renewable energy sources to power these operations, aligning with broader ESG mandates.

Climate change itself poses direct operational risks, with extreme weather events like heavy rainfall and typhoons increasingly disrupting filming schedules, damaging equipment, and impacting outdoor locations. The China Meteorological Administration has noted a trend of more intense summer rainfall in Southern China in recent years, directly affecting outdoor shoots and potentially increasing production costs by 10-20% due to delays and damages.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Alibaba Pictures Group is informed by a robust blend of official government reports, reputable industry publications, and up-to-the-minute market research data. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.