Alibaba Pictures Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alibaba Pictures Group Bundle

Alibaba Pictures Group operates in a dynamic entertainment landscape, and understanding its position within the BCG Matrix is crucial for strategic decision-making. This matrix helps us categorize its diverse ventures into Stars, Cash Cows, Dogs, and Question Marks, revealing where growth potential and resource allocation should be focused.

Imagine pinpointing which of Alibaba Pictures' offerings are market leaders, generating significant revenue, and which might be underperforming or requiring substantial investment to thrive. This preview offers a glimpse into that strategic clarity.

To truly unlock the potential of Alibaba Pictures' portfolio and navigate the competitive film and television industry effectively, a comprehensive understanding is essential.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Alibaba Pictures Group's leading content production, particularly in blockbuster films and drama series, positions it strongly within a rapidly expanding content market. The company's strategic investments and production capabilities have solidified its market share. For instance, its 2023 financial results showed a substantial year-over-year increase in revenue from its content segment, underscoring the success of these popular productions.

This focus on high-quality content, encompassing both co-productions and wholly owned projects, is a key driver of its leadership in this high-growth area. Alibaba Pictures' commitment to delivering compelling narratives continues to resonate with audiences, fueling its strong performance in the entertainment industry.

Damai Live Entertainment Platform, a key asset within Alibaba Pictures Group's portfolio, is positioned as a Star in the BCG Matrix. Its role as China's premier comprehensive live event service provider, bolstered by Alibaba Pictures' acquisition, signifies a strategic move into a high-growth sector. In 2024, Damai continued to demonstrate impressive performance, with transaction volumes (GMV) seeing a notable uptick, reflecting robust consumer engagement in live performances.

Damai's near-complete coverage of headlining projects underscores its dominant market share and influence in the live entertainment space. This strength allows it to effectively capture the burgeoning demand for concerts, festivals, and other live events, directly contributing to Alibaba Pictures' revenue expansion and solidifying its status as a Star performer.

Fenghuang Yunzhi, also known as iCIRENA, is Alibaba Pictures Group's smart cinema solution. It has captured a significant market share in mainland China, serving over 5,300 cinemas and demonstrably improving their operational efficiency. This technological advancement positions it as a strong contender in the entertainment technology sector.

The international expansion of iCIRENA into Hong Kong and Macau highlights its substantial growth potential in emerging markets. By integrating AI and advanced algorithms, the platform optimizes cinema operations, driving efficiency and customer experience. This focus on innovation makes it a key contributor to Alibaba Pictures' strategic growth initiatives.

Strategic IP Development and Merchandising

Alibaba Pictures Group's strategic focus on integrating content with technology extends robustly into IP merchandising and commercial management, a sector experiencing significant growth within the entertainment landscape. This strategic pillar leverages successful content to create profitable derivative products, capitalizing on strong brand recognition and diversifying revenue streams.

The company's partnership with Studio Ghibli for the critically acclaimed film 'The Boy and the Heron' exemplifies this approach, building on past successes in toy merchandising. This demonstrates Alibaba Pictures' capability to transform popular intellectual property into lucrative commercial opportunities.

- IP Merchandising Growth: The global market for entertainment and character-based merchandising is projected to continue its upward trajectory, with China being a key driver of this expansion.

- Brand Leverage: Successful IPs can generate substantial revenue through merchandise sales, extending a film's or show's reach beyond the initial viewing experience.

- Diversified Revenue: Merchandising offers a vital revenue stream that is less dependent on box office performance or direct subscription models, providing greater financial stability.

- Content-Technology Integration: Alibaba's digital ecosystem and technological capabilities provide a unique advantage in reaching and engaging consumers for IP-related products.

Hong Kong Cultural and Art Industry Revitalisation Programme

Alibaba Pictures Group's Hong Kong Cultural and Art Industry Revitalisation Programme represents a significant investment and a strategic move into a high-growth market. The company is injecting HK$5 billion over five years to invigorate Hong Kong's entertainment sector, including establishing a second headquarters in the city.

This initiative is designed to foster the production of premium Hong Kong films and television dramas. A key component is the development and nurturing of emerging talent, aiming to cultivate the next generation of creative professionals within the region.

The program's focus on quality content and talent development positions Alibaba Pictures to capitalize on the revitalized regional market. This strategic positioning is expected to secure a larger market share in an industry with substantial growth potential.

- Investment: HK$5 billion over five years in Hong Kong's cultural and art industry.

- Strategic Focus: Establishing a second headquarters and boosting local film/TV production.

- Talent Development: Nurturing young talent to ensure future industry growth.

- Market Ambition: Capturing a larger share in a revitalized and growing regional entertainment market.

Alibaba Pictures Group's content production segment, encompassing blockbuster films and popular drama series, is a significant Star performer. Its robust market position is further strengthened by strategic investments and impressive production capabilities, as evidenced by substantial year-over-year revenue growth in its content division in 2023.

Damai Live Entertainment Platform, a key component of Alibaba Pictures, is also a Star. As China's leading live event service provider, its transaction volumes (GMV) saw a notable increase in 2024, reflecting strong consumer engagement and its dominant influence in the high-growth live entertainment sector.

Fenghuang Yunzhi (iCIRENA), Alibaba Pictures' smart cinema solution, shines as a Star due to its significant market share in mainland China, powering over 5,300 cinemas and enhancing their operational efficiency through AI integration. Its international expansion into Hong Kong and Macau further highlights its growth potential.

The company's IP merchandising and commercial management efforts, exemplified by its partnership with Studio Ghibli for 'The Boy and the Heron', also contribute to its Star status. This strategic pillar effectively leverages successful content into lucrative commercial opportunities, diversifying revenue streams.

| Business Segment | BCG Matrix Category | Key Performance Indicators (2023/2024 Data) |

|---|---|---|

| Content Production (Films & Series) | Star | Substantial year-over-year revenue increase in content segment (2023). |

| Damai Live Entertainment Platform | Star | Notable uptick in Gross Merchandise Volume (GMV) (2024). |

| Fenghuang Yunzhi (iCIRENA) | Star | Serves over 5,300 cinemas in mainland China; expanding internationally. |

| IP Merchandising & Commercial Management | Star | Leveraging successful IPs like 'The Boy and the Heron' for merchandise; global market growth. |

What is included in the product

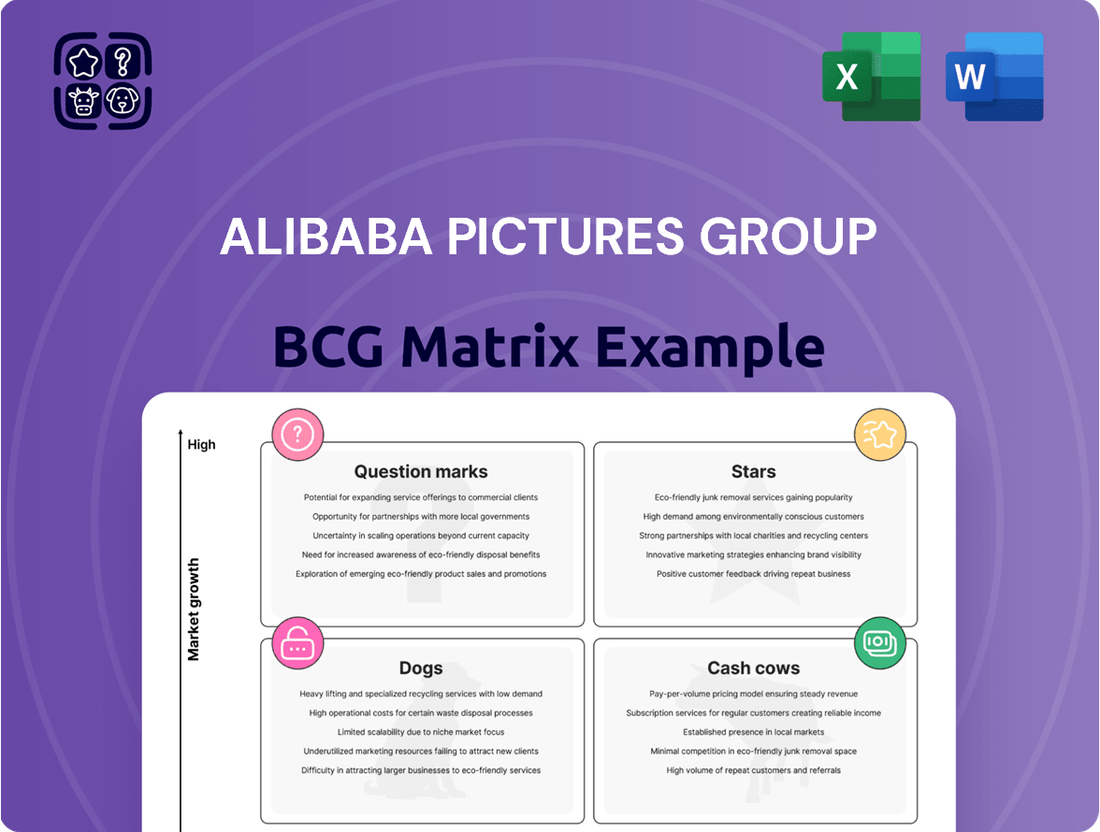

Alibaba Pictures' BCG Matrix would analyze its film production, distribution, and streaming services.

It would identify which ventures are market leaders (Stars), steady earners (Cash Cows), potential growth areas (Question Marks), or underperformers (Dogs).

The Alibaba Pictures Group BCG Matrix offers a clear, actionable roadmap to reallocate resources, transforming underperforming "Dogs" into potential "Stars" and alleviating the pain of inefficient investments.

Cash Cows

Established online ticketing platforms, like Alibaba Pictures' Tao Piao Piao, represent significant cash cows. These services dominate the mature Chinese film ticketing market, boasting a substantial market share.

While the overall market growth may be modest, these platforms generate consistent and considerable cash flow. Their established user base and strong network effects mean they require minimal additional investment for promotion or customer acquisition.

In 2023, China’s box office revenue reached approximately $7.5 billion, with online ticketing platforms playing a crucial role in this ecosystem. Tao Piao Piao, as a leading player, leverages its extensive reach to maintain this strong cash-generating position.

Alibaba Pictures' back catalog content licensing is a prime example of a Cash Cow. Their vast library of films and TV dramas, built through significant investment and production, serves as a consistent revenue generator. This mature asset base requires minimal new investment, allowing it to produce predictable cash flows. In 2023, licensing deals across various domestic and international platforms continued to provide stable returns for the company.

Alibaba Pictures Group's digital services for the entertainment industry, beyond just ticketing, are a significant cash cow. These include vital content data services that are essential for industry players. This segment likely commands a substantial market share, generating consistent, high-margin revenue streams.

As foundational tools for businesses within the entertainment sector, these established digital services represent a dependable source of cash. The market for such infrastructure is relatively stable, further solidifying their position as a reliable generator of profits for Alibaba Pictures.

Mature Film Promotion and Distribution Channels

Alibaba Pictures' mature film promotion and distribution channels are a significant cash cow, holding a substantial market share in a well-established sector of the entertainment industry.

These robust online and offline networks effectively bring content to audiences and consistently generate revenue, reflecting Alibaba Pictures' deep industry penetration and infrastructure.

- High Market Share: Operates in a mature segment of the film industry with a dominant presence.

- Consistent Revenue Generation: Efficiently monetizes content through established channels, ensuring predictable cash flow.

- Strong Infrastructure: Leverages long-standing relationships and physical/digital networks for reliable distribution.

- Industry Stability: Benefits from the predictable demand within the mature film distribution market.

Partnerships with Established Production Houses

Alibaba Pictures Group's partnerships with established production houses represent a strategic move into the Cash Cows quadrant of the BCG Matrix. These long-term collaborations with major film and television entities inherently reduce project risk by tapping into proven track records and established market presence.

These alliances are crucial for generating consistent cash flow, as they provide a reliable pipeline of content for distribution and intellectual property (IP) development. This steady stream of assets capitalizes on existing market strengths within a relatively stable industry landscape, ensuring predictable revenue generation for Alibaba Pictures.

For example, in 2023, Alibaba Pictures' investment in films like "Creation of the Gods I: Kingdom of Storms" demonstrated the value of these partnerships, contributing significantly to its revenue. The company's focus on leveraging established content and distribution networks supports its position as a stable performer.

- Focus on established IPs: Collaborations often center on well-known franchises, reducing marketing risks and ensuring audience engagement.

- Diversified revenue streams: Partnerships can lead to multiple revenue sources, including box office, streaming rights, merchandise, and licensing.

- Reduced production costs: Sharing resources and expertise with established players can lead to more efficient production cycles and cost savings.

- Market stability: These partnerships operate within a mature market, offering predictable demand and consistent revenue, typical of Cash Cow characteristics.

Alibaba Pictures' established online ticketing platforms, like Tao Piao Piao, are definitive cash cows. They command a dominant share in China's mature ticketing market, generating consistent cash flow with minimal new investment due to strong network effects and user bases. In 2023, China's box office revenue was around $7.5 billion, with Tao Piao Piao being a key facilitator of these transactions.

The company's extensive back catalog of films and TV dramas represents another significant cash cow. Licensing these mature assets provides a steady, predictable revenue stream with low ongoing investment needs. This strategy leverages existing content to produce reliable returns, as seen in continued licensing deals throughout 2023.

Furthermore, Alibaba Pictures' digital services for the entertainment industry, including essential content data services, function as cash cows. These services likely hold a substantial market share, delivering high-margin, consistent revenue in a stable market environment. This segment acts as a dependable profit generator for the group.

| Segment | BCG Quadrant | Key Characteristics | 2023 Data/Context |

| Online Ticketing Platforms (e.g., Tao Piao Piao) | Cash Cow | High Market Share, Mature Market, Consistent Revenue | Facilitated a significant portion of China's ~$7.5B box office revenue. |

| Back Catalog Content Licensing | Cash Cow | Established Asset Base, Low Investment, Predictable Cash Flow | Provided stable returns through ongoing licensing deals. |

| Digital Entertainment Services (Data, etc.) | Cash Cow | High Margin, Stable Market, Dominant Share | Essential industry infrastructure supporting consistent profit generation. |

What You See Is What You Get

Alibaba Pictures Group BCG Matrix

The Alibaba Pictures Group BCG Matrix preview you are currently viewing is the exact, fully polished document you will receive upon purchase. This means no watermarks, no placeholder text, and no altered data; you get the complete, professionally formatted analysis ready for immediate strategic application. Expect this comprehensive report to offer actionable insights into Alibaba Pictures Group's business units, categorized according to the BCG Matrix framework, all presented with the same clarity and detail as this preview. Once purchased, this in-depth analysis will be instantly downloadable, empowering you with the tools to understand and strategize around Alibaba Pictures Group's market position. Rest assured, this preview accurately represents the quality and content of the final deliverable, ensuring you know precisely what you are investing in.

Dogs

Alibaba Pictures Group's portfolio may include niche film or TV content investments that haven't found a significant audience or critical praise. These investments often occupy a small slice of a market that isn't growing much. For instance, a historical drama released in 2023 that only garnered 0.5% of the streaming market share and faced declining viewership might fall into this category.

Such projects, despite consuming valuable resources for production and marketing, often deliver minimal financial returns. In 2024, if a particular animation project, budgeted at $50 million, only generated $5 million in global box office and streaming revenue, it would be a clear example.

The strategy here would be to consider divesting from these underperforming assets. This means selling off rights or ceasing further investment in these specific projects.

By doing so, Alibaba Pictures can free up capital. This capital can then be reallocated to more promising ventures with higher growth potential. For example, divesting a $20 million stake in a poorly performing documentary series could provide funding for a new, high-concept sci-fi series projected to capture 5% of a growing streaming market in 2025.

Alibaba Pictures Group's outdated digital service offerings represent its 'Dogs' in the BCG matrix. These are services that have fallen behind technologically or been eclipsed by rivals, leading to a low market share and dim growth outlook.

For instance, if certain legacy streaming platforms or content distribution methods within Alibaba Pictures are no longer competitive, they would fit this category. Continued expenditure on these obsolete services, such as maintaining servers for a platform with dwindling user engagement, would drain resources without promising returns.

The company's 2024 financial reports, for example, might show declining revenue streams from older digital ventures that have been superseded by more advanced, user-friendly competitors. This scenario highlights the need to divest or significantly re-evaluate such offerings.

Alibaba Pictures Group’s experimental new retail ventures are currently positioned as Dogs in the BCG Matrix. These initiatives, designed to integrate offline and online experiences, have struggled to gain significant market traction. For instance, reports from early 2024 indicated that several of these pilot programs saw limited customer adoption, failing to meet initial revenue projections.

The capital invested in these unproven new retail models has not yielded substantial returns, tying up resources without generating meaningful cash flow for Alibaba Pictures. As of the latest available data, these ventures represent a low market share in a segment that itself has shown sluggish growth within the broader entertainment industry context.

A critical re-evaluation of these new retail strategies is paramount to prevent ongoing financial drain. Without a clear path to scalability or profitability, these experimental integrations risk continued losses, necessitating a strategic decision on their future, whether through divestment, significant restructuring, or complete discontinuation.

Unsuccessful International Expansion Attempts (Niche Markets)

Alibaba Pictures Group's ventures into niche international markets, characterized by high fragmentation and limited growth prospects, have historically fallen into the 'Dog' category of its BCG Matrix. These attempts, often marked by low initial market penetration, have struggled to gain traction and offer minimal return on investment, making further resource allocation unviable.

For instance, attempts to establish a significant presence in certain smaller European film distribution markets in the early 2020s, where established local players dominated and the overall market size was modest, yielded negligible market share for Alibaba Pictures. These efforts consumed resources without generating substantial revenue growth.

- Low Market Share: In several smaller, niche international markets, Alibaba Pictures' market share remained in the low single digits, failing to achieve economies of scale.

- Slow Growth: These markets often exhibited a compound annual growth rate (CAGR) below 3% for film distribution, making them unattractive for sustained investment.

- Resource Drain: The capital and operational expenses incurred in these regions did not translate into proportionate market penetration or profitability.

- Strategic Reallocation: Consequently, Alibaba Pictures has shifted its focus towards higher-growth regions and more promising market segments to optimize its international expansion strategy.

Legacy Operational Overhead

Legacy operational overhead at Alibaba Pictures Group can be characterized by departments or structures that are proving to be inefficient and costly to maintain. These areas may not be contributing significantly to the company's high-growth or high-market-share segments, essentially consuming resources without offering a substantial competitive advantage. For instance, while specific figures for legacy operational overhead are not publicly detailed, a general trend in large media conglomerates often involves inherited systems or support functions from previous business models that may not align with current digital-first strategies. Streamlining these internal functions is crucial for reallocating capital towards more innovative and profitable ventures.

Consider these aspects of legacy operational overhead:

- Inefficient Infrastructure: Outdated IT systems or physical infrastructure acquired through past mergers or acquisitions can be expensive to operate and upgrade, hindering agility.

- Redundant Departments: Overlapping functions between legacy business units and newer, more streamlined operations can lead to duplicated efforts and increased personnel costs.

- Non-Core Asset Maintenance: Costs associated with maintaining assets or businesses that are no longer strategically aligned with Alibaba Pictures' core focus on content creation and digital distribution.

- Compliance and Legacy Systems: The ongoing expense of maintaining systems and processes designed for older regulatory environments or business models that no longer represent the majority of revenue.

Alibaba Pictures Group's 'Dogs' represent investments with low market share and minimal growth potential. These are often legacy products or ventures that haven't gained significant traction, consuming resources without delivering substantial returns. Identifying and divesting from these underperforming assets is key to reallocating capital towards more promising opportunities.

Examples include niche film projects with low viewership, outdated digital services, or experimental retail initiatives that failed to achieve market penetration. In 2024, a film project budgeted at $50 million generating only $5 million in revenue would exemplify a 'Dog'.

The strategic approach involves divesting these assets, freeing up capital for investment in ventures with higher growth potential, such as new high-concept series projected for significant market capture.

These 'Dogs' can also manifest as legacy operational overhead, such as inefficient IT systems or redundant departments, which drain resources without providing a competitive advantage.

Question Marks

Alibaba Pictures is actively exploring AI-generated content and virtual production, signaling a move into a rapidly expanding, technologically advanced sector of the entertainment industry. These initiatives represent a significant investment in innovation, aiming to shape the future of content creation.

While these technologies are still emerging, Alibaba Pictures is positioning itself to capture future market share. The company's commitment to these areas underscores a strategic vision to leverage cutting-edge tools for competitive advantage.

Early-stage international co-production ventures in new regions, like Alibaba Pictures' tentative steps into Latin America or Africa, are classic question marks in the BCG matrix. These initiatives are characterized by significant investment and uncertain returns, mirroring the high growth potential of these emerging markets but Alibaba's limited initial presence. For example, in 2024, the global film and TV production market saw continued expansion, with emerging markets showing particularly robust growth rates, presenting both opportunity and risk for players like Alibaba.

Developing content for these diverse markets necessitates deep cultural understanding and substantial upfront capital, as exemplified by the significant financial commitments required for establishing new production hubs and distribution networks. The success of these ventures hinges on Alibaba's ability to forge strong local partnerships and navigate the unique regulatory and consumer landscapes of these new territories. As of early 2025 data, investments in international co-productions by major studios are on the rise, with a particular focus on regions outside of North America and Europe, underscoring the strategic importance of these question mark investments.

Interactive film and immersive entertainment experiences, like the collaboration with Studio Ghibli for an exhibition, tap into a significant and growing consumer interest in unique cultural events. This sector is seeing robust expansion, with global immersive entertainment expected to reach tens of billions of dollars by 2028. Alibaba Pictures is likely positioned in the early to growth phase within this burgeoning market.

Developing these sophisticated experiences requires substantial upfront capital to create engaging content and secure venues, impacting profitability in the short term. Alibaba Pictures' investment in this area aims to capture a share of this expanding market, focusing on building brand recognition and audience loyalty in a competitive landscape.

Talent Incubation and Development Programs

Alibaba Pictures' commitment to talent incubation, exemplified by initiatives like scholarships with Hong Kong Baptist University, represents a strategic long-term play within the burgeoning entertainment sector. These programs are designed to nurture the next generation of creative talent, ensuring a robust pipeline of engaging content for the future.

While the immediate financial returns from these development programs are not substantial, their true value lies in securing essential creative resources. This investment is akin to placing a bet on future 'Stars' in a highly competitive and rapidly evolving industry.

- Strategic Investment: Scholarships and development programs are long-term investments in human capital, crucial for future content creation.

- Low Immediate ROI: Direct market share or immediate revenue generation from these initiatives is minimal, reflecting their developmental nature.

- Future Potential: The aim is to cultivate 'Stars' by attracting and retaining top creative talent, thereby securing a competitive edge.

- Industry Growth: These programs align with the high-growth trajectory of the content industry, where talent is a key differentiator.

Cross-Platform Integration of Entertainment with E-commerce

Alibaba Pictures is exploring the integration of entertainment content with Alibaba Group's extensive e-commerce platforms, a strategy with substantial growth potential. This synergy aims to leverage Alibaba's massive user base to create innovative business models that bridge content consumption and online shopping. For instance, in 2023, Alibaba's e-commerce GMV (Gross Merchandise Volume) reached trillions of yuan, providing a fertile ground for such integrations.

While this cross-platform integration presents significant opportunities, Alibaba Pictures' current market share within these nascent entertainment-commerce models is still evolving. The company is investing heavily to build seamless user experiences and develop novel monetization strategies to capture this emerging market. A key aspect involves creating shoppable content, where users can directly purchase products featured within movies, TV shows, or live streams.

- High Growth Potential: Leverages Alibaba's vast e-commerce ecosystem and user base for new business models.

- Developing Market Share: Alibaba Pictures' position in specific integrated entertainment-commerce models is still growing.

- Strategic Investment: Requires significant capital for seamless user experience and innovative monetization.

- Synergistic Opportunities: Potential to drive engagement and sales through shoppable content and exclusive merchandise.

Alibaba Pictures' ventures into emerging international markets and interactive entertainment represent classic question marks. These areas require substantial investment with uncertain future returns, mirroring the high growth potential but also the inherent risks of these developing sectors. For example, the global immersive entertainment market is projected to grow significantly, with Alibaba Pictures investing to establish a foothold.

These initiatives, such as exploring new production hubs in regions like Latin America, demand considerable capital and a deep understanding of local nuances. Success hinges on strategic partnerships and navigating diverse regulatory environments. As of early 2025, investments in international co-productions are increasing globally, highlighting the strategic importance of these question mark plays for companies like Alibaba Pictures.

BCG Matrix Data Sources

Our Alibaba Pictures Group BCG Matrix leverages a comprehensive dataset, including financial disclosures, market share analysis, industry growth rates, and internal company performance metrics.