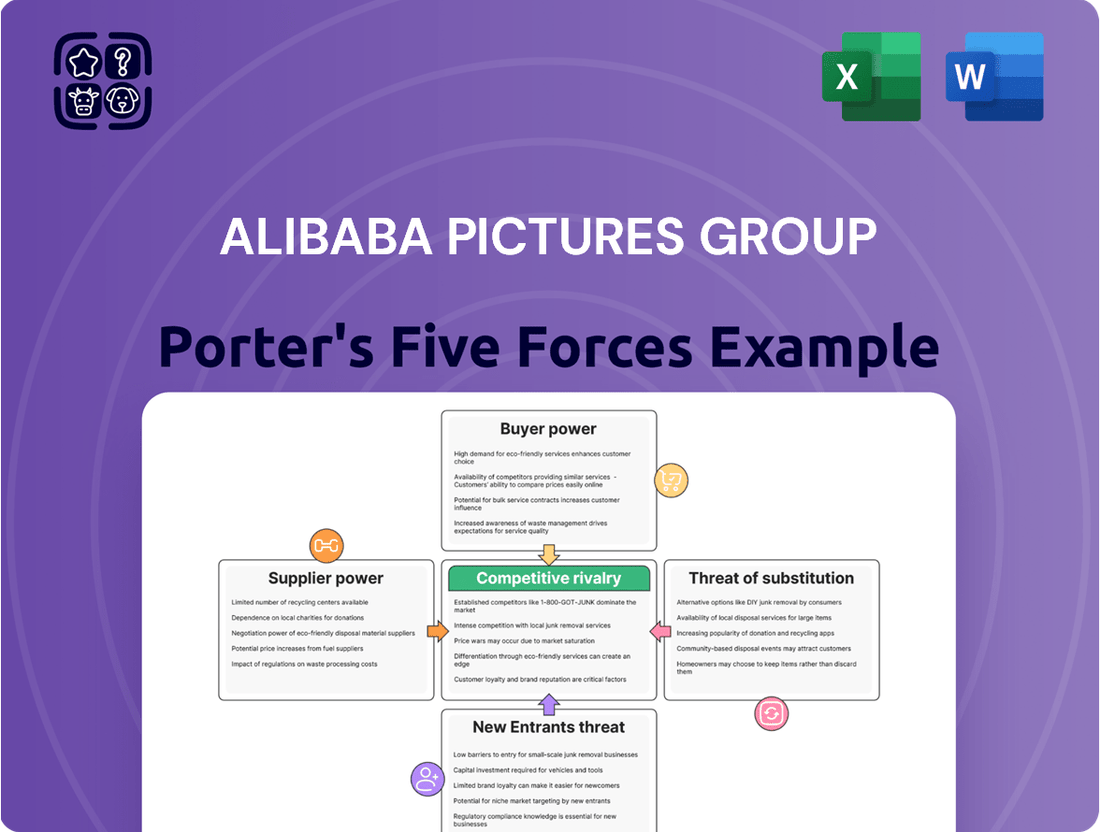

Alibaba Pictures Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alibaba Pictures Group Bundle

Alibaba Pictures Group operates in a dynamic entertainment landscape, facing considerable pressure from powerful buyers and a moderate threat of substitutes, with intense rivalry among existing players significantly shaping its competitive environment.

Understanding the nuances of supplier power and the barriers to entry for new competitors is crucial for Alibaba Pictures' strategic planning and long-term success.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Alibaba Pictures Group’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The bargaining power of top-tier directors, actors, screenwriters, and other creative talent is substantial for Alibaba Pictures. Their unique skills and established reputations are direct drivers of a film's potential success, giving them considerable leverage. This is evident in the high salaries commanded by A-list talent, with leading actors in major productions often earning tens of millions of dollars per film.

The limited availability of highly sought-after individuals means that studios like Alibaba Pictures must compete intensely for their services. This scarcity can significantly inflate production costs and extend project timelines, as securing key personnel becomes a critical bottleneck. For instance, a single, in-demand director can dictate terms that impact the entire budget and schedule.

Alibaba Pictures frequently finds itself in a position where it must secure exclusive contracts with such talent to ensure access to their creative vision and marketability. The ability of these professionals to choose which projects to attach themselves to, and the terms they demand, underscores their significant supplier power within the film industry.

Content rights holders, particularly those possessing exclusive or highly sought-after intellectual property like original stories, literary works, or popular franchises, wield significant bargaining power over Alibaba Pictures Group. The expense and competitive nature of acquiring these rights directly influence the company's content creation capabilities and its potential for market differentiation.

The leverage of these suppliers is intrinsically tied to the uniqueness and market demand for their specific intellectual property. For instance, securing rights to a globally recognized franchise could involve substantial upfront payments and ongoing royalty fees, impacting Alibaba Pictures' profitability and strategic content acquisition decisions. In 2024, the market for premium content rights remained fiercely contested, with major studios and independent creators commanding higher prices for compelling narratives, a trend likely to continue impacting companies like Alibaba Pictures.

Technology and equipment providers, such as those supplying specialized production gear or visual effects software, hold a moderate level of bargaining power over Alibaba Pictures. This power stems from the necessity of cutting-edge technology for high-quality film and television production, particularly in areas like CGI and virtual production.

While alternative suppliers may exist, the reliance on specific, advanced tools for sophisticated visual elements can create dependency and potential cost pressures for Alibaba Pictures. For instance, the development and licensing of proprietary rendering engines or motion capture systems can be a significant cost factor.

Innovation plays a crucial role; a supplier introducing a groundbreaking technology essential for competitive production can significantly shift the power dynamic. Companies that lead in AI-driven post-production tools or advanced camera stabilization systems, for example, could command higher prices or more favorable terms.

Marketing and Promotion Channels

The bargaining power of suppliers in marketing and promotion channels for Alibaba Pictures Group is influenced by the effectiveness and reach of various platforms. While Alibaba's internal ecosystem provides a strong base, external channels are crucial for wider market penetration.

Key marketing and distribution platforms, including major advertising agencies, social media giants like Douyin and Kuaishou, and traditional media, can significantly impact content promotion costs and reach. For instance, the cost of advertising on leading social media platforms can fluctuate based on demand and platform policies, giving these platforms leverage.

- Advertising Agencies: Their influence stems from established relationships and negotiation power with media owners, potentially increasing costs for content placement.

- Social Media Platforms: Platforms like Douyin saw a significant increase in advertising revenue, with digital advertising spending in China projected to reach over $200 billion in 2024, giving them considerable pricing power.

- Traditional Media Outlets: While their reach may be declining for certain demographics, their established audience for specific segments still grants them some leverage in negotiating advertising rates.

- Talent Agencies: For securing popular actors and influencers, these agencies hold substantial power, often dictating terms and fees for endorsements and promotional appearances.

Film and TV Production Service Providers

Film and TV production service providers, like specialized studios and post-production houses, can wield significant bargaining power. This power is often tied to their unique expertise, established reputation, and the availability of their highly sought-after services. For instance, companies offering cutting-edge visual effects or unique filming locations can dictate higher prices, impacting Alibaba Pictures' production costs.

Alibaba Pictures, to mitigate this supplier power, strategically balances its in-house production capabilities with outsourcing. This approach allows them to leverage internal resources for cost control and creative alignment while selectively engaging external specialists for specific needs. The global film and TV production market saw significant investment in 2024, with major studios continuing to rely on specialized external partners.

- Specialized Expertise: Providers with niche skills (e.g., CGI, animation) can command premium pricing.

- Reputation and Track Record: Proven success in delivering high-quality results enhances supplier leverage.

- Availability and Demand: Limited capacity for in-demand services increases supplier bargaining power.

- Strategic Outsourcing: Alibaba Pictures' use of both internal and external resources helps manage supplier influence.

Alibaba Pictures faces significant bargaining power from key creative talent, with top directors, actors, and screenwriters able to command substantial salaries, often in the tens of millions of dollars per project, as seen in major 2024 productions. This leverage is amplified by the limited pool of highly sought-after individuals, forcing studios to compete intensely and potentially inflate production costs. Securing exclusive contracts with this elite talent is a common strategy to mitigate this power and ensure access to market-driving creative vision.

Content rights holders also exert considerable influence, especially for unique or popular intellectual property. The acquisition costs for these rights, including upfront payments and ongoing royalties, directly impact Alibaba Pictures' profitability and content strategy. In 2024, the market for desirable content rights remained highly competitive, with significant investment driving up prices for compelling narratives.

Technology and equipment providers, particularly those offering specialized or advanced production tools like CGI software or virtual production systems, hold moderate bargaining power. The necessity of cutting-edge technology for high-quality output creates dependency, and suppliers who innovate in areas like AI-driven post-production can significantly influence pricing and terms. This reliance on specific, advanced systems can lead to cost pressures for Alibaba Pictures.

| Supplier Type | Source of Power | Impact on Alibaba Pictures | 2024 Data/Trend |

|---|---|---|---|

| Creative Talent (Directors, Actors) | Unique skills, established reputation, limited availability | High salaries, increased production costs, project delays | A-list talent commanding tens of millions per film; intense competition for top stars. |

| Content Rights Holders | Uniqueness and market demand for intellectual property | Substantial acquisition costs (upfront fees, royalties), strategic content decisions | Fiercely contested market for premium rights; higher prices for compelling narratives. |

| Technology/Equipment Providers | Necessity of cutting-edge tools, proprietary systems | Cost pressures, dependency on specific advanced gear | Companies leading in AI post-production or virtual production can command higher prices. |

What is included in the product

This Porter's Five Forces analysis for Alibaba Pictures Group assesses the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes within the entertainment industry.

Instantly understand competitive pressures within the film industry, identifying key threats and opportunities for Alibaba Pictures Group to navigate effectively.

Customers Bargaining Power

Individual consumers engaging with online ticketing services, such as those offered through Alibaba Pictures Group's Taopiaopiao, possess significant bargaining power. This is largely due to the readily available alternatives from numerous competing platforms, each vying for user attention. In 2024, the online ticketing market in China saw continued growth, with users accustomed to comparing prices and benefits across various apps, giving them considerable leverage.

The ease with which consumers can switch between different ticketing platforms, often with minimal effort or cost, further amplifies their influence. Promotions, discounts, and user experience are key drivers of consumer choice. For instance, a successful flash sale by a competitor on a popular film could directly impact Taopiaopiao's customer acquisition and retention rates, demonstrating the direct impact of consumer preferences on platform strategy.

Viewers and subscribers hold significant sway because the entertainment landscape is brimming with choices, from streaming services to traditional media. This abundance means they can easily switch if they don't find value, impacting revenue for content providers like Alibaba Pictures.

Their purchasing decisions are directly tied to what they perceive as worthwhile, considering factors like the quality of films, TV dramas, and animated content, as well as the sheer variety and ease of access. For instance, in 2024, the global streaming market saw continued growth, with more platforms vying for subscriber attention, further amplifying consumer choice.

Ultimately, keeping these viewers engaged and subscribed hinges on maintaining a strong library of appealing content and ensuring a smooth, enjoyable user experience. A study in early 2024 indicated that content freshness and exclusive releases were key drivers of subscriber loyalty in the digital entertainment space.

Third-party distributors and broadcasters hold considerable sway over Alibaba Pictures' content, especially for both domestic and international releases. Their market reach and established audience bases mean they can dictate terms, impacting licensing fees and distribution agreements. In 2024, the fragmented nature of some international distribution channels means that securing shelf space or broadcast slots requires competitive offers, potentially driving down margins for content creators.

The power of these intermediaries stems from their ability to select from a wide array of content providers. If Alibaba Pictures' offerings aren't unique or in high demand, distributors can leverage this to negotiate more favorable terms. For instance, a successful genre like historical dramas in China might have multiple competing films, giving distributors more options and thus more bargaining power.

Building robust relationships with key distributors and creating content that stands out are vital strategies for Alibaba Pictures to counter this influence. By offering exclusive or highly sought-after content, they can reduce the distributors' leverage. This was evident in early 2024 when a major streaming platform secured exclusive rights to a highly anticipated Chinese fantasy series, paying a premium but gaining a significant competitive advantage.

Advertisers on Platforms

Advertisers seeking to reach audiences through Alibaba Pictures' platforms possess moderate bargaining power. This power is shaped by factors such as the platform's audience size, engagement levels, and the availability of comparable advertising options on other media channels. Alibaba Pictures' ability to offer precise audience targeting and demonstrate a strong return on investment for advertising spend directly influences the leverage advertisers hold. In 2024, digital advertising spend in China continued its robust growth, with platforms offering unique user data and high engagement rates commanding premium pricing, thereby calibrating advertiser influence.

Key considerations for advertisers include:

- Audience Reach and Engagement: The sheer volume and active participation of users on Alibaba Pictures' platforms are primary drivers of advertiser interest and, consequently, their bargaining leverage.

- Targeting Capabilities and ROI: The precision with which advertisers can target specific demographics and the demonstrable return on their advertising investment significantly empower their negotiation position.

- Alternative Advertising Channels: The presence and attractiveness of competing platforms and advertising methods in the market provide advertisers with options, thereby moderating their dependence on any single platform.

New Retail and Merchandise Buyers

New retail and merchandise buyers looking for entertainment-related products connected to Alibaba Pictures' intellectual property generally have a moderate level of bargaining power. Their purchasing decisions are shaped by several factors: the strength of the brand, the quality of the merchandise itself, the price point, and how easily they can find comparable items from other companies in the market. For instance, in 2023, the global merchandise licensing market was valued at approximately $314 billion, indicating a large and competitive landscape where consumer choice is paramount.

The perceived authenticity and any sense of exclusivity surrounding these merchandise offerings also significantly influence whether a customer chooses to buy. If buyers feel a strong connection to the intellectual property and see the merchandise as a unique way to engage with it, their willingness to pay might increase, somewhat reducing their bargaining power. However, if similar themed merchandise is readily available from other entertainment franchises, consumers can easily switch, thereby amplifying their leverage.

- Brand Appeal: Stronger brand recognition can lessen buyer power, but diverse offerings still provide choices.

- Product Quality & Pricing: Customers expect good value, and competitive pricing in the $314 billion global merchandise market (2023) means they can shop around.

- Availability of Alternatives: The presence of similar merchandise from competing entertainment properties gives buyers more options and thus more power.

- Perceived Exclusivity: Limited edition or unique items can reduce bargaining power by creating a sense of urgency or special access for consumers.

Individual consumers, especially those using platforms like Taopiaopiao, wield considerable bargaining power due to abundant alternatives and a market where price and promotions are key. In 2024, consumers were adept at comparing options, giving them leverage. This ease of switching amplifies their influence, making platform features and discounts critical for retention.

Alibaba Pictures' content consumers, both viewers and merchandise buyers, possess significant leverage. The vast array of entertainment choices and merchandise options means they can easily shift their spending if value or quality is lacking. In 2024, the digital entertainment market continued to expand, offering consumers more avenues for engagement, thereby increasing their power to demand better content and products.

The bargaining power of customers for Alibaba Pictures is substantial, driven by the ease of switching between platforms and the wide availability of entertainment content and related merchandise. Consumers in 2024, accustomed to comparing prices and benefits across numerous digital services, held considerable sway. This dynamic forces Alibaba Pictures to focus on delivering compelling content and a superior user experience to maintain customer loyalty and engagement.

| Factor | Impact on Customer Bargaining Power | Example/Data Point (2024 unless stated) |

| Availability of Alternatives (Ticketing) | High | Numerous competing online ticketing platforms in China. |

| Ease of Switching | High | Minimal effort or cost for consumers to move between ticketing apps. |

| Content Abundance | High | Consumers can easily switch between streaming services, films, and TV dramas. |

| Merchandise Market Competition | Moderate to High | The global merchandise licensing market reached approx. $314 billion in 2023, offering diverse choices. |

| Brand Loyalty vs. Exclusivity | Variable | Strong brand appeal can reduce power, but perceived exclusivity can increase it. |

Preview Before You Purchase

Alibaba Pictures Group Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. Our comprehensive Porter's Five Forces analysis of Alibaba Pictures Group delves into the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitutes, offering a complete picture of the competitive landscape. You're looking at the actual document, which meticulously details each force with relevant industry insights specific to Alibaba Pictures. Once you complete your purchase, you’ll get instant access to this exact file, enabling you to leverage this strategic intelligence without delay.

Rivalry Among Competitors

Alibaba Pictures Group's content production studios operate within China's highly fragmented film and television market, characterized by a multitude of domestic studios. This intense competition, often fueled by significant backing from major tech firms and established media conglomerates, drives a constant battle for essential resources. Companies vie fiercely for top creative talent, compelling intellectual property, and a larger slice of market share, which directly impacts their ability to secure a strong position.

The direct consequence of this intense rivalry is a noticeable escalation in production costs and a substantial increase in marketing expenditures. Studios must invest heavily to stand out and capture audience attention in a crowded landscape. For instance, in 2024, the average budget for a major Chinese film production saw a notable uptick, reflecting these increased costs. This competitive pressure, however, also serves as a powerful catalyst for innovation, pushing studios like those under Alibaba Pictures to consistently develop and deliver high-quality, engaging content to maintain their edge.

Alibaba Pictures' Taopiaopiao operates in a highly competitive Chinese online ticketing market, with Maoyan Entertainment being a particularly strong rival. This intense rivalry drives frequent price promotions and exclusive pre-sale content to capture market share.

In 2023, Maoyan Entertainment reported a revenue of approximately RMB 4.7 billion, highlighting its significant market presence and the scale of competition Taopiaopiao faces. Both platforms invest heavily in user interface improvements and new service features to retain and attract customers.

The competitive rivalry among streaming service providers in China, including Youku which aligns with Alibaba Pictures Group, is fierce. Major players like Tencent Video and iQiyi heavily invest in exclusive content to attract and retain subscribers, leading to escalating production costs. For instance, in 2023, the Chinese online video market was valued at over $20 billion, with these top platforms vying for market share.

This intense competition forces companies to constantly innovate their subscription models and user experience to stand out. Youku, as part of the Alibaba ecosystem, benefits from cross-platform integration and marketing, but still faces pressure to differentiate its content library and features against formidable rivals. The constant need for premium content acquisition and original production fuels this aggressive market dynamic.

Digital Entertainment Service Providers

The digital entertainment service sector is intensely competitive, with Alibaba Pictures Group facing rivalry from specialized technology firms and larger entertainment conglomerates developing their own in-house digital solutions. These competitors offer a range of services, including data analytics for audience insights, targeted marketing campaigns, and platforms designed to foster fan engagement. For instance, companies like Tencent Music Entertainment are leveraging their vast user bases and data capabilities to provide integrated digital services within the entertainment ecosystem.

Alibaba Pictures' strategy to provide comprehensive digital solutions across the entire entertainment value chain means it's up against players who are also focusing on integration. Differentiation through cutting-edge technology, such as AI-driven content recommendation engines or immersive fan experiences, and the ability to offer truly integrated service packages are crucial for success. The market demands constant innovation; for example, by 2024, the global digital advertising market, a key component for marketing solutions, was projected to exceed $800 billion, indicating the scale of investment and competition.

- Intense Rivalry: Specialized tech firms and in-house capabilities of large entertainment groups directly compete with Alibaba Pictures' digital services.

- Service Scope: Competition spans data analytics, marketing solutions, and fan engagement platforms, often offered in integrated packages.

- Differentiation is Key: Success hinges on technological advancement and providing cohesive, end-to-end digital solutions.

- Market Scale: The significant size of related markets, like digital advertising, underscores the competitive landscape and investment potential.

New Retail and IP Commercialization Competitors

Rivalry in new retail and intellectual property (IP) commercialization is intensifying, with entertainment companies, e-commerce giants, and merchandise manufacturers all vying for consumer attention. These competitors leverage popular IPs to create innovative products, engaging fan experiences, and rapid monetization opportunities from trending content.

This competition demands agility in product design and a keen ability to connect with fan bases. For instance, Disney's extensive IP portfolio and its Parks, Experiences and Products division generated approximately $28.7 billion in revenue in fiscal year 2023, showcasing the financial power of effective IP commercialization. Alibaba Pictures Group faces similar pressures to build and effectively monetize its own robust IP assets.

- Intensified Competition: Entertainment firms, e-commerce players, and merchandise makers compete using popular IPs.

- Key Strategies: Success hinges on innovative product design, strong fan engagement, and swift capitalization on trending content.

- IP Portfolio Importance: Building and managing a strong IP portfolio is critical for sustained competitive advantage in this market.

- Market Example: Disney's $28.7 billion in Parks, Experiences and Products revenue (FY2023) highlights the significant financial returns from effective IP commercialization.

Alibaba Pictures Group faces intense competition across its various business segments. In content production, a fragmented market with numerous domestic studios, often backed by tech giants, drives up costs for talent and IP. This rivalry forces significant investment in marketing, as seen with rising average film production budgets in China during 2024.

The online ticketing sector sees fierce competition, particularly from Maoyan Entertainment, which reported roughly RMB 4.7 billion in revenue in 2023. Streaming services, including Alibaba's Youku, contend with heavy spending on exclusive content by rivals like Tencent Video and iQiyi, in a market valued over $20 billion in 2023.

Digital entertainment services also witness rivalry from specialized tech firms and conglomerates, emphasizing integrated solutions. The digital advertising market, projected to exceed $800 billion by 2024, fuels competition in marketing capabilities. Finally, IP commercialization is a battleground where companies like Disney, with its $28.7 billion Parks, Experiences and Products revenue in FY2023, demonstrate the immense value of strong IP portfolios.

| Segment | Key Competitors | Competitive Tactics | Market Data Point |

| Content Production | Numerous domestic studios, tech firms | Bidding for talent, IP acquisition | Rising production costs (2024) |

| Online Ticketing | Maoyan Entertainment | Price promotions, exclusive content | Maoyan revenue ~RMB 4.7 billion (2023) |

| Streaming Services | Tencent Video, iQiyi | Exclusive content, subscription models | Chinese online video market >$20 billion (2023) |

| Digital Entertainment Services | Tech firms, entertainment conglomerates | Integrated digital solutions, tech innovation | Global digital ad market >$800 billion (2024 projection) |

| IP Commercialization | Disney, merchandise manufacturers | Product innovation, fan engagement | Disney Parks, Experiences & Products revenue $28.7 billion (FY2023) |

SSubstitutes Threaten

Consumers have an ever-expanding universe of entertainment options beyond traditional film and television, directly challenging Alibaba Pictures. Video games, short-form video platforms like Douyin and Kuaishou, live events, and even social media all vie for eyeballs and leisure time. For instance, Douyin reported over 750 million daily active users in 2023, illustrating the immense reach of these substitute platforms. This intense competition for consumer attention and discretionary spending significantly raises the threat of substitutes for Alibaba Pictures' core offerings.

User-generated content (UGC) platforms present a significant threat to traditional media like Alibaba Pictures. The sheer volume and accessibility of UGC, often free, directly compete for audience attention. For instance, platforms like TikTok and YouTube saw billions of hours of content consumed in 2024, diverting viewership from professionally produced films and series.

The low cost of entry for creators on UGC platforms means an ever-increasing supply of alternative entertainment. This accessibility erodes the perceived value of higher-budget productions. Consider that over 100 million new videos are uploaded to TikTok daily, showcasing a vast and constantly refreshing content pool.

Traditional entertainment like reading books, e-books, and listening to podcasts or audio dramas are significant substitutes for Alibaba Pictures Group's offerings, especially for narrative and informative content. These alternatives often present a lower cost barrier and more flexible consumption patterns, attracting diverse audience segments. For instance, the global podcasting market was valued at approximately $15.5 billion in 2023 and is projected to grow substantially, highlighting the increasing preference for audio-based content.

The inherent convenience of audio content, in particular, makes it a powerful competitor for consumers' leisure time. While specific market share data for substitutes directly impacting Alibaba Pictures is complex to isolate, the broader trend of digital media consumption shows a strong shift towards easily accessible and portable formats. This suggests that consumers may opt for a podcast during their commute instead of watching a movie or series, representing a direct trade-off in entertainment choices.

Outdoor Activities and Socializing

The threat of substitutes for Alibaba Pictures Group's offerings, particularly in the realm of entertainment, is significant when considering outdoor activities and socializing. Consumers have a finite amount of leisure time, and this time can be allocated to a wide array of non-digital pursuits. Activities like attending live concerts, participating in sports, dining with friends, or traveling directly compete for consumer attention and discretionary spending that might otherwise be directed towards cinematic experiences or digital content.

These real-world engagements offer distinct value propositions, such as physical activity, direct social interaction, and unique experiences, which digital entertainment cannot fully replicate. For instance, a 2024 report indicated a notable increase in consumer spending on experiences and travel, suggesting a growing preference for tangible activities over passive consumption. This trend highlights how tangible, social, and physical experiences act as powerful substitutes, diverting potential audiences away from screen-based entertainment.

- Increased Spending on Experiences: Global consumer spending on experiences, including travel and events, saw a projected 15% year-over-year increase in 2024.

- Live Event Popularity: Major music festivals and sporting events in 2024 reported record attendance and revenue, demonstrating strong demand for in-person entertainment.

- Outdoor Recreation Growth: Participation in outdoor recreational activities like hiking and camping experienced a steady rise, with a 10% increase in national park visits reported in early 2024.

- Social Gathering Trends: Social dining and community events continue to be popular, with restaurant industry data showing a 7% growth in dining-out frequency in major urban centers during the first half of 2024.

Education and Self-Improvement Platforms

Platforms offering online courses and skill-building content represent a significant threat of substitutes for Alibaba Pictures Group. These educational and self-improvement platforms, such as Coursera, Udemy, and MasterClass, compete directly for consumers' leisure time and discretionary spending, especially those seeking personal development.

For individuals looking to invest in their future, these platforms provide a productive alternative to passive entertainment, which is Alibaba Pictures' core offering. The value proposition shifts from pure enjoyment to tangible skill acquisition or knowledge enhancement.

The growing trend of lifelong learning and the increasing accessibility of online education further amplify this threat. For instance, the global e-learning market was valued at approximately $250 billion in 2023 and is projected to grow significantly in the coming years, indicating a strong consumer preference for such alternatives.

- Increased Consumer Demand for Skill Development: As the job market evolves, individuals are actively seeking to upskill and reskill, making educational platforms a more attractive substitute for entertainment.

- Hybrid Content Models: Some platforms are blending entertainment with educational value, creating a more compelling offering that directly challenges traditional entertainment providers.

- Accessibility and Affordability: The low cost and high accessibility of many online learning platforms make them a convenient and budget-friendly alternative to cinema tickets or streaming subscriptions.

The rise of interactive gaming and esports presents a formidable substitute for traditional film and television content provided by Alibaba Pictures. These platforms offer active engagement and a sense of community that passive viewing cannot match. In 2024, the global gaming market was projected to exceed $200 billion, with esports viewership alone reaching hundreds of millions worldwide, demonstrating a significant draw on consumer leisure time and entertainment budgets.

| Substitute Category | Key Characteristics | 2024 Market Data/Trends |

|---|---|---|

| Interactive Gaming & Esports | Active participation, social interaction, competitive engagement | Global gaming market projected to exceed $200 billion. Esports viewership continues strong growth. |

| User-Generated Content (UGC) Platforms | High volume, free access, diverse creators | TikTok daily uploads exceed 100 million; YouTube sees billions of hours consumed. |

| Audio Content (Podcasts, Audio Dramas) | Convenience, portability, narrative focus | Global podcasting market valued at $15.5 billion in 2023, with strong growth projected. |

| Experiences & Social Activities | Tangible engagement, direct social interaction, personal development | Consumer spending on experiences projected for 15% YoY increase in 2024; significant growth in live events and outdoor recreation. |

| Online Learning & Skill Development | Personal growth, tangible skill acquisition, productive leisure | Global e-learning market valued at $250 billion in 2023, with increasing demand for upskilling. |

Entrants Threaten

The film and television production and distribution industry demands immense financial resources. Creating compelling content, attracting top talent, and executing effective marketing campaigns all require significant upfront investment. Alibaba Pictures, for instance, operates within a landscape where major studios routinely spend hundreds of millions of dollars on blockbuster productions and global distribution networks.

Securing the necessary capital to match the scale of established players like Alibaba Pictures presents a formidable hurdle for newcomers. This capital intensity, encompassing everything from studio infrastructure to international distribution rights, effectively deters many potential entrants from even attempting to compete, thereby limiting the threat of new competition.

Alibaba Pictures Group, like other major players, benefits from significant established brand loyalty and intellectual property (IP). Incumbent companies have cultivated deep trust with audiences over time, often through years of successful content production and distribution. This brand equity makes it challenging for new entrants to capture market share quickly. For instance, a new streaming service would find it difficult to immediately compete with the vast, recognized libraries of established studios. In 2024, major studios continued to leverage their extensive back catalogs and character universes, which remain a primary draw for consumers, effectively creating a high barrier to entry.

The Chinese entertainment sector is heavily regulated, particularly concerning content approval and foreign investment limits, creating a significant barrier for any potential new players aiming to enter Alibaba Pictures Group's market. For instance, in 2024, the National Radio and Television Administration continued to enforce strict guidelines on film and television production, impacting what content can be aired and distributed.

New entrants must possess substantial legal and compliance resources to navigate this intricate and often unpredictable regulatory framework. Failure to adhere to these rules can lead to severe penalties, including content bans and operational shutdowns, thereby deterring the necessary investment for market entry.

This inherent regulatory complexity translates into considerable uncertainty, making it challenging for new companies to forecast market viability and secure funding, thereby effectively limiting the threat of new entrants.

Access to Talent and Distribution Channels

Newcomers to the film and media landscape face a significant hurdle in securing top-tier creative talent and establishing robust distribution channels. Alibaba Pictures Group, like other established players, benefits from existing relationships with directors, actors, and writers, as well as a developed network of cinemas and online streaming platforms. For instance, in 2024, the competitive landscape for securing A-list talent intensified, with major studios reportedly offering lucrative multi-picture deals, a luxury new entrants often cannot match.

Building these crucial connections and infrastructure is a time-consuming and capital-intensive endeavor. New entrants often struggle to attract sought-after talent due to a lack of proven track record and established industry credibility. Furthermore, gaining access to prominent online streaming services or physical cinema chains can be challenging, as these platforms often prioritize content from established studios with a history of delivering reliable audience draw. This can leave new companies with limited reach and exposure.

- Talent Acquisition Costs: Securing A-list talent can represent a substantial portion of a film's budget, with top actors and directors commanding multi-million dollar salaries.

- Distribution Network Barriers: Established players have pre-existing deals with major cinema chains and streaming platforms, making it difficult for new entrants to secure prime exhibition slots.

- Brand Recognition: New entrants lack the brand recognition that helps established companies attract both talent and audiences.

Economies of Scale and Experience Curve

Alibaba Pictures Group, like many established players in the media and entertainment sector, benefits significantly from economies of scale. This means that as their production, distribution, and marketing efforts increase, their cost per unit of content tends to decrease. For instance, in 2024, major studios can leverage bulk purchasing of raw materials, advanced production technologies, and extensive marketing campaigns that would be prohibitively expensive for smaller, new entrants.

The experience curve further solidifies this advantage. Companies that have been operating longer have refined their processes, learned from past projects, and optimized their supply chains. This accumulated knowledge allows them to operate more efficiently and predict market trends with greater accuracy. New entrants must invest heavily in acquiring this expertise, a process that takes considerable time and resources, making it difficult to match the operational efficiencies of incumbents like Alibaba Pictures.

- Economies of Scale: Alibaba Pictures can spread the high costs of film production, digital platform development, and marketing across a larger volume of projects, lowering the per-unit cost.

- Experience Curve: Years of operation have allowed Alibaba Pictures to optimize its content acquisition, production workflows, and audience engagement strategies, leading to more efficient resource allocation.

- Barriers to Entry: The substantial capital investment required to achieve comparable scale and the time needed to build operational expertise present significant hurdles for potential new competitors in 2024.

- Cost Disadvantage for Newcomers: Start-ups entering the market would face higher per-unit costs for production, marketing, and technology adoption compared to established entities with existing infrastructure and scale.

The threat of new entrants into the film and television industry, where Alibaba Pictures Group operates, remains relatively low due to several significant barriers. The immense capital required for production, distribution, and marketing makes it difficult for newcomers to compete with established players. Furthermore, strong brand loyalty and extensive intellectual property held by incumbents like Alibaba Pictures create a substantial challenge for any new entity attempting to gain market traction.

Regulatory complexities within key markets, such as China, add another layer of difficulty for potential entrants, demanding significant legal and compliance resources. The established networks for talent acquisition and distribution channels are also heavily guarded by incumbents, often requiring years to replicate. These combined factors, including the need for substantial upfront investment and the cultivation of industry relationships, effectively deter many prospective competitors.

Economies of scale and the experience curve further solidify the position of established companies like Alibaba Pictures Group. The ability to spread high costs across a larger volume of projects and the accumulated operational efficiencies gained over time create a cost disadvantage for any new entrant. In 2024, securing advantageous deals for talent and distribution remained a critical, yet difficult, step for emerging companies.

| Barrier Type | Description | Impact on New Entrants | Example for Alibaba Pictures Group (2024) |

| Capital Intensity | High cost of production, marketing, and distribution | Significant financial hurdle | Hundreds of millions spent on blockbuster productions and global distribution networks. |

| Brand Loyalty & IP | Established trust and recognized content libraries | Difficulty in capturing market share | Leveraging vast back catalogs and character universes to attract consumers. |

| Regulatory Hurdles | Content approval and foreign investment restrictions | Requires extensive legal and compliance resources | Adherence to strict guidelines from the National Radio and Television Administration. |

| Talent & Distribution Access | Existing relationships with talent and distribution channels | Challenging to attract talent and gain exposure | Lucrative multi-picture deals for A-list talent, pre-existing deals with cinema chains and streaming platforms. |

| Economies of Scale | Lower per-unit costs due to large-scale operations | Cost disadvantage for smaller competitors | Bulk purchasing of materials, advanced technology adoption, and extensive marketing campaigns. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Alibaba Pictures Group is built upon a comprehensive review of publicly available financial statements, investor relations reports, and industry-specific market research from reputable firms. We also incorporate insights from news articles and trade publications detailing competitor strategies and market trends.