Alfresa Holdings SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alfresa Holdings Bundle

Alfresa Holdings navigates a dynamic healthcare landscape, leveraging its established distribution network as a key strength while facing potential regulatory shifts and competitive pressures. Understanding these internal capabilities and external forces is crucial for strategic planning.

Want the full story behind Alfresa Holdings' market position, including detailed insights into its opportunities and threats? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Alfresa Holdings boasts a comprehensive product portfolio spanning pharmaceuticals, medical devices, diagnostic reagents, and veterinary products, which provides a strong, diversified revenue stream. This broad offering makes them a key player across various segments of the healthcare market.

The company's integrated supply chain, featuring a network of warehouses and distribution centers throughout Japan, ensures efficient delivery of these diverse products to pharmacies, hospitals, and medical facilities. This robust infrastructure is a significant competitive advantage, solidifying their role as a vital partner in Japan's healthcare ecosystem.

Alfresa Holdings boasts a dominant position in Japan's healthcare sector, particularly in ethical pharmaceutical wholesaling where it commands an impressive 27.5% market share. This leadership is underpinned by deep-rooted trust with manufacturers and a robust, efficient logistics network.

The company's strategic focus on high-value areas like specialty pharmaceuticals and medical devices, coupled with ongoing investments in supply chain optimization and digital transformation, solidifies its competitive advantage. These initiatives are crucial for maintaining its strong foothold in the dynamic Japanese market.

Alfresa Holdings distinguishes itself by actively engaging in pharmaceutical manufacturing and the research and development of novel drugs and medical devices, extending beyond its core distribution business. This vertical integration strategy is crucial for maintaining stringent quality control, fostering innovation, and broadening its product portfolio, which now includes active pharmaceutical ingredients (APIs) and highly potent preparations.

The company's dedication to R&D and production is evident in its recent strategic investments, such as the construction of a new manufacturing facility designed to enhance its production capacity. Furthermore, Alfresa's expansion into contract manufacturing services highlights its commitment to leveraging its expertise and infrastructure to meet growing market demands and solidify its position in the pharmaceutical value chain.

Strategic Alliances and Investments

Alfresa Holdings actively pursues growth via strategic capital and business alliances, exemplified by its collaboration with Morikubo CA Medical Inc. in veterinary care. This forward-thinking approach extends to partnerships with companies like Ascent Robotics, focusing on AI integration within the medical and pharmaceutical industries. These alliances are crucial for expanding market presence and adopting cutting-edge technologies.

Further strengthening its strategic position, Alfresa Holdings invests in emerging fields such as cellular raw materials for cell therapy. These investments are not just about diversification; they represent a calculated move to tap into future growth markets and harness innovative solutions. For instance, the company's commitment to AI through partnerships is designed to streamline operations and unlock new service potentials.

- Strategic Partnerships: Collaborations with Morikubo CA Medical Inc. (veterinary care) and Ascent Robotics (AI in healthcare) highlight a commitment to expanding capabilities and market reach.

- Investment in Future Growth: Significant investments in areas like cellular raw materials for cell therapy signal a proactive strategy to capitalize on emerging biotechnological advancements.

- Synergistic Development: These alliances and investments are geared towards creating synergies that enhance overall business development and explore new market opportunities.

Commitment to Social Infrastructure and Sustainability

Alfresa Holdings demonstrates a strong commitment to social infrastructure by ensuring the consistent and dependable distribution of pharmaceuticals across Japan. This dedication is particularly evident in their disaster preparedness efforts, exemplified by agreements like the one with Shunan City for the provision of emergency pharmaceutical supplies.

The company actively pursues sustainability through a multi-faceted approach. Initiatives are in place to protect the environment, foster diversity within its workforce, and cultivate a corporate culture that upholds high compliance standards.

- Social Infrastructure: Alfresa Holdings plays a critical role in Japan's social infrastructure by guaranteeing a stable pharmaceutical supply chain.

- Disaster Preparedness: Agreements, such as with Shunan City, highlight their commitment to providing essential medicines during emergencies.

- Sustainability Focus: The company prioritizes environmental protection, workforce diversity, and robust compliance as key pillars of its operations.

- Societal Contribution: Alfresa Holdings aligns its business practices with broader societal well-being, reinforcing its position as a responsible corporate citizen.

Alfresa Holdings commands a significant market share in pharmaceutical wholesaling in Japan, holding an impressive 27.5% of the market. This leadership is built on strong relationships with manufacturers and an efficient distribution network.

The company's diversified product portfolio, encompassing pharmaceuticals, medical devices, and diagnostic reagents, provides a stable and broad revenue base, making it a cornerstone of Japan's healthcare system.

Alfresa's strategic investments in high-value segments like specialty pharmaceuticals and medical devices, alongside ongoing supply chain optimization and digital transformation, reinforce its competitive edge in a dynamic market.

What is included in the product

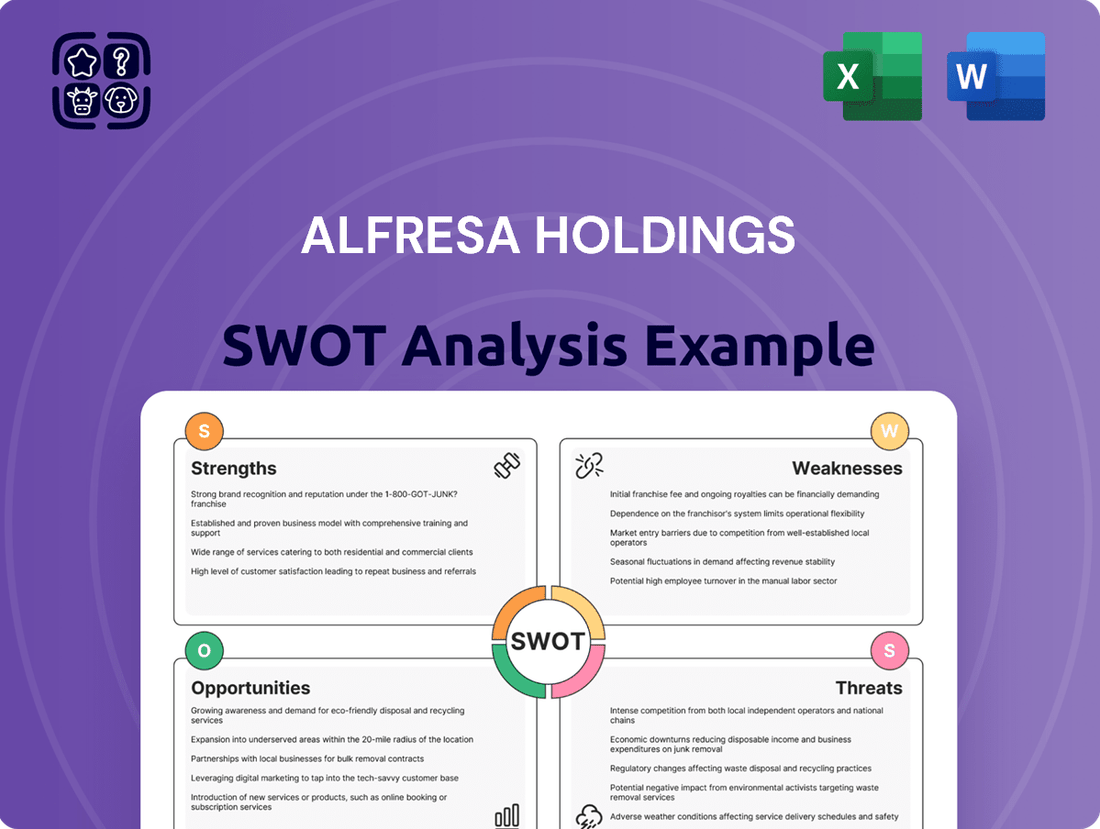

Delivers a strategic overview of Alfresa Holdings’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable breakdown of Alfresa Holdings' strategic landscape, simplifying complex market dynamics for effective decision-making.

Weaknesses

Alfresa Holdings faced a profitability challenge in the fiscal year ending March 31, 2025. Despite an uptick in net sales, both operating profit and profit attributable to owners of the parent saw a decline. This downturn was largely due to the impact of National Health Insurance (NHI) drug price revisions, which reduced revenue streams from key products.

Furthermore, the company contended with escalating operational expenses. Increases in personnel costs, coupled with rising logistics and depreciation and amortization expenses, put additional pressure on the bottom line. These combined factors contributed to the overall weakening of Alfresa Holdings' profitability during this period.

The Japanese government's drug price revisions, occurring biennially and in off-years, present a persistent weakness for pharmaceutical wholesalers like Alfresa Holdings. For instance, the price cuts slated for April 2025 will directly challenge the sector's profitability.

These recurring revisions can substantially erode revenue and gross profit margins. In Alfresa Holdings' Ethical Pharmaceuticals Wholesaling Business, attempts to reduce selling, general, and administrative (SG&A) expenses were negated by increased purchasing costs and taxes that couldn't be deducted.

Alfresa Holdings faces challenges with its cash flow conversion and earnings per share (EPS). Despite a recent dividend increase, the company's ability to consistently convert profits into cash remains a concern, potentially impacting the long-term sustainability of shareholder returns if earnings don't rebound.

For the full year 2025, Alfresa Holdings' EPS fell short of analyst expectations, and the company reported a year-on-year decline in pre-tax profit, highlighting underlying profitability pressures that need to be addressed.

Intensifying Competition in the Healthcare Market

Alfresa Holdings faces a highly competitive environment across its core businesses, including drug manufacturing, import/export, and wholesaling. This intense rivalry comes from both established global pharmaceutical giants and agile new market entrants, creating pressure on pricing and profitability. For instance, the global pharmaceutical market, valued at over $1.5 trillion in 2023, is characterized by significant R&D investment and strategic partnerships, areas where Alfresa must continually adapt to remain competitive.

The dynamic nature of the healthcare sector means that continuous innovation and operational efficiency are not just advantages but necessities for market share preservation and growth. Companies that fail to adapt to evolving market demands and technological advancements risk falling behind. In 2024, the healthcare industry is seeing increased focus on personalized medicine and digital health solutions, areas that require substantial investment and strategic foresight.

- Intensified Price Wars: Competitors, particularly those with larger scale or lower cost structures, can engage in aggressive pricing strategies, potentially eroding Alfresa's profit margins.

- Innovation Race: The need to constantly develop or acquire new products and technologies to meet evolving patient needs and regulatory requirements is a significant challenge.

- Market Share Erosion: Without strong differentiation or cost advantages, Alfresa could see its market share dwindle as customers opt for competitors offering more attractive terms or novel solutions.

- Regulatory Hurdles: Navigating complex and often country-specific healthcare regulations adds another layer of difficulty, especially for companies involved in international trade.

Rising Operating Costs and Debt-Equity Ratio

Alfresa Holdings faces a significant challenge with its escalating operating expenses. Notably, raw material costs saw a substantial increase of 5.1% year-on-year, directly impacting profitability. This rise in input costs, coupled with a considerable 39.18% jump in interest expenses over the previous semi-annual period, puts pressure on the company's bottom line.

The company's financial structure also presents a point of concern. Alfresa Holdings' debt-equity ratio has reached its peak over the last five semi-annual periods. This elevated ratio suggests an increased reliance on borrowed funds, which could potentially strain future financial flexibility and limit capacity for new investments or strategic initiatives.

- Rising Raw Material Costs: Increased by 5.1% year-on-year.

- Increased Interest Expenses: Grew by 39.18% in the latest semi-annual period.

- Highest Debt-Equity Ratio: Reached its highest point in the past five semi-annual periods.

Alfresa Holdings grapples with the persistent impact of Japanese National Health Insurance (NHI) drug price revisions, which directly reduce revenue from key products. For instance, the April 2025 price cuts will continue to challenge the sector's profitability, eroding gross profit margins. Attempts to mitigate these by reducing selling, general, and administrative (SG&A) expenses were offset by increased purchasing costs and non-deductible taxes, particularly in their Ethical Pharmaceuticals Wholesaling Business.

The company also faces challenges converting profits into cash and with its earnings per share (EPS). Despite a recent dividend increase, the sustainability of shareholder returns could be impacted if earnings do not improve, especially as the full year 2025 EPS fell short of analyst expectations, with a year-on-year decline in pre-tax profit.

Alfresa Holdings is exposed to intense competition across its drug manufacturing, import/export, and wholesaling segments, facing pressure from both established global players and emerging companies. This competitive landscape, within a global pharmaceutical market exceeding $1.5 trillion in 2023, necessitates continuous adaptation and innovation to maintain market share and profitability.

Escalating operating expenses, including a 5.1% year-on-year rise in raw material costs and a significant 39.18% increase in interest expenses, are pressuring the company's bottom line. Furthermore, Alfresa Holdings' debt-equity ratio has reached its highest point in the last five semi-annual periods, indicating increased financial leverage and potentially limiting future investment capacity.

| Weakness | Specific Impact | Financial Data Point |

| NHI Drug Price Revisions | Reduced revenue from key products, eroded gross profit margins. | April 2025 price cuts impacting profitability. |

| Profit Conversion & EPS | Concern over converting profits to cash, falling short of analyst expectations. | Full year 2025 EPS below expectations, year-on-year pre-tax profit decline. |

| Intense Competition | Pressure on pricing and profitability from global and new market entrants. | Global pharmaceutical market valued over $1.5 trillion (2023). |

| Rising Operating Expenses | Increased input costs and interest expenses. | Raw material costs up 5.1% YoY; Interest expenses up 39.18% semi-annually. |

| Elevated Debt-Equity Ratio | Increased reliance on borrowed funds, potential strain on financial flexibility. | Highest ratio in the past five semi-annual periods. |

Full Version Awaits

Alfresa Holdings SWOT Analysis

The preview you see is the same document the customer will receive after purchasing. This means you're getting a direct look at the comprehensive Alfresa Holdings SWOT analysis, with no hidden surprises.

You’re viewing a live preview of the actual SWOT analysis file. The complete version, detailing Alfresa Holdings' Strengths, Weaknesses, Opportunities, and Threats, becomes available after checkout.

This preview reflects the real document you'll receive—professional, structured, and ready to use. It offers a clear insight into Alfresa Holdings' strategic positioning.

Opportunities

Japan's demographic landscape is rapidly shifting, with its aging population creating a substantial and enduring market for healthcare solutions. By the end of 2023, approximately 29.1% of Japan's population was aged 65 or older, a figure projected to climb further, underscoring a consistent demand for medical services and related products.

Alfresa Holdings is strategically positioned to benefit from this trend. Its broad range of offerings, from pharmaceuticals to medical devices and distribution services, directly addresses the needs of an aging demographic, particularly for conditions common in older adults such as cardiovascular diseases and dementia.

The expanding digital transformation in Japan's healthcare sector, encompassing remote consultations and AI diagnostics, presents a significant opportunity for Alfresa Holdings. By embracing these advancements, the company can optimize its pharmaceutical logistics and distribution networks, ensuring more efficient delivery of essential medicines.

Alfresa Holdings can capitalize on the growing adoption of health-related mobile apps and electronic medical records to develop integrated digital health solutions. This strategic move could streamline patient data management and enhance service offerings, improving overall operational efficiency and patient accessibility in the healthcare ecosystem.

The Japanese government's commitment to fostering pharmaceutical innovation presents a significant opportunity for Alfresa Holdings. Recent reforms aim to expedite drug development and market entry, potentially reducing the 'drug lag' that has historically affected new therapy introductions. This proactive stance is designed to create a more dynamic market for novel treatments.

Specifically, initiatives like revised drug pricing structures and support for decentralized clinical trials are anticipated to benefit companies like Alfresa. These changes are expected to streamline the process of bringing new drugs to patients, offering Alfresa enhanced opportunities for product launches and market expansion within Japan's healthcare landscape.

Expansion into New Business Areas and Technologies

Alfresa Holdings has a significant opportunity to broaden its reach by addressing varied medical demands through ventures like dispensing pharmacies and other healthcare-related services. This expansion aligns with the growing need for accessible and specialized medical care.

Exploring emerging technologies presents another key avenue for growth. The company can integrate artificial intelligence and robotics into medical diagnostics and logistics, streamlining operations and improving patient outcomes. Furthermore, venturing into regenerative medicine offers the potential to develop innovative treatments and create entirely new value propositions.

- Expanding Pharmacy Networks: Alfresa aims to increase its dispensing pharmacy footprint, a segment that saw continued growth in the Japanese market throughout 2024.

- AI in Diagnostics: Investment in AI for medical imaging analysis is a strategic focus, with early adoption showing promise in accuracy and efficiency gains by late 2024.

- Logistics Automation: Implementing robotics in their pharmaceutical distribution centers is projected to reduce operational costs by up to 15% by the end of fiscal year 2025.

- Regenerative Medicine R&D: Alfresa is actively exploring partnerships in regenerative medicine, anticipating significant market growth in this sector by 2025.

Increased Investment in R&D and Innovative Therapies

The Japanese pharmaceutical sector is experiencing a significant upswing in research and development, with a strong focus on cutting-edge treatments like biopharmaceuticals and precision medicine. Alfresa Holdings, with its established presence in pharmaceutical manufacturing and R&D, is well-positioned to capitalize on this growth by developing and distributing advanced therapies. This includes a focus on areas like gene therapies and oncology treatments, which have seen a notable increase in regulatory approvals in recent years.

This trend is underscored by increasing R&D expenditure within the Japanese pharmaceutical industry. For instance, in 2023, the industry saw continued investment, with a particular emphasis on novel drug discovery and development.

- Growing demand for advanced therapies: The market is shifting towards personalized and targeted treatments.

- Alfresa's R&D capabilities: The company can leverage its expertise in developing and manufacturing complex pharmaceutical products.

- Pipeline potential: Opportunities exist to develop and commercialize gene therapies and oncology drugs.

Alfresa Holdings is well-positioned to expand its pharmacy networks, capitalizing on the consistent demand for accessible healthcare services in Japan. The company's strategic focus on integrating AI into medical diagnostics, as seen with early 2024 advancements in AI imaging analysis, promises enhanced efficiency and accuracy.

Furthermore, the planned logistics automation through robotics is set to significantly reduce operational costs, with projections of up to a 15% reduction by the end of fiscal year 2025. Alfresa's active exploration of regenerative medicine partnerships signals a commitment to future growth in a sector anticipated to see substantial market expansion by 2025.

The company is also poised to benefit from the growing demand for advanced therapies, leveraging its R&D capabilities to develop and commercialize innovative treatments like gene therapies and oncology drugs, a trend clearly visible in the increased R&D expenditure within the Japanese pharmaceutical industry in 2023.

| Opportunity Area | Key Development/Trend | Alfresa's Strategic Action | Projected Impact/Benefit |

|---|---|---|---|

| Pharmacy Network Expansion | Continued growth in Japanese dispensing pharmacies | Increase dispensing pharmacy footprint | Enhanced market accessibility and revenue |

| AI in Diagnostics | Advancements in AI for medical imaging analysis (early 2024) | Investment in AI diagnostics | Improved accuracy and efficiency in diagnosis |

| Logistics Automation | Implementation of robotics in distribution | Robotics in pharmaceutical distribution centers | Up to 15% operational cost reduction by FY2025 |

| Regenerative Medicine | Anticipated significant market growth by 2025 | Exploration of partnerships in regenerative medicine | Entry into high-growth, innovative medical sector |

| Advanced Therapies | Increasing R&D in biopharmaceuticals and precision medicine (2023) | Leverage R&D for gene therapies and oncology drugs | Capitalize on demand for novel treatments |

Threats

The Japanese government's ongoing drug price revisions, with potential further cuts anticipated in 2025, present a substantial threat to Alfresa Holdings. These recurring adjustments directly impact the revenue streams of pharmaceutical wholesalers, creating a volatile operating environment.

These price revisions can significantly squeeze profit margins for companies like Alfresa, potentially affecting their ability to invest in research and development or maintain robust distribution networks. For instance, a hypothetical 5% reduction in drug prices could translate to a substantial revenue shortfall for a major wholesaler.

Alfresa Holdings faces significant threats from supply chain disruptions and global procurement risks. The increasing internationalization of pharmaceutical sourcing, highlighted by events such as the COVID-19 pandemic, poses a substantial challenge to maintaining a stable drug supply within Japan.

A critical vulnerability lies in the company's reliance on overseas suppliers for active pharmaceutical ingredients (APIs) and finished pharmaceutical products. This dependence can directly translate into potential drug shortages, impacting Alfresa Holdings' capacity to consistently fulfill market demand and potentially affecting its revenue streams in 2024 and 2025.

New ways of getting medicines directly to pharmacies or even to patients themselves are starting to appear. These models could potentially skip over the traditional wholesale distributors like Alfresa Holdings.

While these alternative distribution methods haven't had a huge effect yet, if more companies start using them, it could really shake up Alfresa Holdings' usual role in the market. This would mean the company would need to make some big changes to how it operates and plans for the future.

Regulatory Compliance and Oversight Challenges

Alfresa Holdings faces increasing regulatory scrutiny as Japan revises its Pharmaceutical and Medical Device Act. These amendments aim to bolster compliance and oversight in manufacturing processes. For Alfresa, this could translate into more rigorous quality standards and enhanced data integrity requirements, potentially increasing operational costs.

The evolving regulatory environment, while fostering innovation, also presents a threat of heightened compliance burdens. Companies like Alfresa Holdings must adapt to these stricter rules, which may impact their manufacturing and distribution chains. For instance, increased inspections or mandatory digital reporting could add to overheads.

- Stricter Quality Control: New regulations may necessitate investments in advanced quality assurance systems.

- Data Integrity Mandates: Enhanced requirements for data accuracy and traceability could demand significant IT infrastructure upgrades.

- Increased Compliance Costs: Adhering to new oversight measures and potential penalties for non-compliance represent a financial risk.

Economic Risks and Healthcare Expenditure Strain

Persistent inflation and broader global economic slowdowns present significant threats to Alfresa Holdings. These macroeconomic factors can reduce consumer spending power and increase operational costs for the company. For instance, the Bank of Japan's efforts to combat inflation through monetary policy adjustments could impact borrowing costs and investment returns.

Japan's rapidly aging demographic is a critical concern, directly fueling escalating healthcare expenditures. This trend places considerable pressure on the government to implement cost-containment measures within the healthcare sector. Such measures could manifest as further reductions in pharmaceutical prices or structural changes to the healthcare system, potentially squeezing margins for distributors like Alfresa Holdings.

- Rising Healthcare Costs: Japan's healthcare spending as a percentage of GDP has been steadily increasing, reaching approximately 11% in recent years, underscoring the demographic challenge.

- Government Cost Control Measures: Past drug price revisions, such as those implemented in 2022 and anticipated for 2024, demonstrate the government's commitment to managing healthcare outlays.

- Impact on Distribution Margins: Lower drug prices directly translate to reduced revenue for pharmaceutical distributors, potentially impacting profitability if sales volumes do not compensate.

Alfresa Holdings faces significant threats from ongoing Japanese government drug price revisions, with further cuts anticipated in 2025, directly impacting revenue and profit margins. Supply chain vulnerabilities due to reliance on overseas suppliers for APIs and finished products pose risks of drug shortages, affecting consistent market fulfillment. Emerging direct-to-pharmacy or patient distribution models could bypass traditional wholesalers like Alfresa, necessitating strategic adaptation.

| Threat Category | Specific Threat | Potential Impact on Alfresa Holdings (2024-2025) | Illustrative Data/Fact |

|---|---|---|---|

| Pricing & Reimbursement | Government Drug Price Revisions | Reduced revenue and profit margins due to lower wholesale prices. | Anticipated further price cuts in 2025, following revisions in 2022 and 2024. |

| Supply Chain & Procurement | Reliance on Overseas Suppliers | Risk of drug shortages, impacting ability to meet market demand and revenue. | Global events like the COVID-19 pandemic highlighted API sourcing vulnerabilities. |

| Market Disruption | Alternative Distribution Models | Potential erosion of traditional wholesale role, requiring business model adjustments. | Growing interest in direct-to-patient and direct-to-pharmacy models. |

| Regulatory Environment | Evolving Pharmaceutical Laws | Increased compliance costs, stricter quality standards, and data integrity demands. | Amendments to Japan's Pharmaceutical and Medical Device Act. |

| Macroeconomic Factors | Inflation and Economic Slowdown | Reduced consumer spending power and increased operational costs. | Bank of Japan's monetary policy adjustments impacting borrowing costs. |

| Demographic Shifts | Aging Population & Rising Healthcare Costs | Government pressure for cost containment leading to potential price pressures. | Japan's healthcare spending as a percentage of GDP around 11%. |

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of robust data, including Alfresa Holdings' official financial statements, comprehensive market research reports, and expert industry analyses to ensure a thorough and insightful assessment.