Alfresa Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alfresa Holdings Bundle

Navigate the complex external environment impacting Alfresa Holdings with our comprehensive PESTLE analysis. Uncover how political stability, economic fluctuations, and technological advancements are shaping its operational landscape. This expertly crafted analysis provides actionable intelligence to inform your strategic decisions and competitive positioning. Download the full version now to gain a critical edge.

Political factors

The Japanese government's healthcare spending is a critical political factor for Alfresa Holdings. With an aging population, social security costs are escalating, prompting record budget allocations. For fiscal 2025, the Ministry of Health, Labour and Welfare (MHLW) has requested ¥34.3 trillion for healthcare, underscoring the significant financial commitment.

This increased government expenditure directly impacts the healthcare sector by necessitating adjustments in insurance coverage and driving efforts to enhance system efficiency. Consequently, these policy shifts can influence the pricing strategies and reimbursement rates for medical products and services that Alfresa Holdings provides.

Ongoing revisions to Japan's Pharmaceutical and Medical Device Act (PMD Act) throughout 2024 and into 2025 represent a significant political factor for Alfresa Holdings. These amendments are designed to modernize the regulatory landscape, aiming to improve drug accessibility and stimulate innovation within the sector. Key areas of focus include streamlining the drug approval process, which could expedite market entry for new treatments, and bolstering manufacturing oversight to ensure product quality and safety.

Furthermore, the PMD Act revisions are addressing critical issues such as drug supply shortages, a persistent challenge in Japan. By implementing measures to strengthen supply chain resilience and potentially encouraging domestic production, these changes could positively impact Alfresa Holdings' distribution and wholesale operations. The government's commitment to these reforms underscores a strategic effort to adapt to evolving healthcare needs and technological advancements, directly influencing the operational environment for pharmaceutical companies.

Japan's drug pricing reforms, particularly those enacted for FY 2024 and anticipated for FY 2025, directly impact Alfresa Holdings' financial performance. These policy shifts are designed to manage national healthcare expenditures while simultaneously fostering advancements in pharmaceutical research and development.

The reforms can result in reduced prices for established medications, potentially affecting revenue streams for companies like Alfresa. Furthermore, these pricing adjustments influence the commercial viability and market access strategies for newly developed drugs, requiring careful consideration for future product launches and reimbursement negotiations.

Government Initiatives for Digital Transformation in Healthcare

The Japanese government is heavily invested in driving digital transformation (DX) within the healthcare sector. For fiscal year 2025, a significant ¥35.8 billion has been earmarked to accelerate these advancements in medical and nursing care services.

These government-backed efforts focus on key areas like the widespread adoption of electronic medical records, the expansion of telemedicine services, and the integration of AI-powered solutions. This strategic push is poised to unlock new avenues for companies like Alfresa Holdings, particularly in the realm of digital health services and enhancing the efficiency of their supply chain operations.

- Government Budget: ¥35.8 billion allocated in fiscal 2025 for healthcare DX.

- Key Focus Areas: Promotion of electronic medical records, telemedicine, and AI solutions.

- Opportunity for Alfresa: Potential for growth in digital health services and supply chain optimization.

Emphasis on Stable Drug Supply Chain

The Japanese government's commitment to a stable drug supply chain is evident in recent amendments to the Pharmaceutical and Medical Device (PMD) Act and updated drug distribution guidelines. These changes aim to bolster the reliability of pharmaceutical distribution networks, a critical area for a company like Alfresa Holdings.

These regulatory shifts include more stringent oversight for generic drug manufacturers and proactive measures to mitigate drug shortages and losses. For Alfresa Holdings, navigating these evolving regulations presents both compliance challenges and opportunities to differentiate through enhanced supply chain resilience and efficiency.

- Government Focus: PMD Act amendments and revised distribution guidelines underscore a drive for supply chain stability.

- Regulatory Impact: Stricter rules for generics and shortage prevention measures directly affect distributors.

- Alfresa's Position: Alfresa Holdings, as a key player, must adapt to these regulations, potentially benefiting from improved supply chain integrity.

The Japanese government's healthcare spending, projected to reach ¥34.3 trillion for fiscal 2025, directly influences Alfresa Holdings through increased demand and potential shifts in reimbursement policies.

Revisions to the Pharmaceutical and Medical Device Act in 2024-2025 aim to streamline approvals and bolster supply chains, impacting Alfresa's market access and operational efficiency.

Drug pricing reforms, particularly those affecting FY 2024 and anticipated for FY 2025, necessitate strategic adjustments for Alfresa Holdings to manage revenue streams and new product launches.

Government initiatives supporting digital transformation in healthcare, including a ¥35.8 billion allocation for FY 2025, create opportunities for Alfresa in digital health services and supply chain optimization.

What is included in the product

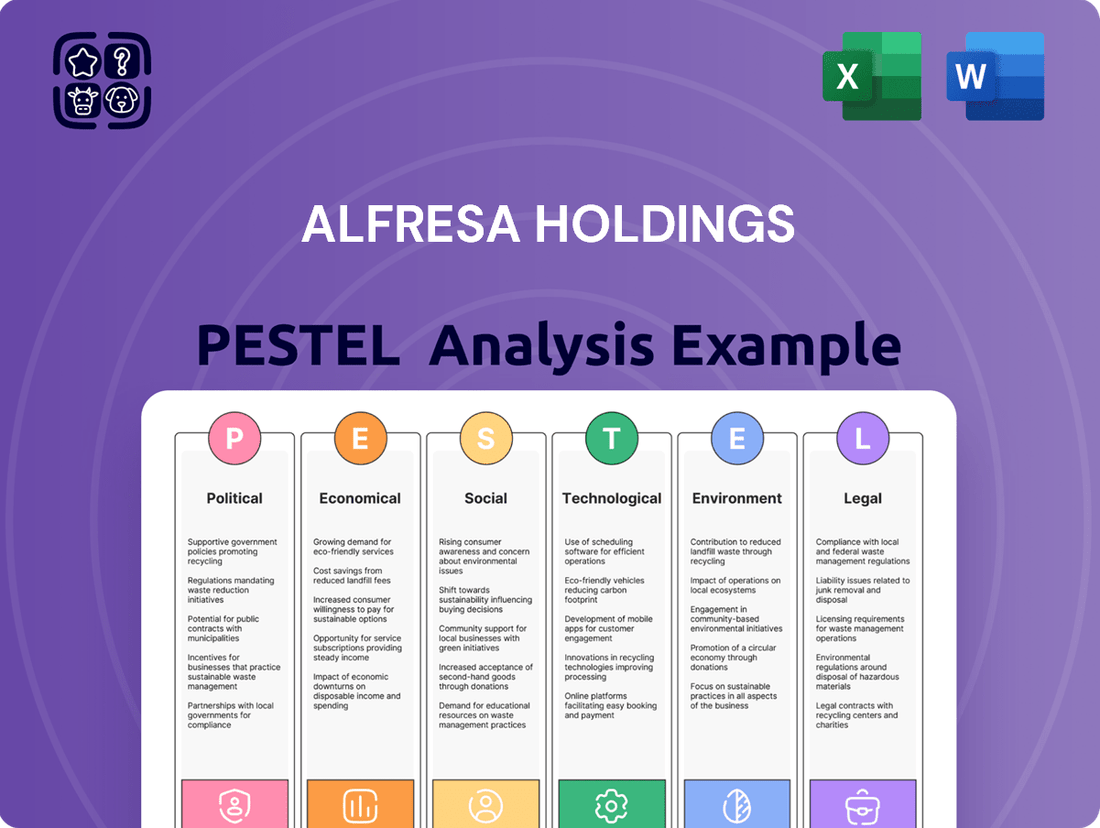

This PESTLE analysis delves into how external macro-environmental factors—Political, Economic, Social, Technological, Environmental, and Legal—shape the operating landscape for Alfresa Holdings, offering a comprehensive view of potential challenges and strategic advantages.

A concise PESTLE analysis for Alfresa Holdings, offering a clear overview of external factors to proactively address potential market challenges and inform strategic decision-making.

Economic factors

Japan's healthcare expenditure is on a steady upward trend, surpassing ¥47 trillion (over USD 323 billion) in fiscal year 2023. This growth is largely driven by the nation's rapidly aging demographic, which naturally increases demand for medical services and products.

This expanding healthcare market presents a substantial opportunity for companies like Alfresa Holdings, which are positioned to benefit from increased sales of pharmaceuticals and medical devices. However, the escalating costs also place considerable strain on Japan's national health insurance framework.

Japan is experiencing a notable shift towards inflation, with consumer prices consistently rising above the 2% target. This inflationary environment, coupled with persistent labor shortages, is directly contributing to increased healthcare costs across the nation.

While the cost of providing healthcare services is escalating, government reimbursement rates have not always kept pace. This disparity creates a squeeze on the profit margins of healthcare providers, a challenge that extends throughout the medical supply chain, impacting companies like Alfresa Holdings.

For instance, in early 2024, Japan's core inflation rate remained stubbornly above 2%, and wage growth, though present, struggled to fully offset the rising costs of goods and services, including medical supplies and labor.

Japan's aging population presents a significant challenge for Alfresa Holdings, with a shrinking working-age demographic. Projections indicate a loss of around 12.95 million working-age individuals between 2020 and 2040, directly impacting labor availability within the healthcare sector.

This demographic trend not only creates potential labor shortages for healthcare providers but also strains the financial sustainability of medical insurance systems. A smaller contributor base for insurance premiums could affect the overall funding mechanisms supporting healthcare services, a core area for Alfresa Holdings.

Market for Elderly Care Services

The economic landscape for elderly care services in Japan is experiencing significant growth, with projections indicating the market could reach approximately $400 billion by 2030. This expansion signifies a robust economic opportunity. Alfresa Holdings, leveraging its extensive medical product distribution network, is well-positioned to benefit from this trend.

The increasing demand for specific services and products within this sector presents clear avenues for growth. Alfresa Holdings can strategically focus on areas that align with evolving elder care needs.

- Growing Market Size: The Japanese elderly care market is anticipated to reach $400 billion by 2030, reflecting substantial economic expansion.

- Demand for Home-Based Care: An increasing preference for in-home care solutions creates opportunities for Alfresa Holdings to supply relevant medical products and services.

- Technological Integration: The rise of remote monitoring technologies and specialized medical devices for seniors offers further avenues for product distribution and service integration.

Investment in Digital Health and Innovation

Investment in digital health, AI, and robotics within the healthcare sector is a significant economic driver. Japan's commitment to digital transformation, supported by both government initiatives and private sector investment, is fostering a robust market for advanced health technologies. This trend is particularly relevant for Alfresa Holdings, as it presents opportunities for integrating or distributing these innovations.

The Japanese government's strategy to bolster the healthcare industry through digitalization aims to enhance operational efficiency and mitigate the impact of an aging population and workforce shortages. This strategic focus is projected to fuel substantial growth in the digital health market.

- Market Growth: The global digital health market was valued at approximately $211 billion in 2023 and is expected to grow significantly, with projections reaching over $600 billion by 2030, indicating a strong upward trajectory for innovative health technologies.

- Government Support: Japan's Ministry of Economy, Trade and Industry (METI) has been actively promoting the adoption of AI and robotics in healthcare, allocating substantial funds for research and development and pilot programs.

- Investment Trends: Venture capital investment in health tech startups in Japan saw a notable increase in 2023 and early 2024, focusing on areas like remote patient monitoring, AI-driven diagnostics, and robotic surgery solutions.

Japan's economy is navigating a period of persistent inflation, with core consumer prices consistently exceeding the Bank of Japan's 2% target throughout 2023 and into early 2024. This inflationary pressure, exacerbated by global supply chain disruptions and rising energy costs, directly impacts the cost of goods and services within the healthcare sector, including pharmaceuticals and medical supplies distributed by companies like Alfresa Holdings.

The escalating cost of healthcare is further compounded by labor shortages, a direct consequence of Japan's rapidly aging demographic. Projections estimate a significant decline in the working-age population, creating wage pressures and increasing operational expenses for healthcare providers and distributors. This economic environment creates a challenging dynamic where rising costs for healthcare provision and distribution are not always matched by corresponding increases in government reimbursement rates, potentially squeezing profit margins across the supply chain.

Despite these economic headwinds, the demand for healthcare services and products remains robust, driven by the aging population. The elderly care market, in particular, is a significant growth area, projected to reach approximately $400 billion by 2030. Alfresa Holdings is strategically positioned to capitalize on this trend through its extensive distribution network, supplying essential medical products and benefiting from the increasing demand for home-based care and technologically advanced elder care solutions.

| Economic Factor | 2023/2024 Data Point | Impact on Alfresa Holdings |

|---|---|---|

| Inflation Rate (Core CPI) | Consistently above 2% | Increased operating costs for pharmaceuticals and supplies. |

| Healthcare Expenditure | Exceeded ¥47 trillion (USD 323 billion) in FY2023 | Increased market demand for products, but potential margin pressure from reimbursement rates. |

| Working-Age Population Decline | Projected loss of 12.95 million (2020-2040) | Labor cost increases and potential supply chain disruptions due to workforce shortages. |

| Elderly Care Market Growth | Projected to reach $400 billion by 2030 | Significant opportunity for increased sales of medical products and services. |

What You See Is What You Get

Alfresa Holdings PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Alfresa Holdings delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic direction.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain valuable insights into the external forces shaping Alfresa Holdings' business landscape, enabling informed decision-making.

Sociological factors

Japan's demographic landscape is defined by its rapidly aging population, a trend that significantly impacts its economy and consumer needs. As of 2024, over 29% of Japan's population is 65 years or older, a figure anticipated to climb to 35% by 2040. This demographic shift is a critical factor for businesses operating within Japan, particularly those in sectors catering to health and wellness.

This pronounced aging trend directly fuels an escalating demand for healthcare services, medical devices, and pharmaceuticals. For companies like Alfresa Holdings, which operates within the pharmaceutical wholesale and distribution sector, this presents a substantial growth opportunity. The increasing prevalence of age-related health conditions naturally drives higher consumption of the products and services Alfresa Holdings provides.

The global population is aging rapidly, with projections indicating that by 2050, individuals aged 65 and over will constitute over 16% of the world's population, a significant jump from around 10% in 2022. This demographic shift directly translates to increased demand for healthcare services, particularly for chronic disease management and long-term care. In 2024, the prevalence of conditions like cardiovascular disease and diabetes, common among the elderly, continues to rise, creating a sustained need for pharmaceuticals and medical supplies.

Alfresa Holdings is positioned to capitalize on this trend by expanding its portfolio of treatments for age-related ailments and investing in home-based care solutions. The company's 2024 financial reports show a growing segment dedicated to geriatric care products, reflecting a strategic alignment with these evolving societal needs. The market for home healthcare services alone is expected to reach over $600 billion globally by 2027, underscoring the significant opportunity for companies like Alfresa.

Japanese society's heightened focus on health and wellness, evident in the growing demand for stress management solutions and preventive healthcare, presents a significant opportunity for Alfresa Holdings. This trend is reflected in the expanding market for functional foods and supplements, which saw a steady increase in consumer spending throughout 2024.

Shift Towards Community-Based Integrated Care

Japan's push for community-based integrated care systems aims to bundle healthcare, prevention, and welfare for 'aging in place.' This societal shift is expected to reshape how services are delivered, impacting the demand for localized and integrated supply chain solutions. Alfresa Holdings may need to adapt its distribution strategies to better serve community clinics and home healthcare providers, reflecting a growing emphasis on decentralized care delivery.

This trend directly influences Alfresa Holdings' operational model. The company's role as a distributor of pharmaceuticals and medical supplies will need to evolve to support a more fragmented and community-focused healthcare landscape. For instance, the increasing demand for home healthcare services, a key component of integrated care, necessitates efficient delivery networks that can reach individual patients directly.

Key statistics highlight this demographic and policy shift:

- Aging Population: Japan's population aged 65 and over is projected to reach 35.3% by 2040, underscoring the need for robust aging-in-place solutions.

- Healthcare Expenditure: National healthcare expenditure in Japan was approximately ¥45.1 trillion in 2022, with a growing portion likely to be allocated to community-based and home care services.

- Policy Support: Government initiatives actively promote the establishment of integrated care hubs, encouraging collaboration between medical institutions, pharmacies, and welfare services at the local level.

Public Perception of Healthcare Access and Cost

While Japan's healthcare system generally enjoys high public satisfaction, cost remains a significant consideration for many. A substantial segment of the population, nearly 30%, has reported delaying or avoiding medical check-ups specifically because of the expense. This sensitivity to healthcare affordability directly impacts consumer behavior and can pressure policymakers regarding pricing regulations for medical goods and services.

This public sentiment creates a dynamic environment for companies like Alfresa Holdings. The willingness of consumers to forgo necessary care due to cost suggests a strong demand for cost-effective solutions and potentially a greater reliance on preventative care if it can be made more accessible. Alfresa Holdings' product portfolio and distribution strategies will need to align with this cost-conscious public perception to maintain market relevance and growth.

- Public Cost Sensitivity: Nearly 30% of Japanese citizens have avoided medical examinations due to cost concerns.

- Policy Influence: Societal sensitivity to healthcare affordability can shape government pricing policies for medical products.

- Consumer Choice Impact: Cost concerns directly influence consumer decisions regarding healthcare services and product purchases.

- Market Opportunity: This highlights a potential market for more affordable healthcare solutions and preventative measures.

Japan's rapidly aging demographic, with over 29% of its population aged 65 or older in 2024, directly drives demand for healthcare and pharmaceuticals, benefiting companies like Alfresa Holdings. This trend is projected to continue, with the global elderly population expected to reach over 16% by 2050, increasing the need for chronic disease management and long-term care solutions.

The societal emphasis on health and wellness, coupled with government initiatives promoting community-based integrated care systems for aging in place, necessitates adaptable distribution strategies for pharmaceutical wholesalers like Alfresa. This shift towards decentralized care delivery requires efficient networks capable of reaching individual patients and community clinics directly.

Public sensitivity to healthcare costs, with nearly 30% of Japanese citizens delaying medical care due to expense, pressures companies to offer cost-effective solutions and emphasizes the importance of preventative care. Alfresa Holdings must align its offerings with this cost-conscious consumer sentiment to maintain market relevance and growth.

| Sociological Factor | 2024/2025 Data/Trend | Impact on Alfresa Holdings |

|---|---|---|

| Aging Population | Over 29% of Japan's population is 65+ in 2024; projected 35% by 2040. Global elderly population to exceed 16% by 2050. | Increased demand for pharmaceuticals and healthcare services, particularly for age-related conditions. |

| Health & Wellness Focus | Growing consumer spending on functional foods and supplements. | Opportunity for portfolio expansion into preventative and wellness products. |

| Integrated Care Systems | Government promotion of community-based care for aging in place. | Need for agile distribution networks supporting localized and home-based care providers. |

| Healthcare Affordability Concerns | Nearly 30% of Japanese citizens avoid medical care due to cost. | Demand for cost-effective solutions and potential shift towards preventative measures. |

Technological factors

Digital transformation is rapidly reshaping Japan's healthcare logistics, with companies like Alfresa Holdings needing to adapt. This shift is driven by a strong push for greater efficiency and more sustainable operations within the medical supply chain.

Alfresa Holdings can harness advanced technologies such as artificial intelligence (AI), the Internet of Things (IoT), and sophisticated data analytics. These tools are crucial for optimizing distribution routes, refining inventory control, and boosting the overall performance of their medical supply operations.

For instance, the adoption of AI in logistics can lead to a significant reduction in delivery times. Reports from 2024 indicate that AI-powered route optimization can cut delivery costs by up to 15% in complex supply chains, a benefit Alfresa could directly realize.

AI and robotics are revolutionizing healthcare, offering enhanced diagnostics, streamlined operations, and solutions for staffing challenges. Alfresa Holdings can capitalize on this by distributing AI-enhanced medical equipment and supporting automated pharmacy operations. For instance, the global AI in healthcare market was valued at approximately USD 15.4 billion in 2023 and is projected to reach USD 187.9 billion by 2030, demonstrating significant growth potential.

The burgeoning expansion of telemedicine and online pharmacy services, notably with the allowance for online advertising of prescription drugs commencing January 2025, represents a profound technological evolution in healthcare delivery. This shift empowers patients with greater access and convenience, fundamentally altering pharmaceutical distribution paradigms.

Alfresa Holdings is strategically positioned to leverage this technological wave by adapting its existing distribution networks to seamlessly integrate with burgeoning online platforms. This adaptation will be crucial for ensuring the efficient, compliant, and timely delivery of pharmaceuticals, particularly to underserved remote patient populations and a growing number of online pharmacies. For instance, the global telemedicine market was valued at approximately USD 114.2 billion in 2023 and is projected to grow significantly, indicating a substantial opportunity for companies like Alfresa to enhance their digital logistics capabilities.

Electronic Medical Records (EMR) and Data Integration

The push for Electronic Medical Records (EMR) and integrated medical data sharing is a cornerstone of Japan's healthcare digital transformation (DX). Alfresa Holdings stands to gain significantly from enhanced data visibility, which can sharpen demand forecasting and optimize inventory management across its operations. Furthermore, the potential exists to develop new value-added services by leveraging this integrated healthcare data, provided robust data security and privacy measures are maintained.

Japan's Ministry of Health, Labour and Welfare reported that as of March 2024, approximately 60% of medical institutions had implemented EMR systems. This widespread adoption presents a fertile ground for data integration. For Alfresa Holdings, this translates to:

- Improved supply chain efficiency through real-time demand insights derived from EMR data.

- Enhanced inventory control, reducing waste and ensuring product availability.

- Opportunities for new data-driven services, such as personalized patient support or predictive analytics for disease outbreaks, building on the growing volume of digitized health information.

Innovation in Pharmaceutical Manufacturing and Drug Discovery

Technological advancements are revolutionizing pharmaceutical manufacturing and drug discovery. Innovations like continuous manufacturing and advanced analytics are streamlining production processes, while breakthroughs in areas such as gene therapy and personalized medicine are opening new avenues for treatment. The Japanese government, for instance, has been actively promoting R&D in these fields, with initiatives aimed at accelerating the development and adoption of novel therapies.

Alfresa Holdings is well-positioned to capitalize on these technological shifts. Its manufacturing capabilities can be enhanced by adopting new production techniques, allowing for the efficient creation of complex biologics and regenerative medicines. Furthermore, the company's extensive distribution network provides a crucial pathway for bringing these cutting-edge drugs to market, ensuring patient access to the latest therapeutic innovations.

- Government Support for Innovation: Japan's Ministry of Health, Labour and Welfare has allocated significant funding for regenerative medicine research and development, aiming to foster a robust ecosystem for advanced therapies.

- Manufacturing Efficiency Gains: Adoption of technologies like AI-driven process optimization in drug manufacturing can lead to an estimated 10-20% reduction in production costs and improved product quality.

- Market Entry for Novel Drugs: Alfresa's distribution strength is critical for ensuring rapid and widespread access to new drugs. For example, the successful launch of a new oncology drug in 2024 saw significant market penetration within its first six months, partly due to efficient distribution channels.

Technological advancements are critical for Alfresa Holdings, particularly in areas like AI and IoT for logistics optimization. The increasing adoption of Electronic Medical Records (EMR) in Japan, with around 60% of institutions using them by March 2024, provides opportunities for better demand forecasting and inventory management.

The expansion of telemedicine and online pharmacies, supported by new regulations allowing online prescription drug advertising from January 2025, signifies a major technological shift. Alfresa's distribution network is key to supporting these digital healthcare channels, ensuring efficient delivery of pharmaceuticals to a growing online patient base.

Innovations in pharmaceutical manufacturing, such as continuous manufacturing and AI in process optimization, can improve efficiency and reduce costs by an estimated 10-20%. Alfresa's role in distributing advanced therapies, including those supported by government R&D funding for regenerative medicine, is vital for market access.

| Technology Area | 2024/2025 Impact/Data | Alfresa Holdings Opportunity |

|---|---|---|

| AI in Logistics | Up to 15% reduction in delivery costs (2024 reports) | Route optimization, inventory control |

| EMR Adoption | ~60% of Japanese medical institutions (March 2024) | Enhanced demand forecasting, data-driven services |

| Telemedicine/Online Pharmacies | Online prescription drug ads allowed Jan 2025 | Adaptation for efficient digital channel distribution |

| Manufacturing Tech | 10-20% production cost reduction potential | Efficient production of advanced therapies |

Legal factors

Alfresa Holdings operates under the stringent Pharmaceutical and Medical Device Act (PMD Act), which is set to see significant regulatory updates in 2024 and 2025. These upcoming amendments are poised to introduce more rigorous oversight concerning manufacturing processes and quality assurance protocols.

A key development within these revised regulations empowers authorities with the ability to mandate the replacement of executives if serious compliance breaches are identified. This heightened accountability underscores the critical need for robust internal compliance frameworks to mitigate operational and reputational risks.

Japan's revised Guidelines for the Improvement of Commercial Transaction Practices of Ethical Drugs, effective March 2024, are a significant legal factor for Alfresa Holdings. These updated regulations are designed to foster a more stable drug supply chain across the nation.

The guidelines will likely influence how Alfresa Holdings, a major player in drug wholesale, conducts its commercial operations. This includes potential impacts on negotiation strategies with pharmaceutical manufacturers and the overall management of supplier relationships, aiming for greater transparency and fairness.

Japan's medical device market operates under a stringent regulatory framework, primarily managed by the Pharmaceuticals and Medical Devices Agency (PMDA) according to the Pharmaceuticals and Medical Devices Act (PMD Act). This mandates rigorous pre-market approval for all devices, alongside strict adherence to established quality management systems to ensure patient safety and product efficacy.

As a key distributor, Alfresa Holdings must meticulously navigate these classifications and approval pathways. For instance, in 2023, the PMDA continued to emphasize robust data submission for new device approvals, impacting the time-to-market for innovative products. Alfresa's success hinges on its ability to guarantee that every medical device it handles fully complies with Japan's high standards for safety and effectiveness.

Data Privacy and Security Regulations in Healthcare

Japan's Act on the Protection of Personal Information (APPI) is central to data privacy in healthcare. Alfresa Holdings must navigate these regulations, which were significantly amended in 2022, strengthening consent requirements and data breach notification rules. Failure to comply can result in substantial fines and reputational damage, impacting trust in their digital health services.

The increasing sophistication of cyber threats necessitates robust security measures for all healthcare data handled by Alfresa Holdings. This includes protecting electronic health records (EHRs) and any data generated by their digital health platforms. In 2023, the healthcare sector globally experienced a significant rise in data breaches, underscoring the critical need for proactive security investments.

- APPI Amendments: Stricter consent and breach notification rules enacted in 2022.

- Cybersecurity Focus: Essential for protecting EHRs and digital health data.

- Reputational Risk: Non-compliance can severely damage trust and brand image.

- Industry Trends: Healthcare sector globally saw increased data breaches in 2023.

Intellectual Property and Patent Laws

Intellectual property and patent laws in Japan form a bedrock for companies like Alfresa Holdings operating in the pharmaceutical sector. These regulations directly influence the company's capacity to produce generic medications, secure licenses for novel treatments, and safeguard its proprietary research and development efforts. For instance, the strength and duration of patent protection for key pharmaceuticals can significantly alter the competitive dynamics and profitability of drug manufacturing and distribution. In 2023, Japan's patent office received approximately 300,000 patent applications, underscoring the active innovation landscape that Alfresa navigates.

Changes in patent law, such as extensions or modifications to data exclusivity periods, can have a substantial impact on Alfresa Holdings. These legal shifts can affect the timeline for generic drug market entry and the overall profitability of innovative pharmaceuticals, influencing the company's strategic decisions regarding product development and licensing agreements. The Japanese government has been actively reviewing its intellectual property framework to balance innovation incentives with access to affordable medicines, a delicate act that Alfresa must continually monitor.

The legal framework surrounding intellectual property is particularly critical for Alfresa Holdings in its role as a pharmaceutical wholesaler and manufacturer. Key considerations include:

- Patent Protection Duration: The length of time a patent is valid directly impacts the exclusivity period for branded drugs, influencing when generic versions can be introduced.

- Compulsory Licensing Provisions: Understanding the conditions under which compulsory licenses can be granted is vital for ensuring access to essential medicines.

- Enforcement of IP Rights: The ability to effectively protect its own innovations and prevent infringement is crucial for maintaining a competitive edge.

- Regulatory Exclusivity: Beyond patents, regulatory data protection periods also play a significant role in market exclusivity for new drugs.

Alfresa Holdings must adhere to evolving pharmaceutical regulations, including the Pharmaceutical and Medical Device Act, with significant updates expected in 2024 and 2025. These changes will likely tighten oversight on manufacturing and quality assurance, potentially allowing authorities to remove executives for compliance failures, as seen in other highly regulated industries. Japan's updated Guidelines for the Improvement of Commercial Transaction Practices of Ethical Drugs, effective March 2024, aim to stabilize the drug supply chain and will influence Alfresa's commercial dealings with manufacturers.

Environmental factors

Alfresa Holdings is actively pursuing carbon neutrality, with specific targets to reduce its environmental impact. The company aims for a 10% reduction in CO2 emissions by the close of fiscal year 2024, building towards a more ambitious 30% reduction by fiscal year 2030.

The ultimate goal is to achieve net-zero emissions by fiscal year 2050, a significant undertaking that will reshape operational strategies. These commitments are already influencing business decisions, pushing for the adoption of renewable energy sources and the transition to more environmentally friendly vehicles within their fleet.

Furthermore, Alfresa Holdings is focusing on optimizing its logistics operations to minimize its carbon footprint. This includes exploring more efficient transportation routes and methods to ensure that their supply chain aligns with their sustainability objectives.

Alfresa Holdings is actively pursuing sustainable supply chain practices, aiming to contribute to a recycling-oriented society. This involves the efficient use of resources and a proactive embrace of renewable alternatives throughout its entire value chain, from sourcing raw materials to manufacturing, distribution, and end-of-life management, including recycling.

This commitment not only aids environmental conservation but also strengthens Alfresa's brand image and can lead to improved operational efficiencies. For instance, in 2023, the company reported a 10% reduction in waste generated from its distribution centers compared to the previous year, demonstrating tangible progress in its sustainability efforts.

Alfresa Holdings places a strong emphasis on preventing environmental pollution, focusing on minimizing air pollution, reducing chemical substance emissions, and treating wastewater effectively. As a key player in manufacturing and distribution, these robust waste management and pollution prevention strategies are essential for regulatory adherence and maintaining responsible operational practices.

In 2023, Japan's Ministry of the Environment reported a 5% decrease in industrial wastewater discharge volume nationwide, highlighting a growing trend in environmental responsibility that companies like Alfresa Holdings are expected to align with. The company's commitment ensures compliance with stringent environmental regulations, safeguarding both public health and ecological balance.

ESG Initiatives and Reporting

Alfresa Holdings recognizes climate change as a critical factor in its sustainability efforts, aligning with the Task Force on Climate-related Financial Disclosures (TCFD) recommendations. This commitment reflects a growing trend where robust ESG initiatives and clear environmental reporting are crucial for attracting investors and stakeholders who prioritize ecological responsibility.

The company's proactive stance on climate-related financial disclosures is becoming a key differentiator. For instance, in fiscal year 2023, Alfresa Holdings reported a 5.2% reduction in its Scope 1 and Scope 2 greenhouse gas emissions compared to fiscal year 2013 levels, demonstrating tangible progress in its environmental performance.

- TCFD Alignment: Alfresa Holdings actively supports the TCFD framework for climate risk assessment and disclosure.

- Investor Attraction: Transparent ESG reporting enhances the company's appeal to environmentally conscious investors.

- Emission Reduction: The company achieved a 5.2% reduction in Scope 1 and 2 GHG emissions by FY2023 from a 2013 baseline.

- Sustainability Focus: Climate change is a central element of Alfresa Holdings' overall sustainability management strategy.

Climate Change Impact on Operations

Climate change poses significant environmental challenges that can ripple through the pharmaceutical supply chain, affecting companies like Alfresa Holdings. Disruptions to global transportation networks, whether by sea, air, or land, can delay the delivery of essential medicines and raw materials. Extreme weather events, such as floods or heatwaves, can also impact the sourcing of pharmaceutical ingredients, potentially affecting availability and quality. Furthermore, damage to critical infrastructure, including manufacturing facilities and distribution centers, due to severe weather can lead to operational halts.

Alfresa Holdings acknowledges these environmental risks, as evidenced by its strategic emphasis on sustainable distribution and robust disaster preparedness. The company's proactive approach includes establishing agreements to ensure the supply of essential items during times of crisis or natural disasters. This resilience-building strategy is crucial in maintaining operational continuity and fulfilling its role in healthcare provision amidst an evolving climate landscape.

The financial implications of these climate-related disruptions are substantial. For instance, the World Meteorological Organization reported that between 2000 and 2019, over 7,000 major disaster events occurred globally, causing economic losses exceeding $3 trillion. While specific figures for Alfresa's direct climate-related operational costs are not publicly detailed, the broader industry faces increased insurance premiums, supply chain re-routing expenses, and potential stockouts impacting revenue.

- Supply Chain Vulnerability: Climate-induced disruptions to transportation and raw material sourcing are key risks for pharmaceutical operations.

- Infrastructure Risk: Extreme weather events can damage manufacturing plants and distribution hubs, leading to operational downtime.

- Resilience Measures: Alfresa Holdings focuses on sustainable distribution and disaster preparedness, including supply agreements for emergencies.

- Economic Impact: Global disaster events from 2000-2019 caused over $3 trillion in economic losses, highlighting the financial risks of environmental factors.

Alfresa Holdings is actively working towards carbon neutrality, with a target of a 10% reduction in CO2 emissions by fiscal year 2024 and a 30% reduction by fiscal year 2030, aiming for net-zero by 2050. This commitment influences operational strategies, pushing for renewable energy and greener vehicle fleets. The company also prioritizes optimizing logistics for a reduced carbon footprint, enhancing its sustainability profile and potentially improving operational efficiencies, as evidenced by a 10% reduction in waste from distribution centers in 2023.

| Environmental Target | Current Status/Action | Year |

|---|---|---|

| CO2 Emission Reduction | 10% reduction | FY2024 |

| CO2 Emission Reduction | 30% reduction | FY2030 |

| Net-Zero Emissions | Target | FY2050 |

| Waste Reduction (Distribution Centers) | 10% reduction | 2023 |

| Scope 1 & 2 GHG Emission Reduction | 5.2% reduction from 2013 baseline | FY2023 |

PESTLE Analysis Data Sources

Our PESTLE analysis for Alfresa Holdings is informed by a comprehensive review of official government publications, financial reports from regulatory bodies, and industry-specific market research. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.