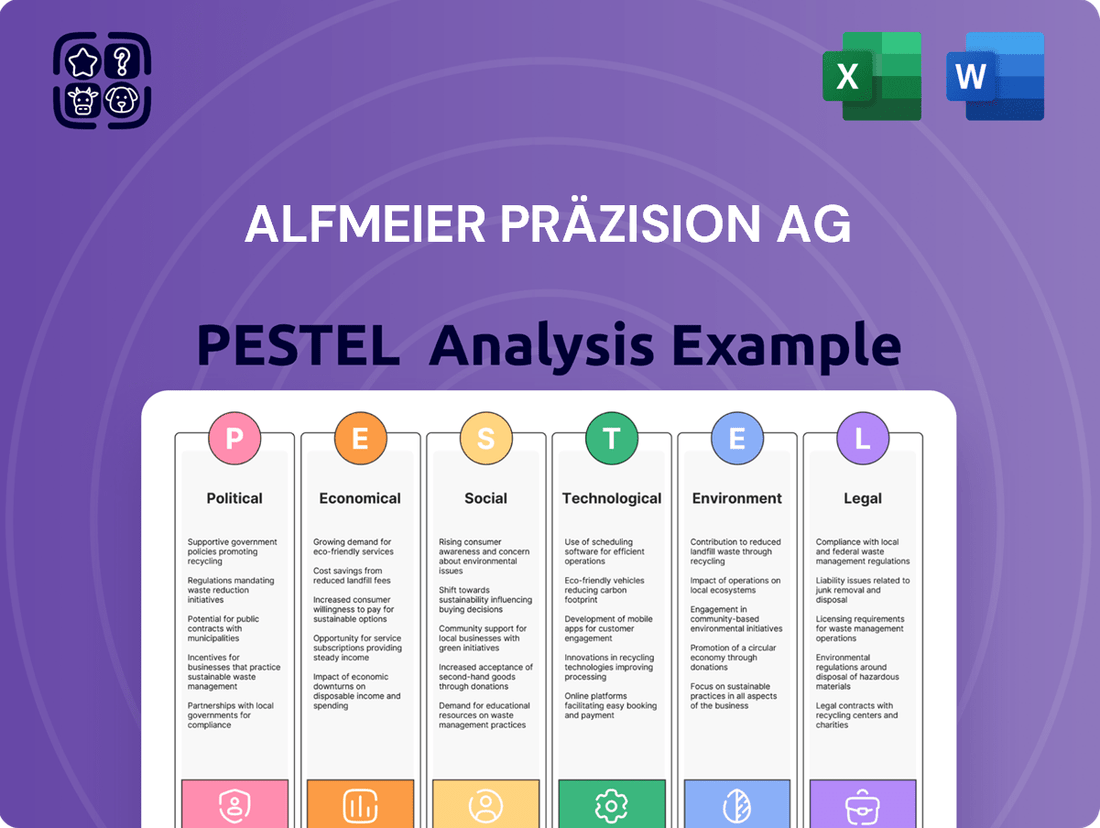

Alfmeier Präzision AG PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alfmeier Präzision AG Bundle

Gain a critical edge with our comprehensive PESTLE analysis of Alfmeier Präzision AG. Understand the intricate political, economic, social, technological, legal, and environmental forces shaping their operational landscape. This expert-crafted report will equip you with the foresight needed to anticipate challenges and capitalize on opportunities. Download the full version now for actionable intelligence to refine your own market strategy.

Political factors

Government policies, particularly those concerning vehicle emissions, are a significant driver for the automotive sector. For instance, the U.S. Environmental Protection Agency's (EPA) Multi-Pollutant Emissions Standards for Model Years 2027 and beyond are pushing manufacturers toward cleaner technologies such as plug-in hybrids and fully electric vehicles. This regulatory push directly influences companies like Alfmeier Präzision AG, which specializes in fluid management systems, necessitating adaptation in their product development to align with these environmental goals.

The evolving political climate in key markets like the U.S. and the European Union introduces a degree of uncertainty regarding the future of emission regulations. This uncertainty can impact Original Equipment Manufacturers' (OEMs) strategic decisions concerning the pace and scale of their electric vehicle (EV) adoption, which in turn affects suppliers like Alfmeier Präzision AG. For example, varying national targets for EV sales, such as the EU's goal of phasing out new internal combustion engine car sales by 2035, create a complex regulatory landscape for global automotive suppliers.

Trade policies, especially tariffs on automotive components, present a significant challenge. For instance, the United States has maintained tariffs on steel and aluminum, impacting the cost of raw materials used in vehicle manufacturing. These policies, particularly those targeting imports from countries like China, Mexico, and Canada, directly influence the automotive supply chain, potentially increasing production expenses for companies like Alfmeier Präzision AG.

The imposition of tariffs on vehicles and auto parts can lead to higher production costs and, consequently, increased prices for consumers. This dynamic could dampen demand for new vehicles, thereby affecting sales volumes for auto part suppliers. Alfmeier Präzision AG, operating globally, must strategically manage these trade barriers to ensure competitive sourcing and maintain access to key markets, a crucial consideration in its 2024 and 2025 planning.

Ongoing geopolitical tensions, particularly between China and Western nations, are creating significant trade barriers. These barriers can hinder the widespread adoption of crucial automotive technologies like connectivity, autonomy, software, and electrification (CASE) in affected regions. This market fragmentation directly impacts global supply chains, potentially limiting the diversity of competitive electric vehicle (EV) products available to consumers.

Alfmeier Präzision AG must closely monitor these evolving geopolitical dynamics. Such tensions pose a risk of disruption to the company's international operations and existing strategic partnerships, necessitating proactive risk management strategies.

Government Incentives and Subsidies

Government incentives, like tax credits and purchase subsidies, have historically driven electric vehicle (EV) adoption. For instance, in 2023, Germany's federal government contributed €450 million to EV subsidies, a significant driver of sales. However, many European nations, including Germany, are phasing out or reducing these incentives to manage public finances, as seen by Germany's planned reduction in EV subsidies starting in 2024. This shift directly impacts the demand for components like those Alfmeier Präzision AG supplies for EV and hybrid powertrains.

The tapering of these incentives can slow the rate of electrification, potentially affecting Alfmeier Präzision AG's growth projections in the EV sector. For example, the reduction in subsidies in key markets could lead to a more gradual increase in EV sales compared to previous years. This necessitates a strategic focus on cost-efficiency and technological innovation to maintain competitiveness in a market where upfront purchase price remains a key consumer consideration.

- EV Subsidy Reductions: Germany and other European countries are scaling back EV purchase incentives, impacting consumer affordability.

- Market Demand Shift: The phasing out of subsidies can lead to a slower adoption rate of electric vehicles.

- Component Demand Impact: Changes in EV market growth directly influence the demand for specialized automotive components from companies like Alfmeier Präzision AG.

Political Stability in Key Markets

Political risks and an uncertain tariff environment are projected to dampen global automotive sales volumes in 2025. For Alfmeier Präzision AG, maintaining stable political conditions in its primary operational and sales regions is essential for securing consistent demand and predictable business operations. Political instability can introduce volatility in demand and create significant operational hurdles.

The automotive sector, a key market for Alfmeier Präzision AG, is particularly sensitive to geopolitical shifts. For instance, trade disputes and protectionist policies can directly affect the cost of components and the accessibility of markets. In 2024, several major economies experienced heightened political uncertainty, impacting cross-border trade agreements and investment flows, which directly influences automotive production forecasts.

- Trade Policy Volatility: Ongoing trade negotiations and potential tariff adjustments between major economic blocs, such as the US and China, or within the European Union, could significantly alter supply chain costs and market access for automotive components.

- Regulatory Changes: Shifts in government regulations concerning emissions standards, vehicle safety, and local manufacturing requirements can necessitate costly product redesigns and impact market entry strategies.

- Geopolitical Tensions: Conflicts or political instability in regions where Alfmeier Präzision AG operates or sources materials can disrupt logistics, increase insurance premiums, and create unpredictable demand fluctuations.

- Government Support for Industry: Political decisions regarding subsidies for electric vehicles or incentives for domestic manufacturing can create both opportunities and challenges, depending on how they align with Alfmeier Präzision AG's strategic positioning.

Government policies on emissions, like the EPA's stringent standards for 2027 and beyond, are pushing the automotive industry towards electrification, directly impacting fluid management system suppliers like Alfmeier Präzision AG. This regulatory push requires significant adaptation in product development to meet cleaner technology demands.

The political climate in key markets introduces uncertainty regarding emission regulations. For instance, the EU's 2035 target for phasing out new internal combustion engine cars creates a complex landscape for global automotive suppliers navigating varying national EV sales goals.

Trade policies, including tariffs on steel and aluminum, increase raw material costs for vehicle manufacturing. These tariffs, especially those targeting imports, directly affect the automotive supply chain, potentially raising production expenses for companies like Alfmeier Präzision AG in 2024 and 2025.

Geopolitical tensions create trade barriers that can hinder the adoption of advanced automotive technologies. This market fragmentation impacts global supply chains, potentially limiting the diversity of competitive EV products available to consumers and posing risks to Alfmeier Präzision AG's international operations.

What is included in the product

This PESTLE analysis examines the external macro-environmental factors influencing Alfmeier Präzision AG, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides a comprehensive overview of how these global and regional forces create both challenges and strategic advantages for the company.

This PESTLE analysis for Alfmeier Präzision AG acts as a pain point reliever by providing a clear, summarized version of the full analysis for easy referencing during meetings or presentations.

Economic factors

The automotive sector is experiencing significant headwinds towards the end of 2024 and into 2025, marked by a general downturn in sales volumes across key markets and a subdued global economic forecast. This economic climate directly impacts consumer confidence and discretionary spending, making new vehicle purchases less of a priority for many households.

Global new vehicle sales are projected to see only minimal growth, or potentially stagnate, throughout 2025. This broad economic deceleration and its ripple effect on consumer purchasing power directly translate into reduced demand for new automobiles, which in turn dampens the need for specialized automotive components supplied by companies like Alfmeier Präzision AG.

Persistent inflation and elevated interest rates are creating headwinds for the automotive sector. For instance, in the US, the average interest rate for a new car loan hovered around 7.1% in early 2024, a significant increase from previous years, contributing to higher monthly payments and impacting consumer affordability. This trend is projected to continue impacting vehicle sales forecasts into 2025, potentially dampening demand for automotive components.

For Alfmeier Präzision AG, these economic conditions translate directly into higher borrowing costs for their manufacturing operations, potentially squeezing profit margins. Furthermore, if consumer demand for vehicles softens due to high financing costs and rising vehicle prices, it could lead to reduced production volumes for Alfmeier's products. Inflation also directly impacts the cost of raw materials and components, forcing the company to manage its supply chain and pricing strategies carefully to maintain competitiveness.

Ongoing supply chain disruptions, particularly persistent shortages of semiconductor chips and other crucial automotive components, are expected to continue impacting the industry through 2024 and into 2025. These shortages directly translate into production delays and increased costs for manufacturers like Alfmeier Präzision AG.

The automotive sector experienced significant price hikes for key materials in 2023, with some raw material indices showing increases of over 15%. This trend is projected to persist, placing further pressure on Alfmeier Präzision AG's profitability as they face higher input costs for their precision components.

Profit Margins for Suppliers

Automotive suppliers, including companies like Alfmeier Präzision AG, have been navigating a challenging economic landscape with notably thinner profit margins than the original equipment manufacturers (OEMs) they supply. This trend has been evident since 2020, with German suppliers, in particular, experiencing significantly compressed profitability. For instance, in 2023, the average profit margin for German automotive suppliers hovered around 4-6%, a stark contrast to the 8-12% often seen by OEMs.

This persistent economic pressure underscores the critical need for suppliers to prioritize operational efficiency and rigorous cost management. To maintain and improve profitability, businesses like Alfmeier Präzision AG must actively seek out new avenues for revenue generation and explore innovative business models that can offer higher value.

- Lower Margins: German automotive suppliers averaged profit margins between 4-6% in 2023.

- OEM Disparity: Supplier margins remain substantially lower than the 8-12% typical for OEMs.

- Strategic Imperative: Focus on efficiency, cost reduction, and new revenue streams is crucial for profitability.

Shift in Vehicle Demand

Consumer interest in fully electric vehicles (BEVs) has seen a slowdown in many key markets, with a noticeable uptick in demand for traditional internal combustion engine (ICE) and hybrid models. This evolving consumer preference directly influences automotive manufacturers' production plans.

Consequently, this shift impacts the demand for specialized fluid and fuel management systems, a core product area for suppliers like Alfmeier Präzision AG. For instance, in the first half of 2024, while BEV sales continued to grow, the pace moderated in several European markets, leading some automakers to re-evaluate their EV rollout timelines and production volumes.

This recalibration means Alfmeier Präzision AG must adapt its product development and manufacturing strategies to cater to a more balanced demand across ICE, hybrid, and BEV powertrains. The company's ability to flexibly supply components for these varied propulsion systems will be crucial for maintaining its market position.

- Consumer preference shift: Data from early 2024 indicated a plateauing of BEV adoption rates in some regions, contrasting with sustained or growing interest in ICE and hybrid vehicles.

- Production strategy impact: Automakers are adjusting production forecasts, potentially reducing the immediate ramp-up of BEV-specific components and maintaining or increasing ICE/hybrid component needs.

- Supplier demand implications: Alfmeier Präzision AG faces a dynamic demand landscape, requiring agility in supplying systems for a mixed vehicle portfolio.

The global economic outlook for late 2024 and 2025 presents a challenging environment for the automotive sector, characterized by slowing growth and reduced consumer spending. This economic deceleration directly impacts demand for new vehicles, consequently affecting suppliers like Alfmeier Präzision AG.

Persistent inflation and higher interest rates are making vehicle purchases less affordable, with new car loan rates in the US averaging around 7.1% in early 2024. These financial pressures are expected to continue, potentially dampening demand for automotive components throughout 2025 and increasing borrowing costs for manufacturers.

Supply chain disruptions, including ongoing semiconductor shortages, continue to affect production volumes and increase costs for automotive component suppliers. Furthermore, raw material prices saw significant increases in 2023, with some indices rising over 15%, a trend likely to persist and squeeze profit margins for companies like Alfmeier Präzision AG.

German automotive suppliers experienced notably thin profit margins, averaging 4-6% in 2023, significantly lower than the 8-12% typical for OEMs. This necessitates a strong focus on operational efficiency and cost management for Alfmeier Präzision AG to maintain profitability.

Preview Before You Purchase

Alfmeier Präzision AG PESTLE Analysis

The content and structure shown in the preview is the same document you’ll download after payment. This comprehensive PESTLE analysis of Alfmeier Präzision AG covers all key external factors impacting the company's operations and strategic planning. You'll gain valuable insights into the political, economic, social, technological, legal, and environmental landscape relevant to Alfmeier Präzision AG.

Sociological factors

Consumer expectations for vehicles are shifting dramatically, with a strong emphasis on advanced in-car technology, heightened safety features, and superior fuel economy. For instance, a 2024 survey indicated that over 60% of car buyers consider advanced driver-assistance systems (ADAS) a crucial factor in their purchase decision.

Alfmeier Präzision AG's expertise in developing sophisticated seat comfort systems, which often integrate advanced electronic controls and ergonomic designs, directly addresses this trend towards personalized and enhanced user experiences within the vehicle. This focus on precision engineering aligns perfectly with the desire for premium, feature-rich automotive interiors.

To maintain its competitive edge, Alfmeier Präzision AG needs to proactively invest in research and development to anticipate and meet these evolving consumer demands for seamless integration of comfort, connectivity, and safety technologies in future vehicle models.

Consumer awareness regarding environmental impact is a significant sociological driver, with a growing preference for sustainable and eco-friendly products. This translates directly into the automotive sector, where buyers increasingly seek vehicles manufactured with responsible materials and processes.

This heightened demand pressures automakers to integrate lightweight and bio-based materials, necessitating that their suppliers, such as Alfmeier Präzision AG, demonstrate strong sustainability credentials. For instance, a 2024 report indicated that over 60% of consumers consider a brand's environmental stance when making purchasing decisions.

Younger generations are increasingly favoring mobility-as-a-service (MaaS) options over personal car ownership. For instance, in 2024, ride-sharing services and micro-mobility solutions saw continued growth in urban centers across Europe, with user adoption rates climbing by an estimated 8% year-over-year.

While car usage frequency remains high, this shift signals a potential long-term impact on traditional vehicle sales and the components manufacturers like Alfmeier Präzision AG supply. The demand might transition towards more durable, adaptable components suitable for shared and commercial fleets rather than individual consumer preferences.

Alfmeier Präzision AG should assess how its precision components, such as those used in seating systems or fluid management, can be integrated into the evolving shared mobility ecosystem. This could involve designing for higher utilization, easier maintenance, and potentially modularity to adapt to different service models.

Public Perception of Autonomous Vehicles

Public perception of autonomous vehicles (AVs) continues to be a critical factor for companies like Alfmeier Präzision AG, whose components are integral to these systems. Despite technological progress, a significant segment of the population harbors reservations about self-driving technology, impacting market penetration. For instance, a 2024 survey indicated that only around 40% of US adults felt comfortable riding in a fully autonomous vehicle.

Alfmeier Präzision AG's success in the AV sector is therefore closely tied to building consumer trust in the safety and reliability of autonomous functions. The company's contributions to advanced driver-assistance systems (ADAS), which are stepping stones to full autonomy, need to be perceived as robust and dependable by the public. Addressing these trust concerns is paramount for wider adoption and market growth.

- Consumer Trust: Surveys in late 2024 and early 2025 consistently show a substantial portion of consumers expressing unease about fully autonomous driving, with safety concerns being the primary driver.

- ADAS Adoption: While full autonomy faces skepticism, consumer acceptance of ADAS features like adaptive cruise control and lane-keeping assist is generally higher, providing a pathway for gradual trust-building.

- Regulatory Impact: Public perception is also influenced by media coverage of AV incidents and the evolving regulatory landscape, which Alfmeier Präzision AG must monitor closely.

Workforce Availability and Skill Gaps

The automotive supply sector, including companies like Alfmeier Präzision AG, is grappling with significant workforce challenges. Labor shortages are a growing concern, exacerbated by an increasing demand for specialized skills. This is particularly true in rapidly evolving fields such as software engineering and data analytics, which are crucial for the development of modern automotive technologies.

To maintain its competitive edge and drive innovation, Alfmeier Präzision AG needs to prioritize robust workforce development and strategic talent acquisition. This investment is essential to secure the expertise required to meet production targets and adapt to the technological advancements shaping the automotive industry. For instance, the German automotive industry alone reported a shortage of around 100,000 skilled workers in early 2024, highlighting the broader trend.

- Skilled Labor Shortage: The automotive sector faces a deficit in qualified personnel, impacting production and innovation.

- Demand for Tech Skills: There's a critical need for expertise in software development, AI, and data analysis.

- Talent Acquisition Strategy: Companies must focus on attracting and retaining talent to fill these skill gaps.

- Workforce Development: Investing in training and upskilling existing employees is vital for future readiness.

Societal shifts are profoundly influencing automotive preferences, with consumers increasingly prioritizing advanced in-car technology and safety. A 2024 survey revealed that over 60% of car buyers consider advanced driver-assistance systems (ADAS) a critical factor. Alfmeier Präzision AG's focus on precision engineering for comfort systems aligns with this demand for premium, feature-rich interiors.

Environmental consciousness is another major sociological driver, leading to a preference for sustainable products. This translates to automotive buyers seeking eco-friendly manufacturing processes and materials, pushing suppliers like Alfmeier Präzision AG to demonstrate strong sustainability credentials. Reports from 2024 indicated that more than 60% of consumers factor a brand's environmental stance into their purchasing decisions.

The rise of mobility-as-a-service (MaaS) presents a long-term challenge to traditional car ownership, potentially altering demand for automotive components. For instance, ride-sharing services saw continued growth in European urban centers in 2024, with user adoption rates climbing by an estimated 8% year-over-year. Alfmeier Präzision AG must consider how its components can adapt to shared mobility ecosystems.

Public trust in autonomous vehicles (AVs) remains a hurdle, with a 2024 survey showing only about 40% of US adults felt comfortable in a fully autonomous vehicle. Alfmeier Präzision AG's success in this area depends on building consumer confidence in the safety and reliability of AV technology, particularly through robust ADAS components.

Technological factors

Technological advancements in fluid and fuel management systems are a key factor for Alfmeier Präzision AG. The global automotive fluid management system market is expected to reach approximately $35 billion by 2028, growing at a CAGR of over 5% from 2023.

This growth is fueled by the rising popularity of electric vehicles (EVs) and the increasing implementation of advanced driver-assistance systems (ADAS). Furthermore, stricter emission standards worldwide necessitate more sophisticated fluid control technologies.

Alfmeier Präzision AG's expertise in fuel and fluid management positions it to capitalize on these trends. The company can develop specialized systems to meet the distinct cooling and lubrication demands of electric and hybrid powertrains, which differ significantly from traditional internal combustion engines.

Tomorrow's vehicles are increasingly sophisticated technological hubs, with innovations like massaging seats and advanced personalization significantly enhancing the passenger experience. This trend is driving demand for integrated comfort solutions that go beyond basic climate control.

Alfmeier Präzision AG's core competency in active seat climate control systems is well-positioned to capitalize on these advancements. By integrating technologies such as artificial intelligence (AI) and Industry 4.0 principles, the company can develop more intuitive and personalized comfort solutions. For instance, AI could learn passenger preferences over time, automatically adjusting seat temperature and massage intensity for an optimized ride.

The automotive industry's focus on in-cabin experience is a significant driver. In 2024, the global automotive seating market was valued at approximately $50 billion, with a projected compound annual growth rate (CAGR) of over 5% through 2030, indicating strong growth potential for innovative comfort technologies.

The automotive sector's embrace of 3D printing, or additive manufacturing, is revolutionizing how vehicle parts are made and repaired. This technology promises to slash production times and expenses, a significant shift for manufacturers. For a company like Alfmeier Präzision AG, specializing in precision engineering, integrating 3D printing for intricate components could unlock substantial gains in operational efficiency and cost savings.

Autonomous Driving and Connected Car Technologies

The automotive sector's rapid embrace of autonomous driving and connected car technologies presents a significant technological shift. Alfmeier Präzision AG's future product development will likely need to align with these advancements, potentially incorporating solutions that support V2X communication or AI-powered driving systems. By 2024, the global market for autonomous vehicles was projected to reach over $17 billion, highlighting the immense growth potential.

These evolving technologies demand sophisticated component integration.

- V2X Communication: Enabling vehicles to communicate with their surroundings, improving safety and traffic flow.

- AI Integration: Powering advanced driver-assistance systems (ADAS) and fully autonomous capabilities.

- Data Processing: Requiring robust systems to handle the vast amounts of data generated by connected vehicles.

- Cybersecurity: Ensuring the secure transmission and protection of vehicle data and control systems.

Software-Defined Vehicles and AI Integration

The automotive industry is rapidly shifting towards software-defined vehicles (SDVs), where software and electrification are key differentiators. Artificial intelligence (AI) is at the forefront of this transformation, enhancing everything from in-car user experiences to predictive maintenance. Alfmeier Präzision AG must recognize that software's role in defining a vehicle's appeal is growing, necessitating the integration of AI capabilities into its product offerings to stay competitive and enable advanced intelligent vehicle functions.

The increasing reliance on software means that traditional hardware suppliers like Alfmeier Präzision AG need to adapt. For instance, by 2025, it's projected that the software content in a new vehicle could account for over 30% of its total value. This trend underscores the urgency for Alfmeier Präzision AG to develop expertise in software development and AI integration to remain relevant in the evolving automotive landscape.

- Software-Defined Vehicles: By 2025, software is expected to represent over 30% of a new vehicle's value, highlighting its critical role in differentiation.

- AI Integration: AI is revolutionizing user interfaces, autonomous driving features, and vehicle diagnostics, creating new opportunities and challenges for component suppliers.

- Competitive Imperative: Alfmeier Präzision AG needs to embed AI hardware and software into its products to support intelligent vehicle functions and maintain market position.

Technological shifts are profoundly reshaping the automotive industry, impacting companies like Alfmeier Präzision AG. The increasing prevalence of electric vehicles (EVs) and advanced driver-assistance systems (ADAS) necessitates sophisticated fluid and fuel management, a market projected to exceed $35 billion by 2028. Furthermore, the growing emphasis on in-cabin comfort, with the automotive seating market valued at around $50 billion in 2024, presents opportunities for integrated climate control solutions.

The rapid integration of software-defined vehicles (SDVs) is a critical trend, with software expected to constitute over 30% of a new vehicle's value by 2025. This highlights the need for Alfmeier Präzision AG to embrace AI and software development to support intelligent functions and maintain competitiveness. Innovations like 3D printing also offer substantial efficiency gains for precision component manufacturing.

Legal factors

Stricter environmental regulations, like the U.S. EPA's Multi-Pollutant Emissions Standards for 2027 and beyond, are a significant legal factor. These rules mandate substantial reductions in greenhouse gases and other pollutants, directly impacting automotive component manufacturers.

Alfmeier Präzision AG must adapt its product lines to meet these evolving standards. This necessitates a focus on components that enable greater fuel efficiency, support hybrid powertrains, and integrate with electric vehicle technologies.

Automakers and their suppliers face stringent vehicle safety standards, with non-compliance leading to significant legal repercussions. Defects can trigger costly recalls, substantial regulatory fines, and severe reputational damage, impacting market trust and sales. For instance, in 2023, the US National Highway Traffic Safety Administration (NHTSA) oversaw over 900 recalls affecting millions of vehicles, highlighting the pervasive nature of these issues.

Alfmeier Präzision AG's commitment to precision engineering means its components must consistently meet rigorous quality and safety benchmarks. Avoiding involvement in recall events is paramount, as even a single component defect can initiate a cascade of legal and financial liabilities. The financial impact of recalls can be immense; a major automotive recall can cost tens or even hundreds of millions of dollars in repair costs, logistics, and associated expenses.

The automotive industry's increasing reliance on connected vehicle technology and the vast amounts of data generated necessitate stringent adherence to data privacy and cybersecurity laws. Failure to comply can result in significant penalties, as seen with GDPR fines, which can reach up to 4% of global annual revenue. Alfmeier Präzision AG, as a key supplier of integrated systems, must ensure its products and data handling practices meet these evolving legal standards, including those concerning data portability and the secure management of sensitive information.

Consumer Protection Laws

Consumer protection laws are continuously adapting, focusing on areas like misleading advertising, undisclosed charges, and false claims about vehicle capabilities. While specific regulations, such as the FTC's CARS Rule, have encountered legal hurdles, the core tenets against unfair and deceptive business practices are firmly in place. Alfmeier Präzision AG must ensure its promotional materials and product assertions are clear and truthful to navigate this landscape effectively.

For instance, in 2024, regulatory bodies globally continued to scrutinize environmental claims made by automotive suppliers. A report by the European Commission highlighted a significant increase in investigations into greenwashing accusations within the automotive sector. This underscores the need for Alfmeier Präzision AG to substantiate all environmental performance data with verifiable evidence.

- Transparency in Pricing: Adherence to regulations preventing hidden fees in product pricing is paramount.

- Accurate Performance Claims: Ensuring all marketing materials accurately reflect product capabilities is critical.

- FTC Enforcement: The Federal Trade Commission actively pursues companies engaging in deceptive advertising practices, with penalties often reaching substantial figures for non-compliance.

- Data Privacy: Evolving data privacy laws necessitate careful handling of customer information related to vehicle usage and preferences.

Trade Compliance and Anti-Trust Regulations

Alfmeier Präzision AG must meticulously adhere to international trade compliance, navigating a complex web of tariffs and import regulations that directly impact its global supply chain and product distribution. For instance, the European Union's Common External Tariff (CET) and various national import duties can significantly affect the cost of components and finished goods. Staying current with these evolving trade policies is crucial for maintaining competitive pricing and market access.

Furthermore, strict adherence to anti-trust regulations is paramount to prevent unfair competition and potential market monopolization. These regulations, enforced by bodies like the European Commission's Directorate-General for Competition, ensure a level playing field for all market participants. Alfmeier Präzision AG's commitment to fair practices avoids hefty fines and reputational damage, fostering trust with partners and customers.

- Trade Compliance: Alfmeier Präzision AG must manage compliance with global trade laws, including tariffs and import/export controls, which saw over $25 trillion in global merchandise trade in 2023.

- Anti-Trust Enforcement: Adherence to anti-trust laws prevents monopolistic practices, ensuring fair competition within the automotive sector, a market where regulatory scrutiny on mergers and acquisitions remains high.

- Navigating Regulations: Proactive monitoring of trade agreements and competition law updates is essential for Alfmeier Präzision AG's international operations and strategic partnerships.

Alfmeier Präzision AG operates within a legal framework that demands rigorous compliance with environmental standards, such as the EU's upcoming CO2 emission targets for vehicles, which will influence component design towards electrification and fuel efficiency.

Adherence to stringent vehicle safety regulations, exemplified by the NHTSA's ongoing focus on advanced driver-assistance systems (ADAS) and potential recalls, is critical to avoid substantial financial penalties and reputational harm.

Data privacy and cybersecurity laws, including the global expansion of regulations similar to GDPR, necessitate secure handling of connected vehicle data, with non-compliance potentially leading to fines equivalent to a significant percentage of global revenue.

Navigating international trade compliance, including tariffs and import/export controls, is essential for global operations, as demonstrated by the fluctuating trade policies that impacted the automotive sector in 2024.

| Legal Factor | Impact on Alfmeier Präzision AG | Relevant Data/Example |

| Environmental Regulations | Need for components supporting fuel efficiency and electrification. | EU CO2 emission targets for new vehicles. |

| Vehicle Safety Standards | Mandatory compliance to avoid recalls, fines, and reputational damage. | NHTSA's scrutiny of ADAS technology. |

| Data Privacy & Cybersecurity | Secure handling of connected vehicle data to avoid penalties. | GDPR-like regulations globally; potential fines up to 4% of global annual revenue. |

| International Trade Compliance | Management of tariffs and import/export controls for global supply chain. | Fluctuating trade policies affecting automotive sector in 2024. |

Environmental factors

The automotive sector is under intense scrutiny to curb greenhouse gas emissions, pushing for stricter environmental standards globally. For instance, the European Union's fleet-wide CO2 emission targets for 2030 are set at 50% lower than 2021 levels, a significant driver for change.

Alfmeier Präzision AG's core business, focusing on fuel and fluid management systems, is directly affected by these evolving regulations. The company must invest in research and development to ensure its components enable greater fuel efficiency in traditional internal combustion engines and support the burgeoning electric and hybrid vehicle markets.

The automotive industry's growing emphasis on sustainability is driving a significant shift towards eco-friendly materials. Automakers are increasingly specifying lightweight, bio-based, and recycled content for vehicle components, aiming to lower overall emissions and appeal to environmentally conscious consumers. This trend is expected to accelerate, with projections indicating a substantial increase in the use of sustainable materials in vehicle manufacturing over the next few years.

Alfmeier Präzision AG must proactively adapt to these evolving environmental demands. This involves researching and integrating innovative, eco-responsible materials into its product lines, such as advanced composites or recycled plastics, where feasible. Furthermore, optimizing manufacturing processes to reduce energy consumption and waste generation is crucial to align with the industry's decarbonization goals and meet rising consumer expectations for sustainable automotive parts.

Environmental concerns are driving stricter waste management and recycling rules for manufacturers like Alfmeier Präzision AG. These regulations are designed to reduce landfill waste and promote resource conservation.

Adherence to these evolving standards is crucial, potentially requiring Alfmeier Präzision AG to invest in technologies and processes that support a circular economy. For instance, in 2024, the EU continued to push for higher recycling rates, with some member states targeting over 65% of municipal waste recycling by 2030, a trend impacting all industrial players.

Climate Change Driving EV Adoption

Growing concerns about climate change are significantly accelerating the adoption of electric vehicles (EVs). This shift is primarily driven by the environmental benefits EVs offer, most notably zero tailpipe emissions, which directly combat air pollution in urban areas. For instance, in 2024, projections indicated that EV sales could reach over 20% of the global automotive market, a substantial leap from previous years.

Despite ongoing challenges such as the need for more robust charging infrastructure and the initial affordability of EVs, the long-term trajectory clearly favors electrification. This sustained demand for electric and hybrid vehicles is a positive signal for companies like Alfmeier Präzision AG, which specialize in components crucial for these greener automotive technologies.

- EV sales globally were projected to exceed 15 million units in 2024.

- Governments worldwide are implementing stricter emissions standards, pushing manufacturers towards electrification.

- Investments in EV charging infrastructure are rapidly increasing, with billions allocated globally for expansion through 2025.

- Alfmeier Präzision AG's expertise in precision components positions it to benefit from the growing demand in the EV and hybrid segments.

Resource Scarcity and Supply Chain Resilience

The automotive industry's pivot to electric vehicles (EVs) and plug-in hybrids presents significant environmental challenges, particularly concerning resource scarcity and supply chain resilience. Sourcing critical raw materials like lithium, cobalt, and nickel for batteries requires robust and sustainable supply chains. For instance, the International Energy Agency (IEA) projected in its 2024 report that demand for critical minerals in clean energy technologies could grow by over 40 times by 2040, highlighting the urgency of securing these resources responsibly.

Alfmeier Präzision AG, a key player in automotive supply, must proactively address these environmental shifts. Building resilient supply chains capable of meeting the escalating demand for sustainable components is paramount. This involves strategic collaborations with suppliers to ensure a steady and ethical supply of materials, mitigating risks associated with geopolitical instability and environmental regulations.

- Resource Demand Growth: Projections indicate a substantial increase in demand for battery materials, necessitating proactive sourcing strategies.

- Supply Chain Vulnerability: Geopolitical factors and environmental regulations can impact the availability and cost of essential raw materials.

- Supplier Collaboration: Partnering with suppliers to foster transparency and sustainability in material sourcing is crucial for long-term resilience.

- EV Transition Impact: The shift to EVs directly influences the types of materials and components required, reshaping traditional automotive supply chains.

The automotive industry is under immense pressure to reduce its environmental footprint, with global regulations tightening around CO2 emissions and vehicle pollutants. This push is accelerating the adoption of electric vehicles (EVs), with projections suggesting EV sales could surpass 20% of the global market in 2024. Alfmeier Präzision AG's expertise in precision components for fuel and fluid management systems positions it to benefit from this electrification trend.

The demand for sustainable materials in vehicle manufacturing is also on the rise, with automakers increasingly seeking lightweight, bio-based, and recycled content. Alfmeier Präzision AG needs to integrate these eco-responsible materials into its product offerings and optimize its manufacturing processes to minimize waste and energy consumption, aligning with the industry's decarbonization goals.

Stricter waste management and recycling rules are impacting manufacturers, requiring adherence to circular economy principles. This necessitates investment in technologies that support resource conservation, as seen in the EU's targets for increased waste recycling rates.

The growing EV market presents challenges related to resource scarcity for battery materials like lithium and cobalt, with demand for these critical minerals projected to rise significantly. Alfmeier Präzision AG must ensure resilient and ethical supply chains for its components, fostering collaboration with suppliers to navigate these environmental and resource complexities.

| Environmental Factor | Impact on Alfmeier Präzision AG | Supporting Data/Trend (2024/2025) |

| CO2 Emission Regulations | Increased demand for fuel-efficient and EV components. | EU fleet-wide CO2 targets for 2030: 50% lower than 2021 levels. |

| Shift to EVs | Opportunity for components in electric and hybrid vehicles. | EV sales projected to exceed 15 million units globally in 2024. |

| Sustainable Materials | Need to integrate eco-friendly materials into products. | Growing automaker specification for lightweight, bio-based, and recycled content. |

| Waste Management & Recycling | Requirement for circular economy practices in manufacturing. | EU aiming for over 65% municipal waste recycling by 2030. |

| Resource Scarcity (Batteries) | Challenge in securing raw materials for EV components. | Demand for critical minerals in clean energy projected to grow over 40 times by 2040. |

PESTLE Analysis Data Sources

Our PESTLE analysis for Alfmeier Präzision AG is meticulously crafted using data from leading economic indicators, government policy updates, and reputable industry research firms. We integrate insights from global market trends, technological advancements, and environmental regulatory bodies to ensure a comprehensive understanding of the macro-environment.