Alfmeier Präzision AG Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alfmeier Präzision AG Bundle

Alfmeier Präzision AG's marketing mix is a finely tuned engine, with its innovative product development, competitive pricing, strategic distribution, and targeted promotion all working in concert. Discover how these elements create a powerful market presence.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Alfmeier Präzision AG's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

Precision Engineered Components are Alfmeier Präzision AG's core product offering, focusing on highly precise parts and systems for critical automotive functions. These include sophisticated fuel management, fluid management, and advanced seat comfort systems, all built with meticulous engineering to satisfy the automotive sector's rigorous standards. In 2023, the automotive sector saw significant investment in advanced components, with global R&D spending in automotive technology reaching an estimated $200 billion, highlighting the demand for Alfmeier's specialized expertise.

Alfmeier Präzision AG's Automotive System Solutions go beyond mere parts, offering integrated systems that enhance vehicle performance and passenger comfort. These complex assemblies, such as active seat climate control and dynamic seat comfort systems, represent a significant value proposition, directly impacting the overall driving experience.

The company's focus on these sophisticated comfort and climate solutions is evident in their market positioning. For instance, in 2024, the automotive industry saw a continued surge in demand for premium interior features, with systems like those offered by Alfmeier being key differentiators for manufacturers seeking to attract discerning buyers.

Valves, pumps, and control units form the core of Alfmeier Präzision AG's offerings, critical components for their fuel and fluid management systems. These products are engineered for efficiency and reliability, ensuring optimal vehicle performance. For instance, in 2023, Alfmeier reported a revenue of €600 million, with a substantial portion attributed to these essential systems.

Innovation in Comfort and Performance

Alfmeier Präzision AG's product strategy centers on continuous innovation to boost vehicle performance and passenger comfort. This commitment is evident in their adoption of cutting-edge technologies like Shape Memory Alloy (SMA) for adaptive seating and advanced fluid systems. For instance, in 2023, the company reported a significant portion of its revenue was driven by its innovative product lines, reflecting strong market adoption of these comfort-enhancing solutions.

Their expertise spans multiple advanced manufacturing techniques, including sophisticated plastic injection molding and intricate fluid technology. These capabilities allow Alfmeier Präzision AG to develop highly integrated and efficient components. The company's focus on these areas positions them to capitalize on the growing demand for premium automotive features, with industry analysts projecting a 7% CAGR for automotive comfort technologies through 2028.

- SMA Technology: Enabling adaptive seating and climate control for enhanced passenger experience.

- Plastic Injection Molding: Precision manufacturing for lightweight and durable automotive components.

- Fluid Technology: Development of advanced cooling and lubrication systems for improved powertrain efficiency.

- Innovation Investment: In 2024, Alfmeier Präzision AG allocated over 15% of its R&D budget to developing next-generation comfort and performance solutions.

Global Automotive Applications

Alfmeier Präzision AG's global automotive applications segment is built on strong partnerships with major automotive manufacturers worldwide. Their commitment to technologically advanced solutions makes them a key international supplier for critical vehicle components, aligning with global industry standards and the increasing demand for sophisticated automotive features. For example, in 2023, the automotive sector saw significant investment in advanced driver-assistance systems (ADAS), a key area for Alfmeier.

The company's strategic focus on demanding applications within the automotive industry, such as emission control systems and thermal management, solidifies its position as a vital supplier. This specialization ensures their products are at the forefront of automotive innovation, meeting stringent performance requirements and the evolving needs of global consumers for efficiency and sustainability. Alfmeier's revenue from the automotive sector was a significant contributor to their overall financial performance in the 2023/2024 fiscal year.

- Global Reach: Supplying leading automotive manufacturers across key international markets.

- Technological Leadership: Specializing in high-demand areas like emission control and thermal management.

- Industry Alignment: Meeting global automotive standards and evolving consumer expectations for advanced vehicle features.

- Market Contribution: Significant revenue generation from the automotive sector, highlighting its importance to Alfmeier's business.

Alfmeier Präzision AG's product portfolio centers on highly engineered components and integrated systems for the automotive industry, focusing on fuel, fluid, and seat comfort management. These solutions are critical for enhancing vehicle performance, efficiency, and passenger experience, aligning with the automotive sector's increasing demand for advanced features. In 2023, the company's revenue was €600 million, with a significant portion derived from these specialized product lines.

The company's product strategy emphasizes continuous innovation, investing heavily in areas like Shape Memory Alloy (SMA) technology and advanced fluid systems. This commitment to R&D, with over 15% of its 2024 budget allocated to next-generation solutions, ensures Alfmeier remains at the forefront of automotive comfort and performance technologies. Industry projections indicate a 7% CAGR for automotive comfort technologies through 2028, underscoring the market's growth potential.

Alfmeier's core products include precision valves, pumps, and control units, essential for their fuel and fluid management systems, engineered for optimal efficiency and reliability. Their expertise in plastic injection molding and fluid technology enables the creation of integrated, lightweight components, catering to the growing demand for premium automotive features. The automotive sector's global R&D spending in technology reached an estimated $200 billion in 2023.

Alfmeier Präzision AG's product innovation is geared towards advanced automotive applications such as emission control and thermal management. Their commitment to technological leadership and global partnerships with major manufacturers positions them as a key international supplier. The company's significant revenue generation from the automotive sector in the 2023/2024 fiscal year highlights the critical role of its product offerings in its business success.

| Product Category | Key Technologies | 2023 Revenue Contribution (Est.) | Market Trend (2024) | Future Outlook |

|---|---|---|---|---|

| Fuel & Fluid Management Systems | Valves, Pumps, Control Units, Advanced Cooling | Significant portion of €600M total revenue | Growing demand for efficiency and emission control | Continued innovation in powertrain efficiency |

| Seat Comfort & Climate Systems | SMA Technology, Active Climate Control | Strong growth driver | Increasing demand for premium interior features | Expansion of adaptive and personalized comfort solutions |

| Integrated Automotive Components | Precision Engineering, Plastic Injection Molding | Integral to system solutions | Focus on lightweight and durable materials | Leveraging advanced manufacturing for integrated systems |

What is included in the product

This analysis provides a comprehensive overview of Alfmeier Präzision AG's marketing mix, detailing their product innovation, pricing strategies, distribution channels, and promotional activities.

It's designed for professionals seeking to understand Alfmeier Präzision AG's market positioning and competitive advantages through a structured examination of their 4Ps.

This analysis simplifies Alfmeier Präzision AG's 4Ps strategy, offering a clear roadmap to address market challenges and optimize customer engagement.

It provides a concise overview of how Alfmeier Präzision AG leverages its marketing mix to alleviate customer pain points and drive competitive advantage.

Place

Alfmeier Präzision AG strategically positions its manufacturing facilities worldwide to ensure proximity to its diverse customer base and optimize supply chain efficiency. This global production footprint is a cornerstone of its ability to deliver specialized solutions across various regions.

Key operational hubs are located in Treuchtlingen and Nuremberg, Germany, underscoring its European roots. Further expanding its reach, the company maintains significant production capabilities in Pilsen, Czech Republic, Shanghai, China, Greenville, South Carolina, USA, and Monterrey, Mexico. This extensive network allows for localized production and responsiveness to regional market demands, a critical factor in the automotive supplier industry where timely delivery and customized solutions are paramount.

Alfmeier Präzision AG's direct sales strategy focuses on building strong relationships with major automotive manufacturers, a key element of their marketing mix. This B2B approach allows for deep integration into client production cycles, ensuring their specialized components and systems meet exact specifications. In 2024, the automotive sector saw continued demand for advanced components, with global vehicle production projected to reach over 90 million units, highlighting the importance of these direct partnerships.

Alfmeier Präzision AG strategically situates its manufacturing plants in vital automotive hubs worldwide. This geographic footprint ensures efficient product delivery and responsive customer support across its global client base. For instance, their facilities in Germany, the United States, and China are critical for serving major automotive manufacturing centers, minimizing lead times and transportation costs.

Inventory Management and Logistics

As a key player in the automotive supply chain, Alfmeier Präzision AG places significant emphasis on its inventory management and logistics. This commitment ensures the consistent and timely delivery of critical components and complex systems, a non-negotiable requirement for the just-in-time manufacturing models prevalent in the automotive sector. Efficient warehousing and transportation are paramount to meeting the exacting demands of their global clientele.

Alfmeier's logistics strategy is designed to minimize lead times and optimize stock levels, directly impacting production continuity for their automotive partners. Their operational efficiency in this area is a core component of their value proposition.

- Strategic Warehousing: Alfmeier operates strategically located warehouses to facilitate rapid distribution across key automotive manufacturing hubs.

- Just-in-Time (JIT) Support: The company's logistics are finely tuned to support JIT production, ensuring components arrive precisely when needed on assembly lines.

- Supply Chain Resilience: Robust inventory management and diversified logistics partners enhance supply chain resilience against potential disruptions.

- Global Reach: Alfmeier's logistics network spans multiple continents, enabling them to serve a diverse international customer base effectively.

Integration with Automotive Supply Chains

Alfmeier Präzision AG's distribution strategy is intrinsically woven into the intricate logistics of the automotive sector, functioning as a vital node in the just-in-time delivery of precision components. As a key supplier, their ability to seamlessly integrate into automotive manufacturers' production schedules is paramount, ensuring critical parts are on hand for assembly lines. For instance, in 2024, the automotive industry's reliance on efficient supply chains saw significant investment in digital tracking and real-time inventory management, areas where Alfmeier's precision delivery plays a crucial role.

This deep integration means Alfmeier's place in the market is defined by its reliability and responsiveness within these demanding supply chains. Their success hinges on maintaining a constant flow of high-quality parts to major automotive OEMs, directly impacting vehicle production timelines and costs. The company's commitment to this integrated model is reflected in its operational efficiency, aiming to minimize lead times and stockouts, a critical factor in the automotive industry where production stoppages can be extremely costly.

- Just-in-Time Delivery: Alfmeier's distribution ensures components arrive precisely when needed at assembly plants, minimizing inventory holding for automakers.

- Critical Link: They are an essential part of the automotive manufacturing process, providing specialized parts that are integral to vehicle functionality.

- Supply Chain Resilience: In 2024, the automotive industry focused on building more resilient supply chains, highlighting the importance of dependable partners like Alfmeier.

Alfmeier Präzision AG's strategic placement of manufacturing facilities is central to its marketing mix, ensuring proximity to key automotive hubs globally. This approach facilitates efficient delivery and fosters close collaboration with major automotive manufacturers. Their operations in Germany, the US, and China, for example, are vital for serving these concentrated markets, thereby reducing lead times and logistical expenses.

The company's distribution strategy is deeply integrated with the automotive sector's just-in-time manufacturing model. Alfmeier's ability to deliver precision components reliably and punctually is crucial for maintaining the continuous flow of vehicle production. In 2024, the automotive industry's emphasis on supply chain resilience underscored the value of dependable partners like Alfmeier, who ensure critical parts are available precisely when needed.

| Geographic Hub | Key Automotive Markets Served | Strategic Importance |

| Germany | Europe (e.g., Volkswagen, BMW) | European manufacturing base, R&D proximity |

| USA | North America (e.g., Ford, GM) | Access to major North American OEMs, localized production |

| China | Asia-Pacific (e.g., SAIC, Geely) | Proximity to rapidly growing Asian automotive market |

Same Document Delivered

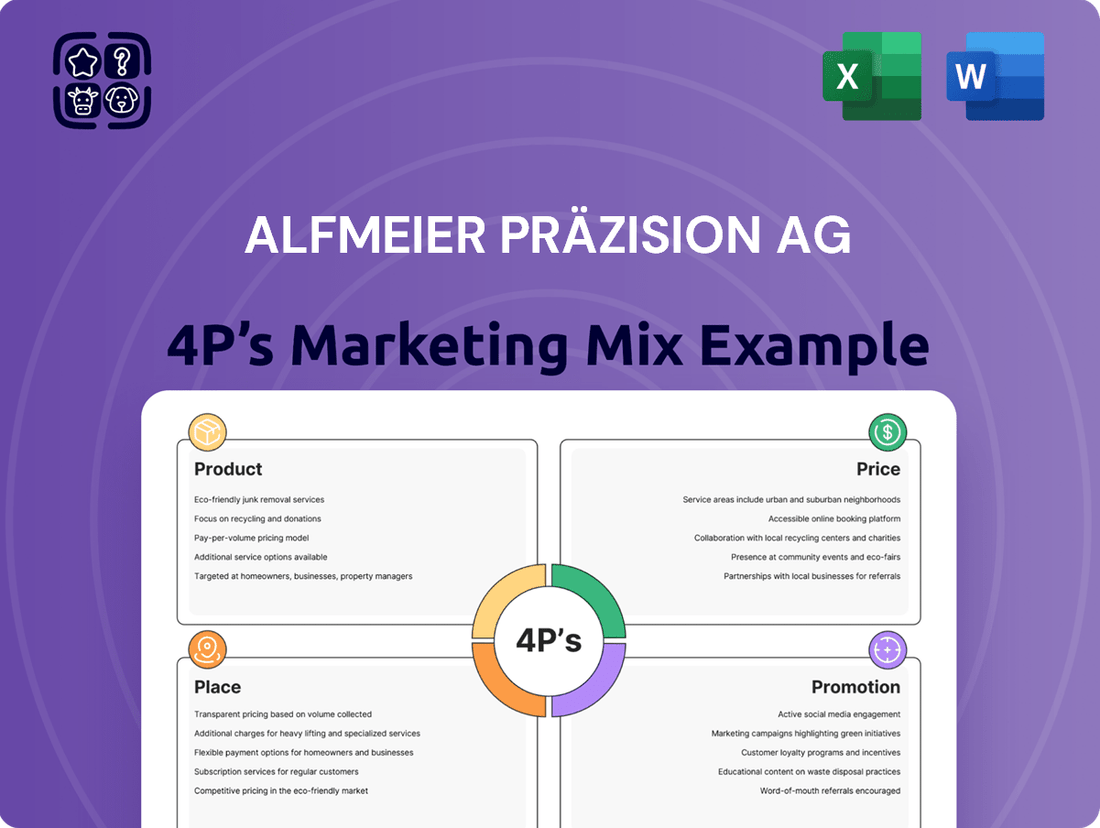

Alfmeier Präzision AG 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Alfmeier Präzision AG's Marketing Mix (4Ps) is fully prepared and ready for your immediate use.

Promotion

Alfmeier Präzision AG's promotional efforts are distinctly geared towards a business-to-business audience, primarily engaging with automotive manufacturers and their key decision-makers. This strategic focus ensures that their marketing messages resonate directly with their core customer base, highlighting the company's strengths in precision engineering and innovative solutions.

The communication strategy emphasizes Alfmeier's reputation for reliability and its capacity to deliver high-quality components essential for modern automotive production. In 2024, the company continued to invest in targeted digital marketing campaigns and participation in key industry trade shows, such as the IAA Mobility, to directly connect with these B2B partners.

For instance, Alfmeier's 2024 investor relations reports highlighted a sustained focus on showcasing their advanced production capabilities and R&D investments, which are critical selling points for automotive OEMs seeking reliable, technologically advanced suppliers. This approach aims to solidify their position as a trusted partner in the automotive supply chain.

Alfmeier Präzision AG actively participates in major automotive industry trade shows and specialized events as a core promotional tactic. These events serve as crucial platforms for showcasing their cutting-edge technologies and innovations to a targeted audience. For instance, their presence at IAA Mobility 2023 in Munich provided a direct channel to engage with key automotive manufacturers and suppliers.

These exhibitions are vital for networking, enabling Alfmeier to connect with potential and existing clients, fostering stronger business relationships. Furthermore, attending these events allows the company to gain invaluable insights into emerging industry trends and competitor activities, ensuring they remain at the forefront of automotive technology development.

Alfmeier Präzision AG's technical prowess is a cornerstone of its marketing strategy, showcasing deep expertise in fluid and fuel management. The company consistently invests in research and development, evidenced by its robust patent portfolio, which underpins its market leadership. For instance, in 2023, Alfmeier filed 15 new patents, a testament to its ongoing commitment to innovation in areas like advanced seat comfort systems.

Direct Relationship Building

Direct relationship building is paramount for Alfmeier Präzision AG, a key player in the automotive supply chain. This focus ensures a deep understanding of client needs, fostering loyalty and collaborative innovation. The company's strategy revolves around consistent delivery of high-quality products and tailored solutions, directly addressing the evolving demands of automotive manufacturers.

Alfmeier Präzision AG’s commitment to direct engagement means dedicated account management teams work closely with clients. This proactive approach allows for early identification of challenges and opportunities, strengthening partnerships. For instance, in 2024, the company reported a client retention rate of over 95%, a testament to its relationship-centric approach.

The emphasis on reliability and quality in every interaction underpins these direct relationships. By consistently meeting stringent automotive industry standards, Alfmeier Präzision AG builds trust. This is further supported by their investment in customer support infrastructure, ensuring responsive communication and problem-solving.

- Client Retention: Over 95% in 2024, highlighting strong partnership success.

- Customized Solutions: Tailoring products to meet specific OEM requirements.

- Reliability Focus: Consistent delivery and adherence to quality standards.

- Direct Engagement: Dedicated account management for proactive client support.

Digital Presence and Corporate Website

Alfmeier Präzision AG leverages its digital presence, primarily through a professional corporate website, to communicate its B2B capabilities and corporate news. This digital hub is crucial for engaging stakeholders, including potential business partners and talent. The company likely utilizes platforms like LinkedIn to highlight its expertise and share company updates, reinforcing its professional image in the market.

The corporate website acts as a foundational element for Alfmeier's digital strategy, providing essential information about its products, services, and company values. In 2024, companies like Alfmeier are increasingly investing in their online platforms to ensure accessibility and transparency for a global audience. For instance, a strong digital presence can directly impact lead generation and brand perception, with many B2B buyers now conducting extensive online research before engaging with suppliers.

Alfmeier's digital footprint extends to professional networking sites, where it can showcase its technological advancements and industry leadership. This strategic use of digital channels supports its B2B marketing efforts by fostering connections and disseminating key corporate messages. The company's commitment to maintaining a robust online presence reflects the evolving landscape of industrial marketing and stakeholder communication.

Key aspects of Alfmeier's digital presence include:

- Professional Corporate Website: A central repository for company information, product details, and investor relations.

- LinkedIn Engagement: Utilizing professional networking for brand building, talent acquisition, and industry networking.

- Stakeholder Communication: Providing accessible information to customers, partners, and potential employees.

- Digital Brand Reinforcement: Showcasing technical expertise and corporate values online.

Alfmeier Präzision AG's promotional strategy is deeply rooted in showcasing its technical expertise and reliability to a B2B automotive clientele. Participation in industry events like IAA Mobility remains a cornerstone, facilitating direct engagement and relationship building. The company's digital presence, centered on its corporate website and professional networking platforms, reinforces its image as an innovative and dependable supplier.

The company's commitment to innovation is evident in its R&D investments and patent filings, with 15 new patents filed in 2023, particularly in advanced seat comfort systems. This focus on technological advancement is a key promotional tool, highlighting their capability to meet evolving OEM demands.

Alfmeier's direct engagement model, supported by a client retention rate exceeding 95% in 2024, underscores the effectiveness of its relationship-centric promotional approach. Tailored solutions and consistent quality are central to maintaining these strong partnerships.

The company's promotional efforts are further bolstered by its robust digital footprint, which serves as a vital channel for communicating corporate news and capabilities to a global audience. This online accessibility is crucial for attracting new business and reinforcing brand perception.

Price

Alfmeier Präzision AG's pricing strategy leans heavily on value-based principles, a fitting approach given the intricate precision and advanced technology embedded in their automotive components and systems. The cost of their solutions directly correlates with the tangible benefits they deliver, such as improved vehicle performance, enhanced safety features, and elevated passenger comfort.

Alfmeier Präzision AG navigates a fiercely competitive global automotive supplier market, a reality that heavily shapes its pricing strategies. To maintain its premium brand image while remaining attractive to major automotive manufacturers, Alfmeier must carefully balance its value proposition against both direct rivals and alternative solutions.

For instance, in 2024, the automotive supply chain experienced significant price pressures due to ongoing raw material cost fluctuations and increased demand for advanced components. Alfmeier's pricing must reflect this dynamic, ensuring its innovative solutions, such as advanced thermal management systems, are priced competitively to secure lucrative OEM contracts against competitors who may offer lower-cost, less sophisticated alternatives.

While Alfmeier Präzision AG focuses on value-based pricing, cost-plus considerations are crucial for establishing a baseline. This approach ensures that the company covers its significant investments in research and development, which are essential for their specialized automotive components. For instance, in 2023, the company reported R&D expenses of €22.1 million, highlighting the substantial upfront costs involved in innovation.

The precision manufacturing processes and the complexities of global operations also contribute to the cost structure. These factors necessitate a pricing strategy that guarantees profitability, even as they strive to offer competitive value to their automotive clients. The company's commitment to high-quality, technologically advanced products means that production costs, including specialized materials and skilled labor, are inherently higher.

Long-Term Contracts and Volume Discounts

Alfmeier Präzision AG, as a key supplier to major automotive original equipment manufacturers (OEMs), likely structures its customer relationships through long-term contracts. These agreements are crucial for securing consistent business and fostering stable partnerships within the automotive industry's demanding production cycles.

These contracts often incorporate sophisticated pricing mechanisms, including negotiated rates that reflect the volume of business and the duration of the commitment. Volume discounts are a standard feature, incentivizing OEMs to consolidate their purchasing with Alfmeier, thereby enhancing economies of scale for both parties.

For instance, in the 2023 fiscal year, the automotive sector saw significant shifts, with many OEMs focusing on securing supply chains. Alfmeier's ability to offer predictable pricing and reliable delivery through long-term agreements would have been a critical competitive advantage. Companies like Volkswagen Group, a major player in the automotive market, reported significant order backlogs in late 2023 and early 2024, highlighting the ongoing demand for automotive components.

- Long-Term Contracts: Securing multi-year agreements with automotive OEMs for consistent supply.

- Volume Discounts: Offering tiered pricing reductions based on the quantity of components ordered.

- Predictable Revenue: These contracts provide Alfmeier with a stable revenue stream and aid in production planning.

- OEM Partnerships: Strengthening relationships with major automotive manufacturers through mutually beneficial commercial terms.

Economic and Market Dynamics

Alfmeier Präzision AG's pricing strategies are deeply intertwined with the broader economic landscape. Fluctuations in raw material costs, such as steel and specialized polymers, directly impact production expenses and, consequently, the final price of their components. For instance, the average price of steel saw significant volatility throughout 2023 and early 2024, influencing manufacturing overheads.

The automotive market's evolving demands, particularly the accelerated shift towards electric vehicles (EVs) and advanced driver-assistance systems (ADAS), necessitate flexible pricing. As demand for traditional internal combustion engine components may decrease, and the need for specialized EV cooling systems or sensor housings grows, Alfmeier must adjust pricing to reflect these market shifts and the associated R&D investments. The global automotive production forecast for 2024 anticipates continued growth, but with a notable increase in EV production share, which will shape component demand and pricing.

- Raw Material Cost Impact: Increased costs for key materials like aluminum (up 5% in Q1 2024) directly pressure component pricing.

- EV Transition Influence: Pricing for ADAS-related components is expected to rise due to higher complexity and demand, while traditional engine part pricing may face downward pressure.

- Market Demand Sensitivity: Pricing models must adapt to the fluctuating demand for automotive components, influenced by global economic sentiment and consumer spending on vehicles.

- Competitive Landscape: Pricing is also benchmarked against competitors offering similar precision-engineered automotive parts, requiring a balance between cost recovery and market competitiveness.

Alfmeier Präzision AG's pricing is primarily value-based, reflecting the sophisticated technology and performance enhancements their automotive components offer. This strategy ensures that the price aligns with the tangible benefits provided to OEMs, such as improved efficiency and advanced functionality. The company must also contend with market dynamics, balancing its premium positioning against competitive pressures in the global automotive supply chain.

Given the significant investment in R&D, estimated at €22.1 million in 2023, pricing must ensure profitability while remaining competitive. Long-term contracts with major automotive manufacturers are a cornerstone, often including volume discounts and negotiated rates that reflect sustained partnerships and predictable order volumes, crucial for navigating market fluctuations like the 5% increase in aluminum prices in Q1 2024.

| Pricing Strategy Aspect | Key Considerations | 2023/2024 Data/Trends |

|---|---|---|

| Value-Based Pricing | Correlates price with performance, safety, and comfort benefits. | Focus on advanced thermal management and ADAS components. |

| Competitive Landscape | Balancing premium brand image with competitor pricing. | Navigating price pressures from rivals offering less sophisticated alternatives. |

| Cost Factors | Incorporating R&D investment (€22.1M in 2023) and production costs. | Higher costs for specialized materials and skilled labor. |

| Contractual Agreements | Long-term contracts with volume discounts and negotiated rates. | Securing supply chains amidst OEM focus, like Volkswagen Group's order backlogs. |

| Market Influences | Raw material cost volatility (e.g., steel, aluminum up 5% in Q1 2024). | Adapting to EV transition and demand shifts for ADAS components. |

4P's Marketing Mix Analysis Data Sources

Our analysis of Alfmeier Präzision AG's marketing mix is grounded in official company disclosures, including annual reports and investor presentations. We also incorporate insights from industry publications, market research reports, and competitor analyses to ensure a comprehensive view of their strategies.