Alfmeier Präzision AG Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alfmeier Präzision AG Bundle

Alfmeier Präzision AG operates in an industry characterized by moderate rivalry and significant supplier power, impacting their pricing flexibility. The threat of substitutes is present, though less pronounced, while buyer bargaining power requires careful management of customer relationships.

The complete report reveals the real forces shaping Alfmeier Präzision AG’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Suppliers of essential materials like steel and aluminum to the automotive sector, including those serving Alfmeier Präzision AG, are experiencing substantial cost hikes. This situation grants them greater leverage to negotiate increased prices for their components, directly affecting Alfmeier's manufacturing expenses and profit margins.

For instance, the price of aluminum surged by approximately 25% in early 2024 compared to the previous year, while steel prices saw a rise of around 15%. This upward trend in raw material costs is projected to continue through 2025, creating sustained pressure on the entire supply chain and potentially impacting Alfmeier's ability to maintain its current pricing strategies.

Ongoing global supply chain disruptions, especially concerning semiconductor chips and specialized metals, are significantly boosting supplier leverage. Alfmeier Präzision AG, as a maker of precision components, is particularly exposed to these issues, facing potential delays and price hikes from suppliers of scarce materials. This vulnerability is a major hurdle for automotive suppliers throughout 2024, with projections indicating continued challenges into 2025.

Alfmeier Präzision AG's reliance on specialized component suppliers for complex parts like valves and integrated electronics grants these suppliers considerable bargaining power. These niche providers often possess unique expertise or proprietary technology, making it costly and difficult for Alfmeier to find alternative sources, especially for cutting-edge solutions such as Shape Memory Alloy (SMA) technology where supplier options are extremely limited.

Labor Shortages

Labor shortages are significantly impacting the automotive supply chain, particularly for skilled manufacturing and logistics personnel. This scarcity drives up operating costs for suppliers, who then pass these increased expenses onto companies like Alfmeier Präzision AG. For instance, in 2024, the automotive industry experienced a notable deficit in skilled trades, with some estimates suggesting millions of unfilled positions globally by 2025, directly impacting wage inflation and supplier pricing power.

This situation directly enhances the bargaining power of suppliers. They are better positioned to demand higher prices for their components and services to offset their own rising personnel expenses. Addressing workforce development and retention remains a critical strategic challenge for these suppliers heading into 2025, further solidifying their leverage.

- Skilled Worker Deficit: Reports indicate a persistent shortage of skilled labor in automotive manufacturing and logistics throughout 2024.

- Increased Operating Costs: Suppliers face higher wage demands and recruitment costs due to labor scarcity.

- Cost Pass-Through: Higher supplier costs are likely to be transferred to OEMs like Alfmeier Präzision AG, impacting their profitability.

- 2025 Outlook: Workforce development and talent acquisition are paramount for suppliers to mitigate future cost pressures and maintain competitive pricing.

Supplier Consolidation and Profit Pressure

The automotive supplier sector has seen a sustained drop in profitability, placing many companies under significant financial strain. This challenging economic climate is likely to drive consolidation among suppliers, potentially strengthening the bargaining power of the remaining entities. Consequently, Alfmeier Präzision AG may face increased procurement costs and a reduced selection of available suppliers.

Industry-wide earnings before interest and taxes (EBIT) margins are expected to remain under pressure through 2024 and into 2025. This persistent margin pressure could compel suppliers to leverage their position more aggressively to protect their profitability.

- Structural decline in automotive supplier profitability.

- Financial pressure on suppliers leading to consolidation.

- Increased bargaining power for remaining suppliers.

- Projected continued pressure on industry EBIT margins in 2024-2025.

Suppliers to Alfmeier Präzision AG benefit from rising raw material costs, with aluminum up 25% and steel up 15% in early 2024, and ongoing supply chain disruptions for critical components like semiconductors. This scarcity and increased input costs empower suppliers to negotiate higher prices, directly impacting Alfmeier's expenses.

The automotive sector faces a significant skilled labor shortage, with millions of unfilled positions projected by 2025, driving up supplier operating costs through higher wages and recruitment expenses. This deficit strengthens suppliers' ability to pass increased personnel costs onto their clients, including Alfmeier.

Many automotive suppliers are experiencing declining profitability, with industry EBIT margins expected to remain under pressure through 2024-2025. This financial strain may lead to consolidation, potentially increasing the bargaining power of remaining suppliers and raising procurement costs for Alfmeier.

| Factor | Impact on Suppliers | Effect on Alfmeier Präzision AG |

|---|---|---|

| Raw Material Costs (Early 2024) | Aluminum: +25%, Steel: +15% | Increased component prices, higher manufacturing costs |

| Skilled Labor Shortage (Projected 2025) | Higher wages, increased recruitment costs | Elevated supplier pricing, potential supply delays |

| Supplier Profitability (2024-2025 Outlook) | Pressure on EBIT margins, potential consolidation | Higher procurement costs, reduced supplier options |

What is included in the product

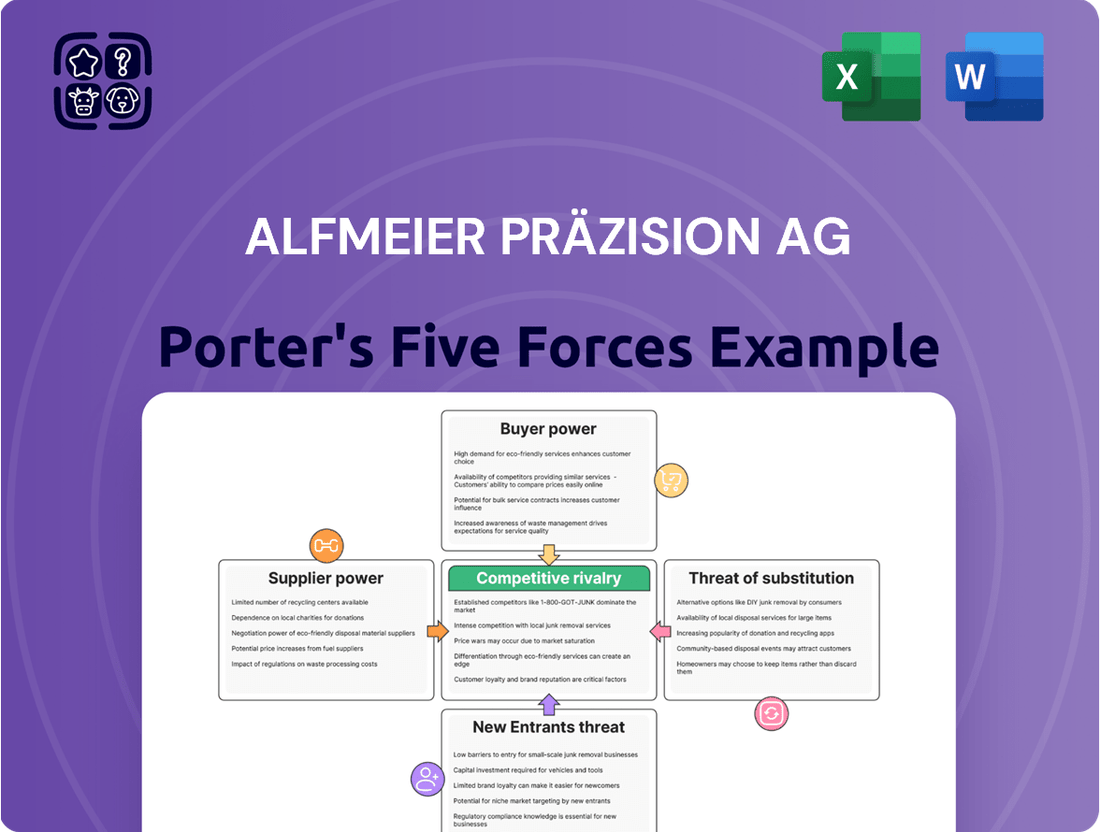

This Porter's Five Forces analysis for Alfmeier Präzision AG assesses the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes on the precision engineering market.

Effortlessly identify and mitigate competitive threats by visualizing Alfmeier Präzision AG's Porter's Five Forces with an intuitive, interactive dashboard.

Customers Bargaining Power

Alfmeier Präzision AG's customer base is dominated by major global automotive Original Equipment Manufacturers (OEMs). These powerful entities wield significant bargaining power, primarily due to their substantial purchasing volumes. For instance, in 2024, the top automotive OEMs continued to consolidate market share, meaning even greater leverage in negotiations.

The sheer scale of these automotive giants allows them to dictate terms and press for competitive pricing, directly impacting Alfmeier's pricing strategies and profitability. This reliance on a few large, influential buyers creates a dynamic where customer demands heavily shape business operations and financial outcomes for suppliers like Alfmeier.

Automotive Original Equipment Manufacturers (OEMs) are navigating intense price competition, especially within the burgeoning electric vehicle (EV) market. This market dynamic forces them to aggressively seek cost reductions throughout their entire production process. In 2024, the global automotive industry saw continued pressure on vehicle pricing, with some reports indicating average transaction prices remaining elevated but with increasing incentives offered to consumers, signaling underlying cost pressures for manufacturers.

This relentless drive for lower costs by OEMs directly translates into significant bargaining power for customers within the supply chain. Component manufacturers, such as Alfmeier Präzision AG, find themselves compelled to offer more competitive pricing and often must absorb cost increases rather than passing them on to their OEM clients. For instance, in 2023, the average cost of key EV battery components saw fluctuations, and while some saw slight decreases, the overall demand meant suppliers had limited room to pass on any potential upstream cost increases.

As new vehicle inventory levels climbed throughout 2024 and into early 2025, consumers in the new car market found themselves with more leverage. This increased supply directly translated into more incentives and dealer discounts being offered, giving buyers more room to negotiate prices.

This shift in bargaining power at the retail end of the automotive industry inevitably puts more pressure on Original Equipment Manufacturers (OEMs) to reduce their vehicle prices. Consequently, OEMs are intensifying their demands for cost reductions from their component suppliers, including companies like Alfmeier Präzision AG.

Supplier Switching and Multiple Sourcing by OEMs

Original Equipment Manufacturers (OEMs) often mitigate supply chain risks by qualifying and utilizing multiple suppliers for crucial components, even in specialized sectors like precision engineering where Alfmeier Präzision AG operates. This practice inherently grants OEMs significant bargaining power.

The ability for OEMs to switch between Alfmeier and other qualified suppliers, despite potential switching costs, compels Alfmeier to offer competitive pricing and drive ongoing innovation to retain business. For instance, in the automotive sector, a major market for precision components, OEMs routinely aim for a dual-sourcing strategy for critical parts. A 2024 industry survey indicated that over 70% of automotive OEMs actively manage at least two suppliers for key powertrain and chassis components, directly impacting the pricing leverage they hold.

This strategic diversification by OEMs is not solely about price; it's fundamentally about building resilient supply chains. By not relying on a single source, they can better navigate potential disruptions, whether from geopolitical events, natural disasters, or supplier-specific issues. This resilience objective further strengthens the OEM's position, as Alfmeier must demonstrate consistent reliability and value to remain a preferred partner.

- Multiple Supplier Strategy: OEMs commonly maintain a portfolio of qualified suppliers for critical components to ensure supply continuity and foster competition.

- Switching Costs vs. Leverage: While switching suppliers involves costs, the potential for OEMs to move business to competitors gives them considerable leverage over Alfmeier, influencing pricing and innovation demands.

- Supply Chain Resilience: OEM diversification of suppliers is a key strategy to build robust and adaptable supply chains, reducing dependency on any single entity.

- Competitive Landscape: In 2024, industry data suggests a strong trend towards dual-sourcing in sectors like automotive, with over 70% of OEMs managing multiple suppliers for essential parts, underscoring the competitive pressure on precision engineering firms like Alfmeier.

Integration and Customization Demands

Original Equipment Manufacturers (OEMs) are increasingly pushing for highly integrated and customized solutions, especially in sophisticated areas such as seat comfort and fluid management systems. This trend presents Alfmeier with chances to innovate, but it also means that customers often set the precise specifications and anticipate substantial research and development investments from suppliers. For instance, in 2024, the automotive industry saw a significant rise in demand for bespoke electronic control units for advanced driver-assistance systems, directly impacting supplier R&D budgets and timelines.

This dynamic shifts considerable power to the OEM, allowing them to heavily influence product development direction and pricing structures. Suppliers like Alfmeier must adapt to these demands, potentially absorbing higher development costs. The expectation for tailored solutions means that suppliers have less leverage in dictating terms, as the OEM's specific needs become paramount. This is evident as many OEMs in 2024 sought suppliers capable of delivering end-to-end solutions rather than individual components, thereby consolidating their purchasing power.

- OEMs dictate specifications for integrated systems.

- Suppliers face pressure for significant R&D investment.

- Customer power increases in product development and pricing.

- Trend towards end-to-end solutions consolidates OEM purchasing power.

Alfmeier Präzision AG's customer bargaining power is substantial, driven by the dominance of major automotive OEMs. These large buyers, representing significant purchasing volumes, can exert considerable pressure on pricing and terms. In 2024, the automotive sector continued to experience intense price competition, particularly with the growth of electric vehicles, forcing OEMs to aggressively seek cost reductions across their supply chains.

OEMs' ability to switch suppliers, despite some switching costs, grants them leverage. This is amplified by their strategy of dual-sourcing critical components; for example, a 2024 industry survey indicated over 70% of automotive OEMs managed multiple suppliers for key parts. Furthermore, the trend towards highly integrated and customized solutions means OEMs often dictate specifications and absorb R&D investments, consolidating their power in product development and pricing.

| Factor | Impact on Alfmeier Präzision AG | 2024 Data/Trend |

|---|---|---|

| Customer Concentration | High reliance on a few large automotive OEMs | Dominant OEMs continue to consolidate market share. |

| Purchasing Volume | Significant leverage for OEMs due to large order sizes | Large-scale orders enable OEMs to dictate terms. |

| Price Sensitivity | OEMs push for cost reductions due to market competition | Intense price competition in the EV market drives cost-saving demands. |

| Supplier Diversification | OEMs maintain multiple suppliers to mitigate risk | Over 70% of OEMs dual-source critical automotive components. |

| Customization Demands | OEMs set specifications, increasing supplier R&D burden | Increased demand for bespoke integrated solutions. |

Same Document Delivered

Alfmeier Präzision AG Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders, detailing Alfmeier Präzision AG's Porter's Five Forces Analysis. The analysis meticulously examines the intensity of rivalry among existing competitors, the bargaining power of buyers, the threat of new entrants, the bargaining power of suppliers, and the threat of substitute products or services within Alfmeier Präzision AG's industry landscape. You'll gain a comprehensive understanding of the competitive forces shaping the company's strategic environment.

Rivalry Among Competitors

The global automotive supplier market is incredibly competitive, with many established companies battling for business. Alfmeier faces this intense rivalry, constantly needing to innovate and offer competitive pricing, high quality, and cutting-edge technology to win contracts from major car manufacturers. This challenging environment is projected to persist through 2025, demanding continuous adaptation and strategic maneuvering.

Automotive suppliers, including those in Alfmeier Präzision AG's sectors, have faced consistent pressure leading to structurally declining profit margins. This environment naturally escalates competition as firms strive to preserve their profitability in a shrinking margin landscape.

Industry-wide EBIT margins are anticipated to stay suppressed through 2024 and into 2025. This forecast highlights a persistent financial challenge that consequently fuels more aggressive competitive behavior among market participants.

The automotive sector is in a period of intense technological change, with electrification and software becoming paramount. This rapid evolution demands substantial and ongoing investment in research and development from suppliers like Alfmeier Präzision AG.

This creates a fierce competition where companies are racing to pioneer advanced technologies, such as sophisticated thermal management systems for electric vehicles, to win future contracts. For example, the global automotive thermal management market was valued at approximately $25 billion in 2023 and is projected to grow significantly as EV adoption accelerates.

Alfmeier must actively innovate and adapt its product portfolio to meet these evolving demands, particularly in areas like battery cooling and advanced thermal solutions for electric powertrains, to maintain its competitive standing.

Emergence of Chinese Competitors

The global automotive landscape is witnessing a significant shift with the rise of Chinese competitors. These companies are not only increasing their market presence but are also employing aggressive pricing strategies that directly challenge established Western suppliers like Alfmeier Präzision AG. This intensified competition puts considerable pressure on margins for traditional players.

Western automotive suppliers are increasingly feeling the squeeze from these emerging Chinese players. The aggressive market entry and cost advantages enjoyed by many Chinese manufacturers and suppliers are fundamentally reshaping regional power dynamics. This trend is particularly evident in the global supply chain, where price sensitivity is a major factor.

- Aggressive Pricing: Chinese automotive suppliers often leverage lower production costs and economies of scale to offer components at significantly lower prices than Western counterparts. For instance, by 2024, many Chinese suppliers have demonstrated the ability to undercut established players by 15-25% on comparable parts.

- Market Share Gains: Chinese automakers, supported by their domestic supply chains, are rapidly expanding their global footprint. This growth directly translates into increased demand for local suppliers and, consequently, a larger competitive base for global Tier 1 suppliers.

- Technological Advancement: While historically focused on cost, Chinese suppliers are increasingly investing in research and development, particularly in areas like electric vehicle (EV) components and advanced driver-assistance systems (ADAS), narrowing the technology gap.

- Supply Chain Integration: Many Chinese automotive groups have highly integrated supply chains, allowing them to control costs and delivery times more effectively, presenting a formidable challenge to more fragmented Western supply networks.

Market Segmentation and Niche Specialization

While the automotive supplier industry generally sees robust competition, Alfmeier Präzision AG carves out a defensible position through its focus on specialized niches. Its expertise in precision engineering for areas such as fuel management, fluid systems, and advanced seat comfort technologies allows for a degree of differentiation, even amidst a crowded market.

However, this niche specialization doesn't eliminate competitive pressure. Rivals are actively investing in comparable advanced manufacturing and technological capabilities within these same segments. For instance, in the realm of sophisticated fluid management systems, competitors are also pushing boundaries with lightweight materials and integrated sensor technologies, mirroring Alfmeier's own innovation efforts.

This necessitates continuous investment in research and development for Alfmeier to sustain its leadership and protect its market share. The company's ability to maintain its edge hinges on its ongoing commitment to innovation, ensuring its offerings remain superior and more advanced than those of its competitors. As of the latest available data, the global automotive fluid handling systems market, a key area for Alfmeier, was projected to reach over $30 billion by 2024, indicating significant market activity and competitive intensity.

- Niche Specialization: Alfmeier focuses on precision engineering for fuel management, fluid management, and seat comfort systems, enabling differentiation.

- Technological Parity: Competitors are also investing in advanced technologies within these specialized segments, increasing rivalry.

- Innovation Imperative: Continuous R&D is crucial for Alfmeier to maintain leadership and defend market share against technologically advancing rivals.

- Market Context: The automotive fluid handling systems market, a key sector for Alfmeier, was valued significantly in 2024, highlighting the competitive landscape.

Competitive rivalry is a defining characteristic of Alfmeier Präzision AG's operating environment, with intense pressure stemming from both established global players and emerging Chinese manufacturers. This rivalry is exacerbated by the industry's ongoing technological transformation, particularly the shift towards electrification, which necessitates significant R&D investments from all participants.

The market is characterized by declining profit margins, driving companies to compete more aggressively on price and innovation to secure market share. Chinese competitors, in particular, are leveraging cost advantages, with many demonstrating the ability to undercut Western suppliers by 15-25% on comparable parts by 2024.

Alfmeier navigates this landscape by specializing in niche areas like fluid management and seat comfort systems. However, rivals are also investing heavily in these segments, creating a constant need for Alfmeier to innovate and maintain a technological edge to defend its position.

The global automotive fluid handling systems market, a key area for Alfmeier, was projected to exceed $30 billion by 2024, underscoring the substantial competitive activity and the high stakes involved in maintaining market leadership.

SSubstitutes Threaten

The burgeoning electric vehicle (EV) market presents a significant threat of substitutes for traditional automotive fluid management systems. As EV powertrains become more integrated, with components like electric motors and transmissions often combined, the need for separate, specialized fluid management systems for each may diminish. For instance, a single, highly efficient cooling system might replace multiple individual fluid circuits found in internal combustion engine vehicles, directly impacting demand for certain Alfmeier Präzision AG products.

New technologies in seat comfort, like advanced sensor systems and AI-driven personalization, offer alternatives to Alfmeier's current pneumatic and mechanical solutions. These innovations promise superior comfort and advanced features, driving the automotive industry toward more integrated and intelligent seating systems.

For example, companies are developing smart fabrics that can adapt to temperature and pressure, potentially reducing the need for complex mechanical adjustments. By 2024, the automotive seating market is projected to reach over $70 billion globally, with a significant portion driven by these emerging comfort technologies.

The accelerating shift towards software-defined vehicles (SDVs) presents a significant threat of substitution for Alfmeier Präzision AG. As vehicle architectures evolve to be more software-centric, there's a growing tendency to consolidate functions into fewer, more integrated modules. This means that many of the discrete hardware components Alfmeier currently produces could be replaced by software-driven solutions or entirely new, consolidated electronic control units (ECUs). For instance, features previously managed by separate mechanical or electronic parts might be handled by a single, powerful central computer, diminishing the demand for Alfmeier's specialized offerings.

Alternative Materials and Manufacturing Processes

The automotive sector's increasing focus on lightweighting and environmental responsibility is accelerating the adoption of novel materials and production methods. This trend presents a significant threat of substitution for Alfmeier Präzision AG.

Innovations such as additive manufacturing, commonly known as 3D printing, and the integration of bio-based materials are emerging as viable alternatives. These advancements can potentially replace components that Alfmeier traditionally manufactures using its core expertise, like plastic injection molding. For instance, the global 3D printing market, valued at approximately USD 19.9 billion in 2023, is projected to grow significantly, indicating a rising acceptance of these technologies across industries, including automotive.

- Emerging Materials: The automotive industry saw a 15% increase in the use of advanced composites and recycled plastics in vehicle production in 2023, driven by sustainability mandates.

- Additive Manufacturing: Companies are exploring 3D printing for producing complex vehicle parts, potentially reducing reliance on traditional molding techniques for certain components.

- Impact on Core Competencies: A shift towards these alternative methods could diminish the competitive edge derived from Alfmeier's established plastic injection molding capabilities if they do not adapt.

- Market Trends: The demand for sustainable automotive solutions is projected to drive 20% of new material development in the sector by 2025, directly challenging established manufacturing processes.

Shift to Autonomous Driving and Cabin Concepts

The automotive industry's accelerating shift towards autonomous driving presents a significant threat of substitutes for traditional interior comfort systems. As vehicles evolve into mobile living spaces, the emphasis moves from driver engagement to passenger experience, potentially displacing established comfort solutions.

New cabin concepts, prioritizing passenger well-being and reconfigurability, could directly substitute Alfmeier Präzision AG's current offerings. For instance, integrated wellness systems or modular seating arrangements might replace conventional seat adjustment mechanisms. The market for advanced driver-assistance systems (ADAS) and eventually fully autonomous driving, projected to reach over $100 billion globally by 2030, underscores this transformative trend.

- Autonomous driving redefines vehicle interiors: Focus shifts from driver to passenger experience, creating demand for new cabin concepts.

- New solutions threaten existing comfort systems: Integrated wellness, reconfigurable seating, and advanced entertainment systems can substitute traditional components.

- Market growth in ADAS and autonomy: The expanding autonomous vehicle market, expected to exceed $100 billion by 2030, signals a fundamental industry shift.

The increasing adoption of electric vehicles (EVs) poses a significant threat of substitutes for conventional automotive fluid management systems. As EV architectures consolidate functions, the need for multiple, specialized fluid circuits decreases, impacting demand for components like those produced by Alfmeier Präzision AG.

Emerging technologies in automotive seating, such as AI-driven personalization and smart fabrics, offer advanced comfort alternatives to current pneumatic and mechanical solutions. The global automotive seating market, projected to exceed $70 billion by 2024, is increasingly influenced by these innovative comfort technologies.

The automotive industry's move towards software-defined vehicles (SDVs) threatens traditional hardware components. Functions previously handled by discrete parts may be consolidated into software-driven modules or central ECUs, potentially reducing the need for Alfmeier's specialized offerings.

Innovations in lightweighting and sustainability, including additive manufacturing and bio-based materials, present substitutes for components traditionally made through methods like plastic injection molding. The global 3D printing market, valued at $19.9 billion in 2023, highlights the growing acceptance of these alternative production techniques.

| Technology Trend | Impact on Alfmeier | Market Data (2023/2024) |

|---|---|---|

| Electric Vehicles (EVs) | Reduced demand for traditional fluid management systems | EV market share grew significantly in 2023, with projections for continued expansion. |

| Advanced Seating Technologies | Substitution of pneumatic/mechanical comfort solutions | Global automotive seating market projected over $70 billion by 2024. |

| Software-Defined Vehicles (SDVs) | Potential replacement of hardware components by software | Increasing consolidation of vehicle functions into central computing units. |

| Additive Manufacturing (3D Printing) | Alternative to traditional molding for certain parts | Global 3D printing market valued at $19.9 billion in 2023. |

Entrants Threaten

The automotive components manufacturing sector, where Alfmeier Präzision AG operates, is characterized by exceptionally high capital investment requirements. Establishing state-of-the-art production facilities, acquiring specialized machinery, and developing intricate tooling can easily run into tens or even hundreds of millions of euros. For instance, a new plant for producing advanced engine components or complex electronic systems might necessitate an initial outlay exceeding €100 million.

This significant financial barrier makes it exceedingly challenging for new entrants to challenge established players like Alfmeier. Existing companies already benefit from economies of scale and have amortized much of their initial infrastructure costs. A newcomer would need to secure substantial funding not only for manufacturing but also for research and development, quality control systems, and building relationships with automotive manufacturers, further increasing the entry hurdle.

New entrants into the automotive supply sector, like those looking to compete with Alfmeier Präzision AG, face substantial barriers due to the industry's stringent regulatory landscape. Compliance with rigorous safety, emissions, and quality standards requires significant investment in testing, certification, and ongoing adherence, making it difficult and expensive for newcomers to establish a foothold.

For instance, the European Union’s General Safety Regulation (GSR) mandates advanced driver-assistance systems (ADAS) in new vehicles, adding complexity and cost for suppliers. Similarly, evolving emissions standards, such as Euro 7, necessitate substantial R&D and manufacturing adjustments, which can be prohibitive for smaller, less established companies.

Major automotive manufacturers, or OEMs, generally favor established suppliers with a history of reliability and the capacity for global production. Alfmeier Präzision AG benefits from these deep-rooted connections, making it difficult for newcomers to penetrate the market.

Securing long-term supply agreements with OEMs is a complex and time-consuming endeavor. This process requires demonstrating consistent quality, production capacity, and financial stability, presenting a significant hurdle for new entrants lacking established credibility and operational scale.

Proprietary Technology and Intellectual Property

Alfmeier Präzision AG's significant investment in proprietary technology and intellectual property acts as a substantial barrier to entry. The company holds a considerable portfolio of patents, safeguarding its innovative designs and manufacturing processes in areas like precision fluid control systems.

This robust intellectual property, coupled with deep tacit knowledge accumulated over years of specialized engineering, makes it exceedingly challenging for newcomers to match Alfmeier's product quality and efficiency. For instance, in 2024, Alfmeier continued to emphasize its R&D, allocating a significant portion of its budget to developing next-generation solutions, further solidifying its technological lead.

- Patented Innovations: Alfmeier's patent filings demonstrate a commitment to protecting its unique technological advancements.

- Tacit Knowledge Advantage: The company's experienced workforce possesses skills and know-how that are difficult to transfer or replicate.

- High R&D Investment: Continuous investment in research and development by Alfmeier ensures a widening technological gap for potential entrants.

- Incumbent Strength: This technological moat provides Alfmeier with a strong competitive advantage, deterring new companies from entering its specialized markets.

Economies of Scale and Experience Curve

Existing automotive component manufacturers, like those supplying Alfmeier Präzision AG, benefit from substantial economies of scale. This means they can spread their high fixed costs, such as those for specialized machinery and research and development, over a larger production volume, leading to lower per-unit costs. For instance, a large-scale automotive supplier might achieve production costs 15-20% lower than a smaller competitor due to these efficiencies.

Furthermore, the experience curve plays a crucial role. As companies produce more over time, they become more efficient through process improvements, learning by doing, and better resource allocation. This accumulated experience translates into lower production times and reduced waste. A new entrant would need years of consistent production to reach a similar level of operational expertise and cost advantage.

Consequently, new entrants face a significant hurdle in matching the cost structures of established players. To achieve comparable economies of scale and experience curve benefits, a new company would require massive upfront investment in production capacity and a long-term commitment to market penetration, making it difficult to compete on price initially.

- Economies of Scale: Lower per-unit costs due to high-volume production, spreading fixed costs over more units.

- Experience Curve: Increasing efficiency and cost reduction through accumulated production knowledge and process optimization over time.

- Cost Disadvantage for New Entrants: Difficulty in achieving similar cost efficiencies without substantial volume and experience, impacting price competitiveness.

- Investment Barrier: Significant capital outlay required for new entrants to build production capacity and gain market experience to rival established firms.

The threat of new entrants for Alfmeier Präzision AG is relatively low, primarily due to the substantial capital requirements and established relationships within the automotive sector. New companies would need to invest heavily in advanced manufacturing technology and navigate complex OEM supplier qualification processes, which often favor proven track records and existing partnerships.

Alfmeier's significant investment in proprietary technology and intellectual property, including numerous patents in precision fluid control, creates a strong technological moat. This, combined with the deep tacit knowledge of its workforce, makes it difficult for newcomers to replicate its product quality and manufacturing efficiency. For instance, in 2024, Alfmeier continued to focus on R&D to maintain its technological edge.

Furthermore, the automotive industry's stringent regulatory environment, demanding compliance with safety and emissions standards like Euro 7, adds another layer of complexity and cost for potential entrants. These combined factors, including economies of scale and the experience curve, present formidable barriers, limiting the likelihood of significant new competition challenging Alfmeier's market position.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Alfmeier Präzision AG is built upon a foundation of comprehensive data, including the company's annual reports, investor presentations, and industry-specific market research from reputable sources like Statista and IHS Markit. We also incorporate insights from competitor filings and trade publications to provide a robust understanding of the competitive landscape.