Alerus Financial Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alerus Financial Bundle

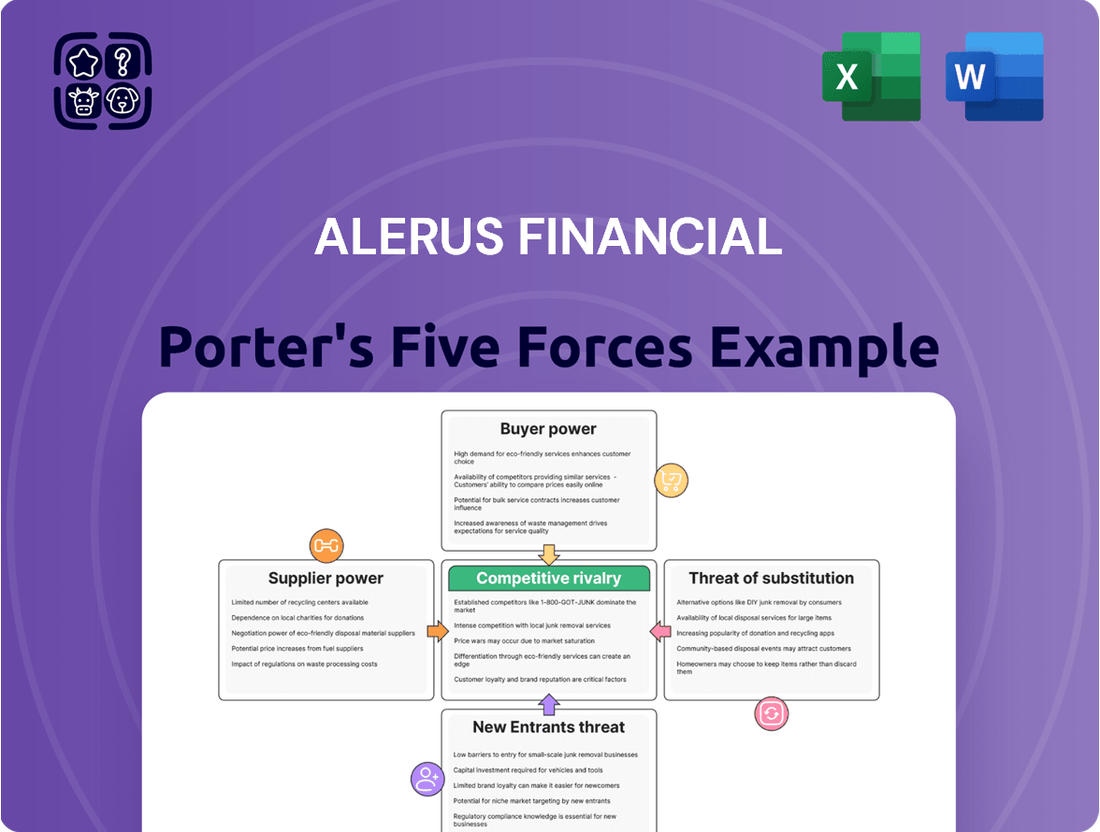

Alerus Financial navigates a competitive landscape shaped by moderate buyer power and the persistent threat of new entrants. Understanding these forces is crucial for strategic planning.

The complete report reveals the real forces shaping Alerus Financial’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

A concentrated supplier market significantly impacts Alerus Financial's bargaining power. The financial services sector depends heavily on a limited number of providers for essential technologies like core banking software and advanced data analytics platforms. For instance, in 2024, the global core banking solutions market was dominated by a handful of major players, with the top three vendors holding an estimated 40% market share, according to industry reports.

When these key technology and specialized service providers, such as payment networks and cybersecurity firms, are few and hold substantial market sway, they gain considerable leverage over Alerus. This can translate into Alerus facing dictated terms, inflated pricing, and potentially less favorable service level agreements, directly affecting its operational costs and competitive positioning.

Alerus Financial's bargaining power of suppliers is influenced by switching costs associated with its core technology vendors. If Alerus needs to change its core system providers, the expenses can be substantial. These include the direct financial cost of new systems, the complexities of migrating existing data, and the necessary retraining of staff.

These high switching costs effectively increase the leverage of Alerus's current technology suppliers. For instance, a significant portion of Alerus's operational efficiency relies on its core banking platform. Replacing such a system in 2024 could easily involve millions in upfront licensing, implementation, and integration fees, alongside potential months of disrupted service if not managed perfectly.

The uniqueness of Alerus Financial's supplier offerings significantly impacts supplier bargaining power. When suppliers provide highly specialized or proprietary services that are difficult for Alerus to replicate, their leverage grows. For instance, exclusive access to unique data feeds or advanced AI/ML tools vital for risk assessment could make Alerus reliant on these specific providers.

Financial institutions are increasingly adopting AI to boost operational efficiency. In 2024, the global AI in financial services market was valued at approximately $15.5 billion and is projected to grow substantially, highlighting the critical nature of AI-related suppliers. If Alerus depends on a few key AI vendors for its competitive edge, these suppliers can exert greater influence over pricing and terms.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers, while not a dominant force for Alerus Financial in 2024, represents a potential shift in supplier leverage. Certain technology or data providers, if they were to move into offering direct financial services, could transform from partners into rivals. This possibility, even if currently theoretical, grants these suppliers greater bargaining power as Alerus would likely seek to preserve amicable relationships to deter such competitive entry.

This dynamic can influence Alerus's cost of acquiring and utilizing essential technologies and data. For instance, if a core data analytics platform provider were to consider launching its own wealth management tools, Alerus would be incentivized to negotiate favorable terms for its existing services. The potential for a supplier to capture a larger share of the value chain by offering end-to-end solutions means Alerus must carefully manage these supplier relationships.

- Supplier Integration Risk: Technology and data providers could potentially integrate forward into financial services, creating direct competition for Alerus.

- Negotiating Leverage: This potential threat enhances the bargaining power of suppliers, as Alerus seeks to maintain positive relationships to avoid fostering direct competition.

- Strategic Relationship Management: Alerus must proactively manage its supplier partnerships to mitigate the risk of these suppliers becoming direct competitors in the financial services market.

Importance of Supplier's Input to Alerus's Business

The criticality of a supplier's input directly influences their bargaining power over Alerus Financial. When Alerus relies heavily on a supplier for essential services, that supplier gains leverage. For example, secure and efficient IT infrastructure is non-negotiable for Alerus's banking, mortgage, retirement, and wealth management operations, making IT service providers significant power players.

Alerus’s dependence on specialized technology for its core financial services, such as core banking platforms and advanced data analytics software, amplifies supplier power. Disruptions in these critical systems, whether due to technical failures or supplier-imposed changes, can severely impact Alerus's service delivery and customer trust.

- IT Infrastructure and Software: Alerus's reliance on robust IT systems for transaction processing, data security, and customer relationship management makes suppliers of these technologies highly influential. For instance, a core banking system provider's ability to offer upgrades or maintain service levels directly impacts Alerus's operational efficiency.

- Data Processing and Security Services: Given the sensitive nature of financial data, Alerus depends on specialized third-party providers for data processing, cybersecurity, and compliance. The expertise and reliability of these suppliers are paramount, granting them considerable bargaining power.

- Payment Processing Networks: Access to and reliability of payment processing networks, such as those for credit and debit card transactions, are vital for Alerus’s banking and wealth management arms. Suppliers controlling these networks can exert significant influence.

- Regulatory Compliance Tools: As a financial institution, Alerus must adhere to stringent regulations. Suppliers offering essential compliance software and consulting services hold sway due to the critical nature of regulatory adherence.

The bargaining power of suppliers significantly impacts Alerus Financial, primarily due to the concentrated nature of providers for critical technologies and specialized services. For example, in 2024, a few dominant players controlled a substantial portion of the core banking solutions market, giving them considerable leverage over financial institutions like Alerus. This concentration means Alerus often faces dictated terms and potentially higher costs for essential software and data analytics.

High switching costs further bolster supplier power. Migrating core banking platforms, a necessity in 2024 for many financial firms seeking enhanced digital capabilities, can cost millions in fees and implementation, alongside significant operational disruption. This makes Alerus hesitant to change providers, strengthening the hand of its current technology vendors.

The uniqueness of supplier offerings, such as proprietary AI tools for risk assessment, also amplifies their leverage. As the AI in financial services market, valued around $15.5 billion in 2024, grows, Alerus's reliance on a few key AI vendors for a competitive edge grants these suppliers greater influence over pricing and contract terms.

| Supplier Characteristic | Impact on Alerus Financial | Example (2024 Data) |

|---|---|---|

| Supplier Concentration | Increased leverage for few dominant providers | Top 3 core banking vendors held ~40% market share globally |

| Switching Costs | Reduced Alerus flexibility, increased vendor power | Core system replacement costs can reach millions in licensing and implementation |

| Uniqueness of Offering | Heightened dependence on specific vendors | Reliance on AI vendors for competitive advantage in a $15.5B market |

What is included in the product

This analysis delves into the competitive forces impacting Alerus Financial, examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the financial services industry.

Instantly visualize competitive pressures with a dynamic spider chart, simplifying complex market dynamics for Alerus Financial.

Customers Bargaining Power

Alerus Financial's diverse client base, encompassing both individuals and businesses, significantly moderates customer bargaining power. The company's offerings span banking, mortgage services, retirement plan administration, and wealth management, ensuring revenue streams are not overly reliant on any single customer segment. This broad reach means no one group of customers can exert overwhelming influence over Alerus's pricing or service terms.

For many basic banking services, customers can switch providers with minimal hassle or expense. This ease of movement is amplified by the growing prevalence of digital banks and fintech companies, which often offer streamlined account opening and transfer processes.

In 2024, the digital banking landscape continued to mature, with many neobanks and challenger banks reporting significant customer acquisition. For instance, some of the leading digital-only banks in the US saw their customer bases grow by over 20% year-over-year, indicating a strong customer appetite for easily accessible and often lower-cost alternatives.

This low barrier to entry and exit means that if Alerus Financial, or any similar institution, fails to offer competitive rates on deposits or loans, or provide a superior customer experience, individuals and businesses can readily shift their accounts. This directly enhances customer bargaining power, as they have viable alternatives readily available.

In the financial sector, especially for products like checking accounts or mortgages, customers often have a keen eye on pricing. This means Alerus Financial faces significant customer price sensitivity, as consumers can readily compare rates and fees across different institutions. For example, in 2024, the average interest rate for a 30-year fixed-rate mortgage hovered around 6.5% to 7.5%, making even small differences impactful for borrowers.

Availability of Information

The widespread availability of information, particularly through the internet and financial comparison websites, significantly bolsters customer bargaining power. Consumers can easily access and compare details on interest rates, fees, and service quality across numerous financial institutions. This transparency allows them to identify the most advantageous offerings and exert pressure on providers to remain competitive.

- Information Accessibility: Online platforms and comparison tools offer unprecedented access to data on financial products.

- Informed Decision-Making: Customers can readily evaluate options, leading to more strategic choices.

- Price Sensitivity: Increased transparency drives greater customer sensitivity to pricing and service differentials.

- Market Dynamics: In 2024, the digital landscape continues to empower consumers, forcing financial firms to prioritize value and transparency to attract and retain clients.

Customer Demand for Personalized and Digital Services

Customers, particularly younger demographics, are increasingly seeking tailored financial solutions and effortless digital platforms. This trend is amplified by fintech innovations that set new benchmarks for convenience and personalization, thereby boosting customer leverage.

In 2024, the demand for personalized financial advice and digital-first banking continued to surge. For instance, a significant portion of Gen Z and Millennial banking customers expressed a preference for mobile-first interactions, with many willing to switch providers for superior digital experiences. This heightened expectation directly translates to increased bargaining power for customers who can now readily compare and demand these advanced features.

- Customer Expectations: A growing segment of consumers, especially those under 40, prioritize digital accessibility and personalized financial management tools.

- Fintech Influence: The rise of fintech has accustomed customers to user-friendly interfaces and customized offerings, raising the bar for traditional institutions.

- Digital Service Demand: Data from 2024 indicated that over 70% of new account openings for some digital banks were initiated through mobile apps, highlighting the shift in customer behavior.

- Bargaining Power: This elevated demand for personalized digital services empowers customers to negotiate better terms or switch to competitors offering these conveniences.

The bargaining power of customers for Alerus Financial is moderate, influenced by the ease of switching for basic services and increasing price sensitivity. While Alerus's diverse offerings somewhat mitigate this, the digital landscape empowers customers with readily available alternatives and transparent pricing information.

In 2024, the financial sector saw continued growth in digital-only banks, with some reporting customer base increases exceeding 20% year-over-year, underscoring the competitive pressure from easily accessible, often lower-cost options. This environment means customers can readily compare rates, such as the 2024 average 30-year fixed mortgage rates between 6.5% and 7.5%, and switch providers if Alerus's offerings are not competitive.

Furthermore, evolving customer expectations, particularly among younger demographics for personalized digital experiences, heighten their leverage. Data from 2024 shows that over 70% of new account openings for some digital banks occurred via mobile apps, signaling a strong preference that can be used to influence traditional institutions.

| Factor | Impact on Bargaining Power | 2024 Data/Trend |

|---|---|---|

| Ease of Switching | Increases bargaining power | Digital banks simplify account transfers. |

| Price Sensitivity | Increases bargaining power | Mortgage rates in 2024 highlighted customer focus on pricing. |

| Information Accessibility | Increases bargaining power | Comparison websites provide transparent product data. |

| Digital Service Demand | Increases bargaining power | Mobile-first banking preference growing, especially among younger demographics. |

Full Version Awaits

Alerus Financial Porter's Five Forces Analysis

This preview showcases the comprehensive Alerus Financial Porter's Five Forces Analysis, providing a clear understanding of the competitive landscape. The document displayed here is the exact, professionally formatted analysis you’ll receive, ready for immediate download and use the moment you complete your purchase. Rest assured, there are no mockups or samples; what you see is precisely what you get, ensuring a transparent and valuable acquisition.

Rivalry Among Competitors

Alerus Financial operates within a crowded financial services arena, where it encounters a broad spectrum of competitors. These include established traditional banks, member-focused credit unions, agile fintech innovators, and niche firms specializing in wealth management and retirement solutions.

Key players in this competitive environment for Alerus include entities such as Ameris Bancorp, Brookline Bancorp, and First Busey, among many other financial institutions. This diverse competitive set means Alerus must constantly adapt its strategies to remain relevant and attractive to its customer base.

The overall industry growth rate presents a mixed picture for financial institutions like Alerus. While certain areas, such as wealth management, are anticipated to expand, traditional banking and mortgage sectors might face slower growth or even contraction. This is particularly true given the current environment of fluctuating interest rates and economic uncertainty, which directly impacts lending volumes and profitability.

This moderating or declining growth in core segments naturally fuels more intense competitive rivalry. As the pie stops growing, or even shrinks, companies are compelled to fight harder for every available customer and every dollar of market share. For instance, in 2024, the Federal Reserve's monetary policy, including adjustments to the federal funds rate, significantly influenced mortgage origination volumes, with many lenders reporting decreased activity compared to previous years.

Alerus Financial operates in a sector characterized by substantial fixed costs, including significant investments in technology infrastructure and robust regulatory compliance. For instance, in 2024, the financial services industry continued to see major tech spending, with many institutions allocating billions to digital transformation and cybersecurity.

These high fixed costs, coupled with considerable exit barriers such as specialized assets and regulatory hurdles, create a competitive landscape where firms are compelled to fight for market share. This dynamic can intensify rivalry, as companies strive to spread their overhead across a larger customer base, even when market conditions are challenging.

Product and Service Differentiation

While Alerus Financial provides a broad range of financial services, many of these products, such as basic checking accounts or standard loans, can become quite similar across different institutions. This commoditization means that competition often shifts to factors beyond just the product itself. For Alerus, standing out requires a focus on what makes them unique.

The key to mitigating intense price competition lies in Alerus's ability to differentiate itself. This can be achieved through exceptional customer service that builds strong relationships, the implementation of cutting-edge technology that simplifies banking and investment processes, or by developing highly specialized financial solutions tailored to specific client needs, like wealth management for high-net-worth individuals or specialized lending for small businesses.

- Customer Service: Alerus's commitment to personalized service can foster loyalty, making clients less likely to switch based on minor price differences.

- Technological Innovation: Investing in user-friendly mobile apps and online platforms can attract and retain customers seeking convenience and efficiency.

- Specialized Offerings: Developing niche products or expertise, such as agricultural lending or trust services, can create a distinct market position.

Strategic Acquisitions and Consolidation

The financial services sector consistently experiences consolidation, with strategic acquisitions reshaping the competitive arena. Alerus Financial's own growth strategy includes such moves, exemplified by its acquisition of HMN Financial, Inc. This type of transaction can intensify rivalry as larger, more integrated players emerge, potentially leveraging greater scale and broader service offerings.

- Alerus Financial acquired HMN Financial, Inc. in a transaction valued at approximately $146.5 million, completed in the first quarter of 2024.

- This acquisition expanded Alerus's presence in key markets and increased its total assets.

- Such consolidation can lead to fewer, but larger, competitors, potentially increasing pricing pressure and the need for innovation.

The competitive rivalry for Alerus Financial is intense, driven by a diverse range of players from traditional banks to fintech firms. This means Alerus must continuously differentiate itself through superior customer service, technological advancements, and specialized offerings to retain its market share.

Industry consolidation, like Alerus's acquisition of HMN Financial in Q1 2024 for approximately $146.5 million, further intensifies this rivalry. Larger, integrated entities can exert greater pricing pressure and necessitate ongoing innovation to remain competitive.

| Competitor Type | Examples | Rivalry Impact |

|---|---|---|

| Traditional Banks | Ameris Bancorp, Brookline Bancorp | High - Established customer bases, broad service offerings |

| Credit Unions | Local and regional credit unions | Moderate - Member-focused, often competitive pricing |

| Fintech Innovators | Digital-only banks, payment processors | High - Agility, lower overhead, innovative user experiences |

| Niche Specialists | Wealth management firms, retirement advisors | Moderate to High - Deep expertise in specific segments |

SSubstitutes Threaten

Fintech companies are increasingly offering digital-first banking services, mobile payment apps, and peer-to-peer lending platforms that directly substitute traditional banking offerings. These innovations provide consumers with greater convenience, improved efficiency, and often lower costs compared to established financial institutions. For instance, the global fintech market was valued at approximately $111.8 billion in 2023 and is projected to grow significantly, indicating a robust and expanding competitive landscape for Alerus Financial.

For wealth management, online investment platforms and robo-advisors are significant substitutes for Alerus Financial. These digital services provide automated, often lower-cost investment management, attracting investors who prioritize convenience and affordability.

The rise of these platforms is notable; for instance, the robo-advisor market managed over $1.5 trillion in assets globally by the end of 2023, a figure projected to grow substantially. This trend directly challenges traditional wealth management models by offering accessible, technology-driven alternatives.

The threat of substitutes for traditional retirement plan administration is growing, particularly from direct-to-consumer (DTC) solutions. These platforms empower individuals and small businesses to manage their retirement plans with reduced dependence on established administrators. For instance, as of early 2024, the rise of robo-advisors and user-friendly investment apps offering retirement accounts presents a significant alternative for those seeking simpler, often lower-cost, management.

The SECURE Act 2.0, enacted in late 2022, further influences this landscape by introducing provisions that may streamline or alter how retirement plans are established and managed. This legislation could indirectly bolster the appeal of DTC solutions by simplifying administrative burdens or offering new avenues for individual savings, potentially diminishing the perceived necessity of traditional, full-service administration for some market segments.

Alternative Lending Platforms

Alternative lending platforms and non-bank lenders are increasingly posing a threat to traditional banks like Alerus Financial in the mortgage market. These platforms often utilize technology to streamline the application and approval process, making it faster and more accessible for borrowers. Their growing market share means they are a significant substitute for conventional bank mortgages.

These fintech companies are innovating with different lending criteria and faster turnaround times. For instance, by mid-2024, non-bank mortgage originations were projected to capture a substantial portion of the market, reflecting a continued shift away from traditional banking channels for home financing.

The competitive landscape is evolving with these substitutes, forcing traditional institutions to adapt. Key aspects of this threat include:

- Technological Agility: Alternative lenders often have more agile technology stacks, enabling quicker innovation and customer onboarding.

- Niche Market Focus: Some platforms specialize in specific borrower segments or loan types, offering tailored solutions that traditional banks may not readily provide.

- Reduced Overhead: Digital-native platforms can operate with lower overhead costs compared to brick-and-mortar banks, potentially allowing for more competitive pricing.

Cryptocurrencies and Decentralized Finance (DeFi)

Cryptocurrencies and Decentralized Finance (DeFi) represent a growing threat of substitutes for traditional financial institutions like Alerus Financial. These digital assets and platforms offer alternative avenues for payments, lending, and borrowing, potentially bypassing conventional banking services. For instance, the total value locked in DeFi protocols reached over $200 billion in early 2024, demonstrating significant user adoption and a growing ecosystem.

While still in their nascent stages, the capabilities of DeFi are expanding. Services like peer-to-peer lending and decentralized exchanges (DEXs) provide direct alternatives to bank loans and trading platforms. The ongoing development of regulatory frameworks around crypto assets, though still evolving, could further legitimize these alternatives and increase their appeal to a broader user base.

The potential for cryptocurrencies to act as a store of value and medium of exchange also poses a long-term threat. As more individuals and businesses adopt digital currencies, the reliance on traditional banking infrastructure for these functions may diminish. For example, El Salvador adopted Bitcoin as legal tender in 2021, showcasing a real-world instance of a nation integrating cryptocurrency into its financial system.

- DeFi Total Value Locked (TVL): Exceeded $200 billion in early 2024, indicating substantial growth and user engagement in alternative financial services.

- Cryptocurrency Adoption: Global cryptocurrency ownership continued to rise, with estimates suggesting over 420 million users worldwide by the end of 2023.

- Regulatory Landscape: Governments globally are actively developing regulations for digital assets, which could either foster or hinder the growth of crypto as a substitute for traditional finance.

The threat of substitutes for Alerus Financial is significant and multifaceted, stemming from technological advancements and evolving consumer preferences. Fintech companies offer digital banking, mobile payments, and peer-to-peer lending, providing convenience and lower costs. Robo-advisors and online investment platforms are also directly competing in wealth management, managing over $1.5 trillion in assets globally by the end of 2023. Furthermore, direct-to-consumer retirement solutions and alternative lending platforms are gaining traction, challenging traditional banking models.

Cryptocurrencies and Decentralized Finance (DeFi) present a more nascent but growing substitute threat. The total value locked in DeFi protocols exceeded $200 billion in early 2024, demonstrating substantial user adoption. These digital alternatives offer new avenues for payments, lending, and borrowing, potentially bypassing conventional banking services and reducing reliance on traditional financial infrastructure.

| Substitute Area | Key Players/Technologies | Market Data/Impact |

|---|---|---|

| Digital Banking & Payments | Fintech Companies (e.g., Chime, Square) | Global Fintech Market valued at ~$111.8 billion in 2023. |

| Wealth Management | Robo-Advisors (e.g., Betterment, Wealthfront) | Managed over $1.5 trillion in assets globally by end of 2023. |

| Retirement Administration | Direct-to-Consumer Platforms | SECURE Act 2.0 may influence DTC appeal. |

| Lending | Non-bank Lenders, Alternative Platforms | Non-bank mortgage originations projected to capture substantial market share. |

| Financial Services (General) | Cryptocurrencies, DeFi | DeFi Total Value Locked exceeded $200 billion in early 2024. |

Entrants Threaten

The financial services sector, where Alerus Financial operates, presents substantial hurdles for newcomers due to extensive regulatory oversight. Obtaining necessary licenses and meeting rigorous compliance standards demands significant investment and expertise, effectively deterring many potential entrants.

Capital requirements are particularly daunting. For instance, in 2024, many jurisdictions mandate substantial minimum capital reserves for banks and other financial institutions to ensure stability and protect depositors. These high capital thresholds act as a powerful barrier, favoring well-capitalized incumbents like Alerus.

Established financial institutions like Alerus Financial often possess strong brand loyalty and deep-seated customer trust, cultivated through years of reliable service. This existing trust acts as a significant barrier, making it difficult for new entrants to attract customers away from their preferred providers.

Building brand recognition and establishing a reputation for trustworthiness in the financial sector is a complex and resource-intensive undertaking for newcomers. For instance, a 2024 survey indicated that over 60% of consumers stick with their primary bank due to trust and convenience, highlighting the challenge new entrants face.

Alerus Financial, as a diversified financial services firm, leverages significant economies of scale in areas like technology infrastructure and marketing. For instance, in 2023, Alerus reported a net interest margin of 3.37%, demonstrating efficient cost management. New entrants often face the daunting task of building comparable operational efficiencies and customer bases, making it difficult to compete on cost.

Furthermore, Alerus benefits from economies of scope by offering a broad suite of integrated financial products, from banking to wealth management. This allows them to cross-sell services and deepen customer relationships. A new entrant would need substantial investment to replicate this diverse product portfolio and the associated customer engagement strategies, presenting a substantial barrier.

Access to Distribution Channels

New entrants to the financial services sector often grapple with securing access to effective distribution channels, a significant hurdle when competing with established players like Alerus Financial. Alerus benefits from its existing network of physical branches and robust digital platforms, which are crucial for customer reach and service delivery.

Developing comparable distribution capabilities demands substantial capital outlay and considerable time, making it difficult for newcomers to match Alerus's market penetration. For instance, establishing a new bank branch can cost millions of dollars, and building a competitive digital banking infrastructure requires ongoing investment in technology and cybersecurity.

- Established Network: Alerus Financial leverages its existing physical branches and digital platforms to serve its customer base.

- High Entry Costs: Building a comparable distribution network requires significant capital investment and time.

- Competitive Disadvantage: New entrants face challenges in quickly replicating Alerus's market reach and customer access.

Technological Advancements and Fintech Disruption

Technological advancements, particularly in fintech, are significantly altering the threat of new entrants for Alerus Financial. While fintech can act as a substitute, it simultaneously lowers entry barriers for specialized financial services. For instance, the rise of digital-first models, supported by accessible cloud infrastructure and AI tools, enables new players to offer niche services with considerably less overhead than traditional institutions.

This shift empowers focused new entrants to challenge established players like Alerus. By leveraging these technologies, startups can rapidly develop and deploy specialized financial products, often targeting underserved market segments. The ease of access to these platforms means that the traditional capital requirements for entering the financial services sector are being redefined, intensifying the competitive landscape.

- Fintech lowers barriers: Digital platforms and AI reduce the need for extensive physical infrastructure, making it easier for new firms to enter.

- Niche specialization: New entrants can focus on specific services, offering tailored solutions that may appeal to particular customer segments.

- Agility and speed: Technology allows startups to adapt quickly to market changes and customer demands, a key advantage over larger, more established entities.

- Increased competition: The reduced barriers mean a greater number of specialized competitors can emerge, potentially fragmenting market share.

The threat of new entrants for Alerus Financial remains moderate, largely due to significant regulatory hurdles and high capital requirements common in the financial services industry. For instance, in 2024, many financial institutions must maintain substantial capital reserves, a barrier that favors established, well-capitalized firms. While technological advancements, particularly in fintech, are lowering some barriers by enabling digital-first models, the need for trust and brand recognition still favors incumbents.

Porter's Five Forces Analysis Data Sources

Our Alerus Financial Porter's Five Forces analysis is built upon a foundation of robust data, including Alerus's own SEC filings, annual reports, and investor presentations. We supplement this with industry-specific market research reports and data from reputable financial databases to provide a comprehensive view of the competitive landscape.