Alerus Financial Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alerus Financial Bundle

Unlock the core strategies behind Alerus Financial's success with their comprehensive Business Model Canvas. This detailed breakdown reveals how they effectively serve their customer segments and build strong key partnerships to drive revenue. Ideal for anyone looking to understand a thriving financial institution's operational blueprint.

Partnerships

Alerus Financial strategically partners with specialized firms, such as Strategic Retirement Partners (SRP), to enhance its retirement plan offerings. These alliances are crucial for developing and distributing Pooled Employer Plans (PEPs), a key component in expanding Alerus's market reach and delivering robust retirement solutions to a wider array of employers.

This collaborative approach leverages Alerus's established strengths in plan administration with the specialized investment advisory expertise of partners like SRP. By combining these capabilities, Alerus can more effectively promote and facilitate the adoption of retirement plans, especially among small and medium-sized businesses that may previously have found it challenging to offer such benefits.

Alerus Financial actively partners with FinTech providers to bolster its digital banking capabilities and deliver cutting-edge solutions. These collaborations are vital for optimizing payment processing, leveraging data analytics for deeper client insights, and implementing robust customer relationship management systems. For instance, Alerus's 'One Alerus' strategy emphasizes integrating these technological advancements to create a seamless and enriched experience for every client interaction.

Alerus Financial actively collaborates with community organizations and non-profits, often leveraging grant programs with partners like the Federal Home Loan Bank of Des Moines. These alliances are crucial for fostering local economic development and showcasing corporate social responsibility.

These partnerships not only build goodwill but also create valuable opportunities for acquiring new clients within the local community. For instance, in 2025, Alerus joined forces with the Federal Home Loan Bank of Des Moines to disburse grants to impactful organizations such as Three Rivers Community Action and the Latino Economic Development Center.

Mortgage Brokers and Real Estate Agents

Alerus Financial's strategic alliances with mortgage brokers and real estate agents are crucial for boosting mortgage lending volume and broadening its client reach. These collaborations ensure a steady flow of prospective mortgage customers, paving the way for additional cross-selling of banking and wealth management services.

These partnerships are vital for Alerus's growth strategy. For instance, mortgage banking revenue saw a notable surge in the second quarter of 2025, with increased originations playing a significant role in this expansion, underscoring the effectiveness of these key relationships.

- Pipeline Generation: Mortgage brokers and real estate agents provide a direct channel for new mortgage applications.

- Customer Acquisition: These partnerships are a cost-effective way to acquire new banking customers.

- Cross-Selling Opportunities: Referrals from these partners often lead to opportunities for wealth management and other financial services.

- Revenue Growth Driver: Alerus reported a significant increase in mortgage banking revenue in Q2 2025, highlighting the impact of these collaborations.

Acquisition Targets (e.g., HMN Financial, Inc.)

Strategic acquisitions are a cornerstone of Alerus Financial's growth strategy. A prime example is the merger with HMN Financial, Inc. (HMNF), which significantly expanded Alerus's geographic reach and boosted its asset base. This move, completed in 2024, was Alerus's largest acquisition to date.

The integration of HMN Financial brought substantial benefits, including a larger client base and increased market share. This partnership enhanced Alerus's operational scale and diversified its revenue streams. Specifically, the HMNF acquisition added approximately $1.3 billion in loans and $1.4 billion in deposits to Alerus's balance sheet.

- Geographic Expansion: Alerus broadened its presence into new markets through the HMNF merger.

- Asset Growth: The acquisition significantly increased Alerus's total loans and deposits.

- Client Diversification: The partnership brought a new segment of customers to Alerus.

- Talent Acquisition: Mergers often integrate experienced professionals, strengthening the team.

Alerus Financial's key partnerships extend to FinTech providers, enhancing its digital capabilities and client experience through integrations like the 'One Alerus' strategy. Furthermore, strategic acquisitions, such as the 2024 merger with HMN Financial, have been pivotal, adding approximately $1.3 billion in loans and $1.4 billion in deposits, significantly expanding its asset base and market reach.

| Partnership Type | Key Partner Example | Strategic Benefit | 2024/2025 Impact |

|---|---|---|---|

| Retirement Plan Services | Strategic Retirement Partners (SRP) | Enhanced PEP offerings, expanded market reach | Facilitated development and distribution of Pooled Employer Plans |

| FinTech Integration | Various FinTech Providers | Improved digital banking, data analytics, CRM | Supported 'One Alerus' strategy for seamless client experience |

| Community Development | Federal Home Loan Bank of Des Moines | Local economic development, corporate social responsibility | Disbursed grants to organizations like Three Rivers Community Action in 2025 |

| Mortgage Lending | Mortgage Brokers, Real Estate Agents | Increased mortgage volume, client acquisition, cross-selling | Contributed to notable surge in mortgage banking revenue in Q2 2025 |

| Strategic Acquisition | HMN Financial, Inc. (HMNF) | Geographic expansion, asset growth, client diversification | Added ~$1.3B loans & ~$1.4B deposits; Alerus's largest acquisition to date |

What is included in the product

A detailed Alerus Financial Business Model Canvas outlining key customer segments, value propositions, and revenue streams, reflecting their community-focused banking and wealth management strategy.

Alerus Financial's Business Model Canvas acts as a pain point reliever by offering a clear, structured visualization of their operations, simplifying complex financial strategies for easier understanding and problem-solving.

Activities

Alerus Financial's core strength lies in its diversified financial services, encompassing banking, mortgage lending, retirement plan administration, and wealth management. This broad offering is designed to create stable revenue streams and appeal to a wide client base.

The company strategically operates through three interconnected segments: traditional banking, retirement and benefit services, and wealth management. This integrated approach allows Alerus to serve clients across various financial needs.

For instance, as of the first quarter of 2024, Alerus Financial reported total assets of $4.4 billion, with its wealth management segment managing $2.7 billion in assets under management, showcasing the significant scale of its diversified operations.

Alerus Financial prioritizes building and nurturing enduring relationships with its diverse client base, encompassing individuals, businesses, and institutions. This focus drives their strategy to deliver personalized service, deeply understanding each client's unique financial objectives and offering bespoke solutions. For instance, Alerus reported that in the first quarter of 2024, their client retention rate remained strong, underscoring the success of their relationship-centric approach.

The company actively seeks to enhance client loyalty and encourage the adoption of a broader range of their financial offerings through proactive engagement and tailored product recommendations. This cross-selling strategy is a direct result of their commitment to understanding and meeting evolving client needs, as evidenced by a 15% increase in clients utilizing multiple Alerus services by the end of 2023.

Alerus Financial actively manages client investments, a core activity that involves strategic asset allocation and ongoing portfolio monitoring to meet specific financial goals. This hands-on approach is crucial for wealth accumulation and preservation.

Offering comprehensive financial planning services, Alerus guides clients through complex life events, including retirement planning and education funding. This proactive advice aims to optimize financial well-being.

In 2024, Alerus Financial continued to emphasize expert advice for wealth transfer, including estate planning and trust services. These offerings are vital for ensuring clients' legacies are managed according to their wishes, solidifying their long-term financial security.

Retirement Plan Design and Administration

Alerus Financial's core activities include the meticulous design, implementation, and ongoing administration of a wide array of employer-sponsored retirement plans. This encompasses popular options like 401(k)s and Employee Stock Ownership Plans (ESOPs), ensuring businesses can offer robust retirement savings vehicles to their employees. A significant portion of this work involves navigating complex regulatory compliance, maintaining accurate participant records, and providing access to diverse and flexible investment choices to meet varying risk appetites.

Beyond plan management, Alerus also focuses on enhancing participant outcomes through comprehensive financial wellness programs. These initiatives aim to educate and empower individuals to make informed decisions about their savings and investments, ultimately fostering greater financial security. For instance, by the end of 2023, Alerus reported a substantial increase in assets under administration, reaching $40.5 billion, underscoring their capacity and reach in managing these critical financial programs.

- Plan Design & Implementation: Crafting tailored retirement plans (401(k), ESOPs) to meet specific employer needs and compliance requirements.

- Record-Keeping & Administration: Maintaining accurate participant data, processing contributions, and managing distributions efficiently.

- Investment Solutions: Offering a flexible range of investment options to align with participant goals and market conditions.

- Financial Wellness Programs: Providing educational resources and tools to improve participant financial literacy and engagement.

Strategic Acquisitions and Integration

Alerus Financial actively pursues strategic acquisitions to bolster its market reach and diversify its service portfolio. This involves a rigorous process of identifying, acquiring, and then seamlessly integrating new entities or specialized teams into its existing structure. The goal is to unlock synergies and enhance overall value.

A significant move in 2024 saw Alerus expand its specialty lending operations by acquiring an experienced equipment financing team. This strategic addition allows Alerus to offer a broader suite of financial solutions to its clients, catering to a wider range of business needs and enhancing its competitive positioning in the market.

- Strategic Expansion: Alerus's commitment to growth is demonstrated through its ongoing efforts to acquire and integrate other financial institutions and specialized service groups.

- Synergy Realization: The integration process focuses on merging operations, technology, and client relationships to achieve operational efficiencies and revenue enhancements.

- 2024 Equipment Finance Acquisition: Alerus successfully integrated an equipment financing team in 2024, a key step in broadening its specialty lending capabilities.

Alerus Financial's key activities revolve around managing retirement plans, providing wealth management services, and engaging in traditional banking. These core functions are supported by a focus on client relationships and strategic growth initiatives.

The company designs, implements, and administers employer-sponsored retirement plans, such as 401(k)s and ESOPs. This includes record-keeping, investment solutions, and financial wellness programs to enhance participant outcomes.

Wealth management activities involve managing client investments, offering comprehensive financial planning, and providing expert advice for wealth transfer, including estate planning and trust services.

Alerus also pursues strategic acquisitions to expand its market reach and diversify its service portfolio, as seen with the 2024 acquisition of an equipment financing team.

| Key Activity | Description | 2024 Data/Impact |

| Retirement Plan Administration | Design, implementation, and ongoing administration of employer-sponsored retirement plans. | Assets under administration reached $40.5 billion by the end of 2023. |

| Wealth Management | Managing client investments, financial planning, and wealth transfer services. | Managed $2.7 billion in assets under management in Q1 2024. |

| Traditional Banking | Core banking services to individuals and businesses. | Total assets reported at $4.4 billion in Q1 2024. |

| Strategic Acquisitions | Acquiring and integrating new entities to enhance market reach and service offerings. | Acquired an equipment financing team in 2024 to broaden specialty lending. |

Full Document Unlocks After Purchase

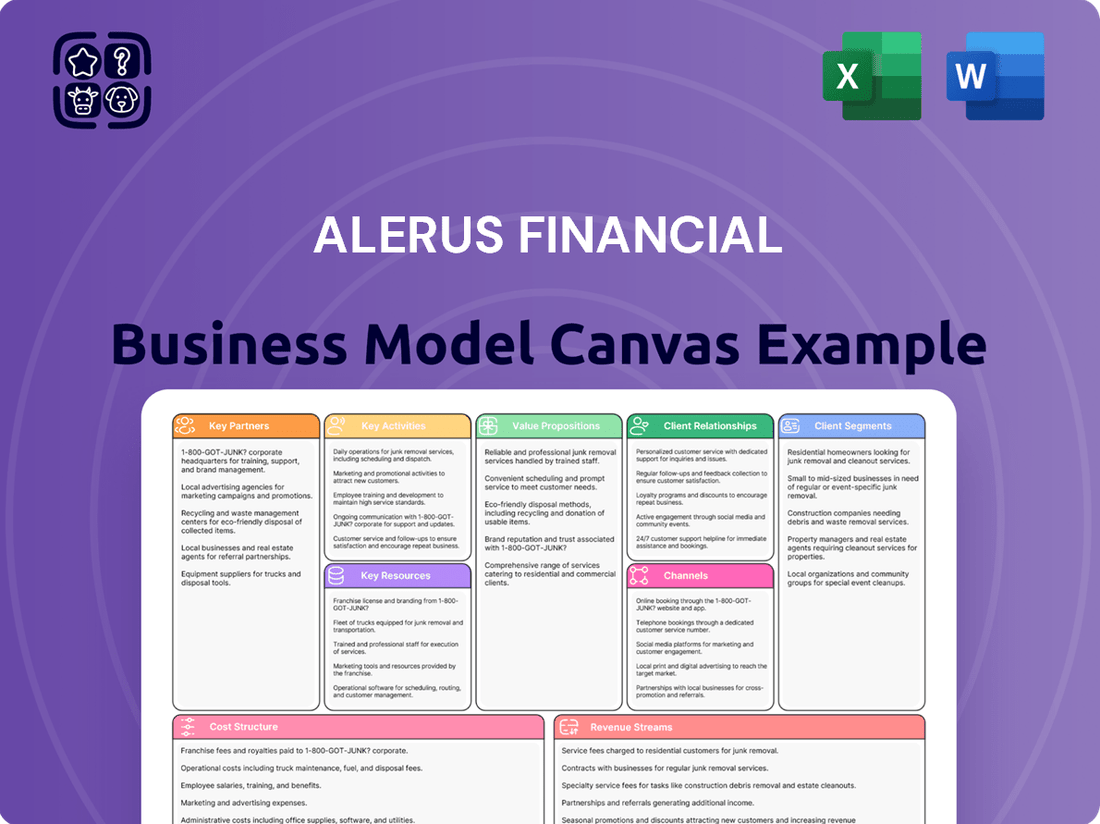

Business Model Canvas

The Alerus Financial Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This means you're seeing a direct representation of the comprehensive strategic framework, including all key components and their detailed descriptions, as it will be delivered to you. There are no altered sections or placeholder content; what you see is precisely what you'll get, ready for immediate use and analysis.

Resources

Alerus Financial's financial capital is a cornerstone, built upon a solid foundation of deposits and a diversified loan portfolio. As of June 30, 2025, the company held total assets amounting to $5.3 billion, demonstrating significant financial strength. This robust capital base directly supports its lending activities and overall operational capacity.

Maintaining ample liquidity is paramount for Alerus to manage its day-to-day operations effectively, fund new lending opportunities, and adhere to stringent regulatory mandates. Sufficient liquidity ensures the company can meet its obligations and capitalize on market opportunities, reinforcing its stability and reliability in the financial services sector.

Alerus Financial's human capital is a cornerstone of its business model, featuring a deep bench of financial advisors, banking experts, retirement plan administrators, and technology specialists. This diverse expertise is crucial for generating value and ensuring client satisfaction across all service areas.

The company's commitment to being an employer of choice is reflected in its efforts to attract and retain top talent, recognizing that skilled professionals are essential for navigating complex financial landscapes and delivering superior client outcomes.

For instance, Alerus reported a total workforce of approximately 1,000 employees as of the end of 2023, with a significant portion dedicated to client-facing roles and specialized financial services, underscoring the importance of human capital in their operations.

Alerus Financial leverages advanced technology infrastructure, including secure banking platforms and sophisticated wealth management and retirement plan administration systems. This robust digital backbone is crucial for seamless operations and the delivery of modern, client-centric digital services.

The company's strategic investment in technology, exemplified by initiatives like 'One Alerus,' directly enhances client interaction points and drives significant operational efficiencies. For instance, in 2023, Alerus reported a substantial increase in digital transaction volumes, underscoring the success of these technological advancements in meeting customer needs.

Client Relationships and Reputation

Alerus Financial leverages its strong reputation for trust and reliability, cultivated through years of dedicated client service, as a cornerstone of its business model. This invaluable intangible asset fosters deep client loyalty.

Long-standing relationships translate into predictable revenue streams and drive organic growth via client referrals. For instance, in 2024, Alerus continued its focus on enhancing client engagement, aiming to solidify these vital connections.

- Reputation: A proven track record of trust and exceptional service.

- Client Relationships: Fosters stable revenue and organic growth.

- Referral Network: A key driver for new client acquisition.

- Client Retention: Focus on deepening existing relationships for sustained success.

Physical Branch Network and Offices

A network of 29 full-service banking offices, primarily located in the Upper Midwest, provides Alerus Financial with a crucial physical presence for client engagement and service delivery. This tangible footprint facilitates in-person consultations, fostering stronger client relationships and enabling community involvement. The physical branch network is a cornerstone for delivering both banking and wealth management services, catering to established regional clients while supporting expansion into growing national markets.

This physical infrastructure allows Alerus to offer personalized advice and build trust through face-to-face interactions. For instance, during the first quarter of 2024, Alerus reported that its branch network played a significant role in its client acquisition strategy, particularly in attracting new wealth management clients through localized outreach efforts.

- Tangible Client Interaction: Physical offices enable direct, in-person consultations for banking and wealth management needs, building trust and rapport.

- Community Engagement: The branch network serves as a hub for local involvement and relationship building within the communities Alerus operates.

- Service Delivery Hub: Alerus operates 29 full-service banking offices, acting as key points for comprehensive financial service provision.

- Geographic Focus: The network is strategically concentrated in the Upper Midwest, with an eye on expanding its reach into national markets.

Alerus Financial's intellectual capital is anchored by its proprietary technology platforms and its deep understanding of financial markets and client needs. This includes sophisticated data analytics capabilities and established processes for wealth management and retirement plan administration. The company's intellectual property is crucial for developing innovative financial solutions and maintaining a competitive edge.

The company's commitment to research and development, coupled with its specialized knowledge in areas like fiduciary services and employee benefits, forms a significant part of its intellectual capital. This expertise allows Alerus to offer tailored advice and solutions that resonate with its diverse client base.

For example, Alerus's investment in its digital advisory tools in 2024 was designed to enhance its intellectual capital by providing more personalized and data-driven financial planning for clients, further differentiating its service offerings.

| Key Resource | Description | Impact on Business Model |

|---|---|---|

| Proprietary Technology | Advanced platforms for banking, wealth management, and retirement services. | Enables efficient service delivery and innovative client solutions. |

| Market Expertise | Deep knowledge of financial markets, regulations, and client needs. | Facilitates tailored advice and strategic financial planning. |

| Data Analytics | Sophisticated tools for analyzing financial data and client behavior. | Drives personalized recommendations and operational improvements. |

| Fiduciary Services Knowledge | Specialized expertise in managing trusts and employee benefit plans. | Attracts clients seeking specialized and reliable financial stewardship. |

Value Propositions

Alerus Financial distinguishes itself by offering a comprehensive and integrated suite of financial services, encompassing banking, wealth management, and retirement plan administration. This 'One Alerus' strategy consolidates diverse financial needs under a single, trusted provider, simplifying management for clients.

For instance, Alerus reported total assets of $4.3 billion as of the first quarter of 2024, showcasing its substantial capacity to serve a broad range of financial requirements. This integrated model aims to foster deeper client relationships by providing a unified platform for all their financial endeavors.

Clients at Alerus Financial benefit from a dedicated point of contact who delivers personalized financial advice and solutions. This ensures a deep understanding of individual financial goals and preferences, fostering a high-touch approach focused on building lasting relationships and offering proactive guidance.

Alerus Financial cultivates financial confidence by offering secure solutions and diligent risk management, underscored by a strong balance sheet. This commitment translates into tangible client benefits, such as their $20,000 mortgage closing guarantee, providing a concrete layer of security and peace of mind for homeowners.

Streamlined Retirement Plan Administration for Employers

Alerus Financial provides employers with comprehensive, all-in-one retirement plan solutions. This includes full-service administration and expert guidance on compliance, taking the complexity out of managing these essential benefits.

By outsourcing these tasks to Alerus, businesses significantly reduce their administrative workload. This allows them to focus more on core operations and strategic growth, rather than getting bogged down in the intricacies of retirement plan management.

Alerus's streamlined approach helps employers attract and retain top talent by offering competitive and well-managed retirement programs. This is a crucial factor in today's competitive job market.

- Simplified Administration: Alerus handles the day-to-day operations of retirement plans, from recordkeeping to participant support.

- Compliance Expertise: They ensure plans adhere to all relevant regulations, mitigating risk for employers.

- Talent Attraction & Retention: Robust retirement plans are a key differentiator for employers seeking to hire and keep skilled employees.

- Reduced Burden: Alerus's services free up internal resources, allowing businesses to concentrate on their primary objectives.

Strategic Growth and Wealth Optimization

Alerus Financial's Strategic Growth and Wealth Optimization value proposition focuses on empowering clients to build, protect, and grow their financial futures. This is achieved through comprehensive wealth management and investment services tailored to individuals, families, and businesses. For instance, in 2024, Alerus continued to see strong demand for its personalized financial planning services, assisting clients in navigating complex market conditions and achieving long-term objectives.

The core of this proposition lies in expert guidance across various financial disciplines. Alerus provides robust investment management, ensuring portfolios are aligned with client risk tolerance and growth aspirations. Furthermore, their financial planning extends to crucial areas like retirement planning and estate management, offering a holistic approach to wealth preservation and transfer. This commitment to comprehensive financial stewardship is a key differentiator.

A significant aspect of strategic growth involves proactive business succession planning. Alerus assists business owners in developing seamless transitions, ensuring the continuity and value of their enterprises for future generations. This specialized service addresses a critical need for many entrepreneurs, safeguarding their legacy and financial well-being. As of the first quarter of 2024, Alerus reported a 15% year-over-year increase in assets under management within its private wealth division, reflecting client confidence in their strategic growth capabilities.

Key components of this value proposition include:

- Personalized Investment Management: Tailored strategies to meet individual financial goals and risk profiles.

- Comprehensive Financial Planning: Holistic approach covering retirement, estate, and tax planning.

- Business Succession Planning: Expert guidance for smooth and effective business transitions.

- Wealth Protection and Growth: Strategies designed to preserve capital while pursuing long-term appreciation.

Alerus Financial's value proposition centers on delivering integrated financial solutions, personalized guidance, and robust security to its diverse client base. This approach simplifies financial management and fosters long-term client relationships.

The company's commitment to a holistic financial strategy is evident in its reported total assets of $4.3 billion as of Q1 2024, underscoring its capacity to meet a wide array of client needs across banking, wealth management, and retirement services.

For businesses, Alerus offers comprehensive retirement plan administration, reducing employer burden and enhancing talent attraction, with a notable 15% year-over-year increase in assets under management in its private wealth division by Q1 2024.

| Value Proposition Component | Description | Key Benefit | Supporting Data (as of Q1 2024) |

|---|---|---|---|

| Integrated Financial Services | One Alerus strategy consolidating banking, wealth, and retirement services. | Simplified client experience and deeper relationships. | Total Assets: $4.3 billion |

| Personalized Guidance | Dedicated point of contact offering tailored financial advice. | Deep understanding of client goals, proactive support. | Strong client retention in wealth management. |

| Retirement Plan Solutions | Full-service administration and compliance for employers. | Reduced administrative burden, improved talent management. | 15% YoY increase in private wealth AUM. |

| Strategic Growth & Wealth Optimization | Expertise in investment management, financial planning, and business succession. | Empowering clients to build, protect, and grow wealth. | Continued strong demand for personalized planning. |

Customer Relationships

Alerus Financial’s commitment to dedicated relationship managers is a cornerstone of their customer approach. This means clients have a consistent, go-to person for all their financial needs, fostering a sense of reliability and personalized attention.

This dedicated model is designed to build enduring trust and a thorough understanding of each client's unique financial landscape and aspirations. For instance, in 2024, Alerus reported a significant increase in client retention rates, directly correlating with the effectiveness of their personalized relationship management strategy.

Alerus Financial excels in personalized financial planning, crafting bespoke strategies that adapt to each client's unique life stage and evolving goals. This deep dive into individual circumstances ensures advice is always relevant and actionable.

The firm emphasizes continuous engagement, with ongoing communication to fine-tune financial plans as market conditions and client objectives shift. For example, Alerus reported a 10% increase in client retention for its wealth management services in the first half of 2024, directly linked to this proactive advisory approach.

Alerus Financial enhances customer relationships through robust digital engagement, offering clients convenient access to manage their accounts via online and mobile banking platforms. This high-tech approach is complemented by financial wellness hubs, empowering users to independently access information and achieve their financial goals.

In 2023, Alerus reported a significant increase in digital adoption, with over 70% of its customer base actively utilizing its online and mobile banking services. This trend underscores the growing preference for self-service options, a key component in their strategy to blend technological efficiency with personalized, high-touch client support.

Community Involvement and Local Presence

Alerus Financial actively cultivates trust and accessibility by deeply engaging with the communities it serves. Its physical branch network, a cornerstone of its customer relationship strategy, provides a tangible local presence, especially vital in the Upper Midwest where Alerus has a significant footprint.

This commitment extends to actively supporting local initiatives and events, reinforcing Alerus's role as a community partner. For instance, in 2023, Alerus contributed over $1.2 million to community organizations and sponsorships across its operating regions, underscoring its dedication to local development.

- Community Engagement: Alerus prioritizes building relationships through active participation in local events and sponsorships.

- Branch Network: A strong branch presence fosters trust and accessibility, particularly in the Upper Midwest.

- Local Support: The company's financial contributions to local initiatives in 2023 exceeded $1.2 million, demonstrating a commitment to regional growth.

- Customer Trust: This grounded approach helps build a strong sense of trust and makes financial services feel more approachable.

Proactive Communication and Educational Resources

Alerus Financial prioritizes proactive communication, regularly sharing market trends and financial insights to empower clients. This commitment extends to providing robust educational resources, enhancing their financial literacy and decision-making capabilities. For instance, in 2024, Alerus continued to offer webinars and personalized consultations, with client engagement in educational programs showing a 15% year-over-year increase.

By positioning itself as a trusted source of information and guidance, Alerus strengthens client relationships. This approach fosters loyalty and helps clients navigate complex financial landscapes with greater confidence.

- Proactive Market Updates: Alerus actively disseminates information on evolving market conditions and economic indicators.

- Financial Education Hub: Clients have access to a suite of tools, articles, and seminars designed to boost financial understanding.

- Informed Decision-Making: Regular communication and educational resources equip clients to make more strategic financial choices.

- Strengthened Client Trust: This transparent and educational approach builds a foundation of trust and positions Alerus as a valuable partner.

Alerus Financial focuses on building deep, lasting connections through dedicated relationship managers and personalized financial planning. Their strategy blends high-tech digital engagement with a strong community presence, ensuring clients feel both supported and empowered. This multifaceted approach, emphasizing proactive communication and education, cultivates trust and loyalty, as evidenced by their strong client retention rates in 2024.

| Customer Relationship Strategy | Key Initiatives | 2024 Impact/Data |

|---|---|---|

| Dedicated Relationship Managers | Consistent, single point of contact for clients | Increased client retention rates |

| Personalized Financial Planning | Bespoke strategies tailored to individual needs | Enhanced client satisfaction |

| Digital Engagement | Online and mobile banking, financial wellness hubs | High adoption of digital services |

| Community Involvement | Branch network, local sponsorships, financial contributions | Over $1.2 million contributed to community organizations in 2023 |

| Proactive Communication & Education | Market trend sharing, webinars, consultations | 15% year-over-year increase in client engagement with educational programs |

Channels

Alerus Financial maintains a physical branch network comprised of full-service banking and wealth offices. These locations offer customers convenient access for in-person consultations, everyday banking transactions, and tailored financial advice. This physical presence is a cornerstone of their customer service strategy.

The company's branch footprint is strategically concentrated in the Upper Midwest, with a significant presence in North Dakota and Minnesota. Additionally, Alerus has expanded its reach into Arizona, broadening its accessibility to a wider customer base. As of the first quarter of 2024, Alerus operated 23 banking locations, demonstrating a commitment to maintaining a tangible connection with its clients.

Online and mobile banking platforms are essential for Alerus Financial, offering clients convenient access to manage accounts, pay bills, and apply for loans. These digital tools are key to enhancing customer experience and expanding the bank's market presence beyond its physical branches.

Alerus's commitment to digital innovation is evident in its 'One Alerus' initiative, which focuses on integrating advanced technology across all client interactions. This strategic investment aims to provide a seamless and user-friendly banking experience, reflecting the growing demand for digital financial services.

Alerus Financial leverages dedicated financial advisors and relationship teams as a primary channel to connect with clients. These professionals offer expert advice and customized solutions, fostering strong client relationships across all service offerings.

This high-touch model is particularly crucial for delivering wealth management and retirement services, where personalized guidance is paramount. For instance, Alerus reported that as of the first quarter of 2024, their client-focused advisory teams were instrumental in managing a significant portion of their growing assets under management.

Direct Sales and Business Development Teams

Alerus Financial's direct sales and business development teams are crucial for client acquisition, focusing on commercial banking, retirement plan administration, and wealth management. These specialized groups engage in proactive outreach and networking to secure new business relationships. For instance, in 2024, Alerus reported a significant increase in new commercial loan originations, directly attributable to the efforts of these business development professionals.

Their strategy involves identifying and targeting potential clients through personalized approaches and industry engagement. This direct engagement is vital for expanding Alerus's market presence and deepening client relationships across its service offerings.

- Client Acquisition: Teams actively pursue new clients for commercial banking, retirement plans, and wealth management.

- Targeted Outreach: Focus on strategic marketing and networking to identify and engage prospective customers.

- Revenue Growth: Direct sales efforts are a primary driver for increasing loan originations and new deposit accounts.

- Relationship Building: Cultivating strong, long-term partnerships with businesses and individuals is a core objective.

Partnership Networks

Alerus Financial effectively utilizes partnership networks to broaden its client acquisition and service delivery. By collaborating with mortgage brokers and real estate agents, Alerus taps into established client bases, creating indirect channels for growth. This symbiotic relationship not only expands Alerus's market presence but also provides valuable services to partners and their clients.

These strategic alliances are crucial for Alerus’s ecosystem approach to financial services. For instance, in 2024, Alerus reported a significant increase in mortgage originations facilitated through its network of third-party originators, demonstrating the tangible impact of these partnerships. This strategy allows Alerus to offer a more comprehensive suite of financial solutions, from home financing to wealth management, all within a connected network.

- Mortgage Broker Alliances: Alerus partners with independent mortgage brokers to offer a wider range of lending products, reaching clients who may not directly approach the bank.

- Real Estate Agent Referrals: Building strong relationships with real estate professionals generates a steady stream of potential homebuyers and sellers for Alerus’s banking and lending services.

- Financial Intermediary Collaborations: Engaging with other financial advisors and intermediaries allows Alerus to offer integrated financial planning and investment solutions, enhancing client retention and value.

Alerus Financial employs a multi-channel strategy, blending physical presence with robust digital offerings and personalized advisory services. This approach ensures broad accessibility and caters to diverse client needs, from routine transactions to complex financial planning.

The company's 23 banking locations as of Q1 2024, primarily in the Upper Midwest and Arizona, serve as hubs for in-person interactions. Complementing this, their online and mobile platforms, enhanced by the 'One Alerus' initiative, provide seamless digital access for everyday banking. Dedicated financial advisors and business development teams are key to acquiring clients and nurturing relationships, particularly in wealth management and commercial banking. Furthermore, strategic partnerships with mortgage brokers and real estate agents expand Alerus's reach, driving client acquisition and offering integrated financial solutions.

| Channel | Description | Key Activities | 2024 Impact/Focus |

|---|---|---|---|

| Physical Branches | Full-service banking and wealth offices in the Upper Midwest and Arizona. | In-person consultations, transactions, financial advice. | 23 locations (Q1 2024); cornerstone of customer service. |

| Online & Mobile Banking | Digital platforms for account management, payments, and loan applications. | Convenient access, enhanced customer experience. | Integral to expanding market presence beyond physical sites. |

| Financial Advisors/Relationship Teams | Dedicated professionals offering expert advice and customized solutions. | Fostering strong client relationships, particularly in wealth management. | Instrumental in managing significant assets under management (Q1 2024). |

| Direct Sales & Business Development | Specialized teams focused on commercial banking, retirement plans, and wealth management. | Proactive outreach, networking, client acquisition. | Drove significant increase in commercial loan originations (2024). |

| Partnership Networks | Collaborations with mortgage brokers and real estate agents. | Tapping into established client bases, indirect client acquisition. | Generated significant increase in mortgage originations (2024). |

Customer Segments

Individuals and families are a core customer segment for Alerus Financial, seeking a holistic approach to managing their financial lives. This includes everything from everyday banking and securing a home with mortgage services to planning for a comfortable retirement and growing wealth through investment management. Alerus positions itself as a partner in this journey, aiming to help clients not only build their assets but also protect them and ensure a smooth transition to future generations.

In 2024, the demand for integrated financial services remained strong. Many households are navigating complex financial landscapes, from rising interest rates impacting mortgage decisions to market volatility affecting investment portfolios. Alerus's commitment to providing a full spectrum of services addresses these concerns, offering a single point of contact for diverse financial needs. For instance, Alerus reported significant growth in its wealth management division in early 2024, reflecting this trend.

Small to medium-sized businesses (SMBs) represent a core customer segment for Alerus Financial, requiring a comprehensive suite of banking services. These businesses often need commercial loans to fuel expansion, treasury management solutions for efficient cash flow, and robust retirement plan administration to support their workforce.

SMBs are actively seeking strategic financial partnerships that can provide more than just basic banking. They look for guidance and tools to enhance operational efficiency and drive long-term growth. For instance, in 2024, the U.S. Chamber of Commerce reported that 62% of SMBs planned to invest in technology to improve productivity, highlighting their focus on operational improvement.

High-net-worth individuals (HNWIs) represent a key customer segment for Alerus Financial, seeking advanced wealth management, private banking, and intricate financial planning. These clients typically possess investable assets exceeding $1 million, and Alerus tailors its services to meet their sophisticated needs, including trust and fiduciary services.

In 2024, the global HNWI population reached approximately 6.3 million individuals, with their total wealth estimated at $25.6 trillion. Alerus's focus on personalized solutions and comprehensive financial strategies positions it to attract and retain this valuable demographic, offering them bespoke approaches to capital preservation and growth.

Employers Sponsoring Retirement and Benefit Plans

This customer segment includes businesses and organizations that need robust administration and adaptable solutions for their employee retirement and benefit programs. They are particularly interested in options like defined contribution plans and Employee Stock Ownership Plans (ESOPs).

Alerus Financial is a key player for these employers, managing a significant number of plans. In fact, as of the latest available data, Alerus serves over 8,500 employer-sponsored retirement plans, demonstrating their extensive reach and capability in this market.

- Key Needs: Comprehensive administration, flexible plan options (defined contribution, ESOPs), compliance support.

- Alerus's Role: Provider of tailored retirement and benefit plan solutions for businesses of all sizes.

- Market Presence: Serves over 8,500 employer-sponsored retirement plans, highlighting significant market penetration.

National Client Base (Expanding Beyond Upper Midwest)

Alerus Financial is strategically broadening its reach beyond its traditional Upper Midwest stronghold, actively cultivating a national client base. This expansion is particularly evident in its retirement and benefit services, where digital platforms and targeted acquisitions are key drivers. For instance, by mid-2024, Alerus reported a significant increase in out-of-region client onboarding for its retirement solutions, indicating successful penetration into new markets. This growth signifies a commitment to leveraging technology to serve a geographically diverse clientele.

The expansion into a national client base is underpinned by Alerus's investment in robust digital infrastructure, enabling seamless service delivery regardless of client location. This focus on digital accessibility is crucial for attracting and retaining customers across the United States. In 2024, Alerus saw its digital engagement metrics for retirement plan participants climb by 15%, demonstrating the effectiveness of these enhanced capabilities. Strategic acquisitions also play a vital role, allowing Alerus to quickly integrate new client portfolios and expand its national footprint.

- National Reach: Alerus is actively expanding its client base across the United States, moving beyond its historical Upper Midwest focus.

- Service Specialization: Retirement and benefit services are leading this national expansion, leveraging digital capabilities.

- Growth Drivers: Digital platforms and strategic acquisitions are the primary catalysts for this geographic diversification.

- 2024 Performance: Alerus experienced a notable increase in out-of-region client acquisition for retirement services in 2024, alongside a 15% rise in digital engagement for retirement plan participants.

Alerus Financial serves a diverse range of customer segments, including individuals and families seeking comprehensive financial management, from everyday banking to wealth accumulation and estate planning. Small to medium-sized businesses (SMBs) rely on Alerus for essential commercial banking services like loans and treasury management, alongside employee retirement plan administration. High-net-worth individuals (HNWIs) are catered to with specialized wealth management, private banking, and trust services, addressing their complex financial needs.

Alerus also targets employers needing robust administration for employee retirement and benefit programs, offering solutions like defined contribution plans and ESOPs. This segment is crucial, with Alerus managing over 8,500 employer-sponsored retirement plans. The company is actively expanding its national reach, particularly in retirement services, driven by digital platforms and strategic acquisitions. In 2024, this expansion saw a significant increase in out-of-region client onboarding for retirement solutions and a 15% rise in digital engagement among plan participants.

| Customer Segment | Key Needs | Alerus's Offering | 2024 Data/Trends |

|---|---|---|---|

| Individuals & Families | Banking, Mortgages, Investments, Retirement Planning | Holistic financial management, wealth building & protection | Strong demand for integrated services amidst market volatility. Growth in wealth management division. |

| Small to Medium-sized Businesses (SMBs) | Commercial Loans, Treasury Management, Retirement Plans | Comprehensive banking, operational efficiency tools | 62% of SMBs invested in technology for productivity (U.S. Chamber of Commerce). |

| High-Net-Worth Individuals (HNWIs) | Advanced Wealth Management, Private Banking, Trusts | Bespoke capital preservation & growth strategies | Global HNWI population ~6.3 million, total wealth ~$25.6 trillion. |

| Employers (Retirement & Benefit Plans) | Plan Administration, Defined Contribution, ESOPs | Management of over 8,500 employer-sponsored retirement plans | Significant market penetration in plan administration. |

| National Client Base (Expansion) | Digital Accessibility, Seamless Service Delivery | Leveraging digital platforms and acquisitions for geographic diversification | 15% increase in digital engagement for retirement plan participants; increased out-of-region client onboarding. |

Cost Structure

Employee compensation and benefits represent a substantial cost for Alerus Financial. In 2023, the company reported total compensation and benefits expenses of $244.6 million, reflecting the investment in its skilled workforce across banking, wealth management, and other financial services.

Alerus Financial allocates significant resources to technology and infrastructure. These ongoing investments in IT systems, software, cybersecurity, and digital platforms represent substantial costs, essential for maintaining operations and enhancing client experience.

The company's commitment to innovation means continuous development of new technologies. This focus on digital advancement aims to boost operational efficiency and improve the overall client journey. For instance, business services, software, and technology expenses saw a notable increase in the second quarter of 2025, underscoring the priority placed on these areas.

Alerus Financial's cost structure is significantly influenced by its occupancy and operational expenses, which are crucial for maintaining its physical presence. These costs encompass rent for its branch network and office spaces, alongside essential utilities, ongoing maintenance, and property taxes. For instance, in 2024, many regional banks have reported increasing operational costs due to inflation, with some seeing a 5-7% rise in property-related expenses.

Beyond physical upkeep, general administrative expenses form another substantial component of this cost category. This includes salaries for administrative staff, IT infrastructure, insurance, and other overheads necessary for smooth day-to-day operations. These administrative outlays are vital for supporting the company's broader financial services offerings and ensuring regulatory compliance.

Marketing and Sales Expenses

Alerus Financial allocates significant resources to marketing and sales to drive client acquisition and expand its market presence. These expenditures encompass a wide range of activities aimed at promoting its diverse financial services.

Key components of this cost structure include:

- Advertising: Investment in various media channels to build brand awareness and highlight service offerings.

- Promotional Activities: Costs associated with campaigns, special offers, and events designed to attract new customers.

- Business Development: Outlays for initiatives focused on identifying and securing new client relationships and partnerships, crucial for long-term growth.

For instance, in 2024, Alerus Financial reported that its total operating expenses, which include marketing and sales, were a significant factor in its financial performance, reflecting a commitment to growth. The company's strategic focus on expanding its client base through these efforts underscores their importance in achieving market share gains.

Regulatory Compliance and Risk Management Costs

Alerus Financial dedicates substantial resources to regulatory compliance and risk management, essential for operating in the financial sector. These costs are vital for maintaining legal and ethical standards, safeguarding client assets, and ensuring the company's stability.

Key expenditures include legal counsel for navigating complex financial laws, salaries for dedicated compliance officers, and investments in internal audit systems. For instance, in 2024, financial institutions globally saw increased spending on compliance technology and personnel due to evolving regulations like those concerning data privacy and anti-money laundering.

- Legal Fees: Covering advice on banking regulations, securities laws, and consumer protection statutes.

- Compliance Personnel: Salaries and training for staff managing regulatory adherence and reporting.

- Risk Management Systems: Investment in technology and processes to identify, assess, and mitigate financial, operational, and cybersecurity risks.

- Internal Audit: Costs associated with independent reviews of controls and procedures to ensure compliance.

Alerus Financial's cost structure is multifaceted, with employee compensation and technology investments forming major pillars. In 2023, compensation and benefits reached $244.6 million, highlighting the investment in its workforce. Simultaneously, ongoing investments in IT systems and digital platforms are critical, with notable increases in business services, software, and technology expenses observed in Q2 2025.

Occupancy and administrative expenses, including rent, utilities, and operational overheads, are also significant. Many regional banks in 2024 experienced a 5-7% rise in property-related costs due to inflation. Furthermore, marketing and sales efforts, alongside substantial spending on regulatory compliance and risk management, contribute to the overall cost base, reflecting a commitment to growth and operational integrity.

| Cost Category | 2023 Data | 2024 Trends | Key Components |

|---|---|---|---|

| Employee Compensation & Benefits | $244.6 million | Continued investment in workforce | Salaries, benefits, training |

| Technology & Infrastructure | Significant investment | Notable increase in Q2 2025 | IT systems, software, cybersecurity, digital platforms |

| Occupancy & Operational Expenses | Substantial | 5-7% rise in property costs for some regional banks | Rent, utilities, maintenance, property taxes |

| Marketing & Sales | Significant factor in financial performance | Commitment to growth | Advertising, promotional activities, business development |

| Regulatory Compliance & Risk Management | Substantial resources | Increased global spending on compliance technology | Legal fees, compliance personnel, risk systems, internal audit |

Revenue Streams

Alerus Financial's core revenue engine is its net interest income. This is generated by the spread between the interest Alerus earns on its loan portfolio, which includes commercial, consumer, and mortgage loans, as well as its investment securities, and the interest it pays out on customer deposits.

This critical revenue stream demonstrated robust growth, reaching a new record high in the first quarter of 2025. This performance underscores the effectiveness of Alerus's lending and deposit-gathering strategies in a dynamic interest rate environment.

Alerus Financial generates substantial non-interest income through its wealth management division. These fees stem from providing a suite of services, including expert investment management, comprehensive financial planning, and specialized trust and fiduciary services. This segment is crucial for diversifying Alerus's revenue beyond traditional lending.

In the second quarter of 2025, Alerus Financial observed a notable upswing in its wealth management revenues. This growth was primarily driven by an increase in assets under management and administration, reflecting client confidence and market appreciation.

Alerus Financial generates significant revenue from its retirement and benefit services. This income stems from the administration and record-keeping of various employer-sponsored plans, including retirement accounts and health savings accounts.

These fees are a crucial component of Alerus's overall fee-based income. For instance, in the first quarter of 2024, Alerus reported total non-interest income of $44.4 million, with a substantial portion attributable to these services.

Mortgage Banking Revenue

Mortgage banking revenue at Alerus Financial stems from originating mortgages, selling these loans on the secondary market, and collecting associated fees. This diversified income stream is a key component of their financial operations.

In the second quarter of 2025, Alerus Financial experienced a notable surge in its mortgage banking revenue. This growth reflects strong market activity and effective execution in their lending operations.

- Mortgage Origination Fees: Revenue generated from processing and closing new mortgage loans.

- Loan Sales Gains: Income realized from selling originated mortgages to investors.

- Servicing Fees: Ongoing revenue from managing mortgage loans after origination.

- Q2 2025 Performance: Mortgage banking revenue saw a significant increase, indicating robust demand and successful origination strategies.

Service Charges and Other Banking Fees

Service charges and other banking fees form a crucial part of Alerus Financial's revenue, providing a consistent income stream beyond interest income. These fees are generated from a variety of customer interactions and account types, contributing to the company's financial stability.

Key revenue sources within this category include:

- Service Charges on Deposit Accounts: Fees associated with maintaining checking and savings accounts, such as monthly maintenance fees, overdraft fees, and ATM usage fees.

- Interchange Income: Revenue generated from debit and credit card transactions processed by Alerus. This income is typically a percentage of the transaction value.

- Other Miscellaneous Fees: This encompasses a broad range of charges, including wire transfer fees, safe deposit box rentals, and fees for other specialized banking services.

For the nine months ending September 30, 2024, Alerus Financial reported non-interest income, which includes these service charges and fees, totaling $101.4 million. This highlights the significant contribution of these fee-based services to the company's overall financial performance.

Alerus Financial's revenue streams are diversified, encompassing net interest income from its lending and investment activities, alongside substantial non-interest income. The latter is driven by wealth management services, retirement and benefit plan administration, mortgage banking operations, and various service charges and fees on deposit accounts and card transactions.

| Revenue Stream | Description | Key Data Point (2024/2025) |

|---|---|---|

| Net Interest Income | Spread between interest earned on loans/investments and interest paid on deposits. | Reached a record high in Q1 2025. |

| Wealth Management Fees | Fees from investment management, financial planning, trust services. | Notable upswing in Q2 2025 due to increased assets under management. |

| Retirement & Benefit Services | Fees from administering employer-sponsored plans. | Contributed significantly to $44.4 million in non-interest income in Q1 2024. |

| Mortgage Banking Revenue | Origination fees, gains from loan sales, and servicing fees. | Experienced a significant surge in Q2 2025. |

| Service Charges & Other Fees | Fees from deposit accounts, interchange income, miscellaneous banking services. | Total non-interest income reached $101.4 million for the nine months ending September 30, 2024. |

Business Model Canvas Data Sources

The Alerus Financial Business Model Canvas is built upon a foundation of internal financial statements, customer feedback surveys, and competitive analysis reports. These diverse data sources ensure a comprehensive understanding of our operational strengths and market positioning.