Alerus Financial Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alerus Financial Bundle

Curious about Alerus Financial's strategic positioning? This glimpse into their BCG Matrix reveals which products are driving growth and which may need a closer look. Understand where Alerus Financial's portfolio shines and where potential challenges lie.

Unlock the full strategic picture by purchasing the complete Alerus Financial BCG Matrix. Gain detailed quadrant analysis, data-driven insights, and actionable recommendations to inform your investment and product development decisions.

Stars

Alerus Financial's wealth management services are positioned as a strong contender within the BCG matrix, showcasing significant growth. In the second quarter of 2025, this segment saw its revenue climb by an impressive 15.8% when compared to the same period in 2024. This upward trend is largely fueled by a robust 10.6% expansion in assets under administration and management (AUA/AUM) over the same timeframe.

The company's strategic focus on this high-potential area is evident in its ambitious plans. Alerus aims to double its advisor count and grow its AUM in tandem with its banking assets. This proactive strategy underscores a clear commitment to capturing a larger share of an expanding market, solidifying wealth management as a key growth driver for the organization.

Retirement and Benefit Services represent a significant growth engine for Alerus Financial, forming a vital part of its fee-based income. In the second quarter of 2025, assets under administration within this segment saw a healthy increase of 7.8% when compared to the same period in the previous year. This demonstrates strong momentum and continued client trust.

The revenue generated from retirement and benefit services experienced a 2.9% rise in the first quarter of 2025, building on the prior year's performance. This growth was primarily fueled by a 3.7% expansion in assets under administration and management (AUA/AUM), indicating successful client acquisition and asset retention.

Alerus's commitment to this sector is further underscored by its active pursuit of strategic acquisitions. This acquisition strategy, coupled with organic growth, positions Alerus as a formidable national provider in the retirement and benefit services market, signaling a clear high-growth trajectory.

Alerus's strategic acquisition approach is a key driver of its growth, exemplified by the successful integration of HMN Financial, Inc. This merger, which finalized in the fourth quarter of 2024, significantly bolstered Alerus's financial standing.

In the first two quarters of 2025, the HMN Financial acquisition contributed substantially to Alerus's expansion, leading to an increase in total assets, loans, and deposits. This growth directly translated into higher net interest income and an improved net interest margin for the company.

By strategically acquiring entities like HMN Financial, Alerus expands its reach into new markets. These integrations are designed to cultivate high-growth areas, enhancing market share by bringing new assets and client bases under the Alerus umbrella.

Organic Loan Growth at Higher Yields

Alerus Financial has showcased impressive organic loan growth, a key driver for its enhanced interest income and a widening net interest margin throughout the first half of 2025. This performance underscores their adeptness at capitalizing on new lending opportunities and optimizing their loan book for superior yields.

This strategic success is further evidenced by Alerus's ability to secure a significant share of newly originated loans amidst a robust demand for credit. For instance, in Q1 2025, the company reported a substantial increase in its loan portfolio, contributing directly to a higher net interest income compared to the previous year.

- Strong Organic Loan Growth: Alerus experienced significant expansion in its loan portfolio during Q1 and Q2 2025, directly boosting interest income.

- Higher Yields Achieved: The company successfully originated loans at higher interest rates, contributing to an expanded net interest margin.

- Market Share Capture: This growth indicates a strong competitive position in acquiring new loans within a favorable credit market.

Expansion into New Metropolitan Markets

Alerus Financial is strategically expanding into new metropolitan markets, a move that positions it as a potential star in the BCG matrix. This expansion is driven by both organic growth and key acquisitions. For instance, the acquisition of HMN Financial, based in Rochester, Minnesota, is a clear indicator of this ambition. This move aims to solidify Alerus's presence in a growing region.

The company's focus on markets like Phoenix and Rochester, Minnesota, highlights a deliberate effort to tap into areas with significant growth potential. This geographic diversification moves Alerus beyond its established Upper Midwest base. The goal is to build market share in these vibrant new geographies.

- Market Entry: Alerus is actively entering new metropolitan areas, such as Phoenix and Rochester, Minnesota.

- Acquisition Strategy: The acquisition of HMN Financial in Rochester exemplifies the growth-through-acquisition approach.

- Growth Objective: This expansion aims to increase Alerus's market share in high-potential, new geographies.

- Geographic Diversification: The strategy extends Alerus's reach beyond its traditional Upper Midwest footprint.

Alerus Financial's expansion into new metropolitan markets, including Phoenix and Rochester, Minnesota, positions its geographic diversification strategy as a potential star in the BCG matrix. This strategic move, bolstered by acquisitions like HMN Financial, aims to capture market share in high-growth regions, extending its reach beyond the Upper Midwest.

| Strategic Initiative | Key Markets | Supporting Data (Q2 2025 vs Q2 2024) | Growth Driver |

| Metropolitan Market Expansion | Phoenix, AZ; Rochester, MN | HMN Financial acquisition completed Q4 2024 | Acquisition of new client bases and assets |

| Geographic Diversification | Beyond Upper Midwest | Focus on high-potential regions | Increased market penetration |

What is included in the product

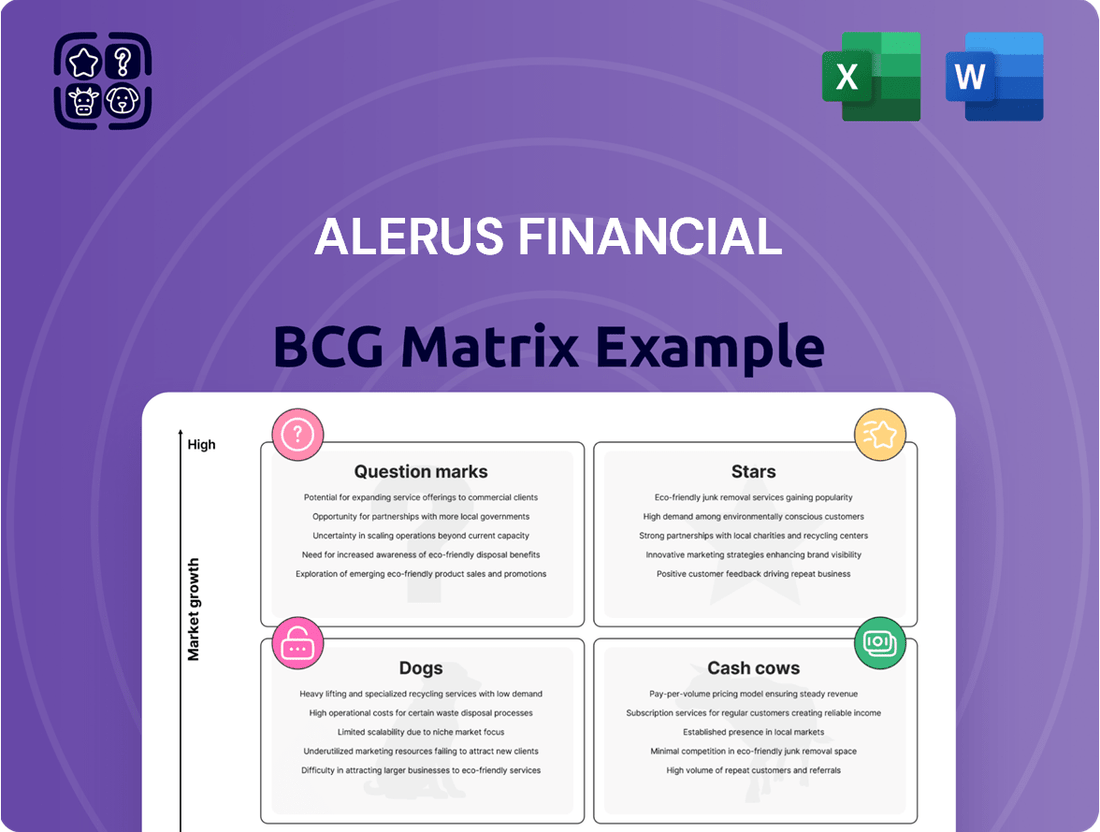

Alerus Financial's BCG Matrix provides a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs to guide investment decisions.

A clear Alerus Financial BCG Matrix provides a visual roadmap, easing the pain of strategic uncertainty.

Cash Cows

Net Interest Income (NII) from core banking operations is Alerus Financial's clear Cash Cow. This segment is the bedrock of their revenue, making up a substantial 54.4% of their total income over the last twelve months leading up to June 30, 2025. It’s a consistent performer, showing healthy growth with a 7.5% increase in Q1 2025 and a further 4.6% rise in Q2 2025, reaching $41.2 million and $43.0 million respectively.

This strong and growing NII, driven by foundational banking services, signifies a business unit with a high market share in a mature industry. It reliably generates more cash than it needs, a hallmark of a true Cash Cow, providing Alerus with the financial stability to invest in other areas of their business or return capital to shareholders.

Alerus Financial's total deposits stood at a robust $4.5 billion as of March 31, 2025. This figure represents a healthy 2.4% increase compared to the $4.4 billion recorded at the end of December 2024. This substantial and expanding deposit base acts as a stable, cost-effective funding reservoir, crucial for supporting Alerus's lending operations and overall business functions.

The consistent growth and significant volume of these deposits indicate a strong market position in capturing and retaining customer funds. Within a banking market that is generally mature, this ability to attract and hold deposits highlights Alerus's effectiveness as a reliable generator of cash, positioning its total deposits as a clear cash cow in the BCG matrix.

Synergistic deposits at Alerus Financial demonstrated robust growth, reaching $1.0 billion as of March 31, 2025, an increase of 7.5%. This expansion underscores the effectiveness of Alerus's integrated approach, where banking services are closely tied to its retirement and wealth management offerings.

These synergistic deposits are characterized by their stickiness and high value, directly benefiting from the strong relationships Alerus cultivates with its clients across various financial services. This segment acts as a stable, cash-generating engine for the company, requiring limited further investment to maintain its performance.

Diversified Revenue Model

Alerus Financial's diversified revenue model is a significant strength, positioning its various business segments as potential cash cows. The company effectively blends traditional banking services with capital-light, fee-based operations.

This strategic mix, which includes wealth management and retirement benefits, generates stable and resilient income. Fee income consistently makes up more than 40% of Alerus's total revenue, a figure notably higher than the industry average. This robust fee income stream acts as a collective cash cow, ensuring stability and providing substantial cash flow for other corporate initiatives and investments.

- Diversified Income Streams: Alerus combines commercial banking, private banking, wealth management, and retirement benefits.

- Fee Income Dominance: Fee income consistently represents over 40% of total revenues.

- Resilience and Stability: This diversification provides robust and stable revenue generation.

- Funding for Growth: The ample cash flow supports corporate needs and further investments.

Mortgage Servicing Revenue

Mortgage servicing revenue at Alerus Financial functions as a cash cow within its portfolio. While mortgage originations can fluctuate seasonally, the mortgage banking segment saw a substantial 43.0% revenue increase in Q2 2025 compared to the prior year's second quarter. This growth was largely fueled by an improved gain on sale rate and, crucially, augmented mortgage servicing revenue.

The servicing component is key to its cash cow status, offering a predictable, recurring fee income. This stability is further enhanced by strategic recent acquisitions, solidifying its reliable contribution to overall profitability even amidst the inherent cyclicality of the mortgage business.

- Consistent Fee Income: Mortgage servicing generates predictable revenue streams through ongoing fees.

- Growth Driver: Revenue from mortgage servicing increased significantly in Q2 2025.

- Acquisition Support: Recent acquisitions have bolstered the servicing portfolio.

- Stability in Cyclical Market: Provides a reliable income source despite mortgage origination seasonality.

Alerus Financial's Net Interest Income (NII) stands out as a prime cash cow, consistently fueling the company's operations. This core banking segment generated $43.0 million in Q2 2025, reflecting a solid 4.6% increase from the previous quarter. The substantial deposit base, reaching $4.5 billion by March 31, 2025, provides a stable and cost-effective funding source, underpinning this strong NII performance.

The company's diversified revenue, with fee income exceeding 40% of total revenues, also functions as a collective cash cow. This blend of banking and capital-light services, including wealth management and retirement benefits, ensures a resilient and predictable income stream. Furthermore, mortgage servicing revenue, bolstered by recent acquisitions and a 43.0% year-over-year increase in Q2 2025, offers consistent fee income, adding to the portfolio of reliable cash generators.

| Segment | Q2 2025 Revenue | YoY Growth | Key Driver |

|---|---|---|---|

| Net Interest Income | $43.0 million | 4.6% (QoQ) | Robust deposit base |

| Fee Income (Overall) | >40% of Total Revenue | Stable | Diversified services |

| Mortgage Servicing | N/A | 43.0% (YoY) | Acquisitions, recurring fees |

Full Transparency, Always

Alerus Financial BCG Matrix

The Alerus Financial BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks or demo content will be present; you'll get the complete, analysis-ready report for immediate strategic application. Rest assured, what you see is precisely what you'll download, enabling you to directly integrate this professional market analysis into your business planning without any further modifications required.

Dogs

Alerus Financial's strategic sale of $62.5 million in non-owner occupied commercial real estate loans in Q2 2025, which also led to a gain and the reversal of reserves, clearly places these assets in the 'dog' category of the BCG Matrix.

This divestiture signals that these loans were likely underperforming or not aligned with Alerus's core growth objectives, tying up valuable capital with minimal returns.

By selling these assets, Alerus effectively removed a drag on their portfolio, freeing up resources that can be reallocated to more promising areas, thereby improving overall capital efficiency.

Alerus Financial's proactive credit risk management, marked by a decline in nonperforming loans and a low net charge-off ratio, suggests certain legacy loan segments might be categorized as 'dogs' in a BCG matrix analysis. These are likely areas with subdued growth prospects and elevated risk profiles. For instance, as of the first quarter of 2024, Alerus reported a net charge-off ratio of just 0.16%, a testament to their effective risk mitigation strategies.

Alerus Financial's mortgage origination business often faces headwinds in the first quarter, typically seeing a sequential dip in revenues. This early year period can be characterized as a low-growth, low-return phase for this segment.

While Alerus's mortgage business does experience seasonal recovery, Q1 often exhibits characteristics of a 'dog' in the BCG matrix. This means it requires continued operational investment without generating substantial income during this specific timeframe, though performance typically improves later in the year.

Noninterest-Bearing Deposits (slight sequential decrease)

While Alerus Financial's overall deposits saw growth, their noninterest-bearing deposits experienced a slight sequential decrease. Specifically, these deposits declined by $14.2 million between December 31, 2024, and March 31, 2025.

This dip in a low-cost funding source, though small, warrants attention. It could signal a segment that is not expanding or facing challenges in attracting new noninterest-bearing accounts compared to competitors.

If this downward trend persists, Alerus Financial may need to re-evaluate its strategy for this deposit category to ensure a healthy and competitive funding mix.

- Noninterest-Bearing Deposit Change: A $14.2 million decrease from Q4 2024 to Q1 2025.

- Potential Implication: Suggests a possible lack of growth or competitive pressure in attracting these low-cost funds.

- Strategic Consideration: A continued decline could position this segment as a 'dog' requiring strategic intervention.

Highly Localized, Stagnant Traditional Banking Branches

Highly localized, traditional banking branches in stagnant markets are often categorized as 'dogs' in the BCG matrix. These branches typically exhibit low growth potential and a limited market share, catering to a mature customer base.

Such branches might generate just enough revenue to cover their operating costs, or in some cases, consume more resources than they contribute to the company's overall growth trajectory. For instance, a report from the FDIC in late 2023 indicated a continued trend of branch consolidation, with many smaller, community-focused branches facing challenges in attracting new customers in areas with little economic expansion.

- Low Market Share: These branches often serve a niche, localized market with little room for expansion.

- Stagnant Growth: The economic environment surrounding these branches shows minimal to no growth, limiting new customer acquisition.

- Break-Even or Negative Contribution: Revenue generated may only cover operational expenses, with minimal profit or even a net loss.

- Resource Drain: Despite low returns, these branches require ongoing investment in staffing, maintenance, and technology.

Assets like the $62.5 million in non-owner occupied commercial real estate loans sold in Q2 2025 are considered 'dogs' in the BCG matrix. This divestiture indicates they were underperforming and tying up capital with minimal returns. Alerus’s proactive risk management, evidenced by a 0.16% net charge-off ratio in Q1 2024, also points to certain legacy loan segments being 'dogs' due to low growth and higher risk.

The mortgage origination business, particularly in Q1, often shows characteristics of a 'dog' with sequential revenue dips. While it recovers later, this early year period represents low growth and low returns. Similarly, a $14.2 million decrease in noninterest-bearing deposits from Q4 2024 to Q1 2025 suggests this funding source might be a 'dog' if the trend continues, requiring strategic attention.

Question Marks

Alerus Financial's 'One Alerus' initiative represents a significant push into new technology, aiming to weave digital capabilities into every client interaction. This focus on innovation positions Alerus for potential high growth by boosting operational efficiency and enhancing the customer journey.

While the long-term promise is substantial, the 'One Alerus' initiative is currently a cash-intensive endeavor, requiring considerable investment for its development and rollout. The tangible market share gains from these digital advancements are still in their nascent stages, classifying this area as a question mark.

This strategic investment is crucial for Alerus to solidify its position in a rapidly evolving digital landscape. The company is betting that these substantial upfront costs will translate into future market leadership and improved client retention, a common characteristic of question mark businesses needing significant capital to mature.

In highly competitive banking sectors, acquiring new clients, especially in areas where Alerus Financial is still building its presence, demands significant upfront investment in marketing and sales. These emerging segments, characterized by high growth potential but currently low market share for Alerus, are classic question marks. For instance, in 2024, the cost of acquiring a new retail banking customer in a saturated metropolitan area could easily exceed $500, reflecting the intense competition for deposits and loans.

Alerus's strategy to capture market share in these question mark areas requires a focused approach. By 2024, many banks were increasing their digital marketing spend by 15-20% year-over-year to reach these new customer segments. Successfully converting these question marks into stars, where Alerus becomes a dominant player, hinges on sustained resource allocation for targeted campaigns and relationship building.

The integration of HMN Financial has indeed introduced Alerus Financial to new loan segments within expanded geographies, potentially positioning them as question marks within the BCG framework. These newly acquired loan portfolios, while promising high growth, may represent a smaller initial market share for Alerus in these specific regions. For instance, if Alerus saw a 5% market share in a particular loan type in a new state post-acquisition, that segment could be considered a question mark.

Developing Niche Financial Products/Services

Alerus Financial, as a diversified financial services provider, is likely evaluating the development of specialized financial products or services tailored to high-growth niche markets. These new ventures typically begin with a small market share as they are introduced and require significant investment to gain momentum. For instance, a new digital wealth management platform targeting Gen Z investors could be a prime example, requiring substantial capital for technology development and marketing campaigns throughout 2024.

These initiatives are classified as question marks within the BCG matrix because they represent potential future growth areas but also carry inherent risks. Their success hinges on their ability to capture market share and achieve profitability. Consider the trend of increasing demand for ESG-focused investment products; Alerus might be developing new funds in this area, which, if successful, could transition from question marks to stars. In 2024, the global sustainable investment market reached an estimated $37.7 trillion, indicating a substantial opportunity for niche product development.

- Niche Market Focus: Developing specialized offerings for underserved or emerging customer segments.

- Investment Requirements: Significant capital allocation for research, development, marketing, and client acquisition.

- Market Share Dynamics: Starting with low market share, with the potential to grow into market leaders.

- Risk and Reward: High potential upside if successful, but also the risk of failure and capital loss.

Expansion into New States/Regions Beyond Existing Footprint

Alerus Financial's ambition to broaden its national reach, as evidenced by its strategic acquisition of a wealth management firm in the Dallas-Fort Worth metroplex in late 2023, positions expansion into new states as a classic question mark in the BCG matrix. This move into a market with minimal existing presence necessitates considerable initial capital for building out operations and establishing brand awareness. The potential for high returns in these virgin territories is significant, but the investment required to capture market share is equally substantial.

These new market entries represent high-growth opportunities, aligning with Alerus's stated objective of a growing national client base. For instance, entering a state like Florida, which saw a net in-migration of over 300,000 people in 2023, could offer substantial long-term growth potential. However, the financial commitment to establish physical branches, hire local talent, and implement targeted marketing campaigns in such a state would be considerable, reflecting the inherent risks and rewards of a question mark strategy.

- High Growth Potential: New regions offer untapped customer bases and opportunities for market share capture.

- Significant Investment: Establishing infrastructure, marketing, and client acquisition in new states requires substantial upfront capital.

- Strategic Acquisitions: Past acquisitions, like the one in Dallas-Fort Worth, signal a willingness to invest in new metropolitan areas.

- Brand Building: Creating brand recognition and trust in unfamiliar markets is a key challenge requiring dedicated resources.

Question marks for Alerus Financial represent areas with high growth potential but currently low market share, demanding significant investment to achieve success. These ventures, such as new digital initiatives or expansion into new geographic markets, require substantial capital for development, marketing, and client acquisition. The success of these question marks hinges on their ability to effectively capture market share and transition into profitable ventures, a process that often involves considerable risk.

Alerus Financial's 'One Alerus' digital transformation is a prime example of a question mark. While aiming to enhance client interactions and operational efficiency, it requires considerable upfront investment without immediate tangible market share gains. Similarly, expansion into new states, like entering Florida with its significant in-migration, offers high growth prospects but necessitates substantial capital for infrastructure and brand building, with an estimated 15-20% year-over-year increase in digital marketing spend by banks in 2024 to capture such segments.

The integration of HMN Financial also introduced potential question marks through new loan segments in expanded geographies. These newly acquired portfolios, while promising high growth, may represent a smaller initial market share for Alerus in specific regions. For instance, a 5% market share in a particular loan type in a new state post-acquisition would classify that segment as a question mark, reflecting the need for further investment to grow.

Developing specialized financial products, such as ESG-focused investment funds, also falls into the question mark category. These ventures require significant capital for technology and marketing, with the global sustainable investment market reaching an estimated $37.7 trillion in 2024, indicating a substantial opportunity for niche product development.

| BCG Category | Description | Alerus Financial Example | Key Characteristics | 2024 Data/Trends |

|---|---|---|---|---|

| Question Marks | High market growth, low market share | 'One Alerus' digital initiative, new geographic expansion (e.g., Florida), acquired loan segments, niche financial products (e.g., ESG funds) | Requires significant investment, high risk, potential for future stars | Digital marketing spend increased 15-20% YoY; Sustainable investment market $37.7 trillion |

BCG Matrix Data Sources

Our BCG Matrix leverages Alerus Financial's internal financial statements, market share data, and product performance metrics. This is supplemented by external industry research and competitor analysis to provide a comprehensive view.