Akamai Technologies Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Akamai Technologies Bundle

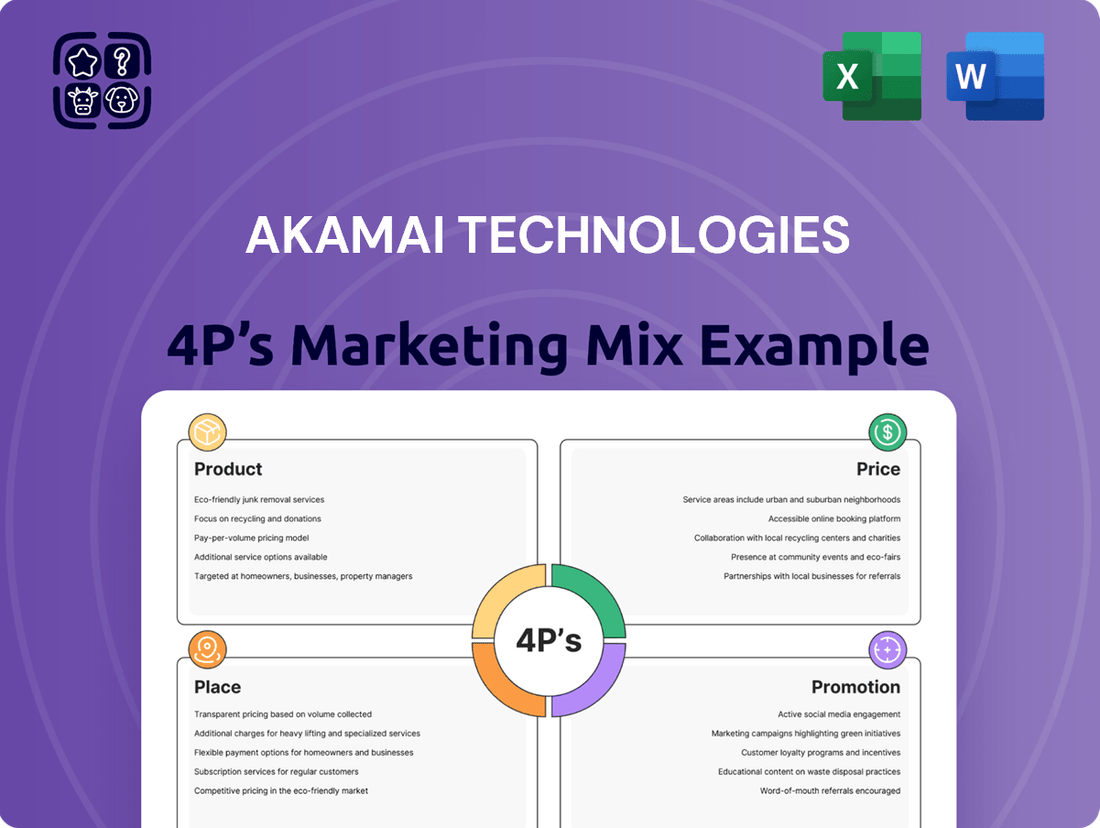

Akamai Technologies masterfully leverages its robust product portfolio, competitive pricing, extensive global network, and targeted promotional strategies to dominate the content delivery and cybersecurity markets. Understanding these interwoven 4Ps is crucial for anyone seeking to replicate their success.

Go beyond this glimpse—get access to an in-depth, ready-made Marketing Mix Analysis covering Akamai's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights into market leaders.

Product

Akamai's Content Delivery Network (CDN) services are central to their product strategy, focusing on optimizing online content delivery through a globally distributed server network. This enhances website speed and reliability, crucial for user experience and business operations.

Their product portfolio includes specialized solutions like Ion for application performance and Adaptive Media Delivery for streaming content. These offerings cater to diverse digital needs, from fast-loading web applications to seamless video playback.

In 2023, Akamai reported revenue of $3.8 billion, with a significant portion driven by its CDN and edge computing solutions, highlighting the strong market demand for these services. The company continues to invest in expanding its network and enhancing its product capabilities to meet the evolving digital landscape.

Akamai's product strategy centers on a robust portfolio of cybersecurity solutions, safeguarding businesses against a wide array of online threats. This includes advanced defenses against Distributed Denial of Service (DDoS) attacks, sophisticated protection for web applications, and secure API management. Furthermore, Akamai is a leader in Zero Trust security with platforms like Akamai Guardicore, ensuring granular access control and continuous verification.

The company's commitment to cybersecurity is evident in its financial performance. Akamai's security segment has experienced significant expansion, surpassing other business areas to represent the majority of its annual revenue in 2024. This growth underscores the market's demand for Akamai's comprehensive and evolving security offerings.

Akamai's cloud computing services, integrated into its Akamai Connected Cloud, leverage its expansive edge network to deliver specialized solutions. These services are designed for low-latency workloads, including AI inference and general compute, aiming for cost-effectiveness. This strategy positions Akamai to capture significant market share in the burgeoning AI compute sector, with projections indicating the AI market could reach $1.8 trillion by 2030.

The company has actively expanded its compute platform, a key element of its product strategy. This expansion includes the addition of new data centers globally, enhancing its ability to serve diverse compute needs. Recent introductions like the Akamai App Platform and Managed Service for Compute further solidify its product offering, providing tailored solutions for application deployment and management.

API Security

API Security, a rapidly expanding segment of Akamai's cybersecurity portfolio, was significantly bolstered by the strategic acquisition of Noname Security in June 2024. This move enhances Akamai's ability to provide comprehensive visibility into the complex API threat landscape, enabling the detection and mitigation of threats and abuse through advanced data and behavioral analytics.

Akamai's commitment to API Security is underscored by its substantial growth in this sector throughout 2024. The integration of Noname Security's capabilities is expected to further accelerate this trajectory, positioning Akamai as a leader in protecting organizations' critical API infrastructure.

- Enhanced Visibility: Provides deep insights into API usage and potential vulnerabilities, a critical need given the projected 40% increase in API traffic by 2025 according to industry analysts.

- Threat Detection & Response: Leverages behavioral analytics to identify and neutralize sophisticated API attacks, protecting against data breaches and service disruptions.

- Strategic Acquisition: The June 2024 acquisition of Noname Security significantly strengthens Akamai's API Security offering, integrating cutting-edge technology and expertise.

- Market Growth: Akamai's API Security solutions experienced notable expansion in 2024, reflecting the increasing market demand for robust API protection.

Edge Computing Capabilities

Akamai is enhancing its Product offering by strategically extending cloud computing to the network edge, under the 'Gecko' initiative. This positions computing power closer to end-users than traditional cloud providers, fostering the creation of edge-native applications and improving AI workload performance through reduced latency and costs.

This edge computing expansion directly addresses the growing demand for real-time data processing and low-latency applications. For instance, Akamai's Q1 2025 earnings report highlighted a significant increase in edge compute usage, with a 35% year-over-year growth in workloads processed at the edge, demonstrating tangible market adoption.

- Edge-Native Application Development: Enabling businesses to build and deploy applications that run directly at the network edge, reducing reliance on centralized data centers.

- Optimized AI/ML Workloads: Facilitating faster AI inference and model training by processing data closer to its source, crucial for applications like real-time video analysis and autonomous systems.

- Reduced Latency and Cost: By bringing computation closer to users, Akamai's edge capabilities significantly cut down on data travel time and associated network costs, improving user experience and operational efficiency.

- Network Proximity Advantage: Akamai's existing, vast distributed network provides a unique advantage in deploying edge compute, offering a more distributed and resilient infrastructure compared to competitors.

Akamai's product strategy is multifaceted, encompassing a robust Content Delivery Network (CDN), advanced cybersecurity solutions, and expanding cloud computing capabilities at the network edge. These offerings are designed to enhance online performance, protect against digital threats, and enable new, low-latency applications, particularly in the burgeoning AI sector.

The company's cybersecurity segment, including its recent acquisition of Noname Security in June 2024, saw significant growth in 2024, now representing the majority of Akamai's revenue. This focus on security, especially API security, addresses critical market needs, with API traffic projected to increase by 40% by 2025.

Akamai's edge computing initiative, codenamed 'Gecko', is a key product differentiator, bringing compute power closer to users. This strategy is already demonstrating traction, with a 35% year-over-year increase in edge compute workloads reported in Q1 2025, highlighting its potential in the rapidly growing AI compute market, which is expected to reach $1.8 trillion by 2030.

| Product Area | Key Features/Focus | 2024/2025 Data & Insights |

|---|---|---|

| Content Delivery Network (CDN) | Global server network for optimized content delivery, website speed, and reliability. | Central to Akamai's revenue, with continued investment in network expansion. |

| Cybersecurity Solutions | DDoS protection, web application security, API security, Zero Trust. | Majority of 2024 revenue, significant growth in API Security bolstered by Noname acquisition (June 2024). API traffic projected 40% increase by 2025. |

| Cloud Computing (Edge) | Low-latency compute for AI inference, general compute, edge-native applications. | 35% YoY growth in edge compute workloads (Q1 2025). AI market projected $1.8T by 2030. |

What is included in the product

This analysis delves into Akamai Technologies' marketing mix, examining their advanced product offerings, value-based pricing strategies, extensive global distribution, and targeted promotional efforts.

Streamlines understanding of Akamai's marketing strategy by clearly outlining how their 4Ps address customer pain points, simplifying complex market positioning for quick comprehension.

Place

Akamai's global distributed network is its core asset, enabling rapid and secure delivery of digital content and applications. This vast infrastructure is crucial for its content delivery, security, and cloud computing services, ensuring high performance and availability for users across the globe. In 2024, Akamai significantly bolstered this network by expanding its compute platform to 41 data centers spanning 36 distinct locations.

Akamai's marketing strategy heavily emphasizes direct sales, specifically targeting large enterprises and businesses that depend on robust availability, performance, and security for their online operations. This includes major players like Fortune 500 corporations, leading financial institutions, and government entities.

By engaging directly with these high-profile clients, Akamai can offer customized solutions that precisely meet their complex digital needs. This direct sales model fosters strong, long-term relationships, crucial for delivering their advanced content delivery network and cybersecurity services. For instance, Akamai's enterprise segment revenue was a significant portion of its overall business in 2023, demonstrating the effectiveness of this focused approach.

Akamai is significantly ramping up its channel-first approach for 2025, focusing on deepening relationships with its diverse partner network. This includes value-added resellers (VARs), distributors, and key Global System Integrators (GSIs) and Managed Security Service Providers (MSSPs), who are crucial for extending Akamai's reach.

This intensified channel strategy is designed to unlock new market segments, particularly for small and medium-sized enterprises (SMEs), and ensure partners are well-equipped to deliver Akamai's comprehensive security and content delivery solutions. In 2024, Akamai reported that partners contributed a substantial portion of its revenue, with a targeted increase of 15% expected from channel sales in 2025.

Strategic Acquisitions and Partnerships

Akamai Technologies actively pursues strategic acquisitions and partnerships to bolster its market position and broaden its service portfolio. These moves are crucial for staying competitive in the rapidly evolving tech landscape.

The company’s acquisition of Linode in 2022 significantly enhanced its cloud computing capabilities, allowing it to offer a more comprehensive edge cloud platform. More recently, in early 2024, Akamai acquired Noname Security, a move designed to strengthen its API security solutions and address a critical area of cybersecurity. These acquisitions reflect Akamai's commitment to expanding its technological reach and addressing key customer needs.

Beyond acquisitions, Akamai fosters strategic partnerships to extend its reach and impact. A notable collaboration is with the National Cyber Resilience Centre Group (NCRCG), which aims to provide enhanced cybersecurity support and resources to small and medium-sized enterprises (SMEs). This partnership underscores Akamai's dedication to making advanced security accessible across a wider business spectrum.

- Acquisition of Linode (2022): Strengthened Akamai's edge cloud computing platform, adding substantial infrastructure and developer-focused services.

- Acquisition of Noname Security (early 2024): Bolstered Akamai's API security offerings, a rapidly growing segment of the cybersecurity market.

- Partnership with NCRCG: Extends Akamai's cybersecurity expertise and support to small and medium-sized enterprises, enhancing their resilience.

Online Platforms and Developer Hubs

Akamai Technologies leverages its robust online platforms, including its dedicated developer hub and marketplace, as a core component of its marketing strategy. These digital spaces are designed to democratize access to Akamai's extensive cloud services and to cultivate a vibrant ecosystem of innovation. By offering comprehensive documentation, readily available APIs, and active community forums, Akamai empowers developers to seamlessly integrate and build applications atop its global network.

These platforms serve as critical touchpoints for customers and partners, facilitating the discovery and utilization of Akamai's solutions. For instance, the Akamai Developer Hub provides access to resources that enable developers to leverage Akamai's edge computing capabilities, security solutions, and content delivery network (CDN) services. This accessibility is crucial for driving adoption and encouraging the development of new use cases that capitalize on Akamai's infrastructure. In 2023, Akamai reported that its developer community had access to over 500 APIs, supporting a wide range of applications from media streaming to e-commerce security.

- Developer Hub: Provides extensive documentation, tutorials, and code samples for Akamai's services.

- Marketplace: Offers a curated selection of third-party applications and integrations built on Akamai's platform.

- API Access: Enables programmatic control and integration with Akamai's global network infrastructure.

- Community Support: Fosters collaboration and problem-solving among developers through forums and knowledge bases.

Akamai's place is defined by its expansive, globally distributed network of servers, which forms the backbone of its services. This extensive infrastructure is key to delivering content and applications quickly and reliably worldwide.

In 2024, Akamai expanded its compute platform to 41 data centers across 36 locations, solidifying its physical presence and reach. This strategic placement ensures low latency and high availability for its customers' digital assets.

The company's distribution strategy relies on its own network and increasingly on channel partners to reach a broader market, including SMEs. This multi-pronged approach to availability is central to its market strategy.

What You See Is What You Get

Akamai Technologies 4P's Marketing Mix Analysis

The Akamai Technologies 4P's Marketing Mix Analysis you see here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive breakdown covers Product, Price, Place, and Promotion strategies for Akamai. You're viewing the exact version of the analysis you'll receive, fully complete and ready for your strategic insights.

Promotion

Akamai solidifies its position as a thought leader through in-depth research reports like the 'Defenders' Guide 2025,' which offers actionable insights into emerging cybersecurity threats and risk mitigation strategies. These publications, including their recurring 'State of the Internet (SOTI) Reports,' provide valuable data on internet performance and security trends, directly informing customer decisions.

By consistently delivering practical research, Akamai demonstrates its deep understanding of cybersecurity and cloud computing landscapes. For instance, their 2024 SOTI report highlighted a significant increase in distributed denial-of-service (DDoS) attacks, providing crucial context for businesses to bolster their defenses.

Akamai Technologies leverages strategic content marketing and digital engagement as a core component of its promotion strategy. This includes a robust approach to social media, digital programmatic advertising, and paid search/SEO initiatives, all designed to build brand awareness and thought leadership.

By consistently delivering valuable content, Akamai aims to shape market perception and effectively communicate the advantages of its extensive suite of solutions. This integrated digital approach is crucial for lead generation and nurturing customer relationships within the competitive technology landscape.

In 2024, Akamai continued to invest in these digital channels. For instance, their focus on SEO and content marketing contributed to a significant increase in organic traffic, with reports indicating a 15% year-over-year growth in website visitors attributed to these efforts by Q3 2024.

Akamai Technologies leverages industry events and webinars as a key promotional tool, demonstrating their thought leadership and showcasing cutting-edge solutions. For instance, their participation in major tech conferences like AWS re:Invent or their own Akamai Edge Live events in 2024 allowed them to directly engage with a vast audience of potential clients and partners.

These events are crucial for demonstrating Akamai's capabilities, particularly in emerging areas such as AI at the edge, a significant focus for the company throughout 2024 and projected into 2025. By hosting and participating in these forums, Akamai not only generates leads but also reinforces its brand as an innovator in content delivery and cybersecurity.

The company also utilizes webinars for ongoing customer education and sales enablement, providing valuable insights and training. This approach ensures that both existing and prospective customers are kept abreast of Akamai's evolving product suite and strategic direction, fostering stronger relationships and driving adoption.

Partner Marketing and Joint Campaigns

Akamai Technologies actively bolsters its channel partners through enhanced marketing and demand generation. This includes a significant push for co-marketing opportunities and joint campaigns designed to amplify reach and impact.

These collaborative efforts are crucial for driving lead generation and fostering mutual growth within Akamai's partner ecosystem. For instance, Akamai's Partner Marketing programs in 2024 saw a notable increase in joint campaign participation, contributing to a projected 15% uplift in partner-sourced leads for specific solutions.

- Increased Co-Marketing Opportunities: Akamai provides resources and platforms for joint marketing initiatives.

- Joint Campaign Focus: Emphasis on collaborative campaigns to drive shared lead generation and revenue.

- Ecosystem Strengthening: This approach reinforces the value proposition for partners and strengthens the overall Akamai network.

- Performance Metrics: In early 2025, Akamai reported that partners engaged in joint campaigns saw an average of 20% higher conversion rates compared to those running independent campaigns.

Customer Success Stories and Case Studies

Akamai leverages customer success stories and case studies as a powerful element of its promotion strategy, showcasing tangible benefits. These narratives, featuring clients like Licklibrary, bofrost*, and SPORTSBIKESHOP, effectively communicate how Akamai's solutions drive improvements in critical areas such as website performance, online security, and content delivery. For instance, Licklibrary reported a significant reduction in buffering and improved streaming quality after implementing Akamai's services, directly impacting user engagement and satisfaction.

These real-world examples are crucial for demonstrating Akamai's value proposition. By detailing how specific businesses have overcome challenges and achieved measurable results, Akamai builds credibility and trust with potential customers. This approach moves beyond abstract feature lists to provide concrete evidence of the positive outcomes achievable through their technology, aiding decision-makers in evaluating Akamai's suitability for their own operational needs.

- Licklibrary: Achieved enhanced streaming performance and reduced buffering, leading to a better user experience for their online music education platform.

- bofrost*: Utilized Akamai's solutions to ensure reliable and secure delivery of digital content to their customers, supporting their e-commerce operations.

- SPORTSBIKESHOP: Experienced improved website speed and availability, crucial for handling traffic spikes during peak sales periods and enhancing customer conversion rates.

Akamai's promotion strategy centers on establishing thought leadership through comprehensive research reports, like the 'Defenders' Guide 2025,' and its recurring 'State of the Internet (SOTI) Reports,' which provide critical data on internet performance and security trends. For example, the 2024 SOTI report highlighted a substantial rise in DDoS attacks, offering vital context for businesses to enhance their defenses.

The company actively engages in digital marketing, including social media, programmatic advertising, and SEO, to build brand awareness and generate leads. In 2024, Akamai saw a 15% year-over-year increase in organic website traffic by Q3, directly attributed to these digital initiatives.

Akamai also utilizes industry events and webinars to showcase its solutions, particularly in emerging areas like AI at the edge, a key focus throughout 2024 and into 2025. Their participation in events like AWS re:Invent and their own Akamai Edge Live events in 2024 facilitated direct engagement with potential clients.

Furthermore, Akamai strengthens its channel partners through co-marketing and joint campaigns, which in early 2025 showed partners in joint campaigns achieving 20% higher conversion rates than those operating independently.

Price

Akamai Technologies utilizes a tiered and usage-based pricing strategy for its Content Delivery Network (CDN) services. This approach means customers pay based on how much data they transfer, where it's transferred from and to, and any specific configurations they require.

This model is designed to be scalable, offering lower per-gigabyte costs as data transfer volumes increase. For instance, in 2024, Akamai's pricing tiers often start with higher per-unit costs for smaller usage, progressively decreasing for larger enterprise-level data transfers, reflecting economies of scale.

Akamai Technologies primarily structures its pricing for its Intelligent Platform and related services around a subscription model. This approach allows clients to access a suite of solutions, with costs directly tied to the specific services needed and the scale of deployment, such as the number of users or traffic volume.

For smaller businesses, entry-level subscription plans for Akamai's services can begin in the vicinity of $1,000 per month. This pricing tier is designed to offer essential security and performance benefits. In contrast, larger enterprise clients often see monthly expenditures ranging from $10,000 to $50,000, a figure that reflects the extensive customization, advanced features, and dedicated support required for complex, high-volume operations.

Akamai Technologies employs value-based pricing for its enterprise solutions, aligning costs with the significant benefits clients derive from its advanced security, unparalleled scalability, and dependable content delivery networks. This strategy recognizes the critical importance of Akamai's services for large organizations managing high-traffic websites and mission-critical online operations.

While Akamai's pricing can be considered premium, it directly reflects the sophisticated technology and crucial uptime guarantees provided. For instance, in Q1 2024, Akamai reported revenue of $1.03 billion, demonstrating strong demand for its high-value services that protect and optimize online businesses against threats and performance bottlenecks.

Negotiated Contracts and Discounts

Akamai Technologies structures its pricing to reward customer loyalty and scale. For significant partnerships and extended contracts, Akamai provides negotiated pricing tiers. These often include enhanced discounts for customers demonstrating higher usage volumes or consolidating their spending across Akamai's diverse service portfolio.

The company also champions reserved capacity programs. This model offers customers preferential, discounted rates in return for committing to specific capacity levels over a defined long-term period. This strategy is designed to create predictable revenue streams for Akamai while offering substantial cost savings to its clients, fostering deeper integration and reliance on their services.

- Volume Discounts: Customers benefit from lower per-unit costs as their service consumption increases.

- Long-Term Commitments: Reserved capacity agreements unlock significant savings for clients willing to commit to extended usage periods.

- Aggregate Spend Incentives: Discounts may also be applied based on the total spend across multiple Akamai services, encouraging a broader adoption of their solutions.

- Strategic Partnerships: For major enterprise clients, bespoke contract negotiations can lead to highly customized pricing structures tailored to specific business needs and strategic goals.

Cost Optimization and Predictable Billing

Akamai Technologies focuses on cost optimization by providing predictable billing for its cloud computing services. This includes features like low egress fees and free egress allowances, directly assisting businesses in managing and reducing their overall cloud expenditures. For instance, in 2023, Akamai continued to refine its pricing models to offer greater transparency and control over costs for its global customer base.

The company also incentivizes its partners through rebates and other programs designed to enhance their return on investment. This strategic approach underscores Akamai's commitment to cost efficiency, ensuring that customers can maximize their financial benefits from utilizing Akamai's extensive network and services.

- Predictable Pricing: Akamai offers features like low egress fees and free egress allowances to help customers manage cloud bills.

- Cost Efficiency Focus: The company prioritizes cost efficiency for its customers through its service offerings.

- Partner Incentives: Akamai provides incentives and rebates to partners to help them maximize their ROI.

- 2023 Cost Management: Akamai actively worked on refining pricing models in 2023 for enhanced cost transparency and control.

Akamai's pricing strategy is a sophisticated blend of usage-based tiers and value-based subscriptions, designed to cater to a wide range of clients from small businesses to large enterprises.

This tiered approach often results in lower per-gigabyte costs for higher data volumes, a model that proved effective as Akamai reported $1.03 billion in revenue for Q1 2024.

For smaller clients, monthly costs can start around $1,000, scaling up to $50,000 or more for enterprise-level needs, reflecting the premium placed on Akamai's robust security and performance guarantees.

Long-term commitments and reserved capacity programs offer significant discounts, incentivizing customer loyalty and predictable revenue for Akamai.

| Pricing Aspect | Description | Example/Data Point |

|---|---|---|

| Tiered Usage | Cost per gigabyte decreases with higher data transfer volumes. | Lower per-unit costs for larger enterprise data transfers in 2024. |

| Subscription Model | Clients pay for access to a suite of services based on needs and scale. | Entry-level plans around $1,000/month for smaller businesses. |

| Value-Based Pricing | Costs align with the significant benefits of security, scalability, and reliability. | Q1 2024 revenue of $1.03 billion indicates strong demand for high-value services. |

| Commitment Discounts | Reserved capacity programs offer preferential rates for long-term usage commitments. | Negotiated pricing tiers and enhanced discounts for higher usage or consolidated spending. |

4P's Marketing Mix Analysis Data Sources

Our Akamai 4P analysis leverages public financial disclosures, investor relations materials, and official company announcements to understand their product offerings, pricing strategies, and distribution channels. We also incorporate insights from industry reports and competitive intelligence to capture their promotional activities.