Akamai Technologies Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Akamai Technologies Bundle

Akamai Technologies' diverse portfolio presents a fascinating case study for the BCG Matrix, hinting at potential Stars and Cash Cows within its CDN and security offerings. Understanding which segments are driving growth and which require careful resource management is crucial for navigating the competitive landscape.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for Akamai Technologies.

Stars

Akamai's Cloud Security Solutions are a shining example of a Star in the BCG Matrix. This segment was Akamai's top revenue generator in 2024, surpassing $2 billion, a significant milestone. Its impressive 16% year-over-year growth in 2024, further bolstered by an 8% increase in Q1 2025, clearly indicates its strong market position and rapid expansion.

Akamai's Web Application Firewall (WAF) and Distributed Denial of Service (DDoS) protection services represent a significant strength within its portfolio. These offerings are vital for businesses facing increasingly complex cyber threats, ensuring continuous availability and data integrity.

In 2024, Akamai continued to solidify its leadership in cybersecurity, with its WAF and DDoS solutions being key drivers of its market position. The company's ability to detect and mitigate sophisticated attacks, such as the record-breaking DDoS attack mitigated in early 2024, underscores the effectiveness and demand for these services.

Akamai Technologies is positioned as a strong contender in the Zero Trust Security Platforms market. In Forrester's Q3 2025 Zero Trust Platforms report, Akamai was named a 'Customer Favorite,' earning high marks for its capabilities in segmentation, control, and the support services it offers. This recognition highlights Akamai's ability to deliver a reliable and practical method for managing security risks in complex, distributed IT infrastructures.

The company's zero trust security approach is designed to ensure that access is granted strictly based on verified user identity and contextual information. This granular control is crucial for preventing unauthorized access and limiting the spread of threats within an organization's network by enforcing precise segmentation policies. Akamai's platform empowers businesses to build a more resilient security posture in today's evolving digital landscape.

API Security Offerings

Akamai Technologies is significantly strengthening its API security capabilities, recognizing the escalating risks associated with widespread API adoption. The company's strategic acquisitions, such as the 2024 purchase of Noname Gate Ltd., directly enhance its API security offerings and attack analysis. This move underscores the critical importance of API security in today's interconnected digital landscape, a market segment experiencing rapid growth.

The expansion of Akamai's API security portfolio is a direct response to the increasing number of APIs deployed by organizations, which naturally leads to a greater attack surface. By investing in and enhancing these offerings, Akamai aims to equip its customers with robust tools to counter emerging API threats effectively.

- Enhanced Attack Analysis: The acquisition of Noname Gate Ltd. in 2024 bolsters Akamai's ability to analyze API-related attacks.

- Strategic Market Focus: Akamai is prioritizing API security due to the growing exposure and threat landscape for application programming interfaces.

- Portfolio Expansion: Continuous enhancements to its API security offerings demonstrate Akamai's commitment to addressing evolving customer needs and market demands.

AI-driven Cybersecurity Solutions

Akamai Technologies is significantly bolstering its cybersecurity portfolio with AI-driven solutions, a strategic move reflected in its BCG Matrix positioning. The company is actively investing in artificial intelligence to enhance its security offerings, evidenced by new product launches like Firewall for AI. This specific product is designed to safeguard AI investments from critical vulnerabilities such as data leaks and prompt injection, addressing a growing concern in the market.

The imperative for these advanced solutions is underscored by Akamai's research, which reveals that cybercriminals are increasingly leveraging AI to execute more evasive and efficient attacks. This trend necessitates a parallel advancement in defensive capabilities, driving the demand for AI-based security solutions capable of real-time threat detection and response. Akamai's proactive stance in developing and deploying these technologies positions it at the forefront of combating the evolving landscape of AI-driven cyber threats.

- AI Integration: Akamai is investing heavily in AI to create more robust cybersecurity products, exemplified by Firewall for AI.

- Threat Landscape: Cybercriminals are adopting AI for sophisticated attacks, making AI-powered defense essential.

- Market Position: Akamai's focus on AI-driven security solutions positions it as a leader in addressing emerging cyber threats.

Akamai's Cloud Security Solutions, particularly its Web Application Firewall and DDoS protection, are clear Stars. These services generated over $2 billion in revenue in 2024, showing a strong 16% year-over-year growth, with an additional 8% increase in Q1 2025, highlighting their market dominance and rapid expansion.

The company's strong performance in Zero Trust Security Platforms, recognized in a Q3 2025 Forrester report, further solidifies its Star status. Akamai's strategic acquisitions, like Noname Gate Ltd. in 2024, enhance its API security, a rapidly growing market segment critical for modern digital infrastructures.

Akamai's investment in AI-driven security, including products like Firewall for AI, directly addresses the evolving threat landscape where cybercriminals are also leveraging AI. This proactive approach ensures Akamai's security offerings remain competitive and highly effective.

| Segment | 2024 Revenue (Est.) | YoY Growth (2024) | Q1 2025 Growth | BCG Status |

|---|---|---|---|---|

| Cloud Security | >$2 Billion | 16% | 8% | Star |

| Zero Trust Platforms | N/A (Strong Market Position) | N/A | N/A | Star |

| API Security | N/A (Growing Segment) | N/A | N/A | Star |

What is included in the product

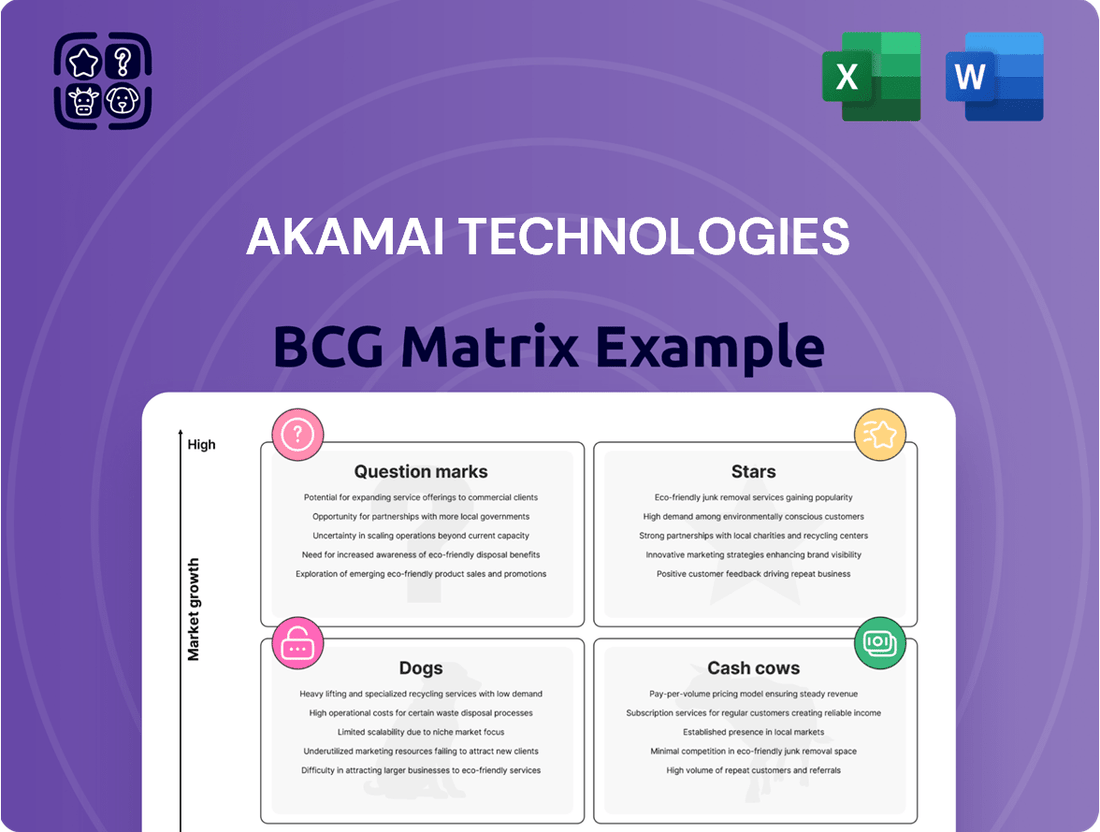

This BCG Matrix overview of Akamai Technologies highlights strategic decisions for investing in Stars, maintaining Cash Cows, developing Question Marks, and divesting Dogs.

Akamai's BCG Matrix offers a clear, one-page overview of its business units, simplifying strategic decision-making and alleviating the pain of complex portfolio analysis.

Cash Cows

Akamai's Core Content Delivery Network (CDN) services are a prime example of a Cash Cow. This segment boasts a substantial historical market share and remains a significant revenue generator for the company, despite facing a declining market trend. In 2024, Akamai's delivery revenue, while down 15% year-over-year to $1.31 billion, still represents a vital component of its financial stability.

The enduring strength of Akamai's vast global network of distributed servers underpins its Cash Cow status. This robust infrastructure is fundamental to delivering a wide range of digital content and applications, ensuring reliable performance for its customers. Its established presence and continued utility solidify its position as a consistent revenue stream.

Akamai's Media Delivery Solutions are a cornerstone of their business, consistently performing as a cash cow. These services are crucial for major media companies, ensuring smooth streaming and excellent video playback for millions of users. The company's vast Content Delivery Network (CDN) is the backbone of this success, facilitating efficient and high-quality content distribution.

Even with evolving market trends, the need for robust and high-performing media delivery for large-scale operations remains a significant driver of profitability for this segment. In the first quarter of 2024, Akamai reported that its Media and Communications business segment, which heavily includes media delivery, saw revenue growth, underscoring its continued strength.

Akamai's Enterprise Application Performance Solutions are a cornerstone of its business, acting as reliable cash cows. These services are essential for businesses that depend on seamless and rapid delivery of their critical applications, ensuring a robust online presence.

The maturity of these offerings allows Akamai to generate consistent cash flow with minimal need for substantial reinvestment in marketing or development. This stability is a key characteristic of a cash cow within the BCG matrix, providing the financial fuel for other growth areas.

In 2023, Akamai reported that its Security and Edge segment, which heavily includes these enterprise solutions, generated $2.2 billion in revenue, a significant portion of its total revenue and a testament to the enduring demand for application performance optimization.

Global Network Infrastructure

Akamai's global network infrastructure functions as a robust cash cow within its BCG matrix. This vast, distributed network of servers, meticulously built over many years, is the backbone of all Akamai's offerings, from content delivery to advanced security solutions.

The sheer scale and ubiquity of this infrastructure create a powerful competitive advantage, a moat that is difficult for rivals to replicate. This widespread deployment ensures consistent demand and revenue generation, as businesses rely on Akamai's network for efficient and secure data delivery.

Akamai reported revenue of $3.9 billion for the full year 2023, with its Edge platform, which leverages this global network, being a significant contributor. The efficient management of operational costs associated with maintaining this extensive network further solidifies its cash-cow status, enabling it to generate substantial profits.

- Global Network Scale: Akamai operates a highly distributed network of over 4,000 points of presence (PoPs) across more than 1,400 cities globally.

- Revenue Contribution: In 2023, Akamai's Security and Compute segment, heavily reliant on its network infrastructure, generated $2.1 billion in revenue.

- Operational Efficiency: The company's focus on optimizing its network operations helps maintain strong margins, contributing to its cash-generating capabilities.

- Competitive Moat: The decades-long investment in building and maintaining this extensive infrastructure presents a significant barrier to entry for potential competitors.

Established Customer Base

Akamai Technologies benefits from an established customer base, a key characteristic of its Cash Cows. These are long-standing relationships with a wide array of enterprise clients, including prominent brands and government organizations. These clients depend on Akamai's reliable content delivery and performance-enhancing services.

These client relationships are often secured through multi-year contracts with consistent pricing structures. This creates a predictable and stable source of recurring revenue for Akamai. For instance, in the first quarter of 2024, Akamai reported revenue from its Edge platform services, which directly serve this customer base, demonstrating the ongoing value derived from these established relationships.

- Customer Loyalty: The loyalty of this extensive customer base is a significant factor in Akamai's consistent cash generation.

- Predictable Revenue: Multi-year commitments ensure a stable and predictable revenue stream, a hallmark of a Cash Cow.

- Enterprise Focus: Serving major brands and government entities highlights the maturity and stability of these customer segments.

- Q1 2024 Performance: Revenue from Edge platform services in Q1 2024 underscored the ongoing financial contribution of this established customer base.

Akamai's core Content Delivery Network (CDN) services, particularly Media Delivery Solutions, continue to operate as strong Cash Cows. These mature offerings leverage Akamai's extensive global infrastructure to provide reliable content distribution for major media companies, ensuring consistent revenue streams. Despite market shifts, the fundamental need for efficient media delivery solidifies their Cash Cow status.

Akamai's Enterprise Application Performance Solutions also represent significant Cash Cows. These services cater to businesses requiring seamless application delivery, benefiting from the company's established network and minimal reinvestment needs. The Security and Edge segment, housing these enterprise solutions, demonstrated robust performance in 2023, highlighting their ongoing profitability.

The company's vast global network infrastructure itself functions as a powerful Cash Cow. This decades-old investment provides a significant competitive advantage and a stable revenue base, as businesses depend on its scale and efficiency for data delivery. Akamai's operational efficiency in managing this network further enhances its cash-generating capabilities.

Akamai's established customer base, often secured through long-term contracts, underpins the predictable and stable revenue characteristic of its Cash Cows. These loyal enterprise clients, including major brands and government entities, ensure consistent demand for Akamai's services, reinforcing the financial stability of these segments.

| Segment/Service | BCG Category | 2023 Revenue (USD Billions) | Key Characteristic |

| Core CDN (Media Delivery) | Cash Cow | N/A (part of broader segments) | Mature, high market share, stable revenue |

| Enterprise Application Performance | Cash Cow | N/A (part of Security and Edge) | Established client base, low reinvestment |

| Global Network Infrastructure | Cash Cow | N/A (underpins all services) | Significant competitive moat, operational efficiency |

| Established Customer Base | Cash Cow | N/A (drives revenue across segments) | Predictable, recurring revenue from loyal clients |

Preview = Final Product

Akamai Technologies BCG Matrix

The Akamai Technologies BCG Matrix you're previewing is the complete, unwatermarked document you will receive immediately after purchase. This comprehensive analysis, detailing Akamai's product portfolio across the BCG matrix quadrants, is fully formatted and ready for your strategic planning. You can confidently use this preview as an exact representation of the valuable, actionable insights you'll gain.

Dogs

Legacy CDN services for commoditized content are facing significant headwinds. Intense price competition and waning demand are squeezing profit margins as the market matures and new players emerge. Akamai's overall delivery revenue decline of 15% in 2024 highlights the challenges within this segment, suggesting these older services offer little competitive differentiation.

Certain niche Content Delivery Network (CDN) offerings from Akamai Technologies, particularly those focused on specialized delivery protocols or legacy content types, are showing signs of underperformance. These segments, while once important, are experiencing declining adoption as newer, more efficient technologies emerge, leading to a potential classification in the 'Dogs' quadrant of the BCG Matrix.

For instance, Akamai's historical strength in specific media streaming formats might now be overshadowed by the widespread adoption of adaptive bitrate streaming and cloud-native video solutions. This shift means these older offerings may require significant investment to maintain relevance, yielding minimal returns and potentially draining resources. In 2023, Akamai reported a slight decline in its media delivery revenue segment, hinting at the challenges within these specialized niches.

Content acceleration technologies that depend on older protocols or less efficient methods might be categorized here, especially as the market increasingly favors more advanced and performant solutions. For example, Akamai's historical reliance on certain caching mechanisms, while groundbreaking at the time, could be seen as less competitive against newer, AI-driven content delivery networks (CDNs) that optimize delivery in real-time. The ongoing costs of maintaining these legacy systems, without a corresponding revenue stream, further solidify their position in this quadrant, prompting a strategic evaluation of their future.

Highly Price-Sensitive, Low-Margin CDN Contracts

Highly Price-Sensitive, Low-Margin CDN Contracts fall into the Dogs category of Akamai Technologies' BCG Matrix. These are contracts for fundamental content delivery services where the market is intensely competitive, leading to razor-thin profit margins. While these agreements bolster Akamai's top-line revenue, their contribution to overall profitability is negligible and can potentially siphon resources away from more promising, high-growth ventures. Such engagements typically offer minimal strategic advantage for Akamai's long-term growth trajectory.

In 2024, the CDN market continued to be characterized by aggressive pricing strategies, particularly for basic content delivery. Akamai’s revenue from its Media and Delivery Solutions segment, which includes these types of contracts, saw continued pressure due to this intense competition. For instance, while the overall CDN market was projected to reach approximately $30 billion in 2024, a significant portion of this revenue was generated from high-volume, low-margin deals.

- Market Dynamics: The highly competitive nature of the CDN market, with numerous providers vying for market share, forces Akamai to offer aggressive pricing for basic services.

- Profitability Concerns: These low-margin contracts, while contributing to revenue, yield minimal profit, impacting the company's overall financial health.

- Resource Allocation: The need to service these contracts can divert valuable resources, including engineering talent and infrastructure, from Akamai's more innovative and profitable offerings.

- Strategic Value: From a strategic standpoint, these contracts offer little in terms of future growth potential or differentiation in the evolving digital landscape.

Overlapping or Redundant Delivery Solutions

As Akamai Technologies continues to grow through acquisitions and the expansion of its cloud services, it's important to identify any delivery solutions that might be doing the same job. For instance, if a recently acquired company's content delivery network (CDN) capabilities significantly overlap with Akamai's existing offerings, it could lead to inefficiencies.

These overlapping solutions might represent opportunities for divestiture or require substantial reorganization. Such redundancies can tie up valuable capital and operational resources that could be better utilized in areas with higher growth potential. In 2023, Akamai completed its acquisition of Linode, a cloud computing provider, which, while strategic, may necessitate a review of existing cloud delivery infrastructure to avoid duplication.

- Identify Overlapping Services: Akamai's strategy of acquiring companies like Linode in 2023 means a thorough review of all delivery solutions is crucial to pinpoint redundancies.

- Assess Strategic Alignment: Solutions that no longer fit the company's long-term vision or market strategy should be flagged for potential divestment.

- Capital and Resource Allocation: Redundant delivery solutions can drain financial and operational resources, impacting overall efficiency and growth initiatives.

- Focus on Core Strengths: Streamlining operations by eliminating overlaps allows Akamai to concentrate on its core strengths and future growth areas.

Akamai's legacy CDN services for commoditized content are struggling due to intense price competition and declining demand, leading to squeezed profit margins. These mature offerings provide little differentiation in the evolving market. Akamai's overall delivery revenue declined by 15% in 2024, underscoring the challenges within this segment.

Certain specialized or legacy CDN offerings from Akamai are underperforming as newer, more efficient technologies emerge. These segments, once significant, are experiencing reduced adoption. For example, Akamai's older media streaming formats are now overshadowed by adaptive bitrate streaming and cloud-native video solutions, potentially placing them in the Dogs quadrant of the BCG Matrix.

Highly price-sensitive, low-margin CDN contracts for fundamental delivery services are also categorized as Dogs. While these boost revenue, their profitability is minimal and can divert resources from growth areas. In 2024, the CDN market saw aggressive pricing for basic services, impacting Akamai's Media and Delivery Solutions segment.

| Segment | BCG Category | Key Characteristics | 2024 Data/Trend |

| Legacy CDN Services | Dogs | Commoditized, price-sensitive, low differentiation | 15% overall delivery revenue decline |

| Niche/Specialized CDN Offerings | Dogs | Declining adoption due to new technologies | Slight decline in media delivery revenue (2023) |

| Low-Margin CDN Contracts | Dogs | High volume, low profit, resource drain | Continued pressure on Media and Delivery Solutions |

Question Marks

Akamai Connected Cloud, a strategic integration of computing, security, and content delivery, targets modern applications demanding high performance and low latency. This initiative represents a substantial investment and a move into the fiercely competitive cloud market, currently dominated by established hyperscalers.

While the Akamai Connected Cloud platform exhibits high growth potential, its current market share remains modest. This necessitates ongoing, significant investment to capture greater market traction and compete effectively against larger players.

Akamai's edge computing services are positioned as a question mark in the BCG matrix, reflecting a high-growth market with a relatively low current market share. The edge computing market is expected to see substantial expansion, with a projected compound annual growth rate (CAGR) of 28% to 44.7% starting in 2025, indicating significant future potential.

Despite this promising market trajectory, Akamai's penetration within the broader cloud provider landscape remains modest, hovering around the 1% mark when compared to dominant players like Amazon Web Services (AWS) and Microsoft. This suggests that while the opportunity is vast, Akamai needs to substantially increase its investment to gain a more competitive foothold.

Akamai's Public Cloud Infrastructure-as-a-Service (IaaS) offering, bolstered by the 2022 Linode acquisition, is positioned as a significant growth area. This segment achieved $630 million in revenue in 2024, marking a substantial 25% year-over-year increase, with ambitious targets to hit $1 billion by 2027.

While this rapid expansion is promising, Akamai operates in a highly competitive IaaS landscape. The market is largely controlled by giants like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform. To carve out a larger market share, Akamai will need considerable investment and astute strategic planning to effectively compete with these established leaders.

Managed Kubernetes and Virtual Private Cloud (VPC) Offerings

Akamai's new managed Kubernetes and secured Virtual Private Cloud (VPC) offerings represent significant investments in high-growth areas of cloud infrastructure. These services are designed to meet sophisticated enterprise demands for container orchestration and private network isolation, positioning Akamai to capture a larger share of the enterprise cloud market. The success of these initiatives hinges on Akamai's ability to rapidly gain market traction and secure widespread customer adoption, a common challenge for new, advanced service deployments.

- Market Potential: These offerings target the rapidly expanding managed Kubernetes and private cloud market, which is projected for substantial growth. For instance, the global managed Kubernetes market was valued at approximately $2.5 billion in 2023 and is expected to reach over $10 billion by 2028, indicating a strong potential revenue stream.

- Investment and Adoption: Significant upfront investment is required for developing and scaling these complex services. Akamai's strategy relies on demonstrating clear value propositions to enterprises, encouraging early adoption and building a strong customer base to justify the initial capital outlay.

- Strategic Positioning: By integrating these services into its existing edge and security portfolio, Akamai aims to offer a comprehensive and differentiated cloud solution. This strategic move allows them to compete more effectively with established cloud providers by offering enhanced security and performance benefits at the network edge.

AI Inference and Edge AI Capabilities

Akamai is leveraging its vast distributed network to facilitate AI inference at the edge, a critical move to address the growing demand for real-time AI processing. This positions them to capture a significant portion of the burgeoning AI workload market. For instance, the global edge computing market, which includes edge AI, was projected to reach hundreds of billions of dollars by 2028, with AI inference being a major driver.

This segment represents a high-growth opportunity for Akamai as AI adoption continues to surge across various sectors. The company's infrastructure is well-suited to handle the low-latency requirements of AI inference, a key differentiator. By 2024, the demand for efficient AI deployment at the edge was already a significant trend, with companies investing heavily in solutions that can process data closer to the source.

- Strategic Positioning: Akamai's distributed network is ideal for large-scale AI inference.

- Growth Potential: Accelerating AI adoption fuels immense growth prospects in this area.

- Competitive Landscape: It's an emerging, competitive space demanding continuous innovation.

- Market Share: Significant investment is needed to establish dominance and convert potential into market share.

Akamai's edge AI inference capabilities are a prime example of a question mark. The market is experiencing explosive growth, with edge AI projected to be a significant driver of the overall edge computing market, which is expected to reach hundreds of billions of dollars by 2028. Akamai's existing infrastructure positions it well to capitalize on this trend, as real-time AI processing at the edge is increasingly critical. However, Akamai's current market share in this nascent, highly competitive space is relatively small, necessitating substantial investment to gain a stronger foothold.

| Area | Market Growth Potential | Akamai's Current Position | Investment Need | Strategic Implication |

|---|---|---|---|---|

| Edge AI Inference | Very High (AI driving edge computing growth) | Low Market Share, High Potential | Significant Investment Required | Develop competitive edge AI solutions |

| Managed Kubernetes | High (Growing demand for cloud-native orchestration) | Emerging Player | Substantial Investment for Scale | Integrate with edge and security offerings |

| Public Cloud IaaS (Linode) | High (Continued cloud adoption) | Modest Market Share vs. Hyperscalers | Continued Investment for Market Share | Differentiate through edge integration |

BCG Matrix Data Sources

Our Akamai BCG Matrix leverages comprehensive data from financial reports, market research, and competitive analysis to accurately position each business unit.