Akamai Technologies Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Akamai Technologies Bundle

Akamai Technologies navigates a landscape shaped by intense rivalry and the constant threat of substitutes, particularly from cloud providers. Understanding the leverage of its powerful buyers and the moderate threat of new entrants is crucial for its sustained success.

The complete report reveals the real forces shaping Akamai Technologies’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of suppliers for Akamai Technologies is typically low. This is largely because Akamai relies on a wide array of standard hardware and software components, sourced from a fragmented supplier base rather than a few key players. For instance, in 2024, Akamai's diverse infrastructure needs mean they procure servers, networking equipment, and software from numerous vendors globally, preventing any single supplier from holding significant leverage.

While Akamai Technologies' core service hinges on sophisticated software and network design, the fundamental hardware components like servers, networking gear, and power infrastructure are generally considered commodities. This widespread availability of hardware means that individual suppliers of these basic inputs have limited leverage over Akamai, as the company can readily switch between providers if pricing or terms become unfavorable. For instance, in 2024, the global server market saw continued price competition among major manufacturers, reinforcing the commoditized nature of these essential inputs.

For Akamai, the bargaining power of suppliers is influenced by switching costs. While the company can source core infrastructure hardware from multiple vendors, leading to lower supplier power in that segment, the situation shifts with highly integrated software platforms or proprietary network technologies. If Akamai relies on specialized, hard-to-replace supplier solutions, those suppliers gain leverage.

However, Akamai actively works to reduce this dependency. The company's significant investment in developing its own proprietary software solutions is a key strategy to mitigate the bargaining power of software suppliers. This internal development capability allows Akamai to control its technology stack, thereby reducing reliance on external proprietary systems and lowering potential switching costs.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Akamai's core markets, like content delivery networks (CDNs) or cybersecurity, is quite low. These suppliers, often dealing in hardware or generic software, simply don't possess the deep technical know-how, extensive global infrastructure, or specialized expertise in edge computing and cybersecurity that Akamai has cultivated.

Building a comparable network and service offering would demand colossal investments and a substantial amount of time, making it an improbable strategic move for most of Akamai's suppliers.

- Low Threat: Suppliers generally lack the specialized infrastructure and expertise required for CDN and cybersecurity markets.

- High Barrier to Entry: Significant capital and time investment are needed to replicate Akamai's global network and capabilities.

- Akamai's Competitive Edge: Akamai's established global presence and deep expertise in edge computing and security create a formidable barrier.

Importance of Akamai to Suppliers

Akamai's substantial global network infrastructure makes it a significant customer for numerous hardware and software component providers. This scale of demand translates into a crucial revenue stream for many of these suppliers, affording Akamai considerable bargaining power when negotiating prices and contract terms.

For instance, in 2023, Akamai's capital expenditures, which include network infrastructure investments, were reported to be in the hundreds of millions of dollars, highlighting the volume of components it procures. This significant purchasing volume allows Akamai to negotiate favorable terms, as suppliers often prioritize securing such a large and consistent client.

However, the bargaining power dynamic can shift for very large, diversified suppliers. If Akamai represents only a minor fraction of a major technology conglomerate's total revenue, that supplier's reliance on Akamai is diminished, potentially lessening Akamai's leverage in negotiations.

- Significant Customer: Akamai's vast global network requires substantial hardware and software, making it a key client for many component suppliers.

- Revenue Stream: The scale of Akamai's procurement offers a vital revenue source for its suppliers, enhancing Akamai's negotiation leverage.

- Supplier Diversification: For suppliers with a broad customer base, Akamai's importance may be less pronounced, influencing the bargaining power balance.

Akamai's bargaining power with suppliers is generally low due to its reliance on a fragmented base of commodity hardware and software providers. In 2024, the company procures essential components like servers and networking equipment from numerous global vendors, preventing any single supplier from wielding significant influence. This broad sourcing strategy allows Akamai to readily switch providers if terms become unfavorable, reinforcing its leverage.

The commoditized nature of essential hardware, such as servers and networking gear, further limits supplier power. For instance, the continued price competition in the global server market throughout 2024 means Akamai can secure these inputs from various manufacturers at competitive rates. While specialized software or proprietary technologies could increase supplier leverage, Akamai mitigates this by investing in its own software development, thereby reducing reliance on external systems and associated switching costs.

| Supplier Characteristic | Impact on Akamai | Example (2024 Data/Trends) |

|---|---|---|

| Fragmented Supplier Base | Low Bargaining Power | Procurement of servers and networking equipment from numerous global vendors. |

| Commoditized Inputs | Low Bargaining Power | Price competition among server manufacturers limits individual supplier leverage. |

| Proprietary Technology Reliance | Potential for Increased Bargaining Power | Mitigated by Akamai's internal software development to reduce dependency. |

What is included in the product

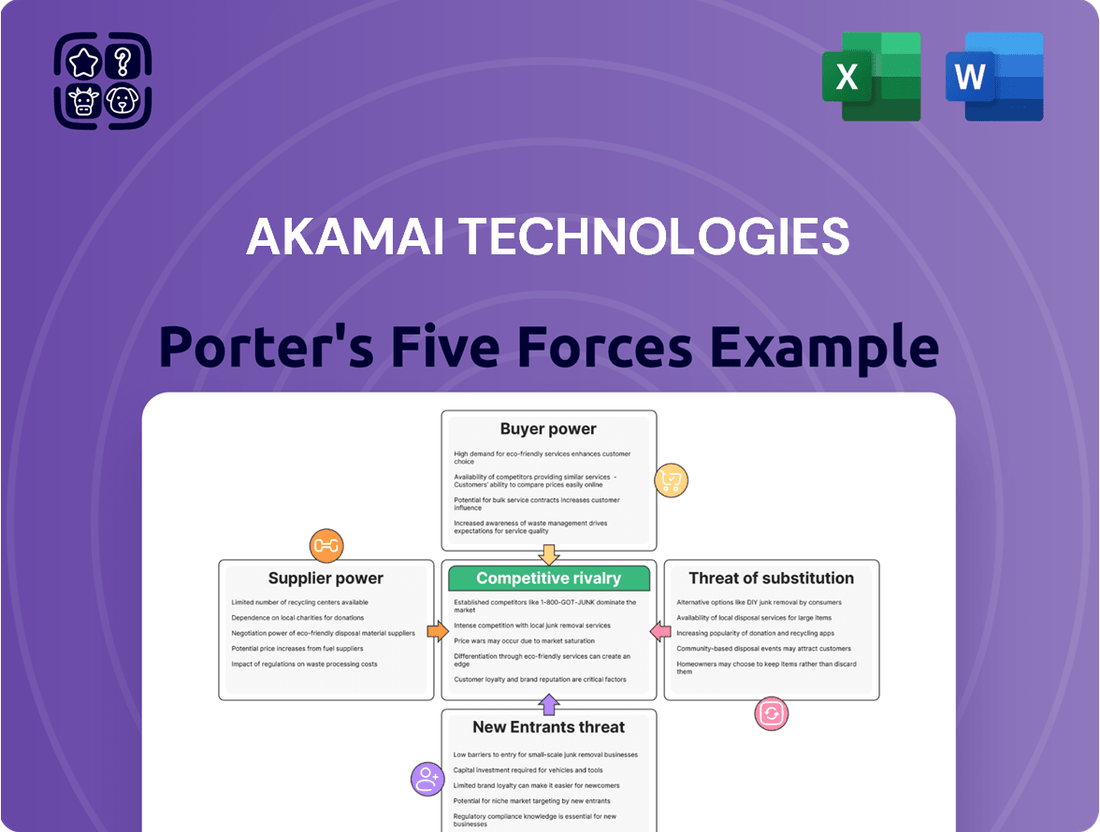

This Porter's Five Forces analysis for Akamai Technologies delves into the intense competition within the CDN and cybersecurity markets, buyer power of large enterprises, supplier power of network infrastructure providers, threat of new entrants, and the potential for substitute solutions.

Effortlessly visualize Akamai's competitive landscape, pinpointing key threats and opportunities with an intuitive, interactive dashboard.

Customers Bargaining Power

Akamai Technologies serves a diverse clientele, from massive corporations to smaller businesses across sectors like media, finance, and e-commerce. This broad reach is generally a positive, as it diversifies revenue streams.

However, the concentration of customers can shift the balance of power. A few very large clients, such as major streaming platforms or significant tech firms, could account for a substantial portion of Akamai's income. This concentration means these key customers wield considerable bargaining influence.

For instance, Akamai's Q1 2025 earnings report highlighted an anticipated decrease in revenue from its largest customer. This signals that the leverage held by such significant clients can directly impact Akamai's financial performance, underscoring the importance of managing these relationships carefully.

The bargaining power of Akamai's customers is a significant factor, often leaning towards moderate to high. This is primarily driven by the sheer number of substitute products and services available in the competitive Content Delivery Network (CDN) and cybersecurity landscapes.

Major players like Cloudflare, Amazon Web Services (AWS) CloudFront, Google Cloud CDN, and Microsoft Azure offer comparable solutions. These alternatives provide customers with viable options, allowing them to compare features, performance, and pricing across different providers.

This competitive environment empowers customers to negotiate more favorable terms and pricing with Akamai. For instance, a large enterprise might leverage quotes from multiple CDN providers to secure a better deal with Akamai, directly impacting Akamai's pricing power and profit margins.

While migrating from one Content Delivery Network (CDN) or cybersecurity provider to another can involve some technical complexity and integration efforts, the switching costs for Akamai's customers are generally not prohibitively high, particularly for those with robust in-house technical expertise. This means customers can more readily explore alternatives if they find Akamai's offerings or pricing unsatisfactory.

The increasing adoption of multi-CDN strategies by businesses, coupled with the prevalence of standardized APIs across the industry, further diminishes these switching costs. For instance, in 2024, many enterprises are actively diversifying their CDN providers to mitigate risks and optimize performance, making the technical hurdles of moving to a competitor less daunting.

Price Sensitivity of Customers

Customers in the Content Delivery Network (CDN) and cybersecurity sectors, particularly those managing substantial traffic volumes or operating under strict budgetary constraints, often exhibit significant price sensitivity. This is a key factor influencing Akamai Technologies' market position.

The increasing commoditization of fundamental CDN services, coupled with the fierce competition present in the market, frequently translates into considerable pricing pressure. Providers are often compelled to offer more competitive rates to attract and retain clients.

Consequently, customers tend to actively search for solutions that deliver strong value, balancing cost-effectiveness with their essential performance and security requirements. This dynamic directly impacts Akamai's pricing strategies and service offerings.

- Price Sensitivity Drivers: High-volume traffic users and budget-conscious organizations are key segments driving price sensitivity in the CDN market.

- Competitive Pricing Landscape: Intense competition and the commoditization of basic CDN features exert downward pressure on prices.

- Customer Demand for Value: Buyers seek solutions that optimize costs without compromising on critical performance and security standards.

- Akamai's Strategic Response: Akamai must continually balance competitive pricing with its advanced service offerings to meet customer demands.

Customer Information and Transparency

Customers today are highly informed, readily accessing detailed information on pricing, features, and performance benchmarks for various Content Delivery Network (CDN) and cybersecurity solutions. This widespread availability of data through market research reports, independent reviews, and direct competitor analysis empowers them to make well-informed choices and negotiate more assertively.

This transparency directly translates into increased bargaining power for customers. For instance, in 2024, many enterprise clients actively compared Akamai's offerings against those of rivals like Cloudflare and Amazon CloudFront, leveraging detailed performance metrics and pricing structures to secure more favorable terms. This competitive landscape means providers must continuously demonstrate value to retain business.

- Informed Decision-Making: Customers can easily compare Akamai's pricing and feature sets against competitors, leading to more informed purchasing decisions.

- Negotiating Leverage: Access to market data and competitor pricing gives customers significant leverage when negotiating contracts with Akamai.

- Switching Costs: While Akamai aims to increase switching costs, the availability of comparable services from competitors can mitigate this, allowing customers to switch if dissatisfaction arises.

The bargaining power of Akamai's customers is considerable, driven by a competitive market with numerous viable alternatives for Content Delivery Network (CDN) and cybersecurity services. Key providers like Cloudflare, AWS CloudFront, and Google Cloud CDN offer comparable solutions, empowering customers to negotiate favorable terms. This dynamic is further amplified by generally manageable switching costs for businesses, especially those with strong technical capabilities, allowing them to readily explore other options if Akamai's offerings are not competitive.

Customers, particularly large enterprises, are increasingly price-sensitive due to the commoditization of basic CDN features and intense market competition, which puts downward pressure on pricing. For example, many businesses in 2024 are actively adopting multi-CDN strategies, reducing reliance on a single provider and increasing their leverage. This informed customer base, armed with readily available performance data and competitor pricing, can negotiate more assertively, directly impacting Akamai's pricing power and profit margins.

| Factor | Impact on Akamai | Supporting Data/Trend |

|---|---|---|

| Availability of Substitutes | Moderate to High Bargaining Power | Competitors like Cloudflare, AWS CloudFront, Google Cloud CDN offer similar services. |

| Switching Costs | Low to Moderate Bargaining Power | Technical complexity is decreasing, especially for technically adept clients. Multi-CDN adoption in 2024 reduces lock-in. |

| Price Sensitivity | High Bargaining Power | Commoditization of basic CDN services and fierce competition lead to price pressure. High-volume users and budget-conscious clients are key drivers. |

| Customer Information | High Bargaining Power | Easy access to performance benchmarks and competitor pricing in 2024 empowers informed negotiation. |

Full Version Awaits

Akamai Technologies Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details Akamai Technologies' competitive landscape through Porter's Five Forces, analyzing the intense rivalry among content delivery networks and the growing threat of new entrants. The document also thoroughly examines the bargaining power of both buyers and suppliers, alongside the persistent threat of substitute services, providing a comprehensive strategic overview.

Rivalry Among Competitors

The content delivery network (CDN) and cybersecurity sectors are intensely competitive, featuring a broad array of companies. Akamai contends with major cloud infrastructure providers, including Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform, all of whom offer integrated CDN and security services.

Furthermore, Akamai must contend with specialized firms like Cloudflare, Fastly, and Imperva, each carving out significant market share with focused solutions. This multifaceted competitive environment, encompassing both hyperscale cloud providers and niche security specialists, significantly heightens the rivalry within the industry.

The content delivery network (CDN) market is booming, with an estimated compound annual growth rate (CAGR) of 11% projected from 2024 to 2029. This rapid expansion, coupled with the concurrent growth in the cybersecurity sector, fuels intense competition. While a growing market can sometimes ease competitive pressures, in this instance, it primarily acts as a magnet for new players and spurs existing companies to ramp up investments in innovation and aggressively pursue market share, thereby sustaining a high level of rivalry.

Akamai distinguishes itself through its expansive global network, robust security offerings, and a dedicated focus on enterprise clients like major streaming platforms and financial institutions. This broad reach and specialized service portfolio are key differentiators.

While Akamai leads in certain areas, rivals like Cloudflare offer compelling differentiation through integrated security and user-friendly interfaces. Amazon Web Services (AWS) leverages deep integration within its comprehensive cloud ecosystem as a significant competitive advantage.

For Akamai, actively maintaining and communicating its unique value proposition is paramount to sustaining its market position against these strong, specialized competitors. In 2024, Akamai continued to invest heavily in its Edge platform, aiming to further solidify its differentiation in performance and security for its enterprise customer base.

Exit Barriers

Exit barriers for Akamai Technologies are substantial, largely due to the immense capital expenditure required for its global network infrastructure and data centers. These significant sunk costs make it difficult and financially unappealing for companies to simply walk away from the content delivery network (CDN) and cybersecurity sectors. For instance, Akamai's extensive network of servers and edge computing facilities represents billions in investment, creating a strong incentive to continue operating and competing rather than abandoning these assets.

The specialized nature of the talent and technology involved also contributes to high exit barriers. Companies like Akamai invest heavily in cybersecurity expertise and proprietary software, which are not easily transferable or salvageable if a business decides to cease operations. This lock-in effect from specialized assets and human capital means that Akamai and its competitors are likely to remain engaged in the market, facing each other directly.

- High Capital Investment: Akamai's global infrastructure, including thousands of servers and data centers, represents a massive, largely irrecoverable investment.

- Specialized Expertise: The company relies on highly specialized talent in network engineering and cybersecurity, making it difficult to redeploy these resources elsewhere.

- Customer Relationships: Exiting the market would mean forfeiting established relationships with a vast array of enterprise clients who depend on Akamai's services.

- Brand and Reputation: Years of building a strong brand in CDN and security mean that a sudden exit could damage Akamai's reputation in other technology ventures.

Switching Costs for Customers

While Akamai Technologies customers do face some switching costs, these are generally not high enough to create significant lock-in. The existence of multiple competing content delivery network (CDN) providers and aggressive pricing from rivals means Akamai cannot solely rely on these costs to mitigate competitive rivalry.

For instance, in 2024, the CDN market is characterized by intense price competition, with providers like Cloudflare and Amazon CloudFront often offering competitive or even lower pricing tiers. This environment necessitates Akamai continuously proving its value proposition through performance, reliability, and advanced features, rather than depending on customer inertia.

- Customer Inertia: Some customers might hesitate to switch due to the effort involved in reconfiguring their services, even if alternatives are cheaper.

- Integration Efforts: The time and resources required to integrate a new CDN solution can act as a minor deterrent.

- Market Dynamics: Despite these costs, the prevalence of numerous alternatives and competitive pricing strategies means switching costs alone do not significantly dampen competitive rivalry.

- Value Demonstration: Akamai must consistently deliver superior performance and unique features to retain its customer base in this competitive landscape.

Akamai operates in a highly competitive landscape, facing pressure from both hyperscale cloud providers and specialized CDN and security firms. The rapid growth of these markets, with the CDN sector projected to grow at an 11% CAGR from 2024 to 2029, intensifies this rivalry. While Akamai differentiates through its extensive network and security focus, competitors like Cloudflare and AWS leverage integrated offerings and ecosystem advantages, forcing Akamai to continuously demonstrate its value.

The intense competition is further fueled by aggressive pricing strategies and continuous innovation from rivals. Akamai's ability to maintain its market position hinges on effectively communicating its unique value proposition, which includes its expansive global network and robust security features, particularly for enterprise clients. This dynamic environment necessitates ongoing investment and strategic positioning to counter the advantages of its diverse set of competitors.

| Competitor | Key Differentiators | Market Focus |

| Amazon Web Services (AWS) | Deep integration within its cloud ecosystem | Broad cloud services, including CDN and security |

| Microsoft Azure | Integration with Microsoft's enterprise software suite | Comprehensive cloud solutions |

| Google Cloud Platform | Advanced networking and data analytics capabilities | Cloud infrastructure and services |

| Cloudflare | Integrated security, user-friendly interface, competitive pricing | CDN, security, performance optimization |

| Fastly | Edge compute capabilities, developer-centric platform | Edge cloud services, CDN |

| Imperva | Specialized web application firewall (WAF) and data security | Application security, data security |

SSubstitutes Threaten

The most significant threat of substitutes for Akamai's services comes from the integrated cloud offerings of major providers. Companies already deeply embedded in ecosystems like Amazon Web Services (AWS), Google Cloud, or Microsoft Azure can leverage their native content delivery and security solutions. For instance, AWS CloudFront, Google Cloud CDN, and Azure CDN offer comparable functionalities, making it a natural choice for businesses already utilizing these platforms for their broader cloud infrastructure needs.

Large enterprises with substantial traffic and technical expertise might opt to develop their own content delivery networks, a do-it-yourself CDN approach. This alternative offers these companies complete control over their infrastructure and potentially reduced long-term expenses, presenting a direct substitute for Akamai's services.

Akamai has acknowledged that a segment of its major clients are indeed exploring or implementing these in-house CDN solutions. This trend indicates a growing willingness among large organizations to invest in their own infrastructure rather than relying solely on third-party providers.

Open-source Content Delivery Network (CDN) and proxy solutions present a viable threat of substitutes for Akamai Technologies. These alternatives, such as Nginx or Varnish Cache, allow businesses with in-house technical capabilities to build and manage their own CDN infrastructure, often at a significantly lower direct cost. For instance, while Akamai's revenue for Q1 2024 was $1.03 billion, many smaller or niche players might find the upfront and ongoing costs of Akamai prohibitive compared to deploying open-source options.

While these open-source solutions may not match Akamai's extensive global network, performance optimization, or advanced security features, they can effectively serve as substitutes for companies with less demanding requirements or specific technical expertise. The total market for CDN services was estimated to be around $20 billion in 2023, and a portion of this, particularly in the small to medium-sized business segment, could migrate to self-managed open-source solutions if cost savings are substantial enough.

However, it's crucial to note that the adoption of open-source CDNs necessitates significant internal investment in skilled personnel for implementation, ongoing maintenance, and security patching. This can offset the perceived cost advantage, especially when considering the total cost of ownership and the potential risks associated with managing such critical infrastructure without specialized vendor support.

Alternative Security Approaches

The threat of substitutes in the cybersecurity landscape for Akamai Technologies is moderate. While Akamai offers integrated edge security and DDoS mitigation, other solutions exist. These include traditional on-premise security appliances, standalone firewall providers, and specialized vendors focusing on niche security areas.

These substitutes can appeal to organizations with existing infrastructure or specific compliance needs that might favor a more piecemeal approach. For instance, some enterprises might rely heavily on hardware-based firewalls from vendors like Palo Alto Networks or Fortinet, viewing them as direct substitutes for certain aspects of Akamai's offering.

However, Akamai's strength lies in its unified platform that combines content delivery network (CDN) capabilities with security. This integration offers a distinct advantage by reducing complexity and improving performance, which can be a significant differentiator against point solutions. In 2023, Akamai reported that its security business revenue grew by 9% year-over-year, reaching $1.7 billion, indicating continued demand for its integrated security services despite the availability of alternatives.

- On-Premise Security Appliances: Traditional hardware solutions offering firewall, intrusion prevention, and other security functions.

- Specialized Cybersecurity Vendors: Companies focusing on specific security layers like endpoint protection, cloud security posture management, or identity and access management.

- Integrated Security Platforms: Competitors offering a broader suite of security services, though often not as tightly integrated with delivery networks as Akamai.

Performance Optimization Tools

While Akamai Technologies is a leader in Content Delivery Networks (CDNs), the threat of substitutes for web performance optimization exists. Businesses can employ various tools that offer partial solutions without being full CDNs.

These substitutes include website caching plugins, image optimization services, and basic load balancing solutions. For instance, many WordPress sites utilize caching plugins like WP Super Cache or W3 Total Cache to improve loading times by serving static versions of pages. Image optimization tools such as TinyPNG or ShortPixel compress images, reducing file sizes and speeding up delivery.

However, these alternatives generally lack the extensive global network infrastructure and advanced features that Akamai provides. Akamai's CDN, for example, offers distributed servers across numerous geographic locations, sophisticated traffic management, and security features that simpler tools cannot match. In 2024, the demand for faster website performance continues to grow, with studies showing that a one-second delay in page load time can decrease conversions by 7%. This underscores the need for robust solutions, making the comprehensive nature of CDNs like Akamai's a significant differentiator against these partial substitutes.

- Website Caching Plugins: Tools like WP Rocket or LiteSpeed Cache can significantly improve page load speeds by serving cached content, reducing server requests.

- Image Optimization Services: Platforms such as Cloudinary or ImageKit offer on-the-fly image resizing, compression, and format conversion, crucial for faster visual content delivery.

- Basic Load Balancing: Solutions like HAProxy or even cloud provider-native load balancers can distribute traffic across multiple servers, improving availability and response times, though without the global reach of a CDN.

- Akamai's Advantage: Akamai's CDN offers a vast, globally distributed network, advanced edge computing capabilities, and integrated security features that surpass the functionality of individual optimization tools.

The threat of substitutes for Akamai's core CDN services is primarily driven by major cloud providers offering integrated solutions. Companies already invested in platforms like AWS, Google Cloud, or Microsoft Azure can leverage their native Content Delivery Network (CDN) services, such as AWS CloudFront or Google Cloud CDN. This poses a significant challenge as these integrated offerings provide a seamless experience for businesses already utilizing these cloud ecosystems for their broader infrastructure needs.

Large enterprises with the technical expertise and scale may also consider building their own Content Delivery Networks (CDNs). This do-it-yourself approach grants them complete control over their infrastructure and potentially lower long-term operational costs. Akamai has noted that a portion of its major clients are indeed exploring or implementing these in-house CDN strategies, highlighting a growing trend towards self-sufficiency among large organizations.

Open-source CDN and proxy solutions, such as Nginx or Varnish Cache, represent another viable substitute. These options allow technically proficient businesses to establish and manage their own CDN infrastructure, often at a substantially lower direct cost compared to Akamai's services. While these open-source alternatives might not replicate Akamai's global reach or advanced security features, they can serve as effective substitutes for organizations with less demanding requirements or specific technical proficiencies.

| Substitute Type | Key Characteristics | Potential Impact on Akamai |

|---|---|---|

| Integrated Cloud CDNs | Native offerings from AWS, Google Cloud, Azure; seamless integration with existing cloud infrastructure. | High, especially for clients already heavily invested in these cloud ecosystems. |

| In-house/DIY CDNs | Full control, potential long-term cost savings; requires significant technical expertise and investment. | Moderate to High for large enterprises with the capacity to build and manage their own infrastructure. |

| Open-Source Solutions | Lower direct cost (e.g., Nginx, Varnish Cache); requires internal technical resources for management and maintenance. | Moderate, particularly for smaller businesses or those with specific technical capabilities seeking cost-efficiency. |

Entrants Threaten

The capital required to establish a competitive presence in the content delivery network (CDN) and advanced cybersecurity sectors is immense. Building a global infrastructure of servers, data centers, and the necessary software development demands significant upfront investment, acting as a formidable barrier for potential new entrants.

Akamai's extensive network, boasting over 300,000 servers strategically located in more than 130 countries, exemplifies this high capital requirement. This vast, established infrastructure makes it exceedingly difficult and costly for newcomers to replicate Akamai's reach and performance capabilities, thereby deterring new competition.

Established players like Akamai Technologies leverage substantial economies of scale, enabling them to offer competitive pricing and absorb significant operational expenditures. This scale advantage makes it difficult for newcomers to match their cost structure and service delivery capabilities.

Network effects are a crucial barrier, as Akamai's vast and interconnected infrastructure enhances performance and reliability. A larger network translates to better service, creating a virtuous cycle that attracts more customers and deters new entrants who cannot immediately offer comparable reach and quality.

While not insurmountable, customer switching costs do exist, and established brand loyalty to trusted providers like Akamai can deter new entrants. Akamai has cultivated a strong reputation for reliability, performance, and security over many years, making it a go-to for many businesses. For instance, Akamai's CDN services are critical for delivering content efficiently, and the effort to reconfigure and test a new provider can be substantial.

New entrants would need to offer compelling advantages, such as significantly lower pricing or demonstrably superior technology, to overcome this inertia and convince customers to switch. The perceived risk associated with migrating critical online infrastructure to an unproven provider is a significant barrier. In 2024, Akamai continued to invest heavily in its platform, further solidifying its position and increasing the challenge for newcomers.

Proprietary Technology and Expertise

Akamai's proprietary technology, particularly its intelligent edge platform and sophisticated routing algorithms, represents a formidable barrier. Developing comparable capabilities would require immense investment in research and development, making it difficult for new players to compete effectively.

The company's specialized cybersecurity solutions further enhance this entry barrier. Acquiring or replicating Akamai's advanced security expertise and intellectual property is a significant hurdle for potential competitors.

- Proprietary Technology: Akamai's intelligent edge platform and advanced algorithms are key differentiators.

- Intellectual Property: Significant investment in R&D has created a strong IP portfolio.

- Specialized Cybersecurity: Expertise in this area adds another layer of difficulty for new entrants.

Regulatory Hurdles and Compliance

The cybersecurity and data delivery sectors are heavily regulated, with global standards for data privacy and security. For instance, the General Data Protection Regulation (GDPR) in Europe and similar frameworks elsewhere impose strict requirements on how data is handled. Navigating these complex legal and compliance landscapes requires significant investment and expertise, creating a substantial barrier for potential new entrants.

These regulatory hurdles translate into considerable upfront costs and operational complexities. New companies must invest in legal counsel, compliance officers, and robust security infrastructure to meet mandates like those outlined in the California Consumer Privacy Act (CCPA). This financial and operational commitment can deter many aspiring competitors.

- Global Regulatory Landscape: Companies must comply with a patchwork of international data protection laws, such as GDPR and CCPA, impacting service delivery and data handling.

- Compliance Costs: Meeting these standards involves substantial investment in legal, technical, and operational resources, estimated to be millions for initial setup and ongoing maintenance.

- Time to Market: The lengthy process of achieving regulatory approval and establishing compliant operations can significantly delay a new entrant's ability to compete.

The threat of new entrants in Akamai's market remains moderate due to significant barriers. High capital requirements for global infrastructure, estimated in the hundreds of millions for a comparable network, alongside substantial R&D investment for proprietary technology, deter many. Furthermore, navigating complex global regulations like GDPR and CCPA adds considerable compliance costs and time-to-market delays.

| Barrier Type | Description | Estimated Impact on New Entrants |

|---|---|---|

| Capital Requirements | Building a global CDN infrastructure with thousands of servers requires significant investment. | Very High; hundreds of millions to billions USD. |

| Proprietary Technology & IP | Akamai's advanced edge platform and algorithms are protected by patents and continuous innovation. | High; requires substantial R&D to replicate. |

| Regulatory Compliance | Adherence to data privacy laws (e.g., GDPR, CCPA) necessitates significant legal and operational investment. | High; millions in initial setup and ongoing maintenance. |

| Network Effects & Brand Loyalty | Akamai's established user base and reputation create a strong competitive advantage. | Moderate to High; difficult to overcome without significant differentiation. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Akamai Technologies is built upon a robust foundation of data, including their annual reports and SEC filings, alongside industry-specific research from firms like Gartner and IDC.