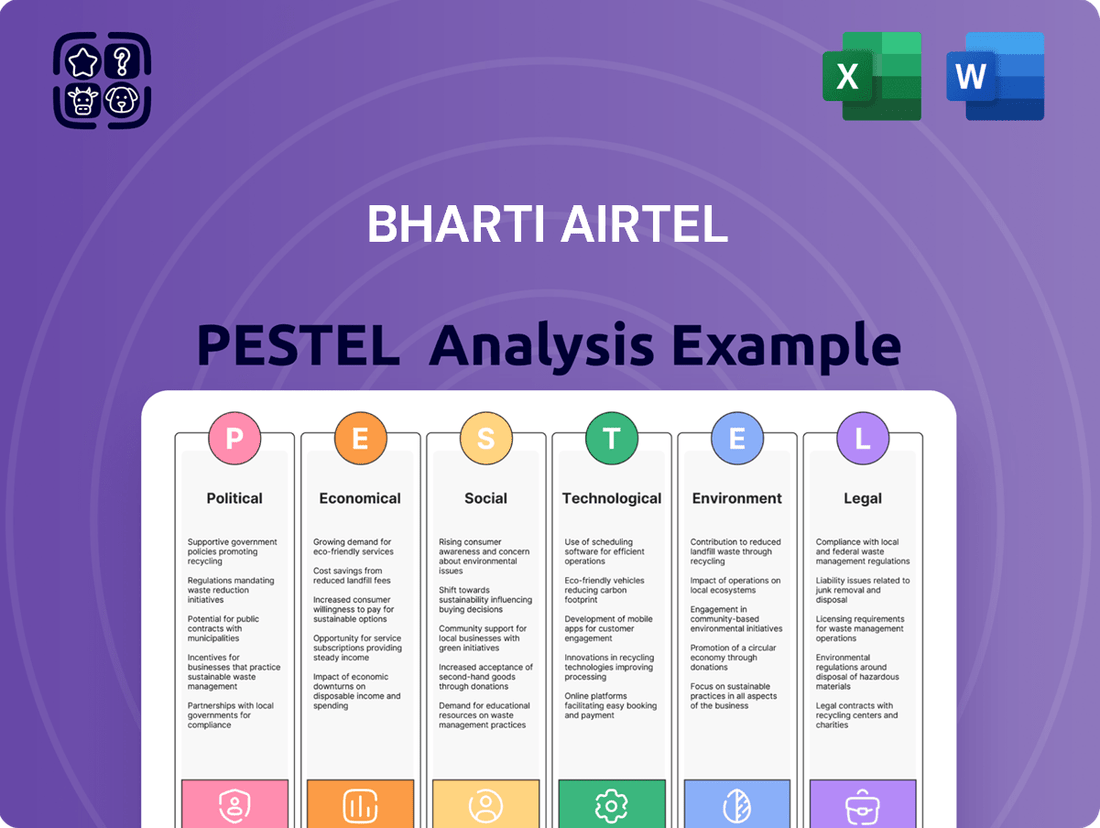

Bharti Airtel PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bharti Airtel Bundle

Uncover the critical Political, Economic, Social, Technological, Legal, and Environmental factors shaping Bharti Airtel's trajectory. Our expert-crafted PESTLE analysis provides a deep dive into these external forces, offering actionable intelligence to inform your strategic decisions. Gain a competitive edge by understanding the complete landscape. Download the full version now and equip yourself with the insights you need to succeed.

Political factors

Government regulations, particularly from the Telecom Regulatory Authority of India (TRAI) and the Department of Telecommunications (DoT), significantly influence Bharti Airtel's operations. For instance, the Indian government's Adjusted Gross Revenue (AGR) dues settlement process, which saw Bharti Airtel pay approximately ₹13,000 crore in early 2021, highlights the impact of regulatory decisions on financial health.

Recent policy adjustments and spectrum allocations directly impact the company's financial strategies and expansion plans. Bharti Airtel's participation in the 2022 spectrum auction, where it acquired 19,800 MHz spectrum for ₹8,396 crore, demonstrates how these allocations shape investment and service rollout strategies.

Compliance with these evolving frameworks is crucial for sustained growth and avoiding penalties. The ongoing focus on data privacy and net neutrality also necessitates continuous adaptation of operational practices and service offerings to align with regulatory expectations.

Spectrum availability and its pricing are critical political considerations for Bharti Airtel. The Indian government's policies regarding the allocation and cost of radio frequencies, particularly for advanced technologies like 5G, directly shape Airtel's ability to expand its network and execute its investment plans.

The Department of Telecommunications (DoT) held spectrum auctions in 2024, with Bharti Airtel acquiring spectrum across various bands. However, industry projections suggest that major telecom players, including Airtel, might adopt a more cautious approach to acquiring additional spectrum in 2025. This potential pause in aggressive spectrum investment stems from the substantial 5G spectrum holdings already secured and the ongoing rollout efforts, indicating a strategic shift towards network optimization rather than immediate expansion through new spectrum purchases.

Political stability in India is a cornerstone for attracting and retaining foreign direct investment, particularly within the dynamic telecom industry. The Indian government's commitment to programs like Digital India, coupled with ongoing telecom sector reforms, actively cultivates an environment conducive to growth for players like Bharti Airtel.

These policy frameworks directly incentivize the expansion of digital infrastructure and bolster the burgeoning digital services market, thereby enhancing investor sentiment and fueling the sector's overall trajectory. For instance, the Production Linked Incentive (PLI) scheme for telecom and networking products, launched in 2021, aims to boost domestic manufacturing and exports, creating a more robust ecosystem for companies operating in India.

National Telecom Policy 2025

The draft National Telecom Policy (NTP) 2025, released by India's Department of Telecommunications, positions the nation to become a leading 'telecom product nation.' This policy sets forth key strategic goals, including achieving universal connectivity, fostering innovation, boosting domestic manufacturing, and enhancing cybersecurity. Bharti Airtel's strategic planning must therefore align with these national aspirations to leverage the evolving regulatory landscape.

The NTP 2025 outlines ambitious targets, such as expanding 4G and 5G network coverage, generating significant employment opportunities, and substantially reducing the carbon footprint of the telecom sector by 2030. For Bharti Airtel, this presents a dual opportunity: to contribute to these national objectives while simultaneously expanding its service offerings and market reach.

- Universal Connectivity: The policy emphasizes extending telecom services to all corners of India, a mission Bharti Airtel is already actively pursuing through network expansion.

- Domestic Manufacturing: A focus on local production of telecom equipment could lead to supply chain efficiencies and cost reductions for Bharti Airtel.

- Innovation and 5G Rollout: The policy's drive for innovation will likely encourage faster adoption and development of new 5G services, benefiting operators like Airtel.

- Cybersecurity: Increased emphasis on cybersecurity measures will require operators to invest in robust security infrastructure, a critical area for customer trust.

International Relations and Geopolitics

International relations and geopolitical shifts significantly impact Bharti Airtel's operations, especially concerning currency fluctuations and market stability across its African footprint. For instance, ongoing regional conflicts or changes in trade agreements can directly affect the cost of imported technology and the repatriation of profits. In 2024, the company's exposure to markets like Nigeria and Kenya means it must navigate the economic consequences of evolving regional alliances and potential trade disputes.

Geopolitical uncertainties present tangible risks to Bharti Airtel's international expansion and investment plans. Tensions in the Middle East, for example, can indirectly influence global energy prices, impacting operational costs for its infrastructure. While Bharti Airtel has demonstrated adaptability, a sudden escalation of a regional conflict could disrupt supply chains for network equipment or lead to increased security expenditures, potentially affecting its 2025 growth projections in key African markets.

- Currency Volatility: Fluctuations in currencies like the Nigerian Naira and Kenyan Shilling, driven by geopolitical events, directly impact Bharti Airtel's reported earnings and the cost of capital.

- Supply Chain Disruptions: Geopolitical instability can hinder the timely and cost-effective delivery of essential network infrastructure components, affecting network upgrades and expansion timelines.

- Investment Climate: Unfavorable geopolitical developments can deter foreign direct investment into the African telecommunications sector, potentially limiting Bharti Airtel's access to crucial funding for future growth.

Government policies, especially those from the Telecom Regulatory Authority of India (TRAI) and the Department of Telecommunications (DoT), heavily influence Bharti Airtel. Recent spectrum auctions, like the one in 2024 where Airtel acquired spectrum, demonstrate how these allocations shape investment and rollout strategies. The draft National Telecom Policy (NTP) 2025 aims for universal connectivity and domestic manufacturing, aligning with Airtel's expansion and operational efficiency goals.

Political stability in India fosters foreign investment in the telecom sector, supported by government initiatives like Digital India and sector reforms. The NTP 2025, with its focus on 4G/5G expansion and job creation, presents opportunities for Bharti Airtel to align its growth with national objectives.

Geopolitical shifts impact Bharti Airtel's African operations, affecting currency stability and the cost of imported technology. For instance, currency volatility in markets like Nigeria and Kenya in 2024 directly influences reported earnings and capital costs.

These geopolitical uncertainties pose risks to international expansion and investment, potentially disrupting supply chains for network equipment and increasing security expenses, which could affect 2025 growth projections in key African markets.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Bharti Airtel's operations across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers strategic insights into market dynamics and regulatory landscapes, enabling stakeholders to identify opportunities and mitigate risks for informed decision-making.

A concise Bharti Airtel PESTLE analysis that highlights key external factors, acting as a pain point reliever by providing actionable insights for strategic decision-making and risk mitigation.

This PESTLE analysis for Bharti Airtel is designed to relieve the pain of complex market understanding by offering a clear, segmented view of political, economic, social, technological, legal, and environmental influences, enabling faster and more informed strategic adjustments.

Economic factors

Bharti Airtel's performance is intrinsically tied to the economic trajectory of India. The nation's robust economic expansion, with an anticipated GDP growth of 6.5% for FY 2024-25, provides a fertile ground for the telecom industry's development. This positive economic environment directly translates to increased consumer spending and business investment in telecommunications services, benefiting Airtel.

Furthermore, the strategic vision outlined in the National Telecom Policy 2025 is a significant tailwind. This policy aims to substantially boost the telecom sector's contribution to India's GDP, potentially doubling it. Such a supportive economic policy framework signals a favorable outlook for telecom operators like Bharti Airtel, encouraging further investment and innovation within the sector.

Bharti Airtel has showcased robust financial health, with its Q4 FY2024-25 results highlighting substantial revenue and net profit increases. This strong performance is attributed to the company's solid footing in the Indian market and the positive impact of recent tariff adjustments.

Specifically, in Q4 FY2024-25, Bharti Airtel's revenue experienced a significant jump of 24.97%, reaching ₹48,419.70 crore. Concurrently, the company's net profit saw an impressive surge of 432.04%, amounting to ₹11,021.80 crore during the same quarter, underscoring its enhanced profitability.

Average Revenue Per User (ARPU) is a critical indicator for telecom companies like Bharti Airtel. The company reported a significant increase in its ARPU, reaching ₹245 in the fourth quarter of fiscal year 2025. This marks a substantial rise from the ₹209 recorded in the same period of the previous fiscal year.

This upward trend in ARPU is largely attributed to strategic tariff increases implemented by Bharti Airtel. Such hikes directly bolster the company's financial health, leading to enhanced cash flows and improved profitability, which are vital for continued investment and growth in the competitive telecom landscape.

Capital Expenditure and Debt Management

Bharti Airtel's capital expenditure (capex) saw a significant surge in FY2024, largely driven by the aggressive expansion of its 5G network across India. This strategic investment is projected to moderate in fiscal years 2025 and 2026 as the initial rollout phase matures.

Concurrently, the company has made substantial progress in managing its debt obligations. Bharti Airtel's focus on deleveraging its balance sheet has resulted in a notable decrease in its net debt to EBITDA ratio. This improvement is a direct outcome of robust operational performance and consistent free cash flow generation, strengthening its financial foundation.

- FY2024 Capex Peak: Bharti Airtel's capital expenditure reached its highest point in FY2024, fueled by the rapid deployment of 5G services.

- Projected Capex Moderation: The company anticipates a slight easing of capex in FY2025 and FY2026 following the initial 5G rollout intensity.

- Deleveraging Success: Bharti Airtel has successfully reduced its net debt to EBITDA ratio, indicating a healthier balance sheet.

- Cash Flow Support: Strong operational results and positive free cash flow generation have been instrumental in supporting the company's debt reduction efforts.

Market Competition and Pricing Pressure

The Indian telecom landscape, characterized by intense rivalry among major players like Bharti Airtel, Reliance Jio, and Vodafone Idea, continues to exert significant pricing pressure. While recent tariff adjustments have improved Average Revenue Per User (ARPU), the competitive environment demands continuous strategic pricing adjustments and a broader range of services to retain and grow subscriber bases.

Bharti Airtel, alongside its competitors, faces the challenge of balancing revenue generation with subscriber acquisition in a price-sensitive market. For instance, in Q4 FY24, Bharti Airtel reported an ARPU of ₹209, a notable increase, yet the need to offer competitive data and voice plans remains paramount. This dynamic necessitates innovation in service bundles and a focus on customer retention strategies.

- Intense Competition: The Indian telecom market is an oligopoly with Bharti Airtel, Reliance Jio, and Vodafone Idea holding substantial market share.

- ARPU Growth vs. Pricing Pressure: While ARPU has seen increases, ongoing competition limits the extent of further tariff hikes.

- Strategic Imperatives: Diversified service offerings beyond basic voice and data, such as enterprise solutions and digital services, are crucial for market differentiation and sustained growth.

- Subscriber Acquisition Costs: Aggressive pricing by competitors can increase the cost of acquiring new subscribers, impacting profitability.

India's economic growth, projected at 6.5% for FY 2024-25, directly fuels telecom demand, boosting Bharti Airtel's revenue. The National Telecom Policy 2025 aims to double the sector's GDP contribution, creating a favorable environment for investment and innovation.

Bharti Airtel's financial performance in Q4 FY2024-25 was strong, with revenue up 24.97% to ₹48,419.70 crore and net profit soaring 432.04% to ₹11,021.80 crore, driven by strategic tariff adjustments and increased ARPU to ₹245.

The company's capital expenditure peaked in FY2024 for 5G rollout but is expected to moderate in FY2025-26. Bharti Airtel has also successfully reduced its net debt to EBITDA ratio through strong operational performance and free cash flow generation.

| Metric | Q4 FY2024-25 | Q4 FY2023-24 | YoY Change |

|---|---|---|---|

| Revenue (₹ crore) | 48,419.70 | 38,745.60 | 24.97% |

| Net Profit (₹ crore) | 11,021.80 | 2,070.00 | 432.04% |

| ARPU (₹) | 245 | 209 | 17.22% |

Same Document Delivered

Bharti Airtel PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, detailing Bharti Airtel's PESTLE analysis.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive PESTLE breakdown for Bharti Airtel.

The content and structure shown in the preview is the same document you’ll download after payment, offering a complete PESTLE analysis of Bharti Airtel's operational environment.

Sociological factors

Bharti Airtel is actively working to bridge the digital divide, with a stated goal of positively impacting 150 million lives by 2025 through the expansion of its 4G and 5G networks into previously underserved areas. This commitment directly addresses the rising demand for digital services across India.

The surge in smartphone ownership, projected to reach over 1 billion by 2026 according to various industry reports, coupled with escalating data consumption per user, creates a substantial growth avenue for Airtel. This increasing reliance on digital platforms for communication, entertainment, and essential services fuels the demand for robust and accessible connectivity solutions.

Consumer behavior is rapidly shifting towards higher data consumption and a greater reliance on digital services. This fundamental change directly fuels the demand for robust mobile and broadband infrastructure, which Bharti Airtel is well-positioned to meet. As of early 2024, India's average mobile data consumption per user has surpassed 20 GB per month, a significant increase year-over-year, highlighting this trend.

This evolving landscape presents a clear opportunity for Bharti Airtel, as it offers a comprehensive suite of services including high-speed mobile (4G and 5G), home broadband, and digital TV. The company's strategic focus on upgrading feature phone users to smartphones is particularly astute, directly tapping into this growing digital adoption and increasing data usage among a wider demographic.

The gap in digital access between urban and rural India presents a significant sociological challenge. While cities are quickly embracing high-speed internet and advanced mobile services, many rural communities still lag behind, impacting education, healthcare, and economic opportunities.

Bharti Airtel's strategic push to extend 5G coverage to all towns and crucial rural locations by March 2024 directly tackles this urban-rural divide. This initiative is key to fostering inclusive growth and ensuring that the benefits of digital transformation reach every corner of the nation, aiming for universal connectivity.

Growth of Mobile Commerce and Digital Payments

Bharti Airtel's expansion into mobile commerce and payment bank services directly taps into a profound sociological trend: the widespread adoption of digital financial transactions. This reflects a growing consumer comfort and dependence on mobile platforms for managing money. For instance, in India, the digital payments market saw a significant surge, with transaction volumes reaching an estimated INR 3.7 trillion (approximately $44.5 billion USD) in FY24, a testament to this societal shift.

This increasing reliance on mobile-based financial solutions is a key driver for Airtel's strategy. The company's payment bank, Airtel Payments Bank, has been instrumental in this, onboarding millions of users and facilitating a vast number of transactions. By August 2024, Airtel Payments Bank had surpassed 100 million customers, showcasing the immense trust and utility consumers find in these digital channels for everyday financial needs.

- Societal Shift: Growing comfort and preference for digital financial transactions over traditional methods.

- Mobile-First Approach: Consumers increasingly use smartphones for banking, payments, and commerce.

- Financial Inclusion: Mobile payment services are expanding access to financial services for previously unbanked or underbanked populations.

- E-commerce Growth: The rise of online shopping is intrinsically linked to the ease and security of mobile payment options.

Workforce Diversity and Inclusion

Bharti Airtel, through its subsidiary Nxtra, is making significant strides in workforce diversity. The company has set a target to achieve at least 20% women employees by the financial year ending March 2025. This commitment reflects a broader societal push for gender equality in the corporate world.

This focus on diversity extends beyond just numbers; it's about fostering an inclusive environment where diverse talents can thrive. Initiatives like the 'NxtWave' program are designed to develop and empower employees from various backgrounds, aligning with Bharti Airtel's social responsibility goals.

- Targeted Gender Diversity: Aiming for a minimum of 20% women employees by FY ending March 2025.

- Talent Development: Programs like 'NxtWave' focus on nurturing diverse talent.

- Social Responsibility: Demonstrating a commitment to equitable representation and opportunity.

- Inclusion Focus: Creating an environment where all employees feel valued and can contribute fully.

Bharti Airtel's commitment to bridging the digital divide is evident in its expansion efforts, aiming to impact 150 million lives by 2025 through enhanced 4G and 5G networks in underserved regions. This directly addresses India's increasing demand for digital services, as smartphone penetration is projected to exceed 1 billion by 2026, driving higher data consumption per user.

The company is also leveraging the societal shift towards digital financial transactions, with its Airtel Payments Bank surpassing 100 million customers by August 2024. This growth mirrors the broader Indian digital payments market, which reached an estimated INR 3.7 trillion in FY24, underscoring the public's increasing reliance on mobile platforms for financial management.

Furthermore, Bharti Airtel is actively pursuing workforce diversity, targeting at least 20% women employees by the financial year ending March 2025, reflecting a societal emphasis on gender equality in the corporate sector.

Technological factors

Bharti Airtel's aggressive 5G network expansion is a key technological driver. The company achieved its goal of pan-India 5G coverage by March 2024, a significant milestone.

Airtel has deployed over 300,000 5G sites and continues to expand its 5G Plus services, offering faster speeds and improved connectivity to a growing user base across India.

This rapid rollout positions Airtel to capitalize on the increasing demand for high-speed mobile data, enabling new services and enhancing customer experience.

Bharti Airtel is significantly expanding its home broadband offerings by utilizing 5G Fixed-Wireless Access (FWA). This technology is crucial for delivering the high-speed internet demanded by consumers and businesses alike, enabling Airtel to reach areas where traditional fiber deployment is challenging or costly.

The company is actively investigating and implementing cost-effective solutions to enhance FWA capabilities. This includes the strategic use of millimeter-wave (mmWave) spectrum, which offers immense capacity but faces limitations in range. By optimizing mmWave deployment, Airtel aims to overcome these constraints and unlock substantial growth potential within its FWA services.

Bharti Airtel's DTH and mobile commerce platforms showcase its tech adaptability. The company's Airtel Payments Bank, launched in 2017, has grown significantly, processing over ₹1.2 lakh crore in transactions by March 2024, highlighting the increasing reliance on digital financial services.

These evolving platforms, integrating features like seamless mobile payments and enhanced content delivery on DTH, are vital for Airtel's competitive edge. The ongoing advancements in digital TV technology, such as 4K streaming and interactive services, coupled with the expansion of mobile commerce capabilities, directly address evolving consumer preferences for integrated digital experiences.

Emerging Technologies: AI, IoT, and Quantum Communications

Bharti Airtel's strategic roadmap is heavily influenced by the National Telecom Policy 2025, which emphasizes the critical role of advanced technologies like Artificial Intelligence (AI), the Internet of Things (IoT), and Quantum Communications. To maintain its competitive edge and unlock novel revenue streams, Airtel must proactively embed these burgeoning technologies across its service offerings and internal operations.

The integration of AI, for instance, can significantly enhance customer experience through personalized services and predictive network management. Similarly, the expansion of IoT networks presents substantial opportunities for Airtel to provide connectivity solutions for a rapidly growing ecosystem of connected devices, a market projected for significant growth in the coming years.

Quantum Communications, while still in its nascent stages, represents a future frontier for secure and high-speed data transmission. Airtel's early exploration and potential investment in this area could position it as a leader in next-generation secure communication infrastructure.

- AI Integration: Bharti Airtel is leveraging AI for network optimization and customer service, aiming to improve operational efficiency and personalize user experiences.

- IoT Expansion: The company is actively building its IoT capabilities to support a wide range of connected devices, targeting sectors like smart cities and industrial automation.

- Quantum Communications Exploration: Airtel is monitoring advancements in quantum communication, recognizing its potential for ultra-secure and high-capacity data transfer in the future.

Network Virtualization and Software-Defined Networks (SDN)

The Draft National Telecom Policy 2025 actively promotes the adoption of Network Virtualization and Software-Defined Networks (SDN). This policy shift is a significant technological factor for Bharti Airtel.

By integrating these advanced networking concepts, Bharti Airtel can create more flexible, cost-effective, and easily manageable network infrastructures. This agility is paramount for handling the exponential growth in data consumption and for launching innovative services like 5G and IoT.

Key benefits for Bharti Airtel include:

- Enhanced Network Agility: Faster deployment of new services and network upgrades.

- Improved Efficiency: Optimized resource utilization and reduced operational costs through automation.

- Scalability: Ability to seamlessly scale network capacity to meet surging demand.

Bharti Airtel's technological advancements are central to its strategy, particularly its rapid 5G rollout, achieving pan-India coverage by March 2024 with over 300,000 5G sites deployed.

The company is leveraging 5G Fixed-Wireless Access (FWA) for home broadband, utilizing mmWave spectrum to enhance capacity and reach, demonstrating a commitment to innovative connectivity solutions.

Airtel's digital platforms, including Airtel Payments Bank which processed over ₹1.2 lakh crore by March 2024, highlight its adaptation to the growing demand for integrated digital financial and entertainment experiences.

Bharti Airtel is actively integrating AI for network optimization and personalized customer service, while also expanding its IoT capabilities to support a growing ecosystem of connected devices, aligning with the National Telecom Policy 2025's focus on advanced technologies.

The company is also exploring quantum communications, a future-oriented technology for secure data transmission, and adopting Network Virtualization and Software-Defined Networks (SDN) for greater network agility and efficiency.

Legal factors

Bharti Airtel navigates a dynamic telecom regulatory landscape governed by India's Telecom Regulatory Authority of India (TRAI) and the Department of Telecommunications (DoT). This necessitates strict adherence to licensing conditions and spectrum allocation rules, crucial for maintaining operational continuity and avoiding substantial financial penalties.

In 2024, the Indian government continued its focus on spectrum availability and pricing, with potential auctions influencing capital expenditure for telcos like Airtel. For instance, the government aims to make more spectrum available, particularly in the mid-band and millimeter-wave frequencies, to support 5G expansion.

The legal framework for spectrum auctions, including assignment, payment, and surrender terms, significantly shapes Bharti Airtel's investment choices and financial commitments. For instance, the Department of Telecommunications (DoT) sets these rules, and the earnest money deposits submitted by telcos like Airtel in the 2024 auctions, totaling ₹20,500 crore for Bharti Airtel, underscore the substantial legal and financial obligations involved in acquiring spectrum rights.

Data protection regulations, like India's proposed Digital Personal Data Protection Act, 2023, which is expected to be fully implemented and enforced in 2024-2025, significantly shape how Bharti Airtel manages its vast customer information. The company must ensure rigorous compliance with these laws to safeguard customer privacy and avoid substantial penalties, which could impact its operational costs and reputation.

Antitrust Laws and Competition Commission Oversight

Antitrust laws and the Competition Commission of India's (CCI) oversight play a vital role in ensuring a level playing field in the telecommunications industry, preventing any single player from dominating unfairly. Bharti Airtel's operations are closely watched to maintain healthy competition and deter any practices that could stifle market rivals.

The CCI actively scrutinizes mergers, acquisitions, and pricing strategies within the telecom sector. For instance, in 2023, the CCI approved Bharti Airtel's acquisition of a 49% stake in its subsidiary, Airtel Digital Limited, subject to certain conditions, highlighting ongoing regulatory scrutiny. This vigilance aims to protect consumer interests and promote innovation by ensuring smaller players can also thrive.

Bharti Airtel's market share, which stood at approximately 32% as of early 2024, places it as a significant player, making regulatory oversight particularly important. The CCI's interventions can influence market dynamics, impacting pricing, service offerings, and infrastructure sharing agreements.

- Regulatory Scrutiny: The CCI's mandate includes investigating and penalizing anti-competitive practices.

- Market Share Impact: Bharti Airtel's substantial market presence necessitates adherence to antitrust regulations.

- Consumer Protection: Oversight ensures fair pricing and service quality for consumers.

- Fair Competition: Regulations prevent monopolistic tendencies and encourage a competitive telecom environment.

Consumer Protection Laws and Service Quality Standards

Bharti Airtel operates under a strict framework of consumer protection laws and service quality standards mandated by regulatory bodies like the Telecom Regulatory Authority of India (TRAI). These regulations ensure fair practices and protect subscriber interests.

Compliance with these legal factors directly influences Bharti Airtel's operational strategies and financial performance. For instance, TRAI's quality of service (QoS) regulations, which include parameters like call drop rates and network availability, can lead to penalties if not met. In 2023, TRAI reported that telecom operators, including Airtel, were largely meeting stipulated QoS parameters, though specific regional variations can still occur.

Key legal obligations for Bharti Airtel include:

- Adherence to TRAI's Quality of Service (QoS) benchmarks: This involves meeting targets for network performance, customer service response times, and complaint resolution. For example, TRAI mandates a maximum of 0.5% call drop rate in metros and 1% in other areas.

- Fair trade practices and transparency: Ensuring truthful advertising, clear billing, and ethical sales practices are paramount to avoid legal challenges and maintain customer trust.

- Customer grievance redressal mechanisms: Establishing robust systems for handling customer complaints efficiently and transparently is a legal requirement, impacting customer satisfaction and potential regulatory scrutiny.

Bharti Airtel's legal landscape is heavily shaped by telecom-specific regulations and broader data protection laws. The company must diligently adhere to spectrum allocation rules and licensing conditions set by India's TRAI and DoT, with significant financial implications for non-compliance. For instance, Bharti Airtel submitted ₹20,500 crore in earnest money for spectrum auctions in 2024, highlighting the substantial legal and financial commitments involved in acquiring spectrum rights.

The evolving data protection framework, including the Digital Personal Data Protection Act, 2023, which is expected to be fully enforced by 2024-2025, mandates stringent management of customer data. Furthermore, antitrust laws and the Competition Commission of India's oversight are critical, especially given Bharti Airtel's market share of approximately 32% as of early 2024, influencing pricing and competitive practices.

| Legal Factor | Key Obligation | Example/Data Point (2023-2025) |

|---|---|---|

| Spectrum Allocation & Licensing | Adherence to TRAI/DoT rules | Bharti Airtel's ₹20,500 crore earnest money for 2024 spectrum auctions |

| Data Protection | Compliance with DPDP Act, 2023 | Ensuring rigorous customer data management for full enforcement by 2024-2025 |

| Antitrust & Competition | Fair trade practices, avoiding monopolistic tendencies | CCI approval of Airtel's 49% stake in Airtel Digital Limited (2023) subject to conditions; Airtel's ~32% market share (early 2024) |

| Consumer Protection & QoS | Meeting TRAI's Quality of Service benchmarks | Adherence to max 0.5% call drop rate in metros; TRAI reporting general compliance in 2023 |

Environmental factors

Bharti Airtel is actively addressing climate change, targeting a significant 50.2% reduction in its Scope 1 and 2 carbon emissions by the fiscal year ending March 2031, relative to its FY 2020-21 baseline. This commitment aligns with its broader ambition to achieve net-zero carbon emissions by 2050, a goal supported by aligning with the Science-Based Targets initiative (SBTi).

Bharti Airtel, through its data center subsidiary Nxtra by Airtel, is making substantial strides in adopting renewable energy for its operations. This strategic shift is crucial for reducing its environmental footprint and aligning with global sustainability goals.

Nxtra has set an ambitious target to power 100% of its electricity consumption from renewable sources. Demonstrating this commitment, the company achieved a significant milestone by transitioning to 220,541 MWh of renewable energy usage in its operations during FY 2023-24. This represents a remarkable 41% increase compared to the previous fiscal year, showcasing accelerated progress in their green energy initiatives.

Bharti Airtel is dedicated to responsible e-waste management, selling discarded electronics to authorized recyclers and refurbishers. This commitment directly supports circular economy principles, aiming to minimize the environmental footprint of its operations and product lifecycle.

In 2023, the global e-waste generation reached an estimated 62 million metric tons, highlighting the critical need for such practices. Airtel's approach helps divert waste from landfills and promotes resource recovery, aligning with growing regulatory pressures and consumer expectations for sustainability.

Environmental Regulations and Infrastructure Projects

Environmental regulations are a key consideration for Bharti Airtel's infrastructure development, impacting everything from tower construction to data center operations. These rules often dictate how Airtel can expand its network and manage its energy consumption, pushing for more sustainable practices. For instance, compliance with India's National Green Tribunal mandates or similar directives in other operating countries can influence site selection and construction methods for new cell towers and fiber optic cable laying.

Bharti Airtel is actively investing in improving its network's energy efficiency to meet environmental standards and reduce its carbon footprint. This includes deploying more energy-efficient equipment and optimizing network operations. In 2023, the company reported a significant reduction in its Scope 1 and Scope 2 emissions, a testament to these efforts. This focus on efficiency is crucial for long-term operational cost savings and maintaining a positive environmental image.

- Network Efficiency Investments: Bharti Airtel's commitment to reducing its environmental impact is evident in its ongoing investments in energy-efficient network technologies, aiming to lower carbon emissions.

- Compliance with National Policies: The company actively ensures adherence to national environmental policies and regulations across its operating regions, which can influence infrastructure project timelines and costs.

- Data Center Sustainability: Expansion and operation of data centers, critical for 5G services, are subject to environmental scrutiny, requiring Airtel to implement sustainable cooling and power management solutions.

- Renewable Energy Adoption: Bharti Airtel is increasingly exploring and adopting renewable energy sources, such as solar power, for its base stations and facilities to align with global sustainability goals and reduce reliance on fossil fuels.

Sustainable Supply Chain Management

Bharti Airtel actively pursues sustainable supply chain management, a crucial aspect of its environmental strategy. The company prioritizes responsible sourcing, aiming to integrate eco-friendly practices throughout its network of suppliers and partners. This focus is critical in an industry reliant on extensive infrastructure and equipment, where environmental impact can be significant.

A key indicator of this commitment is Bharti Airtel's emphasis on local procurement. In 2023-2024, the company achieved approximately 99% local procurement for its operational needs, significantly reducing the carbon footprint associated with transportation and logistics. This strategy not only supports local economies but also enhances supply chain resilience and reduces environmental risks.

This dedication to sustainable sourcing extends Bharti Airtel's environmental responsibility beyond its direct operations. By fostering sustainable practices throughout its value chain, the company influences a broader ecosystem. This includes encouraging suppliers to adopt energy-efficient technologies and waste reduction methods, contributing to a more circular economy within the telecommunications sector.

- Local Procurement: Achieved approximately 99% local procurement in the 2023-2024 fiscal year, minimizing transportation emissions.

- Supplier Engagement: Actively promotes sustainable practices among its suppliers, encouraging energy efficiency and waste reduction.

- Value Chain Impact: Extends environmental responsibility beyond direct operations to its entire supply network.

- Industry Influence: Aims to drive broader adoption of sustainable sourcing within the telecommunications industry.

Bharti Airtel is making significant strides in environmental sustainability, notably aiming for a 50.2% reduction in Scope 1 and 2 carbon emissions by FY2031 from an FY2020-21 baseline, aligning with its net-zero goal by 2050. Its data center arm, Nxtra, is aggressively pursuing 100% renewable energy usage, achieving 220,541 MWh in FY2023-24, a 41% year-on-year increase. The company also prioritizes responsible e-waste management, selling discarded electronics to authorized recyclers, a practice increasingly vital given the global rise in e-waste, which reached an estimated 62 million metric tons in 2023.

| Environmental Initiative | Target/Status | Fiscal Year | Key Metric |

|---|---|---|---|

| Scope 1 & 2 Carbon Emission Reduction | 50.2% reduction | FY2030-31 | vs FY2020-21 baseline |

| Net-Zero Carbon Emissions | Achieve by | 2050 | Aligned with SBTi |

| Nxtra Renewable Energy Usage | 100% of electricity consumption | Ongoing | Target for data centers |

| Nxtra Renewable Energy Usage | 220,541 MWh | FY2023-24 | 41% increase YoY |

| Local Procurement | ~99% | FY2023-24 | For operational needs |

PESTLE Analysis Data Sources

Our Bharti Airtel PESTLE Analysis is built on a foundation of comprehensive data from official government reports, reputable financial institutions, and leading industry research firms. We integrate insights from economic indicators, regulatory updates, technological advancements, and socio-cultural trends to provide a holistic view.