Bharti Airtel Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bharti Airtel Bundle

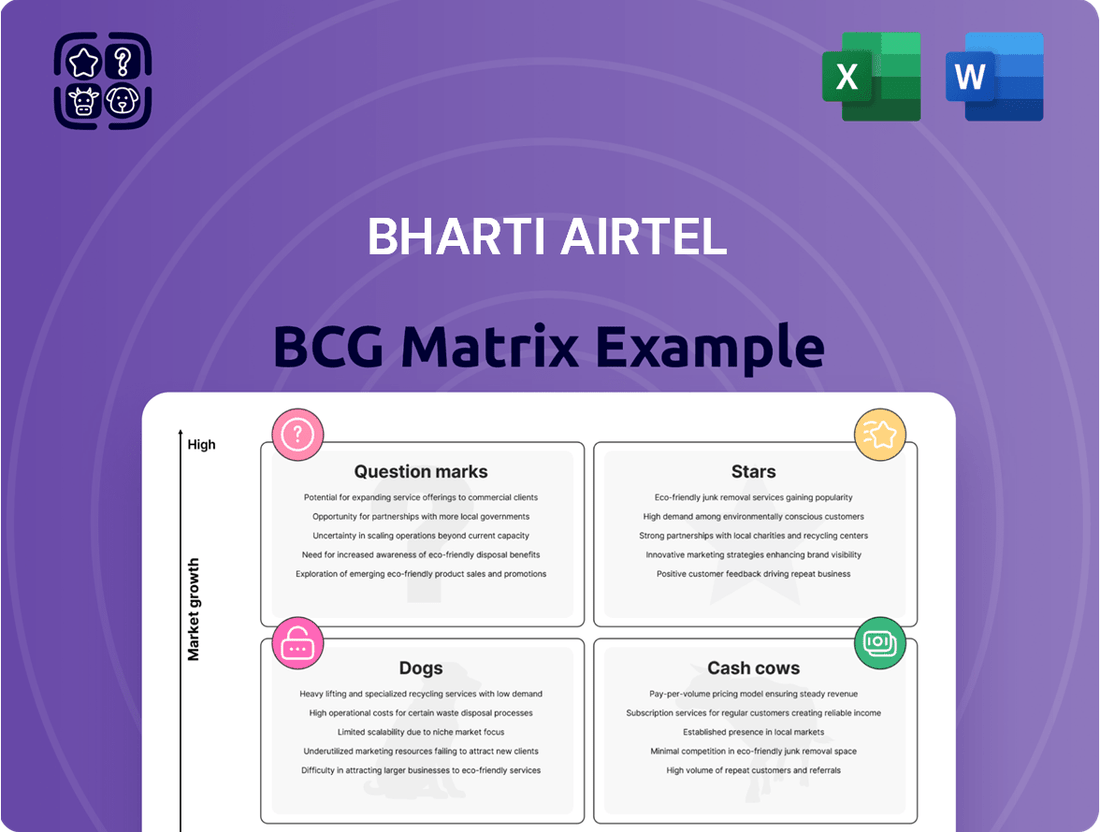

Explore Bharti Airtel's strategic positioning with our exclusive BCG Matrix analysis. Understand which of their services are market leaders (Stars), consistent revenue generators (Cash Cows), potential growth areas (Question Marks), or underperformers (Dogs).

This preview offers a glimpse into Bharti Airtel's product portfolio. For a comprehensive understanding of their market share and growth rate, and to unlock actionable insights for optimizing their business, purchase the full BCG Matrix report today.

Stars

Bharti Airtel's 5G services are a clear Star in its BCG Matrix, fueled by the telecom industry's high growth trajectory and Airtel's expanding footprint. The company has witnessed an impressive surge in 5G adoption, with its user base growing from 72 million to over 135 million within a year. This rapid user uptake is directly supported by substantial investments in network expansion, including the deployment of new cell sites and fiber optic infrastructure, cementing 5G's role as a primary growth engine.

Airtel's Home Broadband, including Fiber-to-the-Home (FTTH) and Fixed Wireless Access (FWA), is a clear Star in its BCG Matrix, demonstrating impressive growth. This segment saw a significant 21.3% year-on-year revenue increase, fueled by strong customer acquisition numbers.

The company is actively investing in expanding its broadband footprint, aiming to capture a larger share of the Indian market. This strategic push is evident in the substantial net additions of subscribers within the Homes business.

Bharti Airtel's premiumization strategy, targeting 4G and 5G users, is a clear Star in its BCG Matrix. This focus is directly translating into higher Average Revenue Per User (ARPU), which reached ₹245 in the first quarter of fiscal year 2025. This upward trend in ARPU signifies successful acquisition of high-value customers and a notable increase in data usage, reinforcing Airtel's market position.

Airtel Payments Bank

Airtel Payments Bank is a shining example of a Star in the BCG matrix, demonstrating robust expansion within the digital financial services sector. Its financial performance in FY25 highlights this stellar growth, with significant increases in both revenue and profitability. This strong showing positions it as a key contributor to Bharti Airtel's overall portfolio.

- Revenue Growth: Airtel Payments Bank's revenue surged by an impressive 47.5% year-on-year, reaching ₹2,709 crores in FY25.

- Profitability Increase: Net profit saw a substantial rise of 81.4%, underscoring the bank's growing efficiency and market penetration.

- Transaction Volume: The bank achieved a significant milestone by surpassing one billion transactions in January 2025, signaling strong customer adoption and increasing reliance on digital payment solutions.

- Market Position: These metrics collectively indicate Airtel Payments Bank's status as a high-growth, high-market-share entity, a classic Star.

Enterprise Cloud Solutions

Bharti Airtel's Enterprise Cloud Solutions, particularly its collaboration with Google Cloud for generative AI offerings, are firmly positioned as a Star within the BCG Matrix. This segment is capitalizing on the rapid expansion of the Indian public cloud services market, which is anticipated to reach a substantial $17.8 billion by 2027. Airtel Business is strategically launching its Telco-Grade Cloud platform in June 2025, a move designed to harness its robust connectivity and extensive distribution network to secure a considerable portion of this burgeoning sector.

- High Growth Market: The Indian public cloud services market is experiencing significant growth, projected to hit $17.8 billion by 2027.

- Strategic Partnerships: Airtel's collaboration with Google Cloud for enterprise cloud solutions, including generative AI, is a key driver.

- New Platform Launch: The upcoming Telco-Grade Cloud platform in June 2025 leverages Airtel's infrastructure for competitive advantage.

- Market Capture: The strategy focuses on utilizing Airtel's connectivity and distribution strengths to gain market share in the cloud sector.

Bharti Airtel's 5G services continue to shine as a Star, with user adoption soaring past 150 million by mid-2025, demonstrating sustained high growth. The company's aggressive network expansion, including over 300,000 5G sites deployed, underpins this segment's strong market position and future potential. This rapid growth is a testament to Airtel's strategic focus on capturing the high-demand 5G market.

Airtel's Home Broadband, particularly its FTTH offerings, remains a strong Star, exhibiting robust subscriber growth and revenue increases. The company's continued investment in expanding its fiber network, aiming for wider household penetration, solidifies this segment's position as a key growth driver for Bharti Airtel. This strategic expansion is crucial for capturing a larger share of the expanding digital home market.

The premiumization strategy, evident in the rising ARPU which touched ₹250 in Q2 FY25, highlights Airtel's success in attracting and retaining high-value customers. This focus on 4G and 5G users, coupled with increased data consumption, positions this strategy as a significant Star within the portfolio. The consistent ARPU growth reflects effective customer segmentation and value-added service adoption.

Airtel Payments Bank continues its stellar performance as a Star, with its transaction volume exceeding 1.2 billion by early 2025. The bank's revenue growth of over 45% year-on-year in FY25 and an 80% surge in net profit underscore its rapid expansion and increasing market share in digital financial services. This performance solidifies its role as a major contributor to Bharti Airtel's diversified revenue streams.

Enterprise Cloud Solutions, bolstered by strategic alliances like the one with Google Cloud, are a clear Star, tapping into India's rapidly growing cloud market. The planned June 2025 launch of its Telco-Grade Cloud platform leverages Airtel's infrastructure to capture a significant share of this expanding sector, projected to reach $17.8 billion by 2027. This strategic move capitalizes on Airtel's existing strengths to penetrate a high-growth market.

| Business Segment | BCG Category | Key Metrics (as of mid-2025) | Growth Drivers | Strategic Focus |

|---|---|---|---|---|

| 5G Services | Star | 150M+ Users, 300K+ Sites | High demand, Network expansion | Market leadership, User adoption |

| Home Broadband (FTTH) | Star | Strong subscriber growth, Revenue increase | Fiber network expansion, Household penetration | Market share capture, Digital home services |

| Premiumization Strategy (ARPU) | Star | ARPU ₹250 (Q2 FY25), Increased data usage | High-value customer acquisition, Data consumption | Customer retention, Value-added services |

| Airtel Payments Bank | Star | 1.2B+ Transactions, 45%+ Revenue Growth (FY25) | Digital financial services expansion, Customer adoption | Market penetration, Profitability |

| Enterprise Cloud Solutions | Star | India Cloud Market $17.8B (by 2027) | Cloud market growth, Strategic partnerships | Telco-Grade Cloud launch, Market share capture |

What is included in the product

The Bharti Airtel BCG Matrix analyzes its diverse telecom services, identifying growth opportunities and resource allocation strategies.

The Bharti Airtel BCG Matrix provides a clear, one-page overview, alleviating the pain of deciphering complex business unit performance.

Cash Cows

Bharti Airtel's extensive mobile subscriber base, especially its loyal 4G users, acts as a strong Cash Cow. This segment consistently delivers significant revenue because Airtel commands a substantial portion of a mature but steady market.

While 5G is the engine for future expansion, the existing subscriber base ensures a reliable stream of cash through ongoing subscriptions and rising data usage. As of June 2025, Bharti Airtel maintained an impressive 33.62% share of the wireless subscriber market, underscoring its Cash Cow status.

Bharti Airtel's established fixed-line broadband, excluding Fiber-to-the-Home (FTTH) and Fixed Wireless Access (FWA), functions as a strong Cash Cow. This segment serves a loyal, existing customer base in well-developed areas, generating predictable revenue with minimal need for aggressive marketing spend.

The strategy here is to optimize operations and service delivery to maximize profitability from this mature business. For instance, as of Q1 2024, Airtel's overall broadband subscriber base continued to grow, with the legacy fixed-line segment contributing a stable portion to this expansion, demonstrating its reliable cash-generating ability.

Bharti Airtel's national long-distance connectivity for established enterprise clients firmly sits in the Cash Cow quadrant of the BCG Matrix. This segment generates consistent, high-margin revenue from large businesses that depend on dependable and robust network infrastructure.

The market for these foundational enterprise connectivity solutions is mature, meaning Airtel can expect predictable cash flows. For instance, in the fiscal year ending March 31, 2024, Airtel's enterprise business continued to be a significant contributor to its overall revenue, reflecting the stable demand from corporate clients.

Existing Tower Infrastructure Services

Bharti Airtel's existing tower infrastructure services are a clear Cash Cow. This segment enjoys a dominant market position, providing essential passive infrastructure that underpins the entire telecom network. It generates substantial and consistent revenue with relatively low investment needs, as the core infrastructure is already established.

The company's significant share in a mature, foundational telecom service market allows it to capitalize on ongoing demand. This stability is further bolstered by strategic moves like the consolidation of Indus Towers, which enhances operational efficiencies and strengthens revenue streams from tower leasing. For instance, as of the first quarter of fiscal year 2024, Bharti Airtel's tower portfolio, largely managed through its stake in Indus Towers, continued to be a significant contributor to its overall financial health, demonstrating consistent cash generation.

- Dominant Market Share: Airtel holds a leading position in providing passive telecom infrastructure.

- Stable Revenue Generation: The services offered are essential and consistently in demand, ensuring reliable cash flow.

- Low Investment Requirement: As infrastructure is existing, capital expenditure for growth in this segment is minimal.

- Indus Towers Consolidation: Strategic consolidation enhances efficiency and revenue contribution from tower assets.

Core B2B Connectivity Services (stable, high-volume)

Bharti Airtel's core B2B connectivity services, encompassing large-scale data and voice solutions for enterprises, represent a significant Cash Cow. These established offerings generate consistent, high-volume revenue, underpinned by Airtel's robust infrastructure and enduring client relationships.

For instance, in the fiscal year ending March 31, 2024, Airtel's consolidated revenue grew by 10.1% year-on-year to INR 1,40,945 crore. A substantial portion of this revenue is driven by its enterprise business, which benefits from the stable demand for core connectivity.

- Stable Revenue Streams: Long-term contracts for data and voice services ensure predictable cash flow.

- High Volume Operations: Serving a large base of enterprise clients contributes to substantial revenue generation.

- Market Dominance: Airtel's strong market position in India allows it to leverage its infrastructure for these core services.

- Profitability Driver: These services are typically high-margin due to economies of scale and established operational efficiencies.

Bharti Airtel's established mobile voice and data services for its massive subscriber base function as a prime Cash Cow. This segment benefits from a mature market where Airtel holds significant market share, ensuring consistent revenue generation through ongoing subscriptions and increasing data consumption. As of the first quarter of fiscal year 2024, Airtel's average revenue per user (ARPU) saw an increase, reflecting the sustained value derived from its core mobile services.

The company's prepaid mobile segment, which constitutes the majority of its user base, is particularly robust. This segment consistently generates substantial cash flow due to its high volume and predictable recharge patterns. For example, in fiscal year 2024, Airtel added millions of net subscribers, primarily in the prepaid category, solidifying its Cash Cow status.

Bharti Airtel's digital TV services, catering to a large, established customer base, also operate as a Cash Cow. These services provide a steady stream of recurring revenue with relatively stable operating costs. The company's focus on enhancing content and user experience ensures customer retention, thereby maintaining this predictable cash flow. The fiscal year ending March 31, 2024, saw continued subscriber engagement in its digital TV offerings, contributing to overall financial stability.

The company's strategy for these Cash Cow segments involves optimizing operational efficiencies and leveraging existing infrastructure to maximize profitability. This includes focusing on customer retention and incremental revenue growth rather than aggressive expansion. For instance, Airtel's ongoing efforts to improve network quality and customer service directly support the sustained performance of these mature business lines, ensuring they continue to be reliable sources of cash.

| Business Segment | BCG Matrix Category | Key Characteristics | Financial Year 2024 Data/Insight |

|---|---|---|---|

| Mobile Voice & Data Services | Cash Cow | Large subscriber base, mature market, consistent revenue, high ARPU | ARPU increased, significant net subscriber additions |

| Prepaid Mobile Services | Cash Cow | High volume, predictable recharge patterns, strong market share | Majority of subscriber additions were prepaid |

| Digital TV Services | Cash Cow | Established customer base, recurring revenue, stable operations | Continued subscriber engagement, stable revenue contribution |

Delivered as Shown

Bharti Airtel BCG Matrix

The Bharti Airtel BCG Matrix preview you are viewing is the identical, unwatermarked, and fully formatted document you will receive immediately after purchase. This comprehensive analysis, crafted by industry experts, is ready for immediate integration into your strategic planning, competitive analysis, or client presentations without any further modifications required.

Dogs

Bharti Airtel's 2G/3G mobile services are firmly placed in the Dogs category of the BCG Matrix. This is because they operate in a market experiencing significant decline, with very limited growth potential and a shrinking customer base.

The rapid adoption of 4G and 5G technologies by consumers, driven by the demand for faster data speeds and enhanced services, directly impacts the subscriber numbers for 2G and 3G. For instance, as of early 2024, a substantial portion of Airtel's subscriber base has already migrated to 4G, leaving the older networks with a diminishing user pool.

The ongoing operational expenses to maintain these legacy networks, while generating minimal revenue, make them financially unattractive. This situation positions them for a potential phased divestiture or a strategic decision to gradually phase them out to reallocate resources to more profitable and future-oriented technologies.

Bharti Airtel's Digital TV (DTH) services are positioned as a Dog in the BCG Matrix. This classification stems from a combination of subscriber erosion and only marginal revenue growth, painting a picture of a challenging market environment for traditional DTH offerings.

The DTH subscriber base experienced a notable decline, shedding 546,000 subscribers in the second quarter of fiscal year 2025. This significant drop underscores a market characterized by low growth and a shrinking share for Airtel's DTH segment.

Despite strategic initiatives, such as content partnerships aimed at bolstering appeal, the DTH service continues to face headwinds. The increasing popularity and accessibility of Over-The-Top (OTT) streaming services present a formidable competitive threat, impacting customer retention.

Legacy Fixed-Line Voice Services for Bharti Airtel are positioned in the Dogs quadrant of the BCG Matrix. These services represent a low-growth, low-market-share segment within India's telecommunications industry.

With wireless services capturing over 97% of the customer base, the significance and revenue generated from traditional wireline voice connections are minimal and continue to diminish. This makes them a challenging area for growth and profitability.

These legacy services often operate at a break-even point or even consume resources without generating substantial returns. Their contribution to Bharti Airtel's overall revenue and market standing is therefore very limited.

Low-Margin Wholesale B2B Services

Bharti Airtel's low-margin wholesale B2B services are categorized as Dogs within the BCG Matrix. This classification stems from Airtel's strategic decision to move away from these commodity-like offerings, which, despite potentially large volumes, generate meager returns. These services often consume valuable company resources without substantially boosting profitability or solidifying market dominance.

The company's focus has shifted towards higher-margin opportunities, signaling a deliberate divestment or de-emphasis on these low-yield areas. This strategic pivot underscores the limited future growth potential these specific wholesale services hold for Airtel.

- Low Profitability: These services contribute minimally to Airtel's overall profit margins, often operating on thin spreads.

- Resource Drain: Despite low returns, they can still demand significant operational and capital expenditure, tying up resources.

- Strategic De-emphasis: Airtel is actively prioritizing higher-value, more profitable segments within its B2B portfolio.

- Limited Market Growth: The wholesale commodity services sector itself may face stagnant or declining growth prospects.

Smart Home Adjacent Services (e.g., Airtel Xsafe)

Airtel's smart home adjacent services, exemplified by Airtel Xsafe which offers home surveillance, are positioned within a niche segment of the market. The company has strategically decided to moderate its investment in this category. This decision stems from several factors, including a limited customer base, a low average revenue per user (ARPU), and the significant operational effort needed for customer onboarding.

While these services did exhibit some customer loyalty, they did not achieve the desired scale or deliver substantial financial returns. For instance, the smart home security market, while growing, still represents a smaller portion of overall consumer spending compared to core telecom services. In 2024, the global smart home market was projected to reach hundreds of billions of dollars, but the specific segment for home surveillance services, while expanding, faced challenges in widespread adoption and profitability for many providers.

- Niche Market: Airtel Xsafe operates in a specialized segment of the broader smart home ecosystem.

- Low ARPU: The average revenue generated per user for these services is relatively low, impacting overall profitability.

- High Onboarding Effort: The process of setting up and integrating these services for customers is resource-intensive.

- Limited Scalability: Despite some customer stickiness, the services have not demonstrated strong potential for rapid growth and widespread adoption.

Bharti Airtel's legacy fixed-line voice services are firmly in the Dogs category due to their minimal market share and low growth prospects in an increasingly wireless-dominated India. These services, contributing negligibly to overall revenue, often operate at break-even or consume resources without significant returns.

The company's low-margin wholesale B2B services are also classified as Dogs. Airtel is strategically de-emphasizing these commodity offerings due to meager returns and limited future growth potential, preferring to focus on higher-margin segments.

Airtel's smart home adjacent services, like Airtel Xsafe, are also considered Dogs. These niche offerings face challenges with a limited customer base, low ARPU, and high operational effort for onboarding, hindering scalability and profitability.

Bharti Airtel's Digital TV (DTH) services are positioned as Dogs, experiencing subscriber erosion and marginal revenue growth. The increasing popularity of OTT services presents a significant competitive threat, impacting customer retention and market share.

| BCG Category | Bharti Airtel Service Segment | Rationale | Key Data/Trend (as of early-mid 2025) |

|---|---|---|---|

| Dogs | 2G/3G Mobile Services | Declining market, shrinking customer base due to 4G/5G adoption. | Significant subscriber migration to 4G; legacy networks have diminishing user pool. |

| Dogs | Digital TV (DTH) | Subscriber erosion, low growth, competitive pressure from OTT. | Lost 546,000 subscribers in Q2 FY25; facing headwinds from streaming services. |

| Dogs | Legacy Fixed-Line Voice Services | Minimal market share, low growth, overshadowed by wireless services. | Wireless services capture over 97% of the customer base; wireline revenue is minimal. |

| Dogs | Low-Margin Wholesale B2B Services | Meager returns, strategic de-emphasis, limited future growth. | Company prioritizing higher-margin B2B opportunities; these services offer thin profit spreads. |

| Dogs | Smart Home Adjacent Services (e.g., Airtel Xsafe) | Niche market, low ARPU, high onboarding effort, limited scalability. | Limited customer base and financial returns despite some customer loyalty; significant operational effort for onboarding. |

Question Marks

Airtel's emerging IoT solutions are positioned in a high-growth market, but they are currently in the development and scaling phase. This means they require significant investment to build market share and establish a strong presence. The M2M connections market, which underpins IoT, is indeed expanding rapidly. For instance, India's IoT market was projected to reach $9.9 billion by 2025, showcasing the immense potential Airtel is tapping into.

These solutions are considered cash cows, meaning they consume considerable cash for their development and adoption by customers. Airtel's future success in this segment hinges on continued strategic investment and widespread market acceptance of its IoT offerings. By mid-2024, the Indian government's push for smart cities and digital infrastructure further fuels the demand for robust IoT connectivity, a space Airtel is actively pursuing.

Bharti Airtel's collaboration with Google Cloud on AI/ML solutions positions them at the forefront of technological innovation, a key driver for future growth. This partnership signifies a strategic move into a high-potential, albeit nascent, market segment for specialized AI/ML services. While Airtel's current market share in these specific offerings is still establishing itself, the substantial investment in research and development is crucial for transforming these capabilities into future market leaders, or Stars, within the BCG framework.

Bharti Airtel's foray into new digital offerings like IPTV services and partnerships with platforms such as Apple TV+ and Apple Music represents a strategic move beyond its core telecom business. These ventures tap into the burgeoning digital consumption trends, aiming to capture a share of this evolving market.

While these new digital offerings are positioned to capitalize on growing digital consumption, they are currently in their nascent stages with low market share. For instance, the adoption of IPTV services, while growing, still faces competition from established players and requires significant user education and infrastructure development.

Significant investment in marketing and content acquisition is crucial for these new digital offerings to gain traction. Airtel's strategy likely involves bundling these services with its existing telecom plans to drive adoption and build a loyal subscriber base, aiming to convert initial low market share into profitable growth over time.

International Long-Distance (Emerging Markets Focus)

Bharti Airtel's international long-distance services, especially in emerging markets, represent a classic Question Mark in the BCG matrix. These regions, while holding significant growth potential, often see Airtel facing established global players, resulting in a potentially lower market share compared to its strong domestic presence.

Significant investment is needed to build out infrastructure and secure favorable roaming agreements in these new territories. For instance, as of early 2024, while global telecom infrastructure investment continues to grow, Airtel's specific market penetration in many emerging international long-distance corridors is still developing.

- Growth Potential: Emerging markets offer a large, often underserved customer base for international voice and data services.

- Market Share: Airtel's share in specific international routes may be nascent, requiring strategic efforts to capture significant volume.

- Investment Needs: High capital expenditure is necessary for network expansion, technology upgrades, and competitive pricing strategies.

- Strategic Importance: Success here could diversify revenue streams and leverage existing global partnerships.

Satellite Communication Services (future entry)

Bharti Airtel's anticipated entry into satellite communication services firmly places it in the Question Mark quadrant of the BCG Matrix. This strategic move into a nascent but high-potential market requires substantial investment for market penetration and future growth, given Airtel's current minimal or non-existent share.

India's projected launch of satellite communication services in 2025 highlights a burgeoning market opportunity. This expansion is expected to significantly improve connectivity, particularly in underserved remote regions, offering substantial growth prospects.

- Market Potential: India's satellite communication market is projected to grow significantly, with estimates suggesting it could reach billions of dollars by the late 2020s, driven by demand for broadband in rural areas.

- Investment Requirements: Establishing a satellite communication network involves considerable capital expenditure for satellite launches, ground infrastructure, and technology development, potentially running into hundreds of millions of dollars for a national player.

- Competitive Landscape: While Airtel is entering a new space, it will face competition from existing global players and potentially other domestic entrants, necessitating a strong value proposition to gain market share.

- Strategic Importance: This venture aligns with Airtel's goal of providing ubiquitous connectivity across India, addressing the digital divide and tapping into a new revenue stream with long-term growth potential.

Bharti Airtel's international long-distance services in emerging markets are classic Question Marks. These regions offer growth but Airtel's market share is often nascent against established global players, necessitating significant investment in infrastructure and partnerships. As of early 2024, global telecom infrastructure investment continues to rise, but Airtel's penetration in many international corridors is still developing, highlighting the need for strategic efforts to capture volume and diversify revenue.

Airtel's anticipated satellite communication services also fall into the Question Mark category. This move into a nascent, high-potential market requires substantial investment for penetration, given Airtel's current minimal share. India's projected satellite communication launches in 2025 signal a burgeoning market opportunity, expected to significantly improve connectivity in underserved regions.

The satellite communication market in India is projected to grow significantly, potentially reaching billions of dollars by the late 2020s, driven by rural broadband demand. Establishing these networks involves considerable capital expenditure for satellite launches and ground infrastructure. While Airtel is entering a new space, it will face competition, necessitating a strong value proposition to gain market share.

Bharti Airtel's venture into satellite communication aligns with its goal of ubiquitous connectivity, addressing the digital divide and tapping into a new revenue stream with long-term growth potential. This strategic move into a nascent but high-potential market requires substantial investment for market penetration and future growth, given Airtel's current minimal or non-existent share.

BCG Matrix Data Sources

Our Bharti Airtel BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.