Bharti Airtel Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bharti Airtel Bundle

Bharti Airtel operates in a dynamic telecom landscape, facing intense rivalry from established players and emerging disruptors, significantly impacting its pricing power and profitability. Understanding the bargaining power of both its suppliers and customers is crucial for navigating this competitive arena effectively.

The threat of new entrants and the availability of substitutes present ongoing challenges that require strategic foresight and continuous innovation to mitigate. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Bharti Airtel’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The substantial capital required for 5G network deployment and fiber optic infrastructure expansion places significant demands on telecom operators like Bharti Airtel. This necessitates heavy investment in cutting-edge equipment and technology.

This high capital expenditure creates a dependency on a limited number of global suppliers who can provide the advanced telecommunications hardware. Consequently, these few vendors can exert considerable bargaining power over Bharti Airtel and its peers.

Bharti Airtel's financial commitments highlight this reality; the company had prepaid spectrum liabilities amounting to ₹5,985 crore as of March 2025, underscoring the significant financial outlays tied to essential network resources and the suppliers providing them.

Bharti Airtel's bargaining power of suppliers is significantly influenced by the limited number of key equipment vendors. The global telecom infrastructure market is heavily consolidated, with a handful of major players like Ericsson, Nokia, and Huawei dominating. This concentration means Airtel has fewer viable alternatives for sourcing critical network hardware, thereby strengthening the suppliers' negotiating position.

The specialized and rapidly evolving nature of technologies like 5G further narrows the field of qualified suppliers. Companies like Ericsson and Nokia, for instance, are at the forefront of 5G deployment, making their equipment essential for network upgrades. This reliance on a small group of advanced technology providers amplifies their bargaining power, as Airtel must secure their cutting-edge solutions to remain competitive.

Spectrum, the airwaves essential for mobile communication, is entirely controlled by the government, making it a critical supplier for telecom operators like Bharti Airtel. The government's ability to set auction prices and allocate spectrum licenses grants it immense bargaining power.

In 2024, the Indian government continued its spectrum auction strategy, with significant amounts of spectrum made available. For instance, the 2024 auctions saw operators bidding for frequencies across various bands, demonstrating the government's role in dictating the cost of this vital resource.

New regulations, such as the Telecommunication Act 2023, further solidify the government's influence by shaping how spectrum is managed and priced, directly impacting the operational costs and strategic planning of companies like Bharti Airtel.

Dependency on infrastructure sharing partners

Bharti Airtel's reliance on infrastructure sharing partners, such as tower companies, significantly influences the bargaining power of suppliers. While sharing infrastructure can lead to cost efficiencies, it also creates a dependency. If there are few infrastructure providers or if these providers hold dominant market positions, they can exert considerable influence over Bharti Airtel through rental fees and service level agreements. This interdependency is a key factor in understanding supplier power.

- Dependency on few, powerful infrastructure partners: Bharti Airtel's operational model involves sharing passive infrastructure like towers and active infrastructure like radio access networks. Concentration among these infrastructure providers, particularly tower companies, can consolidate their market power.

- Impact on cost structure: The rental fees and terms negotiated with these infrastructure partners directly impact Bharti Airtel's operating expenses. Higher bargaining power from suppliers can translate into increased costs for Bharti Airtel, potentially squeezing profit margins.

- Strategic implications of infrastructure sharing: While beneficial for capital expenditure reduction, the strategic decision to share infrastructure means Bharti Airtel must carefully manage its relationships with these suppliers to mitigate risks associated with their increased bargaining power.

Specialized technology and R&D providers

Bharti Airtel's increasing reliance on specialized technology and R&D providers, particularly as it ventures into digital services, IoT, and AI, enhances the bargaining power of these suppliers. For example, partnerships with entities like Google Cloud leverage unique platforms and expertise, giving these technology firms leverage, especially when offering advanced or proprietary solutions.

- Technology Partnerships: Bharti Airtel's strategic alliances, such as its collaboration with Google Cloud for cloud infrastructure and AI capabilities, underscore the dependence on specialized tech providers.

- R&D Intensity: The development of cutting-edge digital services requires deep R&D investment from suppliers, making their unique knowledge a significant bargaining chip.

- Limited Alternatives: For highly specialized or novel technological solutions, the availability of alternative suppliers may be limited, further strengthening the bargaining power of existing partners.

Bharti Airtel faces significant supplier bargaining power due to the consolidated nature of telecommunications equipment manufacturing. A few global giants like Ericsson and Nokia dominate the supply of advanced 5G hardware, giving them leverage in pricing and contract terms.

The government's control over spectrum allocation is another critical factor. In 2024, spectrum auctions continued to set the cost for this essential resource, with operators like Airtel making substantial bids, highlighting the government's powerful supplier role.

Furthermore, Bharti Airtel's reliance on infrastructure sharing partners, such as tower companies, can amplify supplier power if the market is concentrated. Rental fees and service agreements with these partners directly impact Airtel's operational costs.

Bharti Airtel's increasing engagement with specialized technology and R&D providers for digital services also strengthens supplier bargaining power, particularly when unique or proprietary solutions are involved.

| Supplier Category | Key Players | Impact on Bharti Airtel | 2024/2025 Data Point |

|---|---|---|---|

| Network Equipment | Ericsson, Nokia, Huawei | High dependency, limited alternatives, strong pricing power | Continued heavy investment in 5G infrastructure |

| Spectrum | Government of India | Exclusive provider, sets prices and availability | Ongoing spectrum auctions and regulatory updates |

| Infrastructure Sharing | Tower Companies (e.g., Indus Towers) | Cost impact via rental fees, dependency for network reach | Negotiations on long-term agreements and service levels |

| Digital Services Technology | Cloud Providers (e.g., Google Cloud), AI specialists | Leverage from specialized platforms and expertise | Strategic partnerships for advanced capabilities |

What is included in the product

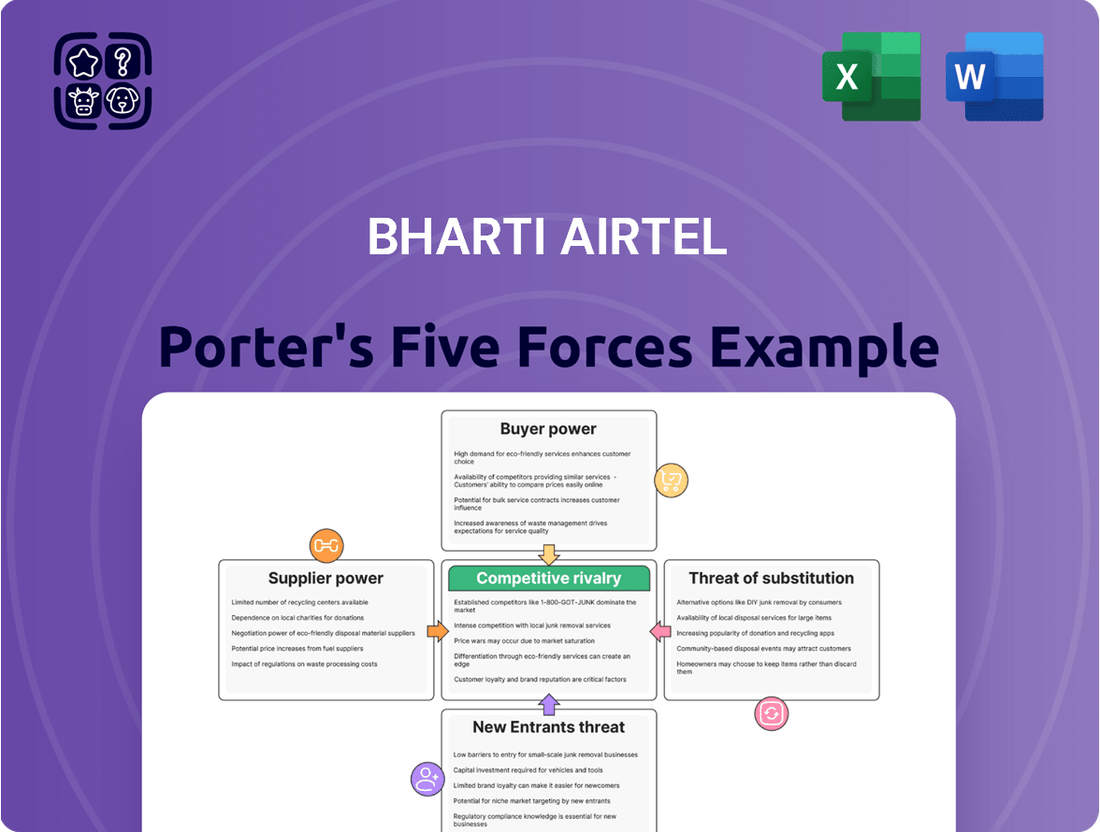

This Porter's Five Forces analysis for Bharti Airtel dissects the competitive intensity within the Indian telecom sector, examining supplier and buyer power, the threat of new entrants and substitutes, and the rivalry among existing players.

Instantly identify and address competitive threats by visualizing Bharti Airtel's Porter's Five Forces, allowing for proactive strategy adjustments.

Customers Bargaining Power

The Indian telecom landscape is a battleground, with Reliance Jio and Bharti Airtel at the forefront, driving fierce price competition. This intense rivalry has resulted in a significant pressure on Average Revenue Per User (ARPU), forcing both companies to remain highly competitive on pricing to retain their customer base.

Customers in this market exhibit high price sensitivity. They can readily switch between providers, often making decisions based solely on the most attractive tariff plans. This ease of switching empowers customers, as even minor tariff increases can lead to a noticeable churn, demonstrating their significant bargaining power.

For instance, in 2023, Bharti Airtel reported an ARPU of ₹200, a figure that, while showing growth, still reflects the pressure from competitive pricing strategies. Any significant upward revision in prices risks alienating a substantial portion of their subscriber base, highlighting the direct impact of customer price sensitivity.

The bargaining power of customers in the mobile services sector is significantly amplified by low switching costs, largely due to Mobile Number Portability (MNP). This feature allows subscribers to retain their existing numbers while moving to a different service provider, effectively removing a major barrier to switching.

In 2023, India's MNP requests saw a substantial volume, with millions of subscribers exercising their right to switch. This constant churn forces operators like Bharti Airtel to continuously innovate and offer competitive pricing and superior service quality to retain their customer base. For instance, during the first half of 2024, telecom operators reported a consistent trend of net subscriber additions and port-outs, highlighting the dynamic nature of customer loyalty driven by better value propositions.

The bargaining power of customers in the Indian telecom market is significantly influenced by the availability of multiple service providers. With key players like Reliance Jio, Bharti Airtel, Vodafone Idea, and BSNL, consumers have a healthy range of choices for mobile, broadband, and digital TV services. This competitive landscape means customers aren't tied to one provider and can easily switch if dissatisfied or if better offers emerge.

Increasing data consumption drives demand for value

The escalating demand for data, fueled by the widespread adoption of smartphones and digital services, significantly amplifies the bargaining power of customers. As more people consume data, they naturally seek better value, pushing telecom providers to offer competitive pricing and superior quality. This trend is particularly evident with the ongoing 5G rollout, where customers anticipate faster speeds at accessible price points.

Bharti Airtel's Average Revenue Per User (ARPU) saw an increase, reaching ₹245 in FY25. This suggests a strategic move towards attracting and retaining higher-value customers who are willing to pay for enhanced services. However, the underlying pressure for overall value remains a constant factor, compelling the company to balance premium offerings with affordability to meet broad customer expectations.

- Growing Data Consumption: Increased usage of digital services and smartphones drives higher data demand.

- Demand for Value: Customers expect high-speed data and affordable pricing, especially with 5G.

- ARPU Growth: Bharti Airtel's ARPU rose to ₹245 in FY25, indicating a focus on higher-paying customers.

- Competitive Pressure: The need to offer value remains strong, influencing pricing strategies.

Customer awareness and digital literacy

Customer awareness and digital literacy significantly influence the bargaining power of customers for telecom providers like Bharti Airtel. With the widespread availability of smartphones and increasing digital literacy, consumers are better equipped than ever to research and compare offerings.

This heightened awareness means customers can readily access information on competitor plans, pricing, and service quality. For instance, by mid-2024, India's internet penetration had surpassed 60%, with smartphone users forming the vast majority, enabling easy access to comparison websites and customer reviews.

- Informed Decisions: Customers can easily compare Bharti Airtel's plans against those of competitors like Reliance Jio and Vodafone Idea, leveraging online resources and app-based tools.

- Demand for Value: Increased digital literacy allows customers to understand the technical aspects of services, such as 5G deployment and data speeds, leading them to demand better value for their money.

- Price Sensitivity: Awareness of competitive pricing makes customers more sensitive to price increases and more likely to switch providers if better deals are available.

- Technological Awareness: Customers are now more aware of technological advancements, expecting providers to offer the latest services and upgrades, thereby increasing pressure on providers to innovate.

Customers in India's telecom sector wield considerable power, primarily driven by low switching costs facilitated by Mobile Number Portability (MNP) and the presence of numerous providers. This allows them to readily switch for better deals, putting pressure on Bharti Airtel to maintain competitive pricing and service quality. The increasing digital literacy and smartphone penetration, exceeding 60% by mid-2024, further empowers customers to research and compare offerings, making them highly price-sensitive.

| Metric | 2023 Value | FY25 Value | Implication for Customer Bargaining Power |

|---|---|---|---|

| Bharti Airtel ARPU | ₹200 | ₹245 | While ARPU growth suggests customer willingness to pay for value, overall price sensitivity remains high due to competition. |

| India Internet Penetration | N/A (Estimated >60% by mid-2024) | N/A | Higher penetration means more informed customers actively comparing plans. |

| MNP Requests | Millions (2023) | Ongoing Trend | Consistent MNP activity demonstrates customer willingness to switch, increasing their leverage. |

Preview the Actual Deliverable

Bharti Airtel Porter's Five Forces Analysis

This preview showcases the comprehensive Bharti Airtel Porter's Five Forces Analysis, detailing the competitive landscape of the telecommunications industry. You are viewing the exact document you will receive immediately after purchase, providing an in-depth examination of buyer power, supplier power, threat of new entrants, threat of substitutes, and industry rivalry. This professionally formatted analysis is ready for your immediate use, offering valuable insights without any surprises.

Rivalry Among Competitors

The Indian telecom landscape is heavily dominated by two major players, Reliance Jio and Bharti Airtel, creating a near duopoly. This intense concentration means that competition for subscribers and market share is fierce, as these giants vie for dominance. Other players like Vodafone Idea and BSNL lag significantly behind, making the rivalry primarily a two-horse race.

Bharti Airtel and Reliance Jio are engaged in a fierce battle for 5G dominance in India, evidenced by one of the world's most rapid 5G network deployments. This aggressive expansion directly translates into intense competition for acquiring new 5G subscribers.

By the end of fiscal year 2025, Bharti Airtel had successfully onboarded over 135 million 5G users, highlighting the scale of this subscriber acquisition drive and the high stakes involved in the competitive rivalry.

Bharti Airtel is locked in a continuous battle for revenue market share (RMS) with Reliance Jio. Airtel has been steadily closing the gap, demonstrating intense rivalry for the industry's overall revenue.

While Jio commands a larger subscriber base, Airtel's focus on active subscribers and a higher Average Revenue Per User (ARPU) highlights its strategic approach to capturing valuable revenue streams. For instance, in Q4 FY24, Airtel's ARPU stood at ₹209.5, a notable increase, showcasing its ability to monetize its customer base effectively amidst this competitive landscape.

High fixed costs and exit barriers

The Indian telecom sector is characterized by substantial fixed costs, primarily due to the immense capital required for network infrastructure, spectrum acquisition, and continuous technological upgrades. For instance, in 2023-2024, Bharti Airtel reported capital expenditure of INR 23,049 crore, highlighting the ongoing investment needed to maintain and expand its network.

These high fixed costs, coupled with the strategic importance of telecommunications to national development, create significant exit barriers. Players are often compelled to remain in the market and compete fiercely to recover their investments, rather than exiting and incurring further losses.

- High Capital Expenditure: Telecom operators like Bharti Airtel invest heavily in building and maintaining extensive network infrastructure, including towers, fiber optic cables, and base stations.

- Spectrum Costs: Acquiring radio spectrum licenses, crucial for providing mobile services, involves substantial upfront payments and ongoing fees, as seen in India's 5G spectrum auctions.

- Technological Obsolescence: Continuous investment in upgrading to newer technologies, such as 5G, adds to the fixed cost burden, making it difficult for companies to exit without significant write-offs.

- Strategic Importance: The essential nature of telecom services means governments are often reluctant to allow major players to exit, further reinforcing the commitment required from existing companies.

Convergence of services and ecosystem battles

Bharti Airtel's competitive landscape is shaped by a growing convergence of services, moving beyond traditional mobile and broadband. Companies are increasingly offering integrated digital solutions, spanning entertainment, payments, and enterprise services.

This strategic shift intensifies rivalry as firms like Reliance Jio and Vodafone Idea also expand their portfolios, creating comprehensive digital ecosystems. For instance, Airtel's digital offerings include Airtel Xstream for content and Airtel Payments Bank for financial services. This multi-service competition means companies battle not just on price for connectivity but also on the breadth and quality of their entire digital ecosystem. By 2024, the Indian telecom market saw significant investment in 5G infrastructure, further fueling this service expansion and ecosystem development.

- Expanding Service Offerings: Telecom players are moving into digital TV, broadband, mobile commerce, and enterprise solutions.

- Ecosystem Battles: Companies aim to build integrated digital ecosystems to lock in customers across multiple services.

- Intensified Rivalry: Competition is no longer just on core connectivity but on the overall digital experience offered.

- Market Dynamics: By early 2024, significant capital expenditure was directed towards 5G rollout, enabling new service integrations.

The competitive rivalry within India's telecom sector is exceptionally intense, primarily driven by the duopoly of Bharti Airtel and Reliance Jio. This fierce competition is evident in their aggressive 5G network deployment, with Airtel reaching over 135 million 5G users by the end of FY25. Both companies are locked in a continuous battle for revenue market share, with Airtel actively working to narrow the gap with Jio, as shown by Airtel's ARPU reaching ₹209.5 in Q4 FY24.

| Metric | Bharti Airtel (Q4 FY24) | Reliance Jio (Q4 FY24) |

| ARPU | ₹209.5 | ₹183.5 |

| 5G Users (approx. end FY25) | 135 million+ | N/A (Jio's specific 5G user count not separately disclosed for FY25 end, but overall subscriber base is larger) |

| Capital Expenditure (FY24) | INR 23,049 crore | INR 27,000 crore (estimated for FY24) |

SSubstitutes Threaten

Over-the-top (OTT) communication apps like WhatsApp, Zoom, and Google Meet pose a significant threat to Bharti Airtel's traditional revenue streams. These platforms offer voice calls, video conferencing, and messaging services, often at a lower cost or for free, directly competing with Airtel's core voice and SMS offerings.

By leveraging internet data, OTT services have drastically reduced customer reliance on traditional telecom plans for communication. For instance, in 2024, a substantial portion of global mobile data traffic is attributed to messaging and video calling apps, indicating a clear shift away from legacy services. This trend directly impacts Airtel's average revenue per user (ARPU) for voice and messaging.

For data consumption, readily available Wi-Fi networks in homes, offices, and public hotspots can substitute mobile data, especially for heavy usage. As of early 2024, the widespread availability of free or low-cost Wi-Fi in urban and semi-urban areas directly competes with Airtel's mobile data plans.

Government initiatives like PM-WANI (Prime Minister Wi-Fi Access Network Interface) aim to expand public Wi-Fi access points across India, further increasing this substitution threat. This expansion makes it even easier for consumers to opt for Wi-Fi over mobile data for their internet needs.

While Bharti Airtel provides fixed-line broadband, alternatives like other broadband providers and fiber-to-the-home (FTTH) services directly substitute for mobile broadband for both residential and commercial internet requirements. Airtel's Homes business segment experienced robust growth, underscoring the importance of this market. For instance, in the fiscal year ending March 2024, Airtel's Homes business reported a significant revenue increase, highlighting the demand for reliable fixed-line internet solutions.

Satellite communication for specific use cases

Emerging satellite communication technologies present a potential threat, particularly for specific use cases where terrestrial networks are less viable. While currently a niche market, advancements in this sector could offer alternative connectivity solutions for remote regions or specialized enterprise needs in the coming years. For instance, Starlink's expansion into India, targeting rural connectivity, highlights this evolving landscape.

The regulatory environment is also shifting, with the Telecommunications Act 2023 enabling unified licensees to offer satellite communication services. This opens the door for established players like Bharti Airtel to explore and integrate these technologies, potentially diversifying their service offerings and creating new competitive dynamics. The government's focus on digital infrastructure, including satellite-based solutions, underscores the growing importance of this segment.

- Satellite communication offers an alternative for underserved or remote areas.

- The Telecommunications Act 2023 permits unified licensees to provide satellite services.

- Advancements in satellite technology could impact specific enterprise connectivity needs.

Content streaming services over traditional DTH

The proliferation of over-the-top (OTT) video streaming services like Netflix and Amazon Prime Video presents a significant threat to traditional Direct-to-Home (DTH) satellite television providers, including Bharti Airtel's DTH arm. These platforms offer a vast library of on-demand content, often at competitive subscription prices, directly appealing to consumers seeking flexibility and a wider selection.

By mid-2024, the Indian OTT market continued its robust growth, with major players reporting substantial subscriber bases and increasing engagement. For instance, reports indicated that by the end of 2023, the number of paid OTT subscribers in India had crossed the 100 million mark, a figure expected to climb further in 2024. This shift in consumer preference towards digital streaming, particularly on mobile devices, directly erodes the market share and revenue potential of traditional DTH services.

- Growing OTT Adoption: Consumers are increasingly opting for the convenience and personalized viewing experience offered by streaming services.

- Content Diversification: OTT platforms provide a broad spectrum of content, from original series to live sports, often surpassing the curated offerings of DTH providers.

- Mobile-First Consumption: The widespread availability of affordable smartphones and data plans has accelerated the trend of consuming content on mobile devices, a space where DTH has limited reach.

- Price Sensitivity: Many OTT services offer tiered pricing models, making them an attractive alternative for budget-conscious consumers compared to bundled DTH packages.

The threat of substitutes for Bharti Airtel is multifaceted, stemming from both communication and content consumption alternatives. Over-the-top (OTT) communication apps like WhatsApp and Zoom directly challenge Airtel's voice and messaging revenues by offering similar services, often for free or at a lower data cost. Furthermore, the increasing availability of Wi-Fi, both public and private, acts as a substitute for mobile data, especially for heavy users. This is further bolstered by government initiatives like PM-WANI, which expand public Wi-Fi access points, making it easier for consumers to bypass mobile data plans.

In the content space, OTT video streaming services such as Netflix and Amazon Prime Video are significant substitutes for Bharti Airtel's DTH offerings. The Indian OTT market saw robust growth, with paid subscribers exceeding 100 million by the end of 2023 and continuing to rise in 2024. This shift towards on-demand, mobile-first content consumption directly impacts traditional DTH revenue streams.

| Substitute Category | Key Players | Impact on Airtel | 2024 Market Trend/Data Point |

|---|---|---|---|

| Communication OTT | WhatsApp, Zoom, Google Meet | Reduced reliance on voice/SMS, lower ARPU | Significant portion of global mobile data traffic in 2024 attributed to messaging/video apps |

| Data Substitution | Public Wi-Fi, Home Broadband | Competition for mobile data revenue | Widespread availability of free/low-cost Wi-Fi in urban/semi-urban areas |

| Content Streaming | Netflix, Amazon Prime Video, Disney+ Hotstar | Threat to DTH business | Over 100 million paid OTT subscribers in India by end of 2023, growing in 2024 |

Entrants Threaten

The Indian telecom sector demands colossal upfront investment, particularly for spectrum auctions and the rollout of advanced networks like 5G. For instance, the 2022 spectrum auction saw the government garnering ₹1.5 lakh crore, with major players like Bharti Airtel investing significantly, highlighting the substantial financial commitment required to even enter the market.

Building a robust nationwide network infrastructure, encompassing towers, fiber optics, and base stations, further escalates these capital expenditure needs. This extensive physical infrastructure is crucial for providing reliable service across diverse geographies, presenting a formidable financial hurdle for any aspiring new entrant aiming to compete with established players.

Stringent regulatory hurdles and licensing significantly deter new entrants in India's telecom market. The sector is governed by the Telecom Regulatory Authority of India (TRAI) and the Department of Telecommunications (DoT), imposing rigorous requirements for licenses and spectrum allocation. The new Telecommunication Act 2023 further solidifies this complex entry landscape, demanding substantial time and resources for compliance.

Established brand loyalty and network effects present a significant barrier for new entrants in the Indian telecom market. Bharti Airtel, for instance, commands a substantial subscriber base, with reports indicating over 377 million wireless subscribers as of early 2024. This loyalty, cultivated through years of service and marketing, makes it difficult for newcomers to attract customers away from trusted brands.

Furthermore, the inherent network effects in telecommunications mean that the value of a network increases with the number of users. Bharti Airtel's vast existing network, both in terms of infrastructure and user connections, offers a superior experience and greater utility to its subscribers. A new entrant would need to invest heavily to replicate this scale and convince users that their network offers comparable or superior value, a daunting challenge given the market saturation.

Difficulty in acquiring scarce spectrum

The scarcity and high cost of acquiring radio spectrum present a substantial barrier to entry in the telecommunications sector. Spectrum is a finite resource, essential for delivering mobile services, and its allocation typically occurs through government auctions. These auctions are highly competitive and demand significant capital investment, making it exceedingly difficult for new companies to secure the necessary airwaves to establish a viable operation and compete with incumbents like Bharti Airtel.

For instance, India's 2022 spectrum auction saw the government garner ₹1.5 lakh crore (approximately $18.3 billion USD) in bids, with major players like Reliance Jio, Bharti Airtel, and Vodafone Idea investing heavily. Bharti Airtel alone committed over ₹21,400 crore (approximately $2.6 billion USD) for spectrum acquisition. This immense financial outlay underscores the challenge new entrants face in obtaining the foundational resources required to enter the market and offer competitive services.

- Spectrum Scarcity: Radio spectrum is a limited natural resource, and its availability for new telecommunications operators is restricted.

- High Auction Costs: Government spectrum auctions are intensely competitive, requiring massive upfront capital investment, often in the billions of dollars, which deters potential new entrants.

- Incumbent Advantage: Established players like Bharti Airtel already possess significant spectrum holdings, giving them a cost and operational advantage that new entrants struggle to overcome.

- Capital Requirements: Beyond spectrum, new entrants need substantial capital for network build-out, technology, and marketing, compounding the financial hurdles.

Intense competition from incumbents

The threat of new entrants into the Indian telecom market, particularly for a company like Bharti Airtel, is significantly mitigated by the intense competition already present from established incumbents. This existing market is characterized by fierce competition and aggressive pricing strategies employed by dominant players. For instance, as of the first quarter of 2024, India’s telecom sector saw a subscriber base of over 1.18 billion, with major players like Reliance Jio and Vodafone Idea actively vying for market share through competitive data and voice plans.

A new entrant would face an uphill battle against these established operators who possess deep pockets and have honed aggressive market tactics over years of operation. These incumbents have built extensive infrastructure, brand loyalty, and economies of scale that are difficult for newcomers to replicate quickly. The capital expenditure required to build a comparable network and acquire customers in such a saturated environment is substantial, making the barrier to entry exceptionally high.

- High Capital Requirements: Building a nationwide telecom network involves billions of dollars in infrastructure investment, a significant hurdle for new players.

- Established Market Share: Incumbents like Reliance Jio and Vodafone Idea already command substantial portions of the market, making customer acquisition challenging.

- Aggressive Pricing: Existing players frequently engage in price wars to retain and attract subscribers, squeezing margins for any new entrant.

- Regulatory Hurdles: Navigating India's complex telecom regulations and licensing processes can also be a deterrent for new companies.

The threat of new entrants in India's telecom sector, where Bharti Airtel operates, is considerably low due to substantial barriers. The immense capital required for spectrum acquisition and network build-out, coupled with stringent regulatory compliance, deters most potential newcomers. For instance, the 2022 spectrum auctions alone generated ₹1.5 lakh crore, with Bharti Airtel investing over ₹21,400 crore, highlighting the financial muscle needed to compete.

Established players like Bharti Airtel benefit from significant network effects and brand loyalty, making it difficult for new entrants to gain traction. With over 377 million wireless subscribers in early 2024, Bharti Airtel's vast user base and established infrastructure present a formidable challenge for any aspiring competitor aiming to capture market share.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | High costs for spectrum, network infrastructure, and technology. | Significant financial hurdle, requiring billions in investment. |

| Regulatory Hurdles | Complex licensing, spectrum allocation, and compliance with new acts like the Telecommunication Act 2023. | Time-consuming and resource-intensive, demanding expertise. |

| Incumbent Advantage | Established brand loyalty, extensive networks, and economies of scale. | Difficult to replicate, leading to challenges in customer acquisition. |

| Spectrum Scarcity | Limited availability of radio spectrum, a crucial resource. | Intense competition in auctions drives up costs and limits access. |

Porter's Five Forces Analysis Data Sources

Our Bharti Airtel Porter's Five Forces analysis is built upon a foundation of publicly available financial reports, investor presentations, and annual filings from the company and its key competitors. We also incorporate data from reputable industry analysis firms, market research reports, and telecom regulatory bodies to provide a comprehensive view of the competitive landscape.