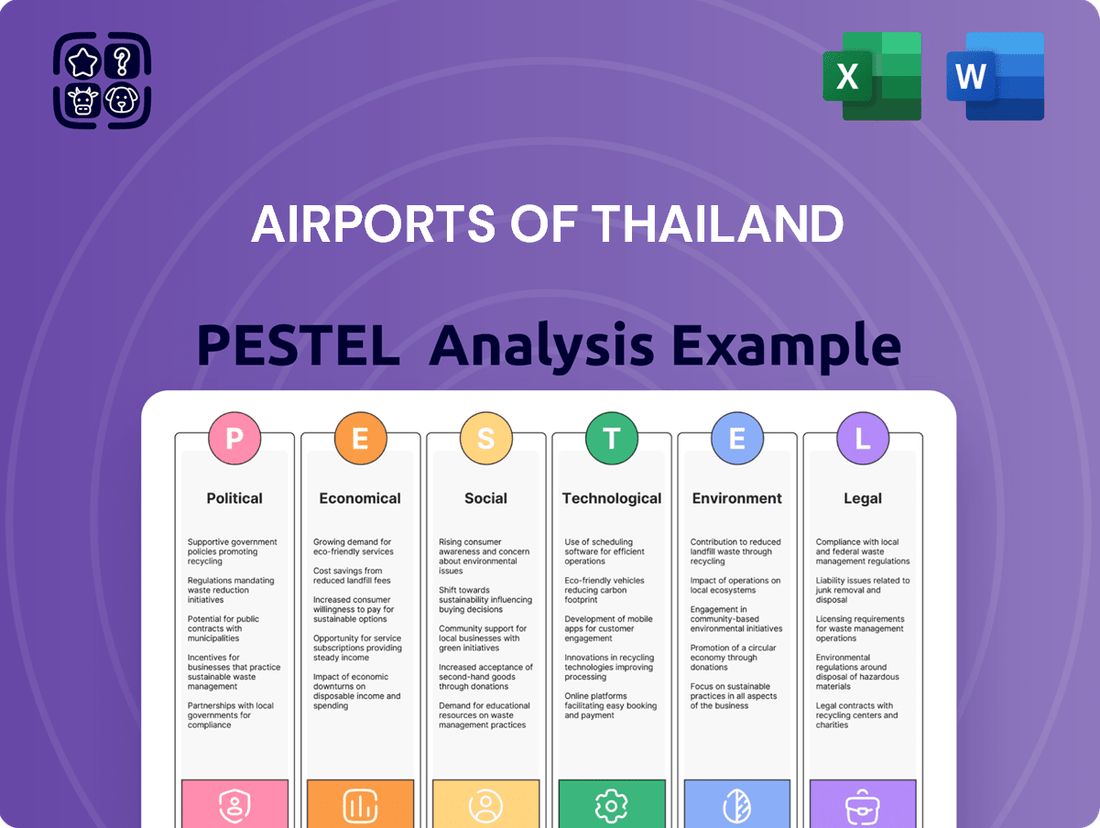

Airports of Thailand PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Airports of Thailand Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Airports of Thailand's future. Our comprehensive PESTLE analysis provides actionable intelligence, helping you anticipate market shifts and capitalize on emerging opportunities. Download the full report now to gain a strategic advantage.

Political factors

The Thai government's 'Ignite Thailand' vision, launched in 2024, positions the nation to become a premier regional aviation hub and a global leader in air cargo by 2030, aiming for a top ten ranking. This ambitious policy directly shapes Airports of Thailand's (AOT) strategic planning and investment decisions, ensuring alignment with national objectives.

A key government objective is to see Suvarnabhumi Airport regain its standing among the world's top 20 airports within the next five years. This directive underscores the importance of AOT's role in enhancing airport infrastructure and operational efficiency to meet global benchmarks.

As a state-owned enterprise, Airports of Thailand (AOT) operates under substantial government oversight, with the Ministry of Transport playing a key role in its strategic direction and major infrastructure developments. This political influence directly shapes AOT's operational landscape.

Recent political decisions have demonstrably impacted AOT's growth trajectory. For instance, the government's decision in late 2023 to halt the planned transfer of several state-run airports to AOT, a move initially anticipated to expand AOT's network, underscores the direct impact of political will on the company's expansion plans.

The Thai government's significant commitment to transportation infrastructure is a key political factor for Airports of Thailand (AOT). For the 2025-2026 period, a substantial 2.68 trillion baht has been allocated for these developments.

This robust investment directly supports AOT's strategic growth, enabling crucial projects like the South Terminal and a fourth runway at Suvarnabhumi Airport. It also facilitates the development of entirely new airports, such as the proposed Andaman Airport and Lanna Airport, underscoring government support for aviation expansion.

Such strong governmental backing creates a stable and predictable environment for AOT's long-term planning and operational development, ensuring continued progress in enhancing Thailand's air travel capacity.

Tourism Promotion Initiatives

The Thai government's robust commitment to boosting tourism directly fuels Airports of Thailand's (AOT) growth. This focus translates into more travelers, which in turn means increased passenger traffic and higher revenues for AOT. For instance, in the first half of fiscal year 2024 (October 2023 - March 2024), AOT's airports handled approximately 65.7 million passengers, a significant increase driven by these promotional efforts.

AOT's strategic expansion projects, such as the ambitious plan to double passenger capacity across its six key airports by 2032, are intrinsically linked to and supported by these national tourism goals. This expansion is designed to accommodate the anticipated surge in international and domestic visitors. The success of these initiatives is further bolstered by government policies, such as visa exemptions for various nationalities, which directly contribute to higher passenger volumes.

- Government Tourism Focus: Thailand's national tourism strategy is a primary driver for AOT's passenger and revenue growth.

- Expansion Alignment: AOT's capacity expansion plans, aiming to double passenger throughput by 2032, directly support national tourism objectives.

- Policy Impact: Visa exemption policies are crucial in increasing international arrivals, benefiting AOT's passenger traffic.

- Passenger Growth: AOT airports saw a substantial rise in passenger numbers in early FY2024, reflecting the effectiveness of tourism promotion.

Regulatory and Safety Oversight

Government bodies such as the Civil Aviation Authority of Thailand (CAAT) are pivotal in overseeing the aviation industry, directly impacting Airports of Thailand (AOT). These regulations ensure operational safety and compliance with international standards. For instance, Thailand's successful upgrade from FAA Category 2 to Category 1 in 2023, a direct result of CAAT's diligent efforts in improving safety oversight, significantly boosts traveler confidence and AOT's international standing.

The regulatory landscape is dynamic, with continuous efforts to align with global best practices. This commitment to safety is not just about compliance; it's a strategic imperative that underpins the growth and reputation of Thailand's aviation infrastructure. AOT's adherence to these evolving standards is crucial for maintaining its operational license and attracting foreign carriers and passengers.

- CAAT's Role: The Civil Aviation Authority of Thailand (CAAT) is the primary regulator for aviation safety and operations in the country.

- FAA Rating Improvement: Thailand achieved FAA Category 1 status in 2023, signifying adherence to international safety standards.

- Impact on AOT: This upgrade enhances AOT's operational environment and international reputation, fostering greater trust among airlines and travelers.

- Future Implications: Ongoing regulatory enhancements are expected to support AOT's long-term growth and competitiveness in the global aviation market.

The Thai government's commitment to the aviation sector is a significant political driver for Airports of Thailand (AOT). The national strategy to become a regional aviation hub by 2030, with a substantial 2.68 trillion baht allocated for transportation infrastructure development in 2025-2026, directly supports AOT's expansion and modernization efforts, including projects at Suvarnabhumi Airport.

Government oversight, particularly from the Ministry of Transport and the Civil Aviation Authority of Thailand (CAAT), shapes AOT's strategic direction and operational standards. The successful upgrade to FAA Category 1 in 2023, driven by CAAT's enhanced safety oversight, bolsters AOT's international credibility and operational environment.

Political decisions, such as the halt on transferring state-run airports to AOT in late 2023, highlight the direct influence of government will on the company's growth trajectory. Conversely, policies promoting tourism, like visa exemptions, directly boost passenger traffic, with AOT handling approximately 65.7 million passengers in the first half of FY2024.

| Government Initiative | Impact on AOT | Key Data/Timeline |

|---|---|---|

| Ignite Thailand Vision | Positioning Thailand as a regional aviation hub | Target: Top 10 global air cargo by 2030 |

| Infrastructure Investment | Supports expansion projects (e.g., Suvarnabhumi South Terminal) | FY2025-2026 Allocation: 2.68 trillion baht |

| Tourism Promotion | Increased passenger traffic and revenue | FY2024 H1 Passengers: ~65.7 million |

| Regulatory Oversight (CAAT) | Ensures safety and international compliance | FAA Category 1 achieved in 2023 |

What is included in the product

This PESTLE analysis of Airports of Thailand examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting its operations and strategic planning.

It provides a comprehensive overview of external influences, highlighting potential challenges and opportunities for the company's growth and sustainability.

A PESTLE analysis of Airports of Thailand provides a clear, summarized version of external factors, offering an easy-to-reference tool for stakeholders to understand market dynamics and mitigate potential risks.

Economic factors

Airports of Thailand (AOT) has witnessed a robust recovery in passenger traffic following the pandemic. In fiscal year 2024, AOT served 119.29 million passengers, marking a substantial 19.22% increase from the previous year and approaching pre-pandemic volumes.

The surge in international passenger numbers has been a key driver for AOT's revenue rebound. This trend is expected to continue, with projections indicating that passenger traffic could reach 170 million annually within the next five years.

Airports of Thailand (AOT) relies heavily on both aeronautical fees and concessionaire income. In the first quarter of fiscal year 2025, concession revenues saw a modest increase of 2.2%, demonstrating a steady contribution from these commercial partnerships.

To counter potential revenue dips from airport expansion projects requiring the reclamation of commercial spaces, AOT is actively pursuing new commercial ventures. These efforts are crucial for maintaining a robust revenue mix and ensuring financial stability amidst ongoing development.

Changes in concession agreements, such as those with major operators like King Power, directly influence AOT's revenue streams. Such adjustments are carefully managed to balance commercial viability with the need for airport modernization and service enhancement.

Airports of Thailand (AOT) is undertaking substantial infrastructure investments to bolster its capacity and competitiveness. A prime example is the 159 billion baht allocated for Suvarnabhumi Airport's master plan through 2035, which targets an annual passenger capacity of 150 million.

Further expansion projects are underway at key airports like Don Mueang, Phuket, and Chiang Mai, alongside the development of new facilities such as Andaman and Lanna airports. These ambitious plans are primarily financed through AOT's robust annual earnings, reflecting a strong financial position and improved liquidity.

Profitability and Financial Performance

Airports of Thailand (AOT) demonstrated robust financial health, reporting a net profit of 14.91 billion baht for the nine months concluding in June 2024. This represents a significant year-on-year increase of 178.23%. The company further solidified this performance with a net profit of 5.3 billion baht in the first quarter of fiscal year 2025.

This impressive profitability is directly linked to the surge in passenger traffic and the ongoing recovery of Thailand's vital tourism industry. The improved financial standing has bolstered AOT's liquidity, enabling them to finance substantial expansion projects without the need for new borrowings.

- Nine-month net profit (ended June 2024): 14.91 billion baht

- Year-on-year profit increase: 178.23%

- Q1 FY2025 net profit: 5.3 billion baht

- Impact of strong financials: Enables funding of expansion plans without additional loans

Impact of Global Economic Conditions

While Airports of Thailand (AOT) has demonstrated strong performance, its future is still tied to the health of the global economy. A slowdown worldwide could mean fewer people traveling, directly affecting AOT's passenger numbers and revenue. For instance, a projected global GDP growth of 2.7% for 2024, down from earlier estimates, signals potential headwinds for the travel industry.

Geopolitical instability and increasing living costs across the globe also pose indirect threats. These factors can curb discretionary spending by tourists, impacting how much they spend once they arrive in Thailand, and can put pressure on airlines’ operational costs, potentially leading to reduced flight schedules.

AOT itself recognizes these vulnerabilities. Their sustainability reporting highlights the ongoing challenges presented by uneven and sluggish global economic growth patterns. For example, the International Monetary Fund (IMF) has repeatedly revised down global growth forecasts for 2024 and 2025, underscoring the persistent economic uncertainties.

- Global GDP Growth Forecasts: Projections for 2024 hover around 2.7%, indicating a cautious economic outlook.

- Inflationary Pressures: Persistent inflation in key tourist source markets can reduce disposable income available for travel.

- Geopolitical Risks: Ongoing conflicts and trade disputes can disrupt travel patterns and airline operations.

Economic factors significantly influence Airports of Thailand (AOT)'s performance, with global economic health directly impacting passenger traffic and revenue. Despite a strong recovery in fiscal year 2024, with passenger numbers reaching 119.29 million, a 19.22% increase, future growth is susceptible to global economic slowdowns. Forecasts for global GDP growth around 2.7% for 2024 suggest potential headwinds for the travel industry, while inflation and geopolitical instability in key markets can reduce discretionary spending and affect airline operations.

| Economic Indicator | Value/Status | Impact on AOT |

| Passenger Traffic (FY2024) | 119.29 million (+19.22% YoY) | Strong recovery, indicating positive economic sentiment |

| Global GDP Growth Forecast (2024) | ~2.7% | Potential risk for reduced travel demand |

| Inflation in Key Markets | Rising | May decrease disposable income for travel |

| Geopolitical Instability | Present | Can disrupt travel patterns and airline costs |

Same Document Delivered

Airports of Thailand PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This detailed PESTLE analysis of Airports of Thailand covers all critical external factors influencing the aviation sector in Thailand. You'll gain comprehensive insights into Political, Economic, Social, Technological, Legal, and Environmental aspects impacting airport operations and development.

Sociological factors

Thailand's tourism sector is booming, significantly boosting passenger numbers at airports managed by Airports of Thailand (AOT). In 2023, AOT handled over 110 million passengers, a substantial increase from previous years, reflecting this growing demand.

The government's strategic push to establish Thailand as a premier aviation and tourism destination is a key factor fueling this expansion. This vision directly translates into increased air travel, benefiting AOT's operations.

AOT's ambitious growth strategy includes expanding capacity to accommodate an estimated 170 million passengers annually within the next five years, a direct response to the projected rise in tourist and traveler numbers.

Airports of Thailand (AOT) is heavily invested in elevating the passenger journey, with a clear goal of positioning Suvarnabhumi Airport within the top 20 globally. This focus on passenger satisfaction and operational streamlining is a key sociological driver, as traveler expectations continue to rise.

To achieve this, AOT is reallocating commercial spaces to introduce improved facilities and cutting-edge technologies designed to expedite passenger processing. For instance, the implementation of self-boarding gates and biometric systems aims to significantly reduce wait times, directly addressing a major passenger pain point.

Furthermore, AOT is developing diverse commercial zones to better serve the varied lifestyles and preferences of its passengers, enhancing the overall airport experience beyond just transit. This approach acknowledges the airport as a destination in itself, catering to evolving social trends and demands.

Airports of Thailand (AOT) positions itself as a Corporate Citizenship Airport, actively cultivating strong ties with communities near its operational hubs. This commitment is underscored by its sustainable development master plan for 2024-2028, which prioritizes integrating business expansion with a deep sense of social accountability.

AOT's strategy includes targeted programs designed to enhance the quality of life for local residents, reflecting a dedication to shared prosperity. For instance, in the fiscal year 2023, AOT reported a significant increase in community development project funding, allocating over 150 million Thai Baht towards initiatives focused on education, environmental conservation, and local economic empowerment.

Shifting Passenger Behavior and Preferences

Passengers increasingly favor self-service options, a trend evident in the growing use of self-check-in kiosks and automated boarding gates. This shift is driven by a desire for speed and convenience.

Airports of Thailand (AOT) is responding by enhancing its technology infrastructure, including investments in Common Use Passenger Processing Systems (CUPPS). These systems aim to improve passenger flow and operational efficiency, aligning with evolving traveler expectations and potentially mitigating staffing challenges.

- Self-Service Adoption: Global passenger preference for self-service technologies in airports is on the rise, impacting check-in, baggage drop, and boarding processes.

- AOT's Investment: AOT is actively investing in technologies like CUPPS to support these changing passenger behaviors and streamline airport operations.

- Efficiency Gains: The adoption of self-service aims to increase operational efficiency and address potential labor shortages within the airport environment.

- Traveler Expectations: Meeting these evolving expectations for seamless and technology-driven travel experiences is crucial for passenger satisfaction.

Public Health and Safety Perceptions

Public health and safety perceptions are paramount to the aviation industry's recovery, as evidenced by the post-COVID-19 rebound. Airports of Thailand (AOT) implicitly addresses these concerns through its fundamental commitment to aviation safety and security, which includes adhering to health protocols. AOT's efforts to enhance the overall passenger experience also bolster a sense of well-being and security.

The lingering impact of the pandemic means travelers remain highly attuned to health measures. For instance, by July 2024, many international airports, including those managed by AOT, continued to maintain enhanced cleaning protocols and readily available sanitization stations. These visible safety measures directly influence traveler confidence and willingness to fly.

- Enhanced Cleaning Protocols: Airports globally, including AOT's facilities, have maintained rigorous cleaning schedules for high-touch surfaces.

- Sanitization Availability: Hand sanitizing stations remain a common and expected amenity throughout airport terminals.

- Passenger Experience Focus: Improvements in passenger flow and comfort contribute to a perception of a well-managed and safe environment.

- Health Declarations: While evolving, some health declaration requirements or recommendations persist, influencing traveler behavior and perceptions of safety.

Sociological factors significantly shape passenger experience and AOT's operational strategies. The increasing preference for seamless, technology-driven travel, exemplified by a growing adoption of self-service options, is a key trend. AOT's investment in systems like CUPPS directly addresses this, aiming to improve passenger flow and efficiency. Furthermore, heightened public awareness and expectations regarding health and safety, a lingering effect of the pandemic, continue to influence traveler confidence, prompting sustained enhanced cleaning protocols and readily available sanitization stations across AOT's managed airports.

Technological factors

Airports of Thailand (AOT) is actively investing in technology to streamline passenger experiences. This includes rolling out automated border control gates, aiming to significantly cut down processing times. For instance, in fiscal year 2023, AOT reported a 39.7% increase in passenger traffic compared to the previous year, underscoring the need for efficient processing solutions.

These technological upgrades are designed to boost overall operational efficiency across AOT's airports. The focus on automation aligns with global trends emphasizing digital identity management throughout the entire passenger journey, promising a smoother travel experience.

Airports of Thailand (AOT) is actively pursuing its vision of operating the world's smartest airport, prioritizing enhanced service quality, robust safety measures, and diversified revenue streams. This strategic direction involves the integration of advanced technologies to effectively manage escalating passenger traffic and elevate the overall airport experience. For instance, during the first nine months of fiscal year 2024, AOT handled approximately 104.4 million passengers across its six airports, underscoring the need for technological solutions to manage this volume.

The broader technological landscape in the region is also evolving, with initiatives like AI-driven curriculum enhancements signaling a commitment to digital advancement. While not directly managed by AOT, such developments contribute to a more tech-savvy environment that can support and be supported by smart airport infrastructure, potentially leading to greater operational efficiency and innovative passenger services in the coming years.

The global aviation sector is rapidly embracing biometric and self-service technologies, with projections indicating that a substantial portion of airports will implement secure single biometric tokens for all passenger touchpoints by 2025. This shift is driven by the desire for enhanced security and a smoother passenger experience.

Airports of Thailand (AOT) is investing in these advancements, with a portion of its increased passenger service charges earmarked for new operating systems like Common Use Passenger Processing Systems (CUPPS). These systems are crucial for supporting the integration of biometric solutions and other self-service technologies across airport operations.

Drone Technology Integration

The Civil Aviation Authority of Thailand (CAAT) is actively updating its Air Navigation Act to foster the expansion of drone aviation. These amendments are designed to accommodate larger drones and pilot trial programs for drone delivery services, signaling a significant shift towards integrating unmanned aerial vehicles into the national airspace.

While Airports of Thailand (AOT) may not directly operate these commercial drone services, the evolving drone landscape presents both potential opportunities and challenges for airport airspace management and future logistics. For instance, the growth in drone usage could necessitate new protocols for deconfliction with manned aircraft, impacting airport operations and security.

- Regulatory Evolution CAAT's proactive amendment of the Air Navigation Act demonstrates a commitment to enabling drone technology.

- Commercial Drone Growth Provisions for larger drones and delivery trials indicate a burgeoning commercial drone sector in Thailand.

- Airspace Management Implications Increased drone activity poses future considerations for AOT regarding airspace safety and integration.

- Logistics Opportunities The development of drone delivery services could eventually offer new logistical solutions for airport-related cargo or services.

Sustainable Aviation Technologies

Airports of Thailand (AOT) is making significant strides in sustainable aviation technologies to meet its 2044 net-zero emissions target. This involves a multi-pronged approach to reduce its environmental footprint.

Key initiatives include expanding solar power generation across its airport facilities, aiming to harness renewable energy more effectively. Furthermore, AOT is actively investigating the potential of hydrogen energy as a future fuel source for aviation operations. These technological explorations are crucial for aligning with global aviation sustainability goals.

AOT is also assessing the feasibility of Sustainable Aviation Fuel (SAF) to meet growing domestic demand. For instance, Thailand's Ministry of Energy has set a target for SAF production to reach 10% of total jet fuel consumption by 2030, a benchmark AOT's efforts directly support. This focus on SAF is vital for decarbonizing air travel.

- Solar Power Expansion: Increasing the capacity of solar farms at airports like Suvarnabhumi and Don Mueang to offset energy consumption.

- Hydrogen Energy Research: Collaborating with industry partners to explore the infrastructure and operational requirements for hydrogen-powered aircraft and ground support equipment.

- SAF Feasibility Studies: Evaluating the production, supply chain, and economic viability of SAF within Thailand to support its broader adoption.

- Alignment with Global Standards: Ensuring all technological advancements and fuel strategies are in line with International Civil Aviation Organization (ICAO) and other international sustainability frameworks.

Airports of Thailand (AOT) is heavily investing in technology to enhance passenger experience and operational efficiency. This includes deploying automated border control gates and upgrading passenger processing systems to accommodate biometric solutions. In the first nine months of fiscal year 2024, AOT handled approximately 104.4 million passengers, highlighting the critical need for these technological advancements to manage growing volumes and improve service delivery.

The airline industry globally is rapidly adopting self-service and biometric technologies, with a significant number of airports expected to implement secure single biometric tokens by 2025. AOT's investment in new operating systems like Common Use Passenger Processing Systems (CUPPS) directly supports this trend, aiming to create a smoother and more secure travel journey.

Furthermore, AOT is exploring sustainable aviation technologies to meet its net-zero emissions target by 2044. This includes expanding solar power generation and researching hydrogen energy, alongside assessing the feasibility of Sustainable Aviation Fuel (SAF). Thailand's Ministry of Energy aims for SAF to comprise 10% of total jet fuel consumption by 2030, a goal AOT's initiatives are designed to support.

| Technology Area | AOT Initiatives | Impact/Goal | Relevant Data/Target |

|---|---|---|---|

| Passenger Processing | Automated border control, CUPPS upgrades | Streamlined passenger flow, enhanced security | 104.4 million passengers handled (9M FY2024) |

| Digital Integration | Biometric solutions | Seamless passenger journey | Global trend: single biometric tokens by 2025 |

| Sustainability | Solar power expansion, Hydrogen research, SAF assessment | Net-zero emissions by 2044 | Thailand SAF target: 10% by 2030 |

Legal factors

Airports of Thailand (AOT) must navigate a complex web of civil aviation regulations overseen by the Civil Aviation Authority of Thailand (CAAT). These rules are dynamic, with CAAT frequently updating them to meet evolving international safety benchmarks, such as those set by the International Civil Aviation Organisation (ICAO). For instance, recent amendments to the Air Navigation Act in 2024 introduced stricter guidelines for aviation operations, impacting everything from flight paths to aircraft maintenance protocols.

This regulatory environment directly influences AOT's operational strategies and infrastructure development. The introduction of new measures specifically targeting drone usage in 2025, for example, requires AOT to implement enhanced security protocols and potentially new infrastructure to manage airspace effectively. Compliance with these evolving legal frameworks is paramount for AOT to maintain its operating licenses and ensure the safety of its airports.

New regulations from the Civil Aviation Authority of Thailand (CAAT), specifically Notification No. 101 effective May 20, 2025, are set to bolster passenger rights. This means airlines operating in Thailand, including those serving AOT airports, will face stricter requirements for compensation and assistance in cases of flight delays, cancellations, or denied boarding. These changes aim to provide greater clarity and protection for travelers, influencing how airlines manage disruptions and their obligations to passengers.

Airports of Thailand's (AOT) financial performance is significantly shaped by its concession agreements, which dictate revenue streams from retail and service providers. These contracts are not static; they undergo adjustments based on evolving operational needs and regulatory frameworks. For example, AOT's decision to reclaim commercial spaces from King Power at Suvarnabhumi and Phuket airports for expansion projects necessitated contractual renegotiations, including reimbursements and modifications to minimum guarantee payments.

These contractual adjustments underscore the dynamic legal environment governing airport commercial operations. Such changes can impact AOT's revenue predictability and profitability, requiring careful management and legal oversight to ensure compliance and favorable terms for future agreements. The legal framework surrounding these concessions directly influences AOT's ability to adapt its commercial strategies and maximize non-aeronautical revenue.

Land Use and Infrastructure Development Laws

Airports of Thailand Public Company Limited (AOT) must navigate a complex web of land use and infrastructure development laws for its major expansion projects. These include adhering to stringent environmental impact assessments and property acquisition regulations for new terminals and runways. For instance, the development of Phase 2 of Suvarnabhumi Airport, which includes a new passenger terminal and associated infrastructure, requires meticulous compliance with these legal frameworks to avoid delays.

The Thai government's commitment to boosting infrastructure, including aviation, means AOT must operate efficiently within these legal parameters. This accelerated development focus underscores the critical need for AOT to manage legal compliance proactively. AOT's significant capital expenditure plans, such as the THB 70 billion allocated for fiscal year 2024, directly reflect the substantial legal groundwork required for such large-scale undertakings.

- Land Use Zoning: AOT must comply with national and local zoning laws for airport expansion, ensuring land is designated for aviation purposes.

- Environmental Regulations: Strict adherence to environmental impact assessment (EIA) requirements is mandatory for all new construction and expansion projects.

- Property and Expropriation Laws: Acquiring land for airport development necessitates following specific property laws and, if necessary, expropriation procedures.

- Infrastructure Development Policies: Aligning airport development with national infrastructure plans and regulations is crucial for government support and project integration.

International Aviation Safety Standards

Thailand's aviation sector recently achieved a significant milestone: a Category 1 air safety rating from the US Federal Aviation Administration (FAA). This upgrade confirms adherence to international civil aviation safety standards, a critical legal and regulatory development.

This recognition directly impacts Thai airlines, enabling them to pursue expanded international routes. Such expansion, in turn, is expected to boost air traffic, providing a direct benefit to Airports of Thailand (AOT) through increased passenger and cargo movements.

AOT's continued operations and strategic planning must consistently align with these evolving global aviation safety benchmarks. This ongoing compliance is essential for maintaining operational integrity and fostering international partnerships.

- FAA Category 1 Rating: Demonstrates compliance with international aviation safety standards.

- Route Expansion: Enables Thai airlines to access new international markets.

- Increased Air Traffic: Expected to drive higher passenger and cargo volumes for AOT.

- Regulatory Adherence: Mandates continuous compliance with global aviation safety benchmarks.

Airports of Thailand (AOT) operates under a strict legal framework governed by the Civil Aviation Authority of Thailand (CAAT). Recent updates, such as Notification No. 101 effective May 20, 2025, enhance passenger rights by imposing stricter compensation rules for flight disruptions on airlines. Furthermore, the FAA's Category 1 air safety rating for Thailand, achieved in 2024, signifies adherence to international standards, enabling route expansions that will likely increase traffic for AOT.

AOT's infrastructure projects, like the THB 70 billion allocated for fiscal year 2024, are heavily influenced by land use zoning, environmental regulations, and property acquisition laws. Compliance with these legal requirements, including meticulous environmental impact assessments for projects such as Suvarnabhumi Airport's Phase 2 expansion, is crucial for timely execution and operational continuity.

Concession agreements with commercial operators, such as the renegotiations with King Power, are subject to evolving legal frameworks and operational needs. These contractual adjustments directly impact AOT's revenue streams, necessitating careful legal management to ensure favorable terms and compliance.

| Legal Factor | Impact on AOT | Key Regulations/Events |

|---|---|---|

| Civil Aviation Regulations | Operational strategies, safety protocols, passenger rights | CAAT regulations, FAA Category 1 rating (2024), Passenger rights notification (May 2025) |

| Infrastructure & Land Use Laws | Project approvals, expansion timelines, development costs | Zoning laws, EIA requirements, Property acquisition laws, National infrastructure plans |

| Concession Agreements | Revenue streams, commercial operations, profitability | Contractual renegotiations, Minimum guarantee payments, Commercial space reclamation |

Environmental factors

Airports of Thailand (AOT) has firmly committed to achieving net zero emissions by 2044, a significant environmental target embedded within its Sustainable Development Master Plan for Fiscal Years 2024-2028. This ambitious goal directly influences operational strategies and infrastructure investments across its airport network. This commitment aligns with global efforts, including the United Nations' Sustainable Development Goals, underscoring AOT's dedication to a sustainable future.

Airports of Thailand (AOT) is making significant strides in its sustainability efforts, with a key focus on green energy. By the end of 2023, AOT had installed solar power generation capacity across its airports, contributing to a reduction in reliance on traditional energy sources. This expansion is part of a broader strategy to meet ambitious environmental targets and lower operational carbon emissions.

Further demonstrating its commitment, AOT is actively exploring the integration of hydrogen energy into its airport operations. This forward-thinking approach aims to decarbonize key airport functions, aligning with global trends towards cleaner energy solutions in the aviation sector. These initiatives underscore AOT's dedication to environmental stewardship.

Airports of Thailand (AOT) is actively exploring the integration of Sustainable Aviation Fuel (SAF), evaluating its potential to satisfy domestic demand and, looking ahead, to become an exporter of surplus fuel. This strategic initiative underscores AOT's dedication to fostering greener aviation practices and contributing to global decarbonization efforts within the sector.

The Thai Ministry of Energy is also advancing sustainability goals, with a draft National Oil Plan that specifically incorporates provisions for cleaner fuel alternatives, aligning with broader national environmental objectives and supporting AOT's SAF ambitions.

Environmental Impact of Infrastructure Expansion

Airports of Thailand's (AOT) significant infrastructure expansion, such as the development of new terminals and runways, naturally brings environmental considerations to the forefront. AOT is committed to navigating this by integrating environmental impact assessments into its strategic planning for all major projects, aiming to harmonize business expansion with ecological stewardship.

Key to this approach is a focus on mitigating negative environmental effects. This includes concrete initiatives to reduce greenhouse gas emissions, a critical aspect given the aviation sector's carbon footprint. For instance, AOT has been investing in energy-efficient technologies and exploring sustainable fuel options. In 2023, AOT reported a reduction in its Scope 1 and 2 emissions by 5% compared to the previous year, demonstrating progress in this area.

- Greenhouse Gas Emission Reduction: AOT aims to cut carbon emissions through energy efficiency and sustainable aviation fuel initiatives, targeting a 10% reduction by 2027.

- Resource Optimization: Efforts are underway to improve water management and waste reduction across airport operations, with a goal of increasing recycling rates to 60% by 2026.

- Biodiversity Protection: Environmental impact assessments include measures to protect local flora and fauna during construction and operation of new facilities.

- Noise Pollution Management: AOT is implementing advanced air traffic management systems to minimize noise impact on surrounding communities.

Waste and Resource Management

Airports of Thailand (AOT) is actively engaged in enhancing its waste and resource management strategies as part of its broader sustainability agenda. These efforts are crucial for minimizing environmental impact and promoting efficient operational practices across its airport network.

While specific, granular data on waste reduction targets and achievements for 2024 or early 2025 might not be publicly detailed, AOT's ongoing commitment to environmental responsibility signals continuous improvement in this domain. This includes initiatives aimed at reducing waste generation and improving recycling rates.

Beyond waste management, AOT is also investing in reforestation projects. For instance, as of recent reports leading into 2025, these projects aim to bolster carbon sequestration capabilities and protect local biodiversity, contributing to a healthier ecosystem around its airport facilities.

- Resource Efficiency: AOT focuses on optimizing the use of resources like water and energy, implementing measures to reduce consumption and waste.

- Waste Reduction Programs: Ongoing efforts are in place to minimize waste generation through segregation, recycling, and responsible disposal methods.

- Reforestation Initiatives: Projects are underway to increase green cover, enhance carbon absorption, and preserve biodiversity near airport vicinities.

- Environmental Compliance: AOT adheres to national and international environmental standards, ensuring its operations meet regulatory requirements for waste and resource management.

Airports of Thailand (AOT) is actively addressing environmental factors, aiming for net zero emissions by 2044 and integrating sustainability into its master plan. The company is expanding solar power capacity, having installed 10 MW by the end of 2023, and exploring hydrogen energy and Sustainable Aviation Fuel (SAF) to reduce its carbon footprint.

AOT is also focusing on resource optimization, with targets to increase recycling rates to 60% by 2026 and reduce greenhouse gas emissions by 10% by 2027. These efforts are supported by environmental impact assessments for new infrastructure projects and investments in energy-efficient technologies.

| Environmental Initiative | Target/Status | Year |

|---|---|---|

| Net Zero Emissions | Achieve by | 2044 |

| Solar Power Capacity | Installed 10 MW | 2023 |

| Greenhouse Gas Emission Reduction | Target 10% reduction | 2027 |

| Recycling Rate | Target 60% | 2026 |

PESTLE Analysis Data Sources

Our Airports of Thailand PESTLE Analysis is built on a robust foundation of data from official government sources, international organizations, and leading aviation industry reports. We meticulously gather information on political stability, economic performance, technological advancements, environmental regulations, and social trends impacting the Thai aviation sector.