Airports of Thailand Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Airports of Thailand Bundle

Airports of Thailand faces moderate bargaining power from buyers, primarily airlines and passengers, who have some flexibility in choosing airports. The threat of new entrants is relatively low due to high capital requirements and regulatory hurdles. However, the intensity of rivalry among existing airports, though limited, can impact pricing and service offerings.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Airports of Thailand’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Airports of Thailand (AOT) faces considerable bargaining power from specialized equipment and technology providers. AOT depends on a select group of global manufacturers for critical airport infrastructure, including air traffic control systems and advanced security screening technology. For instance, in 2023, the global market for airport security screening equipment was valued at approximately USD 10.5 billion, with a few dominant players controlling significant market share.

This reliance on a limited supplier base, particularly for proprietary technologies and essential maintenance services, grants these suppliers substantial leverage. The substantial investment required for these systems, coupled with the imperative for seamless integration with existing airport operations, further solidifies their strong negotiating position.

Airports of Thailand (AOT) faces considerable bargaining power from construction and infrastructure contractors, particularly given its substantial 700 billion baht investment plan for airport development over the next decade. The sheer magnitude and specialized nature of these projects mean AOT relies on a limited pool of large, experienced firms capable of handling such complex undertakings.

This dependence grants these major contractors significant leverage in negotiating terms, including project costs and delivery timelines. Any disruption or escalation in these areas directly impacts AOT's financial health and its ability to achieve strategic expansion goals, making contractor relationships a critical factor.

Fuel and energy providers hold considerable bargaining power over Airports of Thailand (AOT). Airlines, the primary customers of AOT, and AOT's own ground operations are heavily reliant on aviation fuel and electricity. Fluctuations in global oil prices, a key driver for aviation fuel costs, directly impact airline profitability and their ability to pay landing and service fees to AOT. For instance, in 2023, jet fuel prices saw significant volatility, with Brent crude averaging around $82 per barrel, a factor that airlines must absorb, potentially affecting their spending capacity at AOT facilities.

The supply of electricity for the extensive operations of AOT airports, from terminal lighting to air traffic control systems, is another area where energy providers exert influence. While AOT may not directly procure all aviation fuel, the cost structure for airlines is undeniably tied to these energy inputs. For example, the electricity tariff rates set by national utility providers can represent a substantial operational expense for airlines, indirectly influencing their financial health and their relationship with airport operators like AOT.

Skilled Labor and Specialized Service Providers

Airports of Thailand (AOT) faces significant bargaining power from suppliers of skilled labor and specialized services, particularly in critical areas like air traffic control and aviation security. The limited availability of personnel with these highly specialized skills, often unionized, means they can command higher wages and benefits, directly impacting AOT's operational costs. For example, in 2024, the aviation sector globally continued to grapple with a shortage of certified air traffic controllers, a trend that is likely to persist and exert upward pressure on labor costs for airport operators like AOT.

Specialized external service providers also hold considerable sway. Companies offering essential ground handling, maintenance for complex aircraft systems, or advanced security screening technologies often operate in niche markets with few direct competitors. This scarcity, coupled with the absolute necessity of these services for safety and operational efficiency, allows these providers to negotiate favorable contract terms and pricing, impacting AOT's profitability and operational flexibility.

- Skilled Labor Shortages: Global and regional shortages of air traffic controllers and specialized aviation technicians in 2024 contribute to higher labor costs for AOT.

- Unionized Workforce: Unions representing critical airport staff can leverage collective bargaining power for improved wages and working conditions, increasing operational expenses.

- Specialized Service Providers: Limited competition for essential services like advanced security screening or aircraft maintenance grants these suppliers significant pricing power.

Concessionaires (as suppliers of revenue)

Concessionaires, such as King Power, function as crucial suppliers of non-aeronautical revenue for Airports of Thailand (AOT) through concession fees. While AOT views them as tenants, their role in generating revenue makes them significant suppliers in this context.

The bargaining power of these concessionaires can be substantial, particularly if AOT's reliance on their revenue streams is high. For instance, if passenger traffic and spending, which directly impact concessionaire sales, experience downturns, these suppliers may negotiate for more favorable terms, potentially reducing AOT's income. This was evident in periods where concession revenue did not meet projections.

- Concession Fee Reliance: AOT's financial health is partly tied to the concession fees generated, giving powerful concessionaires leverage.

- Market Conditions: Fluctuations in passenger spending and tourism directly affect concessionaire performance and, consequently, their negotiating stance.

- Strategic Realignments: AOT's initiatives, like reclaiming commercial spaces for upgrades, signal a dynamic where AOT also seeks to optimize its revenue-generating assets, influencing supplier relationships.

Suppliers of specialized airport technology and critical infrastructure, such as air traffic control systems and advanced security screening equipment, hold significant bargaining power over Airports of Thailand (AOT). This is due to the limited number of global manufacturers capable of providing these proprietary and essential systems, coupled with the high switching costs and integration complexities involved.

Major construction and infrastructure contractors also wield considerable influence, especially given AOT's substantial investment plans. The specialized nature and scale of these projects necessitate reliance on a select group of experienced firms, allowing them to negotiate favorable terms on costs and timelines.

Fuel and energy providers are key suppliers impacting AOT indirectly through airline operational costs. Volatility in global oil prices, as seen in 2023 with Brent crude averaging around $82 per barrel, affects airline profitability and their capacity to pay airport fees, while electricity tariffs also represent a significant operational expense for airlines using AOT facilities.

Suppliers of skilled labor, like air traffic controllers, and specialized service providers in areas such as ground handling and maintenance, also possess strong bargaining power due to shortages and niche market dominance. For instance, global shortages of certified air traffic controllers in 2024 continue to drive up labor costs.

| Supplier Category | Key Factors Influencing Bargaining Power | Impact on AOT |

|---|---|---|

| Technology & Equipment Providers | Limited suppliers, proprietary technology, high switching costs | Higher procurement costs, dependence on specific vendors for maintenance and upgrades |

| Construction & Infrastructure Contractors | Project scale and complexity, limited qualified firms | Potential for cost overruns, impact on project timelines, negotiation leverage on contract terms |

| Fuel & Energy Providers | Global commodity prices (oil), national electricity tariffs | Indirect impact on airline financial health and spending capacity at AOT, operational cost considerations |

| Skilled Labor & Specialized Services | Labor shortages, unionization, niche market expertise | Increased operational expenses, potential for service disruptions if negotiations fail |

What is included in the product

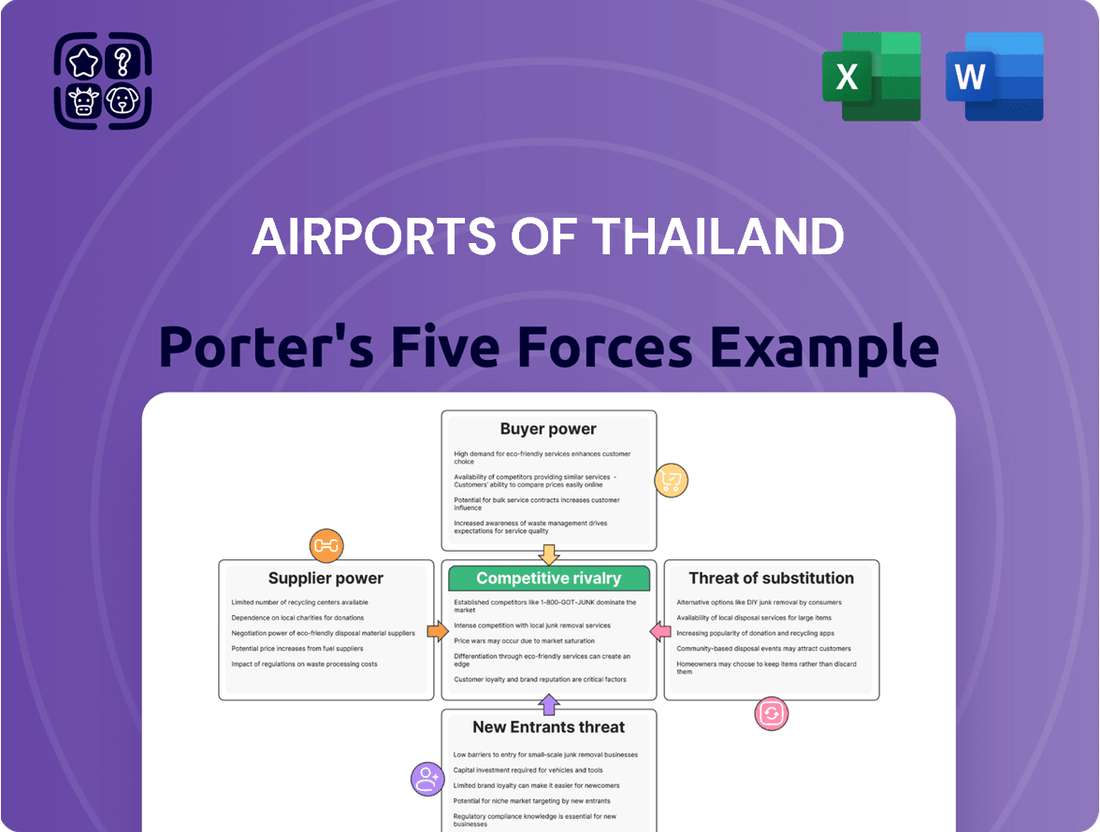

This analysis of Airports of Thailand's competitive landscape reveals the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the potential for substitute services.

Understand the competitive landscape of Airports of Thailand's operations with a clear, one-sheet summary of all five forces—perfect for quick strategic decision-making.

Customers Bargaining Power

Airlines represent a significant customer segment for Airports of Thailand (AOT), primarily purchasing aeronautical services such as landing, parking, and ground handling. In 2024, the volume of passengers handled by AOT airports, reaching over 100 million, underscores the substantial business major airlines represent.

Large airlines and established alliances, particularly those driving substantial passenger and cargo traffic, possess considerable bargaining power. Their ability to consolidate a large portion of AOT's revenue stream allows them to negotiate more favorable terms on fees and services.

While AOT holds a dominant position within Thailand, airlines still retain some leverage by considering alternative regional hubs. This potential, though constrained by AOT's established infrastructure and market share, can influence fee negotiations, especially for carriers with extensive route networks.

Individual passengers hold minimal direct bargaining power over Airports of Thailand (AOT). However, their collective demand is the lifeblood of AOT's operations, making their aggregated influence significant. Factors such as passenger service charges (PSC) are a direct consideration for travelers, and AOT's flexibility in raising these fees is tempered by regional competitive pricing and the passengers' overall price sensitivity.

The robust recovery of tourism, with passenger numbers showing strong growth in 2024 and projected into 2025, creates a favorable demand environment for AOT. This surge in passenger traffic, a key indicator of market health, bolsters AOT's position and somewhat mitigates the direct bargaining power of individual travelers.

Concessionaires, especially major duty-free and retail brands, are vital for Airports of Thailand's (AOT) non-aeronautical income. These businesses pay AOT significant fees and minimum guarantees for prime airport locations, forming a substantial revenue chunk. For instance, AOT's concession revenue experienced a noticeable dip in the first quarter of fiscal year 2025, underscoring the concessionaires' ability to influence AOT's financial results through sales performance and contract negotiations.

Cargo Operators and Freight Forwarders

Cargo operators and freight forwarders represent significant customers for Airports of Thailand's (AOT) cargo handling and warehousing services. Their influence stems directly from the volume of freight they manage and the presence of competing logistics hubs within the region. For instance, in 2024, AOT's cargo throughput reached approximately 1.5 million tons, with a substantial portion originating from these key players.

The burgeoning growth of e-commerce is a dual-edged sword for AOT. While it fuels increased demand for air cargo services, a more competitive landscape among cargo airlines can translate into pressure on AOT to maintain competitive service charges. This dynamic is evident as several regional airports are expanding their cargo facilities, potentially diverting business if AOT's pricing or service levels are not optimized.

- Customer Bargaining Power: Influenced by cargo volume and regional alternatives.

- E-commerce Impact: Drives demand but can intensify airline competition.

- Competitive Pressure: May lead to AOT adjusting service charges to remain attractive.

Tourism and Government Agencies

National tourism authorities and government agencies, while not direct revenue payers, wield significant influence over Airports of Thailand's (AOT) customer base. Their policies directly shape tourism demand, impacting the number of passengers AOT serves.

Government initiatives, such as visa exemptions and targeted tourism promotion campaigns, are crucial drivers of air traffic. For instance, Thailand's efforts to boost tourism have historically led to increased passenger volumes at AOT-operated airports. In 2023, Thailand welcomed approximately 28 million international tourists, a substantial increase from previous years, directly benefiting AOT's passenger throughput and revenue streams.

- Government Policies Impact: Tourism promotion and visa policies directly affect passenger numbers.

- Economic Contribution: Increased tourism boosts AOT's revenue through landing fees, retail concessions, and other services.

- Strategic Alignment: AOT's growth is intrinsically linked to the government's strategic vision for the tourism sector.

Airlines, as AOT's primary customers, possess considerable bargaining power due to the substantial revenue they generate, influencing fee negotiations. While AOT dominates domestically, airlines can explore regional alternatives, a factor that tempers AOT's pricing flexibility. The sheer volume of passengers, exceeding 100 million in 2024, highlights the leverage major carriers hold.

Concessionaires, particularly large retail and duty-free operators, exert influence through their significant contribution to non-aeronautical revenue. Their performance and negotiation stance directly impact AOT's financial results, as seen in the first quarter of fiscal year 2025 where concession revenue showed a dip.

Cargo operators and freight forwarders also wield power based on freight volume, with AOT handling around 1.5 million tons of cargo in 2024. The increasing competitiveness in air cargo, fueled by e-commerce and expanding regional facilities, puts pressure on AOT to maintain attractive service charges.

| Customer Segment | Bargaining Power Drivers | Key Data/Impact (2024/2025) |

|---|---|---|

| Airlines | Revenue volume, potential for regional shifts | Over 100 million passengers handled by AOT airports |

| Concessionaires | Contribution to non-aeronautical revenue, sales performance | Noticeable dip in concession revenue Q1 FY2025 |

| Cargo Operators/Freight Forwarders | Freight volume, regional competition | Approx. 1.5 million tons of cargo handled by AOT |

Preview Before You Purchase

Airports of Thailand Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces analysis for Airports of Thailand, offering a detailed examination of competitive rivalry, the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitute products or services. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy, providing actionable insights into the strategic landscape of Thailand's airport industry.

Rivalry Among Competitors

Airports of Thailand (AOT) contends with intense competition from major regional aviation hubs like Singapore Changi (SIN) and Kuala Lumpur International (KUL). These airports actively vie for transit passengers, cargo volumes, and airline partnerships, aiming to solidify their status as premier regional gateways.

The ongoing development of new airports in emerging Southeast Asian markets, such as Vietnam and the Philippines, further intensifies this rivalry. AOT's strategic response includes significant expansion projects, such as increasing Suvarnabhumi Airport's capacity to 150 million passengers annually, a move designed to bolster its competitive standing.

While Airports of Thailand (AOT) dominates with six major international airports handling about 95% of all flights, smaller, non-AOT managed airports do exist across Thailand. These regional airports, though currently less significant, could emerge as localized competitors. For instance, if airports like U-Tapao or Nakhon Si Thammarat see substantial investment and attract new carriers, they might siphon off domestic traffic or target specific international leisure routes, thereby intensifying competition in those segments.

The competitive landscape for domestic airlines in Thailand significantly influences Airports of Thailand (AOT). Intense price wars among carriers like Thai Airways, Bangkok Airways, and AirAsia Thailand can squeeze their profit margins. For instance, in the first quarter of 2024, the average domestic airfare saw fluctuations, with some routes experiencing double-digit percentage drops as airlines vied for market share.

This intense rivalry can indirectly impact AOT by creating pressure to lower airport fees or potentially leading to reduced flight frequencies if airlines struggle financially. However, a healthy, competitive domestic market also fuels passenger growth, which is beneficial for AOT's aeronautical revenue streams. In 2023, domestic passenger traffic through AOT-operated airports reached approximately 75 million passengers, a substantial increase from the previous year, underscoring the importance of a vibrant airline sector.

Investment in Airport Infrastructure by Competitors

Competitive rivalry is intense, driven by significant investments in airport infrastructure throughout the region. If neighboring countries' airports upgrade or expand rapidly, it poses a risk of diverting air traffic away from Airports of Thailand (AOT).

AOT's strategic response includes a substantial capital expenditure plan. The company has earmarked approximately 700 billion baht for investments over the next five to ten years. This ambitious plan encompasses the development of new terminals and runways, aiming to bolster its competitive position and secure market share.

- Regional Infrastructure Investments: Competitors are actively upgrading and expanding their airport facilities, creating a dynamic regional landscape.

- Traffic Diversion Risk: Rapid modernization by rival airports could attract airlines and passengers, potentially drawing traffic away from AOT's network.

- AOT's Proactive Strategy: AOT's 700 billion baht investment over 5-10 years, focusing on new terminals and runways, is a direct countermeasure to maintain and grow its market share.

Service Quality and Passenger Experience

Competitive rivalry in the airport sector significantly hinges on service quality and the overall passenger experience. Airports worldwide are in a constant race to provide top-tier facilities, streamline operations, and offer appealing amenities to draw in both airlines and travelers. Airports of Thailand (AOT) actively invests in digital transformation and facility upgrades to elevate passenger journeys, aiming for prestigious global recognitions.

For example, Suvarnabhumi Airport's consistent ranking among the world's best airports underscores the importance of these efforts. In 2023, Suvarnabhumi Airport was recognized as the 65th best airport globally by Skytrax, a testament to its focus on passenger satisfaction. This drive for excellence is a critical factor in maintaining a competitive edge.

- Service Quality as a Differentiator: Airports compete not just on capacity but on the quality of services offered, from check-in efficiency to lounge comfort.

- Digitalization for Enhanced Experience: AOT's investment in digital platforms aims to simplify passenger processes, improving convenience and satisfaction.

- Global Rankings as Benchmarks: High rankings in international airport surveys reflect successful service quality initiatives and influence airline and passenger choices.

- Investment in Passenger Amenities: Continuous upgrades to facilities, retail offerings, and passenger comfort zones are vital for attracting and retaining customers.

Airports of Thailand (AOT) faces substantial competitive rivalry from major regional hubs like Singapore Changi and Kuala Lumpur International, which actively compete for transit passengers and airline partnerships. The ongoing development of new airports in emerging Southeast Asian markets further intensifies this rivalry, prompting AOT's significant expansion projects, such as increasing Suvarnabhumi Airport's capacity to 150 million passengers annually.

While AOT dominates with six major airports, smaller, non-AOT managed airports could emerge as localized competitors if they receive substantial investment and attract new carriers, potentially siphoning off domestic traffic or targeting specific leisure routes. This competitive pressure can lead to fluctuations in domestic airfares, as seen in early 2024, impacting airline profit margins and indirectly influencing AOT through potential fee pressures or changes in flight frequencies, though a competitive domestic market also fuels passenger growth for AOT.

AOT's proactive strategy includes a capital expenditure plan of approximately 700 billion baht over the next five to ten years for new terminals and runways to maintain its market share. Service quality is also a key battleground, with AOT investing in digital transformation and facility upgrades to enhance passenger experience, as evidenced by Suvarnabhumi Airport's 2023 Skytrax ranking as the 65th best airport globally. This focus on passenger satisfaction is crucial for retaining a competitive edge in the region.

SSubstitutes Threaten

The expansion of high-speed rail and improved road networks presents a notable threat of substitutes for Airports of Thailand (AOT), especially concerning domestic travel. As these alternatives become more efficient and cost-effective, they can siphon off passengers from shorter domestic flight routes. For instance, the ongoing development of Thailand's high-speed rail projects, aiming to connect major cities like Bangkok and Chiang Mai by 2027, could directly compete with air travel on these high-traffic corridors.

For certain leisure travelers, particularly those undertaking regional trips or visiting island destinations, sea travel through cruises or ferries can present an alternative to air travel. While not directly impacting Airports of Thailand's (AOT) primary long-haul international routes, a burgeoning cruise tourism industry within Thailand could potentially siphon off some short-to-medium haul leisure passengers who might otherwise opt for domestic or regional flights.

In 2024, Thailand's tourism sector saw a significant rebound, with cruise arrivals contributing to this growth. For instance, Phuket welcomed a notable increase in cruise ship calls, bringing substantial numbers of tourists who might have previously flown into the region for island hopping or coastal exploration.

Virtual communication technologies like Zoom and Microsoft Teams have advanced significantly, offering robust alternatives to in-person meetings. This trend was amplified in 2024, with many companies continuing to embrace hybrid work models, potentially reducing the need for some business travel. While not a direct substitute for leisure travel, this could impact the premium segment of Airports of Thailand's (AOT) passenger base.

Alternative Regional Airports/Direct Flights

The threat of substitute regional airports or direct flights exists for travelers whose origins or destinations align with smaller, non-Airports of Thailand (AOT) facilities or even airports in neighboring countries if they offer a more convenient route. For instance, a traveler in Northern Thailand might find a direct flight from Chiang Rai International Airport (CEI) to a regional hub more appealing than connecting through Bangkok's Suvarnabhumi Airport (BKK).

While this substitution is possible, AOT's dominance in Thailand's aviation sector significantly mitigates this threat. In 2024, AOT airports handled a substantial portion of international and domestic air traffic, reinforcing their central role. For example, Suvarnabhumi Airport (BKK) alone processed millions of passengers in the first half of 2024, underscoring its network effect.

- Extensive Network: AOT's portfolio of major airports across Thailand offers unparalleled connectivity, making it difficult for smaller, regional airports to compete on a broad scale.

- Dominant Market Share: AOT airports collectively capture a vast majority of air passenger traffic within Thailand, creating a strong barrier to entry for potential substitutes.

- Ancillary Services: The integrated services and passenger amenities at AOT's hubs often surpass those found at smaller, independent airports, further deterring substitution.

Self-Driving Vehicles and Ride-Sharing for Airport Access

The increasing sophistication of ground transportation, including self-driving vehicles and enhanced ride-sharing platforms, presents a subtle threat to Airports of Thailand (AOT). While these options don't replace the need for air travel, they can diminish AOT's revenue streams derived from airport parking and traditional taxi concessions. For instance, in 2024, ride-sharing services continued to gain market share globally, offering competitive pricing that might draw travelers away from airport-managed parking facilities.

AOT may need to re-evaluate its ground transportation strategy to remain competitive. This could involve integrating new mobility solutions or adjusting pricing for parking and taxi services to align with more convenient and potentially cheaper alternatives. The growing adoption of electric and autonomous vehicles in urban areas by 2025 further underscores the need for AOT to anticipate and adapt to evolving traveler preferences and technological advancements in ground transportation.

- Impact on Ancillary Revenue: Threat of reduced parking fees and taxi commission income.

- Competitive Pricing Pressure: Ride-sharing and autonomous vehicles offer potentially lower costs for airport access.

- Adaptation Needs: AOT may need to update its ground transportation offerings and pricing.

- Future Trends: The rise of electric and autonomous vehicles by 2025 necessitates strategic planning.

The threat of substitutes for Airports of Thailand (AOT) primarily stems from advancements in high-speed rail and improved road networks, particularly impacting domestic travel. These alternatives offer increasing efficiency and cost-effectiveness, potentially diverting passengers from shorter flight routes. For example, Thailand's ongoing high-speed rail development, connecting major cities, directly competes with air travel on key corridors.

Sea travel, such as cruises and ferries, can also serve as a substitute for certain leisure travelers, especially for regional trips or island destinations. While not directly affecting AOT's international routes, a growing cruise tourism sector may divert some short-to-medium haul leisure passengers who would otherwise fly domestically.

Virtual communication technologies, like Zoom and Teams, have become more robust, reducing the need for some business travel, especially with the continued embrace of hybrid work models in 2024. This trend could impact AOT's premium passenger segment.

The threat of substitute regional airports or direct flights from non-AOT facilities exists if they offer more convenient routes for specific traveler origins or destinations. However, AOT's extensive network and dominant market share in Thailand, handling millions of passengers in the first half of 2024, significantly mitigate this threat.

Advancements in ground transportation, including ride-sharing and the anticipated rise of autonomous vehicles by 2025, pose a subtle threat by potentially reducing AOT's ancillary revenue from parking and taxi concessions due to competitive pricing.

Entrants Threaten

The threat of new entrants for Airports of Thailand (AOT) is significantly mitigated by the immense capital required to establish a new airport. Building a modern international airport demands billions of dollars for land acquisition, construction, and advanced technology, creating a formidable financial barrier.

For instance, AOT's ongoing development projects, such as the expansion of Suvarnabhumi Airport, represent investments in the hundreds of billions of Thai baht. This scale of financial commitment makes it nearly impossible for new companies to enter the market and compete effectively.

The threat of new entrants for Airports of Thailand (AOT) is significantly low due to stringent regulatory hurdles and substantial government control. As a state-owned enterprise, AOT benefits from policies that create a near-monopoly, making it exceptionally difficult for new players to enter the market. For instance, in 2023, AOT managed 6 major airports, handling over 120 million passengers, underscoring its dominant infrastructure.

Acquiring the necessary licenses, permits, and approvals is a formidable challenge, compounded by the need to comply with rigorous aviation safety and security standards. These requirements are not only complex but also costly, acting as a significant barrier. The Thai government's strategic aim to position Thailand as a leading regional aviation hub further reinforces AOT's protected status, discouraging potential competitors.

The scarcity of suitable land is a significant barrier to entry for new airports in Thailand. Finding large, strategically located parcels with necessary infrastructure and minimal environmental impact near population centers is exceptionally difficult. This limited availability effectively deters potential new competitors from entering the market.

Established Networks and Economies of Scale

Airports of Thailand (AOT) enjoys a formidable advantage due to its deeply entrenched relationships with a wide array of stakeholders, including airlines, ground handling services, and retail concessionaires. This extensive network, built over years of operation, is a significant barrier to entry for any new player aiming to establish a presence in the airport services sector. For instance, in the fiscal year 2023, AOT handled approximately 112 million passengers across its six major airports, showcasing its vast operational capacity and market dominance.

Furthermore, AOT benefits immensely from substantial economies of scale derived from managing multiple high-traffic airports. This scale allows for greater operational efficiency and cost-effectiveness, making it challenging for a new entrant to match AOT's competitive pricing or service standards. The capital investment required to replicate AOT's existing infrastructure and operational network would be astronomical, effectively deterring potential competitors.

- Established Airline and Concessionaire Relationships: AOT's long-standing partnerships provide preferential access and terms, difficult for newcomers to replicate.

- Significant Economies of Scale: Operating multiple large airports allows AOT to achieve lower per-unit costs in areas like security, maintenance, and retail management.

- High Capital Investment Barrier: The immense cost of acquiring land, building terminals, and establishing operational infrastructure presents a substantial hurdle for new entrants.

- Operational Efficiency and Cost Advantages: AOT's scale translates into streamlined processes and cost savings that new, smaller operations cannot easily match.

Brand Recognition and Passenger Trust

The threat of new entrants is significantly lowered by Airports of Thailand's (AOT) deeply ingrained brand recognition and the substantial passenger trust it has cultivated. AOT's decades of operation, managing Thailand's most critical international hubs, have cemented its reputation for reliability and service quality.

New airport operators would struggle immensely to replicate the established trust and brand loyalty that AOT enjoys. This is particularly true as AOT continues to invest in enhancing its facilities and service standards, aiming to improve its global airport rankings. For instance, in 2023, AOT's airports handled a combined passenger traffic of over 100 million, a testament to their established appeal.

- Established Reputation: AOT's long history fosters passenger confidence in safety and operational efficiency.

- Brand Loyalty: Passengers often prefer familiar and trusted airport brands for their travel experiences.

- Investment in Improvement: Ongoing upgrades at AOT airports directly counter potential competitive advantages of new entrants.

- Market Dominance: AOT's control over major international gateways creates a high barrier to entry for new operators.

The threat of new entrants for Airports of Thailand (AOT) is exceptionally low, primarily due to the colossal capital investment required to establish a new airport. Building and operating a modern airport involves immense costs for land, infrastructure, technology, and regulatory compliance, effectively creating a significant financial barrier.

Furthermore, AOT benefits from strong government backing and existing regulatory frameworks that favor established players. The scarcity of suitable land in prime locations and the need to build extensive stakeholder relationships with airlines and concessionaires also present formidable challenges for any potential new competitor.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | Billions of USD for land, construction, technology. | Extremely High |

| Regulatory Hurdles | Licenses, permits, safety standards, government control. | Very High |

| Land Scarcity | Difficulty finding suitable, large, well-located sites. | High |

| Existing Relationships | Established ties with airlines, concessionaires, and suppliers. | High |

| Economies of Scale | AOT's operational efficiency and cost advantages from managing multiple airports. | High |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Airports of Thailand is built upon a foundation of publicly available financial statements, annual reports, and regulatory filings from the Airports of Thailand Public Company Limited (AOT). We also incorporate data from industry-specific market research reports and aviation authority publications to provide a comprehensive view of the competitive landscape.