Airports of Thailand Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Airports of Thailand Bundle

Airports of Thailand's marketing mix is a fascinating study in balancing infrastructure development (Product) with competitive pricing strategies (Price) and extensive network reach (Place). Their promotional efforts aim to attract both airlines and passengers, creating a robust ecosystem.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies for Airports of Thailand. Ideal for business professionals, students, and consultants looking for strategic insights into Thailand's aviation hub.

Product

Airports of Thailand's (AOT) core product is the comprehensive management and operation of its six major international airports. This includes critical services like air traffic control, ensuring the safe and efficient movement of aircraft. In 2023, AOT handled approximately 111.3 million passengers across its airports, a significant increase from previous years, highlighting the demand for these essential services.

The operational scope extends to ground handling and cargo handling, facilitating seamless operations for airlines and businesses. These services are fundamental to the aviation ecosystem, supporting everything from passenger boarding to the swift transport of goods. AOT's commitment is to maintain high standards of safety, security, and efficiency for all stakeholders.

Airports of Thailand (AOT) is actively investing in infrastructure upgrades to handle the projected surge in air travel. A key initiative includes the ongoing development of Suvarnabhumi Airport (BKK), with the recent opening of its third runway in 2023 significantly boosting operational capacity. This expansion is crucial for solidifying Thailand's status as a premier aviation hub in the region.

Further enhancing passenger experience and airport efficiency, AOT is also focused on terminal expansions. For instance, Suvarnabhumi Airport's Terminal 2 project is underway, aiming to increase its annual passenger handling capacity by an additional 15 million. These infrastructure enhancements directly improve the core product offering by allowing for more flights and accommodating a greater volume of travelers.

Airports of Thailand (AOT) is heavily investing in cutting-edge technology to elevate passenger journeys. This includes implementing biometric systems for check-in and boarding, alongside self-service baggage drop-offs and automated passport control, aiming for a smoother, more efficient travel experience. For instance, Suvarnabhumi Airport (BKK) has been progressively rolling out these technologies, with significant upgrades planned through 2025 to boost passenger throughput.

The recent introduction of the Thailand Digital Arrival Card (TDAC) is another key initiative, simplifying immigration and customs procedures. This digital solution aims to reduce wait times and enhance convenience, contributing to AOT's overall goal of a seamless, secure, and pleasant travel environment for every passenger. By mid-2025, AOT expects TDAC adoption to significantly streamline arrival processes across its major airports.

Non-Aeronautical Services and Commercial Development

Airports of Thailand (AOT) diversifies its product beyond core aviation services by offering a robust suite of non-aeronautical services. These include prime concessionaire spaces for retail outlets and food and beverage establishments, catering to the diverse needs and preferences of travelers. This strategic expansion into commercial development, encompassing real estate and logistics projects, significantly bolsters AOT's revenue streams and enriches the overall airport experience.

These non-aeronautical offerings are crucial revenue generators for AOT. For instance, in the fiscal year 2023, commercial revenue, which largely comprises these services, played a vital role in the company's financial recovery and growth. The development of these commercial spaces not only provides travelers with a wider array of choices but also creates a more vibrant and engaging airport environment.

- Retail and F&B Concessions: AOT manages extensive retail and dining spaces, offering travelers convenience and variety.

- Commercial Real Estate: Development of office buildings, hotels, and convention centers adjacent to airports.

- Logistics and Warehousing: Utilizing airport land for cargo handling and related logistics services.

- Advertising and Branding: Opportunities for companies to reach a captive audience through airport advertising.

Safety, Security, and Sustainability Initiatives

Airports of Thailand (AOT) places paramount importance on aviation safety and security, consistently aligning with both national regulations and global benchmarks set by organizations like ICAO. This commitment ensures passenger and operational integrity across its managed airports.

AOT's product strategy is deeply intertwined with sustainability, targeting net-zero emissions by 2044. This ambitious goal is being pursued through concrete actions such as:

- Investing in clean energy sources like solar power.

- Electrifying ground support equipment and operational vehicles.

- Implementing extensive reforestation and green space development projects.

Airports of Thailand's (AOT) product encompasses both core aviation services and a growing portfolio of non-aeronautical offerings. The core product focuses on efficient and safe airport operations, including air traffic control, ground handling, and cargo services, essential for airline and business functionality. By mid-2025, AOT aims to significantly streamline arrival processes through digital solutions like the Thailand Digital Arrival Card (TDAC).

The non-aeronautical product line, crucial for revenue diversification, includes retail, food and beverage concessions, commercial real estate development, logistics, and advertising. This segment is vital for enhancing the passenger experience and generating significant commercial revenue, as seen in fiscal year 2023. AOT's commitment to sustainability is also a key product differentiator, with a target of net-zero emissions by 2044 through investments in clean energy and green initiatives.

| Product Offering | Key Features/Initiatives | 2023 Passenger Volume (Millions) | Key Developments/Targets |

| Core Aviation Services | Air traffic control, ground handling, cargo handling, safety & security | 111.3 | Suvarnabhumi Airport third runway opened (2023), Terminal 2 expansion underway |

| Non-Aeronautical Services | Retail, F&B, commercial real estate, logistics, advertising | N/A (Commercial Revenue significant contributor) | Focus on enhancing passenger experience and revenue diversification |

| Technology Integration | Biometrics, self-service kiosks, digital arrival cards | N/A | Rollout and upgrades planned through 2025 for passenger throughput |

| Sustainability Initiatives | Clean energy, electric vehicles, reforestation | N/A | Net-zero emissions target by 2044 |

What is included in the product

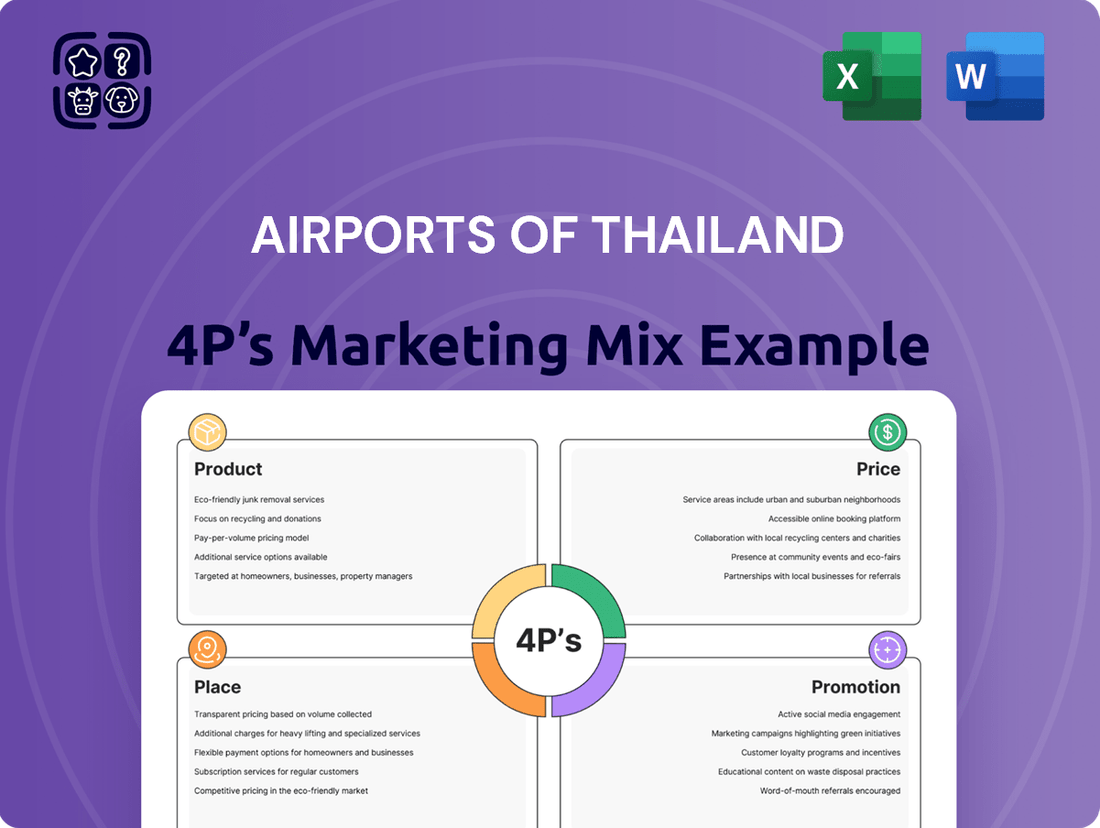

This analysis delves into Airports of Thailand's marketing mix, examining their diverse airport services and infrastructure (Product), competitive and value-based pricing strategies (Price), extensive network of international and domestic hubs (Place), and multifaceted communication and engagement efforts (Promotion).

This analysis simplifies the Airports of Thailand's 4Ps marketing mix, highlighting how strategic product, price, place, and promotion decisions alleviate customer pain points like long wait times and confusing navigation.

Place

Airports of Thailand's (AOT) 'Place' in its marketing mix is anchored by its strategic operation of six major international airports: Suvarnabhumi (BKK), Don Mueang (DMK), Chiang Mai (CNX), Mae Fah Luang–Chiang Rai (CEI), Phuket (HKT), and Hat Yai (HDY). These facilities are crucial hubs, facilitating significant passenger and cargo flows, with Suvarnabhumi and Don Mueang alone handling over 90 million passengers in the fiscal year 2023.

Airports of Thailand (AOT) is actively pursuing the development of strategic hubs to solidify Thailand's standing as a premier global aviation center. This initiative capitalizes on Thailand's advantageous geographical placement within the Asia Pacific, aiming to attract increased air traffic and airline operations.

In fiscal year 2023, AOT's six managed airports served approximately 130 million passengers, a significant increase from the previous year, underscoring the growing demand and the need for expanded infrastructure to support hub development.

The ongoing expansion projects at key airports like Suvarnabhumi Airport are designed to boost passenger handling capacity and introduce enhanced facilities, thereby strengthening Thailand's competitive edge in regional aviation and tourism markets.

Airports of Thailand's 'Place' strategy focuses on enhancing connectivity, integrating airports with broader transportation networks like railways and bus lines. This ensures travelers can reach diverse domestic destinations smoothly. For instance, new premium bus services now operate directly from Suvarnabhumi and Don Mueang airports to popular tourist hubs, facilitating easier onward journeys for millions of passengers.

Infrastructure Expansion for Accessibility

Airports of Thailand (AOT) is significantly investing in infrastructure to boost accessibility, notably at Suvarnabhumi Airport (BKK). The East Expansion project, a key component, aims to increase handling capacity and streamline passenger movement, directly enhancing the 'Place' aspect of their marketing mix. This expansion is crucial for accommodating projected passenger growth.

These infrastructure upgrades are vital for AOT's strategy to improve the physical environment and operational efficiency. The planned South Terminal at Suvarnabhumi Airport is another testament to this commitment, further expanding capacity and accessibility. Such developments are essential for maintaining competitiveness and meeting future demand.

- Suvarnabhumi Airport's East Expansion is a major project to increase capacity.

- A planned South Terminal at Suvarnabhumi Airport will further enhance accessibility.

- These infrastructure investments directly improve the physical 'Place' in AOT's 4P analysis.

- The expansions are designed to accommodate a growing number of passengers, with BKK handling over 80 million passengers in 2023.

Regional Airport Network Strengthening

Airports of Thailand (AOT) is actively bolstering its regional airport infrastructure, aiming to stimulate economic activity and tourism across Thailand's diverse provinces. This strategic push extends beyond major international gateways, focusing on enhancing connectivity to secondary cities.

Significant investments are being channeled into upgrading existing regional facilities. For instance, Chiang Mai International Airport (CNX) and Phuket International Airport (HKT), while major hubs, are also seeing terminal enhancements to accommodate growing passenger traffic. Looking ahead, AOT is exploring the feasibility of developing second airports in these high-demand provinces. This foresight aims to create a more robust and distributed air travel network, improving accessibility and facilitating broader economic development.

- Regional Network Expansion: AOT is committed to developing regional airports to support tourism and economic growth in provinces beyond the primary hubs.

- Terminal Upgrades: Ongoing terminal improvements are underway at key regional airports such as Chiang Mai and Phuket to enhance passenger experience and capacity.

- Second Airport Exploration: AOT is investigating the development of secondary airports in major provincial centers to further improve air travel accessibility and distribution.

- Economic Impact: These initiatives are designed to foster greater economic opportunities and distribute the benefits of tourism more widely across the country.

Airports of Thailand's 'Place' strategy leverages its network of six key airports, with Suvarnabhumi (BKK) and Don Mueang (DMK) being the primary international gateways. These airports are central to Thailand's aviation infrastructure, handling a substantial volume of passengers. In fiscal year 2023, AOT's managed airports saw approximately 130 million passengers, with BKK and DMK accounting for over 90 million combined.

AOT is actively enhancing these locations through expansion projects, such as the East Expansion at Suvarnabhumi, to increase capacity and improve passenger flow. This focus on physical infrastructure development is crucial for maintaining Thailand's position as a regional aviation hub and accommodating future growth, with BKK alone expecting to handle over 80 million passengers in 2023.

| Airport | FY2023 Passengers (Millions) | Key Development |

|---|---|---|

| Suvarnabhumi (BKK) | ~80+ | East Expansion, South Terminal planning |

| Don Mueang (DMK) | ~10+ | Capacity enhancement |

| Chiang Mai (CNX) | ~5+ | Terminal upgrades, second airport feasibility |

| Phuket (HKT) | ~5+ | Terminal upgrades, second airport feasibility |

| Chiang Rai (CEI) | ~1+ | Infrastructure improvements |

| Hat Yai (HDY) | ~1+ | Infrastructure improvements |

Same Document Delivered

Airports of Thailand 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Airports of Thailand 4P's Marketing Mix Analysis covers Product, Price, Place, and Promotion strategies, offering valuable insights for understanding the aviation sector.

This is the same ready-made Marketing Mix document you'll download immediately after checkout. It provides a detailed breakdown of how Airports of Thailand leverages its offerings, pricing structures, distribution channels, and promotional activities to succeed in the competitive travel market.

You're viewing the exact version of the analysis you'll receive—fully complete, ready to use. This document offers a deep dive into the strategic marketing decisions of Airports of Thailand, empowering you with actionable knowledge.

Promotion

Airports of Thailand (AOT) benefits significantly from government-backed tourism promotion campaigns, which directly fuel passenger traffic growth. These national initiatives, such as the "Visit Thailand Year 2023-2024" campaign, act as a powerful promotional umbrella, increasing overall visitor numbers. In 2023, Thailand welcomed approximately 28 million international tourists, a substantial increase from previous years, directly boosting AOT's airport operations.

Airports of Thailand (AOT) is actively communicating its dedication to enhancing the passenger journey through digital innovation. This includes the rollout of technologies like biometric check-in, self-service baggage drops, and automated passport control, aiming to streamline the airport experience.

The communication strategy emphasizes convenience, efficiency, and safety, assuring travelers of a smoother and more secure process. For example, AOT's investment in technology is reflected in its capital expenditure plans, with significant portions allocated to digital infrastructure upgrades and passenger facilitation systems, particularly in anticipation of increased travel volumes in 2024 and 2025.

Airports of Thailand (AOT) actively promotes its facilities by highlighting prestigious global airport rankings and awards. Suvarnabhumi Airport's enhanced position in the Skytrax World Airport Awards, along with accolades like the Prix Versailles 2024 for Most Beautiful Airport Terminal, directly bolster AOT's promotional messaging, underscoring a commitment to superior passenger experience and world-class infrastructure.

Strategic Partnerships and Industry Engagement

Airports of Thailand (AOT) actively cultivates strategic partnerships with airlines and other aviation stakeholders. These collaborations are crucial for broadening international flight routes and solidifying Thailand's standing as a key regional aviation hub. For instance, AOT's engagement with airlines directly impacts passenger traffic, with Bangkok Suvarnabhumi Airport (BKK) handling approximately 70 million passengers in 2023, a significant increase from the previous year.

AOT's commitment to industry engagement is exemplified by its participation in events like the AOT Sister Airport CEO Forum 2024. This forum fosters vital collaboration and the exchange of best practices among global aviation leaders. Such initiatives contribute to operational efficiency and service quality improvements across AOT's managed airports, aiming to enhance the overall passenger experience.

- Expanding Networks: AOT's partnerships with airlines are designed to increase direct flight connectivity to and from Thailand, boosting international tourism and business travel.

- Industry Knowledge Exchange: Events like the Sister Airport CEO Forum facilitate the sharing of insights on airport management, technology adoption, and sustainability practices.

- Economic Impact: By strengthening Thailand's position as an aviation hub, AOT's strategic engagements contribute to the nation's economic growth through increased tourism revenue and trade.

- Operational Synergy: Collaborations with airlines and aviation entities aim to create a more seamless and efficient travel experience for passengers, from check-in to arrival.

Sustainability and Green Airport Initiatives

Airports of Thailand (AOT) actively promotes its dedication to environmental stewardship through various sustainability and green airport initiatives. A significant aspect of this is their pursuit of net-zero emissions, demonstrated by the adoption of clean energy sources and the electrification of airport vehicle fleets. This commitment resonates strongly with travelers and stakeholders who prioritize eco-friendly practices, thereby bolstering AOT's brand reputation.

These efforts are not merely aspirational; AOT has made tangible progress. For instance, by the end of fiscal year 2023, AOT reported a reduction in its carbon footprint, with specific targets set for further decreases in greenhouse gas emissions through 2030. The integration of renewable energy, such as solar power at major airports like Suvarnabhumi, contributes directly to these environmental goals.

- Net-Zero Commitment: AOT is actively working towards achieving net-zero carbon emissions across its operations.

- Clean Energy Adoption: The company is increasing its use of renewable energy sources, including solar power installations at key airports.

- Fleet Electrification: AOT is transitioning its ground support equipment and airport vehicles to electric power to reduce direct emissions.

- Environmental Brand Enhancement: These green initiatives appeal to environmentally conscious consumers and investors, positively impacting AOT's corporate image.

Airports of Thailand (AOT) leverages government tourism campaigns, such as the "Visit Thailand Year 2023-2024," to drive passenger growth, with Thailand seeing around 28 million international tourists in 2023. AOT also promotes its digital advancements, like biometric check-in and self-service baggage, to enhance passenger convenience and efficiency, backed by significant capital expenditure for infrastructure upgrades in 2024-2025.

Furthermore, AOT highlights its prestigious awards, including Skytrax rankings and the Prix Versailles 2024 for Most Beautiful Airport Terminal, reinforcing its commitment to superior passenger experience. Strategic partnerships with airlines are crucial for expanding flight networks, exemplified by Bangkok Suvarnabhumi Airport (BKK) handling approximately 70 million passengers in 2023, solidifying Thailand's role as a regional aviation hub.

AOT's commitment to sustainability, including net-zero emissions goals and solar power integration, enhances its brand image among eco-conscious travelers and investors, with carbon footprint reductions reported by the end of fiscal year 2023.

| Promotion Aspect | Key Initiatives/Facts | Impact/Data (2023-2024) |

|---|---|---|

| Government Tourism Campaigns | Visit Thailand Year 2023-2024 | 28 million international tourists in 2023 |

| Digital Innovation | Biometric check-in, self-service baggage | Streamlined passenger journey, capital expenditure for upgrades |

| Awards & Rankings | Skytrax, Prix Versailles 2024 | Enhanced brand reputation, superior passenger experience |

| Airline Partnerships | Expanding direct flight connectivity | BKK handled 70 million passengers in 2023 |

| Sustainability Initiatives | Net-zero emissions, solar power | Reduced carbon footprint (FY2023), improved corporate image |

Price

Airports of Thailand (AOT) derives a substantial amount of its income from aeronautical revenue. This category encompasses crucial fees like landing charges, aircraft parking fees, and passenger service charges (PSCs) levied on airlines. These charges form the bedrock of AOT's financial model, directly influencing operational costs for carriers and, consequently, airfare prices for travelers.

For the fiscal year 2023, AOT's aeronautical revenue reached approximately THB 26.7 billion, a significant increase from THB 12.6 billion in fiscal year 2022, reflecting the strong recovery in air traffic. Passenger service charges alone contributed a notable portion, with the average PSC per departing international passenger being THB 700 and for domestic passengers THB 100.

Non-aeronautical concessionaire fees represent a critical revenue stream for Airports of Thailand (AOT), significantly bolstering its financial performance. These fees are generated from a diverse range of commercial activities, including duty-free shops, dining establishments, and retail spaces leased to various operators within AOT's airports.

In the fiscal year 2023, AOT reported total revenue of THB 17,567 million, with non-aeronautical revenue accounting for a substantial portion. For instance, concessions at Suvarnabhumi Airport alone generated THB 5,276 million in the same period, highlighting the importance of these agreements.

AOT's pricing strategy for these concessions typically involves a combination of fixed rental fees and a percentage of the operator's gross sales, often with a minimum guarantee to ensure a baseline income. This approach allows AOT to benefit from both predictable revenue and the success of its commercial partners.

Airports of Thailand (AOT) diversifies its revenue streams beyond passenger fees by implementing various service charges for airport operations and facility usage. These charges are crucial for maintaining the high standards expected within the airport environment.

Furthermore, AOT capitalizes on its prime real estate by generating significant rental income from office spaces, retail outlets, and other commercial properties situated within and around its airports. For the fiscal year 2023, AOT reported total revenue of approximately 18,249 million Thai Baht, with a substantial portion attributed to these non-aeronautical sources, reflecting the effectiveness of its comprehensive pricing strategy.

Variable Pricing Based on Traffic and Demand

Airports of Thailand's (AOT) pricing strategy, while not explicitly detailed, clearly adapts to market conditions, particularly traffic and demand. This variable pricing approach means revenue directly correlates with the number of flights and passengers handled.

Evidence of this dynamic pricing is seen in the projected fiscal year 2025 performance. With an anticipated surge in both flight operations and passenger throughput, AOT is positioned for substantial revenue increases, underscoring how volume directly impacts financial outcomes.

- Revenue Growth: Fiscal year 2025 projections show a strong upward trend in revenue, directly linked to increased air traffic.

- Demand Sensitivity: AOT's revenue model inherently adjusts with fluctuations in passenger numbers and flight activity.

- Pricing Mechanism: While specific rates are proprietary, the scaling of revenue with volume suggests a pricing structure that benefits from higher demand.

Strategic Adjustments to Commercial Area Revenues

Airports of Thailand (AOT) is strategically reallocating commercial and office spaces at key airports like Suvarnabhumi and Phuket. This initiative, while potentially causing a temporary dip in minimum guaranteed concession revenue, is designed to elevate the passenger journey. For instance, the reclamation of areas aims to create more modern and appealing retail and service environments.

This long-term vision for improved passenger experience is expected to unlock greater commercial potential. By offering enhanced facilities and introducing new, sought-after commercial activities, AOT anticipates a significant uplift in overall commercial revenues down the line. This strategic shift prioritizes quality and passenger satisfaction as drivers for future financial growth.

- Space Reallocation: Reclamation of commercial and office rental areas at Suvarnabhumi and Phuket airports.

- Short-Term Impact: Potential reduction in minimum guaranteed revenue from concessions.

- Long-Term Strategy: Focus on improving passenger experience and enhancing facilities.

- Future Outlook: Expectation of increased overall commercial revenue through new activities and improved offerings.

Airports of Thailand (AOT) employs a multi-faceted pricing approach across its revenue streams. Aeronautical charges, including passenger service charges (PSCs), are a core component, with international passengers paying THB 700 and domestic passengers THB 100 in fiscal year 2023. Non-aeronautical revenue, derived from concessions and rentals, often utilizes a hybrid model of fixed fees and a percentage of sales, ensuring AOT benefits from both predictable income and partner success.

The company's pricing is inherently sensitive to market demand, with revenue directly scaling with passenger and flight volumes. Projections for fiscal year 2025 indicate a significant revenue uplift driven by anticipated increases in both metrics, demonstrating the direct correlation between traffic and financial performance.

AOT's strategic reallocation of commercial spaces, while potentially impacting short-term guaranteed revenue, aims to enhance passenger experience and unlock greater long-term commercial potential through improved offerings.

| Revenue Stream | Pricing Mechanism | FY2023 Data (THB Billion) | FY2025 Projection Drivers |

|---|---|---|---|

| Aeronautical (PSC) | Per Passenger Fee | 26.7 (Total Aero) | Increased Passenger Traffic |

| Non-Aeronautical (Concessions) | Fixed Rent + % of Sales | 17.567 (Total Revenue) | Space Reallocation & Enhanced Offerings |

| Non-Aeronautical (Rentals) | Fixed Rental Fees | 18.249 (Total Revenue) | Optimized Space Utilization |

4P's Marketing Mix Analysis Data Sources

Our Airports of Thailand 4P's Marketing Mix Analysis is constructed using official annual reports, investor relations materials, and public statements from the Airports of Thailand Public Company Limited. We also incorporate data from aviation industry publications and relevant government aviation authority reports to ensure a comprehensive view.