Air Methods SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Air Methods Bundle

Air Methods, a leader in air medical services, faces a dynamic landscape. Their strengths lie in their extensive network and operational expertise, crucial for rapid response. However, regulatory changes and reimbursement pressures present significant challenges, potentially impacting their financial stability.

Opportunities for growth exist in expanding service lines and technological advancements in patient care. Conversely, intense competition and the need for constant capital investment for fleet upgrades are considerable threats that require careful navigation.

Want the full story behind Air Methods' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Air Methods stands as the largest civilian helicopter operator and a leading air medical services provider in the United States. Its robust network encompasses over 300 bases spread across 48 states, ensuring comprehensive coverage. This vast operational footprint facilitates rapid response times for critical situations. Annually, the company serves more than 100,000 patients, solidifying its market dominance and reach in emergency medical transport.

Air Methods leverages a large team of over 4,500 highly skilled professionals, including a significant number of U.S. veterans, contributing unparalleled discipline and expertise to their operations. The company's commitment to clinical excellence is evident through advanced training initiatives like the Ascend program, which utilizes cutting-edge virtual reality and high-fidelity manikins. This rigorous preparation ensures their clinicians consistently outperform industry benchmarks in critical patient care metrics. As of early 2025, this focus on human capital remains a core competitive advantage.

Air Methods maintains a modern and diverse fleet, consisting of over 400 specialized helicopters and fixed-wing aircraft as of early 2025. The company continuously invests in fleet modernization, notably expanding its collection of Bell 429 helicopters. These aircraft are highly valued for their reliability and advanced safety features. This extensive and varied fleet allows Air Methods to manage a wide range of critical medical transport needs, from routine inter-facility transfers to emergency rescue operations.

Strategic Partnerships with Healthcare Systems

Air Methods maintains robust strategic partnerships with numerous hospitals, healthcare systems, and governmental agencies across the United States. These collaborations, exemplified by their ongoing work with systems like Beacon Health System's Memorial MedFlight, ensure seamless integration into critical emergency response networks. Such strong alliances are fundamental to Air Methods' operational reach and are crucial for sustaining and expanding its market share in the air medical transport sector through 2025.

- Partnerships enhance service delivery efficiency and patient access.

- Strategic alliances are vital for maintaining competitive advantage in a consolidating market.

- These collaborations support a stable revenue base through long-term contracts.

Post-Bankruptcy Financial Restructuring

Following its emergence from Chapter 11 bankruptcy in late 2023, Air Methods significantly strengthened its financial position. The company successfully reduced its debt by approximately $1.7 billion. Furthermore, Air Methods secured $185 million in new capital, boosting operational liquidity. This comprehensive financial restructuring provides a much stronger balance sheet, poised to support long-term strategic growth and investment initiatives through 2024 and 2025.

- Debt Reduction: Approximately $1.7 billion eliminated post-bankruptcy.

- New Capital Secured: $185 million in fresh funding obtained.

- Enhanced Liquidity: Stronger cash position for operations in 2024.

- Strategic Growth: Improved balance sheet supports future investments.

Air Methods exhibits robust strengths, including its market dominance as the largest civilian air medical operator with over 300 bases across 48 states, serving 100,000+ patients annually. A highly skilled workforce of 4,500+ professionals, supported by advanced training, ensures clinical excellence. The company operates a modern fleet of over 400 aircraft and maintains strong partnerships with key healthcare systems. A significant financial restructuring in late 2023, reducing debt by $1.7 billion and securing $185 million in new capital, further strengthens its position for 2024 and 2025.

| Strength Category | Key Metric (2024/2025) | Impact |

|---|---|---|

| Market Reach | 300+ bases, 48 states | Broad operational coverage |

| Patient Volume | 100,000+ annually | Confirms market leadership |

| Fleet Size | 400+ aircraft | Diverse operational capability |

| Debt Reduction | ~$1.7 billion | Improved financial stability |

| New Capital | $185 million | Enhanced liquidity for growth |

What is included in the product

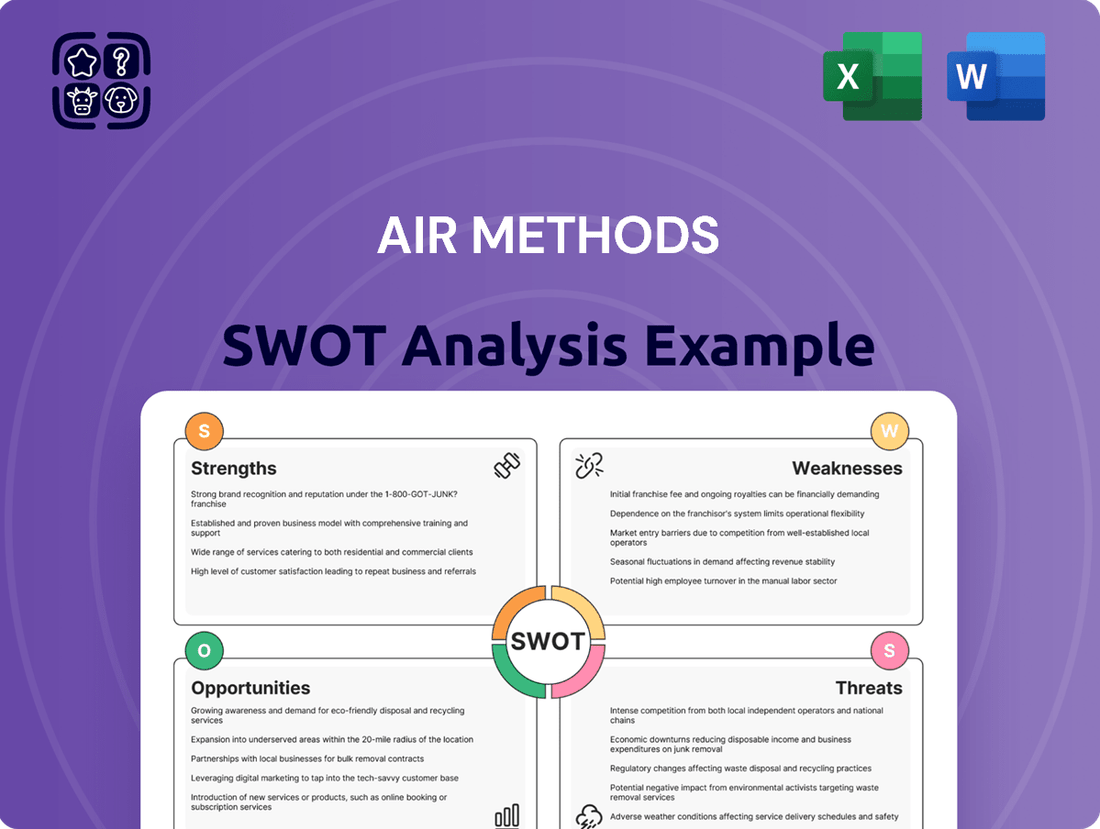

Analyzes Air Methods’s competitive position through key internal and external factors, identifying its strengths in market leadership, weaknesses in operational efficiency, opportunities in service expansion, and threats from regulatory changes.

Simplifies complex SWOT analysis for Air Methods, enabling rapid identification of strategic advantages and mitigation of weaknesses.

Weaknesses

The air ambulance industry is characterized by inherently high operational costs, stemming from extensive aircraft maintenance, fluctuating fuel prices, and the necessity for highly trained medical personnel and pilots. These substantial expenses pressure profit margins, often necessitating high service charges; for instance, the average cost of an air ambulance transport can range from $12,000 to $25,000 as of early 2024. Persistent inflationary pressures observed through 2023 and into 2024 have further strained operations, directly increasing expenses for maintenance parts and jet fuel. This economic environment makes managing profitability a continuous challenge for companies like Air Methods.

Air Methods' financial stability is significantly tied to reimbursement rates from private insurance and government programs like Medicare and Medicaid. Government payer rates, particularly from Medicare, often fall substantially below the actual cost of providing critical air medical transport, impacting profitability. This dependence on third-party payers introduces considerable revenue volatility and uncertainty. For instance, ongoing adjustments to federal healthcare policies and negotiations with private insurers directly influence the company's 2024-2025 revenue streams, making it a key financial vulnerability.

Air Methods grapples with persistent staffing shortages for pilots, mechanics, and critical care medical personnel, a challenge amplified by high demand and rigorous training requirements. This competitive labor market forces the company to offer increasingly competitive compensation and bonuses, directly elevating operational labor costs. For instance, the demand for qualified air medical pilots remains exceptionally high, with some industry reports indicating a 15-20% increase in pilot recruitment costs year-over-year into 2024. These rising expenses directly impact profitability and operational efficiency.

Regulatory Scrutiny and Billing Disputes

Regulatory scrutiny poses a significant weakness for Air Methods, particularly with the ongoing impact of the No Surprises Act, effective since 2022. This legislation, while protecting patients from surprise bills, has introduced an independent dispute resolution (IDR) process with insurers that significantly delays revenue collection. Payer challenges in the IDR system have led to payment delays often extending beyond 90 days, impacting cash flow. For instance, according to recent industry reports, the IDR process has seen a substantial backlog, with over 130,000 disputes initiated by late 2023, creating considerable operational challenges for air ambulance providers like Air Methods.

- Delayed revenue collection due to the independent dispute resolution (IDR) process.

- Increased administrative burden and costs associated with navigating complex billing regulations.

- Potential for reduced reimbursement rates through the IDR system, impacting overall profitability.

Inherent Safety Risks and Potential Litigation

The inherent nature of air medical transport presents significant safety risks, a reality underscored by historical industry accident rates. Despite Air Methods investing heavily in advanced safety protocols and new technologies, such as enhanced flight tracking systems implemented by early 2024, the potential for aviation incidents persists. A single major incident could trigger substantial legal costs, potentially exceeding tens of millions of dollars per case, and severely harm the company's market perception. This ongoing risk impacts operational stability and could deter potential partners or clients seeking reliable transport services. For instance, the National Transportation Safety Board (NTSB) continues to highlight air ambulance safety as a priority, with specific recommendations still under review as of Q1 2025.

- Industry accident rates remain a concern, despite technological advancements.

- Potential litigation costs can be substantial, impacting financial stability.

- Reputational damage from incidents can deter clients and partners.

- Ongoing NTSB focus on air ambulance safety underscores persistent risks.

Air Methods faces substantial operational costs, with average air ambulance transport ranging from $12,000 to $25,000 as of early 2024. Profitability is challenged by low government reimbursement rates and revenue delays from the No Surprises Act's IDR process, which had over 130,000 disputes by late 2023. Persistent staffing shortages, including a 15-20% increase in pilot recruitment costs into 2024, elevate labor expenses. Additionally, inherent safety risks and potential litigation, with NTSB recommendations still under review in Q1 2025, pose ongoing threats.

Preview the Actual Deliverable

Air Methods SWOT Analysis

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail. This comprehensive analysis delves into Air Methods' Strengths, Weaknesses, Opportunities, and Threats, providing actionable insights. You'll gain a clear understanding of their competitive landscape and strategic positioning. Purchase unlocks the entire in-depth version, empowering you with valuable business intelligence.

Opportunities

The global market for air ambulance services is experiencing robust growth, propelled by an aging demographic and increasing chronic disease prevalence.

Valued at over $6 billion in 2023, this sector anticipates sustained strong compound annual growth through 2025 and beyond.

Rising medical emergencies further fuel demand, creating a significant tailwind for core air medical operations.

This fundamental market expansion presents a substantial opportunity for Air Methods to expand its service footprint and revenue streams.

Innovations in aviation and medical technology present substantial opportunities for Air Methods, enhancing operational capabilities and patient care. The company is actively partnering with innovators like Skyryse, aiming to integrate advanced flight operating systems to boost safety and reduce pilot workload, potentially cutting operational costs by 15% through optimized flight paths and automation by late 2024. Furthermore, adopting telemedicine solutions, advanced automated CPR devices, and virtual reality for crew training improves patient outcomes and streamlines efficiency across their 300+ bases. These technological adoptions are projected to improve patient survival rates by up to 10% in critical cases by 2025.

Expanding into new geographic areas, particularly rural and remote communities, offers significant opportunities for Air Methods, addressing limited access to specialized healthcare. The company continues to open new bases, like recent expansions in underserved regions, aligning with the projected 7.5% CAGR for air medical services through 2025. Growth in medical tourism also presents an avenue for international patient transport, with global medical tourism projected to reach $179.6 billion by 2026, increasing demand for specialized air ambulance services. This strategic expansion leverages the ongoing need for rapid, specialized medical transport in areas with healthcare disparities.

Strategic Collaborations and Partnerships

Forming new strategic partnerships with major healthcare systems and insurance providers presents a significant opportunity for Air Methods to expand its reach and secure more in-network agreements, enhancing service delivery nationwide. Collaborations can streamline patient transfers and billing processes, improving overall operational efficiency and patient experience. Furthermore, exploring partnerships with emerging eVTOL aircraft developers, such as Joby Aviation or Archer Aviation, could position Air Methods at the forefront of future air medical transport innovations by 2025, potentially reducing operational costs and increasing speed. Such alliances are crucial for navigating the evolving healthcare landscape and leveraging technological advancements.

- By Q1 2025, expanding in-network agreements could increase patient volume by an estimated 10-15%, boosting revenue streams.

- Strategic alliances with leading technology firms can integrate advanced dispatch and patient monitoring systems, enhancing service quality.

- Partnerships with eVTOL developers offer potential for lower fuel costs and faster response times in urban areas post-2025.

Diversification of Service Offerings

Air Methods can significantly enhance its revenue streams by broadening its service portfolio beyond standard emergency medical transport. This includes specializing in high-demand areas like neonatal and pediatric transport, which saw a market valuation of over $1.5 billion in 2023, and critical organ transplant logistics. Expanding their United Rotorcraft division, which focuses on advanced aeromedical and aerospace technology, presents a substantial opportunity, potentially increasing its contribution to overall company revenue by 10-15% by late 2025.

- Neonatal and pediatric transport services offer a growing specialized market.

- Organ transplant logistics represent a high-value, time-critical niche.

- United Rotorcraft's technological advancements can drive new revenue streams.

- Diversification mitigates risks associated with reliance on traditional EMS.

Air Methods can capitalize on the robust global air ambulance market, projected for sustained growth through 2025, by expanding into underserved rural areas and leveraging medical tourism. Strategic partnerships with healthcare systems and eVTOL developers offer significant growth, potentially boosting patient volume by 10-15% by Q1 2025. Diversifying into high-value services like neonatal transport and organ logistics, alongside United Rotorcraft's advancements, can also enhance revenue streams by 10-15% by late 2025.

| Opportunity Area | Key Metric | 2024/2025 Projection |

|---|---|---|

| Market Growth | Global Air Ambulance Market Value | >$6B (2023) with strong CAGR through 2025 |

| Partnerships | Patient Volume Increase (in-network) | 10-15% by Q1 2025 |

| Service Diversification | United Rotorcraft Revenue Contribution | +10-15% by late 2025 |

Threats

The air ambulance market remains intensely competitive, featuring major players like Global Medical Response and numerous regional providers vying for market share. Competitors differentiate themselves through service quality, expansive coverage networks, and advanced technology, alongside strong relationships with hospital systems. This fierce competition, coupled with regulatory shifts such as the ongoing impact of the No Surprises Act on out-of-network billing, exerts significant pressure on pricing. Consequently, profitability for operators like Air Methods faces headwinds, as evidenced by industry reports indicating sustained margin compression in 2024 due to high operational costs and reimbursement challenges.

Changes in healthcare regulations, especially regarding billing and reimbursement, present a notable threat to Air Methods. The No Surprises Act, effective January 2022, introduced an independent dispute resolution process which has significantly delayed payments, impacting cash flow. For instance, in 2024, many providers still report substantial backlogs in resolving payment disputes, affecting revenue predictability. Future federal or state legislative actions, potentially introducing new rate caps or expanded dispute mechanisms, could further compress margins. Such regulatory shifts directly influence operational viability and financial performance.

Air Methods faces significant threats from rising operating costs, particularly volatile fuel prices, which saw jet fuel average around $2.90 per gallon in early 2024. Economic downturns can reduce elective healthcare procedures, potentially decreasing patient volumes for air medical transport. Furthermore, elevated interest rates, like the Federal Funds Rate holding above 5% through early 2024, increase the cost of capital for necessary fleet upgrades and expansion initiatives. This financial pressure can constrain investment in critical infrastructure and technology, impacting long-term operational efficiency.

Labor Market Challenges

Persistent shortages of qualified pilots, mechanics, and medical professionals significantly constrain Air Methods growth potential and drive up operational expenses. The demanding nature of air medical transport, coupled with high-stress environments, contributes to burnout and elevated employee turnover rates. These factors make it increasingly challenging for the company to attract and retain top-tier talent in a competitive labor market. For instance, the US Bureau of Labor Statistics projects a nearly 6% growth in paramedic and EMT jobs through 2032, highlighting ongoing demand.

- Pilot shortages are estimated to impact air medical operators, with some regions facing a 15-20% deficit in qualified personnel as of early 2024.

- Average annual turnover rates for flight nurses and paramedics can range from 15% to 25% due to high-stress conditions and demanding schedules.

- Labor costs, including competitive wages and retention bonuses, represent a significant portion of operational expenses, potentially increasing by 8-12% annually for specialized roles.

Cybersecurity and Data Privacy Risks

Air Methods faces significant cybersecurity and data privacy risks due to its increasing reliance on digital systems for critical operations, logistics, and sensitive patient data management. A major incident, such as the 2023 data breach experienced by Air Methods, can lead to substantial financial penalties and severe reputational damage. Protecting patient information and operational integrity necessitates continuous investment in robust cybersecurity defenses. The global air ambulance services market, valued at approximately $7.5 billion in 2024, underscores the high-stakes environment for data security.

- The 2023 data breach at Air Methods highlighted vulnerabilities in patient data security.

- Potential financial penalties from data breaches can be substantial, impacting profitability.

- Reputational damage from security incidents can erode trust among patients and partners.

- Increased digital reliance across the healthcare sector amplifies exposure to cyber threats for providers like Air Methods.

Air Methods faces significant threats from intense market competition and evolving healthcare regulations, particularly the No Surprises Act, which pressure margins and delay payments in 2024. Rising operational costs, including volatile fuel prices averaging $2.90 per gallon in early 2024, and high interest rates above 5% elevate financial strain. Persistent labor shortages, with pilot deficits of 15-20% and annual turnover of 15-25% for medical staff, increase expenses and constrain growth. Cybersecurity risks, evidenced by the 2023 data breach, also pose a substantial threat to operations and reputation.

| Threat Area | Key Metric (2024) | Impact |

|---|---|---|

| Operational Costs | Jet Fuel: ~$2.90/gallon | Increased Expenses |

| Labor Shortages | Pilot Deficit: 15-20% | Growth Constraint |

| Regulatory Changes | No Surprises Act | Payment Delays |

SWOT Analysis Data Sources

This analysis leverages a comprehensive blend of data sources, including Air Methods' official financial reports, industry-specific market research, and insights from aviation and healthcare sector experts to provide a well-rounded perspective.