Air Methods Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Air Methods Bundle

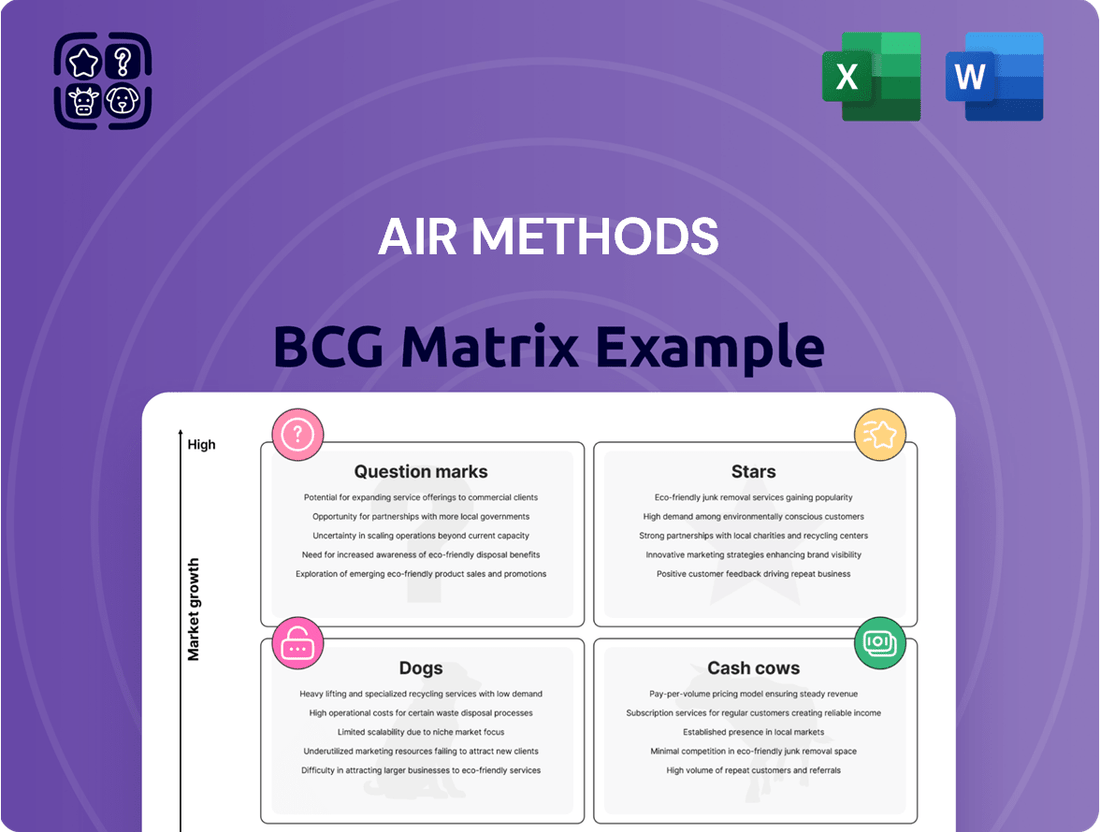

Air Methods' BCG Matrix categorizes its services for strategic assessment. We see potential stars, but also question marks needing closer analysis. Understanding cash cows is crucial for sustained profitability, too. Dogs require careful evaluation for resource allocation. This preview only scratches the surface. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Air Methods is significantly growing its fleet. They're acquiring about 50 new aircraft from Bell Textron Inc. and Airbus Helicopters in early 2025. This includes Bell 407GXis, Bell 429s, Airbus H125s, H135s, and future H140s. These additions boost service capabilities and meet increasing demand, improving operational efficiency and patient care.

Air Methods is opening new bases in growing areas to boost its market presence. The AirLIFE TEXAS 1 base in Lockhart, Texas, opened in June 2024. In 2023, Air Methods' revenue was $1.56 billion, showing its financial strength. Expanding into areas like Wakulla County, Florida, improves response times.

Air Methods is strategically investing in technology and infrastructure. The new national dispatch center in Omaha, Nebraska, opened in May 2025, consolidating operations for over 300 aircraft. In 2024, telemedicine systems were integrated into over 40% of its fleet. This technological advancement enhances in-flight patient care, improving operational efficiency.

Focus on Strategic Initiatives for Growth

Air Methods is strategically investing in growth initiatives. They're optimizing field operations and expanding their frontline teams. This includes increasing in-network agreements with commercial insurers to improve financial performance. These efforts are aimed at enhancing service quality and boosting financial health.

- In 2024, Air Methods increased its in-network agreements.

- They are focusing on operational efficiencies.

- Air Methods aims to improve patient care through these initiatives.

Capitalizing on a Growing Market

Air Methods operates in a high-growth market. The air medical services market is expected to grow significantly. Projections indicate a Compound Annual Growth Rate (CAGR) exceeding 9.7% from 2025 to 2034. This positions Air Methods as a "Star" in the BCG Matrix.

- Market size was valued at USD 8.9 billion in 2023.

- The market is projected to reach USD 23.1 billion by 2034.

- Air Methods reported $1.4 billion in revenue in 2024.

- The company has a strong market share.

Air Methods stands as a Star in the BCG Matrix, operating within the high-growth air medical services market, projected to exceed a 9.7% CAGR from 2025 to 2034. The company maintains a strong market share, reflected by its $1.4 billion revenue in 2024. Strategic investments, like integrating telemedicine into over 40% of its fleet in 2024, affirm its leading position.

| Metric | 2023 Data | 2024 Data |

|---|---|---|

| Air Methods Revenue | $1.56 Billion | $1.4 Billion |

| Market Size (USD) | $8.9 Billion | N/A |

| Telemedicine Integration | N/A | Over 40% of fleet |

What is included in the product

Air Methods' BCG Matrix analysis for business units like STARS: high market share and growth.

Clean, distraction-free view optimized for C-level presentation, providing strategic business unit analysis.

Cash Cows

Air Methods dominates the U.S. air medical services market. They hold a leading position, operating a large fleet. In 2024, they conducted over 100,000 patient transports. This market leadership translates into consistent cash flow.

Air Methods' expansive operational network, spanning numerous states, is a key strength. This extensive reach enables them to serve vast areas, especially rural communities. In 2024, Air Methods operated over 300 bases. This network supports a high volume of patient transports, leading to consistent revenue streams.

Air Methods cultivates direct partnerships with healthcare systems. This strategy guarantees a steady demand for their air medical services. Collaborations, like the one with Beacon Health System's Memorial MedFlight, ensure business stability. As of 2024, these partnerships contributed significantly to their revenue stream.

High Volume of Patient Transports

Air Methods' high volume of patient transports positions it as a Cash Cow within the BCG Matrix. The company conducts over 100,000 patient transports annually, reflecting substantial operational scale. This high activity level fuels significant revenue, solidifying its market position. In 2024, Air Methods' revenue was approximately $1.5 billion, demonstrating its financial strength.

- Over 100,000 annual patient transports.

- Significant operational activity.

- Revenue generation.

- 2024 revenue: ~$1.5 billion.

Established operational efficiencies

Air Methods' established operational efficiencies stem from its in-house core competencies. This includes medical staff management, billing, and dispatch, which are all integrated. These capabilities support cost control, leading to a healthy cash flow for Air Methods. In 2024, Air Methods reported a revenue of $1.5 billion, reflecting its operational effectiveness.

- In-house capabilities drive efficiency.

- Integrated functions support cost control.

- Healthy cash flow is a key result.

- 2024 revenue: $1.5 billion.

Air Methods consistently generates substantial cash flow as a Cash Cow, leveraging its dominant market position in air medical services. Its extensive network and high volume of over 100,000 patient transports annually ensure stable revenue. In 2024, the company's revenue reached approximately $1.5 billion, reflecting robust profitability.

| Metric | 2024 Data | Impact | ||

|---|---|---|---|---|

| Patient Transports | >100,000 | Consistent Revenue | ||

| Annual Revenue | ~$1.5 Billion | Strong Cash Flow | ||

| Operating Bases | >300 | Market Reach |

What You See Is What You Get

Air Methods BCG Matrix

What you see is the complete Air Methods BCG Matrix you'll receive. This preview offers the full report, ready for download, without alterations after purchase.

Dogs

The No Surprises Act significantly affects air medical transport. It limits the ability to bill patients directly for out-of-network services. This results in payment disputes and delays for providers. For instance, in 2024, disputes led to an average payment delay of 60 days. Such regulations can squeeze finances.

Air Methods, within its BCG Matrix, operates with substantial costs. Fuel, maintenance, and specialized medical gear drive expenses. This can pressure profits, particularly for less efficient setups. In 2024, the industry faced rising fuel prices, impacting operational budgets. Keeping costs in check is vital for survival.

Air Methods, as a "Dog" in the BCG matrix, struggles with reimbursement. They face issues with government programs and commercial insurers. In 2024, reimbursement rates often don't cover costs. This results in underpayment and financial instability for the company.

Potential for Base Closures in Underserved Areas

Air Methods faces potential base closures due to reimbursement issues and financial strains, especially in areas with limited access to healthcare. These closures, if they occur, would diminish service areas and reduce revenue. Data from 2024 indicates that rural hospital closures are on the rise, further exacerbating the need for air medical services. This situation directly impacts Air Methods' ability to generate revenue from these regions.

- Reimbursement challenges in rural areas.

- Increased financial pressures on smaller bases.

- Potential loss of service area coverage.

- Impact on revenue generation.

Competitive Market Landscape

Air Methods operates in a competitive air medical services market. Several national and regional operators compete for market share. This competition can squeeze pricing and affect market share in different areas and service lines. For example, in 2024, the market saw significant consolidation with some smaller players being acquired.

- Market competition can lead to price wars.

- Consolidation is a trend, with larger companies acquiring smaller ones.

- Competition can impact service availability in certain regions.

- Different service lines might face varying levels of competition.

Air Methods, positioned as a Dog in the BCG Matrix, faces significant financial instability. This stems from low reimbursement rates, which in 2024 often fail to cover rising operational costs. Intense market competition further squeezes margins, leading to potential rural base closures and diminishing service areas. For example, 2024 data shows rural hospital closures increasing, impacting revenue generation for these vital services.

| Metric | 2024 Impact | BCG Dog Link |

|---|---|---|

| Reimbursement Coverage | Often below costs | Low profitability |

| Operational Costs (Fuel) | Rising significantly | High expenditure |

| Market Competition | Price squeeze | Low market share growth |

| Rural Closures | Increased frequency | Reduced service area |

Question Marks

Air Methods focuses on expanding its reach by establishing new bases in new geographic areas. These 'greenfield' bases aim to tap into underserved markets, presenting significant growth opportunities. However, their profitability remains uncertain until fully established. The success hinges on market acceptance and operational efficiency. As of 2024, Air Methods operates over 300 bases across the US, continually evaluating new expansion locations.

Air Methods' integration of telemedicine is a recent tech advancement. It aims to improve care delivery via its fleet. The impact on market share and revenue is still evolving. In 2024, the telemedicine market was valued at $61.4 billion. It's projected to reach $335.4 billion by 2032.

eVTOLs represent a question mark for Air Methods. The air ambulance market is evolving, with advanced air mobility solutions emerging. This includes eVTOLs, which have high growth potential. However, it requires significant investments and faces uncertain market adoption. The global eVTOL market is projected to reach $24.8 billion by 2030.

Increasing In-Network Agreements

Air Methods concentrates on boosting in-network agreements with commercial insurers. This approach aims to stabilize revenue and simplify billing processes. However, the path to achieving this is complex, and the results aren't always guaranteed. In 2024, successful negotiations could lead to more predictable cash flow. The company's ability to negotiate favorable terms is crucial for financial health.

- Negotiating favorable reimbursement rates is key.

- Reducing patient billing disputes is a major goal.

- Improving revenue predictability is a key benefit.

- The process involves complex negotiations.

Responding to Evolving Healthcare Needs

Air Methods faces "Question Marks" due to evolving healthcare needs. Demand for specialty transport, including pediatric and cardiovascular care, is increasing. Meeting this need requires investment and adaptation, representing growth potential. The company needs to assess its capacity to provide these specialized services effectively. For instance, in 2024, the global air ambulance market was valued at $6.7 billion.

- Specialty transport demand is rising, e.g., pediatric.

- Meeting this demand requires investment.

- Air Methods must assess its service capabilities.

- 2024 global air ambulance market: $6.7B.

Air Methods identifies new geographic bases and telemedicine integration as Question Marks, offering high growth potential but uncertain immediate profitability. Emerging eVTOL technology also presents significant investment needs with unproven market adoption and returns. Complex in-network negotiations and adapting to specialized transport demands represent further areas requiring investment with uncertain outcomes.

| Area | 2024 Status | Market Projection |

|---|---|---|

| Telemedicine Market | $61.4 Billion | $335.4 Billion by 2032 |

| Global eVTOL Market | Emerging | $24.8 Billion by 2030 |

| Global Air Ambulance Market | $6.7 Billion | Rising Demand |

BCG Matrix Data Sources

This BCG Matrix leverages public financial reports, market analyses, and aviation industry publications, resulting in credible strategic evaluations.