Air Canada Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Air Canada Bundle

Air Canada operates in a fiercely competitive landscape, heavily influenced by the bargaining power of its buyers and the constant threat of new entrants. Understanding these dynamics is crucial for any stakeholder.

The full Porter's Five Forces Analysis reveals the real forces shaping Air Canada’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The aviation industry's reliance on a near-duopoly of Boeing and Airbus for commercial aircraft significantly amplifies supplier bargaining power. This concentration means airlines like Air Canada have very few alternatives when sourcing new planes, giving these manufacturers considerable sway over pricing, specifications, and delivery schedules.

For instance, in 2023, Boeing and Airbus continued to dominate the global commercial aircraft market, with orders for new aircraft representing substantial capital outlays for airlines. The long lead times, often spanning years, for custom-built aircraft further entrench the power of these suppliers, as switching manufacturers mid-fleet plan is impractical and costly.

Jet fuel represents a substantial operating cost for Air Canada, directly influenced by global oil market volatility. While hedging strategies can mitigate some of this risk, the airline’s dependence on individual fuel suppliers, often with limited local alternatives at airports, grants these suppliers considerable leverage.

The bargaining power of fuel suppliers is amplified by the critical nature of their product. For instance, in 2024, jet fuel prices saw significant fluctuations, with Brent crude oil averaging around $83 per barrel in the first half of the year, impacting airlines' bottom lines. Geopolitical tensions and supply chain disruptions can quickly escalate fuel expenses, directly affecting Air Canada's profitability.

Aircraft engines are highly specialized, with a market dominated by a few key players like GE Aerospace, Rolls-Royce, and Pratt & Whitney. This limited competition inherently grants these suppliers significant leverage.

These engine manufacturers often bundle their products with long-term maintenance, repair, and overhaul (MRO) contracts. This integration creates substantial switching costs for airlines, as changing engine suppliers would necessitate not only new engines but also new MRO infrastructure and training, solidifying the suppliers' strong bargaining position.

The sheer complexity and the critical safety demands of aircraft engines mean that airlines cannot easily substitute them. This technical barrier further reinforces the dominance of established, reputable engine producers, giving them considerable power in negotiations with carriers like Air Canada.

Airport Infrastructure and Service Providers

Airports, air traffic control, and ground handling services are critical for any airline's operations. These suppliers often operate as monopolies or oligopolies in specific geographic locations, meaning airlines have limited alternatives for essential services. For instance, in 2024, major international airports like Toronto Pearson (YYZ) or Vancouver International Airport (YVR) are the sole providers of critical infrastructure and services for airlines operating there.

The bargaining power of these suppliers is significant because landing fees, gate rentals, and various operational charges represent substantial costs for airlines. Airports, particularly at major hubs where Air Canada needs consistent access, can largely dictate these fees. This localized monopoly means airport authorities and their associated service providers hold considerable sway over airline profitability.

- Essential Services: Airports, air traffic control, and ground handling are non-substitutable for airline operations.

- Market Concentration: These services are often provided by a single entity or a few dominant players in a given region.

- Cost Impact: Landing fees and gate rentals are fixed costs that can significantly affect an airline's bottom line, with airports having pricing power.

- Strategic Importance: Access to prime gates and efficient ground handling at major hubs is crucial for an airline's schedule and customer experience.

High Switching Costs for Major Inputs

Switching aircraft types or engine models carries significant financial implications for airlines like Air Canada. These costs can range from millions to tens of millions of dollars, encompassing pilot retraining programs, modifications to maintenance facilities, and the establishment of new spare parts inventories. For instance, a major fleet overhaul could necessitate investing in entirely new ground support equipment and specialized tooling.

This inherent inertia effectively binds Air Canada to its existing suppliers for aircraft and critical components, such as engines. The substantial investment in current technology limits the airline's ability to easily transition to alternative providers, thereby strengthening the bargaining power of its current partners. This is further compounded by long-term supply and maintenance contracts, which lock in these relationships and reduce Air Canada's negotiation leverage.

- Significant Capital Outlay: Airlines face substantial upfront costs when changing aircraft manufacturers or engine suppliers, often in the hundreds of millions of dollars for a fleet transition.

- Operational Disruption: Retraining flight crews, maintenance personnel, and adapting operational procedures for new equipment can lead to temporary dips in efficiency and increased operational complexity.

- Entrenched Supplier Relationships: Long-term agreements for parts, maintenance, and technical support create strong dependencies, giving established suppliers considerable leverage in pricing and contract negotiations.

The bargaining power of suppliers in the aviation industry is substantial, particularly for aircraft manufacturers and engine producers. Air Canada, like other major carriers, faces limited choices for new aircraft, with Boeing and Airbus holding a near-duopoly. This concentration, evident in 2023 order backlogs, grants these manufacturers considerable pricing and specification leverage. Similarly, the specialized nature of aircraft engines, dominated by a few key players such as GE Aerospace and Rolls-Royce, creates strong supplier power. These companies often bundle engines with long-term, costly maintenance contracts, further entrenching their position and limiting airlines' ability to switch providers.

| Supplier Type | Key Players | Impact on Air Canada | 2023/2024 Data Point |

| Aircraft Manufacturers | Boeing, Airbus | High pricing power, long lead times, limited alternatives | Boeing and Airbus accounted for over 95% of new commercial aircraft orders in 2023. |

| Engine Manufacturers | GE Aerospace, Rolls-Royce, Pratt & Whitney | Significant leverage due to specialization and MRO contracts | GE Aviation's revenue was approximately $32 billion in 2023. |

| Jet Fuel Suppliers | Various Oil & Gas Companies | Vulnerability to oil price volatility, limited local airport alternatives | Average Brent crude oil price was around $83/barrel in H1 2024. |

| Airport Services | Airport Authorities, Ground Handling Companies | Monopoly/oligopoly in specific locations, dictating fees | Landing fees at major hubs can represent a significant percentage of an airline's operating costs. |

What is included in the product

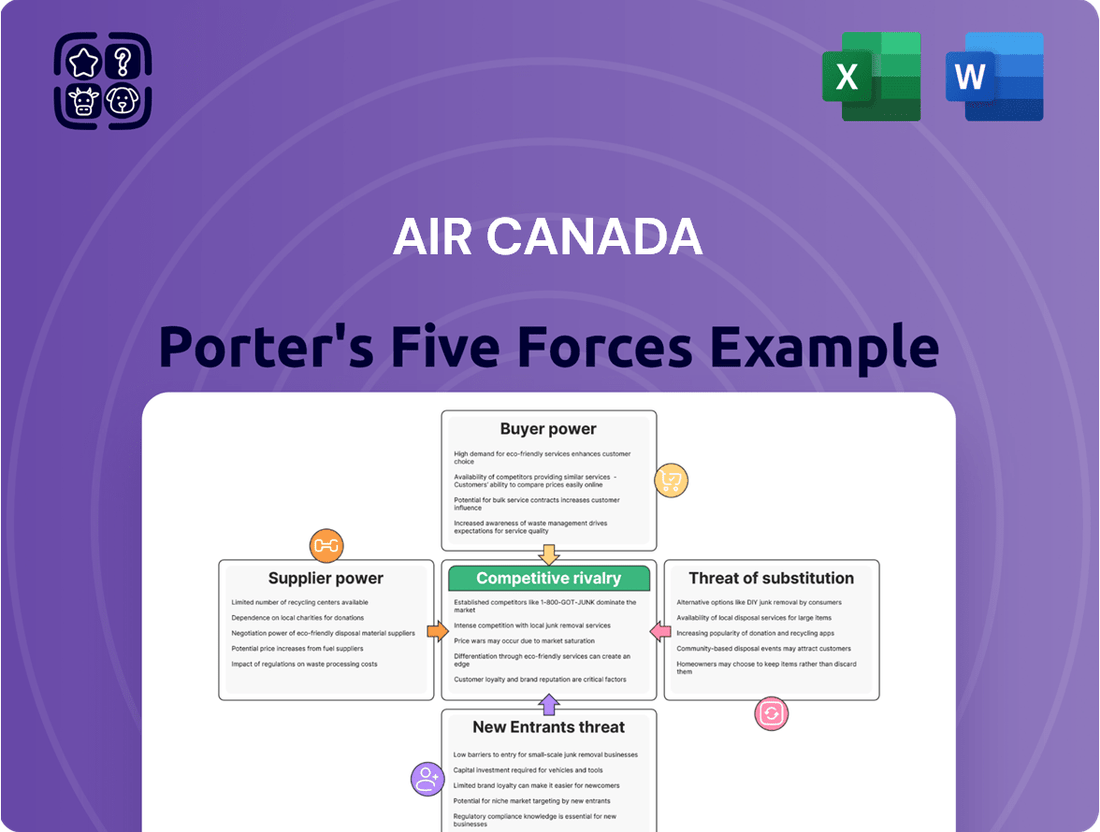

This Porter's Five Forces analysis for Air Canada assesses the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants, and the risk of substitutes, providing a comprehensive view of its competitive environment.

Instantly visualize competitive pressures with a dynamic Porter's Five Forces analysis, allowing Air Canada to pinpoint and address key strategic challenges.

Customers Bargaining Power

Leisure travelers represent a substantial portion of Air Canada's clientele, and their decisions are heavily influenced by price. They actively seek out the most affordable options, often making their choices based on the lowest available fare. This makes them a powerful force in the market.

The digital age has amplified this power. With numerous online travel agencies and airline websites readily available, comparing prices has become incredibly simple for consumers. This ease of comparison fuels intense price competition among airlines like Air Canada.

In 2024, the average fare for a domestic round-trip flight within Canada saw fluctuations, but the overall trend indicates that leisure travelers are consistently looking for deals. For instance, while specific route data varies, industry reports suggest that a significant percentage of leisure bookings are made within a certain price range, highlighting their sensitivity.

Consequently, Air Canada must remain highly competitive with its pricing, particularly on routes that are popular with leisure travelers. Failing to do so could result in a loss of market share to competitors who offer more attractive price points.

Customers on many routes have access to several airlines, including other Canadian carriers like WestJet and Porter, and numerous international airlines for global destinations. This broad choice empowers customers to select based on price, schedule, and service quality. In 2024, the Canadian airline market saw intense competition, with passenger numbers on domestic routes reaching record highs, putting further pressure on carriers like Air Canada to offer compelling value propositions. Air Canada must continually differentiate its offerings and maintain competitive pricing to prevent customer defection.

For the average traveler, switching airlines is as simple as choosing a different website or app to book their flight, making the cost of switching very low. This ease of transition significantly amplifies customer bargaining power.

While airline loyalty programs aim to retain customers, their effectiveness is often limited for less frequent flyers. The immediate allure of a lower ticket price frequently trumps the value of accumulated miles or points, especially when considering the effort involved in managing those rewards.

In 2024, the competitive landscape continues to emphasize price sensitivity. For instance, during peak travel seasons, passengers frequently compare fares across multiple carriers, with differences of even a few dollars influencing their booking decisions, underscoring the low switching costs.

Impact of Loyalty Programs and Corporate Contracts

Air Canada's Aeroplan loyalty program and its corporate agreements are key strategies to manage customer bargaining power. By offering bundled benefits and fostering loyalty, these programs make it more attractive for customers to stay with Air Canada, effectively increasing switching costs. This approach aims to counterbalance the inherent price sensitivity of many travelers and encourage repeat business.

Corporate clients, however, often wield significant bargaining power due to their substantial travel volumes and consistent demand. These larger clients can negotiate more favorable rates and terms, impacting Air Canada's pricing flexibility. For instance, in 2024, major corporate contracts often include clauses for volume-based discounts, directly influencing the average fare paid by these entities.

- Loyalty Programs: Aeroplan aims to retain customers by offering tiered benefits and rewards, reducing the incentive to switch to competitors.

- Corporate Agreements: These contracts leverage high-volume travel needs to secure preferential pricing and service levels for business clients.

- Switching Costs: Loyalty programs and bundled services are designed to make it less appealing for customers to switch, thereby reducing their bargaining leverage.

- Volume Discounts: Large corporate clients often secure discounts based on their consistent and significant travel expenditure, enhancing their negotiation position.

Information Transparency and Online Travel Agencies

The proliferation of online travel agencies (OTAs) and meta-search engines has dramatically boosted information transparency in the airline industry. Customers can now effortlessly compare flight prices and schedules from numerous carriers, directly impacting Air Canada's pricing strategies. For instance, in 2024, a significant portion of Air Canada's bookings are influenced by price comparison tools readily available to consumers.

This heightened transparency directly empowers customers, giving them a stronger hand in negotiations. They can easily identify the lowest available fares, forcing airlines like Air Canada to remain competitive or risk losing business. This dynamic means customers are less likely to accept higher prices without exploring all available options.

- Increased Price Transparency: Online platforms provide easy access to comparative pricing for flights.

- Customer Empowerment: Access to information strengthens the customer's negotiation position.

- Competitive Pressure: Air Canada must offer competitive fares to attract and retain customers in this transparent market.

Customers, particularly leisure travelers, hold significant bargaining power due to the ease of price comparison and low switching costs. In 2024, the airline industry's competitive nature means consumers can readily find cheaper alternatives, forcing Air Canada to maintain competitive pricing. Loyalty programs and corporate agreements are key strategies Air Canada employs to mitigate this power by increasing switching costs and securing volume discounts.

| Factor | Impact on Air Canada | 2024 Data/Observation |

|---|---|---|

| Price Sensitivity of Leisure Travelers | High bargaining power, demanding lower fares. | Leisure travelers frequently book based on the lowest available fare, influencing pricing strategies. |

| Ease of Comparison (Online Platforms) | Increases transparency, empowering customers. | Significant portion of bookings influenced by price comparison tools in 2024. |

| Switching Costs | Generally low for individual travelers, reducing loyalty. | Low switching costs mean customers can easily opt for competitors offering better deals. |

| Corporate Client Bargaining Power | Strong due to high travel volumes, enabling negotiation of discounts. | Major corporate contracts in 2024 often include volume-based discounts. |

Preview Before You Purchase

Air Canada Porter's Five Forces Analysis

This preview shows the exact Air Canada Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. You'll gain a comprehensive understanding of the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the airline industry. This detailed analysis is professionally formatted and ready for your immediate use.

Rivalry Among Competitors

Air Canada contends with significant rivalry from WestJet, Canada's second-largest airline, which directly challenges Air Canada on numerous domestic and transborder routes. This established competition means both carriers are constantly vying for passengers, often through aggressive pricing and service offerings.

The Canadian aviation landscape has also seen a rise in ultra-low-cost carriers (ULCCs), further intensifying price-based competition. These carriers, often operating with leaner cost structures, put downward pressure on fares across the board, forcing legacy carriers like Air Canada to adapt their strategies to remain competitive.

For instance, in 2024, the Canadian airline market continued to see robust activity. WestJet, in particular, has been focusing on expanding its network and improving its customer experience to capture a larger share of the market. This multi-tiered competitive environment demands that Air Canada consistently re-evaluates its route network, pricing strategies, and service levels to protect its market position.

The airline industry, including Air Canada, is burdened by substantial fixed costs. These include the significant expenses of acquiring and maintaining aircraft, as well as securing airport slots and facilities. In 2023, Air Canada reported operating expenses of CAD 19.03 billion, a clear indicator of these high fixed cost structures.

These high fixed costs create intense pressure for airlines to achieve high capacity utilization. Air Canada, like its competitors, must strive to fill as many seats as possible on each flight to cover these overheads. This often translates into aggressive pricing tactics, especially when demand is weaker, to avoid the financial drain of flying with empty seats.

The imperative to fill seats can easily ignite price wars. When airlines are forced to compete on price to ensure planes are full, it can lead to a downward spiral in fares, impacting profitability across the sector. This dynamic is a constant challenge for Air Canada and other major carriers.

Airlines like Air Canada strive to stand out through service quality, loyalty programs, and extensive route networks. However, the fundamental offering, simply getting from point A to point B, is inherently difficult to differentiate significantly. This makes it tough to command higher prices based on service alone, often driving competition to focus on price points.

Consequently, Air Canada must leverage branding, the reach of its network, and the overall customer experience as key differentiators. For instance, in 2024, Air Canada's Aeroplan loyalty program continued to be a significant draw, aiming to foster customer loyalty amidst intense competition. The airline's extensive domestic and international network also serves as a crucial competitive advantage.

Market Share Focus and Strategic Alliances

Air Canada, as Canada's flag carrier, actively works to preserve its leading position within the domestic market and to grow its international reach. This includes a strong focus on expanding its route network, updating its aircraft fleet, and participating in global airline networks such as Star Alliance. These strategic moves are aimed at securing and growing market share, thereby intensifying the rivalry with other carriers.

The airline industry in Canada is characterized by significant competitive rivalry, with major players like Air Canada, WestJet, and increasingly, low-cost carriers such as Porter Airlines, vying for passengers. Air Canada's market share in Canada hovered around 35-40% in recent years, depending on the specific segment and reporting period, reflecting its dominant but not absolute position. For instance, in the first quarter of 2024, Air Canada reported carrying approximately 9.5 million passengers, underscoring its substantial operational scale.

- Market Dominance Efforts: Air Canada prioritizes maintaining its status as the leading Canadian airline, which involves strategic investments in new aircraft and route development to capture a larger share of both domestic and international travel.

- Global Network Integration: Membership in Star Alliance allows Air Canada to offer extensive global connectivity, a key differentiator that strengthens its competitive stance against rivals not part of similar alliances.

- Fleet Modernization: Air Canada's ongoing fleet renewal, including the introduction of Boeing 787 Dreamliners and Airbus A220s, enhances operational efficiency and passenger experience, providing a competitive edge.

- Response to Low-Cost Carriers: The competitive pressure from airlines like Porter Airlines, which has expanded its operations and fleet significantly, forces Air Canada to continually adapt its pricing and service offerings to remain competitive.

Regulatory Environment and Route Freedoms

The Canadian regulatory landscape, while offering a degree of predictability, significantly shapes the competitive intensity within the airline sector. Regulations governing route allocations and the entry of foreign carriers directly influence market structure and the number of players vying for passengers. For instance, in 2024, the Canadian Transportation Agency continued to oversee route approvals and air service licensing, impacting where and how airlines can operate.

Bilateral air service agreements and evolving open skies policies are key drivers of competitive rivalry. These agreements can pave the way for new entrants or allow existing carriers to expand their networks, thereby increasing competitive pressures. Air Canada, like its peers, must constantly adapt its strategies to these regulatory shifts, which can alter market access and introduce new competitive dynamics. For example, the ongoing discussions around potential new bilateral agreements in 2024 could reshape international route competition.

Navigating this complex regulatory environment is crucial for Air Canada as it contends with the strategic maneuvers of other airlines. The ability to secure advantageous route rights and respond effectively to changes in foreign carrier access directly impacts market share and profitability. In 2024, the competitive response to new route approvals for low-cost carriers highlighted the direct link between regulation and rivalry.

- Route Allocation: Canadian regulations dictate which airlines can fly specific routes, influencing market entry and competition.

- Foreign Carrier Access: Bilateral agreements and open skies policies determine the extent to which foreign airlines can compete in Canada, impacting overall rivalry.

- Regulatory Adaptation: Air Canada must continually adjust its strategy to comply with and leverage regulatory frameworks to maintain its competitive position.

Competitive rivalry in the Canadian airline sector is intense, with Air Canada facing strong challenges from WestJet and a growing number of ultra-low-cost carriers. This dynamic forces constant adjustments in pricing and service to retain market share. For instance, in early 2024, Air Canada continued to navigate this landscape, with its Aeroplan loyalty program playing a key role in customer retention amidst aggressive competition.

The high fixed costs inherent in the airline industry, such as aircraft acquisition and maintenance, also fuel this rivalry. In 2023, Air Canada's operating expenses reached CAD 19.03 billion, emphasizing the pressure to maintain high load factors. This often leads to price wars, as airlines strive to fill seats, impacting overall profitability across the sector.

Differentiation beyond basic transportation is challenging, pushing airlines to focus on service quality, network reach, and loyalty programs. Air Canada's extensive global network through Star Alliance and its fleet modernization efforts, including the introduction of new aircraft in 2024, are strategic moves to maintain a competitive edge against rivals like Porter Airlines, which has been expanding its operations.

Regulatory frameworks, including route allocation and foreign carrier access, significantly shape this competitive environment. In 2024, the Canadian Transportation Agency's oversight of route approvals continued to influence market dynamics, requiring Air Canada to adapt its strategies to new competitive pressures arising from regulatory changes.

SSubstitutes Threaten

The increasing sophistication and adoption of virtual communication technologies, like Zoom and Microsoft Teams, present a substantial threat of substitution for traditional business travel. These platforms, which saw massive growth during the pandemic, allow for seamless remote collaboration and meetings, effectively replacing the need for many in-person engagements. For instance, by mid-2024, many companies reported maintaining hybrid work models, indicating a sustained shift away from mandatory business travel for routine meetings.

This trend directly impacts Air Canada's lucrative business class segment. As companies prioritize cost savings and efficiency, they are more likely to choose virtual meetings over expensive flights and accommodation for their employees. This strategic pivot by corporations could lead to a permanent reduction in demand for business travel, a key revenue driver for airlines like Air Canada, especially as virtual tools continue to improve and become more integrated into daily workflows.

For shorter to medium-haul routes in Canada, high-speed rail is emerging as a significant substitute. For instance, the proposed Quebec City-Toronto high-speed rail project aims to connect major urban centers, potentially diverting passengers from Air Canada's domestic flights. This trend is reinforced by increasing investments in rail infrastructure globally, with many countries seeing rail as a more sustainable and convenient option for city-center to city-center travel.

For regional and shorter-distance travel, intercity bus services and private vehicles remain cost-effective alternatives for price-sensitive consumers. For example, in 2024, the average cost of a long-distance bus ticket in Canada can be as low as $50-$100, significantly less than a comparable flight. This makes them a strong substitute for those prioritizing budget over time.

While slower, these ground transportation modes offer flexibility and can be significantly cheaper than airfare, especially for individuals or small groups. The convenience of door-to-door service with private vehicles, or the ability to carry more luggage on buses, further enhances their appeal against air travel's stricter policies and potential extra fees.

Air Canada must therefore compete on speed and convenience for these segments, where the cost-benefit analysis often favors ground transportation. Failure to offer competitive pricing and efficient routes for shorter hauls means losing market share to these more economical substitutes.

Environmental Concerns Driving Alternative Choices

Growing environmental awareness is a significant factor influencing travel choices. Travelers are increasingly concerned about the carbon footprint of air travel, with many actively seeking more sustainable transportation options. This shift in consumer preference, even for less convenient alternatives, represents a long-term threat to traditional airlines like Air Canada.

For instance, in 2024, the International Air Transport Association (IATA) reported that while air travel demand continued to rebound, there was a noticeable uptick in interest for lower-emission travel solutions. This growing sentiment means that even if direct substitutes are not immediately available or as efficient, the underlying *desire* for them can erode future demand for air travel.

- Environmental Awareness: Public concern over aviation's carbon emissions is rising, pushing some travelers to explore alternatives.

- Sustainable Travel Demand: A growing preference for eco-friendly transport, even if less convenient, poses a threat to air travel.

- Mitigation Strategy: Air Canada's investments in sustainability are critical to counteracting this substitution pressure.

- Industry Trends: Data from 2024 indicates an increasing traveler interest in lower-emission travel solutions.

Customer Value Proposition of Alternatives

The choice between Air Canada and its substitutes is heavily influenced by what customers value most. For many, it's a trade-off between speed, cost, and convenience. While flying is often the quickest way to cover long distances, alternatives might offer better door-to-door service or a more budget-friendly option.

For instance, in 2024, the average cost of a domestic flight in Canada could be significantly higher than a train or bus ticket for shorter routes, impacting price-sensitive travelers. For business travelers, time saved is often paramount, but for leisure travelers, the overall travel experience and cost can be more critical.

- Cost: Rail and bus travel can offer substantially lower fares, especially for shorter to medium-haul journeys, making them attractive substitutes for budget-conscious travelers.

- Convenience: Ground transportation often provides door-to-door service, eliminating the need for airport transfers and the associated time and cost.

- Environmental Impact: Growing consumer awareness about climate change makes lower-emission alternatives like trains appealing to an increasingly eco-conscious segment of the market.

The threat of substitutes for Air Canada is multifaceted, encompassing technological advancements and evolving consumer preferences. Virtual communication tools like Zoom and Microsoft Teams are increasingly replacing the need for business travel, a key revenue stream for airlines. By mid-2024, many companies maintained hybrid work models, signaling a lasting shift away from routine in-person meetings.

Furthermore, for shorter to medium-haul routes within Canada, high-speed rail is emerging as a viable and often more sustainable substitute. Infrastructure investments in rail are growing, positioning it as a convenient city-center to city-center option. This trend is further bolstered by the significant cost advantage of intercity bus services and private vehicles, which remain attractive to price-sensitive travelers, with bus tickets often costing between $50-$100 in 2024 for long-distance routes.

Environmental concerns are also driving a demand for lower-emission travel solutions. Data from 2024 by the International Air Transport Association (IATA) indicated a rising interest in eco-friendly transport, even if less convenient. This growing awareness poses a long-term challenge to traditional airlines, compelling them to address their carbon footprint.

| Substitute Type | Key Advantages | Impact on Air Canada | Example/Data Point (2024) |

|---|---|---|---|

| Virtual Communication | Cost savings, efficiency, flexibility | Reduced business travel demand | Sustained hybrid work models |

| High-Speed Rail | Speed (city-center to city-center), sustainability | Potential diversion of short-to-medium haul passengers | Proposed Quebec City-Toronto high-speed rail |

| Intercity Bus/Private Vehicle | Lower cost, door-to-door convenience | Attracts price-sensitive leisure travelers | Bus tickets ~$50-$100 for long-distance |

| Environmental Consciousness | Lower carbon footprint | Erosion of future demand for air travel | Increased traveler interest in low-emission options (IATA data) |

Entrants Threaten

The airline industry is notoriously capital-intensive. Acquiring a fleet of modern aircraft alone can cost hundreds of millions, if not billions, of dollars. For instance, the list price for a Boeing 787 Dreamliner can exceed $300 million. Beyond aircraft, significant investments are needed for maintenance hangars, ground support equipment, IT systems, and regulatory compliance, creating a formidable barrier to entry.

These substantial upfront costs effectively deter most potential new entrants. Establishing a new airline requires not just aircraft but also the complex operational infrastructure and skilled personnel to run it safely and efficiently. This high financial hurdle means that only well-funded organizations or those with significant backing can realistically consider entering the market, thereby protecting incumbent airlines like Air Canada.

New entrants in the airline industry face a formidable gauntlet of regulatory hurdles, including obtaining extensive operating licenses and certifications. For instance, Transport Canada's rigorous safety standards and approval processes can take years and significant capital investment to navigate. This complexity, coupled with international traffic rights acquisition, creates substantial barriers, effectively shielding incumbents like Air Canada from immediate, low-cost competition.

Securing desirable airport slots and gate access presents a significant hurdle for new airlines looking to compete with established players like Air Canada. Major airports, particularly those with high traffic volumes, often have limited availability, and incumbent airlines frequently possess long-standing agreements or preferential rights. For instance, in 2024, Toronto Pearson International Airport (YYZ), a key hub for Air Canada, continued to face significant congestion, with airlines vying for limited operating windows.

Established Brand Loyalty and Network Effects

Air Canada's established brand loyalty, cultivated over decades, presents a formidable barrier to new entrants. Its Aeroplan loyalty program boasts millions of members, fostering repeat business and making it difficult for newcomers to attract and retain customers. In 2023, Aeroplan members redeemed over 1.5 million award flights, showcasing the program's significant engagement.

Furthermore, Air Canada's extensive hub-and-spoke network, deeply entrenched in the Canadian travel landscape, creates powerful network effects. New airlines face immense challenges in replicating this infrastructure and the associated convenience for travelers, who often prioritize the reliability and reach of incumbent carriers. Building a comparable network takes substantial time and capital investment.

- Brand Recognition: Decades of operation have cemented Air Canada's presence in the minds of Canadian travelers.

- Loyalty Programs: Aeroplan, with its extensive member base and redemption options, significantly boosts customer retention.

- Network Effects: A well-established hub-and-spoke system offers superior connectivity and convenience that new entrants struggle to match.

- Customer Preference: Travelers often opt for the perceived reliability and established service of carriers like Air Canada over newer, less proven options.

Economies of Scale and Cost Advantages of Incumbents

Air Canada, a dominant player, leverages substantial economies of scale. This translates into significant cost advantages in areas like bulk fuel purchasing, centralized aircraft maintenance, and widespread marketing campaigns. For instance, in 2024, Air Canada's operational efficiency, driven by its large fleet, likely allowed for per-unit cost savings that are difficult for startups to replicate.

These inherent cost efficiencies empower Air Canada to offer more competitive pricing or maintain healthier profit margins compared to emerging airlines. New entrants face a steep uphill battle to achieve similar cost structures, especially in the initial phases of their operations, making it hard to compete on price.

- Economies of Scale: Air Canada's vast operational size allows for lower per-unit costs in fuel, maintenance, and marketing.

- Cost Advantages: Incumbents like Air Canada benefit from established supplier relationships and bulk purchasing power.

- Barriers to Entry: New airlines struggle to match the cost efficiencies of established carriers, creating a significant barrier.

- Competitive Pricing: Incumbent cost advantages enable them to offer more aggressive pricing, squeezing new entrants.

The threat of new entrants for Air Canada remains relatively low due to the immense capital requirements and regulatory complexities inherent in the airline industry. Building an airline requires billions for aircraft, infrastructure, and certifications, a barrier few can overcome. For example, a new wide-body aircraft like the Airbus A350 can cost over $350 million. This financial hurdle, coupled with stringent safety regulations and the need for airport slots, significantly limits potential competition.

Established players like Air Canada benefit from significant economies of scale, leading to cost advantages in areas such as fuel purchasing and maintenance. In 2024, Air Canada's large fleet likely allowed for per-unit cost savings that are difficult for startups to match. Furthermore, strong brand loyalty and extensive loyalty programs, like Aeroplan which had millions of members actively redeeming points in 2023, create stickiness that new airlines struggle to penetrate.

| Factor | Impact on Air Canada | 2024 Data/Example |

|---|---|---|

| Capital Intensity | High barrier to entry | Boeing 787 list price > $300 million |

| Regulatory Hurdles | Significant time and cost to navigate | Transport Canada safety certifications can take years |

| Airport Access | Incumbents often hold preferential rights | Congestion at YYZ in 2024 made new slot acquisition difficult |

| Brand Loyalty & Programs | Drives customer retention | Aeroplan members redeemed over 1.5 million award flights in 2023 |

| Economies of Scale | Provides cost advantages | Bulk fuel purchasing and maintenance efficiency for large fleets |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Air Canada and Porter Airlines leverages publicly available financial reports, industry-specific market research from firms like IATA and CAPA, and news from aviation trade publications to gauge competitive intensity and market dynamics.