Air Canada Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Air Canada Bundle

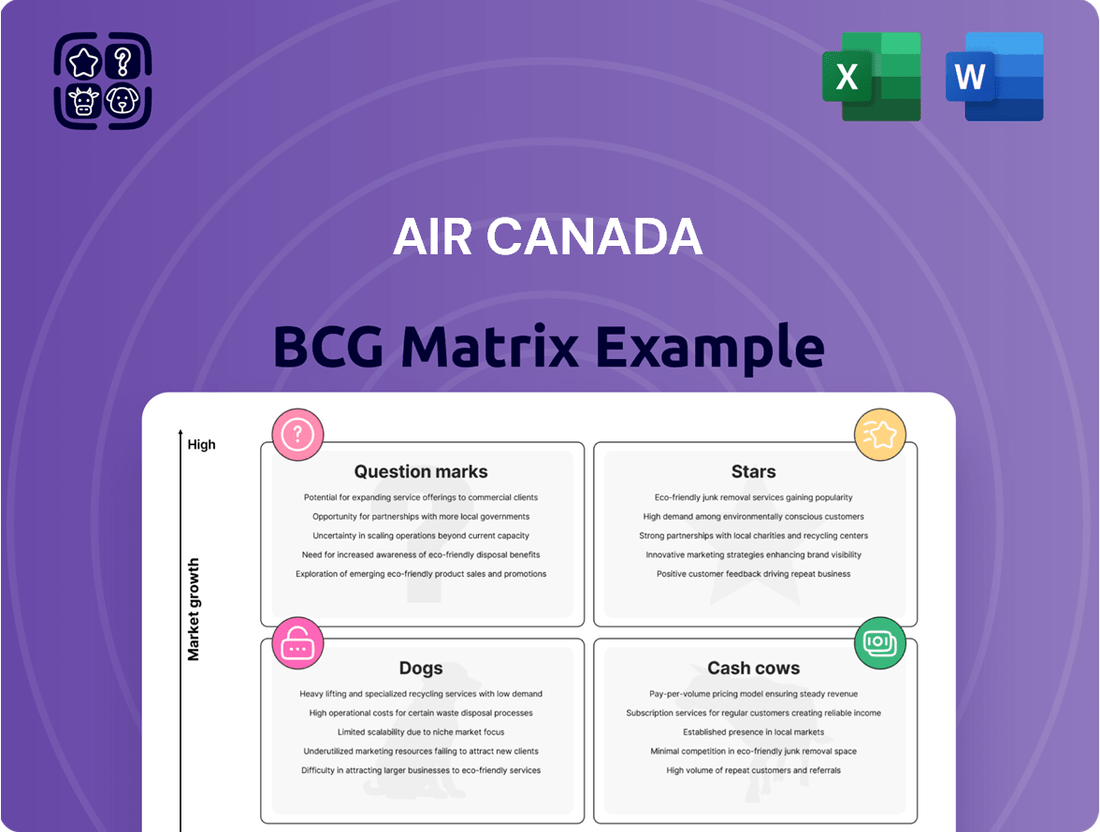

Curious about Air Canada's strategic positioning? This glimpse into their BCG Matrix reveals how their diverse offerings are performing in the market. Are their routes Stars, Cash Cows, Dogs, or Question Marks?

To truly understand Air Canada's competitive landscape and unlock actionable strategies, you need the full picture. Purchase the complete BCG Matrix report for detailed quadrant analysis, data-backed insights, and a clear roadmap for future investment and resource allocation.

Don't miss out on the opportunity to gain a competitive edge. Get the full BCG Matrix now and transform your understanding of Air Canada's product portfolio and market dominance.

Stars

The Aeroplan loyalty program stands as a cornerstone for Air Canada, showcasing robust growth in both its member base and overall engagement. As Canada's premier travel rewards program, it has consistently broadened its network of partners and introduced valuable new perks, such as complimentary Wi-Fi and improved earning potential.

This program's effectiveness in fostering customer loyalty and generating ancillary revenue positions it as a vital growth driver for Air Canada. By the close of 2024, the program boasted over 9 million active members, underscoring its significant market presence and appeal.

Air Canada's cargo services in the Pacific and Latin American markets are performing exceptionally well, marking them as a significant growth area. These regions are a key focus for the airline's cargo division.

In the second quarter of 2025, cargo revenues saw a healthy 10% increase year-over-year. This surge is attributed to both higher shipping volumes and improved yields within these specific markets. The strategic choices of shippers to expedite their shipments ahead of anticipated tariff changes have also played a crucial role in this positive trend.

Air Canada's strategic fleet modernization, notably with the anticipated arrival of Airbus A321XLRs starting in Q4 2025 and ongoing A220 deliveries, signals a substantial commitment to future expansion and efficiency. These advanced aircraft are designed to boost operational performance, extend transatlantic route capabilities, and elevate the passenger experience through enhanced comfort and fuel efficiency. The A321XLRs, in particular, are poised to unlock new long-haul narrowbody routes, contributing to both improved sustainability and cost-effectiveness.

Premium Segment Offerings

Air Canada's premium segment is a clear star in its BCG Matrix. This segment experienced a robust 5% revenue increase in the second quarter of 2025 compared to the previous year. This growth underscores the success of their commercial strategies, particularly in fine-tuning yield management and utilizing the Aeroplan loyalty program to boost ancillary revenue streams.

The strategic emphasis on premium products and services directly targets a valuable customer demographic, significantly contributing to the airline's overall profitability. This focus is a key driver for the star classification.

- Revenue Growth: 5% year-over-year increase in Q2 2025 for the premium segment.

- Key Strategies: Optimized yield management and Aeroplan program leverage for ancillary income.

- Customer Focus: Catering to a high-value customer base.

- Profitability Impact: Significant contribution to overall airline profitability.

International Network Expansion (excluding U.S. Transborder)

Air Canada has strategically shifted capacity towards robust international markets, specifically the Atlantic and Latin America, which has proven beneficial. This focus has driven significant revenue growth in these areas, even as the U.S. transborder market presented difficulties. The airline's network management has been agile, effectively responding to evolving travel demand patterns.

This strategic pivot is reflected in Air Canada's performance. For instance, in the first quarter of 2024, the airline reported a total operating revenue of C$5.16 billion, a notable increase from C$4.85 billion in the same period of 2023. A significant portion of this growth can be attributed to the stronger performance in its international segments, excluding the U.S. transborder. The airline has been actively expanding its route network and increasing flight frequencies in these high-demand regions, demonstrating a clear commitment to capitalizing on international travel recovery.

- Atlantic Division Growth: Air Canada saw strong demand on its Atlantic routes, contributing significantly to overall international performance in early 2024.

- Latin American Market Expansion: Increased capacity and new routes in Latin America have boosted revenue and passenger traffic in this key region.

- Capacity Reallocation Success: The airline's ability to move capacity from less profitable to more lucrative international markets highlights effective network planning.

- Revenue Performance: The strategic focus on these international segments has directly contributed to Air Canada's positive revenue trends in the first half of 2024.

Air Canada's premium segment is a definite star in its BCG Matrix. This segment saw a healthy 5% revenue increase in the second quarter of 2025 compared to the prior year. This growth is a direct result of smart commercial strategies, particularly in yield management and leveraging the Aeroplan program for extra income. The focus on high-value customers in this segment significantly boosts the airline's overall profitability.

| Segment | BCG Category | Q2 2025 Revenue Growth (YoY) | Key Drivers |

|---|---|---|---|

| Premium Segment | Stars | 5% | Optimized yield management, Aeroplan ancillary revenue, high-value customer focus |

What is included in the product

Highlights which Air Canada business units to invest in, hold, or divest based on market share and growth.

A clear, one-page overview of Air Canada's business units in the BCG Matrix quadrants relieves the pain of strategic ambiguity.

Cash Cows

Air Canada's core domestic passenger services function as a classic Cash Cow within its BCG Matrix. This segment benefits from a mature market characterized by significant brand loyalty and established infrastructure across major Canadian hubs like Toronto, Montreal, and Vancouver. In these key locations, Air Canada commands an impressive approximate 50% market share, a testament to its dominant position.

While overall operating revenues saw a minor dip in the first quarter of 2025 compared to the previous year, the domestic segment demonstrated resilience. This stability is largely attributed to a competitive landscape with limited new entrants, which has helped maintain domestic airfares. This consistent pricing power ensures a steady and predictable stream of cash flow, reinforcing its Cash Cow status.

Air Canada's existing wide-body fleet, comprising Boeing 777s, 787 Dreamliners, and Airbus A330s, serves as the core of its international long-haul network. These aircraft are crucial for generating significant revenue on established, profitable routes.

These wide-body jets are consistently well-utilized, boasting high passenger load factors that translate into robust cash flow for the airline. For instance, in 2024, Air Canada reported a passenger load factor of 86.6% for its international services, underscoring the strong demand and efficient operation of this fleet.

While the long-haul international market may not be experiencing explosive growth, the steady and predictable performance of these established aircraft makes them reliable cash cows. Their consistent revenue generation and contribution to overall profitability are vital for Air Canada's financial stability.

Air Canada's Aircraft Maintenance, Repair, and Overhaul (MRO) services represent a significant Cash Cow. These operations, servicing both its internal fleet and potentially external clients, are situated in a mature market characterized by consistent and predictable demand.

The Canadian aircraft MRO sector is anticipated to expand at a compound annual growth rate of 6.2% between 2025 and 2030, underscoring the segment's stable and profitable nature. This robust internal capability, coupled with the possibility of offering these specialized services to other airlines, generates a dependable stream of revenue for Air Canada.

Air Canada Vacations

Air Canada Vacations, the tour operator division of Air Canada, consistently demonstrates strong performance. In the first quarter of 2025, this segment reported solid financial results, underscoring its importance to the airline's overall profitability.

This business unit effectively utilizes Air Canada's expansive network to curate and offer attractive vacation packages. This strategy not only diversifies the company's revenue streams but also taps into the generally stable leisure travel market, providing a reliable income source.

- Revenue Contribution: Air Canada Vacations is a significant contributor to the airline's diversified revenue, benefiting from the stable leisure travel market.

- Network Leverage: The segment effectively leverages Air Canada's extensive network to create compelling vacation packages.

- Cash Generation: Its established market position ensures consistent cash generation with relatively low demands for new investment.

- Q1 2025 Performance: Financial reports for Q1 2025 highlighted the solid results delivered by this tour operator arm.

Established International Routes (non-growth focused)

Air Canada's established international routes, while not prioritized for aggressive expansion, function as significant cash cows. These routes cater to consistent demand from both business and leisure travelers, generating strong yields without requiring substantial new investment in marketing or fleet upgrades. For instance, in 2023, Air Canada reported a substantial portion of its revenue originating from its international network, highlighting the enduring profitability of these established corridors.

These routes benefit from Air Canada's mature brand recognition and existing infrastructure, allowing for efficient operations and predictable revenue streams. The airline's strategy of revenue diversification further bolsters these established segments, ensuring they continue to contribute reliably to overall financial health.

- Consistent Demand: Major international city pairs offer a steady flow of passengers.

- Strong Yields: Premium cabins and business travel contribute to high revenue per passenger.

- Minimal Investment: Existing infrastructure and brand loyalty reduce the need for new capital expenditure.

- Revenue Diversification: These routes provide a stable base income, balancing risk across the network.

Air Canada's established international routes, while not prioritized for aggressive expansion, function as significant cash cows. These routes cater to consistent demand from both business and leisure travelers, generating strong yields without requiring substantial new investment in marketing or fleet upgrades. For instance, in 2023, Air Canada reported a substantial portion of its revenue originating from its international network, highlighting the enduring profitability of these established corridors.

These routes benefit from Air Canada's mature brand recognition and existing infrastructure, allowing for efficient operations and predictable revenue streams. The airline's strategy of revenue diversification further bolsters these established segments, ensuring they continue to contribute reliably to overall financial health.

The consistent demand on major international city pairs, coupled with strong yields from premium cabins and business travel, ensures these routes generate high revenue per passenger. With minimal investment required due to existing infrastructure and brand loyalty, these routes provide a stable base income, effectively diversifying Air Canada's revenue streams.

| Segment | BCG Category | Key Characteristics | 2024 Data Point |

| Domestic Passenger Services | Cash Cow | Mature market, high market share (~50%), stable pricing | 86.6% Load Factor (International, indicative of strong network performance) |

| International Long-Haul Network (Wide-body Fleet) | Cash Cow | Established routes, high utilization, robust cash flow | Significant revenue contribution from international network in 2023 |

| Aircraft Maintenance, Repair, and Overhaul (MRO) | Cash Cow | Consistent demand, growing sector (6.2% CAGR 2025-2030) | Internal capability servicing fleet and potential external clients |

| Air Canada Vacations | Cash Cow | Leverages network, stable leisure market, solid financial results (Q1 2025) | Key contributor to diversified revenue |

What You’re Viewing Is Included

Air Canada BCG Matrix

The Air Canada BCG Matrix preview you're examining is the identical, fully formatted report you'll receive upon purchase. This means you're seeing the precise analysis and strategic insights that will be yours to use immediately, without any alterations or additional content. The document is designed for immediate application, offering a clear and actionable overview of Air Canada's business units. Rest assured, this preview represents the complete, professional-grade report ready for your strategic planning needs.

Dogs

Air Canada's U.S. transborder routes are currently positioned as Dogs in the BCG Matrix. Passenger revenues on these routes saw an 11% decrease in the second quarter of 2025. This downturn is attributed to a confluence of factors, including evolving U.S. government policies, the specter of tariff threats, and more stringent immigration regulations, which have collectively dampened Canadian travel to the United States.

Despite strategic efforts to reallocate capacity, these specific routes remain in a low-growth, low-market share category. The current environment presents challenges for these routes, requiring careful consideration for future investment or potential divestment.

Older aircraft within Air Canada's fleet, such as certain Airbus A320 family jets, are being phased out due to age and lower fuel efficiency, aligning them with the 'dog' category in a BCG matrix analysis. For instance, in 2023, Air Canada continued its fleet modernization, retiring older Boeing 767s and focusing on newer, more efficient aircraft.

These aging planes often come with escalating maintenance expenses and present a less competitive offering in terms of passenger experience and operational costs compared to newer models. This situation necessitates strategic decisions regarding their future, potentially involving divestiture or repurposing for less demanding routes or charter services.

Routes where Air Canada faces intense competition from ultra-low-cost carriers (ULCCs) can be categorized as 'dogs' if they yield low market share and diminished profit margins. For instance, during Q1 2024, Air Canada reported a net income of $181 million, a significant improvement from the previous year, but routes facing aggressive ULCC pricing pressure may not contribute proportionally to this growth.

While Air Canada Rouge is designed to compete in this cost-sensitive market, mainline routes directly challenged by ULCCs might find it difficult to achieve adequate profitability. These routes could become cash traps, consuming resources without generating substantial returns, especially if load factors are high but yields are consistently low.

Certain Less Strategic or Seasonal Charter Operations

Certain less strategic or seasonal charter operations within Air Canada's portfolio might be classified as Dogs in the BCG Matrix. These ventures often experience fluctuating demand and yield lower, inconsistent profits, effectively consuming valuable resources without offering substantial long-term growth potential.

These operations typically hold a small market share and may struggle to achieve profitability, sometimes even operating at a loss. For instance, while Air Canada's main passenger and cargo services are its stars and cash cows, specialized charter flights for events or specific seasonal routes might fall into this category if their contribution is marginal and unpredictable.

Consider the financial performance of such operations. If a particular seasonal charter route, for example, generated only $5 million in revenue in 2024 while incurring $6 million in operating costs, it would represent a net loss and a clear indicator of a Dog. Such activities divert capital and management attention from more lucrative core business areas.

- Low Market Share: These operations capture a minimal portion of the overall charter market.

- Low Growth Potential: Demand is often sporadic, limiting opportunities for expansion.

- Inconsistent Profitability: Returns can be volatile, with a high risk of losses.

- Resource Drain: They tie up assets and personnel without significant strategic benefit.

Non-Core, Divested Assets or Services

Air Canada's 'Dogs' in the BCG Matrix would encompass any non-core assets or services that have been divested or are earmarked for divestment. These are typically business units experiencing low market share and limited growth prospects, making them strategic liabilities.

Divesting these underperforming segments, such as certain regional route operations or ancillary services that no longer fit the core strategy, allows Air Canada to reallocate resources. For instance, in 2023, Air Canada continued to refine its network, potentially exiting less profitable routes that might be considered 'dogs'.

- Divestment of Underperforming Routes: Air Canada has historically divested routes with consistently low passenger volumes and profitability, freeing up aircraft and crew for more lucrative operations.

- Sale of Non-Strategic Ancillary Services: Any services that do not contribute significantly to the core travel experience or revenue streams are candidates for divestment.

- Focus on Core Strengths: The strategy behind divesting 'dogs' is to concentrate capital and management attention on airline operations with higher growth potential and market dominance.

Air Canada's U.S. transborder routes are currently classified as Dogs in the BCG Matrix due to their low market share and low growth prospects. Passenger revenues on these routes declined by 11% in Q2 2025, impacted by U.S. policy shifts and stricter immigration rules. This situation necessitates a strategic review for potential divestment or reallocation of resources.

Aging aircraft, like certain Airbus A320 family jets, also fall into the Dog category, marked by increasing maintenance costs and lower fuel efficiency compared to newer models. In 2023, Air Canada continued its fleet modernization, retiring older Boeing 767s to enhance operational efficiency.

Routes facing intense competition from ultra-low-cost carriers (ULCCs) can become Dogs if they yield low profit margins, even with high load factors. For example, while Air Canada's overall net income improved to $181 million in Q1 2024, these specific routes may not contribute proportionally to this growth, potentially becoming cash traps.

Certain less strategic or seasonal charter operations also fit the Dog profile, characterized by fluctuating demand, inconsistent profitability, and a high risk of losses. These ventures often consume resources without offering substantial long-term growth, diverting capital from core, more lucrative business areas.

| Category | Description | Example at Air Canada | Financial Implication | Strategic Action |

|---|---|---|---|---|

| Dogs | Low market share, low growth potential | U.S. transborder routes facing competition; Aging aircraft (e.g., older A320s) | Low profitability, potential cash drain | Divestment, resource reallocation |

| Dogs | Low market share, low growth potential | Routes with intense ULCC competition; Underperforming charter operations | Inconsistent returns, risk of losses | Focus on core strengths, exit strategy |

Question Marks

Air Canada's foray into new international routes, especially those serving emerging markets, positions these ventures as question marks within its BCG matrix. These markets, while promising for future growth, currently see Air Canada with a limited market share as it builds its operational footprint.

Significant capital will be needed for marketing and network development to transform these emerging routes into stars. For instance, in 2024, Air Canada announced new routes to regions like Southeast Asia, aiming to tap into burgeoning economies with projected GDP growth rates exceeding 5% in many of these areas.

Air Canada's order of 18 Boeing 737 MAX 10 aircraft, currently awaiting certification, positions them as a significant question mark within the BCG matrix. These planes represent a substantial capital investment, as of late 2024, with delivery timelines still uncertain due to ongoing certification processes.

While the MAX family generally offers improved fuel efficiency, a key advantage for airlines, the MAX 10's specific certification hurdles introduce a layer of risk. This means Air Canada is tying up capital in an asset that isn't yet generating revenue, a classic question mark characteristic.

The future success of these aircraft hinges on timely certification and market acceptance, which will determine their contribution to Air Canada's fleet flexibility and overall market share. Without these factors materializing, the return on this investment remains speculative.

Air Canada Rouge's planned integration of Boeing 737 MAX aircraft by 2028 is a notable strategic shift, aiming to leverage these fuel-efficient planes for leisure routes. This move could enhance operational efficiency and broaden the airline's reach into popular vacation spots, potentially improving passenger experience and cost-effectiveness for those specific markets.

However, the success of this transition hinges on robust market demand and competitive pricing in the leisure sector, which often presents lower profit margins compared to business travel. Air Canada's investment in this fleet expansion for Rouge necessitates careful market analysis to ensure it captures significant market share and achieves the desired yields, especially given the intense competition in the leisure travel segment.

Digital Transformation and AI-driven Customer Experience Initiatives

Air Canada's investments in digital transformation, such as enhancing its mobile app and implementing biometric boarding, are currently positioned as question marks in the BCG matrix. These initiatives, alongside AI-driven personalization within its loyalty programs, are designed to elevate the customer journey and optimize operational efficiency. However, their ultimate contribution to market share growth and profitability remains an area of observation, necessitating significant initial capital outlay and widespread user acceptance to transition into 'stars'.

These digital advancements are crucial for staying competitive in the airline industry. For instance, in 2024, Air Canada reported a significant increase in digital engagement, with its mobile app usage growing by 15% year-over-year. The success of these question mark initiatives hinges on their ability to translate into tangible customer benefits and operational cost savings.

- Mobile App Enhancements: Upgrades focus on improved booking, check-in, and in-flight service access, aiming for a seamless user experience.

- Biometric Boarding: Pilot programs are being expanded to key airports, targeting faster and more secure passenger processing.

- AI-driven Personalization: Loyalty program members are receiving tailored offers and travel recommendations based on AI analysis of their past behavior.

- Investment Rationale: These initiatives represent a strategic bet on future customer loyalty and operational efficiency, with the potential for high returns if successful.

Sustainable Aviation Fuel (SAF) Investments and Initiatives

Air Canada's commitment to Sustainable Aviation Fuel (SAF) and other environmental efforts positions these initiatives as question marks within a BCG matrix. While the aviation sector is increasingly focused on sustainability, these ventures represent high-growth potential areas that demand substantial investment. The returns are not yet clearly defined in terms of market share or immediate profit, hinging on wider industry acceptance and supportive regulations.

For instance, Air Canada announced a collaboration with Safran in 2024 to explore SAF production and supply chain development, signaling a strategic move into this burgeoning market. This aligns with the broader industry trend; the International Air Transport Association (IATA) projected that SAF could account for 65% of the reduction in aviation’s carbon emissions by 2050. However, SAF currently represents a small fraction of total jet fuel consumption, estimated at less than 1% globally in 2023, highlighting the nascent stage of this market and the associated investment uncertainty.

- High Investment, Uncertain Returns: SAF production requires significant upfront capital, and the economic viability is still developing.

- Industry Growth Potential: The push for decarbonization in aviation creates a strong growth trajectory for SAF and related technologies.

- Dependence on External Factors: Success is tied to regulatory frameworks, government incentives, and broader airline adoption rates.

- Strategic Importance: These investments are crucial for Air Canada's long-term sustainability goals and corporate image, even if immediate financial returns are unclear.

Air Canada's new international routes, particularly those in emerging markets, are classic question marks. These ventures require substantial investment to build market share, despite their future growth potential, as seen with the 2024 expansion into Southeast Asia.

The significant capital tied up in the uncertified Boeing 737 MAX 10 aircraft, ordered in late 2024, also represents a question mark. While promising fuel efficiency, the delay in certification creates financial uncertainty, with the investment not yet generating revenue.

Investments in digital transformation, such as the mobile app enhancements and biometric boarding pilots, are also question marks. These aim to improve customer experience and efficiency, but their impact on market share and profitability is still being determined, despite a 15% year-over-year increase in mobile app usage in 2024.

Air Canada's commitment to Sustainable Aviation Fuel (SAF) is another question mark. While a strategic move with high growth potential, as highlighted by its 2024 collaboration with Safran, it demands significant investment with currently uncertain returns, especially given SAF's less than 1% global fuel consumption in 2023.

| Initiative | BCG Category | Investment Rationale | Key Uncertainties | Market Context (2024/2025) |

|---|---|---|---|---|

| Emerging Market Routes | Question Mark | Future growth potential in developing economies | Building market share, operational costs | Targeting regions with projected GDP growth >5% |

| Boeing 737 MAX 10 Order | Question Mark | Fleet modernization, fuel efficiency | Certification delays, market acceptance | 18 aircraft on order, delivery timelines uncertain |

| Digital Transformation | Question Mark | Enhanced customer experience, operational efficiency | User adoption, ROI realization | 15% YoY mobile app usage growth |

| Sustainable Aviation Fuel (SAF) | Question Mark | Environmental goals, industry trend | Production costs, regulatory support, adoption rate | Collaboration with Safran, <1% global usage (2023) |

BCG Matrix Data Sources

Our Air Canada BCG Matrix draws from a robust blend of financial disclosures, industry growth forecasts, and operational performance data to accurately position each business unit.