Air Canada Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Air Canada Bundle

Unlock the core strategies that propel Air Canada forward with our comprehensive Business Model Canvas. This detailed breakdown reveals how they connect with customers, manage key resources, and generate revenue in the dynamic airline industry. Discover the blueprint for their success and gain actionable insights for your own ventures.

Partnerships

Air Canada's role as a founding member of the Star Alliance, a network of 26 airlines, is a cornerstone of its global reach. This alliance enables efficient airport operations, smooth transfers for passengers to a vast array of international destinations, and shared benefits within their loyalty programs, enhancing customer value.

Air Canada actively pursues joint venture partnerships to expand its global reach and enhance customer experience. Notable alliances include those with the Lufthansa Group and United Airlines, covering extensive routes between North/Central America and Europe, the Middle East, Africa, and the Indian subcontinent. These collaborations streamline operations such as reservations, check-in, and baggage handling.

Further solidifying its North American presence, Air Canada partners with United Airlines for the majority of its Canada-U.S. flights. Additionally, a strategic partnership with Air China facilitates travel between Canada and China. These joint ventures allow for seamless loyalty program integration, enabling customers to collect and redeem points across all participating airlines, adding significant value for frequent flyers.

Air Canada collaborates with regional carriers like Jazz Aviation LP and PAL Airlines, extending its reach to approximately 40 smaller Canadian communities. This strategic alliance significantly broadens Air Canada's domestic network, offering passengers greater connectivity beyond its primary hubs.

Loyalty Program Partners (Aeroplan)

Air Canada’s Aeroplan loyalty program thrives through strategic alliances, boasting partnerships with 45 airlines globally. This extensive network allows members to accumulate and redeem points across a wide spectrum of travel options, significantly boosting program engagement.

Beyond air travel, Aeroplan extends its reach through a diverse array of non-airline partners. These include collaborations with numerous merchandise providers, hotel chains, and car rental companies. This broadens the opportunities for members to earn and utilize their Aeroplan points, making the program more attractive and versatile.

- Extensive Airline Network: 45 airline partners facilitate global earning and redemption opportunities.

- Diverse Non-Airline Partners: Collaborations with merchandise, hotel, and car rental companies enhance member value.

- Increased Engagement: The breadth of partnerships encourages greater member participation and loyalty.

- Enhanced Value Proposition: Offering multiple avenues for point accrual and redemption makes Aeroplan a compelling program.

Ground Transportation Partners

Air Canada has significantly bolstered its ground transportation partnerships, notably by expanding its multi-modal Landline service. This initiative connects smaller regional airports, such as Kingston Norman Rogers Airport, directly to its major international hub at Toronto Pearson International Airport. The service utilizes luxury motorcoaches, aiming to provide a more integrated travel experience for passengers.

These collaborations are crucial for Air Canada's strategy to improve regional connectivity. By partnering with ground transport providers, the airline ensures that customers traveling from or to less-served areas have a seamless and comfortable transfer to their global network. This directly addresses customer needs for end-to-end travel solutions.

The Landline service exemplifies Air Canada's commitment to offering convenient, door-to-door travel options. For instance, in 2024, the airline continued to refine these partnerships, recognizing the growing demand for integrated travel. This approach not only enhances customer satisfaction but also opens up new revenue streams and strengthens Air Canada's competitive position in the market.

Key aspects of these partnerships include:

- Enhanced Regional Access: Facilitating travel to and from airports not directly served by Air Canada flights.

- Seamless Customer Experience: Providing integrated booking and transfer services for a smoother journey.

- Improved Connectivity: Extending Air Canada's reach beyond its traditional airport network.

- Brand Extension: Offering a premium ground travel experience that aligns with the airline's brand image.

Air Canada's strategic alliances are vital for its operational efficiency and market reach. Its membership in the Star Alliance, comprising 26 airlines, facilitates seamless global travel and loyalty program integration. Joint ventures with Lufthansa Group and United Airlines bolster trans-Atlantic routes, while a significant partnership with United Airlines covers most Canada-U.S. flights. These collaborations streamline operations and enhance customer value through shared benefits.

| Partner Type | Key Partners | Benefit | Scope |

|---|---|---|---|

| Global Alliances | Star Alliance (26 airlines) | Global network access, loyalty integration | Worldwide |

| Joint Ventures | Lufthansa Group, United Airlines | Route expansion, operational efficiency | North America-Europe, Middle East, Africa, India |

| Regional Carriers | Jazz Aviation LP, PAL Airlines | Domestic network expansion | ~40 Canadian communities |

| Loyalty Program Partners | 45 airlines, merchandise, hotels, car rentals | Enhanced member value, increased engagement | Global |

| Ground Transportation | Various providers (e.g., for Landline service) | Improved regional connectivity, seamless travel | Canada-wide |

What is included in the product

This Air Canada Business Model Canvas provides a strategic overview of its operations, detailing key customer segments like leisure and business travelers, and its value proposition centered on reliable, extensive network connectivity and tiered service offerings.

It outlines Air Canada's channels, customer relationships, revenue streams, key resources, activities, partnerships, and cost structure, offering a comprehensive view of how the airline creates, delivers, and captures value in the competitive aviation market.

Air Canada's Business Model Canvas acts as a pain point reliever by offering a clear, one-page snapshot of their operations, simplifying complex strategies for easier understanding and adaptation.

Activities

Air Canada's primary function revolves around offering scheduled air transport for both passengers and freight, connecting numerous domestic and global locations. This core activity underpins its entire operation and value proposition.

In 2024, the airline successfully carried around 47 million passengers, a testament to its extensive network and service reach. This figure highlights its significant role in the aviation industry.

The airline's operational scope is impressive, with flights servicing over 180 airports spread across six continents. This broad network facilitates global connectivity for its diverse customer base.

Air Canada's Key Activities extend beyond just flying planes. A crucial component is their Aircraft Maintenance, Repair, and Overhaul (MRO) operations. This ensures every aircraft in their fleet is safe, compliant, and running at peak efficiency. Think of it as the backbone of their operational reliability.

In 2024, maintaining such a large fleet is a significant undertaking. Air Canada invests heavily in MRO to keep its aircraft airworthy and minimize downtime. This not only guarantees passenger safety but also directly impacts the airline's ability to operate its flight schedule consistently, a vital factor for customer satisfaction and revenue generation.

Managing the Aeroplan loyalty program is a crucial activity for Air Canada, focusing on keeping members engaged, facilitating point accumulation and redemption, and fostering strategic partnerships. This program is central to customer retention and driving repeat business.

In 2024, Aeroplan experienced significant growth, with a 12% increase in membership, underscoring its appeal and effectiveness. Air Canada is actively enhancing the program's value proposition by introducing new benefits, such as complimentary Wi-Fi for members and expanding the network of airline and retail partners.

Network Expansion and Route Development

Air Canada is actively growing its network, introducing new flight paths and boosting service to existing locations. This strategic expansion is crucial for capturing new markets and serving evolving customer demand.

For Summer 2025, Air Canada is set to launch new routes to Europe and the United States. Furthermore, the airline intends to increase flight frequencies to important Asian destinations, demonstrating a commitment to strengthening its international presence.

- Network Expansion: Targeting new markets in Europe and the U.S. for Summer 2025.

- Capacity Increase: Enhancing service to key Asian markets with more frequent flights.

- Summer 2025 Capacity Goal: Aiming to offer over 100,000 weekly seats to 30 destinations across Europe and North Africa.

Fleet Modernization and Investment

Air Canada’s key activity involves a substantial commitment to modernizing and expanding its aircraft fleet. This ongoing effort is crucial for maintaining operational efficiency and competitiveness in the airline industry. The company is actively investing in new, more fuel-efficient aircraft to reduce operating costs and environmental impact.

A significant part of this strategy includes acquiring a substantial number of new planes. Between 2024 and 2029, Air Canada plans to take delivery of approximately 90 new aircraft. This ambitious plan encompasses a mix of advanced models designed to enhance both performance and passenger experience.

The fleet modernization is driven by several strategic objectives. These include improving fuel efficiency, which directly impacts profitability and sustainability efforts. Furthermore, the new aircraft are expected to offer enhanced customer comfort, a key differentiator in the airline market. Finally, these investments are designed to support Air Canada’s long-term growth trajectory and market presence.

- Fleet Expansion: Plans to acquire approximately 90 new aircraft between 2024 and 2029.

- Aircraft Types: Including Airbus A220s, A321XLRs, Boeing 787-10s, and Boeing 737 MAX.

- Strategic Goals: Improved fuel efficiency, enhanced customer comfort, and support for long-term growth.

- Investment Focus: Modernizing the fleet is a core activity to ensure operational excellence and market leadership.

Air Canada's key activities encompass operating a vast flight network, providing essential aircraft maintenance, and managing the highly successful Aeroplan loyalty program. These core functions are supported by strategic network expansion and a significant fleet modernization initiative.

| Activity | Description | 2024/2025 Data/Focus |

|---|---|---|

| Scheduled Air Transport | Connecting domestic and global locations for passengers and freight. | Carried ~47 million passengers in 2024; servicing over 180 airports across six continents. |

| Aircraft Maintenance, Repair, and Overhaul (MRO) | Ensuring fleet safety, compliance, and operational efficiency. | Significant investment in MRO to minimize downtime and ensure consistent flight schedules. |

| Aeroplan Loyalty Program Management | Customer engagement, point management, and partner development. | 12% membership growth in 2024; enhanced benefits like complimentary Wi-Fi. |

| Network Expansion and Fleet Modernization | Introducing new routes and acquiring modern, fuel-efficient aircraft. | New European/US routes for Summer 2025; ~90 new aircraft deliveries planned between 2024-2029. |

What You See Is What You Get

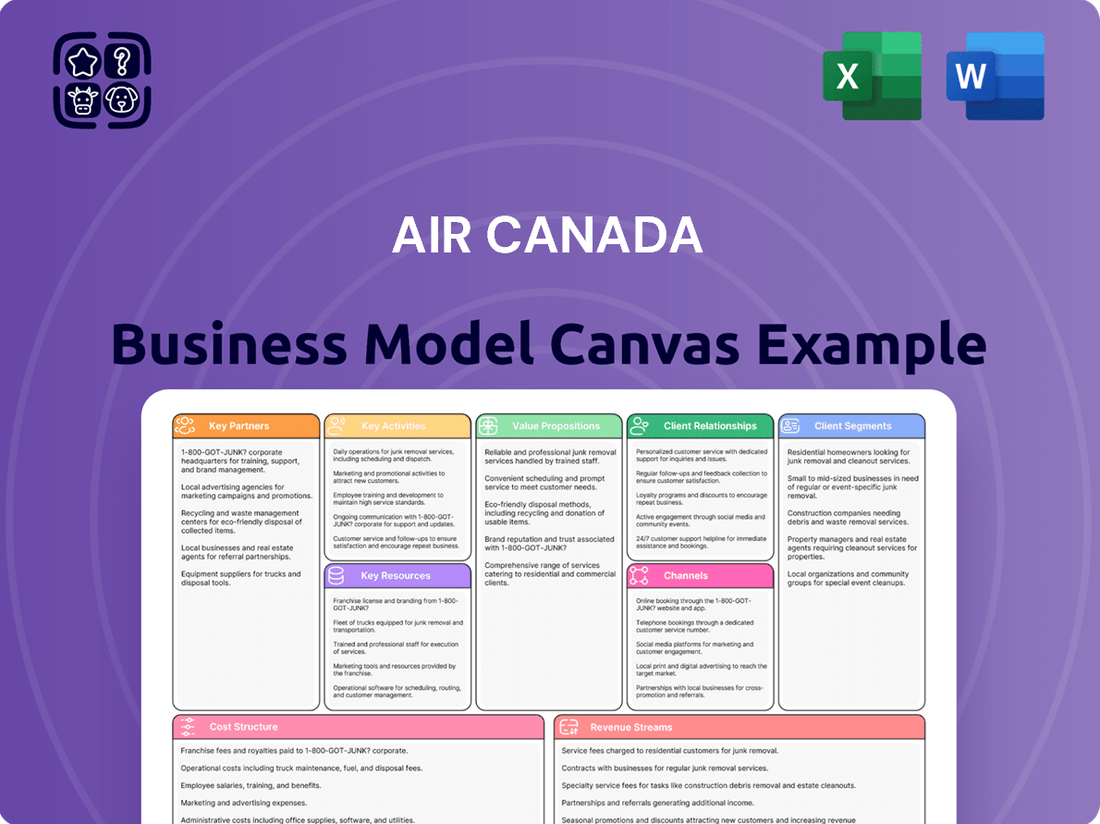

Business Model Canvas

The Air Canada Business Model Canvas you are previewing is the actual document you will receive upon purchase. This isn't a sample or a mockup, but a direct representation of the comprehensive analysis you'll gain access to. Once your order is complete, you'll download this exact file, ready for immediate use and strategic application.

Resources

Air Canada's aircraft fleet, numbering over 350 planes, is a cornerstone of its operations. This diverse collection includes advanced narrow-body jets like the Airbus A220 and Boeing 737 MAX, alongside long-haul wide-body aircraft such as the Boeing 787 Dreamliner and the upcoming Airbus A321XLR.

This substantial and modern fleet is Air Canada's primary physical asset, directly enabling its extensive passenger and cargo transportation services across domestic and international routes.

Air Canada's extensive global route network, reaching nearly 200 destinations across six continents, is a foundational asset. This vast reach allows the airline to serve a broad customer base and tap into diverse markets.

Strategic hubs in major Canadian cities, notably Toronto Pearson International Airport (YYZ) and Montreal-Trudeau International Airport (YUL), are vital for operational efficiency. In 2024, these hubs facilitated seamless passenger and cargo transfers, underpinning the airline's ability to manage complex international operations.

Aeroplan, as a cornerstone of Air Canada's business model, functions as a significant intangible asset, driving customer loyalty and repeat business. As of early 2024, the program boasts over 5 million members, a testament to its premier status in Canada.

The program’s extensive network of over 50 airline and retail partners is crucial for member engagement and provides diverse earning and redemption opportunities. This broad reach directly contributes to Air Canada's customer retention strategies and fuels ongoing program participation.

Skilled Personnel (Pilots, Cabin Crew, Maintenance)

Air Canada's operational excellence hinges on its highly skilled personnel, encompassing pilots, cabin crew, maintenance technicians, and ground staff. These professionals are the backbone of safe and efficient flight operations, directly impacting customer experience and regulatory compliance.

The airline's commitment to its workforce was underscored in 2024 with the ratification of a new contract with its pilots. This agreement aims to provide competitive compensation and working conditions, crucial for retaining and attracting top talent in a demanding industry.

The importance of skilled maintenance staff cannot be overstated, as they ensure the airworthiness of Air Canada's fleet, a critical factor in safety and operational reliability. In 2023, Air Canada reported a fleet of 337 aircraft, each requiring meticulous maintenance by certified technicians.

- Skilled Workforce: Pilots, cabin crew, and maintenance technicians are vital for safe and efficient airline operations.

- Pilot Contract: Air Canada secured a new pilot contract in 2024, reflecting the importance of personnel relations.

- Fleet Maintenance: Ensuring the airworthiness of Air Canada's 337 aircraft (as of 2023) relies on expert maintenance personnel.

Brand Reputation and Customer Trust

Air Canada's position as Canada's largest airline and flag carrier underpins a robust brand reputation and significant customer trust. This is a critical intangible asset that directly influences customer acquisition and loyalty.

The airline's commitment to service excellence is reflected in its consistent recognition, including being named the Best Airline in North America by Skytrax in 2024. This prestigious award, alongside its Skytrax Four-Star ranking, validates the quality of experience Air Canada offers to its passengers.

These accolades are not merely symbolic; they translate into tangible benefits by attracting a broad customer base, from frequent business travelers to leisure passengers, who rely on the airline's established credibility for their travel needs.

- Brand Strength: Canada's largest airline and flag carrier status.

- Customer Trust: Built through consistent service and reliability.

- Industry Recognition: Skytrax Four-Star ranking and Best Airline in North America 2024 award.

- Competitive Advantage: Reputation drives customer choice and retention.

Air Canada's key resources are its extensive fleet, a vast route network, strategic hubs, the Aeroplan loyalty program, a skilled workforce, and a strong brand reputation. These elements collectively enable the airline to deliver its services and maintain its market position.

| Key Resource | Description | 2024/Recent Data Point |

|---|---|---|

| Aircraft Fleet | Over 350 modern aircraft, including Airbus A220, Boeing 737 MAX, and Boeing 787 Dreamliner. | Fleet size of over 350 aircraft. |

| Route Network | Extensive global network serving nearly 200 destinations across six continents. | Covers approximately 200 destinations. |

| Strategic Hubs | Major Canadian airports like Toronto Pearson (YYZ) and Montreal-Trudeau (YUL). | Facilitated seamless transfers in 2024. |

| Aeroplan Loyalty Program | A premier loyalty program with over 5 million members and 50+ partners. | Over 5 million members as of early 2024. |

| Skilled Workforce | Experienced pilots, cabin crew, maintenance, and ground staff. | New pilot contract ratified in 2024. |

| Brand Reputation | Canada's largest airline and flag carrier, recognized for service excellence. | Named Best Airline in North America by Skytrax in 2024. |

Value Propositions

Air Canada's extensive global network is a cornerstone of its value proposition, connecting customers to over 180 airports across six continents. This vast reach ensures travelers can access a wide array of domestic and international destinations with remarkable ease.

In 2024, Air Canada continued to leverage its strong partnerships and route network to offer competitive connectivity. For instance, its operations in the first quarter of 2024 saw significant passenger traffic, underscoring the demand for its broad network reach.

The Aeroplan program offers extensive value with diverse earning and redemption options across 45 airline and many non-airline partners. This broad network significantly enhances the program's appeal, providing members with ample opportunities to accumulate and utilize points.

Recent program updates have further boosted its attractiveness. For instance, extended status validity and complimentary Wi-Fi on select Air Canada flights directly increase member benefits, reinforcing loyalty and encouraging continued engagement with the airline.

Air Canada is significantly enhancing its customer experience by modernizing aircraft interiors. This includes introducing updated seating and advanced in-flight entertainment systems, aiming for a more comfortable journey. In 2024, Air Canada continued its fleet modernization, with a focus on the customer cabin, reflecting a commitment to passenger comfort and satisfaction.

The airline is also rolling out free high-speed Wi-Fi across its fleet, a key amenity for travelers. This initiative, progressing through 2024, directly addresses a major customer demand for connectivity. Furthermore, Air Canada is expanding its Maple Leaf Lounge network, offering premium spaces for passengers to relax and work before their flights.

Reliable and Safe Air Transportation

As Canada's flag carrier, Air Canada places paramount importance on safety and operational reliability, a core promise to its passengers. This commitment is a cornerstone of its value proposition, assuring travelers of a secure and dependable journey.

The airline has demonstrated a focus on enhancing its service, with notable improvements in on-time performance. For instance, in the first quarter of 2024, Air Canada reported a significant increase in its on-time departure rate, which contributes directly to passenger confidence in the airline's reliability.

- Safety First: Air Canada's rigorous safety protocols and continuous investment in fleet modernization underscore its dedication to passenger security.

- Operational Excellence: The airline's efforts to boost on-time performance, a key metric for reliability, directly benefit travelers by minimizing disruptions and delays.

- Customer Trust: By consistently delivering on its promise of safe and reliable air transportation, Air Canada cultivates strong customer loyalty and trust.

Diverse Service Offerings (Cargo, Vacations, Maintenance)

Air Canada extends its value proposition significantly beyond just carrying passengers. It actively leverages its infrastructure and expertise to offer a diverse suite of services, capturing a broader market share.

These offerings include Air Canada Cargo, which transported 200,000 tonnes of freight in 2023, demonstrating a robust demand for its logistics capabilities. Furthermore, Air Canada Vacations provides integrated travel experiences, enhancing customer loyalty and revenue streams.

The airline also provides essential aircraft maintenance, repair, and overhaul (MRO) services. This diversification allows Air Canada to meet a wider spectrum of customer needs, from individual travelers to businesses requiring cargo solutions and even other airlines needing technical support.

- Air Canada Cargo: A significant contributor, moving a substantial volume of global goods.

- Air Canada Vacations: Offers curated travel packages, appealing to leisure travelers.

- Maintenance, Repair, and Overhaul (MRO): Provides technical services, generating additional revenue and utilizing operational capacity.

Air Canada's value proposition is built on a foundation of extensive global connectivity, a superior loyalty program, and an enhanced customer experience. These elements combine to offer travelers convenience, value, and comfort, fostering strong customer relationships.

The airline's commitment to safety and operational reliability further solidifies its appeal, ensuring passengers can depend on Air Canada for secure and punctual journeys. This focus on core service quality builds trust and encourages repeat business.

Beyond passenger services, Air Canada leverages its infrastructure for cargo and vacation packages, diversifying revenue and meeting broader market needs. This multi-faceted approach strengthens its overall market position.

| Value Proposition Element | Description | 2024 Data/Impact |

|---|---|---|

| Global Network | Connecting over 180 airports across six continents. | Significant passenger traffic in Q1 2024, demonstrating strong demand. |

| Aeroplan Program | Extensive earning/redemption with 45+ airline partners. | Enhanced benefits like extended status validity and complimentary Wi-Fi boost member engagement. |

| Customer Experience | Modernized aircraft interiors and fleet upgrades. | Rollout of high-speed Wi-Fi across fleet and expansion of Maple Leaf Lounges underway. |

| Safety & Reliability | Rigorous safety protocols and operational excellence. | Improved on-time departure rates in Q1 2024, increasing passenger confidence. |

| Diversified Services | Air Canada Cargo, Vacations, and MRO services. | Air Canada Cargo transported 200,000 tonnes in 2023, showing robust logistics demand. |

Customer Relationships

Air Canada cultivates deep customer loyalty via its Aeroplan program, which features tiered Elite Status levels. These tiers unlock valuable perks such as eUpgrade credits and bonus miles, directly rewarding frequent flyers and encouraging continued engagement.

The program actively works to retain customers through strategic promotions and improvements. For instance, recent initiatives like extended Elite Status validity and points matching programs are designed to enhance member satisfaction and reduce churn, reinforcing the value proposition of flying with Air Canada.

Air Canada offers a multi-channel approach to customer service, encompassing dedicated contact centers, comprehensive online support through its website and app, and active engagement on social media platforms. These channels are vital for handling a high volume of customer interactions, from flight inquiries and booking modifications to resolving disruptions. In 2024, Air Canada reported handling millions of customer interactions across these touchpoints, underscoring their importance in maintaining customer loyalty and operational efficiency.

Air Canada is significantly enhancing its customer relationships through personalized digital experiences. This includes substantial investments in upgrading its mobile app, aiming to provide a more intuitive and tailored journey for each traveler. For instance, the airline has been rolling out biometric boarding technology, which streamlines the process and offers a more seamless, personalized interaction from check-in to flight.

Further enriching the digital engagement, Air Canada has introduced free Wi-Fi across its fleet. This move directly addresses passenger needs for connectivity during flights, allowing for more personalized communication and access to services. These digital advancements are key to fostering stronger, more convenient relationships with their customer base, making travel with Air Canada a smoother and more engaging experience.

Feedback Mechanisms and Service Recovery

Air Canada actively seeks customer feedback through various channels to drive operational improvements. Their commitment to enhancing on-time performance and baggage delivery directly addresses common pain points, fostering greater customer trust and satisfaction. For instance, in 2024, the airline reported a significant improvement in its baggage handling success rate, aiming to reduce mishandled bags per 1,000 passengers.

The airline’s service recovery efforts are crucial for rebuilding relationships after service failures. By empowering frontline staff to resolve issues promptly, Air Canada aims to turn potentially negative experiences into opportunities to demonstrate customer care. This focus on effective complaint resolution is a cornerstone of their customer relationship strategy.

- Customer Feedback Integration: Air Canada uses feedback from surveys, social media, and direct interactions to inform operational adjustments.

- On-time Performance Focus: In 2024, efforts to improve departure and arrival punctuality were a key area of operational enhancement, with specific targets set for improvement.

- Baggage Handling Improvements: The airline invested in technology and processes to minimize lost or delayed baggage, a critical factor in passenger experience.

- Service Recovery Protocols: Empowering staff to offer appropriate compensation or solutions for service disruptions aims to retain customer loyalty.

Targeted Promotions and Communications

Air Canada actively uses targeted promotions to boost passenger numbers and foster loyalty. For instance, they frequently offer incentives like triple Aeroplan points on select routes, directly encouraging bookings and engagement. This strategy is particularly effective in driving demand for less popular flights or during off-peak seasons.

Regular communication is key to maintaining customer interest and informing them about Air Canada's evolving offerings. This includes updates on new destinations, enhancements to onboard services, and changes to the popular Aeroplan loyalty program. By keeping customers informed, Air Canada ensures they remain aware of the value and benefits of flying with them.

- Targeted Promotions: Offering triple Aeroplan points on specific routes to stimulate demand.

- Customer Engagement: Using loyalty program incentives to encourage repeat business.

- Information Dissemination: Communicating new routes, services, and program updates regularly.

- Demand Stimulation: Proactively driving bookings through strategic promotional activities.

Air Canada's customer relationships are built on a foundation of loyalty programs, personalized digital experiences, and proactive service recovery. The Aeroplan program, with its tiered Elite Status, rewards frequent flyers, while investments in mobile app enhancements and fleet-wide free Wi-Fi aim to create a more seamless and connected travel experience. In 2024, Air Canada reported a significant improvement in its baggage handling success rate, directly addressing a key passenger concern and reinforcing trust.

| Customer Relationship Aspect | Key Initiatives | 2024 Impact/Focus |

|---|---|---|

| Loyalty Program | Aeroplan with Elite Status tiers | Rewarding frequent flyers, encouraging repeat business |

| Digital Experience | Mobile app upgrades, biometric boarding, fleet-wide Wi-Fi | Streamlining travel, enhancing personalization |

| Customer Service | Multi-channel support (contact centers, online, social media) | Handling millions of interactions, improving efficiency |

| Feedback & Improvement | Customer surveys, operational adjustments | Focus on on-time performance and baggage handling success rate improvements |

| Service Recovery | Empowering frontline staff for issue resolution | Rebuilding relationships after disruptions |

Channels

Air Canada's website and mobile app are crucial direct sales channels, allowing customers to book flights, manage bookings, and access loyalty program information seamlessly. These platforms are continuously updated to improve user experience and functionality.

In 2024, Air Canada reported a significant portion of its bookings occurring through these digital channels, reflecting a growing customer preference for self-service options. The airline has invested heavily in enhancing the app's features, including personalized offers and real-time flight updates.

Air Canada leverages Online Travel Agencies (OTAs) like Expedia and Booking.com to significantly broaden its customer reach. These platforms act as crucial distribution channels, allowing the airline to connect with a global audience actively searching for travel options. In 2024, the online travel market continued to be a dominant force, with OTAs facilitating a substantial portion of flight bookings worldwide.

Call centers and ticketing offices are crucial for Air Canada, handling complex bookings and customer support. In 2024, these traditional channels continue to serve customers who prefer direct human interaction, particularly for intricate travel arrangements or when digital solutions fall short. This human touch remains a valuable component of customer service.

Airport Check-in and Lounges

Airports are fundamental physical touchpoints for Air Canada's operations, facilitating essential customer interactions like check-in and boarding. In 2024, Air Canada continued to leverage its extensive network of airport facilities to streamline passenger flow and enhance the overall travel experience.

The Maple Leaf Lounges are a key component of Air Canada's premium offering, providing a comfortable and amenity-rich environment for eligible passengers before their flights. These lounges aim to elevate the pre-flight experience, contributing to customer loyalty and satisfaction.

- Airport Presence: Air Canada operates check-in counters and baggage services at numerous airports globally, ensuring physical accessibility for its customers.

- Maple Leaf Lounges: In 2024, Air Canada maintained and enhanced its network of Maple Leaf Lounges, offering a premium experience with amenities such as complimentary food and beverages, Wi-Fi, and quiet seating areas.

- Customer Segmentation: Access to lounges is typically tied to fare class, frequent flyer status, or credit card partnerships, segmenting the customer base and rewarding loyalty.

Partnership Networks (Star Alliance, Joint Ventures)

Air Canada’s partnership networks, primarily through the Star Alliance and various joint ventures, serve as critical indirect channels. These alliances allow Air Canada to extend its global reach, offering customers access to a vast array of destinations that might otherwise be outside its direct operational footprint. For instance, by participating in the Star Alliance, which boasts over 25 member airlines, Air Canada can facilitate seamless travel for passengers across continents through codeshare agreements and interline services.

These collaborations are vital for enhancing customer experience and expanding market access. Through codeshare agreements, Air Canada can sell tickets on partner airlines, effectively filling gaps in its own route network. This strategy is particularly effective in reaching smaller markets or offering more convenient travel options by combining flights. In 2024, the Star Alliance continued to be a cornerstone of global air travel connectivity, with member airlines operating thousands of flights daily.

Joint ventures with specific airlines further deepen this strategic reach. These ventures often involve more integrated operations, such as revenue sharing and coordinated network planning, allowing for greater efficiency and market penetration. For example, Air Canada’s joint venture with United Airlines on transborder Canada-U.S. routes enables a more competitive offering and a more integrated customer journey between the two countries.

- Global Connectivity: Star Alliance membership provides access to over 1,300 destinations across nearly 200 countries through its 26 member airlines.

- Seamless Travel: Codeshare and interline agreements facilitate single-ticket bookings and baggage transfers for passengers traveling on multiple carriers.

- Market Expansion: Joint ventures, like the one with United Airlines, enhance competitiveness and customer convenience on key international routes.

- Customer Benefits: Passengers benefit from expanded route options, loyalty program reciprocity (earning and redeeming miles), and lounge access.

Air Canada's digital platforms, including its website and mobile app, are primary direct sales channels, facilitating bookings and customer account management. These digital touchpoints are continuously refined to enhance user experience and drive self-service transactions, a trend strongly evident in 2024 booking data.

Online Travel Agencies (OTAs) serve as vital indirect channels, significantly expanding Air Canada's market reach by connecting with travelers actively searching for flights. In 2024, the continued dominance of OTAs in the travel booking landscape underscored their importance for airline distribution.

Physical channels, such as airport operations and customer service call centers, remain critical for handling complex inquiries and providing personalized support. These channels cater to customers who prefer direct interaction, ensuring comprehensive service delivery even in 2024.

Strategic partnerships, notably through the Star Alliance and specific joint ventures, extend Air Canada's network reach and offer customers enhanced connectivity. These alliances facilitate seamless travel across a vast global network, with benefits like loyalty program reciprocity being a key draw for passengers in 2024.

Customer Segments

Leisure travelers, encompassing individuals and families seeking holidays and personal getaways, represent a core customer segment for Air Canada. The airline actively courts this group by offering an expansive network reaching popular vacation spots worldwide. In 2023, Air Canada’s leisure passenger traffic saw significant growth, contributing to the company’s overall recovery post-pandemic.

Air Canada Vacations plays a crucial role in attracting leisure travelers, bundling flights with accommodations and activities to create attractive holiday packages. These packages are designed to simplify planning and offer value, appealing directly to those looking for stress-free vacation experiences. The success of these packages is evident in the increasing booking numbers reported by Air Canada Vacations throughout 2024.

Furthermore, Air Canada's loyalty program, Aeroplan, is a key differentiator for leisure travelers. By offering points, status benefits, and exclusive perks, Aeroplan encourages repeat business and enhances the overall travel experience. As of early 2024, Aeroplan membership continues to expand, demonstrating its strong appeal to frequent leisure flyers.

Business travelers, a key demographic for Air Canada, include corporate clients, executives, and individuals on work assignments. These customers prioritize efficiency, flexibility, and premium services to maximize productivity and comfort during their journeys. In 2024, Air Canada continued to focus on these needs by offering dedicated business class cabins and a robust network of flights connecting major business centers.

Air Canada's strategy for business travelers involves providing a seamless travel experience, from booking to arrival. This includes features like priority check-in, lounge access, and enhanced in-flight amenities. The airline's loyalty program, Aeroplan, also offers tailored benefits, such as mileage accrual and redemption options that appeal to frequent business flyers, encouraging repeat business and brand loyalty.

Cargo shippers, encompassing businesses and individuals needing to transport goods by air, represent a crucial customer segment for Air Canada Cargo. These clients rely on efficient and reliable air freight solutions to move a diverse range of products globally.

Air Canada Cargo facilitates this by offering air freight lift and extensive connectivity to hundreds of destinations spanning six continents. This reach is achieved by leveraging capacity on both its passenger fleet and dedicated freighter aircraft, ensuring flexibility and broad market access for shippers.

In 2024, Air Canada Cargo continued to be a vital link for global trade, handling a significant volume of freight. For instance, the airline's cargo operations contributed substantially to its overall revenue, with specific figures often detailed in quarterly financial reports, underscoring the importance of this segment to the company's financial performance.

Aeroplan Members

Aeroplan Members represent a core, highly engaged customer base for Air Canada, actively participating in the airline's loyalty program. These individuals are driven by the desire to accumulate and utilize Aeroplan points for flights, upgrades, and a variety of other rewards, including merchandise and partner offerings. Their loyalty is often cultivated through tailored promotions and personalized incentives designed to encourage continued engagement and spending.

In 2024, Air Canada's loyalty program, Aeroplan, continued to be a significant driver of customer retention and revenue. The program boasts millions of active members who generate substantial transaction volume. For instance, Aeroplan's partnerships extend beyond flights to include credit cards, retail, and travel partners, broadening the earning and redemption opportunities for members. This ecosystem approach is crucial for maintaining member engagement and increasing the perceived value of the loyalty program.

- Loyalty Program Engagement: Aeroplan members are characterized by their active participation, consistently earning and redeeming points for travel and lifestyle benefits.

- Value Proposition: Members are motivated by exclusive offers, personalized promotions, and the ability to redeem points for a wide array of rewards, enhancing their travel experience and overall value perception.

- Financial Impact: The Aeroplan program contributes significantly to Air Canada's revenue streams through member spending on flights and partner products, underscoring its importance in the airline's business model.

- Growth Opportunities: Air Canada continually seeks to expand Aeroplan's reach through new partnerships and enhanced digital experiences to further deepen member loyalty and attract new participants.

Regional Travelers

Regional travelers represent a crucial segment for Air Canada, particularly those journeying within Canada, especially to smaller communities not directly serviced by its main flight network. This group relies on Air Canada’s extensive reach, facilitated by strategic alliances.

Air Canada effectively serves this segment through its partnerships with regional carriers, most notably Jazz Aviation LP, which operates under the Air Canada Express brand. These collaborations are vital for ensuring comprehensive domestic connectivity, bridging the gap between major hubs and less accessible locales. For instance, in 2024, Jazz Aviation LP continued to be a cornerstone of Air Canada's regional operations, contributing significantly to the total domestic passenger volume.

- Target Audience: Individuals and businesses requiring travel to and from smaller Canadian cities and towns.

- Value Proposition: Providing essential air connectivity to underserved regions, offering a seamless travel experience through integrated networks.

- Key Partnerships: Jazz Aviation LP (Air Canada Express) and agreements with companies like Landline for last-mile connectivity.

- Revenue Streams: Ticket sales for regional flights, often with a focus on connecting passengers to mainline services.

Air Canada's customer segments are diverse, ranging from leisure and business travelers to cargo clients and loyalty program members. Each segment has unique needs and preferences that Air Canada aims to meet through tailored services and offerings. The airline's strategic focus on these distinct groups underpins its operational strategy and revenue generation.

The airline also caters to regional travelers, ensuring connectivity to smaller communities through partnerships. This broad approach allows Air Canada to maximize its market reach and serve a wide array of customer needs across different travel purposes and geographical locations.

| Customer Segment | Key Characteristics | Air Canada's Strategy | 2024 Focus/Data Point |

|---|---|---|---|

| Leisure Travelers | Holidaymakers, families seeking vacations | Expansive network, Air Canada Vacations packages, Aeroplan loyalty program | Continued growth in leisure passenger traffic reported throughout 2024. |

| Business Travelers | Corporate clients, executives, work assignments | Efficiency, flexibility, premium services, dedicated business class, Aeroplan benefits | Focus on seamless travel experience and enhanced in-flight amenities for productivity. |

| Cargo Shippers | Businesses needing air freight transport | Efficient and reliable air freight solutions, global connectivity | Significant contributor to revenue; handled substantial freight volumes in 2024. |

| Aeroplan Members | Loyal customers, frequent flyers | Accumulation and redemption of points, exclusive offers, personalized incentives | Millions of active members driving transaction volume; expanded partnerships in 2024. |

| Regional Travelers | Travelers to smaller Canadian communities | Extensive domestic reach via partnerships, integrated networks | Jazz Aviation LP (Air Canada Express) remains crucial for regional connectivity in 2024. |

Cost Structure

Fuel costs represent a substantial portion of Air Canada's operating expenses. The airline industry is particularly sensitive to jet fuel price volatility, which can significantly affect profitability. In 2024, Air Canada's operating expenses were notably influenced by increased capacity and maintenance needs, with fuel emerging as a critical cost driver.

Personnel and labor costs are a significant expense for Air Canada, encompassing employee salaries, wages, benefits, and pension obligations. In 2024, these costs saw an increase, partly influenced by the ongoing negotiations and finalization of new pilot contracts, which directly impact overall labor expenditures.

Aircraft ownership and maintenance represent a substantial portion of Air Canada's cost structure. This includes the significant expenses related to acquiring new planes, managing depreciation on existing fleets, and the ongoing costs of leases. For instance, Air Canada's 2023 financial statements show a substantial investment in flight equipment, reflecting these capital-intensive decisions.

Comprehensive maintenance, repair, and overhaul (MRO) services are critical and costly. These services ensure the airworthiness and safety of the fleet, directly impacting operational reliability. Air Canada's commitment to a modern fleet means ongoing investment in these vital maintenance programs.

Looking ahead, Air Canada has outlined plans for considerable capital expenditure through 2028. These investments are earmarked for acquiring new, fuel-efficient aircraft and for upgrading the cabins of their current planes. These strategic moves are designed to enhance passenger experience and improve operational efficiency, but they come with significant upfront and ongoing costs.

Airport and Navigation Fees

Airport and Navigation Fees represent a significant operational cost for Air Canada, directly tied to its flight operations and network reach. These expenses encompass charges for landing at airports, utilizing air traffic control services, and accessing airport infrastructure. As Air Canada continues to grow, adding new routes and increasing flight frequencies, these fees naturally escalate, impacting the overall cost structure.

In 2024, these costs are a crucial component of Air Canada's variable expenses. For instance, landing fees alone can vary substantially depending on the airport's size and traffic volume. Air navigation services are essential for safe flight operations, and their associated costs are passed on to airlines. Ground handling services, including baggage, passenger, and aircraft services, also contribute significantly to these airport-related expenditures.

- Landing Fees: Charges levied by airports for each aircraft landing, often based on aircraft weight.

- Air Navigation Service Fees: Costs for air traffic control, communication, and surveillance services provided by national or regional authorities.

- Airport Infrastructure Usage: Fees for using airport facilities such as gates, taxiways, and aprons.

- Ground Handling: Expenses for services like baggage loading/unloading, passenger boarding, and aircraft pushback.

Sales, Marketing, and Distribution Costs

Air Canada's sales, marketing, and distribution costs are significant, encompassing expenses for advertising, promotional activities, sales commissions, and fees paid to various distribution channels. These expenditures are crucial for attracting and retaining customers in a competitive airline market.

The airline actively invests in strategic promotions, notably for its popular Aeroplan loyalty program, which drives customer engagement and repeat business. Furthermore, substantial investment in digital platforms and online presence is necessary to reach a broad audience and facilitate bookings.

- Advertising and Promotion: Costs associated with broad-reaching campaigns and targeted advertising efforts.

- Sales Commissions: Payments made to travel agents and other intermediaries for facilitating ticket sales.

- Distribution Channel Fees: Expenses related to global distribution systems (GDS) and online travel agencies (OTAs).

- Aeroplan Program Investment: Marketing and operational costs to maintain and enhance the loyalty program's value proposition.

Other operating expenses for Air Canada include a range of costs necessary for day-to-day operations, such as IT systems, insurance, and administrative overhead. These are essential for supporting the company's vast network and complex business processes. In 2024, these varied expenses continued to be managed to ensure efficient business functioning.

The airline also incurs significant costs related to its loyalty program, Aeroplan, including marketing, technology, and partner engagement. These investments are vital for customer retention and driving repeat business. Furthermore, Air Canada's commitment to customer experience necessitates ongoing investment in in-flight services and amenities.

Air Canada's cost structure is heavily influenced by its fleet. The airline's 2023 financial reports indicate significant capital expenditures on new aircraft, alongside depreciation and lease costs for its existing fleet. These fleet-related expenses are fundamental to its operational capacity and future growth plans.

| Cost Category | 2024 Impact/Focus | Key Components |

|---|---|---|

| Fuel | Significant driver due to price volatility and increased capacity. | Jet fuel purchases. |

| Personnel & Labor | Increased due to pilot contract finalizations. | Salaries, wages, benefits, pension obligations. |

| Aircraft Ownership & Maintenance | Substantial investment in fleet acquisition and upkeep. | New aircraft purchases, depreciation, leases, MRO services. |

| Airport & Navigation Fees | Escalated with network growth and flight frequencies. | Landing fees, air traffic control, ground handling. |

| Sales, Marketing & Distribution | Crucial for customer acquisition and retention. | Advertising, Aeroplan program, GDS/OTA fees. |

Revenue Streams

The most significant revenue generator for Air Canada is undoubtedly the sale of passenger tickets. This covers all their scheduled flights, both within Canada and to international destinations.

In 2024, Air Canada reported impressive annual revenues totaling $22.3 billion. This record performance was largely fueled by an expansion of their flight capacity and a notable increase in the number of passengers choosing to fly with them.

Air Canada Cargo generates revenue by transporting goods and freight across its global network. This segment offers a crucial diversification of income beyond passenger travel.

In the first quarter of 2025, Air Canada Cargo reported strong performance, a testament to its growing importance in the airline's overall financial health. This segment is a key component of their diversified revenue strategy.

The Aeroplan loyalty program is a powerhouse for Air Canada, generating revenue through selling points to a wide array of partners, including credit card companies and retailers. In 2024, the program's continued strength is evident, with strong engagement metrics and a substantial contribution to Air Canada's top line, reflecting its vital role in fostering customer loyalty and driving repeat business.

Ancillary Services

Ancillary services represent a significant revenue stream for Air Canada, encompassing optional add-ons that enhance the passenger experience. These include charges for checked baggage, preferred seat selection, in-flight entertainment systems, and Wi-Fi connectivity. In 2023, Air Canada reported substantial revenue from these services, reflecting their growing importance in the airline's overall financial performance.

Air Canada is actively working to boost income from these ancillary offerings. Initiatives like upgrading premium seating options and expanding free Wi-Fi access across its fleet are key strategies. These efforts aim to encourage more passengers to opt for these value-added services, thereby increasing overall revenue per passenger.

- Baggage Fees: Revenue generated from checked baggage, a common charge for most air travel.

- Seat Selection: Income derived from passengers paying for specific seat preferences, such as extra legroom or window seats.

- In-Flight Entertainment & Wi-Fi: Earnings from premium entertainment packages and internet access during flights.

- Other Premium Offerings: This category includes services like priority boarding, lounge access, and special meal requests.

Aircraft Maintenance, Repair, and Overhaul (MRO) Services

Air Canada generates revenue from its robust Aircraft Maintenance, Repair, and Overhaul (MRO) services. This segment not only ensures the operational readiness and safety of its own extensive fleet but also offers these specialized services to third-party aircraft operators. In 2023, Air Canada's MRO division played a significant role in supporting the company's financial health, demonstrating its capability beyond core passenger and cargo transport.

The MRO services provided by Air Canada are critical for maintaining the airworthiness of aircraft, encompassing everything from routine checks and component replacements to complex structural repairs and engine overhauls. This diversified revenue stream contributes to overall profitability and operational efficiency.

- Revenue Source: Maintenance, repair, and overhaul services for Air Canada's fleet and external clients.

- Financial Contribution: Supports the company's overall financial performance and operational stability.

- Scope of Services: Includes routine maintenance, component repair, and heavy overhaul operations.

Beyond ticket sales, Air Canada leverages its extensive network for cargo operations, transporting goods and freight. This segment offers a vital income diversification, as evidenced by its strong performance in early 2025.

Business Model Canvas Data Sources

The Air Canada Business Model Canvas is informed by a blend of internal financial reports, customer feedback surveys, and extensive market research on the airline industry. These sources ensure a comprehensive understanding of operational realities and customer needs.