AHIP PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AHIP Bundle

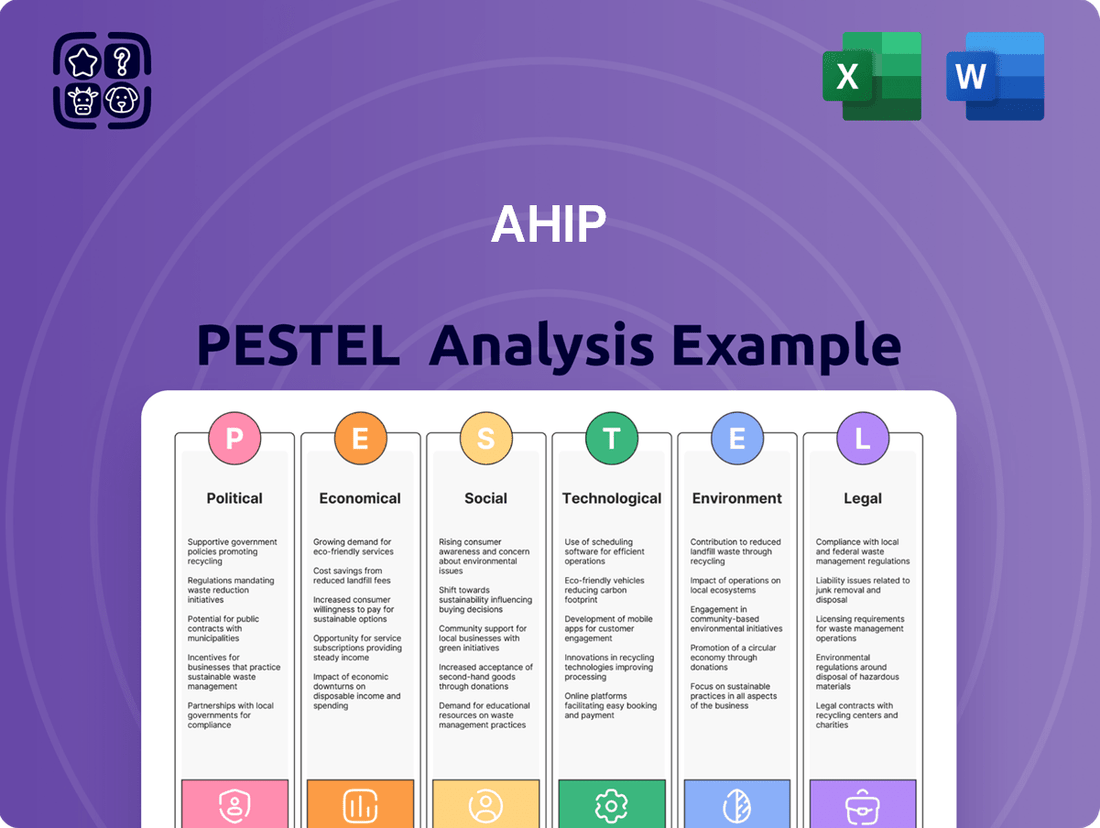

Navigate the dynamic landscape of the health insurance industry with our comprehensive AHIP PESTLE analysis. Understand how political shifts, economic fluctuations, social trends, technological advancements, environmental concerns, and legal frameworks are shaping AHIP's present and future. This expert-crafted report provides actionable insights into the external forces impacting the organization, equipping you with the knowledge to anticipate challenges and seize opportunities. Gain a competitive edge by downloading the full PESTLE analysis today and unlock a deeper understanding of AHIP's strategic environment.

Political factors

Uncertainty in global trade policies and the imposition of new tariffs significantly impact the hospitality sector. Such measures can escalate diplomatic tensions, potentially dampening international business and leisure travel, directly affecting hotel occupancy rates which are projected to reach 65% globally by late 2024. Furthermore, tariffs on imported construction materials and operational supplies, such as a 25% tariff on steel, increase costs for hotel development and renovation projects, squeezing operating margins for hospitality groups like AHIP.

Changes in government per diem rates significantly influence demand, especially for select-service hotels catering to federal and state employees. For fiscal year 2024, the standard CONUS lodging per diem is $107, impacting booking patterns. Budget allocations for government travel are subject to shifting political priorities, as seen with federal appropriations discussions for 2025. AHIP's diverse portfolio across various states remains susceptible to fluctuations in both federal and state government travel budgets, affecting key revenue streams.

Government investment in tourism infrastructure, like the significant federal funding allocated for airport upgrades and highway expansions, directly fuels hotel demand. Political backing for major events such as the 2026 FIFA World Cup across North America, projected to attract over 5.5 million visitors, and the 2028 Los Angeles Olympics, is set to significantly boost international arrivals and hospitality revenue. Conversely, insufficient political will or funding for these critical areas, including reduced tourism marketing budgets, can create a notable headwind for the sector, impacting occupancy rates and average daily rates (ADR) through 2025.

Political Climate and International Relations

The overall political climate and international relations significantly influence the attraction of foreign visitors. An unwelcoming political environment can directly lead to a decline in inbound international travel, impacting hotel demand, especially in major U.S. cities and tourist destinations. For instance, shifts in travel advisories or visa policies can deter potential international guests, directly affecting occupancy rates.

- International visitor arrivals to the U.S. are projected to reach 79 million in 2024, a notable recovery but still influenced by global relations.

- Geopolitical tensions can lead to decreased travel from key markets, with some regions seeing slower recovery in visitor numbers through early 2025.

- Perceptions of political stability and openness are crucial for sustained growth in the hospitality sector.

Immigration Policies

Shifts in immigration policies significantly impact the hospitality sector, affecting both labor supply and international travel. More restrictive policies can tighten an already competitive labor market, making it harder for hotels to fill essential roles, especially with the U.S. hospitality sector facing an estimated 10% labor shortage in Q1 2025 for entry-level positions. Such policies also create a perception of an unwelcoming environment, potentially deterring international tourists and business travelers, with global travel forecasts for 2024-2025 showing sensitivity to policy changes.

- Labor shortages in hospitality are projected to persist into 2025, exacerbated by stricter immigration.

- International tourist arrivals in the U.S. could see slower growth, potentially impacting an estimated $230 billion in annual spending.

Government policies on trade, like tariffs on materials, and shifts in per diem rates impact AHIP's costs and demand, with 2024 CONUS lodging per diem at $107. Political support for tourism infrastructure and major events such as the 2026 FIFA World Cup, projected to attract 5.5 million visitors, boosts revenue. Immigration policies affect labor supply, with 10% hospitality labor shortages in Q1 2025, and international arrivals, projected at 79 million for 2024, are sensitive to geopolitical stability.

| Factor | Impact | 2024/2025 Data |

|---|---|---|

| Trade Tariffs | Increased Costs | 25% steel tariff |

| Per Diem Rates | Demand Fluctuation | $107 CONUS (2024) |

| Immigration Policy | Labor & Travel | 10% labor shortage (Q1 2025) |

What is included in the product

The AHIP PESTLE analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing the organization. This comprehensive overview provides actionable insights for strategic decision-making by highlighting external forces that shape opportunities and threats.

Provides a clear, actionable breakdown of external factors impacting AHIP, enabling proactive strategy development and mitigating potential disruptions.

Economic factors

The prevailing interest rate environment significantly impacts AHIP, influencing its borrowing costs for acquisitions, development, and refinancing activities. As of early 2025, elevated interest rates, with the Federal Funds Rate potentially remaining in the 5.25%-5.50% range, make financing more expensive. This can compress property valuations and capitalization rates for REITs, as seen with the 10-year Treasury yield stabilizing around 4.2% in late 2024. Conversely, a potential shift to lowering rates later in 2025 would reduce capital costs, enhancing AHIP's acquisition potential and potentially leading to higher property valuations. This directly affects portfolio growth and profitability.

Consumer discretionary spending on travel remains highly sensitive to shifts in confidence and economic uncertainty. While overall travel demand has shown resilience, early 2024 data indicates a slight pullback in hotel and airfare spending as inflation and economic concerns persist, with consumer confidence indices like the Conference Board's often fluctuating. This trend suggests a potential trade-down effect, where travelers become more budget-conscious, potentially boosting demand for midscale and select-service properties into 2025, as seen with a 3.5% projected increase in budget hotel occupancy for the latter half of 2024.

Persistent inflation directly elevates hotel operating costs, including labor, utilities, and supplies. Surging labor expenses, projected to rise 4.0% in 2024 according to CBRE, have reached record highs in many U.S. markets. This erodes Gross Operating Profit margins, with some U.S. hotel GOP margins seeing a 100-200 basis point decline in early 2024 versus 2019. Such pressure on profitability compels operators like AHIP to aggressively pursue operational efficiencies to safeguard financial health.

Business and Leisure Travel Demand

The U.S. hotel industry faces a mixed demand landscape, with RevPAR growth projected to decelerate to 2.0% in 2025 from 4.0% in 2024. While domestic leisure travel has slowed, corporate and group travel show some stability, with corporate transient demand up 1.5% year-over-year as of early 2024. The bifurcation in performance continues, as luxury properties outperform economy hotels, a segment relevant to AHIP's select-service portfolio which saw occupancy rates lag.

- U.S. RevPAR growth is expected to slow to 2.0% in 2025, down from 4.0% in 2024.

- Corporate transient demand showed a 1.5% year-over-year increase in early 2024.

- Luxury hotel segments continue to outperform economy and select-service properties.

Real Estate Market and Development

Economic headwinds, including elevated construction costs, which saw a 0.73% increase in Q1 2024 according to the Turner Building Cost Index, and the higher cost of capital with the federal funds rate targeted at 5.25%-5.50% in mid-2024, are dampening new hotel development. This slowdown in new supply, with new hotel starts projected to decline by 15-20% year-over-year in 2024, can be beneficial for existing hotel owners by limiting competition. This environment has also spurred a rise in hotel conversions and adaptive reuse projects, with over 150 conversion projects identified across North America in early 2024, as a strategic alternative to ground-up construction.

- New hotel starts projected to decline by 15-20% year-over-year in 2024.

- Turner Building Cost Index reported a 0.73% increase in Q1 2024 construction costs.

- Federal funds rate target range remains 5.25%-5.50% as of mid-2024.

- Over 150 hotel conversion projects identified across North America in early 2024.

Elevated interest rates, around 5.25%-5.50% in early 2025, increase AHIP's borrowing costs and compress property valuations. Persistent inflation drives up hotel operating expenses, with labor costs projected to rise 4.0% in 2024, eroding profit margins. Consumer spending shifts towards budget-conscious travel, while new hotel development slows by 15-20% in 2024, benefiting existing properties by limiting competition.

| Economic Factor | 2024 Data | 2025 Projection |

|---|---|---|

| Federal Funds Rate | 5.25%-5.50% (mid-2024) | Potentially stable/declining |

| Hotel Labor Cost Increase | 4.0% (projected) | Continued pressure |

| US RevPAR Growth | 4.0% | 2.0% (deceleration) |

| New Hotel Starts Decline | 15-20% | Continued slowdown |

Preview Before You Purchase

AHIP PESTLE Analysis

The content and structure shown in the preview is the same document you’ll download after payment. This comprehensive AHIP PESTLE analysis offers a detailed examination of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the health insurance industry. You'll gain valuable insights into market trends, regulatory landscapes, and competitive forces. Prepare to leverage this expertly crafted resource for strategic decision-making.

Sociological factors

Post-pandemic travelers increasingly seek unique, personalized, and experience-driven stays, shifting away from generic accommodations. Data from early 2025 indicates that nearly 70% of travelers prioritize immersive local experiences over standard amenities. This fuels a growing demand for boutique hotels, which saw a projected market growth exceeding 7% in 2024. This trend significantly challenges traditional select-service models, requiring them to innovate their offerings and provide more memorable guest journeys to maintain competitive relevance in the evolving hospitality landscape.

The rise of bleisure travel, blending business with leisure, is a significant sociological shift, driven by the widespread adoption of remote work. Hotels are adapting by enhancing amenities to support this trend, with 2024 data showing a 15% increase in properties offering dedicated co-working spaces and high-speed Wi-Fi. This creates a prime opportunity for select-service hotels to attract longer-stay guests, as a 2025 forecast indicates bleisure trips could account for nearly 60% of all business-related travel, extending average stays by up to two nights.

Modern travelers increasingly prioritize health and wellness, driving demand for more than just basic fitness facilities.

By 2025, wellness tourism is projected to reach a global market value exceeding 1.12 trillion USD, influencing hotel amenities to include comprehensive wellness packages and healthy dining options.

Guests now expect access to nature or outdoor activities, with a 2024 survey indicating over 60% of travelers seek experiences promoting well-being.

Furthermore, heightened hygiene awareness continues to drive demand for contactless services, with 75% of consumers preferring digital check-ins, and visibly clean environments across all hospitality sectors.

Family and Multigenerational Travel

Family travel remains a significant trend, with nearly 45% of U.S. leisure travelers planning multi-generational trips in 2024-2025 to reconnect with loved ones. This drives demand for hotel properties that can comfortably accommodate groups, offering amenities like suites, connecting rooms, and diverse on-site activities appealing to all ages. Hotels that proactively cater to the unique needs of families, from flexible booking options to tailored recreational programs, are exceptionally well-positioned to capture this growing market segment. Providing seamless experiences for families enhances brand loyalty and repeat business.

- 45% of U.S. leisure travelers plan multi-generational trips in 2024-2025.

- Increased demand for hotel suites and connecting rooms.

- Focus on family-friendly amenities like kids' clubs and diverse dining.

- Hotels with tailored family packages gain market share.

Demand for Sustainable and Eco-Friendly Practices

Consumer consciousness regarding sustainability significantly influences travel decisions, with a rising preference for hotels demonstrating eco-friendly practices. Travelers are increasingly selecting accommodations committed to energy efficiency, waste reduction, and eliminating single-use plastics. This societal value shift pressures hotel operators, including AHIP, to invest in green initiatives and certifications to meet evolving demand.

- 73% of global travelers in 2024 expressed a desire for more sustainable travel options.

- 53% of travelers are willing to pay more for sustainable lodging in 2024.

- Hotel chains are targeting a 20-30% reduction in carbon emissions by 2025 through green investments.

- The market for sustainable tourism is projected to grow annually by 9.5% through 2025.

Sociological shifts are profoundly reshaping hospitality, with travelers prioritizing personalized experiences, evident in the 70% seeking immersive local stays by early 2025. The rise of bleisure travel, accounting for nearly 60% of business trips by 2025, demands adaptable hotel amenities. Guests increasingly expect comprehensive wellness options and sustainable practices, influencing over 73% of 2024 travel decisions.

| Sociological Trend | Impact on AHIP | Key 2024/2025 Data |

|---|---|---|

| Experience-Driven Travel | Demand for unique, personalized stays | 70% of travelers prioritize immersive local experiences by 2025. |

| Bleisure & Remote Work | Need for enhanced co-working spaces | Bleisure trips could account for nearly 60% of business travel by 2025. |

| Wellness & Sustainability | Focus on health amenities, eco-friendly practices | Wellness tourism exceeds $1.12T by 2025; 73% of 2024 travelers prefer sustainable options. |

Technological factors

The travel industry, including AHIP, sees contactless solutions as a baseline expectation for guests. Mobile check-in/out and digital keys are now standard, with 70% of hotels planning to expand these options by 2025. Contactless payment adoption, notably Apple Pay and Google Pay, surged, processing over $100 billion in transactions in 2024 within hospitality. This streamlines front-desk operations, potentially reducing check-in times by 30% and meeting the preferences of modern, tech-savvy travelers.

Artificial intelligence is rapidly moving from experimental phases to impactful applications within the hospitality sector, enabling hyper-personalized guest experiences and optimizing core operations. By 2025, the global AI in hospitality market is projected to reach $1.6 billion, reflecting its widespread adoption. AI analyzes guest data to tailor recommendations, predict needs, and power chatbots for instant service, potentially boosting customer satisfaction by 15-20%. Operationally, AI assists in dynamic pricing, revenue management, and even predicting staffing needs, enhancing efficiency.

The integration of smart room technology and the Internet of Things (IoT) is fundamentally reshaping the guest experience for hotel operators like AHIP. Guests now expect seamless control over lighting, climate, and entertainment systems directly from their voice commands or mobile devices, enhancing convenience significantly. This shift is driven by projections that the global smart home market, a proxy for guest expectations, will exceed 200 billion USD by 2025. Furthermore, IoT solutions allow hotels to achieve notable energy efficiencies; for instance, some smart thermostats can reduce HVAC energy consumption by up to 30%, optimizing operational costs.

Cybersecurity and Data Privacy

As hotels rapidly adopt digital technologies, collecting vast amounts of guest data, cybersecurity has become a critical concern for AHIP members. Protecting sensitive guest information from breaches is paramount for maintaining brand reputation and trust. Investment in robust security measures, including advanced encryption and multi-factor authentication, is essential to defend against sophisticated cyber-attacks, especially given that the average cost of a data breach reached $4.45 million globally in 2023, a figure projected to rise.

- Cybercrime damages are expected to exceed $10.5 trillion annually by 2025, impacting all sectors including hospitality.

- Over 60% of data breaches involve credentials, highlighting the need for strong authentication protocols in hotel systems.

- Compliance with evolving data privacy regulations like GDPR and CCPA is crucial for hotels handling international and domestic guest data.

Robotics and Automation

Robotics and automation are increasingly deployed within the hospitality sector to enhance operational efficiency. Robots now assist with tasks like check-ins and room service deliveries, with projections indicating the global hotel automation market could reach $3.5 billion by 2025. While not fully replacing human interaction, automation helps manage labor costs, a critical factor given average hotel labor expenses often represent 45-55% of total operating costs. This enables hotel staff to concentrate on more complex, high-value guest experiences, improving overall service quality and potentially boosting guest satisfaction scores by 10-15% in automated environments.

- Global hotel automation market is projected to reach $3.5 billion by 2025.

- Automation helps manage labor costs, which typically constitute 45-55% of total hotel operating expenses.

- Robots handle repetitive tasks such as check-ins and room service delivery.

- Enhanced automation can improve guest satisfaction scores by 10-15%.

Technological advancements significantly shape AHIP's operational landscape. Contactless solutions, like mobile check-ins and digital payments, are standard, with 70% of hotels expanding these by 2025 and contactless payments processing over $100 billion in 2024. AI, projected to reach a $1.6 billion market by 2025, enhances personalization and revenue management. Smart room tech and robotics, with the hotel automation market hitting $3.5 billion by 2025, optimize guest experience and labor efficiency, while robust cybersecurity is crucial as cybercrime damages are set to exceed $10.5 trillion annually by 2025.

| Technological Trend | 2024/2025 Projection | Impact |

|---|---|---|

| Contactless Payments | >$100 Billion (2024) | Streamlines check-in, meets guest preference |

| AI in Hospitality Market | $1.6 Billion (2025) | Hyper-personalization, revenue optimization |

| Hotel Automation Market | $3.5 Billion (2025) | Reduces labor costs (45-55% of expenses) |

| Cybercrime Damages | >$10.5 Trillion Annually (2025) | Requires robust security, protects reputation |

Legal factors

As a REIT, AHIP operates under strict regulations governing ownership structures, ensuring at least 100 shareholders, and income sources, with 75% of gross income from real estate. Recent legislative discussions, such as those related to the 'One Big Beautiful Bill Act' in late 2024, could propose changes to the taxable REIT subsidiary (TRS) asset test limit, potentially impacting AHIP's operational flexibility. Furthermore, amendments to FIRPTA (Foreign Investment in Real Property Tax Act) regulations, expected to be clarified by mid-2025, directly influence foreign capital inflows into U.S. REITs, affecting investment attractiveness. Compliance with these evolving tax laws is crucial for AHIP's financial stability and distribution policy, as REITs must distribute at least 90% of their taxable income to shareholders annually.

Employment and labor laws significantly impact AHIP, as they are dynamic at federal, state, and local levels. Rising minimum wage mandates, such as California's fast-food worker minimum wage reaching $20 per hour in April 2024, directly increase labor costs and compress profit margins. AHIP must meticulously navigate these varied regulations across its 22-state portfolio, where some states like New York are also seeing minimum wage increases to $16 per hour in 2024, to ensure compliance and manage operational expenses effectively.

Hotels face increasing scrutiny under data privacy laws like the California Consumer Privacy Act (CCPA), particularly with digital guest data collection. Compliance with these regulations, which govern how personal information is stored and used, demands significant investment in cybersecurity infrastructure. Non-compliance can lead to substantial penalties; for example, CCPA fines can reach $7,500 per intentional violation. Adhering to these evolving legal frameworks is crucial for maintaining guest trust and avoiding costly legal repercussions in 2024 and 2025.

Franchise and Brand Agreements

AHIP operates its extensive portfolio of hotels under strict franchise agreements with major global brands like Marriott, Hilton, and IHG. These legally binding contracts define everything from operational standards and branding requirements to fee structures, significantly influencing AHIP's financial performance and strategic flexibility. For instance, annual franchise fees, often a percentage of gross room revenue, can impact profitability, with typical fees ranging from 5-10% of revenue for major brands in 2024. Adherence to brand-mandated capital expenditures, such as property renovations, also presents a substantial financial obligation, ensuring asset quality and brand consistency.

- Franchise agreements dictate specific operational guidelines, ensuring brand consistency across AHIP's properties.

- Mandatory brand standards often require significant capital expenditures for property upgrades, impacting 2024-2025 budgets.

- Annual royalty and marketing fees, typically 8-12% of gross revenues, are direct costs tied to these agreements.

- Non-compliance can lead to penalties or even termination, posing a significant operational risk.

State and Local Lodging Regulations

Hotel operations are heavily governed by diverse state and local laws, including stringent health and safety codes and specific licensing requirements. As of early 2025, state lodging taxes alone can range from 0% in some areas to over 15% in others, with local surcharges often adding several more percentage points. The North American Securities Administrators Association (NASAA) guidelines, particularly their Statement of Policy for Real Estate Programs, significantly influence state-level regulation of non-traded REITs like AHIP, impacting investor suitability and concentration limits for retail investors. Navigating compliance across numerous, evolving jurisdictional requirements presents a complex and continuous legal challenge for the industry.

- State lodging taxes vary significantly, with combined state and local rates potentially exceeding 18-20% in major urban areas by mid-2025.

- NASAA guidelines continue to shape state oversight of non-traded REIT offerings, influencing sales practices and investor protection standards.

- Annual licensing and permit fees, along with health and safety compliance costs, are ongoing operational expenses determined at local levels.

- Legal costs for monitoring and adapting to new regulations remain a substantial expenditure for large hotel portfolios.

AHIP faces complex legal compliance, from REIT tax regulations requiring 90% income distribution to evolving FIRPTA rules by mid-2025 impacting foreign investment. Rising minimum wages, like California's $20/hour for fast food in April 2024, significantly increase labor costs across its 22-state portfolio. Data privacy laws, such as CCPA, demand robust cybersecurity to avoid fines, while strict franchise agreements dictate operational standards and 8-12% annual royalty fees. Local lodging taxes, exceeding 18% in some areas by 2025, and NASAA guidelines further shape AHIP's legal landscape.

| Legal Factor | Impact on AHIP | 2024/2025 Data Point |

|---|---|---|

| REIT Tax Compliance | Mandatory 90% income distribution. | FIRPTA changes by mid-2025. |

| Labor Laws | Increased operational costs. | CA minimum wage $20/hr (Apr 2024). |

| Franchise Agreements | Operational standards, fee structure. | 8-12% gross revenue in fees. |

Environmental factors

A growing number of cities and states are adopting Building Performance Standards (BPS) mandating reductions in energy consumption and greenhouse gas emissions for existing structures.

For instance, New York City's Local Law 97 imposes escalating carbon intensity limits, with penalties potentially reaching over $268 per metric ton of CO2e above limits starting in 2024.

These regulations necessitate significant capital investment in energy-efficient technologies and comprehensive retrofits.

Such compliance requirements pose a direct and substantial financial challenge for hotel property owners aiming to avoid considerable fines and maintain operational viability through 2025 and beyond.

Hotel properties, including those in AHIP's portfolio, face significant physical risks from climate change, such as more frequent extreme weather events like hurricanes and wildfires. These events can lead to substantial property damage and business interruptions, directly impacting revenue streams. For instance, insured losses from natural catastrophes in 2024 are projected to remain elevated, potentially exceeding $100 billion globally for the fifth consecutive year. AHIP's diverse geographic footprint across various states further exposes it to a wide range of climate-related physical risks, driving up operational and insurance costs which saw increases of 10-15% in some high-risk regions in 2024.

Travelers increasingly prioritize eco-friendly accommodations, with recent surveys indicating over 70% of global consumers consider sustainability when booking hotels by early 2025. This strong preference pressures AHIP properties to adopt robust green practices, including significant waste reduction and energy conservation. Hotels investing in renewable energy, like solar panels, reported up to 20% lower operating costs in 2024. Effectively marketing these sustainability initiatives can provide a crucial competitive edge and attract a growing segment of environmentally conscious guests.

Waste Reduction and Single-Use Plastics

Legislative action and shifting consumer sentiment are significantly impacting waste reduction efforts, especially regarding single-use plastics within the hospitality industry. States like California have pioneered this movement; their law banning small plastic toiletry bottles fully applied to all lodging establishments by January 1, 2024. This forces major hotel brands to transition to bulk dispensers, fundamentally altering procurement and operational practices across the sector.

- California's statewide ban on small plastic toiletry bottles became fully effective for all lodging establishments in early 2024.

- Major hotel chains like Marriott International and IHG Hotels & Resorts have largely completed their transition to bulk amenities.

- Consumer demand for sustainable practices continues to grow, influencing booking decisions for an estimated 60% of travelers by 2025.

- Industry estimates suggest a potential 30% reduction in plastic waste from these changes by mid-2025.

Energy and Water Conservation

Rising utility costs are significantly impacting hotel operations, compelling properties like those under AHIP to prioritize robust energy and water conservation measures. The hospitality sector faces continued pressure to invest in smart energy management systems, efficient LED lighting, and low-flow water fixtures. These green technology adoptions are crucial for reducing the environmental footprint, aligning with growing ESG mandates, and delivering substantial long-term operational cost savings. The focus on sustainability will continue to be a key driver for investment in 2025.

- Utility costs are a major concern, with energy expenses projected to remain elevated into 2025.

- Hotels are increasingly adopting smart systems to monitor and reduce consumption, leading to efficiency gains.

- Investments in low-flow fixtures and water recycling can cut water usage by up to 30% in some properties.

- These initiatives not only meet environmental goals but also enhance net operating income.

Environmental factors significantly impact AHIP, with regulatory pressures like New York City's Local Law 97 imposing carbon intensity limits and California's 2024 plastic bottle ban necessitating operational shifts.

Climate change presents physical risks, including extreme weather that elevated global insured losses to over $100 billion in 2024, driving up AHIP's property and insurance costs.

Consumer demand for eco-friendly accommodations, preferred by over 70% of travelers by early 2025, compels investments in sustainable practices and energy-efficient technologies, which can reduce operating costs by up to 20%.

These trends emphasize the need for strategic capital allocation towards green initiatives to ensure compliance, mitigate risks, and enhance market competitiveness.

| Metric | 2024 Data | 2025 Projections |

|---|---|---|

| Global Insured Catastrophe Losses | >$100 Billion | Elevated |

| Consumer Sustainability Preference | 70%+ of Travelers | Consistent Growth |

| Plastic Waste Reduction (Hospitality) | Ongoing Transition | 30% Potential Reduction |

PESTLE Analysis Data Sources

Our AHIP PESTLE analysis is built on a robust foundation of data from authoritative sources, including government health agencies, leading research institutions, and reputable industry publications. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting healthcare.