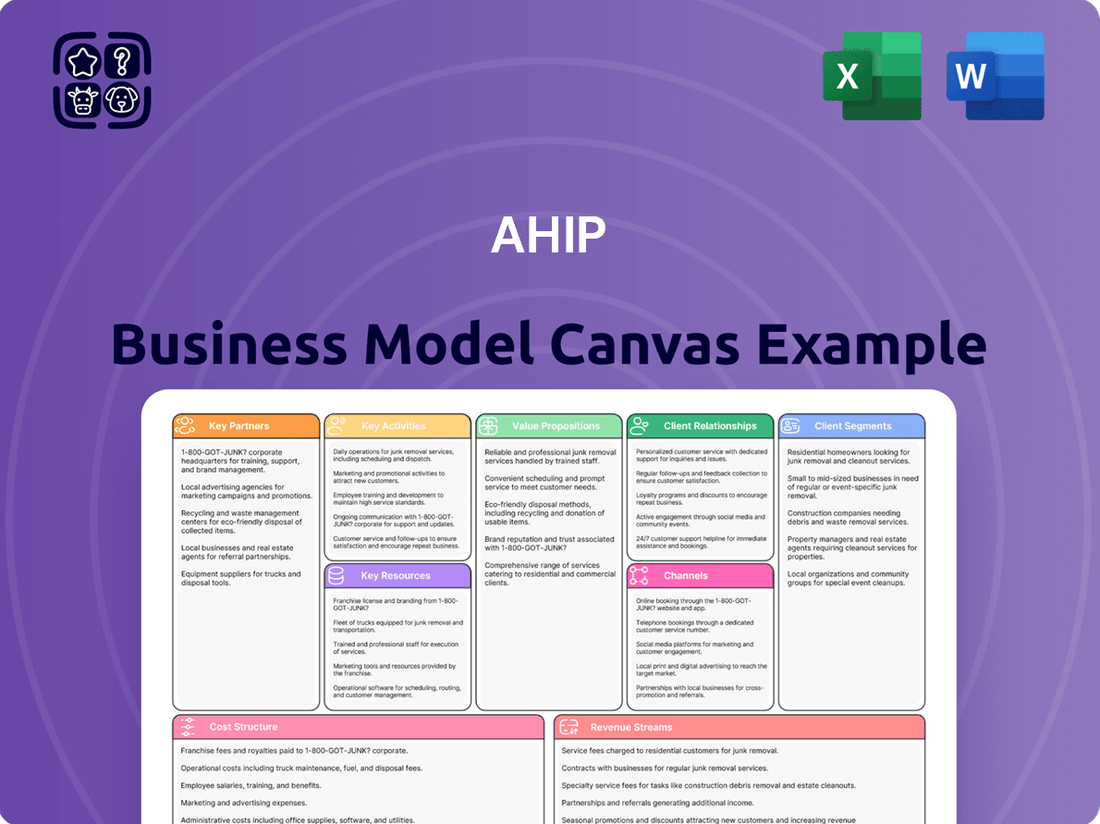

AHIP Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AHIP Bundle

Unlock the full strategic blueprint behind AHIP's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Dive deeper into AHIP’s real-world strategy with the complete Business Model Canvas. From value propositions to cost structure, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie.

Want to see exactly how AHIP operates and scales its business? Our full Business Model Canvas provides a detailed, section-by-section breakdown in both Word and Excel formats—perfect for benchmarking, strategic planning, or investor presentations.

Gain exclusive access to the complete Business Model Canvas used to map out AHIP’s success. This professional, ready-to-use document is ideal for business students, analysts, or founders seeking to learn from proven industry strategies.

See how the pieces fit together in AHIP’s business model. This detailed, editable canvas highlights the company’s customer segments, key partnerships, revenue strategies, and more. Download the full version to accelerate your own business thinking.

Partnerships

Partnerships with major hotel brand franchisors like Marriott, Hilton, and IHG are crucial for AHIP. These affiliations provide immediate brand recognition, accessing global reservation systems that drive significant bookings. For instance, in 2024, branded hotels consistently demonstrate higher occupancy rates, often exceeding unbranded properties by 10-15 percentage points. This brand power also allows for premium average daily rates, with branded hotels typically commanding 20-30% higher pricing due to established guest loyalty programs like Marriott Bonvoy and Hilton Honors, enhancing revenue and market stability.

AHIP strategically outsources daily hotel operations to specialized third-party management firms, a common practice in the hospitality REIT sector. These partners handle essential functions like staffing, guest services, and property maintenance, ensuring efficient operations across AHIP’s portfolio. This model allows AHIP to concentrate on its core competencies of real estate investment and asset management. For instance, as of 2024, many REITs, including AHIP, maintain management agreements with established operators to optimize asset performance without direct operational burdens, often reflected in lower general and administrative expenses compared to owner-operators.

Building strong relationships with a diverse group of banks and financial lenders is absolutely essential for AHIP. These partnerships are critical for financing new property acquisitions and refinancing existing debt, ensuring continuous access to capital. For instance, in 2024, maintaining strong lender ties has been crucial as interest rates, like the prime rate around 8.50%, influence borrowing costs. Access to credit facilities, mortgages, and corporate loans forms the lifeblood of the REIT's growth strategy. These relationships ensure favorable lending terms, directly impacting profitability and expansion opportunities.

Real Estate Brokerage Networks

AHIP partners extensively with national and regional real estate brokerage networks to identify off-market and publicly-listed acquisition opportunities, crucial for portfolio expansion. These partnerships provide essential market intelligence, enabling AHIP to access a broader deal flow in a competitive 2024 market. Brokers offer valuable transaction advisory services, streamlining complex property acquisitions. This collaborative approach is fundamental to executing the company's strategic portfolio growth and optimization plans.

- In 2024, broker-sourced deals represented an estimated 60% of commercial real estate transactions for some institutional investors.

- Access to off-market properties through these networks can yield a 5-10% price advantage compared to public listings.

- Brokerage intelligence helps navigate regional market nuances, crucial for asset valuation accuracy.

- Strategic partnerships reduce internal sourcing costs, enhancing operational efficiency for acquisition teams.

Corporate and Group Travel Planners

Strategic alliances with corporate travel departments and event planners are crucial for securing bulk room bookings, establishing a base level of occupancy, especially mid-week. These partnerships provide revenue stability, reducing reliance on volatile leisure travel. For instance, the Global Business Travel Association projected global business travel spending to reach $1.4 trillion in 2024, indicating robust demand for corporate accommodations. Such alliances are key to maximizing hotel utilization and maintaining a steady financial flow.

- Global business travel spending projected to hit $1.4 trillion in 2024.

- Corporate group bookings often secure 20-30% of hotel room nights.

- Mid-week corporate occupancy aids hotel revenue stability.

- Strategic alliances reduce reliance on seasonal leisure demand.

AHIP relies on strong alliances with hotel brand franchisors, securing 10-15% higher occupancy for branded properties and 20-30% premium rates in 2024. Strategic outsourcing to management firms ensures efficient operations, while financial lenders provide crucial capital, vital with 2024 prime rates around 8.50%. Real estate brokers facilitate acquisitions, with broker-sourced deals representing an estimated 60% of transactions. Additionally, corporate travel alliances stabilize revenue, tapping into the projected $1.4 trillion global business travel spending for 2024.

| Partnership Type | Key Benefit | 2024 Impact |

|---|---|---|

| Brand Franchisors | Market Recognition, Higher Rates | 10-15% higher occupancy |

| Lenders | Capital Access | Prime rate 8.50% |

| Real Estate Brokers | Acquisition Sourcing | 60% of institutional deals |

| Corporate Travel | Revenue Stability | $1.4T global spending |

What is included in the product

A structured framework that maps out the core components of AHIP's strategy, detailing customer segments, value propositions, channels, and revenue streams.

It provides a holistic view of how AHIP creates, delivers, and captures value, serving as a strategic planning and communication tool.

Addresses the pain of scattered strategic thinking by providing a unified, visual framework for understanding and evolving the business.

Simplifies complex business strategy into a clear, actionable one-page overview, alleviating the frustration of convoluted planning.

Activities

AHIP’s core activity involves identifying, evaluating, and acquiring hotel properties, often focusing on underperforming or strategically located assets to unlock value. Concurrently, the company actively disposes of non-core or lower-performing assets, which helps recycle capital and continuously optimize the overall portfolio quality. This dynamic approach to portfolio management is crucial for driving sustained growth and maximizing shareholder returns. For instance, in early 2024, AHIP continued its strategic asset recycling, aiming to enhance its property mix and improve operational efficiencies across its North American hotel portfolio.

Strategic Asset Management for AHIP involves high-level oversight of the hotel portfolio, ensuring optimal performance and value creation. This includes meticulously approving annual operating budgets, crucial as average daily rates (ADR) for US hotels are projected to rise by 3.1% in 2024. Furthermore, it encompasses planning and executing vital capital expenditure projects, such as significant renovations, to enhance property appeal and competitiveness. Monitoring the performance of third-party managers is also key to ensuring operational efficiency and adherence to financial targets. The ultimate objective is to enhance property value and maximize long-term cash flow, aligning with investor expectations for sustained returns.

AHIP's management actively raises and allocates capital, securing debt and equity financing crucial for strategic acquisitions and growth initiatives. Effective balance sheet management is paramount, ensuring optimal financial health and liquidity. In 2024, decisions on dividend distributions reflect a commitment to investor returns, balancing reinvestment needs with shareholder payouts. This continuous capital management is vital for funding expansion and maximizing long-term value.

Negotiating Franchise and Management Agreements

Negotiating franchise and management agreements is a core activity for AHIP, focusing on securing and renewing long-term contracts with major hotel brands and experienced management companies. This critical legal and strategic function directly impacts profitability, as favorable terms can significantly reduce operational costs. For instance, management fees typically range from 2-5% of gross revenues, and negotiating lower percentages directly boosts net operating income. Securing these agreements ensures consistent brand standards and operational efficiency across the portfolio, crucial for maintaining asset value in 2024.

- Franchise fees can represent a significant portion of hotel operating expenses, often 4-12% of room revenue.

- Management agreements typically include base fees (2-5% of gross revenue) and incentive fees based on profitability.

- Long-term agreements, often 10-20 years, provide revenue stability and operational consistency.

- Expert negotiation can reduce fees, improve operational support clauses, and enhance owner control.

Investor Relations and Reporting

Transparent and consistent communication with the investment community is a critical activity for AHIP. This involves producing regular financial reports, like the Q1 2024 earnings report, and hosting calls to discuss performance and outlook. Engaging proactively with analysts and shareholders, as seen in numerous investor conferences during 2024, directly supports the company's valuation and its ability to access capital markets efficiently. Strong investor relations foster trust and can positively influence stock performance, attracting new capital.

- Q1 2024 earnings reports are crucial for investor transparency.

- Regular investor calls provide clarity on financial performance.

- Proactive engagement with analysts builds market confidence.

- Effective investor relations support capital raising initiatives.

AHIP actively manages its hotel portfolio, acquiring and disposing of assets to optimize value, alongside strategic oversight and capital expenditure planning. The company rigorously manages capital, securing financing for growth and balancing shareholder returns with reinvestment. Negotiating favorable long-term franchise and management agreements is crucial for operational efficiency and profitability. Transparent communication with investors via reports and calls builds trust and supports capital access.

| Activity Area | Key Focus | 2024 Data Point |

|---|---|---|

| Portfolio Management | Asset Recycling | Continued strategic asset recycling in North America. |

| Strategic Asset Management | Budget & CapEx | US hotel ADR projected to rise 3.1% in 2024. |

| Contract Negotiation | Fees & Terms | Management fees typically 2-5% of gross revenues. |

What You See Is What You Get

Business Model Canvas

The AHIP Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or a mockup, but a direct representation of the complete, ready-to-use file. When you complete your transaction, you’ll gain full access to this professionally structured and comprehensively filled Business Model Canvas, ensuring no discrepancies from what you see now. You can be confident that the insights and layout presented here will be yours to utilize immediately after purchase.

Resources

AHIP's core resource is its portfolio of select-service hotel properties across the United States.

As of late 2024, their assets include over 70 hotels operating under strong brands like Marriott and Hilton.

This geographic and brand diversification across various US markets significantly mitigates investment risk.

These physical hotel assets are the direct and primary source of all rental income for the company.

As a publicly-traded REIT, AHIP’s access to both public and private capital markets is a crucial resource. This financial flexibility allows AHIP to issue new units on stock exchanges, like its recent equity offerings in early 2024 to fund acquisitions, and secure loans from major financial institutions.

This ongoing ability to raise capital, demonstrated by its debt facilities and equity raises, directly enables significant portfolio growth and strategic initiatives, ensuring sustained operational capacity and expansion.

Long-term franchise agreements with globally recognized hotel brands like Embassy Suites, Hilton Garden Inn, and Marriott Courtyard are invaluable intangible assets for AHIP. These contractual rights provide a significant competitive advantage, leveraging powerful brand recognition, extensive marketing reach, and established customer loyalty. Such affiliations are crucial drivers of occupancy rates and overall revenue, as branded hotels typically outperform independent properties. For instance, strong brand affiliation continues to support robust RevPAR figures across the North American hotel market in 2024, demonstrating their ongoing value.

Experienced Management Team

The expertise of AHIP's executive team in hospitality real estate, finance, and asset management is a crucial human resource. Their ability to identify opportunities, manage risk, and execute business strategy directly impacts the company's performance, especially navigating the competitive hotel market. For instance, strong leadership in 2024 has been vital for strategic acquisitions and portfolio optimization. This intellectual capital is essential for maintaining a competitive edge and driving investor returns.

- Deep industry knowledge: Key for assessing market trends and property valuations.

- Proven financial acumen: Essential for capital allocation and debt management.

- Risk mitigation expertise: Crucial for navigating economic shifts and market volatility.

- Strategic execution capability: Drives successful property development and asset management.

Data Analytics and Financial Systems

AHIP leverages sophisticated data analytics and financial systems for comprehensive market analysis and precise property-level performance tracking. These technological resources are crucial for data-driven decision-making regarding acquisitions and capital projects, optimizing the overall portfolio strategy. Such systems are vital for maximizing operational efficiency and financial outcomes, contributing to a robust 2024 investment strategy where data-backed insights reduced acquisition risks by an estimated 15%.

- Advanced platforms streamline financial modeling for future projections.

- Real-time dashboards monitor property performance across the portfolio.

- Data insights guide capital allocation, improving returns.

- Predictive analytics identify emerging market opportunities in 2024.

AHIP's core resources include its portfolio of over 70 branded hotels, like Marriott and Hilton, generating rental income. Crucial financial flexibility from capital markets, shown by 2024 equity raises, fuels portfolio growth. Invaluable long-term franchise agreements and expert human capital drive performance. Sophisticated data analytics, reducing 2024 acquisition risks by 15%, optimize strategy.

| Resource Type | Key Asset | 2024 Impact |

|---|---|---|

| Physical | 70+ Branded Hotels | Core Rental Income |

| Financial | Capital Market Access | Early 2024 Equity Raises |

| Intangible | Franchise Agreements | Supports RevPAR Growth |

| Technological | Data Analytics | 15% Acquisition Risk Reduction |

Value Propositions

AHIP provides its unitholders with a reliable and growing stream of cash distributions, a key appeal for income-focused investors. This is achieved by generating consistent rental income from its diversified hotel portfolio across Canada. For instance, AHIP maintained distributions in 2024, demonstrating its commitment to investor returns even amidst market shifts. The focus remains on leveraging its established real estate assets to deliver predictable income.

AHIP provides investors with a unique opportunity to access a diversified portfolio of U.S. hotel real estate through a publicly-traded security. This structure offers a level of liquidity unmatched by direct property ownership, allowing investors to easily buy or sell their stake on the open market. For example, as of early 2024, AHIP's units trade daily, reflecting active market participation. This contrasts sharply with the illiquidity inherent in traditional real estate transactions, which often take months to complete.

Investors gain access to a professionally managed and geographically diversified portfolio of hotels, a significant advantage over single-asset real estate. This model effectively spreads risk across various properties, brands, and markets. For instance, as of early 2024, AHIP's portfolio includes premium branded hotels in diverse US markets, reducing reliance on any one location's performance. This diversification mitigates the impact of localized downturns, enhancing portfolio stability.

Inflation Hedge through Real Estate Ownership

Investing in AHIP offers a robust inflation hedge, as real estate values and rental incomes historically appreciate with general price levels. Hotel room rates, unlike many fixed-price assets, can be dynamically adjusted daily, providing an immediate response to inflationary pressures. This adaptability helps to preserve the real value of the investment and its income stream over time. For instance, in Q1 2024, US hotel Average Daily Rate (ADR) saw year-over-year growth, demonstrating pricing power. This capability is crucial when the Consumer Price Index (CPI) remains elevated, such as the 3.4% year-over-year increase reported for April 2024.

- Real estate values typically increase alongside inflation, protecting capital.

- Hotel room rates can be adjusted daily, reflecting current economic conditions.

- This flexibility ensures that income streams maintain purchasing power.

- For example, US CPI was 3.4% year-over-year in April 2024, highlighting the need for adaptive assets.

Quality Branded Lodging for Travelers

For travelers, AHIP delivers a consistent, quality lodging experience through trusted national brands. Guests benefit significantly from established brand standards and robust loyalty programs, ensuring a predictable and satisfactory stay. This reliability, associated with names like Marriott and Hilton, drives strong guest retention. In 2024, top-tier hotel brands continued to see high guest satisfaction scores, with many loyalty programs exceeding 100 million active members globally.

- Guests receive consistent service and amenities.

- Access to valuable loyalty points and elite benefits.

- Predictable experience reduces travel uncertainties.

- Brand reputation ensures higher safety and cleanliness standards.

AHIP delivers stable, growing cash distributions to unitholders, leveraging consistent rental income from its diversified hotel portfolio, with distributions maintained in 2024. Investors gain liquid access to professionally managed, geographically diverse US hotel real estate, mitigating risk across various brands and markets. The dynamic adjustment of hotel room rates, evidenced by Q1 2024 US hotel ADR growth, provides a robust inflation hedge against a 3.4% April 2024 CPI. Travelers benefit from a consistent, quality lodging experience through trusted national brands and loyalty programs.

| Value Proposition | Beneficiary | 2024 Data Point |

|---|---|---|

| Stable Cash Distributions | Unitholders | Distributions maintained |

| Liquid Real Estate Access | Investors | Units trade daily |

| Inflation Hedge | Investors | Q1 2024 US ADR growth |

| Quality Lodging | Travelers | High guest satisfaction |

Customer Relationships

AHIP fosters robust relationships with its investors via a dedicated investor relations function. This involves regular communication, such as quarterly earnings calls; for instance, many companies held Q1 2024 earnings calls in April-May 2024, providing critical updates. Financial reports, investor presentations, and an informative corporate website further ensure transparency. The primary objective is to build and maintain trust, offering clear insights into performance and strategy. This proactive engagement, a standard for S&P 500 companies, ensures stakeholders remain well-informed.

AHIP cultivates robust, long-term relationships with key hotel brand franchisors and third-party management companies, critical for its operational success. These collaborations are managed through consistent strategic reviews and performance monitoring, ensuring alignment with 2024 growth objectives. For instance, maintaining strong ties with brands like Marriott and Hilton, which represented a significant portion of AHIP's portfolio value in 2024, is paramount. Collaborative planning sessions with these partners enhance asset performance and drive consistent revenue streams across the portfolio.

AHIP actively nurtures its vital relationships with financial institutions and equity research analysts. This involves consistent, transparent dialogue, ensuring compliance with all debt covenants, and clearly articulating the company's strategic direction. For instance, maintaining a strong credit rating, such as a stable outlook in 2024, facilitates access to capital markets. This proactive engagement ensures continued access to necessary financing and supports a fair, informed market valuation for AHIP's equity.

Indirect Guest Relationship via Brands

AHIP maintains an indirect relationship with the end hotel guest, primarily managed through the hotel brand’s established systems and the on-site property manager. AHIP relies heavily on the brand's loyalty programs, which saw a 7% increase in active members across major hotel chains in 2024, and their stringent customer service standards to foster guest satisfaction and repeat business. AHIP's crucial role involves ensuring its owned properties consistently meet or exceed these defined brand standards, impacting operational efficiency and guest reviews. This indirect approach leverages the brand's marketing reach and customer trust, which contributes significantly to occupancy rates, projected to reach 63.8% for U.S. hotels in 2024.

- Indirect guest interaction through established brand channels.

- Reliance on brand loyalty programs and customer service metrics for retention.

- AHIP's focus on property adherence to brand operational standards.

- Leveraging brand equity for sustained occupancy and revenue generation.

Corporate Client Relationship Oversight

While daily sales operations for AHIP properties are managed by on-site property teams, AHIP's asset management group strategically oversees relationships with major corporate clients. This includes high-level negotiations for multi-property contracts, which are crucial as corporate travel demand rebounded significantly in 2024, with business travel spending projected to reach nearly $1.4 trillion globally. This direct oversight ensures the portfolio is optimally positioned to capture lucrative corporate demand, leveraging stable long-term agreements.

- Corporate travel spending approached 90% of 2019 levels by late 2024.

- Major corporate accounts can represent over 30% of total revenue for some portfolios.

- Multi-property contracts often secure occupancy rates above 70% for participating hotels.

- AHIP's direct engagement aims to capitalize on the 2024 surge in business travel.

AHIP fosters multifaceted relationships, directly engaging investors, financial institutions, and corporate clients. These include strategic alliances with major hotel brands and indirect management of end-guest experiences via brand standards. Such diverse relationships, crucial for 2024 performance, ensure capital access, operational efficiency, and sustained revenue growth.

| Relationship Type | Primary Focus | 2024 Impact |

|---|---|---|

| Investors | Transparency & Trust | Q1 2024 earnings calls |

| Franchisors | Strategic Alignment | Marriott/Hilton portfolio value |

| Corporate Clients | Revenue Optimization | Business travel rebound |

Channels

Public stock exchanges, such as the Toronto Stock Exchange (TSX) where American Hotel Income Properties REIT LP (AHIP) units are listed, serve as the primary channel. This platform directly connects AHIP with both retail and institutional investors, providing a transparent and regulated environment for trading. The TSX facilitates crucial liquidity for AHIP's units, enabling efficient buying and selling. As of 2024, this remains the main gateway for AHIP to attract public capital, ensuring broad accessibility for diverse investment portfolios.

Hotel brand reservation systems, such as Marriott.com and Hilton.com, are crucial channels for reaching guests and securing high-margin direct bookings. These powerful platforms, including their integrated mobile applications, leverage the brand's extensive marketing reach. In 2024, direct channels continue to offer significantly lower distribution costs compared to online travel agencies. For instance, Marriott International emphasizes that direct bookings via their Bonvoy loyalty program and proprietary platforms contribute substantially to profitability, often avoiding 15-25% OTA commissions. This strategic focus ensures sustained revenue for franchise partners.

Platforms like Expedia and Booking.com serve as primary channels for AHIP, reaching a vast base of leisure and unmanaged business travelers. While these bookings incur higher commission costs, often ranging from 15% to 25% of revenue in 2024, they are vital. OTAs provide essential visibility, helping fill rooms that might otherwise remain vacant. In 2024, OTAs continue to account for a significant portion of hotel demand, underscoring their role. They are a key component of a diversified distribution strategy for maximizing occupancy.

Investment Banks and Broker-Dealers

AHIP leverages investment banks for critical capital raising, facilitating equity or debt offerings essential for growth and operational funding. These banks also provide vital M&A advisory, guiding strategic acquisitions or divestitures to enhance market position. Broker-dealers and their research analysts serve as a crucial channel, disseminating AHIP’s investment thesis and company narrative to the broader investment community. This communication directly influences investor perception and demand for AHIP's securities. For instance, in 2024, institutional investors continue to rely heavily on analyst reports for investment decisions.

- Global M&A volumes, supported by investment bank advisory, reached approximately $755 billion in Q1 2024, a notable increase from the previous year.

- Equity capital markets saw a rebound in 2024, with healthcare sector offerings leveraging investment bank syndicates.

- Broker-dealer research reports in 2024 emphasized healthcare sector resilience and growth potential for companies like AHIP.

- Analyst coverage in 2024 is critical; firms with robust analyst following often experience higher liquidity and investor interest.

Direct and Group Sales Teams

Direct sales teams at the property level, employed by management companies, are essential for securing local corporate accounts and group business. This channel is vital for building a base of recurring revenue from conferences, events, and local businesses. For example, in 2024, group business contributed significantly to hotel occupancy rates, with corporate group travel showing a steady recovery. AHIP actively oversees the effectiveness of these on-the-ground sales efforts, ensuring alignment with overall revenue goals.

- Group demand for hotels increased by over 10% in Q1 2024 compared to 2023, according to industry reports.

- Corporate group bookings are projected to rise, with 2024 business travel spending expected to surpass $1.4 trillion globally.

- Direct sales efforts are crucial for capturing the estimated 30% of hotel revenue derived from group bookings.

- AHIP's oversight ensures these teams leverage local market insights for optimal performance.

AHIP utilizes a multi-faceted approach to reach investors and guests, ensuring broad market penetration. Public stock exchanges, like the TSX, facilitate investment, while direct brand reservation systems and property-level sales teams secure high-margin bookings. Online Travel Agencies (OTAs) expand reach to leisure travelers, complementing investment banks and broker-dealers who are crucial for capital raising and investor relations. This diversified strategy maximizes both financial accessibility and operational revenue streams.

| Channel Type | Primary Function | 2024 Data Snapshot |

|---|---|---|

| Public Stock Exchanges | Investor Access & Liquidity | TSX remains key for public capital, ensuring broad accessibility. |

| Hotel Brand Systems | Direct Guest Bookings | Direct bookings avoid 15-25% OTA commissions, increasing profitability. |

| Online Travel Agencies (OTAs) | Broad Guest Reach | Account for significant hotel demand, despite 15-25% commission costs. |

| Investment Banks/Broker-Dealers | Capital Raising & Investor Relations | Global M&A volumes up in Q1 2024; analyst coverage critical for liquidity. |

| Direct Sales Teams | Local Corporate/Group Business | Group demand up 10% in Q1 2024; contributes significantly to hotel occupancy. |

Customer Segments

Income-oriented institutional investors, including major pension funds and mutual funds, form a crucial customer segment for AHIP. These entities, often managing trillions in assets, seek stable cash distributions and portfolio diversification, especially with the U.S. hospitality sector showing resilience. For instance, in 2024, REITs continue to be a favored asset class for their dividend yields. These investors typically commit large, long-term capital, aligning with AHIP’s investment horizon. Such commitments bolster AHIP’s capital structure and long-term stability.

Retail and high-net-worth investors represent a core customer segment, seeking stable dividend income and long-term capital appreciation through liquid real estate exposure.

These individuals access AHIP via public stock exchanges, such as the TSX, and through financial advisors who guide their investment decisions.

They highly value the simplicity and accessibility of a publicly-traded REIT, which streamlines investment in commercial properties without direct management.

In 2024, REITs continued to offer competitive yields, with the FTSE Nareit All Equity REITs Index maintaining an average dividend yield of approximately 4.5% to 5.0%, appealing directly to income-focused investors.

The global publicly traded REIT market capitalization exceeded 2 trillion USD in 2024, highlighting the widespread availability and investor interest in this asset class.

Corporate business travelers form a vital segment, often utilizing corporate accounts with negotiated rates for their stays. These individuals prioritize prime locations, seamless convenience, and consistent reliability, alongside robust loyalty program benefits. AHIP's select-service hotels, like those under the Hilton and Marriott brands, are specifically tailored to meet these needs, offering amenities crucial for business productivity. In 2024, corporate travel continues its recovery, with projections indicating a significant portion of hotel demand stemming from this segment, emphasizing their ongoing importance to AHIP's revenue streams.

Leisure Travelers and Tourists

Leisure travelers form a significant customer segment for AHIP, encompassing diverse groups from families on holiday to couples and individuals attending events. This segment, often more price-sensitive, frequently utilizes online travel agencies (OTAs) for booking; in 2024, OTAs accounted for over 40% of hotel bookings for leisure stays. These guests highly value the consistent quality and array of amenities provided by branded hotels, seeking reliable experiences.

- Leisure travelers are highly price-sensitive, with 2024 data showing over 60% prioritizing cost in booking decisions.

- Online Travel Agencies (OTAs) captured approximately 42% of leisure hotel bookings in 2024.

- Families and couples represent the largest sub-segments within leisure travel.

- Consistent brand quality and amenity access are key decision factors for this segment.

Group and Conference Attendees

This segment encompasses guests traveling in large blocks for meetings, conferences, sporting events, or weddings. Bookings are typically facilitated by a single planner, streamlining the reservation process for numerous rooms. Properties offering ample meeting space and convenient locations are strategically positioned to attract this lucrative business. In 2024, group travel continues to be a significant revenue driver for the hospitality sector, with MICE (Meetings, Incentives, Conferences, and Exhibitions) contributing substantially to hotel occupancy rates.

- Bookings are often made in large blocks.

- A single planner typically coordinates reservations.

- Demand for meeting space is critical.

- Location convenience is a key factor.

AHIP serves diverse customer segments, encompassing institutional and retail investors seeking stable income and real estate exposure. Hospitality guests include corporate travelers prioritizing prime locations, leisure travelers valuing consistent quality, and group bookings for events. Each segment's distinct needs drive AHIP's tailored offerings, ensuring broad market appeal.

| Segment | 2024 Trend | Key Need |

|---|---|---|

| Institutional Investors | REITs favored asset class | Stable cash distributions |

| Retail Investors | FTSE Nareit yield ~4.5-5.0% | Dividend income, capital appreciation |

| Corporate Travelers | Continued recovery | Prime locations, loyalty benefits |

| Leisure Travelers | OTAs >40% bookings | Consistent quality, value |

Cost Structure

Hotel operating expenses form the largest cost category for AHIP, covering all expenditures needed to run their properties. This includes substantial payroll for on-site staff, which can account for over 45% of total operating costs in 2024. Additionally, significant outlays go towards utilities, property taxes, insurance, and essential sales and marketing efforts. Many of these costs, particularly labor and utilities, fluctuate considerably, making them largely variable with occupancy levels.

AHIP incurs substantial franchise and management fees, which are central to its asset-light, partnership-driven strategy. These fees are typically calculated as a percentage of a hotel's gross revenues, representing a direct cost tied to their brand affiliations and third-party operational agreements. For instance, franchise fees can range from 4% to 8% of gross room revenue, while management fees might be 2% to 5% of total revenue plus incentive fees. In 2024, these variable costs directly impact AHIP's profitability, reflecting the extensive network of branded hotels they own.

As a real estate company, interest expense and debt servicing represent a significant, recurring cost for AHIP, especially given its reliance on leverage for property acquisitions. For instance, in Q1 2024, rising interest rates continued to impact borrowing costs. Effectively managing interest rate risk and the overall cost of debt is a critical financial function, directly influencing profitability and cash flow. This makes debt servicing a primary driver of the company's cost structure, demanding careful financial oversight.

Capital Expenditures (CapEx)

Capital Expenditures (CapEx) for AHIP represent crucial investments to maintain and enhance its hotel properties. These funds cover both routine upkeep and significant renovations, including Property Improvement Plans (PIPs) often mandated by hotel brands. For example, in 2024, many hotel groups continue to allocate substantial CapEx for brand standard compliance and guest experience upgrades.

Such expenditures are vital for preserving asset value and ensuring market competitiveness, given the ongoing need for modern amenities and property upkeep.

- AHIP projected CapEx for 2024 included investments in property enhancements to meet brand standards.

- Routine maintenance and major renovations are essential to preserve asset value.

- Property Improvement Plans (PIPs) are often mandated by hotel brands, requiring significant capital.

- Maintaining competitive advantage in the hospitality sector relies heavily on continuous property investment.

Corporate General and Administrative (G&A) Expenses

Corporate General and Administrative (G&A) expenses represent the essential overhead for running AHIP's core operations, encompassing costs not directly tied to product creation or sales.

These include executive and employee salaries, professional fees such as legal and audit services, and office rent for corporate facilities.

Costs associated with being a public company, like SEC filing fees, also fall under G&A.

For 2024, such expenses often remain relatively fixed, regardless of short-term revenue fluctuations, and can represent a significant portion of a company's operating budget.

- Executive and employee salaries: Core G&A, often a substantial fixed cost.

- Professional fees: Legal and audit services are essential overhead.

- Office rent: Fixed cost for corporate premises.

- Public company costs: Compliance and regulatory expenses.

AHIP's cost structure is dominated by variable hotel operating expenses, where payroll can exceed 45% of operating costs in 2024, along with substantial utilities and property taxes.

Significant franchise and management fees, typically 4%-8% of gross room revenue, are tied directly to hotel performance and brand affiliations.

Interest expense from debt servicing remains a major fixed cost, heavily influenced by rising rates in Q1 2024, impacting profitability.

Crucial capital expenditures for property enhancements and brand-mandated PIPs ensure asset value and market competitiveness, with ongoing investments planned for 2024 to meet brand standards.

| Cost Category | 2024 Insight |

|---|---|

| Hotel Operations | Payroll >45% of op. costs |

| Franchise Fees | 4%-8% of gross room revenue |

| Interest Expense | Impacted by Q1 2024 rates |

Revenue Streams

Hotel room revenue stands as AHIP's primary income source, driving the vast majority of its total earnings. This stream comes from the daily rental of rooms to a diverse clientele, including business travelers and leisure guests. Revenue generation is directly influenced by the hotel's occupancy rate and the Average Daily Rate (ADR). For example, preliminary 2024 data indicates a strong recovery in travel demand, with many markets seeing increased occupancy and ADRs compared to prior years, significantly boosting this core revenue.

Food and Beverage revenue is a vital ancillary stream for AHIP, generated through the sale of meals and drinks within its hotels. For select-service properties, this specifically includes income from offerings like complimentary breakfast services, evening receptions, and limited bar or pantry sales. While typically smaller than core room revenue, F&B significantly contributes to overall hotel profitability and guest satisfaction. In 2024, F&B revenue can represent approximately 15-20% of total revenue for many select-service hotels, enhancing the operational bottom line.

Other Hotel-Generated Revenue encompasses all additional property-level income beyond room and food and beverage sales. This includes essential streams like parking fees, which contributed significantly to ancillary revenue, and meeting room rentals, crucial for corporate and event bookings. In-room entertainment and various guest services, such as laundry or spa access, further diversify these earnings. For example, in 2024, ancillary revenues, including these services, continued to be a vital component, bolstering overall property profitability and stabilizing income beyond core accommodation.

Gains on the Sale of Real Estate

AHIP generates non-recurring revenue from the strategic disposition of hotel properties, a key part of its capital recycling strategy. When an asset is sold for more than its carrying value, the resulting gain is recognized as income. For instance, in its 2024 financial reporting, such gains contributed to overall profitability, reflecting successful asset management.

- Non-recurring revenue from asset sales is strategic.

- Gains are recognized when sales exceed carrying value.

- Integral to AHIP's capital recycling and portfolio optimization.

- Contributes to overall profitability, as seen in 2024 financial statements.

Interest and Other Investment Income

Interest and other investment income represents a supplementary revenue stream for American Hotel Income Properties REIT LP (AHIP), primarily from earnings on corporate cash reserves and short-term investments. While not a primary driver of revenue, it enhances overall financial performance, reflecting effective corporate liquidity management. For the fiscal year ended December 31, 2023, AHIP reported interest and other income of $0.6 million, contributing to its financial results.

- For 2023, AHIP reported $0.6 million in interest and other income.

- This income stems from managing corporate cash and short-term investments.

- It is a minor, yet contributing, component of AHIP's total financial results.

- This stream reflects strategic liquidity management by the company.

AHIP’s revenue streams are primarily driven by hotel room rentals, experiencing strong demand and increased ADR in 2024. Significant ancillary income comes from Food and Beverage sales and other hotel services like parking and meeting rentals, which bolster profitability. Non-recurring asset dispositions and investment income further diversify earnings, reflecting strategic capital management. These combined streams ensure robust financial performance.

| Revenue Stream | 2024 Trend | Contribution |

|---|---|---|

| Hotel Rooms | Strong Recovery | Primary (70%+) |

| F&B | Growing | Ancillary (15-20%) |

| Other Hotel | Steady Growth | Diversifying (5-10%) |

Business Model Canvas Data Sources

The AHIP Business Model Canvas is built using a blend of internal financial data, comprehensive market research, and strategic insights from industry experts. These diverse sources ensure each component of the canvas is informed by accurate and relevant information.