AHIP Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AHIP Bundle

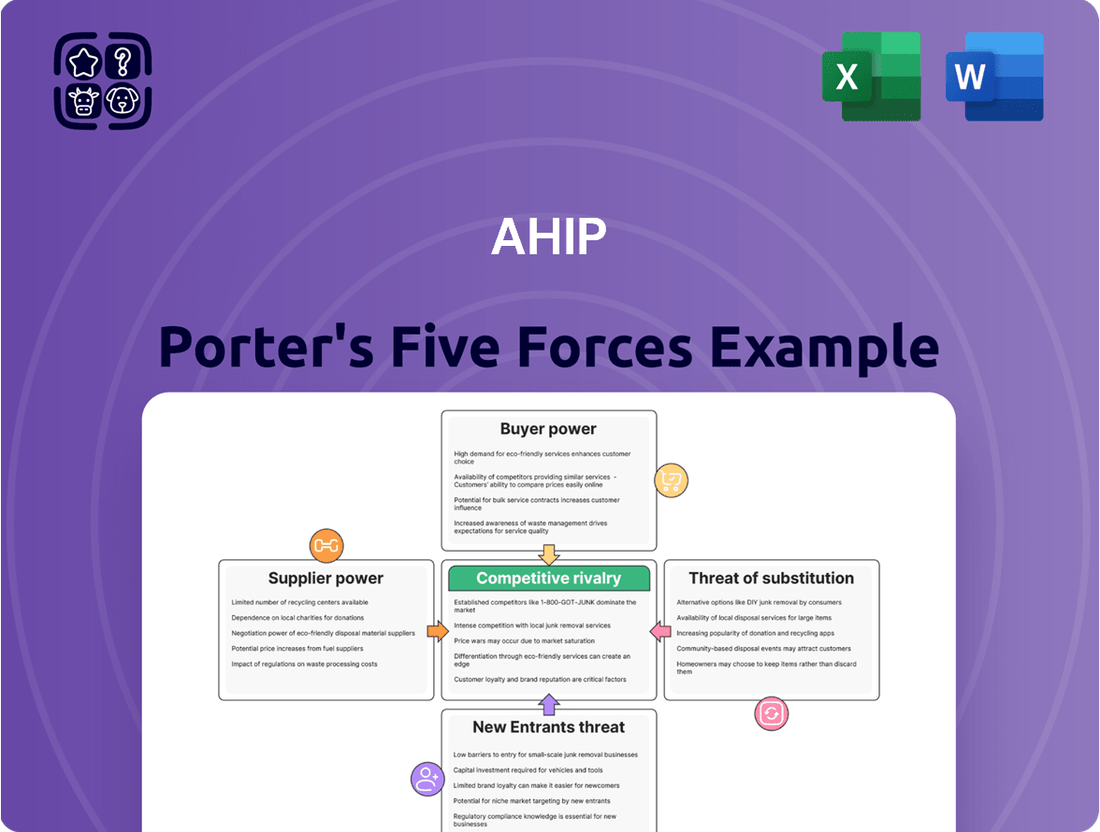

AHIP operates within a dynamic healthcare landscape, and a Porter's Five Forces analysis offers a crucial lens to understand its competitive environment. This framework examines the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the presence of substitute products or services. Analyzing these forces reveals the underlying profitability and strategic challenges within AHIP's industry.

The complete report reveals the real forces shaping AHIP’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Hotel brand franchisors, including Marriott, Hilton, and IHG, hold substantial bargaining power over AHIP. These major brands dictate strict property improvement plans, often requiring significant capital outlays for renovations and upgrades. They also charge substantial fees, typically 4-6% of gross room revenues for royalties and an additional 2-4% for marketing and reservation systems. Given the concentration of dominant brands, switching affiliations is costly and complex, limiting AHIP's flexibility and increasing operational expenses. This leverage ensures franchisors maintain control over brand standards and profitability.

Online Travel Agencies (OTAs) like Booking.com and Expedia exert substantial supplier power over AHIP, acting as vital distribution channels that provide extensive global reach to potential guests. These platforms, while offering broad visibility, typically demand commission fees ranging from 15% to 25% of the booking value in 2024, sometimes even higher. This significant cost directly erodes AHIP's profitability margins for rooms booked through these channels. Consequently, AHIP faces reduced control over its pricing strategies and struggles to cultivate direct customer relationships, becoming reliant on OTAs for a significant portion of its bookings.

The hospitality industry, including AHIP's operations, is inherently labor-intensive, making the labor market a significant supplier force. Rising labor costs, encompassing wages and benefits, exert pressure on profitability. As of late 2024, approximately 79% of U.S. hotels reported being understaffed, leading to increased wage pressure to attract and retain employees. These elevated labor costs can significantly erode margins, especially if not offset by higher room rates, directly impacting AHIP's financial performance.

Furniture, Fixtures, and Equipment (FF&E) Vendors

The market for hotel Furniture, Fixtures, and Equipment (FF&E) is relatively concentrated, with a few major suppliers often dominating significant segments. This concentration provides these vendors with substantial pricing power, as alternatives may be limited. Furthermore, adherence to strict brand standards for FF&E, mandated by franchise agreements, severely restricts the flexibility of AHIP to source lower-cost alternatives. In 2024, the global hospitality FF&E market continued to see key players like American Hotel Register Company and HD Supply maintain strong positions, influencing procurement costs.

- Concentrated market for FF&E vendors, leading to higher pricing power.

- Brand standards in franchise agreements limit sourcing flexibility.

- Major suppliers dictate terms due to their market share.

- For 2024, FF&E expenditures remain a significant capital outlay for hotels.

Technology and Software Providers

Technology and software providers hold significant bargaining power over AHIP, as hotels heavily depend on specialized systems like property management systems (PMS), revenue management platforms, and booking engines. Switching from an incumbent provider, such as Oracle Hospitality or Shiji Group, involves substantial costs and operational disruptions. For instance, the global hotel PMS market was valued at approximately $4.3 billion in 2024, demonstrating the scale of reliance. As guest experience increasingly relies on seamless technology integration, AHIP's dependence on these critical, often proprietary, solutions grows, limiting negotiation leverage.

- Major players like Oracle Hospitality and Amadeus offer integrated solutions critical for daily operations.

- Customization and integration with existing infrastructure create high switching costs for hotel operators.

- The increasing demand for mobile check-ins and personalized guest experiences boosts reliance on advanced software.

- Proprietary systems and specialized support further entrench the power of these key technology vendors.

AHIP faces significant supplier power from various fronts. Hotel franchisors dictate terms and fees, while Online Travel Agencies levy high commissions, often 15-25% in 2024. The labor market, with 79% of U.S. hotels understaffed in late 2024, exerts upward pressure on wages. Additionally, concentrated FF&E and technology providers limit sourcing flexibility and create high switching costs.

| Supplier Type | Key Impact | 2024 Data/Trend | |

|---|---|---|---|

| Hotel Franchisors | High fees, strict PIPs | 4-6% royalties, 2-4% marketing fees | High switching costs |

| Online Travel Agencies | High commission rates | 15-25% of booking value | Reduced pricing control |

| Labor Market | Rising labor costs | 79% U.S. hotels understaffed | Erosion of profit margins |

| FF&E Providers | Concentrated market power | Significant capital outlay | Limited sourcing flexibility |

| Technology Vendors | High switching costs | Global PMS market ~$4.3B | Dependence on proprietary systems |

What is included in the product

This analysis breaks down the competitive forces impacting AHIP, examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the industry.

Quickly identify and address competitive threats by visualizing the intensity of each of Porter's five forces.

Customers Bargaining Power

Customers seeking select-service hotel accommodations, like those offered by AHIP, exhibit high price sensitivity. The proliferation of online travel agencies (OTAs) and price comparison websites in 2024 has significantly increased market transparency. This allows travelers to effortlessly compare rates across numerous properties, often leading to booking decisions based primarily on price. Consequently, AHIP faces pressure to maintain competitive pricing, limiting its ability to implement substantial price increases without risking a decrease in occupancy rates, which could impact revenue per available room (RevPAR).

For individual leisure and business travelers, the cost and effort of switching from one hotel brand to another are minimal. In 2024, the widespread availability of online booking platforms empowers customers to compare options instantly. Unless tied to a specific loyalty program, guests can easily choose a different hotel for their next stay based on price, location, or amenities. This lack of friction significantly empowers customers to seek out the best value proposition for each trip, driving competitive pricing across the industry.

The widespread availability of online reviews and ratings on platforms like TripAdvisor and various Online Travel Agencies (OTAs) has significantly empowered customers. For instance, in 2024, studies indicate that over 80% of travelers consult online reviews before booking accommodation. Negative feedback can severely impact a hotel's reputation and booking volumes, compelling AHIP's properties to consistently uphold high service standards and actively engage with customer comments. This transparency provides customers a powerful voice, directly influencing their booking decisions and driving competition among hospitality providers.

Corporate Travel Planners

Corporate travel planners possess substantial bargaining power as they direct significant room volumes, enabling them to negotiate favorable rates and terms. This leverage is especially critical for select-service hotels, which rely heavily on such bulk bookings. In 2024, corporate travel continues to influence hotel pricing, with large accounts often securing discounts of 15-25%. Their strong negotiating position can directly compress hotel profit margins.

- Corporate accounts secure significant discounts (e.g., 15-25% in 2024).

- Volume bookings give planners strong leverage over hotel rates.

- This segment is crucial for select-service hotel revenue.

- Their power directly impacts and can compress hotel margins.

Growth of Loyalty Programs

The proliferation of hotel loyalty programs, while designed to foster retention, actually amplifies customer bargaining power. Savvy travelers often enroll in multiple programs, such as Marriott Bonvoy or Hilton Honors, allowing them to choose accommodations based on the most attractive 2024 rewards and benefits. This intense competition compels hotel brands to continually enhance their offerings, shifting leverage to the customer.

- By Q1 2024, major hotel loyalty programs collectively boasted hundreds of millions of members globally, indicating widespread participation.

- The average value of loyalty points for top-tier members in 2024 is a key differentiator, influencing booking decisions.

- Customers can leverage their potential long-term value to negotiate better perks or upgrades, especially for frequent stays.

Customers exhibit high bargaining power due to market transparency, low switching costs, and the influence of online reviews. Corporate clients secure significant discounts, often 15-25% in 2024, through volume bookings. The proliferation of loyalty programs further empowers travelers to demand value. This collective leverage pressures AHIP to maintain competitive pricing and service quality.

| Factor | Impact | 2024 Data |

|---|---|---|

| Price Sensitivity | High | OTAs increase transparency |

| Switching Costs | Low | Easy online booking |

| Corporate Discounts | Significant | 15-25% for volume |

What You See Is What You Get

AHIP Porter's Five Forces Analysis

This preview shows the exact, comprehensive AHIP Porter's Five Forces Analysis you'll receive immediately after purchase, detailing threats from new entrants, the bargaining power of buyers and suppliers, the threat of substitute products, and the intensity of rivalry within the industry.

The document displayed here is the complete version of the AHIP Porter's Five Forces Analysis, ready for download and use the moment you buy, offering actionable insights into the competitive landscape.

You're looking at the actual, professionally crafted AHIP Porter's Five Forces Analysis. Once you complete your purchase, you’ll get instant access to this exact file, enabling strategic decision-making.

No mockups, no samples. The AHIP Porter's Five Forces Analysis you see here is exactly what you’ll be able to download after payment, providing a thorough evaluation of the competitive forces impacting AHIP.

Rivalry Among Competitors

The U.S. branded hotel industry, where AHIP primarily operates, is highly concentrated, with dominant players like Marriott, Hilton, and Hyatt controlling significant market share. For instance, Marriott International alone reported over 1.6 million rooms globally as of early 2024, highlighting its massive scale. This intense concentration fosters fierce competition for market share, guest loyalty, and attractive acquisition opportunities among all participants. AHIP directly competes with other hotel REITs and private equity firms that also own and operate properties under these same powerful and widely recognized brands, leading to sustained rivalry.

AHIP's concentration on the select-service lodging market places it in a highly competitive niche. This segment, valued for operational efficiencies and resilience, continues to attract significant capital, with comparable REITs like Apple Hospitality and RLJ Lodging Trust actively expanding portfolios. For instance, Apple Hospitality REIT reported 2024 Q1 RevPAR growth near 2.5%, highlighting the segment's appeal. This intense focus by multiple public and private entities on similar property types significantly amplifies competitive rivalry within the sector.

Price competition is intense within the select-service market, driven by high customer price sensitivity. Hotels meticulously monitor competitor rates, often adjusting their own pricing daily to remain competitive. This constant jockeying for market share can lead to aggressive price wars, particularly as seen in early 2024 in some US markets where ADR growth slowed, making it harder to raise rates. Such pressures on Average Daily Rate (ADR) directly impact overall revenue and profitability for operators like AHIP.

Brand Conversion and Renovation

Competitive rivalry in the lodging sector extends beyond new builds to significant brand conversion and renovation efforts. Competitors actively reposition their assets through Property Improvement Plans (PIPs) to enhance guest appeal and market share. This dynamic is evident in 2024, with brand conversions representing a substantial portion of hotel pipeline activity as owners seek stronger brand alignment. For instance, in Q1 2024, conversions accounted for over 30% of the U.S. hotel pipeline, highlighting this strategic shift.

- Existing properties undergo renovation to boost competitiveness.

- Property Improvement Plans (PIPs) are key to asset repositioning.

- Brand conversions represent a significant portion of hotel development in 2024.

- Owners leverage rebranding to align with stronger market identities.

Strategic Dispositions and Acquisitions

Hotel REITs such as AHIP continually optimize their holdings by divesting non-core assets and acquiring properties in more lucrative markets. This ongoing portfolio refinement signifies intense competition, as firms aggressively pursue the most desirable hotel assets to enhance their overall portfolio quality and financial returns. For instance, the first quarter of 2024 saw significant transaction activity in the hotel sector, reflecting this strategic churn. Companies aim to boost metrics like RevPAR and EBITDA margins through such targeted acquisitions.

- In 2024, hotel transaction volumes continued to adjust, with a focus on premium assets.

- AHIP and its peers aim to improve portfolio RevPAR, a key performance indicator, through strategic acquisitions.

- Dispositions allow for capital reallocation towards higher-growth opportunities or debt reduction.

- This competitive behavior directly impacts asset valuations and market share among hotel REITs.

AHIP faces intense rivalry from concentrated hotel giants like Marriott and Hilton, controlling significant 2024 market share.

Competition in the select-service segment is fierce, with peers like Apple Hospitality showing 2024 Q1 RevPAR growth near 2.5%.

Price competition, coupled with strategic 2024 Q1 brand conversions representing over 30% of the U.S. hotel pipeline, intensifies market dynamics.

| Metric | 2024 Q1 Data | Impact on AHIP |

|---|---|---|

| U.S. Hotel Pipeline Conversions | >30% | Increased asset repositioning |

| Apple Hospitality REIT Q1 RevPAR Growth | ~2.5% | Benchmark for select-service rivalry |

| Marriott Global Rooms | >1.6 million | Dominant competitor scale |

SSubstitutes Threaten

The most significant substitute threat to traditional hotels like AHIP comes from alternative lodging platforms such as Airbnb and Vrbo. These platforms offer diverse options, from single rooms to entire homes, often at competitive prices, appealing to leisure travelers seeking more space or local experiences. In 2024, Airbnb alone is projected to have over 7.7 million active listings globally, directly competing for lodging demand. This vast inventory and pricing flexibility present a substantial challenge to the hotel industry's market share.

The rise of extended-stay hotels poses a significant substitute threat to AHIP's traditional select-service portfolio, despite their own limited presence in this segment. These hotels, offering amenities like kitchenettes and more living space, increasingly attract guests on longer stays, impacting the demand for conventional rooms. The extended-stay segment saw robust growth in 2024, with its supply increasing by over 5% year-over-year. This expansion blurs the lines, creating direct competition as select-service and extended-stay offerings increasingly overlap in guest needs and pricing.

Corporate housing, including furnished apartments, poses a significant substitute threat to AHIP's extended-stay hotels for longer-term needs like corporate relocations or projects. These options offer a more residential environment, often with full kitchens and separate living spaces, appealing to guests seeking a home-like experience. For example, the global corporate housing market was estimated at over $30 billion in 2024, indicating a robust alternative. Such choices can also present a more cost-effective solution for stays exceeding several weeks or months, potentially offering rates 15-30% lower than comparable extended-stay hotel suites for extended periods, directly impacting AHIP's market share in this valuable segment.

Boutique and Independent Hotels

While AHIP primarily operates branded hotels, a growing segment of travelers in 2024 actively seeks unique, non-standardized experiences offered by independent and boutique properties. These hotels often compete on distinctive character, local flavor, and highly personalized service rather than brand uniformity. This appeal can divert guests from more standardized branded select-service hotels, impacting AHIP's market share.

- Independent hotels represented over 40% of the U.S. hotel supply in 2024.

- Boutique hotel RevPAR growth often outpaced traditional segments in niche urban markets.

- Customer acquisition costs for independent hotels remain competitive through direct booking channels.

- Guest preference for authentic local experiences continues to strengthen through mid-2025.

'Bleisure' Travel Trends

The growing bleisure travel trend, where business trips extend into leisure, significantly shifts accommodation preferences. This creates demand for alternatives beyond standard business hotels, as travelers often seek resorts, vacation rentals, or experience-driven boutique hotels for their leisure days. In 2024, bleisure segments are projected to grow, with a notable shift towards unique lodging experiences.

- Global bleisure travel is expected to reach $497.5 billion by 2030, showing its increasing market influence.

- A 2024 study noted over 80% of business travelers consider adding leisure days to their trips.

- Vacation rental platforms reported a 20% increase in bookings for longer stays combining work and leisure in early 2024.

- Boutique hotels are increasingly catering to bleisure travelers with amenity packages.

AHIP faces significant substitute threats from diverse lodging options, including alternative platforms like Airbnb and Vrbo, which offer vast, flexible inventory. The rise of extended-stay hotels and corporate housing also diverts demand for longer stays with appealing amenities. Furthermore, independent and boutique properties, alongside the growing bleisure travel trend, capture market share by offering unique, experience-driven accommodations.

| Substitute Category | 2024 Market Data | Impact on AHIP |

|---|---|---|

| Alternative Lodging | Airbnb: 7.7M global listings | Direct price/volume competition |

| Extended-Stay Hotels | Supply growth: 5%+ YoY | Compete for longer-term guests |

| Corporate Housing | Market value: $30B+ | Alternative for long-term corporate needs |

Entrants Threaten

Entering the hotel industry demands substantial capital outlay for property acquisition or development, making it a significant barrier to entry for new players. The cost to purchase an existing hotel or construct a new one, particularly in prime locations, is immense; for instance, developing a full-service hotel can exceed $500,000 per room in 2024. This high financial hurdle severely limits the number of potential new competitors, providing a strong defense for established REITs like AHIP.

While the construction pipeline shows some activity for new hotels, factors like high interest rates, which averaged around 7.5% for commercial real estate loans in early 2024, and elevated construction costs have significantly constrained the pace of new development. The projected new supply growth for the U.S. lodging industry is relatively low, with forecasts indicating around 1.3% growth in 2024, mitigating the threat of a flood of new competitors. This limited new supply creates a more stable competitive environment for existing owners like AHIP. The reduced new build activity means less pressure from new entrants on occupancy and average daily rates.

New entrants in the hospitality sector face a significant hurdle without strong brand affiliation. Major hotel companies like Marriott and Hilton, boasting loyalty programs with over 190 million and 180 million members respectively in 2024, provide powerful reservation systems and global marketing reach. An unbranded hotel would struggle immensely to achieve comparable visibility and demand generation, making it difficult to compete effectively. This strong brand equity and guest loyalty enjoyed by AHIP's portfolio of branded properties acts as a substantial barrier for new, independent market entrants.

Access to Distribution Channels

New entrants face a significant hurdle in gaining access to essential distribution channels, particularly major Online Travel Agencies (OTAs) like Booking.com and Expedia. Established entities such as Ashford Hospitality Trust (AHIP) have cultivated long-standing relationships and sophisticated strategies for managing these critical platforms. For a new competitor, building these relationships from the ground up and navigating the intricate landscape of online distribution, where OTA commissions can range from 15% to 30%, presents a substantial barrier. This makes attracting guests efficiently a considerable challenge for any newcomer in 2024.

- Major OTAs dominate hotel bookings, with Booking.com and Expedia Group holding significant market share in 2024.

- New entrants must allocate substantial resources to establish trust and integration with these platforms.

- Established players like AHIP benefit from preferred placements and negotiated commission rates due to their volume and history.

- The high cost of customer acquisition through OTAs, often 15-30% of revenue, severely impacts a new entrant's profitability.

Operational Expertise and Economies of Scale

Successfully managing a hotel portfolio demands deep operational expertise in areas like sophisticated revenue management and targeted marketing strategies. Established hotel REITs, such as those with portfolios exceeding 50 properties, benefit significantly from economies of scale, often seeing procurement cost advantages of 10-15% over smaller operators. A new entrant would struggle to replicate this scale and established operational track record, impacting their ability to operate efficiently and profitably in a competitive market like 2024. This lack of scale makes it challenging to optimize administrative overhead and achieve the same profit margins as incumbents.

- New hotel entrants face higher per-unit operational costs due to lack of bulk purchasing power.

- Established hotel REITs can achieve marketing efficiencies, potentially reducing customer acquisition costs by up to 20%.

- Access to specialized talent in revenue management is a significant barrier for new players without a proven track record.

- The competitive landscape in 2024 requires substantial capital and operational efficiency to secure market share.

The threat of new entrants into the hotel industry remains low due to significant capital and operational barriers. High development costs, projected to exceed $500,000 per room for full-service hotels in 2024, coupled with limited new supply growth of around 1.3% in the U.S. lodging market, deter newcomers.

Established players like AHIP benefit from powerful brand affiliations with loyalty programs boasting over 180 million members and preferred access to major OTAs, where commissions can be 15-30%. New entrants also struggle to match incumbents' operational scale and procurement advantages, making profitable entry challenging.

| Barrier Type | 2024 Data Point | Impact on New Entrants |

|---|---|---|

| Capital Costs | >$500,000 per room | High financial hurdle |

| New Supply Growth | ~1.3% (U.S. lodging) | Limited market entry opportunities |

| OTA Commissions | 15-30% of revenue | Higher customer acquisition costs |

Porter's Five Forces Analysis Data Sources

Our AHIP Porter's Five Forces analysis leverages data from AHIP's annual reports, industry expert interviews, and health insurance market research reports to provide a comprehensive view of the competitive landscape.