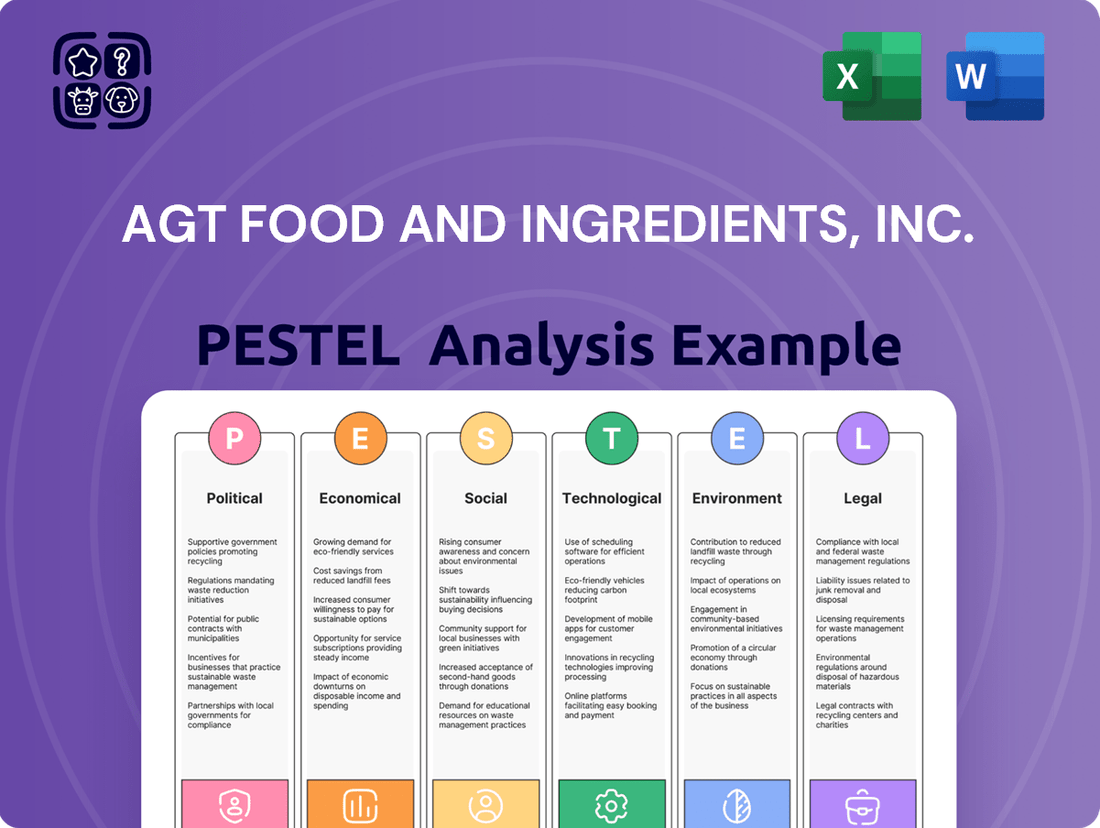

AGT Food and Ingredients, Inc. PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AGT Food and Ingredients, Inc. Bundle

Discover the critical external forces shaping AGT Food and Ingredients, Inc.'s trajectory, from evolving consumer preferences to global trade policies. Our PESTLE analysis provides a comprehensive overview of these influential factors, empowering you to anticipate market shifts and refine your strategic approach. Unlock a deeper understanding of the competitive landscape and gain a significant advantage.

Political factors

AGT Food and Ingredients, a major player in global pulse and grain processing, navigates a complex landscape shaped by international trade policies and tariffs. These governmental decisions directly influence the cost and accessibility of its products in various markets, impacting overall profitability.

The imposition of a 100% tariff by China on Canadian peas in early 2024 serves as a stark example of how trade disputes can rapidly disrupt established supply chains. Such measures can significantly alter competitive dynamics and necessitate swift strategic adjustments for companies like AGT.

Consequently, AGT's ability to maintain market share and profitability hinges on its capacity for agile market diversification. By spreading its export reach across multiple countries, the company can mitigate the risks associated with sudden tariff changes or trade policy shifts in any single region.

Government initiatives and subsidies within Canada's agricultural sector directly impact AGT Food and Ingredients, Inc. by influencing raw material availability and pricing. For instance, in 2024, the Canadian government continued its support for crop insurance programs and investments in agricultural research, aiming to stabilize farm incomes and foster innovation. These programs can lead to more predictable sourcing for AGT, particularly for pulse crops.

Specific support for pulse cultivation, such as efforts to reduce import reliance and enhance soil health through sustainable farming practices, presents a significant advantage for AGT. In 2025, the Canadian federal budget allocated increased funding towards agri-food innovation and climate-resilient agriculture, which often includes support for diverse crop rotations like pulses. This can directly lower AGT's operational costs and improve the quality and consistency of its raw material inputs.

AGT Food and Ingredients, Inc. faces evolving political landscapes impacting its operations, particularly concerning food safety. Stricter regulations and enhanced enforcement by agencies like the Canadian Food Inspection Agency (CFIA) directly influence AGT's processing activities and associated compliance expenses.

The food industry is experiencing a noticeable shift towards more thorough inspections and increased scrutiny, especially for products intended for immediate consumption. This trend means AGT must continually adapt its processes to meet these heightened standards, potentially affecting operational efficiency and cost structures.

Geopolitical Stability and Supply Chain Security

Global geopolitical events, such as the ongoing conflicts in Eastern Europe and the Middle East, significantly impact supply chain stability for companies like AGT Food and Ingredients. These instabilities can disrupt critical transportation routes and lead to increased shipping costs and delivery delays, affecting AGT's ability to move its products efficiently across international markets.

AGT's reliance on global sourcing for key agricultural commodities makes it vulnerable to regional instabilities. For instance, disruptions in the Black Sea region, a major hub for grain exports, directly affect the availability and price of wheat and pulses, core ingredients for AGT. This underscores the necessity of robust risk management strategies.

To counter these geopolitical risks, AGT must continue to invest in and maintain diversified sourcing and distribution networks. As of early 2024, the company's strategic focus includes expanding its presence in regions with greater political stability and developing alternative logistics pathways to ensure consistent product flow. This diversification is key to mitigating the impact of potential trade blockades or political unrest in any single region.

- Geopolitical Risks: Ongoing conflicts and regional instabilities pose direct threats to AGT's global supply chains.

- Supply Chain Vulnerability: Reliance on key agricultural regions makes AGT susceptible to disruptions affecting commodity availability and pricing.

- Mitigation Strategy: Diversifying sourcing and distribution networks is crucial for resilience against political unrest and trade disruptions.

- 2024 Focus: AGT is actively working to expand operations in politically stable regions and explore alternative logistics solutions.

International Relations and Market Access

The diplomatic standing between Canada and its key international markets significantly impacts AGT Food and Ingredients' ability to export. Favorable relations foster smoother trade, while strained ties can lead to disruptions.

Trade agreements, such as the Canada-United States-Mexico Agreement (CUSMA), are crucial for AGT, offering preferential access for its products. For instance, in 2023, Canada's agri-food exports reached a record $69.3 billion, underscoring the importance of these trade frameworks.

- CUSMA's Role: Continues to facilitate duty-free trade for many Canadian agricultural goods, including grains and pulses, which are core to AGT's business.

- Trade Tensions: Geopolitical shifts or bilateral disputes can result in unexpected tariffs or non-tariff barriers, directly affecting AGT's cost of doing business and market competitiveness.

- Global Supply Chains: Canada's international relationships influence its integration into global food supply chains, affecting AGT's sourcing and distribution networks.

Government policies and trade agreements significantly shape AGT Food and Ingredients' operational environment. Canada's trade relationships, including agreements like CUSMA, provide crucial market access, as evidenced by Canada's record $69.3 billion in agri-food exports in 2023. Conversely, geopolitical tensions and protectionist measures, such as China's 2024 tariffs on Canadian peas, create substantial risks by disrupting supply chains and increasing costs.

AGT's reliance on global sourcing makes it susceptible to regional instabilities, with events in areas like the Black Sea impacting core commodity prices. The company's strategy to mitigate these political risks involves expanding into more stable regions and developing alternative logistics, a focus evident in its early 2024 operational planning.

Furthermore, evolving food safety regulations and enforcement by bodies like the CFIA necessitate continuous adaptation by AGT to maintain compliance, potentially affecting operational efficiency and costs. Government support for Canadian agriculture, including crop insurance and research funding in 2024 and 2025, offers opportunities for more predictable sourcing and improved raw material quality.

What is included in the product

This PESTLE analysis unpacks the external macro-environmental forces impacting AGT Food and Ingredients, Inc., examining political, economic, social, technological, environmental, and legal factors.

It provides a data-driven evaluation designed to equip stakeholders with actionable insights for strategic decision-making and competitive advantage.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering AGT Food and Ingredients, Inc. a clear roadmap to navigate external challenges and capitalize on opportunities.

Helps support discussions on external risk and market positioning during planning sessions, allowing AGT Food and Ingredients, Inc. to proactively address potential disruptions and strengthen its competitive advantage.

Economic factors

The global demand for plant-based proteins is surging, fueled by growing consumer interest in health, environmental impact, and ethical eating. This trend is a significant tailwind for companies like AGT Food and Ingredients, whose core business revolves around pulses, a rich source of plant-based protein.

Projections indicate robust expansion for this sector. For instance, the plant-based protein market was valued at approximately USD 32.7 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of around 12.5% from 2024 to 2030, reaching an estimated USD 77.4 billion by 2030.

Fluctuations in the prices of key agricultural inputs such as lentils, peas, chickpeas, and durum wheat directly affect AGT Food and Ingredients, Inc.'s cost of goods sold. For instance, during 2024, global wheat prices experienced significant swings, with futures contracts for December 2024 delivery seeing a notable increase of over 15% in the first half of the year due to supply concerns stemming from adverse weather in major producing regions. This volatility directly impacts AGT's profitability.

Global supply and demand imbalances, alongside unpredictable weather patterns and geopolitical tensions, are major drivers of commodity price volatility. In 2024, drought conditions in Canada, a primary supplier of pulses, led to a reduction in crop yields, pushing up prices for peas and lentils. This directly squeezed AGT's profit margins as they faced higher procurement costs for these essential ingredients.

Rising inflation in 2024 and 2025 directly impacts AGT Food and Ingredients by increasing costs for essential inputs like energy, raw materials, and logistics. For instance, global energy prices saw significant volatility in early 2024, impacting transportation expenses. This necessitates careful cost management to maintain competitive pricing.

Consumers' purchasing behavior is also shifting due to inflation. As the cost of living rises, shoppers become more price-conscious, potentially impacting demand for premium or specialty products, including some plant-based alternatives offered by AGT. In Canada, inflation reached 4.3% in Q1 2024, influencing consumer spending patterns across various food categories.

Exchange Rate Fluctuations

AGT Food and Ingredients, Inc., as a global entity with extensive operations and sales across various countries, is significantly impacted by the ebb and flow of exchange rates. These currency fluctuations directly influence the company's financial health, affecting everything from the cost of imported raw materials to the repatriation of earnings from international markets.

Favorable exchange rates can act as a tailwind, boosting the value of AGT's export revenues when converted back into its reporting currency. Conversely, unfavorable movements can inflate the cost of essential imported goods or diminish the translated value of sales generated in foreign markets. For instance, in early 2024, a strengthening Canadian Dollar against currencies where AGT has significant sales could lead to reduced reported revenues from those regions.

- Impact on Revenue: A stronger Canadian Dollar in 2024 could decrease the reported value of sales made in US Dollars or Euros.

- Cost of Goods Sold: Fluctuations can alter the cost of imported agricultural commodities or processing equipment.

- Profitability: Exchange rate volatility directly affects net income by changing the value of international transactions.

- Hedging Strategies: AGT likely employs hedging instruments to mitigate some of this currency risk, a common practice for global businesses.

Investment in Agricultural Infrastructure

Investment in agricultural infrastructure, like better rail and bulk handling facilities, directly benefits companies such as AGT Food and Ingredients by boosting efficiency and lowering shipping expenses. AGT's strategic divestment of its shortline rail and bulk handling assets, anticipated in late 2024 or early 2025, is designed to foster ongoing development and support for both producers and the communities they serve.

This move is expected to streamline operations, allowing AGT to focus on core competencies while ensuring that essential infrastructure continues to support agricultural supply chains. The sale is a key component of AGT's strategy to maintain its growth trajectory and enhance its operational framework.

- Infrastructure Enhancements: Investments in rail and bulk handling facilities reduce AGT's logistical costs.

- Divestment Strategy: AGT's sale of rail and bulk handling infrastructure in late 2024/early 2025 aims for continued growth.

- Producer Support: The divestment is intended to ensure ongoing improvements for agricultural producers.

- Community Impact: The infrastructure sale also seeks to benefit the communities involved in the agricultural sector.

Government agricultural policies and trade agreements significantly shape the operating environment for AGT Food and Ingredients. Subsidies or tariffs on pulses and grains directly impact AGT's cost structure and market access. For instance, the Canadian government's ongoing support for agricultural innovation, including investments in crop research and development, benefits companies like AGT by fostering improved yields and quality of core ingredients.

Full Version Awaits

AGT Food and Ingredients, Inc. PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This PESTLE analysis of AGT Food and Ingredients, Inc. provides a comprehensive overview of the external factors impacting the company. You'll find detailed insights into Political, Economic, Social, Technological, Legal, and Environmental influences.

Sociological factors

Consumers are increasingly prioritizing health and wellness, actively seeking out nutritious food choices. This global shift directly benefits companies like AGT Food and Ingredients, as demand for their pulse-based products, which are rich in fiber and essential nutrients, continues to climb. For instance, the plant-based protein market was valued at approximately $32.7 billion in 2023 and is projected to reach $162.5 billion by 2030, showcasing a significant growth trajectory that AGT is well-positioned to capitalize on.

The global rise in vegan, vegetarian, and flexitarian diets is a powerful trend, significantly boosting the plant-based food sector. This growing consumer preference directly benefits AGT Food and Ingredients, Inc. because pulses, a key part of their offerings, are fundamental to these dietary choices and are incorporated into a wide array of plant-based food products.

The plant-based food market is projected to reach over $274 billion by 2030, demonstrating the immense scale of this dietary shift. AGT's focus on pulses positions them well to capture a substantial share of this expanding market, as consumers increasingly seek protein alternatives derived from sources like lentils and peas.

Consumers are increasingly prioritizing sustainable eating habits and ethical food production, with a growing concern for environmental impact and animal welfare. This trend is a significant sociological factor influencing food choices globally.

AGT Food and Ingredients, Inc.'s strategic focus on plant-based proteins directly addresses this demand. Plant-based protein production generally requires fewer resources, such as land and water, compared to animal protein production, aligning with consumer values for sustainability.

For instance, the global plant-based food market was valued at approximately USD 29.7 billion in 2023 and is projected to grow significantly, indicating strong consumer adoption. AGT's investment in this sector, including its durum wheat and pulse ingredients, positions it favorably to capture a larger share of this expanding market, enhancing its brand appeal among ethically conscious consumers.

Clean Label and Natural Ingredients Trend

Consumers increasingly prefer foods with simple, recognizable ingredients, often referred to as "clean labels." This shift is driven by a desire for healthier and more transparent food options. For instance, a 2024 report indicated that 70% of consumers actively seek out products with shorter ingredient lists.

AGT Food and Ingredients, Inc. is well-positioned to benefit from this trend. Their business model focuses on transforming raw agricultural products, like pulses and grains, into value-added ingredients and consumer goods. By highlighting the natural origin and minimal processing of their offerings, AGT can directly appeal to this growing consumer preference.

- Rising Demand: A significant portion of consumers, over two-thirds in recent surveys, actively look for clean label products.

- AGT's Advantage: The company's core competency in processing natural agricultural commodities aligns perfectly with this market demand.

- Market Opportunity: AGT can leverage its portfolio to emphasize natural sourcing and minimal ingredient lists, enhancing brand appeal.

Cultural and Culinary Diversity

AGT Food and Ingredients, Inc. benefits significantly from the cultural and culinary diversity that places pulses at the heart of numerous global diets. From the staple dals in India to the ubiquitous hummus in the Middle East, pulses are integral to regional food traditions, creating a broad and consistent demand base for AGT's products.

The increasing globalization of food culture and the growing popularity of ethnic cuisines in Western markets directly translate into higher demand for a wider array of pulse varieties. This trend expands AGT's market reach, allowing the company to tap into new consumer preferences and culinary trends. For instance, the global pulse market was valued at approximately USD 107.8 billion in 2024 and is projected to reach USD 145.2 billion by 2030, demonstrating substantial growth driven by these cultural shifts.

- Global Demand Driver: Pulses are fundamental to diets worldwide, ensuring a consistent market for AGT.

- Market Expansion: The rise of ethnic foods in mainstream markets increases demand for diverse pulse types.

- Projected Growth: The global pulse market is expected to grow significantly, reflecting increased consumer interest.

Consumer focus on health and sustainability is a major driver for AGT Food and Ingredients. The plant-based protein market, valued at approximately $32.7 billion in 2023, is expected to reach $162.5 billion by 2030, a trend AGT is well-positioned to leverage with its pulse-based products.

The growing acceptance of vegan, vegetarian, and flexitarian diets directly benefits AGT, as pulses are a core component of these eating patterns. This dietary shift is substantial, with the plant-based food market projected to exceed $274 billion by 2030, offering significant growth opportunities for AGT's ingredient portfolio.

Consumer demand for clean labels, with 70% of consumers seeking shorter ingredient lists in 2024, aligns with AGT's processing of natural agricultural commodities. Furthermore, the globalization of food culture and the rise of ethnic cuisines are expanding the market for diverse pulse varieties, contributing to a projected global pulse market growth from $107.8 billion in 2024 to $145.2 billion by 2030.

Technological factors

AGT Food and Ingredients, Inc. benefits significantly from ongoing advancements in food processing technology, which directly impact operational efficiency and product integrity. The company's ability to integrate innovations like advanced sorting and cleaning equipment, such as optical sorters, can reduce labor costs and improve the purity of its grain and pulse products, potentially leading to higher market prices.

Embracing energy-efficient machinery is a key technological factor for AGT, especially given rising energy costs. For instance, adopting modern processing lines that consume less electricity can directly lower operating expenses. Similarly, implementing sophisticated water recycling systems not only addresses environmental concerns but also reduces water utility costs, a growing consideration for large-scale food processors.

Innovations in food packaging are also critical for AGT, particularly for extending product shelf life and enhancing food safety. Advanced packaging materials that offer better barrier properties against moisture and oxygen can reduce spoilage and waste, ensuring products reach consumers in optimal condition. For example, modified atmosphere packaging (MAP) could be a strategic adoption for certain product lines, improving market reach and reducing product returns.

The growing consumer demand for plant-based foods is spurring significant innovation in protein processing technologies. Companies are developing advanced methods to enhance the taste, texture, and overall appeal of plant-based alternatives, making them more competitive with traditional animal proteins. This technological evolution is crucial for unlocking the full potential of sustainable protein sources.

AGT Food and Ingredients, Inc. is well-positioned to capitalize on these advancements. The company can leverage new processing techniques to create higher-quality, more palatable plant-based protein ingredients. For instance, advancements in extrusion and fermentation technologies are enabling the creation of plant-based meats that closely mimic the sensory experience of conventional products, a trend expected to continue gaining momentum through 2025.

The food manufacturing sector is heavily embracing AI and robotics to boost efficiency. AGT Food and Ingredients, Inc. can leverage these advancements to streamline production, ensuring greater speed and consistency. Investing in AI-driven systems offers a clear path to reduced operational costs and elevated quality control.

Supply Chain Traceability and Blockchain

Blockchain technology is revolutionizing supply chain management, offering unprecedented traceability for food products. AGT Food and Ingredients can leverage this to provide consumers with real-time data, from the origin of ingredients to the final product, bolstering food safety and consumer confidence. For instance, the global blockchain in food market was valued at approximately USD 400 million in 2023 and is projected to grow significantly, indicating strong industry adoption. This technology helps AGT mitigate risks associated with product recalls and ensures regulatory compliance.

The implementation of blockchain solutions offers tangible benefits for AGT Food and Ingredients:

- Enhanced Transparency: Providing immutable records of product journeys, from farm to fork.

- Improved Food Safety: Enabling rapid identification and isolation of contaminated products.

- Increased Consumer Trust: Offering verifiable proof of origin and quality.

- Operational Efficiency: Streamlining processes and reducing disputes within the supply chain.

Sustainable Packaging Innovations

The growing emphasis on sustainability is accelerating the development and adoption of eco-friendly packaging. This includes a significant push towards biodegradable materials and the integration of smart packaging technologies that offer enhanced functionality and traceability. AGT Food and Ingredients, Inc. can leverage these advancements to significantly cut down on plastic waste, a critical concern for consumers and regulators alike. Meeting these evolving consumer expectations for environmentally responsible products is paramount for maintaining brand loyalty and market share. For instance, the global sustainable packaging market was valued at approximately USD 270 billion in 2023 and is projected to reach over USD 400 billion by 2028, demonstrating a clear market trend AGT can capitalize on.

AGT's strategic adoption of these sustainable packaging innovations can directly support its environmental, social, and governance (ESG) objectives. By investing in biodegradable films and compostable containers, the company can reduce its carbon footprint and waste generation. This proactive approach not only aligns with global environmental targets but also enhances AGT's corporate image, potentially attracting environmentally conscious investors and customers. The company's commitment to reducing single-use plastics, for example, could be highlighted in its annual sustainability reports, showcasing tangible progress.

- Biodegradable Materials: AGT can explore options like plant-based plastics (PLA) or paper-based alternatives for its product packaging, reducing reliance on traditional petroleum-based plastics.

- Smart Packaging Integration: Implementing QR codes or NFC tags on packaging can provide consumers with detailed product information, origin traceability, and recycling instructions, enhancing transparency and engagement.

- Reduced Plastic Waste: By transitioning to sustainable packaging, AGT can aim to decrease its plastic waste by a target percentage, contributing to a circular economy and mitigating environmental impact.

AGT Food and Ingredients, Inc. can leverage advancements in AI and robotics to streamline production, enhancing both speed and consistency, which is crucial in the competitive food manufacturing landscape. Investing in AI-driven systems offers a clear path to reduced operational costs and elevated quality control, a trend projected to see significant adoption through 2025.

The company can also benefit from blockchain technology for enhanced supply chain traceability, improving food safety and consumer trust. The global blockchain in food market was valued at approximately USD 400 million in 2023, indicating strong industry adoption and potential for AGT to mitigate risks and ensure compliance.

Furthermore, the growing demand for sustainable packaging, with the global market valued at approximately USD 270 billion in 2023, presents an opportunity for AGT to adopt biodegradable materials and smart packaging solutions, aligning with ESG objectives and consumer preferences.

Legal factors

AGT Food and Ingredients, Inc. must navigate a complex landscape of food labeling regulations, including those set by the U.S. Food and Drug Administration (FDA). These regulations, which can include uniform compliance dates for new requirements, dictate how products are presented to consumers.

Key areas of compliance include nutrient content claims, allergen disclosure, and the definition of terms like 'healthy.' For instance, the FDA's updated Nutrition Facts label, implemented with phased compliance dates for larger businesses in 2020 and smaller ones in 2021, introduced new requirements for serving sizes and added sugars, directly impacting AGT's packaging and marketing strategies.

AGT Food and Ingredients must navigate international trade agreements, such as the Canada-United States-Mexico Agreement (CUSMA), to secure preferential market access for its agricultural exports. Compliance with CUSMA's rules of origin is crucial; for instance, in 2023, Canadian agri-food exports to the US under CUSMA benefited from reduced tariffs, a key advantage AGT leverages.

Non-compliance with these agreements, including potential changes in tariff structures or new regulatory requirements announced in late 2024 or early 2025, could lead to substantial import duties, impacting AGT's cost competitiveness and potentially disrupting established trade flows with its key partners like the United States and Mexico.

AGT Food and Ingredients, Inc. must navigate a complex web of environmental laws across its global operations. This includes adhering to mandates on carbon emissions, water consumption, and waste disposal, which can vary significantly by country and even by region within countries. For instance, in 2024, many jurisdictions are tightening regulations on agricultural runoff and packaging waste, directly impacting food processing companies like AGT.

The increasing stringency of environmental legislation presents both challenges and opportunities. AGT may face higher compliance costs as it invests in technologies and processes to meet new standards, such as upgrading wastewater treatment facilities or implementing more energy-efficient production methods. However, proactive adoption of sustainable practices, driven by these regulations, can also lead to long-term cost savings and enhance brand reputation among environmentally conscious consumers and investors.

Competition Law and Anti-Greenwashing Legislation

AGT Food and Ingredients, Inc. must navigate increasingly stringent competition laws, particularly those targeting environmental misrepresentations. Recent amendments to Canada's competition framework, such as Bill C-59, introduce substantial penalties for 'greenwashing,' requiring AGT to substantiate all sustainability claims with robust, verifiable data to avoid legal repercussions and maintain consumer confidence.

The company's marketing and product development must align with these evolving regulations. Failure to do so could result in significant fines, reputational damage, and a loss of market share. AGT's commitment to transparent and accurate environmental reporting is therefore paramount for sustained legal compliance and brand integrity.

- Bill C-59 Amendments: These changes strengthen the Competition Bureau's authority to address misleading environmental claims.

- Verifiable Claims: AGT needs data-backed evidence for all sustainability marketing to prevent accusations of greenwashing.

- Penalties: Non-compliance can lead to substantial financial penalties and damage to brand reputation.

- Consumer Trust: Transparency in environmental practices is crucial for maintaining consumer trust and market standing.

Labor Laws and Employment Regulations

AGT Food and Ingredients, Inc. operates in numerous countries, necessitating adherence to a complex web of labor laws and employment regulations. For instance, in Canada, where AGT has significant operations, the minimum wage varies by province, with Ontario's minimum wage at CAD 17.20 per hour as of October 1, 2024. Such variations directly impact labor costs and necessitate adaptable human resource strategies.

Changes in employment legislation, such as those concerning working conditions, overtime pay, or the rights of labor unions, can significantly influence AGT's operational expenses and the effectiveness of its human resource management. For example, potential increases in mandated benefits or stricter regulations on contract employment could lead to higher overheads across AGT's global facilities.

Key legal factors impacting AGT include:

- Compliance with diverse national labor laws: AGT must navigate varying employment standards, termination procedures, and worker protections in each country of operation.

- Impact of minimum wage adjustments: Fluctuations in minimum wage rates, such as the recent increases in several key markets, directly affect payroll expenses.

- Unionization and collective bargaining agreements: The presence and influence of labor unions can lead to negotiations on wages, benefits, and working conditions, requiring careful management.

- Regulations on working hours and employee benefits: Adherence to laws regarding maximum working hours, paid leave, and statutory benefits adds to operational cost considerations.

AGT Food and Ingredients, Inc. must adhere to international trade regulations, including those governing agricultural product standards and import/export procedures. For instance, the World Trade Organization (WTO) agreements set frameworks for trade, and any shifts in these agreements, potentially updated in late 2024 or early 2025, could impact AGT's global market access and pricing strategies.

Compliance with food safety standards, such as HACCP (Hazard Analysis and Critical Control Points), is paramount. Failure to meet these, which are regularly reviewed and updated by bodies like the Codex Alimentarius Commission, can lead to product recalls and severe reputational damage. AGT's commitment to rigorous quality control across its supply chain is therefore a critical legal imperative.

| Legal Factor | Description | Impact on AGT | Example/Data Point (2024/2025) |

| Trade Agreements | Rules governing international commerce, tariffs, and market access. | Affects cost of goods, market penetration, and competitive pricing. | CUSMA (Canada-United States-Mexico Agreement) continues to facilitate agri-food trade; potential renegotiations or clarifications could emerge in 2025. |

| Food Safety Regulations | Mandates for product safety, labeling, and traceability. | Ensures consumer protection, prevents recalls, and maintains brand trust. | FDA's Food Safety Modernization Act (FSMA) continues to drive stricter preventative controls; AGT must maintain robust compliance systems. |

| Environmental Laws | Regulations on emissions, waste, and sustainable practices. | Influences operational costs, investment in green technologies, and corporate social responsibility. | Increased scrutiny on packaging waste and water usage in 2024; potential for new carbon reporting mandates in 2025. |

Environmental factors

Climate change presents significant physical risks to AGT Food and Ingredients, Inc. The increasing frequency of extreme weather events, such as prolonged droughts and intense heatwaves, directly threatens agricultural output. For instance, Canada, a key region for AGT's pulse and grain production, experienced severe drought conditions in 2021, impacting crop yields and quality.

These disruptions can severely affect AGT's supply chains, leading to reduced availability and fluctuating prices of essential commodities like lentils and durum wheat. The variability in weather patterns makes long-term agricultural planning more challenging, potentially impacting AGT's procurement strategies and operational stability throughout 2024 and into 2025.

Water scarcity is a significant environmental factor for AGT Food and Ingredients, Inc., especially impacting its agricultural sourcing. Regions where key crops are grown often face drought conditions, directly affecting supply and cost. For instance, in 2023, parts of Canada, a major agricultural hub for AGT, experienced severe drought, leading to reduced yields for certain grains.

AGT's focus on sustainable processing, including advanced water recycling systems, is crucial for mitigating these risks. By implementing technologies that reuse water in its processing plants, the company can significantly lower its reliance on fresh water sources. This approach not only addresses environmental concerns but also provides operational resilience against water supply disruptions.

AGT Food and Ingredients, Inc.'s commitment to sustainability is deeply embedded in its core business, particularly with its focus on pulses. These crops are naturally nitrogen-fixing, reducing the need for synthetic fertilizers and significantly lowering the water footprint compared to many other agricultural staples. This inherent sustainability makes pulses a cornerstone of environmentally conscious farming practices.

The company's strategic direction actively promotes reduced carbon intensity across its operations and champions plant-based food alternatives. This aligns directly with overarching global sustainability objectives and the growing consumer demand for eco-friendly food choices. For instance, AGT's initiatives aim to contribute to a more resilient and less resource-intensive global food system.

Biodiversity and Land Use

Sustainable land management and biodiversity are becoming critical considerations for agricultural companies like AGT Food and Ingredients. As global awareness grows, so does the expectation for businesses to operate in ways that benefit, rather than harm, natural ecosystems. This includes how land is used and managed for crop cultivation.

AGT's specialization in pulses offers a distinct advantage in this area. Pulses, such as lentils and chickpeas, are known for their ability to fix nitrogen in the soil, which can reduce the need for synthetic fertilizers. This practice inherently supports healthier soil and can contribute to increased biodiversity within agricultural landscapes.

The company's commitment to these practices is not just an environmental consideration but also a strategic one. By promoting biodiversity and sustainable land use, AGT can enhance its long-term supply chain resilience and meet the growing demand from consumers and regulators for environmentally responsible food production. For instance, by 2023, the global pulses market was valued at over $100 billion, with sustainability being a key driver of consumer choice.

- Soil Health Improvement: Pulses contribute to nitrogen fixation, enhancing soil fertility and reducing reliance on chemical inputs.

- Biodiversity Support: Sustainable farming methods associated with pulse cultivation can foster greater variety of plant and animal life in agricultural areas.

- Market Demand: Consumers are increasingly seeking products from companies with strong environmental, social, and governance (ESG) credentials.

- Supply Chain Resilience: Investing in sustainable land use practices helps secure a stable and healthy supply of raw materials for AGT's operations.

Waste Management and Circular Economy Initiatives

The food industry is placing a significant emphasis on waste reduction and the adoption of circular economy models. AGT Food and Ingredients, Inc. can capitalize on this trend by exploring innovative initiatives. For instance, upcycling agricultural byproducts into valuable new products or ingredients offers a dual benefit of waste minimization and revenue generation.

Implementing sustainable packaging solutions is another critical area. As of early 2025, consumer demand for eco-friendly packaging continues to surge, with a growing number of companies setting ambitious targets for recycled content and reduced plastic usage. AGT's commitment to these principles not only minimizes its environmental footprint but also enhances resource efficiency, aligning with evolving market expectations.

- Upcycling Initiatives: Exploring the conversion of agricultural byproducts, such as bran or husks, into animal feed, biofuels, or novel food ingredients.

- Sustainable Packaging: Investing in biodegradable, compostable, or recyclable packaging materials to reduce landfill waste.

- Resource Efficiency: Optimizing water and energy usage throughout the production process to lower operational costs and environmental impact.

- Circular Economy Partnerships: Collaborating with other businesses to create closed-loop systems for materials and waste.

Environmental factors significantly influence AGT Food and Ingredients, Inc.'s operations, particularly concerning climate change and water availability. Extreme weather events, like the 2021 drought in Canada impacting crop yields, pose direct risks to supply chains and price stability for key commodities. AGT's strategic focus on pulses, which are naturally less water-intensive and improve soil health, positions it favorably amidst these challenges.

The company's commitment to sustainability extends to waste reduction and circular economy principles. Initiatives like upcycling agricultural byproducts and adopting eco-friendly packaging are crucial for meeting growing consumer demand for environmentally responsible products. By 2023, the global pulses market exceeded $100 billion, with sustainability a key purchasing driver.

AGT's proactive approach to water management, including advanced recycling systems in processing plants, enhances operational resilience against scarcity. This focus on sustainability, coupled with the inherent environmental benefits of pulse cultivation, supports long-term supply chain stability and aligns with global ESG expectations.

PESTLE Analysis Data Sources

Our PESTLE Analysis for AGT Food and Ingredients, Inc. is built on comprehensive data from reputable sources including government agricultural reports, international trade organizations, and leading market research firms. We analyze economic indicators, regulatory changes, and industry-specific trends to provide a robust understanding of the macro-environmental landscape.