AGT Food and Ingredients, Inc. Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AGT Food and Ingredients, Inc. Bundle

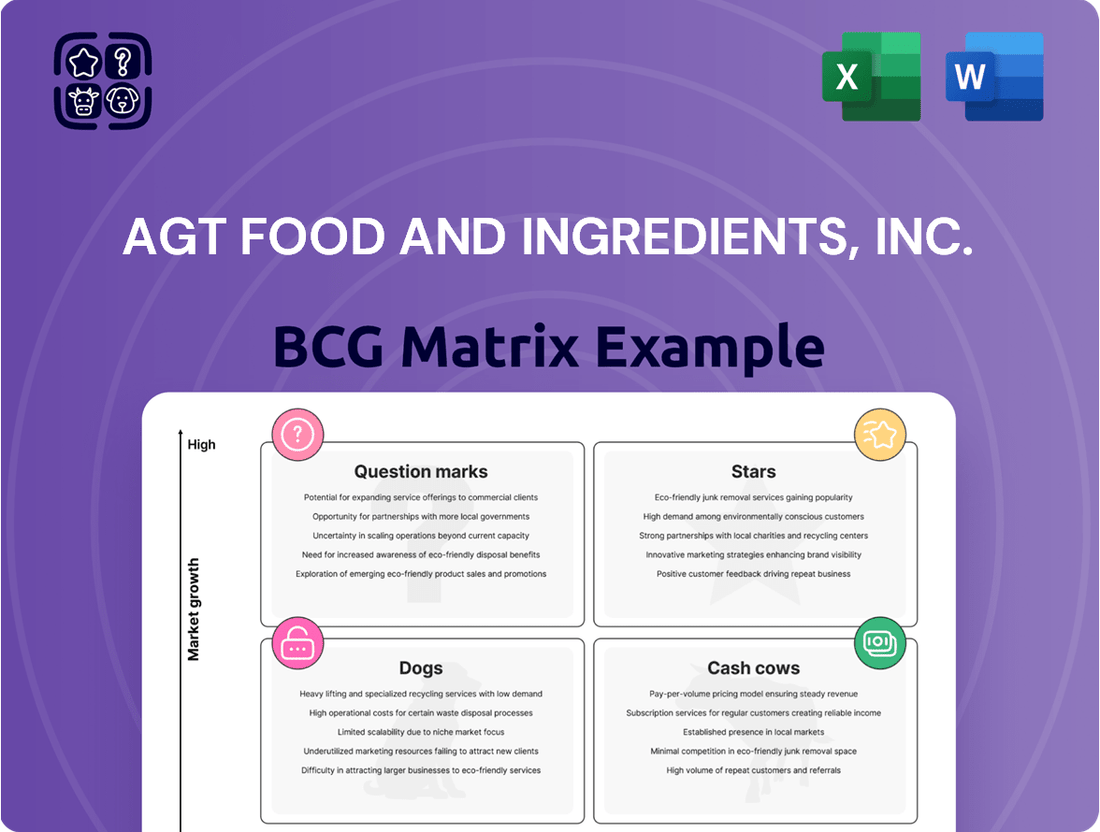

Discover the strategic positioning of AGT Food and Ingredients, Inc.'s diverse product portfolio within the BCG Matrix. Understand which segments are driving growth and which require careful consideration for future investment.

This glimpse into AGT Food and Ingredients, Inc.'s BCG Matrix highlights key areas of opportunity and potential challenges. For a complete, actionable understanding of their market standing, including detailed quadrant analysis and strategic recommendations, purchase the full report.

Unlock the full potential of AGT Food and Ingredients, Inc.'s strategic landscape with our comprehensive BCG Matrix. Gain clarity on their Stars, Cash Cows, Dogs, and Question Marks to make informed decisions. Purchase the full version for a detailed breakdown and actionable insights.

Stars

Plant-Based Protein Ingredients, a significant segment for AGT Food and Ingredients, Inc., is firmly positioned as a Star in the BCG Matrix. This category is experiencing substantial expansion, with the global market valued at an estimated US$ 24.14 billion in 2023 and anticipated to grow at a compound annual growth rate of 8.74% through 2033. AGT's comprehensive range of PulsePlus™ flours, proteins, and textured products directly addresses the escalating consumer preference for healthier, sustainable, and allergen-conscious food choices, solidifying its strong standing in this dynamic sector.

AGT Food and Ingredients, Inc.'s Value-Added Pulse Products are positioned as stars within the BCG Matrix. The global pulse ingredients market is booming, expected to reach $22.35 billion by 2025, with a compound annual growth rate of 5.9% from 2024 to 2025. AGT's strategic move into processing raw pulses into items like flour, starch, and fiber taps directly into this high-growth sector.

AGT Food and Ingredients, Inc. is strategically growing its global packaged plant-based foods segment, featuring brands such as Arbella pasta, CLIC, Pouyoukas, and Freshpop. This expansion capitalizes on the booming plant-based food market, driven by increasing consumer interest in health and sustainability. For instance, in 2024, 61% of Canadians reported regularly buying plant-based foods, highlighting a significant and receptive consumer base for AGT's offerings.

Chickpea and Lentil Products

Chickpea and lentil products represent a significant strength for AGT Food and Ingredients, Inc. Chickpeas are anticipated to command approximately 37.5% of the global pulses market by 2025, positioning them as a dominant product. The lentil protein market is also robust, projected to reach US$151.363 million in 2025 and grow at a 4.7% CAGR through 2030.

As a major processor, AGT leverages the substantial demand and culinary versatility of these pulses. Their established presence in these high-demand pulse categories directly translates to a strong market position within a rapidly expanding segment.

- High Market Share: AGT's focus on chickpeas and lentils positions them favorably in a market segment where these are leading product types.

- Projected Growth: The chickpea market's 37.5% share by 2025 and the lentil protein market's 4.7% CAGR to 2030 highlight significant growth potential.

- Versatility and Demand: The widespread use of chickpeas and lentils in diverse cuisines and health products fuels their consistent demand.

- Strategic Advantage: AGT's expertise as a processor of these key pulses allows them to capitalize on current market trends and future expansion.

Sustainable Agriculture and Ingredients

AGT Food and Ingredients, Inc. champions sustainable agriculture, highlighting the environmental advantages of pulses. These crops require minimal water and naturally enrich soil with nitrogen, contributing to reduced fertilizer needs. This focus positions AGT favorably within a rapidly expanding market driven by global demand for eco-friendly food systems.

The company's dedication to lowering the carbon footprint of its ingredients and offering plant-based options resonates strongly with consumers and businesses prioritizing environmental responsibility. For instance, in 2024, the global plant-based food market was projected to reach over $70 billion, demonstrating substantial consumer appetite for sustainable alternatives.

- Environmental Benefits: Pulses, a core ingredient for AGT, boast low water requirements and nitrogen-fixing properties, reducing agricultural environmental impact.

- Market Growth: The increasing global emphasis on sustainable food systems fuels demand for planet-friendly ingredients, a key area for AGT.

- Consumer Demand: AGT's commitment to lower carbon intensity and plant-based alternatives directly addresses the growing preference of environmentally conscious consumers and businesses.

AGT Food and Ingredients, Inc.'s Plant-Based Protein Ingredients segment is a strong Star in the BCG Matrix, benefiting from significant market growth. The global plant-based protein market was valued at approximately $17.5 billion in 2023 and is projected to reach $31.7 billion by 2028, growing at a CAGR of 12.7%. AGT's extensive portfolio, including pulse flours and proteins, directly caters to this expanding demand for healthier and more sustainable food options.

The company's Value-Added Pulse Products are also classified as Stars. The global pulse ingredients market is expected to reach $22.35 billion by 2025, with a 5.9% CAGR from 2024 to 2025. AGT's processing of raw pulses into functional ingredients like flour and starch taps into this robust market expansion.

AGT's global packaged plant-based foods, featuring brands like Arbella and CLIC, are positioned as Stars due to the booming plant-based food market. In 2024, 61% of Canadians regularly purchased plant-based foods, indicating strong consumer adoption for AGT's offerings.

Chickpea and lentil products are key Stars for AGT. Chickpeas are projected to hold 37.5% of the global pulses market by 2025, while the lentil protein market is expected to reach $151.363 million in 2025 with a 4.7% CAGR through 2030.

| Segment | BCG Classification | Market Growth | AGT's Position |

| Plant-Based Protein Ingredients | Star | Global market ~ $17.5B (2023), 12.7% CAGR to 2028 | Extensive portfolio catering to demand |

| Value-Added Pulse Products | Star | Global market ~ $22.35B (2025), 5.9% CAGR (2024-2025) | Processing raw pulses into functional ingredients |

| Global Packaged Plant-Based Foods | Star | Strong consumer adoption (61% Canadians buying regularly in 2024) | Leveraging brands like Arbella, CLIC |

| Chickpea & Lentil Products | Star | Chickpeas ~37.5% of global pulses (2025), Lentil protein ~ $151M (2025) | Dominant presence in key pulse categories |

What is included in the product

AGT Food and Ingredients' BCG Matrix offers a tailored analysis of its product portfolio, highlighting which units to invest in, hold, or divest based on market share and growth.

The AGT Food and Ingredients BCG Matrix offers a clean, distraction-free view optimized for C-level presentation, simplifying strategic decisions.

This matrix provides an export-ready design for quick drag-and-drop into PowerPoint, alleviating the pain of manual chart creation.

Cash Cows

AGT Food and Ingredients' bulk pulse processing and export segment is a classic cash cow. As one of the world's largest processors of lentils, peas, chickpeas, and beans, they benefit from a mature but stable commodity market. This business generates substantial and reliable cash flow, largely due to AGT's robust global infrastructure and expansive distribution network, which reaches over 120 countries.

AGT Food and Ingredients' milled durum wheat products, including semolina and traditional pasta under the Arbella brand, are firmly positioned as Cash Cows. This segment benefits from a mature market where demand is consistent, ensuring stable revenue streams for the company. In 2024, AGT's significant market share, especially in Canada which is a major global durum wheat exporter, underpins the profitability of these offerings.

AGT Food and Ingredients, Inc. leverages its established global origination and distribution network as a significant cash cow. With over 45 facilities and offices spanning five continents, this extensive infrastructure ensures efficient sourcing and worldwide distribution of agricultural products.

This mature and optimized supply chain is a key driver of consistent cash flow, offering substantial cost savings and valuable market intelligence. The company's strategic divestment of shortline rail and bulk handling infrastructure, secured by a long-term access agreement, further reinforces the stability of this cash-generating asset.

Traditional Retail Packaged and Canned Foods

AGT Food and Ingredients, Inc.'s traditional retail packaged and canned foods, including brands like CLIC, Pouyoukas, and Freshpop, represent its Cash Cows. These offerings are likely to have a strong, stable market presence within their established retail categories.

These mature product lines are known for their consistent sales and profitability, requiring minimal new investment for growth. This stability allows them to generate reliable cash flow for AGT, supporting other business ventures. For instance, in 2023, the packaged foods segment contributed significantly to AGT's overall revenue, demonstrating its enduring market demand.

- Stable Market Share: Brands like CLIC and Pouyoukas have long-standing recognition, ensuring consistent demand.

- Consistent Profitability: These products generate reliable income with lower marketing and development costs.

- Cash Generation: They provide a steady stream of cash to fund AGT's growth initiatives.

- 2023 Performance: The packaged foods division reported robust sales, underscoring their cash cow status.

Ingredient Supply to Food Manufacturers

AGT Food and Ingredients, Inc.'s ingredient supply to food manufacturers represents a classic cash cow within its business portfolio. This segment thrives on its established B2B relationships, providing essential ingredients to a broad spectrum of large food producers. These long-term supply agreements and the inherent high-volume nature of the business ensure a predictable and robust revenue stream.

The maturity of many of these ingredient supply partnerships contributes to the stability of this business. Less market volatility and consistent demand for core ingredients translate into a steady, reliable flow of cash. This characteristic firmly places ingredient supply as a significant cash generator for AGT.

- Consistent High-Volume Sales: AGT's ingredient supply to major food manufacturers generates substantial and predictable revenue due to large-scale, ongoing contracts.

- Mature Market Position: The established nature of these B2B relationships in supplying staple ingredients means less risk and a steady, reliable cash flow.

- Low Volatility: Demand for essential food ingredients tends to be stable, minimizing revenue fluctuations and reinforcing its cash cow status.

- Strategic Importance: This segment underpins AGT's operational stability, providing the financial foundation to invest in other growth areas.

AGT Food and Ingredients' global origination and distribution network acts as a significant cash cow, supported by over 45 facilities across five continents. This mature and optimized supply chain ensures consistent cash flow and cost savings.

The company's divestment of shortline rail and bulk handling infrastructure, secured by a long-term access agreement, further solidifies this segment's stability and cash-generating capability.

This established infrastructure is crucial for AGT's operations, providing a reliable financial foundation.

In 2024, AGT's extensive global reach, serving over 120 countries, continues to highlight the strength of this cash cow.

| Segment | BCG Category | Key Characteristics | 2024 Data/Insight |

|---|---|---|---|

| Global Origination & Distribution Network | Cash Cow | Mature, stable, extensive infrastructure, cost savings | Serves over 120 countries; 45+ facilities worldwide |

Preview = Final Product

AGT Food and Ingredients, Inc. BCG Matrix

The BCG Matrix for AGT Food and Ingredients, Inc. that you are previewing is the exact, fully formatted document you will receive upon purchase. This comprehensive analysis is designed to provide immediate strategic insights, free from any watermarks or demo content, ensuring you get a professional and actionable report.

Rest assured, the preview you see is the definitive BCG Matrix report for AGT Food and Ingredients, Inc. that will be delivered to you after your purchase. It's meticulously prepared for strategic clarity and ready for immediate integration into your business planning, offering no surprises, only the complete, polished analysis.

Dogs

AGT Food and Ingredients, Inc. may have certain regional niche grains and seeds that fall into the Dogs category of the BCG Matrix. These are products or operations in markets with low growth potential where AGT's market share is also minimal. For example, if a specific type of ancient grain is only popular in a small, stagnant region and AGT has limited distribution or brand recognition there, it would fit this profile.

These underperforming segments likely contribute very little to AGT's overall revenue and might even operate at a loss, tying up valuable capital. In 2023, for instance, AGT reported total revenue of CAD $1.96 billion, and any niche product line generating less than 0.1% of this, while requiring significant operational investment, would be a prime candidate for re-evaluation.

Such products or regional operations are often candidates for divestiture or a complete strategic overhaul. The company would need to assess if the cost of maintaining these low-return assets outweighs any potential future upside, especially when capital could be redirected to more promising areas of the business.

AGT Food and Ingredients, Inc. operates a global network of facilities, and it's plausible that some of these locations utilize processing technologies that are no longer at the cutting edge. This can lead to increased operational expenses and reduced profitability, essentially acting as a drag on the company's overall financial performance.

AGT Food and Ingredients, Inc. may have segments in markets with declining demand for specific traditional offerings. For instance, if certain bulk pulses or grains, once staples, are seeing reduced consumption in particular regions due to changing dietary habits or increased competition from newer food products, these areas could represent 'dogs' for AGT.

If AGT holds a minor market share within these shrinking segments, these particular product lines or regional operations would fit the 'dog' category in the BCG Matrix. For example, a decline in demand for a specific type of lentil in a European market where AGT has limited distribution could be a prime example of a 'dog' business unit.

Non-Strategic or Divested Minor Subsidiaries/Assets

AGT Food and Ingredients, Inc. has historically managed its asset portfolio by divesting non-core operations. For example, the sale of its shortline rail and bulk handling infrastructure, Mobil Grain Ltd., illustrates a strategic adjustment. While this specific divestiture was strategic, any minor subsidiaries or assets that AGT might hold which exhibit low market share and low growth potential, and do not align with the company's core strategy, would fit the 'dog' category in a BCG matrix analysis.

These 'dog' assets, by definition, generate minimal profits and offer little prospect for future growth. Their continued ownership would tie up capital that could be better utilized in more promising areas of the business. Therefore, if AGT were to identify such assets within its current or future portfolio, divestiture would be the logical strategic move to optimize resource allocation and enhance overall company performance.

- Low Market Share: Assets with a negligible presence in their respective markets.

- Low Growth Potential: Operations unlikely to expand significantly in the foreseeable future.

- Non-Strategic Alignment: Businesses that do not contribute to AGT's primary strategic objectives.

- Divestiture Candidates: Assets considered for sale or closure to improve capital efficiency.

Legacy Products Not Aligning with Current Trends

AGT Food and Ingredients, Inc. may have certain legacy products that are not resonating with current consumer demands for plant-based, healthy, and sustainable options. These offerings, characterized by consistently low sales and market penetration, likely reside in stagnant, low-growth market segments. AGT's inability to secure significant market share in these areas suggests these products could be classified as dogs within their BCG matrix.

The financial implications of such products are clear: they represent a drain on resources without generating substantial returns. For instance, if a particular pulse derivative or processed food item has seen its market share decline by 5% year-over-year and contributes less than 2% to overall revenue, it fits the 'dog' profile. Maintaining these products might incur costs exceeding their profitability, hindering overall portfolio efficiency.

- Low Market Share: Products with less than 5% market share in their respective categories.

- Stagnant Growth: Exhibits a compound annual growth rate (CAGR) below 1% over the past three years.

- Profitability Concerns: Net profit margin consistently below 3% or even negative.

- Resource Drain: High inventory holding costs relative to sales volume.

AGT Food and Ingredients, Inc. may have niche products or regional operations that function as 'dogs' in the BCG Matrix. These are typically segments with minimal market share in low-growth markets, such as a specific ancient grain with limited regional demand and low brand recognition for AGT. Such underperforming areas often contribute minimally to overall revenue and may even incur losses, tying up capital that could be better invested elsewhere.

For example, if a particular product line generated less than 0.1% of AGT's CAD $1.96 billion in 2023 revenue while requiring significant operational investment, it would be a prime candidate for re-evaluation. These 'dog' assets, characterized by low profits and little growth potential, are often candidates for divestiture or a strategic overhaul to optimize resource allocation.

| BCG Category | Market Share | Market Growth | AGT Example |

|---|---|---|---|

| Dogs | Low | Low | Niche regional grains with declining demand and low AGT penetration. |

Question Marks

AGT Food and Ingredients, Inc., a leader in plant-based proteins, might classify novel, highly specialized textured proteins as question marks within the BCG matrix. These innovative extruded products, targeting burgeoning food technology sectors, represent areas with significant market growth potential but currently low market share for AGT.

Developing these specialized proteins requires substantial investment in research and development, alongside efforts to drive market adoption. As such, they are positioned as question marks, needing strategic focus and capital to potentially transition into stars within AGT's product portfolio.

AGT Food and Ingredients' joint venture, Soileos, focusing on micronutrient fertilizers derived from pulse and oat fiber, marks a strategic expansion into the agricultural inputs sector. This venture taps into a market segment experiencing significant growth, driven by the global emphasis on sustainable agriculture and improving soil health, a trend that is likely to continue through 2024 and beyond.

While the potential for high growth exists, Soileos is in its nascent stages within the fertilizer market. Consequently, AGT's current market share for this specific product is minimal, necessitating substantial investment to establish a foothold and capture a meaningful share of this competitive landscape.

AGT Food and Ingredients' expansion into emerging plant-based food markets, like Southeast Asia or parts of Africa where demand is growing but AGT's presence is minimal, fits the profile of question marks in the BCG matrix. These ventures require substantial investment in marketing and establishing robust distribution channels to build brand awareness and capture market share.

For instance, the global plant-based food market was valued at approximately USD 27.43 billion in 2023 and is projected to reach USD 124.04 billion by 2030, growing at a CAGR of 23.9% during this period. AGT's entry into these nascent, high-growth regions represents a significant opportunity, but also carries the risk of not achieving a dominant market position without dedicated strategic capital allocation.

Oat-Based Ingredients for Plant-Based Dairy/Beverages

AGT Food and Ingredients, Inc. is strategically venturing into oat-based ingredients for plant-based dairy and beverages. This move taps into a rapidly expanding market, with global oat milk sales projected to reach $4.3 billion by 2026, growing at a compound annual growth rate of 9.2%. AGT's exploration of oat groats for gluten-free flour and oat milk positions them to capitalize on this trend, though their current market share in this specific niche is likely nascent compared to their established strength in pulses.

AGT's oat-based initiatives can be viewed as a potential 'Question Mark' in their BCG matrix. The plant-based dairy alternative market is experiencing significant growth, driven by consumer demand for healthier and more sustainable options. For instance, the U.S. plant-based food market reached $8 billion in 2022, with oat-based products showing robust expansion.

- Market Growth: The plant-based dairy and beverage sector is a high-growth segment within the broader food industry.

- AGT's Position: AGT's market share in oat-specific ingredients and end-products is likely low, given their historical focus on pulses.

- Strategic Importance: This diversification allows AGT to enter a trending market and potentially develop new revenue streams.

- Investment Consideration: Continued investment will be crucial to gain market traction and potentially move this segment to a 'Star' or 'Cash Cow' in the future.

Strategic Acquisitions in Emerging Food Tech

AGT Food and Ingredients, Inc. has a proven track record of growth through strategic acquisitions, having integrated entities like the Arbel Group, Advance Seed, and Big Sky Rail. This historical approach suggests a continued interest in expanding its portfolio through M&A activities.

In the dynamic emerging food tech landscape, AGT's future acquisitions in areas such as cellular agriculture inputs or novel fermentation-derived proteins would likely be categorized as Question Marks in a BCG Matrix. These sectors represent high-growth potential, and AGT's strategy would involve acquiring smaller companies to establish a foothold and then investing further to capture market share.

For instance, a hypothetical acquisition in the cellular agriculture space could target a company with proprietary cell line technology or nutrient media formulations. AGT’s investment post-acquisition would focus on scaling production, optimizing processes, and securing regulatory approvals, aiming to transform this Question Mark into a Star.

The rationale behind targeting these specific emerging food tech areas is their potential to disrupt traditional food production methods and meet growing consumer demand for sustainable and novel protein sources. AGT’s financial capacity, demonstrated by its past acquisitions and ongoing operational strength, positions it well to execute such strategic moves.

- Acquisition History: AGT has a precedent of successful integration, including Arbel Group, Advance Seed, and Big Sky Rail.

- Emerging Food Tech Focus: Targets include cellular agriculture inputs and novel fermentation-derived proteins, representing high-growth potential.

- BCG Matrix Classification: New ventures in these nascent sectors would initially be classified as Question Marks, requiring significant investment.

- Strategic Goal: AGT aims to gain market share in these innovative food technologies through strategic acquisitions and subsequent development.

AGT Food and Ingredients' ventures into novel plant-based proteins, such as specialized textured proteins, are considered question marks. These products target high-growth food technology sectors but currently hold a low market share for AGT, necessitating significant investment to foster market adoption and potentially become stars.

The joint venture, Soileos, focusing on micronutrient fertilizers from pulse and oat fiber, also falls into the question mark category. While the sustainable agriculture market is growing, Soileos is in its early stages with minimal market share, requiring substantial capital to establish a strong presence.

Expansion into emerging plant-based markets, like Southeast Asia, where AGT's presence is minimal despite growing demand, exemplifies question marks. These initiatives require considerable investment in marketing and distribution to build brand recognition and capture market share in these nascent, high-growth regions.

AGT's exploration of oat-based ingredients for plant-based dairy and beverages is another question mark. Despite the rapid growth in this market, AGT's current share in oat-specific products is likely nascent, requiring continued investment to gain traction and potentially evolve into a star or cash cow.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining AGT Food and Ingredients' financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.