AGT Food and Ingredients, Inc. Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AGT Food and Ingredients, Inc. Bundle

AGT Food and Ingredients, Inc. faces a dynamic industry landscape, with moderate bargaining power from both buyers and suppliers impacting its profitability. The threat of new entrants is present but somewhat mitigated by capital requirements and established distribution networks.

The complete report reveals the real forces shaping AGT Food and Ingredients, Inc.’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

AGT Food and Ingredients' reliance on key agricultural commodities like lentils, peas, and durum wheat could see suppliers wielding considerable power if the sourcing base is concentrated. For instance, if a significant portion of their pea supply originates from a few large farms or a specific geographic region, those suppliers could dictate terms more effectively.

This concentration is a critical factor. Should a limited number of growers control a substantial share of the market for AGT's essential inputs, they gain leverage. This leverage translates into the ability to influence pricing and contract conditions, particularly if finding comparable alternative sources is difficult or involves substantial costs for AGT.

The uniqueness of raw materials significantly impacts AGT Food and Ingredients, Inc.'s supplier bargaining power. If specific pulse varieties or durum wheat strains require specialized cultivation or possess unique quality attributes that only a limited number of suppliers can consistently provide, these suppliers gain considerable leverage. This is especially true for AGT's premium or specialty food ingredient lines, where precise characteristics are paramount for product differentiation and consumer appeal.

AGT Food and Ingredients, Inc., like all agribusinesses, faces significant risks from weather and climate. For instance, a severe drought in a key growing region in 2024 could drastically reduce the availability of essential grains, directly impacting AGT's raw material costs and supply chain stability. This scarcity empowers the farmers and suppliers of these affected crops, allowing them to command higher prices.

Supplier's Forward Integration Threat

Suppliers of raw pulses and durum wheat might integrate forward into processing and value-added activities, directly competing with AGT Food and Ingredients. This threat means AGT could face reduced access to essential raw materials or find themselves competing against their own suppliers in the finished product market. For instance, a major pulse supplier might invest in milling and packaging operations, cutting out AGT's role in that stage.

- Forward Integration Risk: Suppliers could develop their own processing capabilities, diminishing AGT's sourcing advantage.

- Competitive Pressure: AGT might face increased competition from suppliers in downstream markets.

- Market Dynamics: Such integration could shift market power, potentially increasing raw material costs for AGT or limiting their product offerings.

Importance of Supplier Relationships

AGT Food and Ingredients, Inc. can significantly reduce the bargaining power of its suppliers by cultivating long-term, strategic partnerships with farmers and agricultural cooperatives. These relationships can secure a consistent supply of raw materials and potentially lead to more predictable pricing structures, insulating the company from volatile market fluctuations.

Conversely, a heavy reliance on spot market purchases exposes AGT Food and Ingredients to the full force of supplier pricing power. In 2024, global agricultural commodity prices experienced notable volatility due to factors like weather patterns and geopolitical events, underscoring the importance of supply chain stability.

- Strategic Farmer Partnerships: AGT's commitment to long-term contracts with key agricultural producers can lock in supply and pricing.

- Cooperative Engagement: Collaborating with agricultural cooperatives enhances bargaining leverage for AGT through aggregated purchasing power.

- Spot Market Vulnerability: Dependence on the spot market in 2024, where prices can swing rapidly, directly increases supplier influence.

- Supply Chain Resilience: Building robust relationships is crucial for mitigating the impact of external shocks on raw material availability and cost.

AGT Food and Ingredients, Inc.'s supplier bargaining power is influenced by the concentration of its raw material sources. If a few large farms or cooperatives dominate the supply of key commodities like lentils or durum wheat, they can exert significant price control. For instance, in 2024, adverse weather events in major growing regions led to reduced yields, increasing the leverage of suppliers who managed to produce a stable crop.

The uniqueness of AGT's required inputs also plays a role; specialty pulse varieties or specific durum wheat grades that are difficult to source elsewhere empower those suppliers. Furthermore, the risk of suppliers integrating forward into processing, thereby competing with AGT directly, strengthens their negotiating position by controlling both raw material and early-stage processing stages.

| Factor | Impact on AGT | 2024 Context Example |

|---|---|---|

| Supplier Concentration | High concentration increases supplier leverage. | Reduced supply of peas due to regional drought in 2024 empowered remaining suppliers. |

| Input Uniqueness | Specialty inputs give unique suppliers more power. | Premium pulse varieties for health food markets are sourced from limited, specialized growers. |

| Forward Integration | Suppliers moving downstream can reduce AGT's control. | A key pulse supplier in 2024 began offering pre-packaged flour mixes, challenging AGT's market. |

What is included in the product

This analysis unpacks the competitive forces impacting AGT Food and Ingredients, Inc., detailing supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the food and ingredients sector.

Gain immediate clarity on competitive pressures within the food and ingredients sector, allowing AGT Food and Ingredients, Inc. to proactively address potential threats.

Visualize the impact of supplier and buyer power, enabling AGT Food and Ingredients, Inc. to negotiate more favorable terms and mitigate risks.

Customers Bargaining Power

AGT Food and Ingredients benefits from a widely diversified customer base, encompassing retailers, food manufacturers, and distributors across the globe. This broad reach significantly diminishes the bargaining power of any individual customer. For instance, in 2023, AGT reported that its top ten customers accounted for approximately 30% of its total sales, indicating a healthy spread and reducing dependence on any single entity.

For food manufacturers relying on AGT Food and Ingredients, Inc. for essential components like pulse flours or specialized proteins, the cost and effort involved in switching suppliers can be significant. These costs can include reformulating existing products, re-validating new ingredient sources, and potentially facing disruptions to established production schedules. This creates moderate switching costs for AGT's customers.

These switching costs effectively limit a customer's ability to exert extreme pressure for drastic price reductions. In 2024, the global pulse ingredient market saw continued demand, with companies like AGT benefiting from the trend towards plant-based foods, further solidifying the value proposition for their established ingredient lines.

AGT Food and Ingredients, Inc. faces significant customer bargaining power, largely driven by the price sensitivity of end consumers. Even though AGT's direct buyers are typically large food manufacturers or retailers, these businesses are acutely aware of the price pressures from their own customers, the everyday shoppers.

This sensitivity trickles up the supply chain. Retailers and food processors, needing to maintain competitive pricing on finished goods, will push back on AGT for lower ingredient costs, particularly for high-volume, standardized products like grains and pulses. For example, in 2024, consumer inflation continued to impact grocery spending, making price a critical factor for many households.

This dynamic forces AGT to be highly competitive on pricing for its bulk commodity offerings. The ability of end consumers to easily switch between brands based on price ultimately empowers retailers and manufacturers to negotiate more aggressively with their suppliers, including AGT.

Availability of Substitutes for Customers

The availability of substitutes for AGT Food and Ingredients, Inc. significantly impacts customer bargaining power. Customers can source similar pulse-based ingredients or explore alternative plant-based protein options from various suppliers. This broadens their choices, allowing them to negotiate more favorable terms by leveraging competition among ingredient providers.

The expanding plant-based protein market in 2024 presents a dynamic landscape for AGT. As more companies enter this sector, customers gain an increased number of suppliers to choose from. This competitive environment empowers customers to switch providers if they do not receive satisfactory pricing or terms, thereby increasing their leverage over AGT.

- Increased Supplier Competition: The growth of the plant-based protein market means customers have more options beyond AGT.

- Price Sensitivity: With readily available substitutes, customers are more likely to prioritize price when making purchasing decisions.

- Negotiation Leverage: Customers can use the availability of alternatives to negotiate better pricing and contract terms with AGT.

Customer's Backward Integration Threat

The threat of backward integration by large food manufacturers looms as a significant factor in AGT Food and Ingredients' customer bargaining power. If major buyers, such as large food conglomerates, find it more economical or strategically beneficial to establish their own pulse processing facilities, they gain considerable leverage. This potential shift could reduce their reliance on AGT, impacting pricing and contract terms.

While backward integration demands substantial capital investment and expertise in pulse processing, it remains a viable strategic option for powerful customers. This capability would allow them to control a critical part of their supply chain, potentially securing supply and managing costs more effectively. For AGT, this means customers can credibly threaten to bring processing in-house, thereby strengthening their negotiating position.

- Backward Integration Threat: Large food manufacturers may develop their own pulse processing capabilities, reducing reliance on AGT.

- Customer Leverage: This threat gives major customers more bargaining power in negotiations with AGT Food and Ingredients.

- Strategic Consideration: Such integration is considered when it becomes more cost-effective or strategically advantageous for the customer.

AGT Food and Ingredients' customers, particularly large food manufacturers and retailers, possess considerable bargaining power. This is amplified by the price sensitivity of end consumers, a factor that directly influences the negotiation leverage of AGT's direct buyers. The company's diverse product portfolio, while beneficial, also means customers can often find alternative suppliers for many of its core ingredients, especially as the plant-based market expands.

The threat of backward integration by major customers, where they might establish their own processing facilities, further bolsters customer leverage. This potential move would allow them to control supply and costs more directly, reducing their dependence on AGT. In 2024, the ongoing consumer focus on value due to inflation means customers are more inclined to push for lower ingredient prices.

For instance, in 2023, AGT's top ten customers represented about 30% of its sales, highlighting a degree of concentration that can empower these larger buyers. The availability of substitute ingredients and the increasing number of suppliers in the growing plant-based sector in 2024 also provide customers with viable alternatives, strengthening their negotiating position.

| Factor | Impact on AGT | Customer Leverage |

|---|---|---|

| End Consumer Price Sensitivity | Pressure on AGT for lower ingredient costs. | High |

| Availability of Substitutes | Customers can switch suppliers more easily. | Moderate to High |

| Backward Integration Threat | Customers may control processing internally. | Moderate |

| Customer Concentration (Top 10 Customers) | Larger buyers have more influence. | Moderate |

What You See Is What You Get

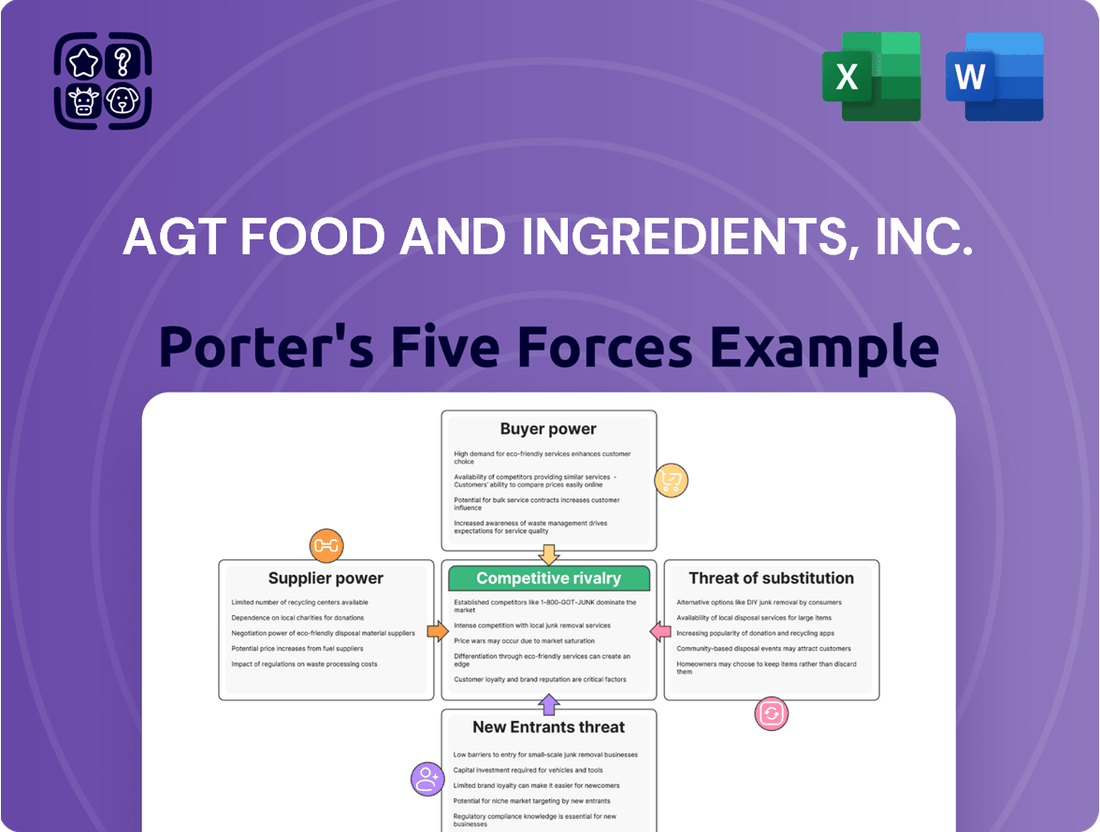

AGT Food and Ingredients, Inc. Porter's Five Forces Analysis

This preview displays the complete Porter's Five Forces Analysis for AGT Food and Ingredients, Inc., offering a thorough examination of competitive forces within the industry. You're looking at the actual document; once purchased, you’ll get instant access to this exact, professionally formatted file. This analysis details the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of existing rivalry, providing actionable insights for strategic planning.

Rivalry Among Competitors

The pulse and plant-based protein processing sector is a dynamic arena, featuring formidable global giants like Ingredion and Bunge Global alongside a multitude of agile, smaller regional competitors. This diverse competitive makeup means AGT Food and Ingredients, Inc. navigates a landscape where intense price competition is a constant, directly impacting profit margins.

The plant-based protein and pulse ingredients markets are booming. The plant-based protein market is expected to surge from $52.08 billion in 2024 to $64.07 billion in 2025. This rapid expansion can ease rivalry by allowing companies to grow by capturing new demand rather than fighting for existing customers.

AGT Food and Ingredients distinguishes itself through value-added processing and a diverse ingredient portfolio, moving beyond simple commodity sales. This specialization allows for a degree of product differentiation, offering customers unique solutions. For instance, their focus on pulse-based ingredients caters to growing demand for plant-based proteins.

However, the competitive landscape is dynamic. If rivals can match AGT's quality, functional ingredient offerings, or innovative plant-based product development, the pressure intensifies. This often leads to increased rivalry, forcing companies to compete more aggressively on price or customer service to retain market share. In 2023, the global pulse ingredient market was valued at an estimated USD 15.6 billion, indicating a substantial market where differentiation is key.

Exit Barriers

AGT Food and Ingredients, Inc. likely faces significant exit barriers due to the specialized nature of its food processing operations. These facilities, often requiring substantial investment and tailored equipment for specific product lines, make it difficult and costly for companies to simply shut down or repurpose assets if they become unprofitable. This can trap capital and expertise, forcing even struggling firms to remain active players in the market, thereby sustaining competitive pressures.

The capital-intensive nature of the food processing industry itself acts as a considerable exit barrier. AGT, involved in various stages from sourcing to processing, would have invested heavily in infrastructure, machinery, and logistics. For instance, in 2023, the global food processing market was valued at approximately $700 billion, highlighting the significant capital required to operate within this sector. This financial commitment means that exiting the market isn't a simple decision, as companies must contend with the potential loss of these substantial investments.

- Specialized Facilities: High upfront costs for processing equipment and dedicated plants create a barrier to exit, as these assets have limited alternative uses.

- Capital Intensity: The significant investment in machinery, technology, and infrastructure within the food processing sector makes it economically challenging to divest or abandon operations.

- Long-Term Contracts: Existing agreements with suppliers or major customers can obligate companies to continue operations, even if they are not performing optimally, thus hindering a swift exit.

- Brand and Reputation: The established brand equity and customer relationships that AGT has cultivated also represent an intangible asset that is difficult to liquidate, potentially influencing decisions to exit.

Strategic Alliances and Acquisitions

The competitive landscape for AGT Food and Ingredients is increasingly shaped by strategic alliances and acquisitions. Companies are actively seeking to bolster their product offerings and operational efficiencies through these maneuvers. For instance, in late 2024 and early 2025, AGT itself divested its rail and bulk handling infrastructure. This strategic decision signals a potential shift in its competitive approach, allowing it to concentrate on its core processing operations and potentially streamline its supply chain.

These industry-wide consolidation trends can significantly alter market dynamics. Companies that successfully integrate acquired businesses or forge strong partnerships can gain substantial advantages in terms of market share, technological capabilities, and cost structures. AGT's move, therefore, should be viewed within this broader context of industry players strategically repositioning themselves to enhance their competitive standing and adapt to evolving market demands.

- Strategic Consolidation: The food and ingredients sector is witnessing a surge in mergers, acquisitions, and strategic partnerships as companies aim to achieve economies of scale and broaden their market reach.

- Portfolio Enhancement: These alliances and acquisitions are often driven by a desire to strengthen product portfolios, gain access to new technologies, or enter emerging markets.

- Operational Focus: AGT's divestiture of its rail and bulk handling infrastructure in late 2024/early 2025 exemplifies a strategic pivot towards core processing capabilities, potentially leading to greater operational agility and specialization.

- Competitive Repositioning: Such strategic moves can significantly impact a company's competitive positioning by allowing it to focus resources on key strengths and adapt more effectively to market changes.

The competitive rivalry within the pulse and plant-based protein sector is intense, driven by a mix of large global players and smaller, agile competitors. AGT Food and Ingredients, Inc. operates in a market where price competition is a constant factor, directly influencing profit margins. The expanding plant-based protein market, projected to grow from $52.08 billion in 2024 to $64.07 billion in 2025, offers opportunities for growth, potentially easing some competitive pressures.

AGT differentiates itself through value-added processing and a diverse ingredient portfolio, moving beyond basic commodities to offer specialized solutions, particularly in pulse-based ingredients. However, if competitors can match AGT's quality and innovation, rivalry escalates, forcing a focus on price and customer service. The global pulse ingredient market, valued at an estimated $15.6 billion in 2023, underscores the importance of differentiation.

The industry faces significant exit barriers due to capital-intensive, specialized facilities, making it costly for firms to leave the market. This can prolong competitive pressures. Furthermore, strategic alliances and acquisitions are reshaping the landscape, with companies like AGT divesting non-core assets, such as its rail and bulk handling infrastructure in late 2024/early 2025, to focus on core processing capabilities and enhance competitive positioning.

| Market Segment | 2023 Value (USD Billion) | Projected 2025 Value (USD Billion) | Key Competitive Factor |

|---|---|---|---|

| Global Pulse Ingredients | 15.6 | N/A | Differentiation & Value-Added Processing |

| Global Plant-Based Protein | 52.08 (2024) | 64.07 | Innovation & Market Share Capture |

SSubstitutes Threaten

The threat of substitutes for AGT Food and Ingredients, Inc. is significant, primarily stemming from a diverse range of alternative protein sources. These include widely adopted options like soy, pea, rice, and hemp proteins, which are actively incorporated into the burgeoning plant-based food market. As the global demand for plant-based alternatives continues to surge, consumers and food manufacturers alike have an expanding menu of protein choices, directly impacting the market share for pulse-based ingredients.

The threat of substitutes for AGT Food and Ingredients, Inc. is amplified by the price-performance trade-off. If alternative ingredients can match AGT's nutritional value, functional properties, or taste at a more competitive price, they become a significant concern for food manufacturers. For instance, in 2024, the global plant-based protein market, a key area for AGT, saw continued growth, with innovations in pea and fava bean protein offering cost-effective alternatives to traditional sources.

Continuous innovation within the food ingredient sector constantly introduces new options that can substitute AGT's offerings. This includes the development of novel protein sources derived from fermentation or algae, as well as advancements in functional ingredients that mimic the texture or binding properties of AGT's products. For example, reports from late 2024 highlighted a surge in investment for cell-cultured ingredients, which, while still nascent, could eventually present a disruptive substitute.

Consumer preferences are shifting dramatically, with a growing demand for clean-label, natural, and sustainable ingredients, alongside specific health benefits. While AGT Food and Ingredients' pulse-based products align well with these trends, other food ingredients can also cater to evolving dietary habits, such as the rise of flexitarianism. For instance, the global plant-based food market, a significant area for substitutes, was projected to reach $74.2 billion in 2025, indicating a strong competitive landscape for alternative ingredients.

Technological Advancements in Food Science

Technological advancements in food science, particularly in areas like precision fermentation and cellular agriculture, are creating innovative protein alternatives. These emerging technologies have the potential to significantly disrupt traditional plant-based protein markets over time.

These new methods could yield products with enhanced functional characteristics or more environmentally friendly production processes. For instance, by 2024, the global alternative protein market is projected to reach substantial figures, indicating a growing acceptance and investment in these disruptive technologies.

- Precision Fermentation: Utilizes microorganisms to produce specific proteins, like dairy or egg proteins, without the need for traditional animal farming.

- Cellular Agriculture: Involves growing meat or seafood directly from animal cells, bypassing the need for raising and slaughtering animals.

- Market Growth: Projections indicate significant expansion in the alternative protein sector, with some analysts estimating the market could reach hundreds of billions of dollars by the early 2030s, driven by these technological leaps.

- Consumer Adoption: While still nascent, consumer interest and acceptance of these novel food technologies are expected to grow as products become more accessible and their benefits are better understood.

Cross-Industry Substitution

The threat of substitutes for AGT Food and Ingredients extends beyond direct ingredient replacements to encompass a wide range of finished food products. Consumers looking for protein sources, for example, have numerous alternatives to pulse-based items, including traditional meat, dairy products, and other plant-based proteins like soy or pea protein isolates that might be processed differently. This broad substitution landscape means AGT's ingredients are not just competing with other pulse suppliers but with the entire protein and meal solutions market.

In 2024, the global plant-based protein market continued its robust growth, with projections indicating further expansion. For instance, the market for plant-based meat alternatives alone was valued in the tens of billions of dollars and is expected to see double-digit annual growth rates. This signifies a substantial competitive pressure from products that may use different protein bases or even compete directly with the end applications of AGT's pulse ingredients.

- Broad Protein Alternatives: Consumers can opt for beef, chicken, fish, eggs, or dairy as primary protein sources, bypassing pulse-derived ingredients entirely.

- Other Plant-Based Proteins: Soy, pea protein isolates, and hemp protein offer direct competition in functional food applications, often with established consumer familiarity.

- Convenience Foods: Ready-to-eat meals and snacks, regardless of their primary protein source, can substitute for home-prepared meals that might otherwise utilize AGT's ingredients.

- Dietary Trends: Shifting dietary preferences, such as keto or paleo diets, may favor animal proteins or specific low-carb ingredients, reducing demand for pulse-based products.

The threat of substitutes for AGT Food and Ingredients is substantial due to the wide array of alternative protein sources and finished food products available. Innovations in food science, like precision fermentation and cellular agriculture, are continuously introducing novel ingredients that can compete with pulse-based offerings. Consumer preferences also play a key role, with growing demand for diverse dietary options that may not prioritize pulse ingredients.

| Substitute Category | Key Examples | 2024 Market Context/Outlook |

| Other Plant-Based Proteins | Soy protein, pea protein isolates, hemp protein | Global plant-based protein market continued robust growth; pea protein isolates saw significant innovation and cost-effectiveness improvements in 2024. |

| Animal Proteins | Beef, chicken, fish, eggs, dairy | Remain primary protein sources for many consumers, potentially reducing demand for plant-based alternatives in certain dietary trends. |

| Novel Food Technologies | Precision fermentation proteins, cellular agriculture | Emerging technologies receiving substantial investment; cellular agriculture could disrupt markets, though still nascent in 2024. |

| Convenience & Finished Foods | Ready-to-eat meals, snacks (various protein bases) | Offer direct competition to home-prepared meals that might use AGT's ingredients, driven by consumer demand for convenience. |

Entrants Threaten

Entering the pulse processing and value-added food ingredients sector, where AGT Food and Ingredients operates, demands considerable financial resources. Significant capital is needed for specialized equipment, modern processing plants, and robust supply chain networks. For instance, establishing a state-of-the-art pulse processing facility can easily run into tens of millions of dollars, a substantial hurdle for newcomers.

Established players like AGT Food and Ingredients leverage significant economies of scale across their operations. This includes bulk purchasing of raw materials, efficient large-scale processing, and optimized distribution networks, all contributing to lower per-unit production costs. For instance, in 2023, AGT reported revenues of CAD 2.07 billion, indicating a substantial operational footprint that smaller competitors would find difficult to match.

New entrants face a considerable hurdle in achieving comparable cost efficiencies. Without the volume to negotiate favorable terms with suppliers or invest in high-capacity, cost-effective processing facilities, their initial per-unit costs will likely be higher. This cost disadvantage makes it challenging for newcomers to compete on price in the global pulses and specialty ingredients market, where AGT operates.

New entrants to the pulse and durum wheat market, where AGT Food and Ingredients operates, would find it difficult to establish reliable access to raw materials. AGT's strength lies in its deep-rooted relationships with farmers and a sophisticated global sourcing network, ensuring a consistent supply of high-quality ingredients.

Securing comparable supply chains presents a significant hurdle for any new competitor. This is further complicated by increasing climate variability, which directly impacts agricultural yields and the availability of essential crops like pulses and durum wheat, making consistent sourcing a major challenge.

Brand Loyalty and Distribution Channels

AGT Food and Ingredients operates globally, offering both consumer-packaged goods and bulk ingredient solutions. This extensive reach suggests well-established distribution networks and strong relationships with retailers and industrial food manufacturers. For potential new entrants, replicating these established channels and securing comparable market access presents a substantial barrier.

Building significant brand loyalty in the food sector requires consistent quality, effective marketing, and a proven track record, all of which take considerable time and investment. AGT's presence across various product categories likely means consumers recognize and trust their brand, making it harder for newcomers to gain traction.

The threat of new entrants is therefore moderated by the significant capital and time required to build comparable distribution infrastructure and brand equity. For instance, in 2023, the global packaged food market was valued at over $1 trillion, highlighting the scale of investment needed to compete effectively.

- Established Distribution Networks: AGT's global presence necessitates extensive logistics and relationships with retailers and food service providers, which are difficult for new companies to replicate.

- Brand Recognition and Loyalty: Consumers often develop loyalty to food brands based on quality and familiarity, creating a hurdle for new entrants seeking to capture market share.

- Capital Investment: Entering the food industry, particularly with packaged goods, requires substantial investment in manufacturing, marketing, and distribution, deterring many potential new competitors.

Regulatory Hurdles and Food Safety Standards

The threat of new entrants for AGT Food and Ingredients, Inc. is significantly impacted by regulatory hurdles and stringent food safety standards. The global food processing sector operates under a complex web of regulations, including HACCP, ISO 22000, and various national food safety acts, which demand substantial investment in compliance and quality assurance systems from any new player. For instance, in 2024, the U.S. Food and Drug Administration (FDA) continued to emphasize enhanced food safety measures, particularly concerning traceability and allergen control, adding to the compliance burden for market entrants.

New companies entering the food ingredients market must navigate diverse international labeling requirements, certifications, and quality control protocols. This necessitates considerable upfront capital expenditure for establishing robust quality management systems and obtaining necessary approvals, creating a significant barrier to entry. AGT Food and Ingredients, with its established global certifications and compliance infrastructure, benefits from this high cost of entry for potential competitors.

- Stringent Food Safety Regulations: Compliance with standards like HACCP and ISO 22000 is mandatory and costly.

- International Labeling and Quality Standards: Navigating diverse global requirements adds complexity and expense for new entrants.

- High Capital Investment: Significant upfront investment is needed for quality assurance systems and certifications.

- Established Compliance Infrastructure: Existing players like AGT have a competitive advantage due to their developed compliance frameworks.

The threat of new entrants for AGT Food and Ingredients is generally considered moderate. Significant capital investment is required for processing facilities and supply chains, with new plants costing tens of millions of dollars. AGT's substantial 2023 revenue of CAD 2.07 billion underscores its operational scale, creating a cost disadvantage for smaller newcomers who cannot achieve similar economies of scale in purchasing and production.

Securing reliable raw material supply chains and establishing extensive global distribution networks are major barriers. AGT's deep farmer relationships and established market access, built over time, are difficult and costly for new players to replicate. Furthermore, regulatory compliance, including stringent food safety standards and international labeling requirements, demands substantial upfront investment in quality assurance systems, deterring many potential market entrants.

| Factor | Impact on New Entrants | AGT's Advantage |

| Capital Investment | High (tens of millions for plants) | Economies of scale, established infrastructure |

| Supply Chain Access | Difficult to establish reliable sourcing | Deep farmer relationships, global network |

| Distribution & Market Access | Challenging to replicate | Global presence, established retail/industrial relationships |

| Regulatory Compliance | Costly and complex (food safety, labeling) | Existing compliance frameworks, certifications |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for AGT Food and Ingredients, Inc. is built upon a foundation of publicly available data, including the company's annual reports and SEC filings. We supplement this with insights from reputable industry publications and market research reports to gain a comprehensive understanding of the competitive landscape.