Agnico Eagle Mines PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Agnico Eagle Mines Bundle

Agnico Eagle Mines operates within a dynamic global landscape, where political stability, economic fluctuations, and technological advancements significantly influence its operations and profitability. Understanding these external forces is crucial for strategic planning and risk mitigation. Our comprehensive PESTEL analysis delves deep into these factors, offering actionable insights to sharpen your market strategy. Download the full version now and gain a competitive edge.

Political factors

Agnico Eagle Mines' operations span Canada, Australia, Finland, and Mexico, making government stability and policy in these regions critical. For instance, Canada's federal and provincial governments generally offer a stable, predictable mining regulatory framework, though policy shifts can occur. Mexico, while rich in resources, has seen policy changes impacting foreign investment and taxation in the mining sector, requiring careful navigation.

Australia's political landscape typically supports resource development, but state-level regulations and environmental policies can vary significantly, influencing project approvals and operational costs. Finland, known for its clear legal framework and commitment to responsible mining, presents a generally stable environment, though adherence to stringent environmental standards is paramount.

Global trade relations significantly impact Agnico Eagle Mines. For instance, potential tariffs or trade disputes, like those seen between major economies in 2023 and continuing into 2024, can directly affect the cost of importing specialized mining equipment and the market access for its gold exports. Navigating these complex international agreements and geopolitical tensions is crucial for maintaining efficient supply chains and profitability.

Agnico Eagle operates in areas with substantial Indigenous populations, making strong relationships and addressing land rights critical for its social license. The company's 2024 Reconciliation Action Plan in Canada underscores its dedication to positive engagement and support for Indigenous Peoples worldwide, vital for project approvals and sustained operations.

Regulatory Environment and Permitting

The regulatory environment is a critical factor for Agnico Eagle Mines. The stringency and efficiency of regulatory bodies in countries where Agnico operates directly influence project timelines and costs. This includes obtaining mining permits, environmental approvals, and operational licenses.

Delays or increased complexity in the permitting process can significantly impact the company's development pipeline. For instance, the permit to take water for the Detour Lake underground project was received in April 2025, highlighting the crucial nature of timely approvals.

- Regulatory Stringency: Varies by jurisdiction, impacting Agnico's operational flexibility and expansion plans.

- Permitting Efficiency: Delays in obtaining permits, such as the April 2025 water permit for Detour Lake, can push back project development and increase costs.

- Environmental Approvals: Increasingly rigorous environmental standards require significant investment in compliance and mitigation strategies.

- Operational Licenses: Renewal and maintenance of operational licenses are subject to ongoing regulatory scrutiny and compliance.

Fiscal and Royalty Regimes

Governments worldwide implement fiscal and royalty regimes that directly influence Agnico Eagle Mines' profitability and cash flow. These policies, including corporate income taxes and specific mining royalties, are critical considerations for the company's operational costs and investment decisions.

Fluctuations in commodity prices, particularly gold, can significantly impact royalty expenses. For instance, in Q1 2025, it was estimated that for every $100 increase in the gold price, Agnico Eagle's royalty costs rose by approximately $5 per ounce, highlighting the sensitivity of these regimes to market volatility.

- Taxation: Corporate income tax rates vary by jurisdiction, directly affecting net earnings.

- Royalties: Specific royalty rates on mineral production are levied, often tied to revenue or profit.

- Price Sensitivity: Royalty costs can increase with higher commodity prices, as demonstrated by the Q1 2025 estimate.

- Regulatory Changes: Potential shifts in government fiscal policies pose a risk and opportunity for mining companies.

Political stability and government policies in Canada, Australia, Finland, and Mexico significantly shape Agnico Eagle Mines' operational landscape. Shifts in mining regulations or taxation, as seen with Mexico's policy changes impacting foreign investment, necessitate adaptive strategies. The company's commitment to Indigenous relations, highlighted by its 2024 Reconciliation Action Plan, is crucial for maintaining social license and securing project approvals.

Governmental fiscal regimes, including tax and royalty structures, directly influence Agnico Eagle's profitability. For example, an estimated $100 increase in gold price in Q1 2025 would raise royalty costs by approximately $5 per ounce, demonstrating the sensitivity of these policies to market fluctuations. Navigating these varying financial frameworks across its operating regions is paramount for financial planning and investment decisions.

| Factor | Impact on Agnico Eagle Mines | 2024/2025 Relevance |

| Government Stability | Affects operational continuity and investment risk. | Stable environments in Canada and Finland contrast with potential policy shifts in Mexico. |

| Fiscal Policies (Tax & Royalties) | Directly impacts profitability and cash flow. | Q1 2025 estimates show a $5/oz royalty cost increase per $100 gold price rise. |

| Regulatory Framework | Influences project timelines, costs, and operational flexibility. | The April 2025 water permit for Detour Lake underscores the importance of timely approvals. |

| Indigenous Relations | Crucial for social license and project development. | The 2024 Reconciliation Action Plan highlights ongoing engagement efforts. |

What is included in the product

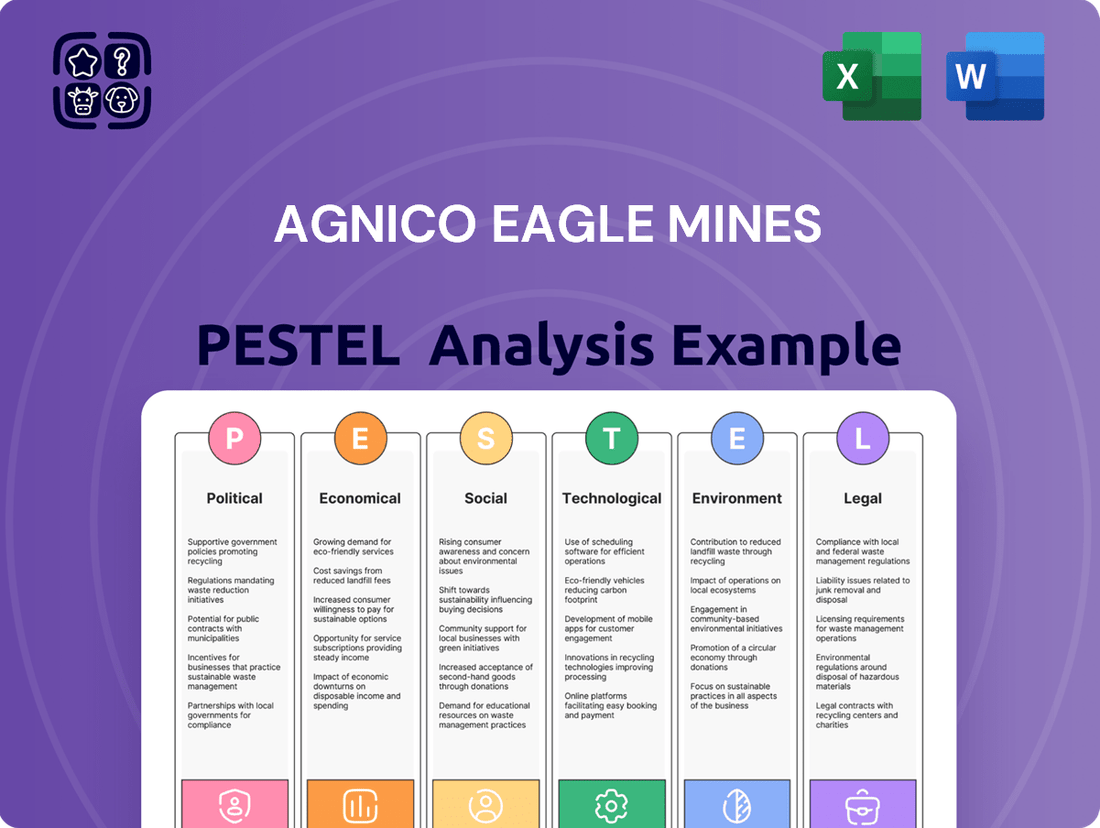

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Agnico Eagle Mines across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying key opportunities and threats within the mining industry.

A concise Agnico Eagle Mines PESTLE analysis that highlights key external factors impacting operations, serving as a readily accessible tool to preemptively address potential challenges and inform strategic decision-making.

Economic factors

Agnico Eagle Mines, as a major gold producer, faces significant volatility due to fluctuating gold prices. For instance, the company reported a realized gold price of $3,288 per ounce in the second quarter of 2025, a figure that directly impacts its revenue and profit margins. This sensitivity means that even minor shifts in the global gold market can have a substantial effect on Agnico Eagle's financial health.

When gold prices are high, as seen with the Q2 2025 average, Agnico Eagle typically experiences robust profitability and strong cash flow generation. Conversely, a downturn in the gold price can quickly erode these gains, putting pressure on the company's financial performance and potentially affecting its investment and expansion plans. This inherent price risk is a critical factor for investors and strategists to consider when evaluating the company.

Rising inflation across Agnico Eagle's operating regions directly impacts its bottom line. Increased costs for essential inputs like labor, energy, and raw materials are squeezing profit margins and driving up overall production expenses.

While Agnico Eagle has maintained a strong focus on cost discipline, persistent inflation and higher royalty payments, triggered by elevated gold prices, are pushing its all-in sustaining costs (AISC) upward. The company projects its AISC to reach approximately $1,350 per ounce in 2025, reflecting these challenging economic conditions.

Global economic growth directly impacts investor sentiment towards gold as a safe-haven asset, influencing its demand and price. In 2024, the International Monetary Fund projected global growth at 3.2%, a steady but moderate pace. This stability can temper extreme gold price volatility, affecting Agnico Eagle's revenue streams.

Economic instability, conversely, often drives increased investment in gold, boosting demand and potentially Agnico Eagle's market position and sales volumes. For instance, geopolitical tensions and inflation concerns in late 2023 and early 2024 saw gold prices reach record highs, demonstrating this correlation.

Currency Exchange Rates

Agnico Eagle Mines' financial results are significantly influenced by currency exchange rate volatility, as the company conducts operations across several countries. Its reporting currency is the U.S. dollar, meaning fluctuations against currencies like the Canadian dollar, Australian dollar, Euro, and Mexican Peso directly impact reported earnings and costs.

For example, a weaker Canadian dollar relative to the U.S. dollar can translate into higher earnings when Canadian operations' profits are converted back to U.S. dollars. Conversely, a stronger Canadian dollar would have the opposite effect.

- Canadian Dollar Performance: As of late 2024, the CAD/USD exchange rate has seen fluctuations, with the Canadian dollar generally trading in a range that can offer a slight tailwind to Canadian dollar-denominated costs for U.S. dollar reporting companies.

- Operational Impact: Agnico Eagle's substantial Canadian operations mean that movements in the CAD/USD rate are a key consideration in its financial forecasting and reporting.

- Global Exposure: The company's presence in Australia and Mexico also exposes it to AUD/USD and MXN/USD rate changes, though the impact of the Canadian dollar is typically more pronounced due to the scale of Canadian operations.

- Hedging Strategies: Companies like Agnico Eagle often employ currency hedging strategies to mitigate some of this risk, but significant unhedged exposures remain a factor in quarterly financial performance.

Capital Availability and Investment

Agnico Eagle's ability to secure capital for its mining ventures is paramount. In 2023, the company demonstrated robust financial management, achieving a net cash position and generating record free cash flow, which directly supports its investment pipeline. This financial strength enables Agnico Eagle to fund high-return exploration, development, and expansion projects, ensuring sustained growth and value creation.

The company's access to capital is further bolstered by its strong balance sheet and consistent operational performance. For instance, Agnico Eagle reported a significant increase in its financial flexibility, allowing for strategic capital allocation towards promising new discoveries and the optimization of existing operations. This proactive approach to capital management is key to navigating the inherent cyclicality of the mining industry and capitalizing on market opportunities.

- Record Free Cash Flow: Agnico Eagle's ability to generate substantial free cash flow in 2023 provides a strong internal funding source for growth initiatives.

- Net Cash Position: Transitioning to a net cash position enhances the company's borrowing capacity and reduces its cost of capital for future investments.

- Investment in High-Return Projects: The company is well-positioned to allocate capital towards exploration and development projects with attractive projected returns, driving long-term value.

- Shareholder Returns: Strong capital availability also supports Agnico Eagle's commitment to returning capital to shareholders through dividends and potential buybacks.

The economic landscape significantly shapes Agnico Eagle Mines' performance. Fluctuating gold prices, as evidenced by a realized price of $3,288 per ounce in Q2 2025, directly impact revenue and profitability. Rising inflation, pushing all-in sustaining costs towards $1,350 per ounce in 2025, increases operational expenses.

Global economic growth influences gold demand, while currency exchange rate volatility, particularly with the CAD/USD, affects reported earnings. Agnico Eagle's strong financial position, demonstrated by record free cash flow in 2023, enables strategic capital allocation for growth.

| Economic Factor | Impact on Agnico Eagle Mines | 2024/2025 Data/Trend |

|---|---|---|

| Gold Price | Revenue and Profitability | Realized price of $3,288/oz (Q2 2025) |

| Inflation | Increased Production Costs | AISC projected at $1,350/oz (2025) |

| Global Economic Growth | Gold Demand and Sentiment | IMF projected 3.2% global growth (2024) |

| Currency Exchange Rates | Reported Earnings and Costs | CAD/USD fluctuations impact Canadian operations |

| Capital Availability | Investment and Growth Funding | Record free cash flow (2023), net cash position |

What You See Is What You Get

Agnico Eagle Mines PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Agnico Eagle Mines PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides a thorough understanding of the external forces shaping Agnico Eagle's operations and strategic decisions.

Sociological factors

Agnico Eagle Mines places significant emphasis on its social license to operate, recognizing that strong community relationships are fundamental to its success. This involves proactive engagement to understand and address local concerns, thereby mitigating potential negative impacts of its mining operations.

The company demonstrates this commitment through tangible investments in local sustainable development. For instance, in 2023, Agnico Eagle reported CAD 10.4 million in community investments, focusing on education, healthcare, and infrastructure projects across its operational regions, fostering goodwill and long-term partnerships.

Agnico Eagle Mines is deeply committed to operating respectfully within Indigenous territories, viewing reconciliation as a core principle. This commitment is underscored by the company's 2024 launch of its first Reconciliation Action Plan, a significant step towards building enduring, positive relationships with Indigenous communities.

This plan outlines concrete actions aimed at fostering economic opportunities for Indigenous peoples, including targeted employment and procurement initiatives. For instance, by the end of 2024, Agnico Eagle aims to increase Indigenous representation in its workforce by 15% across its Canadian operations, a tangible measure of progress in supporting Indigenous growth.

Furthermore, the plan emphasizes the vital importance of respecting Indigenous rights, traditions, and cultural heritage. Agnico Eagle actively seeks to incorporate Indigenous perspectives into its operational planning and decision-making processes, ensuring that its activities are conducted in a manner that honors and supports the unique cultural landscapes of the communities where it operates.

Agnico Eagle Mines places paramount importance on workforce health, safety, and well-being, recognizing its direct correlation with employee morale, operational efficiency, and overall corporate reputation. The company actively pursues a goal of zero harm across all its operations, investing significantly in comprehensive safety training programs and fostering inclusive work environments designed to support employee welfare.

In 2023, Agnico Eagle reported a Total Recordable Injury Frequency Rate (TRIFR) of 0.52 per 200,000 hours worked, reflecting a continued commitment to safety performance. This focus extends to mental health initiatives and robust support systems, acknowledging the holistic well-being of its diverse global workforce.

Local Employment and Economic Contribution

Agnico Eagle Mines plays a significant role in the socio-economic fabric of its operating regions. By prioritizing local hiring and sourcing, the company directly injects capital into these communities, fostering economic growth and stability. This commitment to local contribution is crucial for building trust and ensuring the company's social license to operate.

In 2023, Agnico Eagle reported employing approximately 8,500 people globally, with a strong emphasis on local recruitment. For example, at its Canadian operations, a substantial portion of its workforce is drawn from nearby communities, directly benefiting local economies. This focus on local employment not only provides jobs but also develops skilled labor within the region.

- Local Employment: Agnico Eagle aims to maximize local hiring, contributing to reduced unemployment rates in its host communities.

- Economic Multiplier Effect: Through local procurement of goods and services, the company stimulates broader economic activity beyond direct employment.

- Community Investment: Agnico Eagle invests in community development projects, enhancing social infrastructure and quality of life.

- Securing Social License: Positive socio-economic contributions are vital for maintaining community acceptance and operational continuity.

Public Perception and Reputation

Public perception significantly impacts Agnico Eagle Mines. Concerns about environmental stewardship and social responsibility can affect talent acquisition and financing. In 2023, Agnico Eagle reported a 15% reduction in greenhouse gas intensity compared to 2019, a figure crucial for demonstrating environmental commitment to stakeholders.

Agnico Eagle actively manages its reputation through transparency. The company's 2024 sustainability report details its progress on ESG targets, including a goal to achieve 30% female representation in management roles by 2025. This proactive communication aims to build trust and support for its operations.

- Environmental Stewardship: Public scrutiny of mining's environmental impact is high, influencing Agnico Eagle's operational permits and social license to operate.

- Social Responsibility: Community engagement and benefit-sharing are key to maintaining a positive public image and avoiding operational disruptions.

- Ethical Conduct: Perceptions of ethical practices in labor, governance, and supply chains directly affect investor confidence and brand loyalty.

- Transparency: Agnico Eagle's sustainability reporting, including its 2024 disclosures on water management and biodiversity initiatives, is vital for shaping public opinion.

Agnico Eagle Mines prioritizes strong community ties and Indigenous reconciliation, investing heavily in local development and fostering respectful relationships. The company's 2024 Reconciliation Action Plan aims for a 15% increase in Indigenous workforce representation by year-end in Canadian operations, reflecting a commitment to economic empowerment and cultural respect.

The company also focuses on workforce well-being, striving for zero harm with a 2023 Total Recordable Injury Frequency Rate of 0.52 per 200,000 hours worked. This dedication to safety and comprehensive support systems underpins operational efficiency and corporate reputation.

Agnico Eagle's socio-economic contributions are significant, with a global workforce of approximately 8,500 in 2023, emphasizing local hiring. This approach stimulates regional economies and strengthens its social license to operate.

Public perception, influenced by environmental and social responsibility, impacts Agnico Eagle. The company's 2024 sustainability report details progress on ESG targets, including a 2025 goal for 30% female representation in management, aiming to build trust and support.

| Sociological Factor | Agnico Eagle Mines' Approach | Key Data/Initiatives (2023-2025) |

|---|---|---|

| Community Relations | Proactive engagement, local investment, social license | CAD 10.4 million in community investments (2023) |

| Indigenous Reconciliation | Respect for rights, economic opportunities, cultural heritage | First Reconciliation Action Plan launched (2024), 15% Indigenous workforce increase target (2024) |

| Workforce Health & Safety | Zero harm goal, comprehensive training, well-being support | TRIFR of 0.52 per 200,000 hours worked (2023) |

| Socio-economic Impact | Local hiring, procurement, economic growth | Approx. 8,500 global employees (2023), focus on local recruitment |

| Public Perception & ESG | Transparency, sustainability reporting, ethical conduct | 15% GHG intensity reduction (vs. 2019), 30% female management target (2025) |

Technological factors

Agnico Eagle Mines is increasingly integrating advanced automation and digitalization across its operations. This includes the deployment of autonomous haul trucks and drills, which significantly boost safety by removing personnel from hazardous areas. For instance, in 2023, Agnico Eagle reported progress in implementing autonomous drilling at its Canadian operations, aiming for increased operational uptime and precision.

These technological advancements directly translate into enhanced efficiency and productivity. By optimizing haulage routes and drilling patterns, Agnico Eagle can achieve higher resource extraction rates and reduce the time spent on non-productive activities. This focus on digital transformation is expected to further drive down operational costs per ounce of gold produced, a key metric for profitability in the mining sector.

Agnico Eagle leverages innovative geological surveying techniques, such as advanced seismic imaging and hyperspectral analysis, to pinpoint promising exploration targets. These technologies significantly improve the accuracy and efficiency of identifying potential gold deposits.

Advanced drilling technologies, including directional drilling and automated sampling systems, allow Agnico Eagle to extract core samples more effectively and safely, reducing costs and environmental impact while maximizing data acquisition. This is vital for understanding the extent and grade of discovered mineralization.

Sophisticated data analysis tools, incorporating machine learning and AI, enable Agnico Eagle to process vast amounts of geological and geophysical data. This leads to better resource modeling and more informed decisions regarding reserve delineation, directly supporting their project pipeline and reserve replacement strategies.

Agnico Eagle Mines is keenly focused on advancements in processing and metallurgy. Innovations in gold extraction, such as enhanced leaching techniques and more efficient gravity separation, are crucial for boosting recovery rates. For instance, ongoing research into bio-oxidation for refractory ores aims to unlock gold locked within sulfide minerals, which are common in many deposits.

The company's commitment to R&D in smelting and refining technologies directly translates to lower operational expenses and a reduced environmental footprint. Developments in dry stacking of tailings, for example, minimize water usage and land disturbance. Agnico Eagle's strategic investments in these areas are designed to ensure they can extract maximum value from every ounce of gold mined.

Data Analytics and Artificial Intelligence

Agnico Eagle Mines is increasingly leveraging data analytics and artificial intelligence to refine its operations. These technologies are instrumental in optimizing everything from the predictive maintenance of critical mining equipment, thereby reducing downtime, to enhancing the precision of mine planning and resource allocation. This strategic adoption is projected to yield substantial improvements in operational efficiencies and significant cost reductions across its global mining sites.

The integration of AI and advanced analytics is not just about efficiency; it's about unlocking new levels of insight. For instance, sophisticated algorithms can analyze vast datasets to identify patterns in geological formations, leading to more accurate resource estimations and improved extraction strategies. This data-driven approach is crucial for maximizing yield and minimizing waste in a capital-intensive industry.

- Predictive Maintenance Savings: By anticipating equipment failures, Agnico Eagle can reduce unscheduled downtime, which historically costs the mining industry billions annually. For example, a 2024 report indicated that predictive maintenance strategies can cut maintenance costs by up to 30%.

- Optimized Mine Planning: AI-driven simulations can model various extraction scenarios, leading to more efficient mine layouts and production schedules, potentially increasing resource recovery rates by 5-10%.

- Enhanced Safety Protocols: Analyzing operational data can identify potential safety hazards before they occur, contributing to a safer working environment for employees.

Environmental Technologies and Decarbonization

Technological advancements are critical for mining companies like Agnico Eagle to address environmental concerns. Innovations in reducing greenhouse gas emissions, optimizing water usage, and improving waste management are becoming industry standards for sustainable operations. These technologies are not just about compliance but are increasingly seen as drivers of efficiency and long-term value.

Agnico Eagle Mines is actively pursuing a net-zero emissions goal by 2050. This ambitious target is being supported by significant investments in energy efficiency across its operations and a strategic transition towards electrification of its mining fleet and processes. These efforts are crucial for aligning with global decarbonization trends and mitigating climate-related risks.

Key technological areas Agnico Eagle is focusing on include:

- Electrification of mobile mining equipment: Replacing diesel-powered vehicles with battery-electric alternatives reduces direct emissions at the mine site.

- Renewable energy integration: Increased use of solar and wind power for mine operations lowers the carbon footprint of electricity consumption.

- Advanced water treatment and recycling: Technologies that enable higher rates of water reuse minimize freshwater withdrawal and discharge.

- Improved tailings management: Innovations in dry stacking and filtered tailings reduce water content and improve the stability of waste storage.

Agnico Eagle is heavily investing in automation and digitalization to enhance safety and efficiency. The company is deploying autonomous haul trucks and drills, aiming to boost operational uptime and precision, as seen with progress in autonomous drilling at Canadian operations in 2023. These technological strides are projected to optimize resource extraction and reduce operational costs per ounce.

The company utilizes advanced geological surveying and drilling technologies for more accurate deposit identification and extraction. Sophisticated data analysis tools, including AI and machine learning, are employed for better resource modeling and informed decision-making, supporting their project pipeline and reserve replacement strategies.

Agnico Eagle is also focused on metallurgical advancements to improve gold recovery rates and reduce environmental impact. Innovations in processing, such as enhanced leaching and dry stacking of tailings, are key to maximizing value and minimizing water usage and land disturbance.

The company's commitment to sustainability is reflected in its pursuit of net-zero emissions by 2050, supported by electrification of its mining fleet and increased use of renewable energy sources. These technological focuses are critical for meeting environmental standards and driving long-term value.

| Technology Focus | Impact | Example/Data Point |

|---|---|---|

| Automation & Digitalization | Increased Safety, Efficiency, Reduced Costs | Progress in autonomous drilling at Canadian operations (2023). Predictive maintenance can cut costs by up to 30% (2024 report). |

| Advanced Geological & Extraction Tech | Improved Deposit Identification, Higher Recovery Rates | AI-driven simulations can increase resource recovery by 5-10%. |

| Metallurgical Innovations | Enhanced Gold Recovery, Reduced Environmental Footprint | Focus on bio-oxidation for refractory ores; dry stacking of tailings reduces water usage. |

| Sustainability Technologies | Reduced Emissions, Optimized Resource Use | Net-zero emissions goal by 2050; electrification of mining fleet; increased renewable energy integration. |

Legal factors

Agnico Eagle Mines navigates a complex legal landscape across its operating regions, including Canada, Australia, Finland, and Mexico. These mining laws dictate everything from securing mineral rights and exploration permits to dictating safe operational practices and the crucial process of mine closure. For instance, in 2023, Agnico Eagle reported significant capital expenditures related to environmental and social governance initiatives, underscoring the financial implications of regulatory compliance.

Agnico Eagle Mines operates under stringent environmental protection laws. These regulations cover critical areas like air and water quality, waste management, and the preservation of biodiversity. For instance, in 2023, the company reported investing $100 million in environmental initiatives, reflecting the significant cost of compliance.

Adherence to specific legislation, such as those governing tailings facility management and climate change mitigation, is paramount. Failure to comply can result in substantial penalties and jeopardize Agnico Eagle's ability to continue its mining operations. The company's 2024 sustainability report highlights ongoing efforts to meet evolving climate action targets, aiming for a 30% reduction in Scope 1 and 2 greenhouse gas emissions by 2030 compared to a 2019 baseline.

Agnico Eagle Mines must navigate a complex web of labor laws and employment standards across its global operations. This includes strict adherence to regulations concerning worker safety, with a focus on preventing accidents in mining environments, as well as compliance with minimum wage laws, working hour limits, and provisions for fair working conditions. The company's ability to manage collective bargaining agreements and maintain positive relationships with its workforce is crucial for operational continuity and avoiding disruptions.

In 2023, Agnico Eagle reported a total workforce of approximately 12,000 employees and contractors. The company's commitment to safety is underscored by its Total Recordable Injury Frequency Rate (TRIFR), which aims for continuous improvement. For instance, in Q1 2024, the company reported a TRIFR of 0.69 per 200,000 hours worked, demonstrating ongoing efforts to maintain high safety standards. The financial implications of non-compliance can be significant, ranging from fines to reputational damage, impacting investor confidence and future project viability.

Indigenous Rights and Consultation Requirements

Agnico Eagle Mines operates in jurisdictions, notably Canada, where legal frameworks strongly recognize Indigenous rights and mandate consultation for resource development. These requirements are not just legal obligations but also crucial for maintaining social license to operate. The company’s commitment, as detailed in its Reconciliation Action Plan, underscores the importance of engaging with Indigenous communities throughout its project lifecycle.

Failure to adequately consult can lead to significant project delays, legal challenges, and reputational damage. For instance, in 2023, several mining projects across Canada faced scrutiny and delays due to consultation disputes. Agnico Eagle’s proactive approach aims to mitigate these risks by fostering collaborative relationships and ensuring its operations align with Indigenous expectations and agreements.

- Legal Mandates: Laws like the United Nations Declaration on the Rights of Indigenous Peoples Act (UNDRIP) in Canada influence consultation processes.

- Reconciliation Efforts: Agnico Eagle's Reconciliation Action Plan outlines specific steps for engagement and benefit sharing with Indigenous partners.

- Risk Mitigation: Proper consultation is vital to avoid legal injunctions and operational disruptions, as seen in past resource projects.

- Social License: Building trust and strong relationships with Indigenous communities is paramount for long-term operational success and sustainability.

International Trade and Sanctions Laws

Agnico Eagle Mines operates globally, meaning it must strictly adhere to international trade laws, customs procedures, and any existing sanctions. These regulations are critical for managing the movement of materials, equipment, and financial transactions across different countries, directly affecting Agnico Eagle's supply chain efficiency and its ability to access diverse markets. For instance, in 2023, the company reported that approximately 72% of its revenue came from outside of Canada, highlighting the significant impact of international trade laws on its business model.

Navigating these legal landscapes can present challenges, such as tariffs, import/export restrictions, and compliance costs that can influence profitability. The evolving nature of international relations and trade agreements means Agnico Eagle must remain vigilant and adaptable to new legal requirements. Failure to comply with sanctions, for example, could lead to severe penalties, operational disruptions, and reputational damage, as seen with other multinational corporations facing sanctions-related issues in recent years.

Key considerations for Agnico Eagle include:

- Compliance with Export Controls: Ensuring all shipments of mining equipment and extracted minerals meet the export regulations of the originating and destination countries.

- Adherence to Sanctions: Verifying that no business activities, suppliers, or customers are subject to international sanctions imposed by entities like the UN, OFAC, or EU.

- Customs Duties and Tariffs: Managing the financial impact of import and export duties on machinery, supplies, and precious metals.

- Trade Agreement Utilization: Leveraging free trade agreements to reduce costs and streamline cross-border operations where applicable.

Agnico Eagle Mines faces significant legal challenges related to environmental regulations, labor laws, Indigenous rights, and international trade. Compliance with these varied legal frameworks is essential for operational continuity and financial stability. The company's 2024 sustainability report, for instance, detailed its commitment to reducing greenhouse gas emissions by 30% by 2030 against a 2019 baseline, reflecting the direct impact of climate-related legislation.

In 2023, Agnico Eagle reported a workforce of approximately 12,000, highlighting the importance of adhering to labor laws concerning worker safety and fair employment standards. Its Q1 2024 Total Recordable Injury Frequency Rate (TRIFR) of 0.69 per 200,000 hours worked demonstrates ongoing efforts to meet stringent safety regulations.

Furthermore, the company must navigate evolving legal requirements concerning Indigenous rights, particularly in Canada, where consultation is mandated for resource development. Failure to comply can lead to project delays and legal disputes, impacting operational timelines and financial performance.

International trade laws also play a critical role, with 72% of Agnico Eagle's 2023 revenue generated outside Canada. Managing customs, tariffs, and sanctions is vital for supply chain efficiency and market access.

Environmental factors

Agnico Eagle Mines navigates the complex landscape of climate change, facing both risks and opportunities. Potential impacts include disruptions to water availability, a critical resource for mining operations, and the increasing frequency of extreme weather events that can affect infrastructure and operations.

The company has set ambitious environmental goals, including a commitment to achieve net-zero greenhouse gas (GHG) emissions by 2050. To support this, Agnico Eagle has established an interim target to reduce its GHG emissions by 30% by 2030, compared to a 2019 baseline.

These reductions are being pursued through various initiatives, such as enhancing energy efficiency across its sites and investing in the electrification of its mining fleet. For instance, in 2023, Agnico Eagle reported a 13% reduction in Scope 1 and Scope 2 GHG emissions intensity compared to 2019, demonstrating progress towards its interim target.

Agnico Eagle Mines recognizes that mining is water-intensive, making robust water management a critical component of its operations, especially in regions facing water scarcity. The company's commitment extends to integrating water management with its mine closure plans, aiming to leave a positive legacy and ensure long-term water resource sustainability.

In 2023, Agnico Eagle reported that its water withdrawal intensity across its operations averaged 0.4 cubic meters per tonne of ore processed, demonstrating a focus on efficiency. The company actively works to minimize its impact on local water sources, employing strategies like water recycling and responsible discharge practices to protect water viability for surrounding ecosystems and communities.

Agnico Eagle Mines navigates a complex environmental landscape, operating across diverse ecosystems from the Arctic tundra in Nunavut to boreal forests in Quebec and Ontario. This necessitates highly specific strategies for managing biodiversity and reclaiming land post-operation. The company's 2023 Sustainability Report highlights ongoing efforts in habitat restoration and protection across its various sites.

Minimizing the footprint of mining activities and actively supporting biodiversity are central to Agnico Eagle's operational philosophy. For instance, in 2023, the company reported on its progress in implementing biodiversity action plans at key Canadian operations, focusing on species at risk and ecosystem health. These plans are crucial for ensuring long-term environmental stewardship.

Tailings and Waste Management

Agnico Eagle Mines places significant emphasis on the safe and responsible stewardship of mine tailings and other waste materials, recognizing this as a paramount environmental responsibility. This commitment is underscored by the company's proactive approach to sustainability reporting and protocol implementation.

The company's dedication to robust tailings management is evident in its 2025 Tailings Summary Report. Furthermore, Agnico Eagle is actively implementing the TSM Tailings Protocol at its inactive sites, a move designed to bolster its overall sustainability management framework and ensure best practices are maintained even after operational closure.

- 2025 Tailings Summary Report: Agnico Eagle is committed to transparency and accountability in its tailings management practices, as demonstrated by its forthcoming 2025 Tailings Summary Report.

- TSM Tailings Protocol: The company is implementing the TSM Tailings Protocol at inactive sites, reinforcing its commitment to stringent environmental standards and responsible post-closure care.

- Sustainability Focus: This strategic implementation highlights Agnico Eagle's proactive stance on strengthening its sustainability management systems across all operational phases.

Mine Closure and Reclamation

Agnico Eagle Mines is committed to the responsible closure and reclamation of its operational sites. This commitment involves meticulous long-term planning to ensure environmental restoration after mining activities cease, aiming to minimize ecological impact and restore land to a usable state.

The company actively engages in risk reduction works throughout the mine's lifecycle, anticipating and mitigating potential environmental hazards associated with closure. Adherence to stringent environmental standards and regulations is paramount in their site rehabilitation efforts, reflecting a dedication to sustainable mining practices.

For instance, Agnico Eagle's 2023 Sustainability Report highlighted ongoing reclamation projects across multiple sites, with significant expenditures allocated to these activities. In 2023, the company reported approximately $77 million in reclamation and closure provisions, demonstrating tangible investment in environmental stewardship.

- Progressive Reclamation: Agnico Eagle undertakes reclamation activities concurrently with mining operations where feasible, reducing the overall environmental footprint.

- Long-Term Planning: Detailed closure and reclamation plans are developed years in advance, incorporating geological, hydrological, and ecological considerations.

- Financial Provisions: The company maintains robust financial provisions for closure and reclamation, ensuring adequate funding for post-mining environmental restoration. In 2023, these provisions stood at approximately $1.2 billion.

- Regulatory Compliance: Agnico Eagle operates in strict adherence to local and international environmental regulations governing mine closure and rehabilitation.

Environmental factors significantly shape Agnico Eagle Mines' operations, particularly concerning climate change and resource management. The company is actively pursuing a 30% reduction in GHG emissions by 2030 against a 2019 baseline, with 2023 seeing a 13% reduction in GHG emissions intensity. Water management is also crucial, with a 2023 water withdrawal intensity of 0.4 cubic meters per tonne of ore processed, reflecting efficiency efforts.

Biodiversity and land reclamation are key priorities, with ongoing habitat restoration and protection initiatives detailed in their 2023 Sustainability Report. Agnico Eagle is also committed to responsible tailings management, implementing the TSM Tailings Protocol at inactive sites. Furthermore, the company allocated approximately $77 million in 2023 for reclamation and closure activities, with overall provisions reaching about $1.2 billion.

PESTLE Analysis Data Sources

Our PESTLE analysis for Agnico Eagle Mines is informed by a comprehensive review of official government publications, leading financial news outlets, and industry-specific market research reports. This ensures a robust understanding of political stability, economic fluctuations, and regulatory landscapes impacting the mining sector.