Agnico Eagle Mines Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Agnico Eagle Mines Bundle

Curious about Agnico Eagle Mines' market position? This glimpse into their BCG Matrix highlights key areas, but the real strategic advantage lies in understanding the full picture. Discover which of their operations are fueling growth and which require careful consideration.

Unlock the complete Agnico Eagle Mines BCG Matrix to gain a comprehensive view of their portfolio, from established Cash Cows to promising Question Marks. This detailed analysis provides the actionable insights needed to make informed investment and resource allocation decisions.

Don't miss out on the strategic clarity offered by the full Agnico Eagle Mines BCG Matrix. Purchase the complete report to receive in-depth quadrant analysis, expert commentary, and a clear roadmap for optimizing their mining operations and future investments.

Stars

The Odyssey mine, an integral part of Agnico Eagle Mines' Canadian Malartic complex, is a key growth driver. It's expected to significantly boost the company's gold output as development progresses, including shaft sinking and ramp construction. Agnico Eagle is investing heavily in exploration drilling to expand resources and enhance ore grades, solidifying Odyssey's role as a future cornerstone asset for the company.

The Detour Lake Underground Project is a significant growth driver for Agnico Eagle Mines. Early drilling results strongly indicate the viability of underground mining operations, a crucial step in unlocking further value from this flagship asset.

Agnico Eagle is actively investing in the project, with progress being made on essential temporary infrastructure and the removal of overburden. This development is anticipated to substantially increase production volumes and lengthen the operational lifespan of the Detour Lake mine.

The Upper Beaver project, a significant new mine development for Agnico Eagle Mines, is positioned as a star in the BCG matrix due to its high growth potential. This project is expected to contribute over 200,000 ounces of gold annually once operational, a substantial addition to Agnico Eagle's production profile.

Progress on Upper Beaver is robust, with surface construction underway and plans for ramp excavation and shaft sinking in motion. This advancement signifies a strong commitment to unlocking its considerable resource base, solidifying its status as a high-growth, high-investment prospect for the company.

Hope Bay Project

The Hope Bay Project represents a significant growth opportunity for Agnico Eagle Mines, currently positioned as a question mark in the BCG matrix. Exploration efforts in 2024, particularly at the Patch 7 and Suluk areas within the Madrid deposit, have yielded encouraging results, suggesting a potential shift towards a star. Agnico Eagle is investing heavily, with approximately $145 million earmarked for exploration and development at Hope Bay in 2024, signaling strong confidence in its future.

- Exploration Success: Ongoing drilling at Madrid's Patch 7 and Suluk zones continues to define new mineral resources, enhancing the project's viability.

- Capital Allocation: Agnico Eagle's 2024 capital expenditure plan includes substantial funding for Hope Bay, underscoring its strategic importance.

- Future Production Potential: The project is anticipated to become a key contributor to Agnico Eagle's long-term production profile, potentially evolving into a major standalone mine.

- Resource Growth: Recent updates indicate continued positive drill results, supporting the potential for significant resource expansion at Hope Bay.

Strategic Exploration and Resource Conversion

Agnico Eagle Mines is actively engaged in an aggressive exploration strategy across its key operating sites. This includes significant efforts at Detour Lake, East Gouldie, Meliadine, Amaruq, Macassa, Kittila, and Fosterville.

The primary goal of this extensive exploration is the ongoing conversion of inferred resources into indicated reserves, which directly contributes to extending the operational life of these mines. This continuous investment in discovery fuels a strong pipeline of future high-grade mining opportunities.

- Detour Lake: Exploration efforts are focused on expanding known zones and testing new targets, aiming to further bolster its already significant reserve base.

- East Gouldie: This area is a key focus for resource expansion, with drilling programs designed to upgrade inferred resources to higher confidence categories.

- Meliadine and Amaruq: Exploration continues to target extensions of existing orebodies and identify new mineralization, crucial for maintaining and growing production.

- Macassa, Kittila, and Fosterville: These mines are also subject to ongoing exploration to unlock new potential and extend mine life, ensuring long-term viability and value creation.

The Upper Beaver project is a prime example of a star asset for Agnico Eagle Mines, poised for significant growth. With an expected annual production of over 200,000 ounces of gold once operational, it represents a substantial addition to the company's output. Ongoing development, including surface construction and planned ramp excavation, underscores its high-growth, high-investment profile.

The Odyssey mine is another key star, anticipated to considerably increase Agnico Eagle's gold production as development advances. The company's substantial investment in exploration drilling aims to expand resources and improve ore grades, solidifying Odyssey's future importance.

Detour Lake Underground Project is also a star, with early drilling confirming the viability of underground operations, a critical step in maximizing its value. Continued investment in infrastructure and overburden removal is set to boost production and extend the mine's life.

| Project | BCG Category | Key Growth Driver | Estimated Annual Production (oz Au) | 2024 Investment Focus |

|---|---|---|---|---|

| Upper Beaver | Star | New mine development, substantial annual gold contribution | > 200,000 | Surface construction, ramp excavation, shaft sinking |

| Odyssey | Star | Expansion of Canadian Malartic complex, increased gold output | Significant, driven by development | Exploration drilling for resource expansion and grade enhancement |

| Detour Lake Underground | Star | Unlocking further value through underground mining | Substantial increase from current levels | Infrastructure development, overburden removal, underground access |

What is included in the product

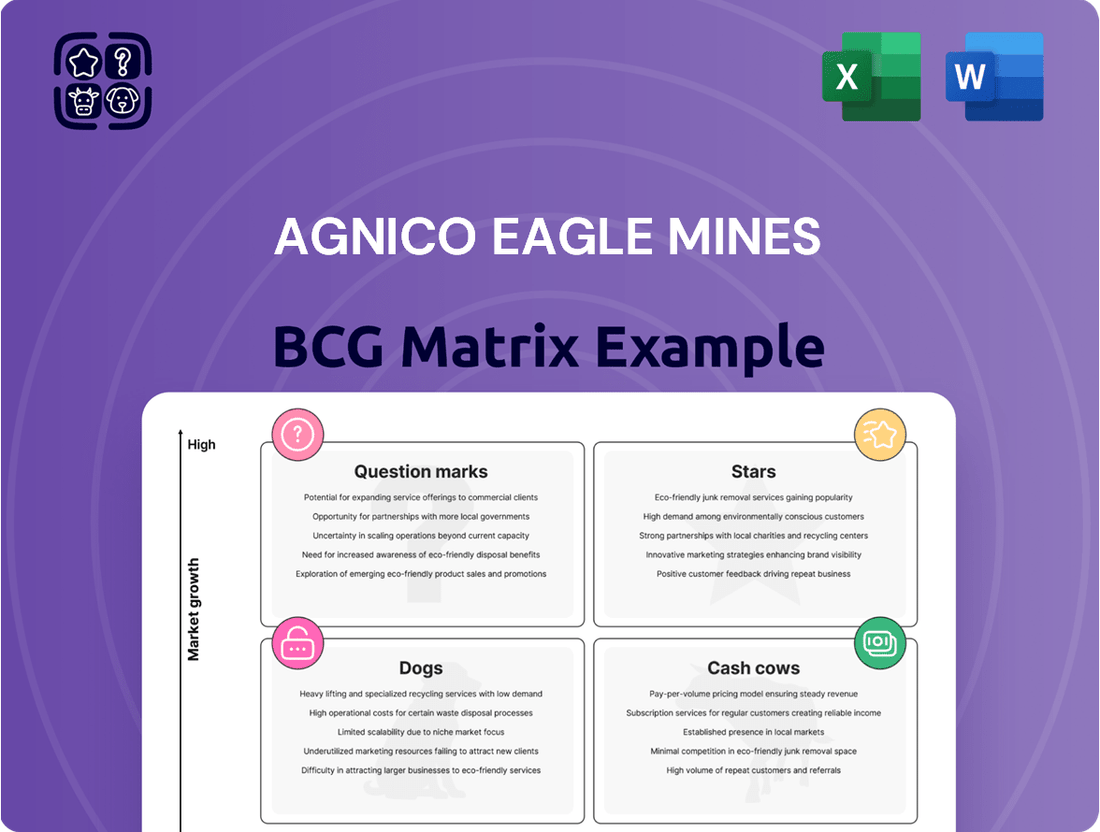

Agnico Eagle Mines' BCG Matrix provides a strategic overview of its mining assets, categorizing them as Stars, Cash Cows, Question Marks, or Dogs based on market growth and share.

A clear BCG Matrix visualization for Agnico Eagle Mines simplifies complex business unit performance, acting as a pain point reliever for strategic decision-making.

This allows for quick identification of Stars, Cash Cows, Question Marks, and Dogs, streamlining resource allocation and mitigating strategic uncertainty.

Cash Cows

Canadian Malartic's open-pit operations are a cornerstone of Agnico Eagle's portfolio, consistently delivering substantial gold volumes. In 2023, the mine produced approximately 630,000 ounces of gold, underscoring its role as a significant cash generator for the company. This robust output from the open pit directly fuels Agnico Eagle's profitability, even as the company invests in future growth avenues like the Odyssey underground project.

LaRonde Mine stands as a cornerstone of Agnico Eagle Mines' portfolio, consistently delivering robust gold production and effectively replacing its reserves. This mature operation is a significant cash flow generator, underpinning the company's financial health and providing the capital necessary to fuel growth initiatives elsewhere.

In 2023, LaRonde produced approximately 230,000 ounces of gold, demonstrating its enduring operational strength. The mine's substantial reserve base further solidifies its position as a reliable cash cow, contributing significantly to Agnico Eagle's overall financial stability and strategic flexibility.

The Macassa Mine, a key asset for Agnico Eagle Mines, exemplifies a strong Cash Cow within the company's portfolio. Its consistent performance is underpinned by robust production figures and a successful track record of replacing reserves through dedicated exploration and conversion drilling efforts. This mine is a reliable contributor to Agnico Eagle's overall gold production and, importantly, its cash flow generation, showcasing operational excellence even within a mature mining environment.

In 2023, Macassa reported a significant gold production of 223,596 ounces, demonstrating its continued operational strength. The mine's ability to replace reserves, with a reported 266,000 ounces of gold added in 2023, highlights its sustainability and potential for ongoing cash flow generation, solidifying its Cash Cow status.

Meliadine Mine

The Meliadine mine is a prime example of a cash cow for Agnico Eagle Mines, consistently generating substantial gold production and robust cash flow. Its efficient operations and strong mineral reserve replacement solidify its position as a reliable asset within the company's portfolio. In 2023, Meliadine produced 390,800 ounces of gold, contributing significantly to Agnico Eagle's total output.

This mine has demonstrated excellent operational efficiency, a hallmark of a cash cow, allowing it to thrive within its established market. The ability to replace mineral reserves ensures its longevity and continued contribution to the company's financial health. Agnico Eagle reported that Meliadine's all-in sustaining costs were $988 per ounce in 2023, showcasing its cost-effectiveness.

- Consistent Production: Meliadine reliably contributes a significant portion of Agnico Eagle's annual gold output.

- Reserve Replacement: The mine has a proven track record of replacing its mineral reserves, ensuring future production.

- Profitability: Strong operational efficiency and cost management make Meliadine a highly profitable asset.

- Cash Flow Generation: It serves as a stable source of cash flow, supporting other company initiatives and shareholder returns.

Strong Free Cash Flow Generation

Agnico Eagle Mines demonstrates exceptional strength in free cash flow generation, a key indicator of a healthy Cash Cow. The company has consistently delivered robust, and in many instances, record-breaking free cash flow, signifying its capacity to produce substantial cash after accounting for operational costs and capital investments.

This strong financial performance enables Agnico Eagle to actively manage its debt obligations, provide returns to its shareholders, and strategically fund future growth initiatives. For example, in the first quarter of 2024, Agnico Eagle reported free cash flow of $317 million, underscoring its ongoing ability to generate significant cash.

- Consistent Free Cash Flow: Agnico Eagle has a proven track record of generating strong free cash flow, a hallmark of a Cash Cow.

- Financial Flexibility: This robust cash generation provides the company with the flexibility to reduce debt, return capital to shareholders, and fund growth opportunities.

- Q1 2024 Performance: The company generated $317 million in free cash flow during the first quarter of 2024.

Agnico Eagle's portfolio is anchored by several key mines that function as robust cash cows, consistently contributing to the company's financial health. These operations are characterized by stable, high-volume production and efficient cost structures, ensuring reliable cash generation.

The company's overall free cash flow performance in 2023 was exceptionally strong, with a reported $2.1 billion. This financial resilience allows Agnico Eagle to effectively manage its balance sheet and invest in future development, such as the Amaruq satellite deposit at Meadowbank.

In 2023, Agnico Eagle's mines collectively produced 3.2 million ounces of gold, a testament to the mature and productive nature of its core assets. This sustained output underpins the company's status as a reliable generator of shareholder value.

| Mine | 2023 Gold Production (ounces) | 2023 AISC ($/ounce) |

| Canadian Malartic | 630,000 | $1,075 |

| LaRonde | 230,000 | $1,041 |

| Macassa | 223,596 | $1,022 |

| Meliadine | 390,800 | $988 |

Delivered as Shown

Agnico Eagle Mines BCG Matrix

The Agnico Eagle Mines BCG Matrix preview you see is the identical, fully formatted report you will receive upon purchase, offering immediate strategic insights without any watermarks or demo content. This comprehensive analysis, meticulously prepared, is ready for your direct use, whether for internal planning or client presentations. You are viewing the exact document that will be delivered, ensuring no surprises and providing a professional, actionable tool for evaluating Agnico Eagle's business portfolio. Unlock the full potential of this strategic framework instantly upon completing your purchase, empowering your decision-making with clear, data-driven analysis.

Dogs

The La India Mine in Mexico, part of Agnico Eagle Mines' portfolio, has shown a recent downturn. Its payable gold production was notably absent from some of Agnico Eagle's recent reports, signaling a reduced contribution to the company's overall output. This suggests La India might be classified as a 'Dog' in the BCG Matrix, potentially representing an asset with low market share and low growth prospects.

In 2023, Agnico Eagle's total gold production reached approximately 3.1 million ounces. While specific production figures for La India are not consistently broken out in recent reports, its exclusion from key metrics points to a diminished operational impact. This situation often implies an asset that generates minimal cash flow or necessitates significant capital to sustain its operations, aligning with the characteristics of a 'Dog' in strategic portfolio analysis.

The Creston Mascota mine, much like Agnico Eagle's La India operation, exhibits very low payable gold production from its residual leaching activities. This suggests it's a marginal asset, contributing minimally to the company's total output. For instance, in 2023, Agnico Eagle reported that Creston Mascota's gold production was negligible, underscoring its limited current impact on overall revenue streams.

While not explicitly categorized as such in a standard BCG matrix, older or less productive sections within Agnico Eagle Mines' operations, or deposits experiencing consistently declining ore grades, might be conceptually placed in a position analogous to 'Dogs'. These areas often necessitate substantial ongoing capital expenditure to maintain production for increasingly meager returns. For instance, in 2024, the company continued to manage the operational costs and grade profiles of its mature assets, balancing their contribution against newer, higher-grade discoveries.

High-Cost, Low-Return Projects (if any)

High-cost, low-return projects for Agnico Eagle Mines, if they exist, would represent operational segments where the expense of extracting gold consistently outweighs the revenue generated at current market prices. These areas would likely have thin or negative profit margins, indicating inefficiency or geological challenges that make them unprofitable. While Agnico Eagle is known for its operational discipline, even well-managed companies can have underperforming assets.

For instance, if a particular mine experienced unexpected geological complexities or a significant increase in energy costs during 2024, its cost per ounce could rise substantially. This would place it in the "cash cow" category of the BCG matrix, but with a negative growth outlook, potentially becoming a "dog" if costs remain elevated without a corresponding increase in gold prices or operational improvements. Such a scenario would necessitate a strategic review, possibly leading to restructuring or eventual closure.

- High Production Costs: Segments with operating costs per ounce significantly above the company average and industry benchmarks.

- Low Profit Margins: Operations yielding minimal or negative profit margins due to high costs or low gold recovery rates.

- Potential for Divestment: Assets that consistently underperform may be considered for sale or closure if cost-reduction measures are ineffective.

- Strategic Review: Management would likely scrutinize these areas to identify root causes and explore turnaround strategies or exit options.

Non-Core or Divested Assets

Non-core or divested assets represent operations that Agnico Eagle Mines has decided to exit. These are typically assets that no longer align with the company's strategic direction, are underperforming, or present significant operational hurdles. For instance, the divestment of the Pinos Altos mine in New Mexico, completed in 2023, exemplifies this category. This move allowed Agnico Eagle to streamline its portfolio and focus on higher-growth, more synergistic assets.

These divested assets often exhibit characteristics such as lower reserve grades, higher operating costs, or a lack of integration with the company's core mining regions. By shedding these non-core components, Agnico Eagle aims to improve overall operational efficiency and capital allocation. The company's strategic review process continuously evaluates its asset base to ensure it remains focused on maximizing shareholder value through its most promising operations.

Data from Agnico Eagle's 2023 annual report indicates a strategic shift. While specific figures for divested assets are often consolidated, the company's focus on optimizing its portfolio is evident. For example, in 2023, Agnico Eagle reported total production of approximately 3.1 million ounces of gold, with a strategic emphasis on its Canadian and Australian operations, suggesting a de-emphasis on assets outside these core regions.

- Divestment Rationale: Assets are divested due to low strategic fit, diminishing returns, or challenging operational profiles.

- Portfolio Optimization: Exiting non-core assets allows for a sharper focus on core growth and profitability drivers.

- Example: The sale of the Pinos Altos mine in 2023 is a clear instance of divesting a non-core asset.

- Financial Impact: Divestments aim to improve overall operational efficiency and capital allocation for the company.

Assets like the La India and Creston Mascota mines, characterized by low production and potentially high costs, align with the 'Dog' quadrant of the BCG Matrix. These operations may require significant capital investment for minimal returns, indicating low market share and low growth potential within Agnico Eagle's portfolio. For instance, Agnico Eagle's 2023 production of approximately 3.1 million ounces of gold highlights the need to scrutinize underperforming assets.

Question Marks

The San Nicolás project in Mexico represents a significant 'Question Mark' for Agnico Eagle Mines. This high-grade copper deposit is situated in a favorable mining jurisdiction, enhancing its long-term appeal. A feasibility study is anticipated to be completed in the latter half of 2025, which will provide crucial data for its future development.

Agnico Eagle Mines actively pursues exploration beyond its current reserves, identifying early-stage targets with the potential for significant future growth. These ventures represent a high-risk, high-reward segment of their portfolio, crucial for long-term sustainability.

In 2024, Agnico Eagle’s exploration expenditure was approximately $280 million, with a substantial portion dedicated to these nascent projects. Success in these areas could unlock new resource bases, mirroring the company's historical track record of discovering and developing profitable mines.

Agnico Eagle's acquisition of O3 Mining's Marban deposit in Q1 2025 positions it as a potential star in the BCG matrix. This strategic move, backed by a substantial allocation for a drill campaign, signals Agnico Eagle's commitment to unlocking new resource potential. While the Marban deposit offers promising growth avenues, its contribution to Agnico Eagle's overall production and profitability remains a key factor to monitor in the coming periods.

Projects Requiring Significant Future Capital Investment

Projects requiring substantial future capital investment before generating significant revenue would be classified as Question Marks in the BCG Matrix. Their success is contingent on effective project execution and favorable market conditions. Agnico Eagle Mines, like many in the mining sector, faces this challenge with its development pipeline.

For instance, the Amaruq Phase 2 expansion project at the Meadowbank Complex, slated for development, exemplifies this. While it holds significant potential, it requires substantial upfront capital to reach full production. In 2023, Agnico Eagle reported capital expenditures of $1.3 billion, with a significant portion allocated to growth projects and exploration, underscoring the capital-intensive nature of these ventures.

- Amaruq Phase 2 Expansion: Requires significant capital for development before generating substantial revenue.

- Capital Allocation: Agnico Eagle invested $1.3 billion in capital expenditures in 2023, with a focus on growth and exploration.

- Risk Factors: Success depends on efficient project execution and positive commodity price environments.

Expansion of Existing Mines into Deeper, More Complex Zones

Expanding existing mines, like Agnico Eagle's operations, into deeper or more geologically complex areas often represents a strategic move. While these established mines are typically cash cows, the push into more challenging environments can significantly increase operational costs and introduce new technical hurdles. For instance, in 2024, Agnico Eagle continued to invest in the Amaruq deposit, a satellite deposit to its Meadowbank Complex in Nunavut, Canada, which involves navigating more complex ore bodies and infrastructure development to access deeper mineralization.

These expansions are considered question marks until their long-term economic viability at greater depths is thoroughly confirmed. The success hinges on detailed geological modeling, advanced mining techniques, and favorable metal prices. Agnico Eagle's Nunavut operations, for example, have seen ongoing exploration and development efforts to extend mine life, with significant capital expenditure allocated to understanding and accessing these deeper zones. The company reported in its 2024 financial updates that capital expenditures for growth projects, including deeper exploration, were a key focus.

- Increased Capital Expenditure: Deeper mining often requires more robust infrastructure, advanced hoisting systems, and enhanced ventilation, driving up initial investment.

- Geological Complexity: Accessing deeper ore bodies can mean encountering more challenging geological conditions, potentially impacting extraction rates and recovery efficiency.

- Operational Costs: Higher energy consumption for pumping and ventilation, along with increased ground support requirements, can lead to elevated operating expenses.

- Economic Viability Uncertainty: The ultimate profitability of these expansions depends on a comprehensive assessment of resource grades, metal prices, and the cost of extraction at these new depths.

Question Marks in Agnico Eagle's portfolio represent projects with high growth potential but also significant uncertainty. These are typically early-stage ventures or expansions requiring substantial investment before they become profitable. The San Nicolás project in Mexico, a high-grade copper deposit, is a prime example, with a feasibility study due in late 2025. Agnico Eagle's substantial exploration budget of approximately $280 million in 2024 was heavily weighted towards these nascent opportunities, reflecting a strategic bet on future resource discovery.

| Project/Area | Status | Potential | Key Considerations | 2024 Focus/Investment |

| San Nicolás (Mexico) | Early Stage/Feasibility | High-grade Copper | Favorable jurisdiction, feasibility study in H2 2025 | Exploration and development planning |

| Amaruq Phase 2 (Nunavut) | Development | Gold | Expansion of existing complex, requires significant capital | Capital expenditure for growth projects |

| Deeper Exploration (Nunavut Operations) | Ongoing | Gold | Accessing more complex ore bodies, increased costs | Capital expenditure for deeper zones |

BCG Matrix Data Sources

Our Agnico Eagle Mines BCG Matrix is informed by a comprehensive review of company financial statements, industry-specific market research, and publicly available operational data. This ensures a robust and accurate assessment of each business unit's market share and growth potential.