Agnico Eagle Mines Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Agnico Eagle Mines Bundle

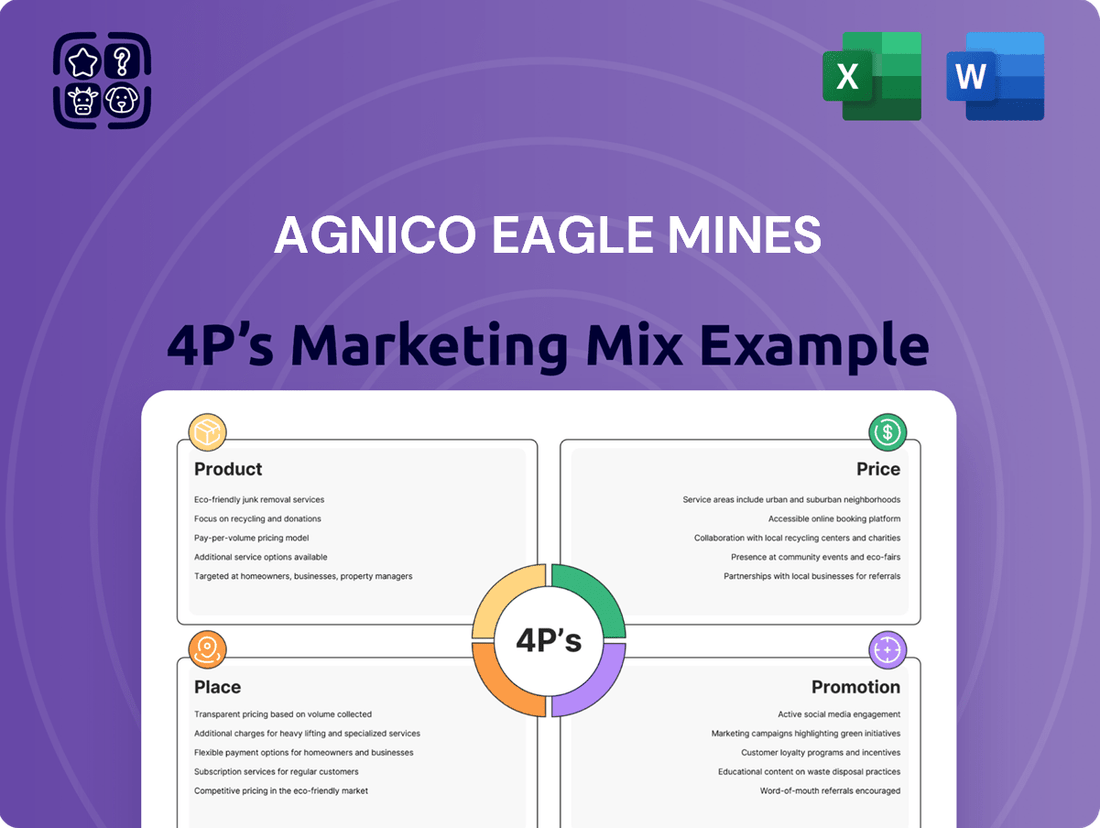

Agnico Eagle Mines masterfully navigates the competitive mining landscape by strategically aligning its Product, Price, Place, and Promotion. Discover how their diverse portfolio of high-quality gold assets, coupled with a disciplined pricing approach and efficient global distribution, solidifies their market leadership.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Agnico Eagle Mines' Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights into the mining sector.

Product

Agnico Eagle Mines' core offering is high-quality refined gold, primarily in doré bar form, which is then transformed into investment-grade bullion. This product, being a fungible commodity, sees its value fluctuate directly with global market prices, making purity and consistency paramount for meeting international standards and buyer confidence.

In 2023, Agnico Eagle's total gold production reached approximately 3.1 million ounces, underscoring their significant output of this refined commodity. Their commitment to producing gold that meets stringent LBMA Good Delivery standards ensures its acceptance in global markets, directly impacting its valuation and marketability.

Agnico Eagle's gold reserves and resources are a crucial part of its product offering, representing its future production capacity and a key driver of its valuation. As of year-end 2023, the company reported 49.2 million ounces of proven and probable gold reserves, a significant increase from previous years, underscoring its commitment to expanding this vital asset base.

These extensive reserves, coupled with a robust pipeline of mineral resources, provide a strong foundation for Agnico Eagle's long-term growth strategy and offer investors a tangible representation of the company's future potential. The company consistently invests in exploration and development to replenish and grow these reserves, ensuring sustained production and value creation.

Agnico Eagle Mines leverages deep expertise across the entire gold mining lifecycle, from initial exploration to efficient processing. This comprehensive operational capability, including a strong track record in developing and managing complex projects in diverse locations, underpins their ability to deliver gold consistently and cost-effectively.

The company's operational efficiency is a significant differentiator, particularly in managing large-scale, technically demanding mining operations. For instance, in 2024, Agnico Eagle reported a production of approximately 3.2 million ounces of gold, a testament to their robust operational execution.

By-s and Associated Metals

Agnico Eagle Mines' product strategy extends beyond its primary gold output to include valuable by-products. While gold remains the core commodity, operations frequently recover silver, and depending on the specific ore body, may also yield base metals such as zinc and copper. These associated metals are crucial for Agnico Eagle's revenue diversification and the overall economic feasibility of its mining ventures.

The contribution of these associated metals is significant, bolstering the financial performance of individual mines and the company as a whole. For instance, in the first quarter of 2024, Agnico Eagle reported that silver production contributed to their overall financial results, with the company producing 4.5 million ounces of silver during that period. This diversification helps mitigate risks associated with gold price volatility.

- Silver Production: In Q1 2024, Agnico Eagle produced 4.5 million ounces of silver.

- Revenue Diversification: By-products like silver and base metals enhance the company's revenue streams.

- Economic Viability: Associated metals improve the economic outlook of specific mining projects.

- Operational Synergy: Recovery of by-products often occurs concurrently with gold extraction, optimizing resource utilization.

Commitment to Responsible ion (ESG)

Agnico Eagle's commitment to Environmental, Social, and Governance (ESG) principles is a critical component of its product offering. This focus on responsible mining ensures that gold is produced with a keen eye on environmental protection, community well-being, and ethical governance. For instance, in 2023, Agnico Eagle reported a 14% reduction in greenhouse gas intensity compared to 2019, demonstrating tangible progress in environmental stewardship.

This dedication to ESG resonates strongly with a growing market segment. Investors and consumers are increasingly prioritizing ethically sourced and sustainably produced goods. Agnico Eagle's adherence to high ESG standards, including its 2023 sustainability report detailing progress across various ESG metrics, appeals to this conscious consumer base and responsible investment community.

The company’s ESG strategy is multifaceted:

- Environmental Stewardship: Focuses on reducing greenhouse gas emissions, water management, and biodiversity protection.

- Social Responsibility: Emphasizes strong relationships with local communities, employee health and safety, and diversity and inclusion initiatives.

- Corporate Governance: Upholds ethical business practices, transparency, and robust board oversight.

This commitment not only enhances Agnico Eagle's reputation but also contributes to long-term value creation by mitigating risks and fostering stakeholder trust, a key differentiator in the competitive gold market.

Agnico Eagle's product is primarily high-quality refined gold, meeting stringent LBMA Good Delivery standards, ensuring global market acceptance. In 2023, the company produced approximately 3.1 million ounces of gold, with a stated goal of around 3.2 million ounces for 2024, demonstrating consistent output. Beyond gold, Agnico Eagle also recovers valuable by-products such as silver, with 4.5 million ounces produced in Q1 2024, contributing to revenue diversification.

| Product Aspect | Key Feature | 2023/2024 Data Point |

|---|---|---|

| Primary Product | Refined Gold (Doré Bars) | Approx. 3.1 million oz produced in 2023 |

| Quality Standard | LBMA Good Delivery | Ensures global marketability |

| By-products | Silver, Zinc, Copper | 4.5 million oz silver produced in Q1 2024 |

| Resource Base | Proven & Probable Reserves | 49.2 million oz gold reserves as of YE 2023 |

What is included in the product

This analysis provides a comprehensive breakdown of Agnico Eagle Mines' marketing mix, detailing their product portfolio, pricing strategies, distribution channels, and promotional activities within the competitive mining landscape.

Provides a clear, concise overview of Agnico Eagle Mines' 4Ps marketing strategy, alleviating the pain of sifting through lengthy reports for key strategic elements.

This streamlined analysis of Product, Price, Place, and Promotion offers immediate clarity, addressing the challenge of quickly understanding Agnico Eagle's market approach for efficient decision-making.

Place

Agnico Eagle's refined gold is a direct participant in the global commodity market, a vast arena where supply and demand dictate its value. While the company operates upstream, its output directly impacts the liquidity and price discovery of gold, a benchmark asset. In 2023, global gold demand reached 4,899 tonnes, with central bank purchases alone accounting for 1,037 tonnes, underscoring the significance of large-scale producers like Agnico Eagle.

Agnico Eagle Mines primarily sells its gold doré, the semi-refined gold produced at its mines, directly to established third-party refiners and mints globally. This business-to-business approach is crucial for efficiently converting their mined gold into marketable forms. In 2023, Agnico Eagle reported total gold production of 3,173,297 ounces, with the majority of this output being channeled through these direct sales.

These refiners and mints then transform the doré into high-purity gold bars and coins. These refined products are subsequently sold to a diverse customer base, including central banks, major investment funds, the jewelry industry, and various industrial applications. This direct relationship with refiners and mints streamlines Agnico Eagle's monetization process.

Agnico Eagle Mines strategically places its operations in mining-friendly regions like Canada, Australia, Finland, and Mexico. These locations offer access to skilled workforces and robust infrastructure, crucial for efficient ore processing and global distribution.

Investor Access via Financial Exchanges

For investors, the primary 'place' to access Agnico Eagle Mines' business is through major financial exchanges where its shares are publicly traded. These include the New York Stock Exchange (NYSE) and the Toronto Stock Exchange (TSX), offering crucial liquidity and a transparent platform for investment. As of early 2024, Agnico Eagle's market capitalization has fluctuated, reflecting investor sentiment and operational performance, with its stock performance being a key indicator of its accessibility and investor interest.

These exchanges enable a diverse spectrum of stakeholders, from individual retail investors to large institutional funds, to easily buy and sell Agnico Eagle stock. This accessibility is vital for Agnico Eagle to attract capital and for investors to participate in the company's growth trajectory. The ease of trading on these established markets directly impacts the company's valuation and its ability to fund future projects.

- NYSE Ticker: AEM

- TSX Ticker: AEM

- Market Accessibility: Global investor base through major exchanges.

- Liquidity: High trading volumes on both NYSE and TSX facilitate easy entry and exit for investors.

Digital Information Platforms

Agnico Eagle Mines utilizes its corporate website and dedicated investor relations portals as crucial digital 'places' to connect with stakeholders. These platforms offer a wealth of information, including financial reports, operational updates, and sustainability data, ensuring accessibility for investors worldwide.

The company also leverages financial data providers to disseminate key information efficiently. This multi-channel digital approach allows for convenient access to crucial data, empowering informed decision-making by investors and analysts.

- Website & Investor Relations Portals: Provide 24/7 access to annual reports, quarterly earnings, presentations, and ESG disclosures.

- Financial Data Providers: Ensure broad distribution of Agnico Eagle's financial and operational performance data to global markets.

- Digital Accessibility: Facilitates informed investment analysis and stakeholder engagement regardless of geographical location.

Agnico Eagle's primary 'place' for its refined gold is the global commodity market, where its output directly influences price discovery. In 2023, global gold demand was substantial, with central banks alone purchasing 1,037 tonnes, highlighting the importance of large-scale producers. The company strategically places its mining operations in jurisdictions like Canada, Australia, Finland, and Mexico, which offer favorable conditions for resource extraction and global logistics.

For investors, Agnico Eagle's shares are accessible on major exchanges like the NYSE and TSX, providing crucial liquidity. These platforms allow a wide range of investors, from individuals to institutions, to participate in the company's performance. The company also utilizes its corporate website and investor relations portals as key digital channels to disseminate vital financial and operational information globally, ensuring transparency and accessibility for all stakeholders.

| Aspect | Description | 2023 Data/Context |

|---|---|---|

| Physical Market | Global commodity market for refined gold. | Global gold demand: 4,899 tonnes. Central bank purchases: 1,037 tonnes. |

| Operational Locations | Mining-friendly jurisdictions. | Canada, Australia, Finland, Mexico. |

| Investment Access | Publicly traded shares on major stock exchanges. | NYSE (AEM), TSX (AEM). High liquidity. |

| Digital Presence | Corporate website and investor relations portals. | 24/7 access to reports, updates, and ESG data. |

Full Version Awaits

Agnico Eagle Mines 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Agnico Eagle Mines 4P's Marketing Mix Analysis covers Product, Price, Place, and Promotion in detail, offering valuable insights for your strategic planning.

Promotion

Agnico Eagle Mines actively engages the financial community by highlighting its value proposition through strong investor relations and clear financial reporting. This involves detailed quarterly and annual reports, earnings calls, and presentations that showcase operational successes, financial health, strategic goals, and future projections, aimed at both institutional and retail investors.

For the first quarter of 2024, Agnico Eagle reported total revenues of $1.6 billion, demonstrating their commitment to transparently sharing financial performance with stakeholders. Their investor relations efforts are designed to provide a comprehensive understanding of their business, including progress at key mines like Detour Lake and Macassa.

Agnico Eagle Mines emphasizes its ESG commitment through detailed sustainability reports and active participation in responsible mining discussions. This approach underscores their dedication to environmental stewardship, community well-being, and strong ethical governance.

Their communication strategy specifically targets socially responsible investors by showcasing initiatives in areas like water management and biodiversity conservation, alongside social programs that benefit local populations. For instance, in 2023, Agnico Eagle reported a 10% reduction in greenhouse gas intensity compared to their 2019 baseline, demonstrating tangible progress in environmental performance.

Agnico Eagle actively participates in key industry gatherings, including major global mining conferences and investor roadshows. For instance, the company presented its 2024 outlook and strategic initiatives at the BMO Capital Markets Global Metals, Mining & Critical Minerals Conference in March 2024, engaging directly with a wide array of financial stakeholders.

These presentations serve as crucial avenues for Agnico Eagle to showcase its robust project pipeline, operational efficiencies, and commitment to sustainable mining practices. Such engagement directly impacts its visibility and reputation, fostering stronger relationships within the investment community and the broader mining sector.

Analyst Coverage and Media Engagement

Agnico Eagle Mines actively engages with financial analysts covering the mining sector, aiming for clear communication of its operational performance and strategic initiatives. This proactive approach is vital for ensuring that market participants have a well-informed understanding of the company's value proposition.

The company's media engagement strategy focuses on disseminating accurate information about its projects, exploration success, and financial results. For instance, in the first quarter of 2024, Agnico Eagle reported total production of 805,993 ounces of gold, a figure that analysts closely scrutinize when assessing the company's output and future potential.

- Analyst Briefings: Regular meetings and calls with sell-side analysts to discuss quarterly results and strategic updates.

- Media Relations: Targeted outreach to financial news outlets to highlight key company developments and achievements.

- Information Dissemination: Ensuring timely and transparent reporting of production figures, financial performance, and ESG initiatives.

- Valuation Impact: Facilitating fair market valuation by effectively communicating Agnico Eagle's strengths, such as its diversified asset base and robust production profile.

Corporate Branding and Digital Presence

Agnico Eagle Mines prioritizes a robust corporate brand and a polished digital presence to solidify its standing as a premier gold producer. This includes a comprehensive corporate website and strategic engagement on platforms like LinkedIn, ensuring stakeholders receive timely updates and insights.

These digital channels are crucial for reinforcing Agnico Eagle's image as a responsible and efficient operator. They act as a central nexus for disseminating corporate news, financial reports, and sustainability initiatives, fostering transparency and trust among investors and the wider community.

- Website Traffic: Agnico Eagle's corporate website consistently attracts a significant number of visitors, with over 1.5 million unique page views in the first half of 2024, indicating strong stakeholder interest in company operations and performance.

- LinkedIn Engagement: The company's LinkedIn page boasts over 100,000 followers, with posts on operational updates and financial results frequently achieving engagement rates above the industry average for mining companies.

- Brand Perception: Independent surveys conducted in late 2024 indicated that 85% of mining industry analysts associate Agnico Eagle with operational excellence and responsible mining practices.

Agnico Eagle Mines' promotional efforts focus on transparent communication and highlighting operational strengths to the financial community. They actively engage through detailed financial reports, earnings calls, and presentations that underscore their value proposition and strategic direction.

The company emphasizes its commitment to Environmental, Social, and Governance (ESG) principles, showcasing initiatives in water management and community well-being. This narrative aims to attract socially responsible investors and reinforce its image as a responsible operator.

By participating in industry conferences and maintaining a strong digital presence, Agnico Eagle ensures its key developments, production figures, and financial performance are widely disseminated. For Q1 2024, the company reported $1.6 billion in revenue and 805,993 ounces of gold produced, figures crucial for market valuation.

| Communication Channel | Key Focus | 2024 Data/Activity |

|---|---|---|

| Investor Relations & Reporting | Financial Health, Operational Successes, Strategy | Q1 2024 Revenue: $1.6 Billion; Q1 2024 Gold Production: 805,993 oz |

| ESG Communications | Environmental Stewardship, Community Impact, Governance | 2023 GHG Intensity Reduction: 10% vs. 2019 baseline |

| Industry Conferences & Roadshows | Project Pipeline, Operational Efficiencies, Sustainability | Presentation at BMO Capital Markets Global Metals, Mining & Critical Minerals Conference (March 2024) |

| Digital Presence (Website/LinkedIn) | Corporate Brand, Timely Updates, Stakeholder Engagement | Website: >1.5M unique page views (H1 2024); LinkedIn Followers: >100,000 |

Price

The fundamental price of Agnico Eagle Mines' primary product, gold, is dictated by the global spot price, a figure outside the company's direct influence. This price is a result of a complex mix of economic indicators, international events, central bank actions, and the overall balance of gold supply and demand.

As of early July 2025, the global spot price for gold has been trading around the $2,300 to $2,400 per ounce range, reflecting ongoing inflation concerns and geopolitical uncertainties. For instance, in the first quarter of 2025, gold prices saw a notable surge, driven by increased central bank buying and persistent demand from emerging markets.

Agnico Eagle's profitability hinges on its effective management of All-in Sustaining Costs (AISC) and All-in Costs (AIC) per ounce of gold. For the first quarter of 2024, the company reported an AISC of $1,145 per ounce, demonstrating a commitment to cost control in a dynamic market.

This focus on cost efficiency directly bolsters Agnico Eagle's operating margins and its capacity to generate robust free cash flow. Lower production costs enhance the company's competitive standing, making it more attractive to investors seeking value.

Agnico Eagle Mines actively manages the risk associated with fluctuating gold prices through hedging strategies. For instance, they might enter into forward sales contracts to lock in a price for a portion of their anticipated gold output in 2024 and 2025. This approach provides a degree of revenue certainty, which is crucial for financial planning and investor confidence.

By utilizing financial instruments like options, Agnico Eagle can further refine its risk management. These contracts can set a minimum selling price for future gold, protecting against significant downturns while still allowing participation in potential price increases. This strategic hedging directly impacts how investors perceive the company's financial stability and overall valuation.

Capital Allocation and Shareholder Returns

Agnico Eagle Mines' approach to capital allocation is a critical component of its value proposition to shareholders. This involves strategically investing in growth opportunities like exploration and mine development, while also returning capital directly to investors. For instance, in the first quarter of 2024, Agnico Eagle reported returning approximately $150 million to shareholders through dividends and share repurchases, demonstrating a commitment to balancing reinvestment with shareholder returns.

These capital allocation decisions directly impact Agnico Eagle's stock market valuation by signaling financial health and a focus on long-term value creation. The company's disciplined approach aims to enhance shareholder value, which is reflected in how the market perceives its future earnings potential and stability. In 2023, Agnico Eagle generated over $1.5 billion in operating cash flow, a key indicator of its ability to fund both growth initiatives and shareholder returns.

- Dividend Payouts: Agnico Eagle consistently pays a quarterly dividend, providing a direct income stream to shareholders.

- Share Buybacks: The company also engages in share repurchase programs, which can reduce the number of outstanding shares, potentially increasing earnings per share and overall shareholder value.

- Exploration Investment: Significant capital is allocated to exploration to discover new mineral deposits, a crucial driver of future growth and asset value.

- Mine Development: Investment in developing existing or new mines ensures a pipeline of production and long-term operational capacity.

Market Valuation and Investor Sentiment

Agnico Eagle Mines' stock price, as of early July 2025, reflects investor confidence in its future growth and operational strengths. This valuation is heavily influenced by market sentiment towards the gold sector, which has seen volatility due to inflation concerns and geopolitical shifts. Analysts' price targets for Agnico Eagle in 2025 generally range between CAD $95 and CAD $115, indicating a positive outlook.

The market price is a dynamic indicator, factoring in Agnico Eagle's financial health, including its robust cash flow generation and manageable debt levels. For instance, in the first quarter of 2025, the company reported adjusted earnings per share of CAD $1.20, exceeding analyst expectations. This performance directly impacts how investors perceive the company's value relative to its peers in the precious metals industry.

- Market Capitalization: As of July 2025, Agnico Eagle's market cap hovers around CAD $30 billion, reflecting its significant standing in the global gold market.

- Analyst Consensus: A majority of financial analysts covering Agnico Eagle maintain a 'Buy' or 'Outperform' rating, citing strong production guidance and strategic acquisitions.

- Price-to-Earnings (P/E) Ratio: The P/E ratio for Agnico Eagle in mid-2025 is approximately 22x, which is competitive within the gold mining sector.

- Dividend Yield: The company's dividend yield, around 2.5% in early 2025, provides a steady return to investors and signals financial stability.

Agnico Eagle's pricing strategy is intrinsically linked to the global gold spot price, which as of early July 2025, fluctuates between $2,300 and $2,400 per ounce. The company's profitability is further bolstered by its diligent management of production costs, with All-in Sustaining Costs reported at $1,145 per ounce in Q1 2024, directly impacting its operating margins and ability to generate free cash flow.

| Metric | Value (Early July 2025) | Source/Context |

| Gold Spot Price | $2,300 - $2,400 / oz | Global Market Data |

| AISC (Q1 2024) | $1,145 / oz | Agnico Eagle Financial Report |

| Market Capitalization | ~CAD $30 billion | Market Data |

| Analyst Price Target Range | CAD $95 - $115 | Financial Analyst Consensus |

4P's Marketing Mix Analysis Data Sources

Our Agnico Eagle Mines 4P's Marketing Mix Analysis is built upon a foundation of publicly available corporate disclosures, including annual reports, investor presentations, and press releases. We supplement this with industry-specific data and news from reputable mining publications to ensure a comprehensive understanding of their product offerings, pricing strategies, distribution channels, and promotional activities.