Agfa-Gevaert PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Agfa-Gevaert Bundle

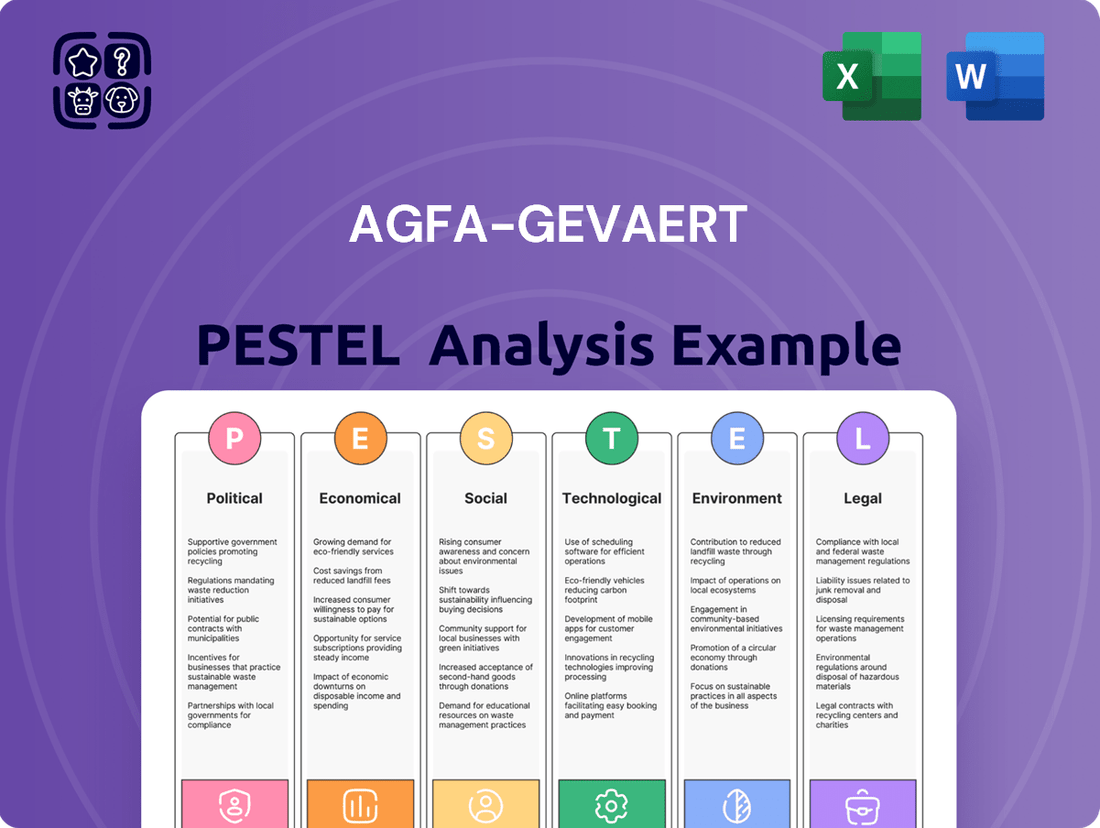

Navigate the dynamic landscape of Agfa-Gevaert with our comprehensive PESTLE analysis. Uncover the critical political, economic, social, technological, legal, and environmental factors shaping its strategic direction and market opportunities. Equip yourself with actionable intelligence to anticipate industry shifts and make informed business decisions. Download the full PESTLE analysis now and gain a decisive competitive advantage.

Political factors

Government healthcare policies directly influence Agfa-Gevaert's radiology and healthcare IT businesses. For instance, increased public health spending, as seen in many European nations aiming for universal healthcare access, can drive demand for advanced medical imaging equipment and digital health solutions. In 2024, many governments are prioritizing digital transformation in healthcare, which benefits Agfa's IT infrastructure offerings.

Changes in regulations, such as those concerning data privacy for patient information or reimbursement rates for medical procedures, also play a critical role. For example, shifts towards value-based care models may encourage the adoption of integrated imaging and IT systems that improve efficiency and patient outcomes, a key area for Agfa.

Regional variations are significant; while the US healthcare system has different funding mechanisms than those in Germany or France, Agfa must adapt its strategies to leverage opportunities presented by each market's specific policy landscape, including digital health initiatives rolled out in 2024.

Agfa-Gevaert's global operations are significantly influenced by international trade regulations and tariffs. For instance, the European Union's trade policies, including those with the United States and China, directly impact the cost of components and the distribution of Agfa's healthcare and imaging products. Changes in these agreements, such as potential adjustments to tariffs on specialized chemicals or electronic components, could alter Agfa's manufacturing costs and final product pricing, affecting its market position.

Global geopolitical shifts, including ongoing conflicts and regional instability, pose significant risks to Agfa-Gevaert's international operations. For instance, the protracted conflict in Eastern Europe and potential flashpoints in other regions can disrupt critical supply chains, leading to increased logistics costs and potential material shortages for Agfa's manufacturing processes.

Such instability also heightens operational risks, potentially impacting the safety of personnel and the security of assets in affected territories. Furthermore, reduced consumer and business spending power in conflict-ridden or politically unstable markets can directly translate to lower demand for Agfa's imaging and healthcare IT solutions.

The stability of governments in Agfa's key markets, such as Europe and North America, is crucial for maintaining investor confidence. For example, in 2024, the ongoing political realignments and potential trade policy shifts in major economies create an environment of uncertainty that can influence Agfa-Gevaert's long-term investment decisions and overall business predictability.

Industrial Policy and Subsidies

Government industrial policies and subsidies can significantly impact Agfa-Gevaert's operations. For instance, the European Union's focus on digital transformation and advanced manufacturing, particularly in sectors like printing and healthcare IT, presents opportunities for Agfa's solutions. In 2024, the EU continued to allocate significant funding towards digital innovation and green technologies, potentially benefiting Agfa's sustainable printing and digital workflow offerings.

Conversely, a lack of targeted support for specific Agfa business units in certain markets could pose challenges. Government-backed research and development grants, especially in areas like inkjet technology or medical imaging, are crucial. For example, national initiatives promoting domestic production or technological advancement within these fields could either bolster Agfa's competitive position or favor local players depending on policy design.

- EU Digital Decade targets aim to boost digital transformation across industries, aligning with Agfa's digital printing and workflow solutions.

- National R&D funding in countries like Germany or Belgium may offer grants for Agfa's advancements in inkjet and healthcare IT.

- Sustainability mandates in manufacturing could drive demand for Agfa's eco-friendly printing solutions.

- Trade policies impacting the import/export of specialized printing equipment and chemicals are also a factor.

Public Procurement Policies

Public procurement policies directly influence Agfa-Gevaert's access to the healthcare market, a key sector for its imaging and IT solutions. Changes in tender processes, such as increased emphasis on digital health integration or cybersecurity standards for medical devices, can create both opportunities and challenges. For instance, a government mandate favoring locally manufactured medical equipment could impact Agfa-Gevaert's supply chain strategy in specific regions.

The 2024/2025 period is likely to see continued scrutiny on public spending efficiency, potentially leading to more competitive bidding processes. Agfa-Gevaert must navigate these tenders, adhering to requirements for transparency, ethical sourcing, and often, local content provisions. Successful engagement with these policies is crucial for securing significant contracts with public hospitals and healthcare networks.

- Tender Competitiveness: Public healthcare tenders often involve multiple suppliers, with contract awards frequently based on a combination of price, technical merit, and service level agreements.

- Local Content Requirements: Some governments implement policies that mandate a certain percentage of goods or services to be sourced locally, influencing Agfa-Gevaert's manufacturing and partnership decisions.

- Ethical Sourcing Guidelines: Increasingly, public procurement includes stipulations on labor practices, environmental impact, and data privacy, requiring Agfa-Gevaert to demonstrate compliance across its operations.

Government healthcare policies are a significant driver for Agfa-Gevaert's radiology and healthcare IT segments. For example, the EU's Digital Decade targets, aiming for widespread digital transformation by 2030, are likely to fuel demand for Agfa's integrated imaging and IT solutions throughout 2024 and 2025.

Regulatory changes, particularly around data privacy and value-based care models, directly influence Agfa's offerings. Stricter data protection laws necessitate robust cybersecurity measures in their IT solutions, while value-based care incentives encourage the adoption of technologies that improve efficiency and patient outcomes, areas where Agfa is investing.

Geopolitical stability and trade policies also impact Agfa's global operations. For instance, ongoing trade tensions or the imposition of tariffs on specialized chemicals or electronic components could affect manufacturing costs and product competitiveness. The company's 2024 financial reports likely reflect strategies to mitigate such risks through diversified sourcing.

Government industrial policies, including R&D funding and subsidies for advanced manufacturing, present opportunities. Agfa may benefit from initiatives supporting digital innovation and sustainable technologies, particularly in its printing and healthcare IT divisions. For example, national R&D grants in countries like Germany could bolster advancements in inkjet technology.

| Policy Area | Impact on Agfa-Gevaert | 2024/2025 Relevance |

|---|---|---|

| Healthcare Digitalization | Increased demand for IT infrastructure and integrated imaging solutions | EU Digital Decade targets, national health IT investments |

| Data Privacy Regulations | Requirement for enhanced cybersecurity in healthcare IT | GDPR compliance, evolving patient data protection laws |

| Trade Tariffs & Agreements | Potential impact on component costs and market access | Global trade policy shifts, supply chain diversification strategies |

| R&D Funding & Subsidies | Opportunities for innovation in printing and healthcare IT | EU and national grants for digital and green technologies |

What is included in the product

This Agfa-Gevaert PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the company, offering a comprehensive view of its operating landscape.

The Agfa-Gevaert PESTLE Analysis provides a structured framework to identify and understand external factors impacting the business, thereby alleviating the pain of navigating an uncertain market by offering clarity and strategic direction.

Economic factors

Global economic growth directly impacts Agfa-Gevaert by influencing demand for its healthcare imaging and industrial printing solutions. Strong economic periods typically see increased capital expenditure from hospitals and manufacturing sectors, boosting sales. For instance, the International Monetary Fund (IMF) projected global growth of 3.2% for 2024, a slight slowdown from 2023, indicating a generally supportive but moderating economic environment.

Conversely, recessionary pressures pose a significant risk. During economic downturns, businesses and healthcare providers tend to cut back on non-essential spending and delay investments in new equipment, which can directly reduce Agfa-Gevaert's revenue streams. Consumer confidence and business investment cycles are critical to monitor as they signal future demand for Agfa's offerings.

Global healthcare spending is projected to reach $11.3 trillion by 2025, driven by aging populations and the increasing burden of chronic diseases. This trend directly influences Agfa-Gevaert's healthcare division, as demand for advanced medical imaging and IT solutions grows. For instance, the World Health Organization reported that non-communicable diseases, which often require sophisticated diagnostic tools, accounted for 71% of global deaths in 2021.

Government budget allocations for health services are also critical. In 2024, many developed nations are increasing their healthcare budgets to address these demographic shifts and technological advancements. This increased investment can translate into greater market opportunities for companies like Agfa-Gevaert, particularly in areas like diagnostic imaging and digital health platforms.

The ongoing shift towards value-based care models in healthcare systems worldwide is another significant factor. This approach emphasizes patient outcomes over the volume of services, encouraging the adoption of integrated IT solutions and advanced imaging technologies that improve diagnostic accuracy and efficiency, directly benefiting Agfa-Gevaert's offerings.

Fluctuations in the cost of essential raw materials like chemicals and specialized components significantly impact Agfa-Gevaert's manufacturing expenses and overall profitability. For instance, the price of key chemical inputs can swing based on global demand and energy costs, directly affecting production budgets.

Supply chain disruptions, often triggered by geopolitical tensions or unexpected events, create volatility in both material availability and pricing. This can lead to production delays and necessitate adjustments in product pricing strategies, as seen with disruptions affecting global shipping routes in late 2023 and early 2024.

Effective management of supplier relationships is paramount for Agfa-Gevaert to mitigate these risks. Maintaining strong ties with suppliers allows for better forecasting, potential bulk purchasing advantages, and collaborative problem-solving during periods of scarcity or price surges.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations present a significant economic factor for Agfa-Gevaert. As a global company, its financial performance is directly impacted by the varying strength of currencies like the Euro, US Dollar, and Japanese Yen. For instance, a stronger Euro can make Agfa-Gevaert's products more expensive for international buyers, potentially dampening export sales. Conversely, a weaker Euro could increase the cost of essential imported raw materials, squeezing profit margins.

Agfa-Gevaert's operational strategy often involves managing these currency risks. The company utilizes hedging strategies to mitigate the impact of adverse currency movements. Furthermore, its geographical diversification of revenue streams helps to naturally offset some of these fluctuations, as profits generated in different currencies can balance out losses incurred elsewhere due to exchange rate shifts.

- Impact on Revenue: A strong Euro relative to other major currencies can reduce the Euro-denominated value of sales made in USD or JPY.

- Impact on Costs: Conversely, a weaker Euro can increase the cost of imported components and raw materials, impacting the cost of goods sold.

- Profitability Concerns: Unfavorable exchange rate movements can directly erode Agfa-Gevaert's net profit margins, especially if not adequately hedged.

- Strategic Responses: Agfa-Gevaert employs financial instruments for hedging and diversifies its sales and manufacturing footprints to manage currency volatility.

Competitive Landscape and Pricing Pressure

Agfa-Gevaert operates in highly competitive printing and healthcare imaging sectors, where intense rivalry often translates into significant pricing pressure. This dynamic directly impacts the company's ability to maintain healthy profit margins.

The market is populated by a multitude of global and regional players, all vying for market share. Competitors frequently introduce new technologies, forcing Agfa-Gevaert to invest heavily in research and development to keep pace. Furthermore, customers consistently seek more cost-effective solutions, compelling the company to optimize its operations and pursue continuous innovation to remain competitive.

- Market Share Dynamics: In the digital printing sector, key competitors like HP Indigo and Canon offer advanced solutions, intensifying the battle for market dominance.

- Healthcare Imaging Competition: In medical imaging, companies such as Siemens Healthineers, GE Healthcare, and Philips are major rivals, driving innovation and influencing pricing strategies.

- Pricing Trends: Industry reports from 2024 indicate a trend of gradual price erosion in certain segments of the printing consumables market due to oversupply and aggressive competitor strategies.

- Innovation Costs: The need to counter rivals' technological advancements means Agfa-Gevaert must allocate substantial resources to R&D, impacting short-term profitability but crucial for long-term survival.

Global economic growth directly influences Agfa-Gevaert's demand for healthcare imaging and industrial printing solutions. A projected global growth of 3.2% for 2024, as forecasted by the IMF, suggests a moderating but generally supportive economic environment. Conversely, economic downturns can lead to reduced capital expenditure and delayed investments, directly impacting Agfa-Gevaert's revenue streams.

Full Version Awaits

Agfa-Gevaert PESTLE Analysis

The Agfa-Gevaert PESTLE analysis you are previewing is the exact document you will receive after purchase. This comprehensive report details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Agfa-Gevaert, providing valuable strategic insights. You can be confident that the content and structure shown here represent the final, ready-to-use file you will download immediately.

Sociological factors

The world's population is getting older, with the proportion of people aged 65 and over projected to reach 16% by 2050, up from 10% in 2022. This demographic shift significantly boosts demand for healthcare, directly benefiting companies like Agfa-Gevaert. An aging populace typically experiences a higher prevalence of chronic and age-related conditions, such as cardiovascular disease and cancer, which require advanced diagnostic imaging solutions.

This increasing need for medical imaging, including X-rays, CT scans, and MRI, translates into expanded market opportunities for Agfa-Gevaert's product portfolio. The growing incidence of age-related diseases will likely drive consistent revenue growth for their healthcare IT and imaging divisions throughout the coming years.

Societal shifts are increasingly pushing healthcare and industries towards digital solutions. This trend fuels demand for Agfa-Gevaert's digital imaging, IT, and printing technologies. For instance, the global digital health market was projected to reach over $660 billion by 2025, indicating a significant societal embrace of these advancements.

The success of this digital transformation hinges on user acceptance and the digital literacy of both healthcare professionals and industrial workers. As of 2024, many regions are investing heavily in digital skills training to bridge this gap, recognizing its critical role in efficient technology adoption.

Societal shifts are profoundly impacting how consumers and businesses view sustainability, directly influencing Agfa-Gevaert's strategic direction. There's a clear and growing demand for products and services that minimize environmental impact, pushing companies to adopt greener operational models and develop eco-conscious solutions. This trend means Agfa-Gevaert must increasingly focus on sustainable printing technologies and responsible chemical handling to align with evolving market expectations.

This heightened consumer and corporate focus on environmental responsibility translates into tangible purchasing decisions. Businesses are actively seeking out suppliers who demonstrate robust environmental, social, and governance (ESG) performance. For Agfa-Gevaert, this means that offering energy-efficient printing systems and prioritizing responsible chemical management are no longer just optional extras but critical factors for maintaining brand reputation and securing market share. For instance, a significant portion of B2B purchasing decisions in 2024 now incorporate sustainability metrics, with some studies indicating over 60% of companies actively evaluating supplier ESG ratings.

Workforce Demographics and Skills Gap

Demographic shifts significantly influence Agfa-Gevaert's operational landscape. Developed nations are experiencing an aging workforce, potentially leading to a reduction in available skilled labor for critical manufacturing, IT, and R&D functions. This trend necessitates proactive strategies to bridge emerging skills gaps.

Addressing the evolving needs of the industry, Agfa-Gevaert must focus on developing expertise in areas such as artificial intelligence, data science, and advanced materials. A key challenge is ensuring a pipeline of talent proficient in these specialized fields, which requires strategic investment in employee training, robust talent acquisition initiatives, and effective retention programs. For instance, in 2024, the global demand for AI specialists saw a significant increase, with job postings for AI engineers rising by an estimated 20% compared to the previous year.

- Aging Workforce: Developed countries face a shrinking pool of experienced workers, impacting knowledge transfer and operational continuity.

- Skills Gap in Tech: A notable deficit exists in specialized IT and R&D roles, particularly in AI, data science, and advanced materials development.

- Talent Acquisition & Retention: Companies like Agfa-Gevaert must compete for scarce talent, emphasizing competitive compensation, professional development, and a positive work environment.

- Diversity & Inclusion: Fostering a diverse and inclusive workforce is crucial for innovation and attracting a broader talent pool, reflecting societal shifts towards greater equity.

Health Awareness and Lifestyle Changes

Growing health awareness significantly influences Agfa-Gevaert's business, particularly its healthcare IT and imaging solutions. As people prioritize preventative care, demand for early detection and screening technologies, like advanced medical imaging, is likely to rise. For instance, in 2024, global spending on digital health solutions, which often integrate with diagnostic imaging, was projected to exceed $300 billion, reflecting this trend.

Conversely, a greater emphasis on healthy lifestyles and preventative measures could potentially moderate the growth in demand for certain diagnostic procedures over the long term. Public health initiatives promoting wellness and increasing health literacy empower individuals to make informed choices, potentially impacting the volume of reactive medical interventions.

- Increased demand for diagnostic imaging: Rising health consciousness drives the need for early disease detection and screening.

- Impact of preventative care: A focus on wellness might reduce the long-term need for certain diagnostic procedures.

- Role of public health: Health campaigns and literacy influence patient behavior and healthcare utilization patterns.

- Digital health integration: The growing digital health market, valued in the hundreds of billions, increasingly incorporates imaging and diagnostic tools.

Societal attitudes toward sustainability are increasingly shaping consumer and corporate behavior, directly impacting Agfa-Gevaert's strategic focus. There's a pronounced demand for eco-friendly products and operations, pushing companies towards greener models and sustainable solutions. This trend necessitates Agfa-Gevaert's commitment to sustainable printing technologies and responsible chemical management to meet evolving market expectations.

This heightened environmental awareness translates into purchasing decisions, with businesses actively seeking suppliers demonstrating strong ESG performance. Offering energy-efficient systems and prioritizing responsible chemical handling are critical for Agfa-Gevaert's brand reputation and market share. By 2024, a significant portion of B2B purchasing decisions incorporated sustainability metrics, with over 60% of companies evaluating supplier ESG ratings.

The global population's aging trend, with the 65+ demographic projected to reach 16% by 2050, significantly boosts demand for healthcare, benefiting Agfa-Gevaert. This demographic shift drives demand for advanced diagnostic imaging solutions due to a higher prevalence of chronic and age-related conditions. This translates into expanded market opportunities for Agfa-Gevaert's imaging and healthcare IT divisions.

| Sociological Factor | Impact on Agfa-Gevaert | Supporting Data (2024-2025 Projections/Trends) |

|---|---|---|

| Aging Population | Increased demand for diagnostic imaging and healthcare IT solutions. | Global population aged 65+ projected to reach 16% by 2050 (up from 10% in 2022). |

| Digital Transformation | Fuels demand for digital imaging, IT, and printing technologies. | Global digital health market projected to exceed $660 billion by 2025. |

| Sustainability Focus | Drives need for eco-conscious products and operations; impacts B2B purchasing. | Over 60% of companies evaluate supplier ESG ratings in purchasing decisions (2024). |

| Health Consciousness | Boosts demand for preventative care and early detection technologies. | Global digital health spending projected to exceed $300 billion (2024). |

Technological factors

Artificial intelligence and machine learning are revolutionizing medical imaging diagnostics and industrial quality control, key areas for Agfa-Gevaert. AI-powered tools enhance image analysis, leading to improved diagnostic accuracy and more efficient workflows. For instance, AI algorithms are showing remarkable success in detecting subtle anomalies in X-rays and CT scans, potentially reducing misdiagnosis rates.

In industrial settings, these technologies enable predictive maintenance by analyzing imaging data to identify potential equipment failures before they occur. This proactive approach minimizes downtime and optimizes operational efficiency. Agfa-Gevaert's strategic investment and integration of AI and ML are therefore vital for maintaining a competitive edge in these sectors.

The digital printing landscape continues its rapid evolution, with advancements in inkjet and wide-format technologies directly impacting Agfa-Gevaert's business. These innovations, such as increased printing speeds and enhanced resolution, are compelling a market shift away from traditional offset printing methods. For instance, the global digital printing market was valued at approximately $18.1 billion in 2023 and is projected to reach $29.1 billion by 2028, showcasing the significant momentum towards digital solutions.

New ink formulations are also a key factor, offering improved durability and a wider range of applications, further accelerating the transition. Agfa-Gevaert's ability to adapt and integrate these cutting-edge developments, particularly in areas like UV-curable inks and sustainable ink options, is crucial for maintaining competitiveness in both its legacy offset and growing digital print divisions. The company's commitment to R&D in these areas is vital to meet the evolving demands for faster, more versatile, and environmentally conscious printing solutions.

Agfa-Gevaert's healthcare IT solutions, which manage sensitive patient information, face significant cybersecurity threats. The escalating global threat landscape necessitates ongoing investment in robust data encryption, advanced network security protocols, and strict adherence to data protection regulations like GDPR. In 2024, the average cost of a data breach in healthcare reached $10.93 million, underscoring the financial and reputational risks associated with inadequate security.

Research and Development (R&D) Investment and Innovation Pipeline

Agfa-Gevaert places a strong emphasis on Research and Development (R&D) as a cornerstone for its future growth and sustained competitive edge. The company's commitment to innovation spans critical areas like advanced materials science, sophisticated imaging algorithms, cutting-edge software development, and the integration of sustainable technologies across its product lines. This dedication is crucial for staying ahead in a rapidly evolving technological landscape.

The true measure of Agfa-Gevaert's R&D efforts lies in its capacity to transform these innovations into commercially successful products and solutions that meet market demands. Successfully navigating the path from laboratory breakthroughs to market-ready offerings, while simultaneously safeguarding its intellectual property through robust patent strategies, is fundamental to its long-term viability and profitability. This pipeline of innovation directly impacts its market position and revenue generation.

- R&D Investment: Agfa-Gevaert consistently allocates significant resources to R&D, aiming to foster a culture of continuous improvement and groundbreaking discovery.

- Innovation Focus Areas: Key areas of research include next-generation printing technologies, advanced healthcare imaging solutions, and eco-friendly materials.

- Commercialization Success: The company's ability to bring novel products to market, such as its recent advancements in inkjet printing technology, demonstrates its R&D effectiveness.

- Intellectual Property: Agfa-Gevaert actively protects its technological advancements through a comprehensive portfolio of patents, ensuring a competitive advantage.

Obsolescence of Analog Systems and Transition to Digital

The global shift from analog to digital imaging systems, particularly in healthcare, is a defining technological factor. This transition impacts Agfa-Gevaert by necessitating a strategic management of its legacy analog product lines while capitalizing on the growth of its digital radiography and healthcare IT solutions. For instance, the global digital radiography market was valued at approximately USD 10.5 billion in 2023 and is projected to reach over USD 17.1 billion by 2030, indicating a strong compound annual growth rate (CAGR) of 7.2%.

Agfa-Gevaert is actively navigating this obsolescence by investing in and promoting its digital imaging technologies. The company's strategy involves offering comprehensive digital solutions that integrate imaging hardware with advanced software platforms, aiming to streamline workflows and improve diagnostic accuracy for healthcare providers. This move is crucial as analog systems, such as traditional X-ray film, are becoming increasingly outdated and less cost-effective for many applications.

The pace of this digital transformation varies significantly across different geographical markets and healthcare infrastructures. Developed economies often adopt digital solutions more rapidly due to established IT capabilities and higher healthcare spending. However, emerging markets are also increasingly investing in digital imaging as costs decrease and awareness of its benefits grows. Agfa-Gevaert's success hinges on its ability to cater to these diverse market needs and support the transition effectively.

Key aspects of this technological shift for Agfa-Gevaert include:

- Phasing out analog products: Managing the decline of revenue from traditional film-based systems.

- Investing in digital solutions: Expanding offerings in digital radiography, computed radiography, and imaging IT.

- Market adoption rates: Adapting strategies to the varying speeds of digital transition across different regions.

- Innovation in digital platforms: Developing advanced software for image analysis, workflow optimization, and artificial intelligence integration.

Agfa-Gevaert's technological trajectory is heavily influenced by advancements in artificial intelligence and machine learning, particularly within its core markets of medical imaging and industrial quality control. These AI-driven tools are enhancing diagnostic precision and streamlining operational workflows, with AI algorithms demonstrating significant promise in identifying subtle anomalies in medical scans, thereby aiming to reduce misdiagnosis rates.

The digital printing sector continues its rapid evolution, driven by innovations in inkjet and wide-format technologies. This ongoing progress, including increased printing speeds and improved resolution, is accelerating the market's shift away from traditional offset printing. The global digital printing market, valued at approximately $18.1 billion in 2023, is projected to reach $29.1 billion by 2028, highlighting the strong momentum towards digital solutions.

Agfa-Gevaert's commitment to R&D is central to its strategy, with significant investments in advanced materials, imaging algorithms, software development, and sustainable technologies. The company's ability to translate these innovations into commercially viable products, such as its advancements in inkjet printing, is crucial for maintaining its competitive edge and ensuring long-term profitability.

The global transition from analog to digital imaging systems, especially in healthcare, is a critical technological shift. This necessitates Agfa-Gevaert's strategic management of legacy analog product lines while capitalizing on the growth of its digital radiography and healthcare IT solutions. The digital radiography market, valued at approximately USD 10.5 billion in 2023, is expected to exceed USD 17.1 billion by 2030, reflecting a compound annual growth rate of 7.2%.

Legal factors

Global data privacy regulations like GDPR in Europe and HIPAA in the United States significantly impact Agfa-Gevaert, especially its healthcare IT operations. These laws govern the collection, storage, processing, and sharing of sensitive patient data, making strict adherence paramount for avoiding substantial penalties and maintaining customer confidence.

Failure to comply with these stringent data privacy frameworks can result in severe financial repercussions; for instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher. For Agfa-Gevaert, whose healthcare IT division manages extensive patient information, ensuring compliance is not just a legal necessity but a critical component of operational integrity and trust-building in the 2024-2025 period.

Intellectual property rights, particularly patents, form the bedrock of Agfa-Gevaert's competitive advantage in its imaging and healthcare IT sectors. These legal protections safeguard innovations in areas like digital radiography, printing technologies, and specialized chemical compounds, preventing rivals from replicating their core offerings. For instance, in 2024, the company continues to actively manage its extensive patent portfolio, which is critical for maintaining market share and justifying premium pricing on its advanced solutions.

The legal landscape surrounding intellectual property presents both opportunities and risks. While strong patent protection allows Agfa-Gevaert to monetize its research and development investments, patent litigation, either as a plaintiff or defendant, can be a substantial financial and operational drain. In 2023, the global increase in patent disputes across the technology sector highlights the ongoing need for vigilant legal strategy and robust enforcement of IP rights.

Agfa-Gevaert faces significant legal obligations concerning product liability and safety, especially within its healthcare divisions. Adherence to stringent medical device regulations, such as the EU Medical Device Regulation (MDR), is critical. Failure to meet these standards can lead to costly product recalls and substantial legal penalties, impacting the company's financial health and market standing.

Ensuring product safety and performance is not just about compliance; it's about risk mitigation. Agfa-Gevaert must maintain robust quality management systems and conduct thorough pre-market testing. For instance, in 2023, the global medical device market saw numerous product recalls, highlighting the persistent challenges and the financial repercussions of non-compliance, with some recalls costing millions in investigation and remediation.

The legal landscape demands continuous vigilance, including clear and accurate product labeling and comprehensive post-market surveillance. This proactive approach helps Agfa-Gevaert identify and address potential issues before they escalate into major legal liabilities or damage its reputation, which is crucial for maintaining trust in the highly regulated healthcare industry.

Antitrust and Competition Laws

Antitrust and competition laws are crucial for Agfa-Gevaert, as they shape market dynamics and dictate acceptable business conduct. These regulations aim to prevent monopolies and foster a level playing field, ensuring that companies like Agfa-Gevaert cannot unfairly dominate their respective sectors. Compliance is paramount to avoid severe penalties, including hefty fines and forced divestitures of assets, which could significantly disrupt operations.

Agfa-Gevaert's strategies, whether in pricing, mergers, or acquisitions, must be carefully scrutinized to ensure they align with competition laws. For instance, in 2023, the European Union continued its robust enforcement of competition rules, with significant fines levied against companies for anti-competitive practices. The company must actively monitor these evolving regulatory landscapes to maintain its market position and operational integrity.

- Regulatory Scrutiny: Agfa-Gevaert faces ongoing scrutiny from competition authorities worldwide, impacting its strategic decisions.

- Merger Control: Acquisitions and mergers require pre-approval from antitrust bodies to prevent undue market concentration.

- Pricing Practices: Pricing strategies must avoid collusion or predatory behavior that could stifle competition.

- Market Access: Fair competition laws ensure that smaller players and new entrants have a viable opportunity to compete.

Employment Laws and Labor Regulations

Agfa-Gevaert must navigate a complex web of employment laws across its global operations, covering fair wages, working conditions, and anti-discrimination statutes. For instance, in 2024, many European Union countries are implementing stricter regulations on pay transparency and parental leave, directly impacting labor costs and HR policies. Compliance is crucial to prevent costly legal battles and maintain a reputable employer brand.

Key legal factors influencing Agfa-Gevaert's employment practices include:

- Minimum Wage Laws: Adherence to varying minimum wage requirements in countries like Germany, Belgium, and the United States, which are subject to annual adjustments.

- Anti-Discrimination Legislation: Compliance with laws prohibiting discrimination based on age, gender, race, and other protected characteristics in hiring, promotion, and termination.

- Labor Union Relations: Managing collective bargaining agreements and labor relations in regions where unions have significant influence, such as in parts of Europe.

- Health and Safety Regulations: Ensuring workplace safety standards meet or exceed legal requirements in all operating jurisdictions, a factor particularly relevant in manufacturing environments.

Agfa-Gevaert's commitment to ethical business practices is legally mandated, particularly concerning anti-bribery and corruption laws like the U.S. Foreign Corrupt Practices Act (FCPA) and the UK Bribery Act. These regulations require stringent internal controls and due diligence in all international dealings, especially in regions with higher perceived corruption risks. In 2024, continued global efforts to combat corruption mean that companies must demonstrate robust compliance programs to avoid severe penalties, including massive fines and reputational damage.

The company must also ensure compliance with environmental regulations, which are increasingly stringent globally. This includes laws governing emissions, waste disposal, and the use of hazardous materials in manufacturing processes. For example, in 2024, the EU's focus on the circular economy and extended producer responsibility places greater legal obligations on manufacturers like Agfa-Gevaert to manage their product lifecycles responsibly and minimize environmental impact.

Navigating the legal framework for international trade and sanctions is also critical for Agfa-Gevaert's global operations. Compliance with export controls and sanctions regimes imposed by various countries and international bodies is essential to avoid legal repercussions and maintain access to global markets. The dynamic nature of geopolitical relations means that companies must stay abreast of evolving sanctions lists and trade restrictions, a challenge that intensified in the 2023-2024 period.

Contract law forms the backbone of Agfa-Gevaert's business relationships, governing everything from supplier agreements to customer contracts and distribution partnerships. Ensuring that all contracts are legally sound, clearly defined, and adhere to the specific legal requirements of each jurisdiction is paramount. In 2024, the increasing complexity of cross-border transactions necessitates meticulous contract management to mitigate risks and enforce agreements effectively.

Environmental factors

Agfa-Gevaert faces significant environmental scrutiny due to its manufacturing of films, plates, and inks, which often involve chemical processes. Stringent regulations govern the disposal of waste, especially hazardous chemical byproducts. For instance, the European Union's Waste Framework Directive sets a clear hierarchy for waste management, prioritizing prevention, reuse, recycling, and recovery over disposal. Failure to adhere to these, including strict emissions standards and proper hazardous waste handling, can result in substantial fines and reputational damage.

Compliance necessitates ongoing investment in advanced waste reduction and recycling technologies. In 2024, companies across the chemical and manufacturing sectors are increasingly allocating capital towards sustainable waste management solutions, recognizing both the regulatory imperative and the potential for cost savings and improved resource efficiency. Agfa-Gevaert's commitment to these areas directly impacts its operational costs and its ability to maintain a license to operate.

Agfa-Gevaert faces increasing pressure to curb its energy use and carbon emissions, a trend amplified by global climate initiatives. This directly affects its manufacturing sites and how it runs its operations, pushing for more sustainable practices.

Stricter environmental regulations, including potential carbon taxes and enhanced energy efficiency mandates, necessitate substantial financial commitments. For instance, the European Union's Emission Trading System (ETS) continues to evolve, with allowances becoming more expensive, impacting operational costs for industrial emitters.

Meeting these environmental targets requires significant investment in renewable energy sources, like solar or wind power for its facilities, and adopting cutting-edge energy-efficient technologies. Companies like Agfa-Gevaert are increasingly reporting on their sustainability performance, with many aiming for net-zero emissions by 2050, a goal that demands proactive adaptation.

Agfa-Gevaert faces growing pressure for supply chain sustainability and ethical sourcing, demanding transparency from raw material extraction to final delivery. This means ensuring suppliers meet stringent environmental and social standards, particularly concerning responsible sourcing of minerals and chemicals, critical for their imaging and healthcare products.

To address this, Agfa-Gevaert implements supplier audits and seeks certifications, actively collaborating to minimize their environmental footprint across the entire value chain. For instance, in 2024, the company continued its focus on responsible sourcing, aligning with global initiatives aimed at reducing the environmental impact of chemical manufacturing and mineral extraction within its extended network.

Resource Scarcity and Circular Economy Initiatives

Increasing global resource scarcity, particularly for specialty chemicals and rare earth elements vital to Agfa-Gevaert's imaging and healthcare solutions, directly impacts raw material availability and drives up costs. For instance, the price of certain rare earth metals saw significant volatility in early 2024 due to supply chain disruptions and geopolitical tensions, potentially affecting production expenses.

Agfa-Gevaert's strategic pivot towards circular economy principles is therefore critical for long-term resilience. This involves designing products with enhanced recyclability, exploring the reuse of materials within its production cycles, and implementing robust waste reduction programs across its operations. Such initiatives are not only crucial for meeting evolving sustainability mandates but also for securing a stable supply of essential inputs.

Innovation in material science plays a pivotal role in this transition. Agfa-Gevaert's research and development efforts are increasingly focused on:

- Developing biodegradable or bio-based alternatives for certain chemical components.

- Improving the efficiency of material recovery and recycling processes for its imaging films and printing plates.

- Exploring partnerships for closed-loop systems to ensure the consistent availability of recycled materials.

- Investing in technologies that reduce reliance on scarce or ethically challenging raw materials.

Environmental Reporting and Corporate Social Responsibility (CSR)

Companies like Agfa-Gevaert face increasing pressure to transparently report on their environmental impact. This includes detailing emissions, waste management, and water consumption, aligning with growing societal expectations for corporate social responsibility. For instance, the EU's Corporate Sustainability Reporting Directive (CSRD), fully applicable from 2024 for many companies, mandates extensive non-financial disclosures, impacting how businesses like Agfa-Gevaert must present their environmental performance to stakeholders.

Demonstrating strong CSR through robust environmental reporting is becoming a key differentiator. This transparency is vital for maintaining stakeholder trust and attracting investment from environmentally conscious funds. By 2025, the demand for ESG (Environmental, Social, and Governance) data is projected to continue its upward trajectory, with many institutional investors prioritizing companies with clear sustainability strategies and verifiable reporting metrics.

Agfa-Gevaert's commitment to sustainability initiatives, such as reducing greenhouse gas emissions and promoting circular economy principles, directly addresses these evolving environmental reporting standards. The company's efforts in these areas are not only about compliance but also about building a reputation for environmental stewardship, which is increasingly valued by customers and investors alike.

Key areas of focus for environmental reporting and CSR include:

- Greenhouse Gas Emissions: Tracking and reporting Scope 1, 2, and increasingly Scope 3 emissions.

- Waste Management: Implementing strategies for waste reduction, recycling, and responsible disposal.

- Water Usage: Monitoring and managing water consumption, particularly in water-scarce regions.

- Sustainable Sourcing: Ensuring raw materials are sourced responsibly with minimal environmental impact.

Agfa-Gevaert operates within a landscape of increasingly stringent environmental regulations, particularly concerning chemical waste disposal and emissions. The EU's Waste Framework Directive, for example, emphasizes waste prevention and recycling, impacting how the company manages its manufacturing byproducts. Failure to comply with standards, including those for hazardous waste handling and emissions, can lead to significant financial penalties and damage its reputation.

The company is actively investing in sustainable waste management and energy efficiency to meet these regulatory demands and operational pressures. By 2024, many manufacturers are prioritizing these areas, recognizing both compliance needs and potential cost savings from improved resource efficiency. Agfa-Gevaert's dedication to reducing its environmental footprint, including carbon emissions, is crucial for maintaining its operational viability and market standing.

Global climate initiatives are driving stricter energy use and carbon emission standards, directly influencing Agfa-Gevaert's manufacturing operations. For instance, the evolving European Union Emissions Trading System (ETS) makes allowances more expensive, increasing operational costs for industrial emitters. Companies like Agfa-Gevaert are thus compelled to invest in renewable energy and energy-efficient technologies to meet targets, with many aiming for net-zero emissions by 2050.

Resource scarcity, especially for specialty chemicals and rare earth elements, poses a significant challenge, impacting raw material availability and cost. Volatility in the prices of certain rare earth metals in early 2024, due to supply chain disruptions, highlights this risk for companies like Agfa-Gevaert. Adopting circular economy principles, focusing on product recyclability and material reuse, is vital for long-term resilience and securing essential inputs.

| Environmental Factor | Impact on Agfa-Gevaert | Key Regulations/Trends | 2024/2025 Focus Areas |

| Waste Management | Requires investment in advanced disposal and recycling technologies. Potential for fines if non-compliant. | EU Waste Framework Directive, hazardous waste regulations. | Waste reduction programs, material recovery, circular economy initiatives. |

| Emissions & Energy | Increased operational costs due to carbon pricing and energy efficiency mandates. | EU Emissions Trading System (ETS), climate change mitigation goals. | Renewable energy adoption, energy-efficient technologies, Scope 1, 2, 3 emissions reporting. |

| Resource Scarcity | Risk of increased raw material costs and supply chain disruptions. | Global demand for specialty chemicals, geopolitical influences on resource availability. | Sustainable sourcing, material science innovation, closed-loop systems. |

| Corporate Reporting | Mandatory disclosure of environmental performance, impacting stakeholder trust and investment. | EU Corporate Sustainability Reporting Directive (CSRD), growing demand for ESG data. | Transparent reporting on emissions, waste, water usage, and sustainable sourcing practices. |

PESTLE Analysis Data Sources

Our Agfa-Gevaert PESTLE analysis draws from a comprehensive range of data, including official government reports on regulations and economic policies, publications from leading financial institutions like the IMF and World Bank, and in-depth market research from industry-specific firms. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.