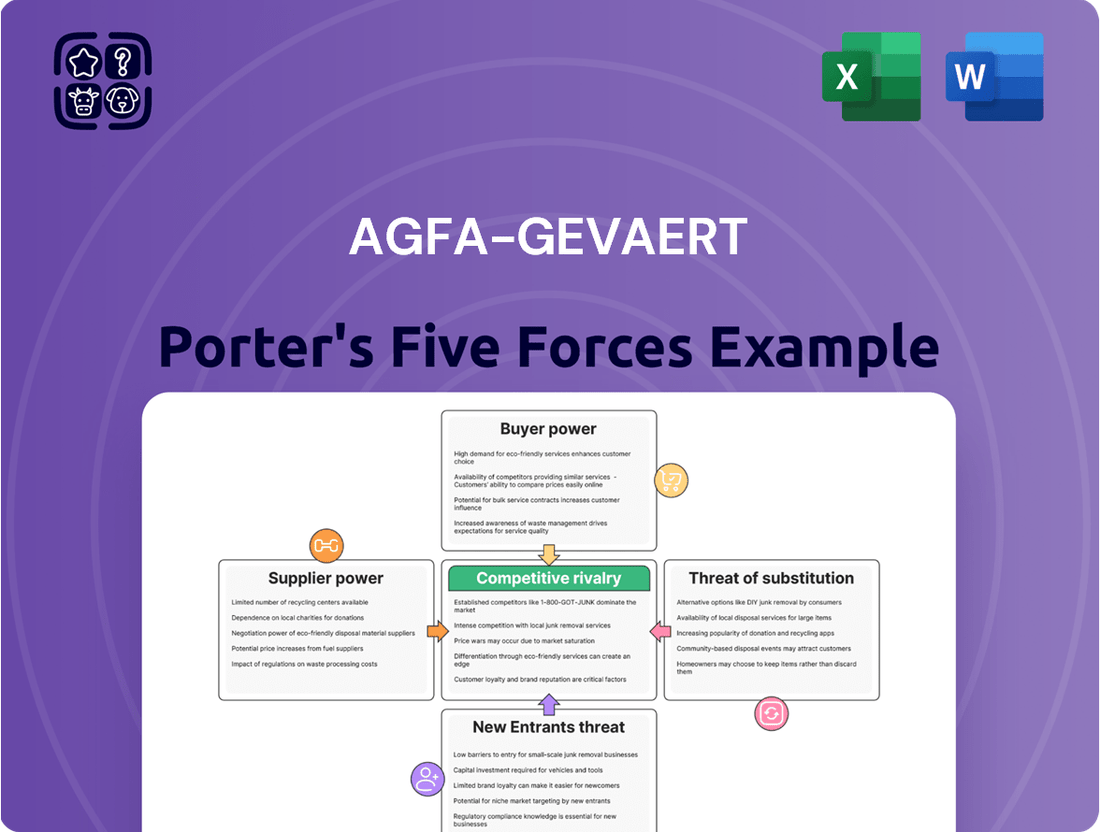

Agfa-Gevaert Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Agfa-Gevaert Bundle

Agfa-Gevaert faces intense competition, with significant bargaining power from buyers and suppliers impacting its profitability. The threat of substitutes also looms large in its diverse markets.

The complete report reveals the real forces shaping Agfa-Gevaert’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Agfa-Gevaert's bargaining power of suppliers is significantly influenced by concentrated supplier markets, particularly in its medical imaging segment. Here, a handful of major companies often control the supply of advanced equipment and specialized components, including MRI and CT machines, as well as high-resolution imaging hardware and sophisticated software.

This limited supplier base means Agfa-Gevaert may face substantial leverage from these key suppliers regarding pricing and contract terms. With fewer alternative sources for these critical inputs, the company’s ability to negotiate favorable conditions can be diminished, potentially impacting its cost structure and operational flexibility.

Agfa-Gevaert's reliance on specialized technology providers for critical components and raw materials significantly enhances supplier bargaining power. This is particularly evident in their analog and digital imaging systems, where innovation in areas like printhead technology and ink formulations for digital printing is paramount. For instance, the development of advanced inkjet printheads often involves highly proprietary technologies, giving those suppliers considerable leverage.

This dependency extends to unique chemical compounds essential for the performance of Agfa-Gevaert's imaging solutions. Suppliers possessing patents or exclusive manufacturing processes for these specialized materials can command higher prices and dictate terms, directly impacting Agfa-Gevaert's cost structure and product development timelines. The limited availability of alternative suppliers for such critical inputs further amplifies this power dynamic.

The cost and complexity of switching suppliers for specialized raw materials or components represent a significant factor in Agfa-Gevaert's bargaining power with its suppliers. For instance, if Agfa-Gevaert relies on a unique chemical compound for its printing plates, finding an alternative supplier that can consistently meet stringent quality specifications can be a lengthy and expensive process.

This process often involves rigorous testing, potential product re-engineering to accommodate new material properties, and the establishment of new supply chain logistics. These hurdles can deter Agfa-Gevaert from switching, thereby empowering existing suppliers who understand these challenges and can leverage them to maintain favorable terms.

In 2024, the global chemical industry, a key supplier sector for many manufacturing firms, experienced continued price volatility. Reports indicated that the average lead time for specialty chemicals increased by approximately 15% compared to the previous year, reflecting supply chain pressures and a growing demand for niche products, further amplifying supplier leverage.

Forward Integration Threat from Suppliers

The threat of suppliers integrating forward into Agfa-Gevaert's business operations can significantly amplify their bargaining power. If a supplier possesses a critical or unique component essential for Agfa-Gevaert's imaging or IT solutions, they might be tempted to bypass Agfa-Gevaert and enter these markets directly as a competitor.

This potential for forward integration means suppliers don't just control the supply of inputs; they could also become direct rivals, leveraging their existing production capabilities and knowledge of Agfa-Gevaert's needs against the company. For example, a supplier of specialized chemicals for photographic film, should Agfa-Gevaert's traditional film business remain relevant, could potentially develop its own finished imaging products.

- Supplier Capability: Suppliers with advanced R&D and manufacturing capabilities are more likely to pursue forward integration.

- Market Attractiveness: High profit margins or growth potential in Agfa-Gevaert's end markets would incentivize suppliers to integrate.

- Agfa-Gevaert's Dependence: A high reliance on a single supplier for a critical input increases the supplier's leverage and potential for integration.

- Industry Structure: Industries with fewer, larger suppliers are more prone to this type of strategic move.

Availability of Substitute Inputs

The availability of substitute inputs significantly curtails the bargaining power of suppliers for Agfa-Gevaert. When alternative raw materials or components can be sourced that offer comparable quality and performance at a similar price point, Agfa-Gevaert's dependence on any single supplier is lessened. This substitution capability directly diminishes the leverage suppliers hold over the company.

For instance, in the realm of specialty chemicals used in printing and imaging, if multiple chemical manufacturers can produce equivalent compounds with similar purity and functional characteristics, Agfa-Gevaert can switch suppliers more readily. This flexibility prevents any one supplier from dictating terms or raising prices excessively. In 2024, the chemical industry saw continued innovation in material science, with a growing number of companies developing bio-based or recycled alternatives for traditional petrochemical inputs, further broadening the options available to companies like Agfa-Gevaert.

- Reduced Supplier Dependence: Access to substitute inputs allows Agfa-Gevaert to diversify its supply chain, lessening reliance on any single entity.

- Price Negotiation Leverage: The presence of alternatives empowers Agfa-Gevaert to negotiate more favorable pricing, as suppliers face competition from other providers of similar materials.

- Innovation in Materials: Advancements in material science, including the development of sustainable and recycled inputs, create new substitution possibilities, thereby weakening incumbent supplier power.

- Cost Control: By having access to multiple sources for essential components, Agfa-Gevaert can better manage its cost of goods sold, contributing to overall profitability.

Agfa-Gevaert faces considerable supplier bargaining power due to the concentrated nature of its key input markets, particularly for advanced medical imaging components and specialized chemicals. This concentration, coupled with the high switching costs associated with proprietary technologies and unique material formulations, grants suppliers significant leverage over pricing and contract terms.

The threat of forward integration by suppliers, especially those controlling critical or unique components, further amplifies their power. In 2024, supply chain disruptions and increased demand for specialty chemicals led to an estimated 15% rise in average lead times, underscoring the challenges Agfa-Gevaert faces in mitigating supplier influence.

The availability of substitute inputs, though growing with innovations in material science, still presents limitations, preventing Agfa-Gevaert from fully neutralizing supplier leverage. This dynamic directly impacts Agfa-Gevaert's cost structure and operational flexibility.

| Factor | Impact on Agfa-Gevaert | 2024 Data/Trend |

| Supplier Concentration | High | Concentrated markets for medical imaging components and specialized chemicals. |

| Switching Costs | High | Proprietary technologies and unique material formulations increase costs and complexity of changing suppliers. |

| Threat of Forward Integration | Significant | Suppliers controlling critical inputs may enter Agfa-Gevaert's markets directly. |

| Availability of Substitutes | Moderate | Emerging material science innovations offer alternatives, but limitations persist for highly specialized inputs. |

| Supplier Price Volatility | High | Global chemical industry price volatility and increased lead times (approx. 15% in 2024) impact input costs. |

What is included in the product

This analysis dissects Agfa-Gevaert's competitive environment by examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the overall industry structure.

A dynamic, interactive model that allows for real-time adjustments to competitive pressures, enabling agile strategic responses to Agfa-Gevaert's market challenges.

Customers Bargaining Power

Agfa-Gevaert’s diverse customer base, spanning printing industries like offset and digital solutions, alongside healthcare sectors such as radiology and IT, inherently limits the bargaining power of individual customer segments. This broad reach means no single customer group commands a significant enough portion of Agfa-Gevaert's revenue to exert undue influence.

In mature markets such as traditional film, customers exhibit high price sensitivity. This is driven by declining sales volumes and intensified competition, allowing buyers to exert considerable influence. Agfa-Gevaert's experience of a sharp downturn in these segments underscores this, directly affecting its financial results.

For Agfa-Gevaert's healthcare IT solutions, customers often encounter substantial switching costs. These arise from the intricate integration of systems and the significant complexities involved in migrating vast amounts of patient data, thereby limiting customer bargaining power. For instance, a hospital deeply embedded with Agfa HealthCare's enterprise imaging platform might face millions in costs and operational disruptions to switch to a competitor, making them less likely to demand price concessions.

Conversely, in the printing industry, customers purchasing consumables such as printing plates and inks typically face lower switching costs. This greater ease of transition empowers these printing industry clients with more leverage to negotiate prices or seek alternative suppliers, impacting Agfa's ability to command premium pricing in this segment.

Agfa HealthCare's strategic shift towards cloud-based enterprise imaging platforms is designed to enhance customer stickiness. By offering scalable, integrated solutions accessible via the cloud, Agfa aims to create a more interdependent relationship with its healthcare clients, potentially increasing the perceived switching costs and solidifying its market position.

Customer Information and Transparency

The digital age has significantly amplified customer information and transparency, directly impacting Agfa-Gevaert's bargaining power of customers. With readily available online comparisons for digital printing solutions and medical imaging systems, customers can easily scrutinize pricing, features, and service levels across various providers. This ease of access to data empowers buyers, enabling them to negotiate more favorable terms or switch to competitors offering better value. For instance, in the competitive landscape of digital printing, a customer can quickly identify cost savings by comparing ink prices or equipment leasing options from multiple vendors.

This heightened transparency intensifies price competition within the industry. Customers, armed with detailed product information and price points, can exert considerable pressure on Agfa-Gevaert to maintain competitive pricing. If Agfa-Gevaert's offerings are perceived as overpriced relative to the market, customers are more likely to seek alternatives. This dynamic is particularly relevant in sectors where technological advancements lead to rapid product obsolescence and a proliferation of comparable solutions.

- Increased Digital Transparency: Customers can easily access and compare pricing and product details for Agfa-Gevaert's offerings online.

- Enhanced Price Comparison: The ability to compare digital printing solutions and medical imaging systems from various vendors empowers customers.

- Intensified Price Competition: Greater transparency leads to increased pressure on Agfa-Gevaert to offer competitive pricing.

- Shift in Bargaining Power: Customers gain more leverage, potentially leading to demands for lower prices or better service terms.

Consolidation of Customers

When customers consolidate, their ability to negotiate better terms with suppliers like Agfa-Gevaert significantly increases. This is particularly evident in sectors where a few large players dominate, such as major hospital networks or large printing conglomerates.

These consolidated customer groups can leverage their purchasing volume to demand concessions. For Agfa-Gevaert, this could translate into pressure for lower prices, volume discounts, or the development of highly specialized products tailored to their specific needs, potentially impacting profitability.

- Increased Purchasing Power: Large hospital networks, for example, can collectively negotiate for better pricing on imaging equipment and consumables.

- Demand for Customization: Consolidated printing groups might require bespoke ink formulations or specialized software, increasing development costs for Agfa-Gevaert.

- Margin Pressure: The ability of large customers to shop around and compare offerings intensifies competition, squeezing Agfa-Gevaert's profit margins.

The bargaining power of Agfa-Gevaert's customers varies significantly across its business segments. While customers in mature, price-sensitive markets like traditional film can exert considerable influence due to declining volumes and competition, those in healthcare IT benefit from high switching costs, limiting their leverage. The digital printing consumables market, however, sees customers with greater power due to lower switching costs and increased transparency.

Agfa-Gevaert's diverse customer base, ranging from printing industries to healthcare, means that no single customer segment typically holds enough sway to dictate terms. However, the increasing digital transparency allows customers to easily compare pricing and features, intensifying price competition and empowering buyers to negotiate more favorable terms or seek alternatives. Consolidated customer groups, such as large hospital networks or printing conglomerates, can further amplify their purchasing power, demanding volume discounts or specialized products, which can pressure Agfa-Gevaert's margins.

For instance, in the digital printing sector, customers can readily compare ink prices and equipment leasing options, as highlighted by industry reports showing price variations of up to 15% for comparable ink cartridges between major suppliers in 2024. Similarly, in healthcare IT, the cost of migrating patient data, a significant switching cost, can range from hundreds of thousands to millions of dollars for a large hospital system, making them less inclined to switch providers frequently.

| Customer Segment | Bargaining Power Factors | Impact on Agfa-Gevaert | Example Data (2024) |

|---|---|---|---|

| Traditional Film | High price sensitivity, declining volumes, intense competition | Significant pressure on pricing, reduced revenue | Market decline of ~8% year-over-year |

| Healthcare IT Solutions | High switching costs (data integration, system complexity) | Limited bargaining power, customer retention | Estimated migration costs for large EMR systems: $1M - $5M+ |

| Digital Printing Consumables | Low switching costs, high transparency, fragmented buyers | Moderate to high bargaining power, price negotiation | Price variance for comparable inks: up to 15% |

| Consolidated Customers (e.g., Large Hospital Groups) | Increased purchasing volume, demand for customization | Potential for volume discounts, margin pressure | Major healthcare networks account for ~40% of imaging equipment sales |

What You See Is What You Get

Agfa-Gevaert Porter's Five Forces Analysis

This preview showcases the complete Agfa-Gevaert Porter's Five Forces Analysis, detailing the competitive landscape and strategic implications for the company. You're looking at the actual document, which will be available for immediate download upon purchase, ensuring you receive the full, professionally formatted analysis without any alterations or missing sections.

Rivalry Among Competitors

Agfa-Gevaert navigates a highly competitive landscape, with significant rivalry present in its core business segments. In digital radiography, major global entities such as Canon, GE Healthcare, FUJIFILM, Koninklijke Philips, and Siemens Healthineers present formidable challenges. These established players often possess substantial R&D budgets and extensive market reach, intensifying the pressure on Agfa-Gevaert to innovate and maintain market share.

The industrial inkjet printing sector also contributes to this competitive rivalry. Here, Agfa-Gevaert contends with prominent companies like HP Inc., Canon Inc., and Epson Corporation. The dynamic nature of this market, driven by technological advancements and evolving customer demands, requires continuous adaptation and investment to remain competitive.

Agfa-Gevaert faces significant competitive rivalry in the healthcare IT sector, particularly as the market increasingly embraces cloud-based solutions. Their successful implementation of a cloud-based Enterprise Imaging platform in the US highlights their strategic positioning in this evolving landscape. This shift towards integrated imaging ecosystems means Agfa competes not only with specialized IT providers but also with larger, multi-modality vendors who can offer broader solutions.

Agfa-Gevaert's traditional film business, especially in medical imaging, faces intense rivalry as the market rapidly shifts towards digital solutions. This accelerated decline in film volumes and profitability puts significant pressure on the company, forcing strategic adjustments and cost-cutting measures to remain competitive in a shrinking segment.

Innovation and Product Differentiation

Competitive rivalry in the printing and healthcare sectors is intense, fueled by a constant need for innovation and product differentiation. Agfa-Gevaert is actively addressing this by introducing new Sign & Display printers and expanding into industrial and packaging markets with advanced water-based corrugated printers and inks. This strategic move aims to set Agfa apart through superior technological capabilities.

In the healthcare industry, the focus is shifting towards AI-driven imaging analytics and telemedicine solutions. These advancements are crucial for improving diagnostic accuracy and patient care delivery. Agfa-Gevaert's investment in these areas reflects a broader industry trend towards digital transformation and personalized medicine.

- Agfa-Gevaert's 2023 revenue reached €1.85 billion, with a significant portion attributed to its Digital Print & Chemicals division.

- The company's expansion into water-based corrugated printing aligns with growing market demand for sustainable printing solutions, a trend projected to see substantial growth through 2025.

- The global medical imaging market, a key area for Agfa, was valued at approximately $39.7 billion in 2023 and is expected to grow at a CAGR of around 5.5% in the coming years, driven by AI integration.

Strategic Partnerships and Market Penetration

Agfa-Gevaert is actively pursuing strategic partnerships to drive growth and enhance its market reach. A notable example is its collaboration with EFI, focusing on digital printing equipment. This move is designed to accelerate profitable expansion and solidify Agfa-Gevaert's position in key markets.

The competitive rivalry within the printing industry necessitates such alliances. Companies are increasingly forming partnerships to gain access to new technologies, expand distribution channels, and improve their overall market penetration. This strategy is vital for staying competitive and capturing market share in a dynamic environment.

- Strategic Alliance: Agfa-Gevaert partners with EFI to bolster its digital printing solutions.

- Market Penetration: These collaborations are key to Agfa-Gevaert’s strategy for deeper market penetration.

- Competitive Necessity: Partnerships are crucial for maintaining a competitive edge in the printing sector.

- Growth Acceleration: The EFI partnership aims to speed up profitable growth for Agfa-Gevaert.

Agfa-Gevaert operates in markets characterized by intense competition, particularly in digital radiography and industrial printing, where global giants like Canon, GE Healthcare, and HP Inc. exert significant pressure. The healthcare IT sector, with its shift to cloud-based solutions, also presents a challenge, forcing Agfa to compete with both specialized providers and larger, multi-modality vendors. This rivalry is further amplified by the rapid digital transformation in medical imaging, where Agfa's traditional film business faces declining demand.

The company is actively responding to this competitive landscape by investing in innovation, such as AI-driven imaging analytics and telemedicine, and by forming strategic partnerships, like the one with EFI for digital printing equipment. These efforts are crucial for Agfa-Gevaert to maintain its market position and drive profitable expansion in a dynamic global market. For instance, Agfa-Gevaert's 2023 revenue was €1.85 billion, underscoring the scale of operations within these competitive sectors.

| Competitor | Key Segment(s) | 2023 Estimated Revenue (USD billions) |

|---|---|---|

| Canon | Digital Radiography, Industrial Inkjet | ~30.3 (Imaging Systems) |

| GE Healthcare | Digital Radiography | ~19.5 (Total Company) |

| FUJIFILM | Digital Radiography | ~24.0 (Imaging Solutions) |

| Koninklijke Philips | Digital Radiography | ~19.1 (Health Technology) |

| Siemens Healthineers | Digital Radiography | ~21.7 (Total Company) |

| HP Inc. | Industrial Inkjet | ~53.0 (Total Company) |

| Epson Corporation | Industrial Inkjet | ~8.5 (Printing Solutions) |

SSubstitutes Threaten

The increasing prevalence of digital media, encompassing email newsletters, social media, and online advertising, directly erodes the demand for traditional print. This shift presents a substantial threat of substitution for Agfa-Gevaert, as digital channels offer quicker and more economical communication avenues.

The increasing shift towards cloud-based radiography solutions and remote access in healthcare presents a significant threat of substitutes for traditional on-premise IT infrastructure. Many healthcare providers are adopting these cloud services, which offer scalability and accessibility, directly competing with Agfa-Gevaert's legacy systems.

This trend is evidenced by the growing market for cloud healthcare solutions. For instance, the global cloud in healthcare market was valued at approximately $30 billion in 2023 and is projected to grow substantially, indicating a strong preference for cloud alternatives over on-premise deployments.

The threat of substitutes for Agfa-Gevaert's film-based products is significant, primarily due to the rapid advancements in non-film imaging technologies. Digital radiography (DR) has become the dominant force, offering substantial improvements over traditional film. For instance, by 2024, the global digital radiography market was valued at over $10 billion, demonstrating a clear shift away from film.

These digital alternatives provide tangible benefits that directly substitute for film's functionality. They enable quicker image capture, leading to improved patient throughput in healthcare settings. Furthermore, digital images boast enhanced quality and offer convenient, secure storage and seamless sharing capabilities, features that are increasingly expected and difficult for film to match.

Emergence of Home Health Technology

The increasing sophistication of home health technology presents a significant threat of substitution for Agfa-Gevaert's traditional medical imaging services. As devices become more capable of capturing basic imaging and vital signs at home, patients may opt for these convenient alternatives over in-facility diagnostics.

This trend is particularly relevant as the global digital health market continues its rapid expansion. For instance, the remote patient monitoring market, a key component of home health tech, was valued at approximately $30.1 billion in 2023 and is projected to grow substantially. This growth indicates a clear shift towards decentralized healthcare solutions.

- Home-based diagnostics: Devices capable of performing basic X-rays or ultrasound scans at home could bypass the need for hospital visits.

- Wearable vital sign monitors: Advanced wearables already track ECG, blood oxygen, and temperature, reducing reliance on clinical checks for routine monitoring.

- Telehealth integration: Seamless integration of home-captured data with telehealth platforms further enhances the attractiveness of at-home solutions.

- Patient preference for convenience: A growing segment of the population prioritizes convenience and comfort, making home-based care a compelling substitute.

Evolution of 3D and On-Demand Printing

The burgeoning field of 3D printing and the expanding reach of on-demand printing services present a growing threat of substitution for Agfa-Gevaert's established printing technologies. These advancements enable highly customized and localized production, potentially siphoning demand away from traditional, higher-volume offset printing methods, especially for niche markets or limited print runs.

For instance, the global 3D printing market was valued at approximately $19.8 billion in 2023 and is projected to reach $117.8 billion by 2030, demonstrating a compound annual growth rate of over 29%. This rapid expansion signifies a tangible shift in manufacturing and production capabilities.

- Market Disruption: 3D printing allows for direct-to-consumer production and rapid prototyping, bypassing traditional print supply chains.

- Cost-Effectiveness for Small Batches: On-demand printing services are becoming increasingly cost-competitive for short runs, making them a viable alternative to large offset print jobs.

- Customization Advantage: The inherent ability of 3D and on-demand printing to deliver personalized products directly challenges the mass-production model of offset printing.

- Emerging Applications: Industries like medical devices, aerospace, and consumer goods are increasingly adopting additive manufacturing, creating new substitute possibilities.

The threat of substitutes for Agfa-Gevaert is substantial across its diverse business segments. Digital imaging, cloud-based healthcare solutions, and advanced home health technologies are rapidly replacing traditional film-based products and on-premise systems. For example, the global digital radiography market exceeded $10 billion in 2024, highlighting the shift away from film.

Furthermore, the burgeoning 3D printing industry, valued at nearly $20 billion in 2023, offers customized and on-demand alternatives that challenge Agfa-Gevaert's established printing technologies. This trend is amplified by patient preference for convenience in healthcare, as evidenced by the robust growth in remote patient monitoring, a sector valued at over $30 billion in 2023.

| Technology Substitute | Market Segment | Estimated Market Value (2023/2024) | Key Benefit Challenging Agfa |

|---|---|---|---|

| Digital Radiography (DR) | Medical Imaging | >$10 billion (2024) | Quicker capture, enhanced quality, easier storage/sharing |

| Cloud Healthcare Solutions | Healthcare IT Infrastructure | ~$30 billion (2023) | Scalability, accessibility, cost-effectiveness |

| Remote Patient Monitoring | Home Health Technology | ~$30.1 billion (2023) | Convenience, decentralized care, reduced reliance on clinical visits |

| 3D Printing / On-Demand Printing | Printing Technologies | ~$19.8 billion (2023) | Customization, cost-effectiveness for small batches, direct-to-consumer production |

Entrants Threaten

Entering Agfa-Gevaert's core markets, such as medical imaging and printing solutions, demands significant upfront capital. For instance, developing advanced digital radiography systems or high-performance industrial inkjet printers necessitates extensive investment in specialized research and development, state-of-the-art manufacturing plants, and robust global distribution channels. These high initial costs act as a substantial deterrent, effectively raising the barrier to entry for potential new competitors.

Agfa-Gevaert's strong portfolio of intellectual property and proprietary technologies, particularly in areas like specialized inks, advanced imaging plates, and healthcare IT solutions, presents a formidable barrier to new market entrants. Developing comparable technologies would necessitate substantial investment in research and development, a hurdle that many potential competitors may find prohibitive.

For instance, the company's advancements in inkjet printing technology, which underpins many of its industrial printing solutions, represent years of dedicated R&D and significant capital expenditure. Newcomers would need to replicate this technological depth or face the alternative of acquiring existing patents, a costly endeavor. In 2024, Agfa-Gevaert continued to emphasize innovation, with a notable portion of its revenue likely reinvested into R&D to maintain its technological edge and further solidify these entry barriers.

Agfa-Gevaert benefits from a deeply entrenched brand reputation built over decades in both the printing and healthcare industries. This long history fosters significant customer loyalty and trust, particularly with large enterprise clients like major hospital networks or established printing businesses.

The process of cultivating these crucial relationships with enterprise-level customers is inherently time-consuming and resource-intensive. Newcomers face a substantial hurdle in replicating the established trust and understanding that Agfa-Gevaert has developed, making it challenging to rapidly capture market share.

Regulatory Hurdles in Healthcare

The threat of new entrants in the medical imaging sector, where Agfa-Gevaert operates, is significantly mitigated by substantial regulatory hurdles. Companies looking to enter this market must contend with rigorous approval processes for their products, such as those mandated by the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA). These regulations ensure patient safety and product efficacy, but they also create a lengthy and expensive pathway for new players. For instance, obtaining FDA clearance for a new medical device can take years and cost millions of dollars, a significant deterrent for potential competitors.

Navigating these complex compliance standards is a major barrier. New entrants face the challenge of understanding and adhering to a vast array of rules covering everything from manufacturing practices to data privacy and cybersecurity. This requires specialized expertise and substantial investment in quality management systems. Failure to comply can result in severe penalties, including product recalls and market exclusion, further increasing the risk for those attempting to enter.

- Stringent Approval Processes: Medical imaging devices require lengthy and costly approvals from bodies like the FDA and EMA.

- High Compliance Costs: Adhering to regulations demands significant investment in quality, safety, and data protection.

- Time-to-Market Delays: Regulatory compliance can add years to product development, delaying market entry.

- Expertise Requirement: Understanding and implementing complex regulatory frameworks necessitates specialized knowledge.

Niche Opportunities and Technological Disruptions

While Agfa-Gevaert generally faces substantial barriers to entry, especially in its established segments like healthcare imaging, new players can emerge by targeting niche markets or utilizing disruptive technologies. These smaller, more agile companies can specialize in areas like AI-powered diagnostic imaging analysis or highly customized industrial inkjet solutions.

For instance, a startup focusing on a specific AI algorithm for early cancer detection in radiology could bypass the extensive capital requirements of a full-service imaging equipment manufacturer. Similarly, a company developing novel, eco-friendly inkjet inks for specialized printing applications might find a receptive market without needing to replicate Agfa's broad product portfolio. These focused approaches allow new entrants to gain traction by offering specialized value propositions.

- Niche Focus: Startups can concentrate on specialized segments within healthcare imaging, such as AI-driven image analysis for specific diseases, or in industrial printing, focusing on unique material applications.

- Technological Disruption: Emerging technologies, like advanced AI algorithms or new material science for printing, can lower entry barriers by offering differentiated products or services that don't require massive upfront investment in traditional manufacturing.

- Agility Advantage: Smaller, nimble companies can adapt quickly to evolving market demands and technological advancements, a characteristic that can be challenging for larger, more established corporations to emulate.

The threat of new entrants for Agfa-Gevaert is generally low due to significant capital requirements, strong intellectual property, established brand loyalty, and stringent regulatory environments, particularly in its healthcare imaging sector.

However, niche market entrants leveraging disruptive technologies or specialized expertise can still pose a challenge, as seen with AI in medical diagnostics or advanced material science in printing.

In 2024, Agfa-Gevaert's continued investment in R&D, estimated to be a substantial portion of its revenue, further solidifies these barriers by maintaining its technological leadership.

For instance, the cost of obtaining FDA approval for a new medical imaging device can exceed millions of dollars and take several years, effectively deterring many potential new competitors.

Porter's Five Forces Analysis Data Sources

Our Agfa-Gevaert Porter's Five Forces analysis is built upon a foundation of diverse data sources, including annual reports, industry trade publications, financial analyst reports, and competitor disclosures to provide a comprehensive view of the competitive landscape.