Agfa-Gevaert Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Agfa-Gevaert Bundle

Uncover the strategic positioning of Agfa-Gevaert's product portfolio with our comprehensive BCG Matrix analysis. See which products are market leaders, which require careful nurturing, and which might be candidates for divestment. This preview offers a glimpse into the power of strategic product management.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Agfa's HealthCare IT division is a standout performer, showing robust growth fueled by its cloud-enabled Enterprise Imaging solutions. This strategic shift to the cloud has propelled Agfa to the forefront of a rapidly expanding market segment within healthcare IT.

The division's success is underscored by its record EBITDA levels achieved in Q4 2024, followed by sustained strong performance into Q1 2025. This momentum is further validated by prestigious KLAS awards, recognizing the excellence of their imaging solutions.

The ZIRFON business, specializing in membranes crucial for green hydrogen production, has become Agfa-Gevaert's most profitable segment and a significant growth engine. This business unit is recognized as the industry benchmark, holding a substantial market share in a burgeoning sector.

Agfa significantly expanded its ZIRFON production capacity throughout 2024. The company also announced plans to launch a new production unit by the close of 2024, underscoring its commitment to this high-potential market.

Agfa's Digital Printing Solutions for the Sign & Display market demonstrated robust performance in 2024, achieving double-digit revenue growth and a notable improvement in profitability. This success is underpinned by a strategic expansion of its product line, introducing advanced printers such as the Anapurna Ciervo, Jeti Bronco, and Jeti Condor, which cater to increasing market demands for speed and higher-end capabilities.

The company's commitment to innovation and market penetration is further amplified by strategic collaborations, including its partnership with EFI. This alliance is instrumental in accelerating Agfa's reach and solidifying its momentum within the dynamic and expanding sign and display sector.

Digital Printing Inks

Digital Printing Inks represent a significant component within Agfa-Gevaert's Digital Printing Solutions division. The segment has experienced impressive growth, with ink sales climbing 15% in 2024 and continuing this upward trajectory with a 16% increase in the first quarter of 2025.

This robust performance is driven by strategic initiatives, including successful customer conversion programs that encourage adoption of Agfa's proprietary ink sets. Furthermore, an increase in ink volumes supplied to Original Equipment Manufacturers (OEMs) contributes to this positive trend.

The strong sales figures for digital printing inks underscore Agfa's substantial market share within the consumables aspect of the digital printing industry. This success is amplified by the expanding installed base of Agfa printers, operating within a market that itself is experiencing considerable expansion.

- Consistent Growth: Ink sales saw a 15% rise in 2024 and a 16% increase in Q1 2025.

- Strategic Drivers: Growth is fueled by customer conversion to Agfa inks and increased OEM ink volumes.

- Market Position: High market share in digital printing consumables, benefiting from a growing printer installed base.

Direct Radiography (DR)

Agfa's Direct Radiography (DR) business is a significant performer within the company's portfolio. In 2024, this segment saw an 8% increase in its top-line revenue, a growth rate that surpassed the broader market trends. This positive trajectory is supported by a robust order book and anticipation of sustained growth, bolstered by recent substantial orders.

The company's commitment to innovation and market leadership in DR is evident. Agfa has achieved EU MDR certification for its complete DR product line. Furthermore, the introduction of pioneering DR technologies at recent industry events underscores its competitive edge in the expanding radiology sector.

- Strong 2024 Performance: Agfa's DR business achieved an 8% top-line increase, outpacing the market.

- Positive Outlook: A strong order book and recent major orders indicate continued momentum.

- Regulatory Compliance: EU MDR certification across the entire DR portfolio is a key advantage.

- Innovation Showcase: Groundbreaking DR innovations highlight Agfa's competitive position.

Agfa's HealthCare IT division is a star performer, experiencing robust growth driven by its cloud-based Enterprise Imaging solutions. This segment achieved record EBITDA levels in Q4 2024 and maintained strong momentum into Q1 2025, further validated by prestigious KLAS awards.

The ZIRFON business, essential for green hydrogen production, has emerged as Agfa-Gevaert's most profitable segment and a key growth driver. Its industry-leading position and substantial market share in a rapidly expanding sector are supported by significant production capacity expansions throughout 2024 and a new unit planned for launch by year-end.

Agfa's Digital Printing Solutions for the Sign & Display market also demonstrated impressive strength in 2024, with double-digit revenue growth and improved profitability. This success is attributed to product line expansion, including new printers like the Anapurna Ciervo, and strategic collaborations, such as the partnership with EFI, to enhance market reach.

The Direct Radiography (DR) business is another significant contributor, with an 8% top-line revenue increase in 2024 that outpaced market trends. A strong order book and recent substantial orders, coupled with EU MDR certification for its entire DR product line, position Agfa favorably for continued growth in the radiology sector.

| Business Unit | 2024 Performance Highlights | Key Growth Drivers | Market Position |

|---|---|---|---|

| HealthCare IT | Record EBITDA (Q4 2024), strong Q1 2025 momentum, KLAS awards | Cloud-enabled Enterprise Imaging solutions | Leading in expanding healthcare IT segment |

| ZIRFON | Most profitable segment, significant growth engine | Industry benchmark membranes for green hydrogen, capacity expansion | Substantial market share in a burgeoning sector |

| Digital Printing Solutions (Sign & Display) | Double-digit revenue growth, improved profitability | New printer introductions (Anapurna Ciervo, Jeti Bronco, Jeti Condor), EFI partnership | Strong momentum in dynamic sign and display sector |

| Direct Radiography (DR) | 8% top-line revenue increase (outpacing market) | Robust order book, substantial recent orders, EU MDR certification | Competitive edge in expanding radiology sector |

What is included in the product

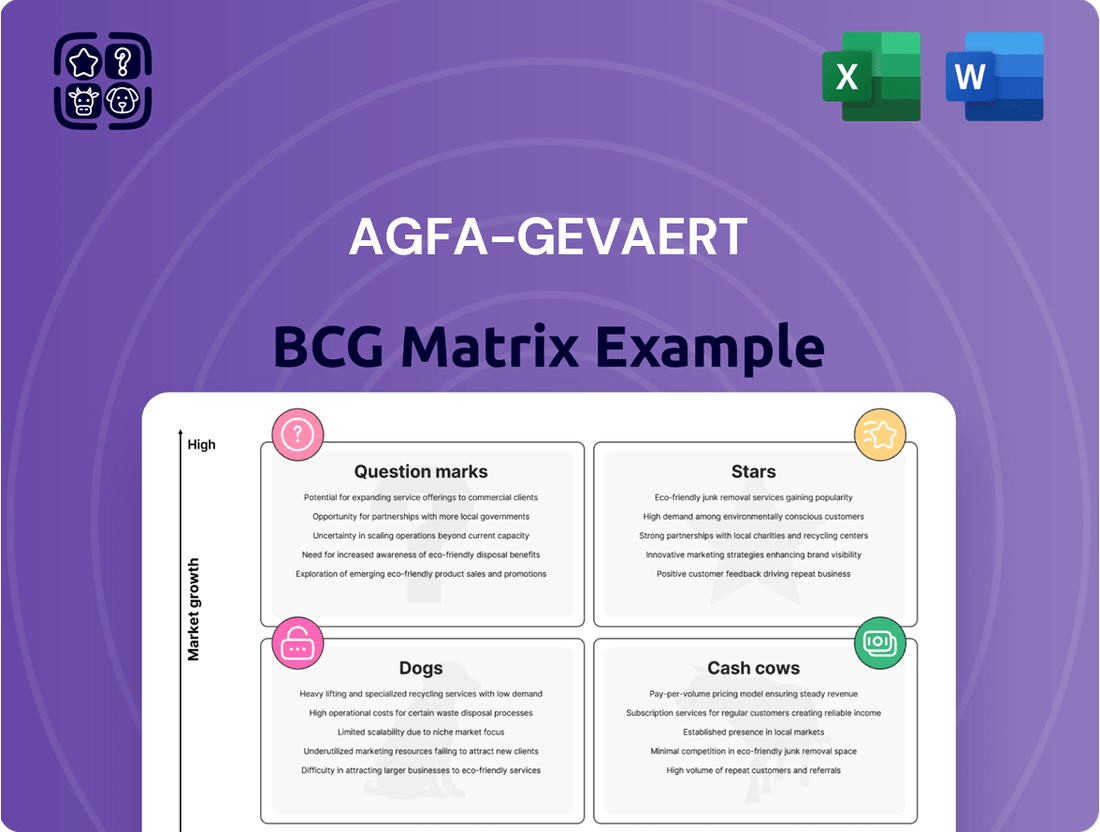

The Agfa-Gevaert BCG Matrix analyzes its business units based on market share and growth to guide investment decisions.

The Agfa-Gevaert BCG Matrix provides a clear, visual roadmap to address underperforming "Dogs" and strategically invest in promising "Stars."

Cash Cows

Agfa-Gevaert's Legacy HealthCare IT Maintenance & Support represents a classic Cash Cow within its BCG Matrix. This segment benefits from a substantial existing installed base of traditional Enterprise Imaging solutions, ensuring a predictable stream of recurring revenue primarily from maintenance contracts and ongoing support services.

Despite the company's strategic shift towards cloud-based offerings, these legacy systems continue to be a significant source of stable cash flow. The operational costs and investment requirements for maintaining these established platforms are relatively low, allowing them to generate substantial profits without demanding significant capital infusion.

For instance, in 2023, Agfa-Gevaert reported that its Healthcare IT division, which encompasses these legacy systems, contributed significantly to the group's overall financial performance, demonstrating the enduring value of its installed base. This foundational revenue stream is crucial for funding growth initiatives in newer, more innovative areas.

Agfa-Gevaert's established digital printing equipment, particularly older models and those in stable market segments, function as cash cows. These systems, having achieved broad market penetration, consistently deliver reliable sales and healthy profit margins. This stability is crucial as it requires minimal ongoing investment in research and development or aggressive marketing efforts.

This segment is vital for Agfa's revenue stream, as it underpins the demand for the company's profitable ink supplies. For instance, in 2024, the digital printing market continued to see steady demand for consumables, with Agfa's installed base of established printers contributing significantly to this recurring revenue.

Within Agfa-Gevaert's Digital Print & Chemicals division, the Specialty Films & Chemicals segment stands out as a significant contributor to both revenue and profitability. This indicates a well-established and mature market position for Agfa in these particular product lines.

While this segment might not exhibit the high-growth trajectory seen in areas like Green Hydrogen Solutions, it reliably generates a steady and predictable cash flow. This consistent performance firmly places Specialty Films & Chemicals within the cash cow category of the BCG matrix.

For instance, in 2024, Agfa-Gevaert reported that its Digital Print & Chemicals division, which encompasses Specialty Films & Chemicals, generated a substantial portion of the group's overall revenue, demonstrating its enduring financial strength and market relevance.

Analog X-Ray Film (Niche Markets)

Agfa-Gevaert's analog X-ray film segment, while facing an overall market decline, likely continues to operate as a cash cow in specialized niche areas. These segments, though diminishing, still represent a significant portion of Agfa's historical strength. For instance, in 2024, while the global medical imaging market is rapidly digitizing, certain developing regions or highly specialized veterinary or industrial radiography applications might still rely on analog film.

Despite the accelerated shift to digital, Agfa's established market share in these remaining analog niches can still yield substantial cash flow. The company's strategy likely involves rigorous cost optimization to match production levels with the reduced demand. This focus on efficiency ensures that even a shrinking market can contribute positively to the company's overall financial health.

- Niche Market Dominance: Agfa may retain a leading market share in specific analog X-ray film applications, such as industrial NDT (non-destructive testing) or certain medical specialties where digital adoption is slower.

- Regional Disparities: The transition to digital imaging is not uniform globally; Agfa could still be a key supplier in regions with less advanced healthcare infrastructure, where analog film remains prevalent.

- Cost Optimization: By streamlining operations and managing inventory effectively, Agfa can maximize profitability from these legacy product lines, even as sales volumes decrease.

Industrial Film Applications (non-medical)

Agfa-Gevaert's industrial film applications, excluding medical uses, represent a significant segment within its portfolio. These films are typically designed for established industrial sectors where Agfa holds a strong market position and a high share. While the broader film industry faces challenges, these specialized industrial films often serve as reliable cash generators.

These products are likely to be classified as Cash Cows in the Agfa-Gevaert BCG Matrix. This classification stems from their operation in mature markets with limited growth potential but a substantial, stable cash flow. The consistent demand in these sectors allows Agfa to generate profits with minimal need for reinvestment, thus supporting other business units.

- Stable Cash Flow: Industrial films in sectors like graphic arts or printing continue to provide a steady income stream.

- Mature Markets: These applications serve established industries with predictable demand.

- Low Investment Needs: Profit generation requires minimal capital expenditure for expansion or new product development.

- Supporting Growth Areas: Cash generated from these industrial films can be strategically allocated to more promising, high-growth segments within Agfa's business.

Agfa's legacy Healthcare IT maintenance and support, alongside established digital printing equipment and specialty films, function as key Cash Cows. These segments benefit from substantial installed bases and mature markets, generating predictable, stable revenue with low investment needs. For instance, in 2023, Agfa-Gevaert's Healthcare IT division contributed significantly to group finances, and in 2024, consumables for established digital printers continued to be a strong recurring revenue source.

| Business Segment | BCG Category | Key Characteristics | 2023/2024 Relevance |

|---|---|---|---|

| Legacy HealthCare IT Maintenance & Support | Cash Cow | Predictable recurring revenue, low investment needs | Significant contributor to group performance |

| Established Digital Printing Equipment | Cash Cow | Stable sales, healthy profit margins, drives consumable demand | Steady demand for consumables in 2024 |

| Specialty Films & Chemicals | Cash Cow | Mature market, steady and predictable cash flow | Substantial portion of Digital Print & Chemicals revenue in 2024 |

Full Transparency, Always

Agfa-Gevaert BCG Matrix

The Agfa-Gevaert BCG Matrix preview you're examining is the identical, fully completed document you will receive immediately after purchase. This means you'll get the complete strategic analysis, free from any watermarks or placeholder text, ready for immediate integration into your business planning processes.

Dogs

Agfa-Gevaert's traditional medical film business is a classic example of a 'cash trap' within the BCG matrix, experiencing an accelerated decline in market volume. This segment's shrinking demand directly impacts the group's overall financial performance, both in terms of revenue and profitability.

The significant drop in demand for traditional medical film means it consumes resources without yielding substantial returns, making it a drag on the company's financial health. Agfa has recognized this and is actively working to mitigate the impact.

To address this challenge, Agfa has implemented a reorganization and cost optimization plan for its traditional medical film activities. The company anticipates initial cost savings to materialize in the latter half of 2025, aiming to reduce the financial burden of this declining segment.

Agfa-Gevaert's Computed Radiography (CR) business is categorized as a Dog in the BCG Matrix. This segment has experienced a persistent downturn in revenue, signaling a contracting market and a diminished market presence.

Despite efforts to boost profitability through strategic actions like facility closures, the overarching market dynamics point to CR as a struggling product line. The business is currently valued at approximately €200 million, reflecting its mature and declining status.

The focus for CR is on managing its decline to mitigate losses, rather than pursuing growth through substantial investment. This approach aligns with the characteristics of a Dog, where capital allocation is minimized.

ORGACON conductive materials and printed circuit board products from Agfa-Gevaert are likely positioned as Dogs in the BCG Matrix. Their sales volumes have been hampered by a general slowdown in the electronics sector, indicating a weak competitive standing in a market that isn't expanding.

This situation points to Agfa holding a small market share in these segments within the Digital Print & Chemicals division. Operating in a low-growth or even shrinking market, these products probably contribute minimally to overall profitability.

Offset Solutions (Pre-Divestment)

Agfa-Gevaert’s decision to divest its Offset Solutions division to Aurelius Group in late 2023, a deal valued at approximately €110 million, clearly positions this business as a ‘dog’ within its BCG Matrix framework. This strategic move indicates that Offset Solutions was perceived as a low-growth, low-market-share segment, no longer aligned with Agfa's core strategic objectives.

The divestment itself is a classic strategy for shedding underperforming assets, allowing Agfa to reallocate resources towards more promising areas. The lingering discussions around outstanding receivables from the division further underscore its historically challenging financial performance and operational complexities.

- Divestment Rationale: Agfa-Gevaert's sale of Offset Solutions to Aurelius Group for €110 million highlights its classification as a 'dog' due to low growth and market share.

- Portfolio Optimization: The divestment represents a strategic effort to remove a non-core, underperforming asset from Agfa's business portfolio.

- Financial Indicators: Ongoing issues with outstanding receivables associated with the Offset Solutions division point to its past financial difficulties.

Outdated/Non-Upgradable Legacy Imaging Hardware

Agfa-Gevaert's legacy imaging hardware, particularly older, non-upgradable systems, represents a classic 'Dog' in the BCG matrix. As the company strategically shifts its HealthCare IT division towards cloud-based platforms, the market relevance and demand for these older, fixed installations naturally diminish. This decline is exacerbated by the inherent limitations of non-upgradable hardware, which cannot integrate with newer, more advanced imaging technologies or workflows, leading to a shrinking market share.

These legacy systems often necessitate continued investment in maintenance and support, diverting valuable resources that could be better allocated to Agfa's growth areas. For instance, while specific figures for Agfa's legacy hardware are not publicly itemized in a way that allows direct comparison to current market trends, the broader trend in medical imaging shows a clear move towards digital, integrated, and AI-enabled solutions. Companies heavily reliant on older, standalone hardware are increasingly finding their products becoming obsolete and costly to maintain relative to their revenue generation potential.

- Declining Market Share: Non-upgradable hardware struggles to compete with modern, integrated imaging solutions, leading to a reduced customer base.

- High Support Costs: Maintaining older systems can be resource-intensive, often involving specialized parts and expertise that become scarcer over time.

- Limited Growth Potential: The inability to upgrade or integrate with new technologies caps the revenue and strategic value of these products.

- Strategic Divestment/Minimization: Such products are typically candidates for phasing out or minimizing investment to focus on more profitable and future-oriented offerings.

Agfa-Gevaert's Computed Radiography (CR) business is a clear 'Dog' in the BCG Matrix, characterized by a persistent revenue decline and a shrinking market presence. Despite efforts like facility closures to improve profitability, market dynamics indicate this is a struggling product line. The business is valued at approximately €200 million, reflecting its mature and declining status, with a strategy focused on managing its decline rather than significant investment.

Agfa-Gevaert's legacy imaging hardware, particularly older, non-upgradable systems, also falls into the 'Dog' category. As the HealthCare IT division moves towards cloud-based platforms, the market relevance of these older, fixed installations diminishes. These systems often require ongoing maintenance, diverting resources from growth areas, and their inability to integrate with new technologies limits their revenue potential.

The divestment of Agfa-Gevaert's Offset Solutions division to Aurelius Group in late 2023 for approximately €110 million clearly marks this business as a 'dog'. This move signifies a strategic decision to shed a low-growth, low-market-share segment that no longer aligns with Agfa's core objectives, allowing for resource reallocation to more promising ventures.

ORGACON conductive materials and printed circuit board products are also likely 'Dogs' due to a slowdown in the electronics sector, which has hampered sales volumes and indicates a weak competitive position in a non-expanding market. These products hold a small market share within the Digital Print & Chemicals division and contribute minimally to overall profitability.

Question Marks

Agfa-Gevaert is demonstrating strong advancement in the industrial and packaging sectors of digital printing. This segment is anticipated to begin contributing financially starting in 2025, signaling a high-growth potential.

Currently, Agfa holds a modest market share in this area, reflecting its relatively new focus. The company's strategic direction suggests this business unit is positioned as a Question Mark within the BCG Matrix, requiring substantial investment to scale and potentially transition into a Star performer.

Agfa-Gevaert's ZIRFON membranes are a key technology for green hydrogen production, a sector with significant long-term growth potential. However, in Western markets, the expansion of green hydrogen has encountered headwinds. Legislation governing its production and distribution is still in flux, creating a complex and uncertain environment for businesses.

This regulatory complexity has slowed the anticipated rapid adoption of green hydrogen solutions. Consequently, while the market itself is a high-growth area, Agfa's current market share within these specific Western regions is constrained by these external factors. This positions green hydrogen solutions in Western markets as a question mark within the BCG matrix, indicating high potential but current uncertainty.

For instance, the European Union's Hydrogen Strategy, while ambitious, faces implementation challenges. By the end of 2023, the bloc had seen a substantial increase in planned renewable energy capacity, but the actual operational green hydrogen projects were still in their nascent stages, highlighting the gap between ambition and execution due to regulatory hurdles.

Agfa-Gevaert presented its new AI-powered radiology solutions, SmartXR and ScanXR, at the European Congress of Radiology (ECR) in 2024. These advancements are designed to significantly boost the efficiency and value of X-ray procedures, tapping into the rapidly expanding healthcare AI market.

As relatively new entrants, SmartXR and ScanXR likely hold a modest market share currently. Agfa's strategy will involve substantial investment to scale these offerings, aiming to elevate them from Question Marks to Stars within the BCG matrix by capturing significant growth in the AI-driven medical imaging sector.

Cloud-enabled Enterprise Imaging (initial large-scale deployments with new customers)

Securing initial large-scale cloud-enabled enterprise imaging contracts with entirely new healthcare IT customers positions these ventures as question marks within Agfa-Gevaert's BCG matrix. These significant projects demand considerable upfront investment for successful implementation and market penetration. Agfa must commit substantial resources to ensure these deployments transition from nascent opportunities into profitable segments with strong market share.

The challenge lies in the inherent risks associated with these early, large-scale cloud adoption projects. Agfa faces the task of proving the value proposition and operational efficiency of its cloud solutions to a new customer base. This requires a strategic ramp-up period, during which the company invests in infrastructure, sales, and support to foster market acceptance.

- High Upfront Investment: Large-scale cloud deployments necessitate significant capital expenditure for infrastructure, integration, and customization, impacting immediate profitability.

- Market Adoption Curve: Converting net new customers to cloud-based imaging solutions involves a learning curve and requires Agfa to invest in customer education and support.

- Strategic Importance: While risky, these question marks represent crucial opportunities to establish Agfa as a leader in the growing cloud enterprise imaging market.

- 2024 Focus: Agfa's 2024 strategy likely emphasizes demonstrating successful case studies from these initial deployments to attract further investment and expand market share.

Recently Launched Digital Printing Equipment Models

Agfa-Gevaert is actively refreshing its digital printing equipment lineup. New models like the Onset Panthera FB3216 and Anapurna Ciervo H2050/H2500 are key examples, with more significant releases anticipated in 2025.

These introductions are targeting a market that's experiencing robust growth, projected to reach $25.5 billion globally by 2027, up from $15.8 billion in 2022. However, Agfa’s current market share in these specific new segments is relatively small.

- New Product Entry: Agfa's latest digital printing equipment, including the Onset Panthera FB3216 and Anapurna Ciervo H2050/H2500, are entering a dynamic market.

- Market Growth: The digital printing market is expanding, with forecasts indicating continued strong performance.

- Low Market Share: Despite market growth, these new models currently represent a low percentage of Agfa's overall market presence in these categories.

- Strategic Focus: Significant investment in marketing and sales is required to increase adoption and move these products towards a Star position within the BCG matrix.

Agfa-Gevaert's AI-powered radiology solutions, SmartXR and ScanXR, introduced in 2024, are positioned as Question Marks. These offerings target the expanding healthcare AI market but currently hold a modest market share, necessitating significant investment to achieve Star status.

Similarly, new digital printing equipment like the Onset Panthera FB3216 and Anapurna Ciervo H2050/H2500 are entering a growing market, projected to reach $25.5 billion by 2027. Agfa's current share in these specific segments is low, requiring substantial marketing and sales investment to drive adoption.

Agfa's ZIRFON membranes for green hydrogen production also represent a Question Mark in Western markets. Despite the sector's high growth potential, regulatory complexities and slow adoption in regions like the EU, where operational projects lagged behind ambitious plans by the end of 2023, limit Agfa's current market penetration.

Securing large-scale cloud-enabled enterprise imaging contracts with new clients are also Question Marks. These ventures demand significant upfront investment to prove value and operational efficiency, with Agfa's 2024 strategy likely focused on demonstrating successful case studies to attract further investment and expand market share.

BCG Matrix Data Sources

Our Agfa-Gevaert BCG Matrix is constructed using a blend of internal financial disclosures, industry-specific market research, and competitor performance data to provide a comprehensive strategic overview.