Affirm Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Affirm Bundle

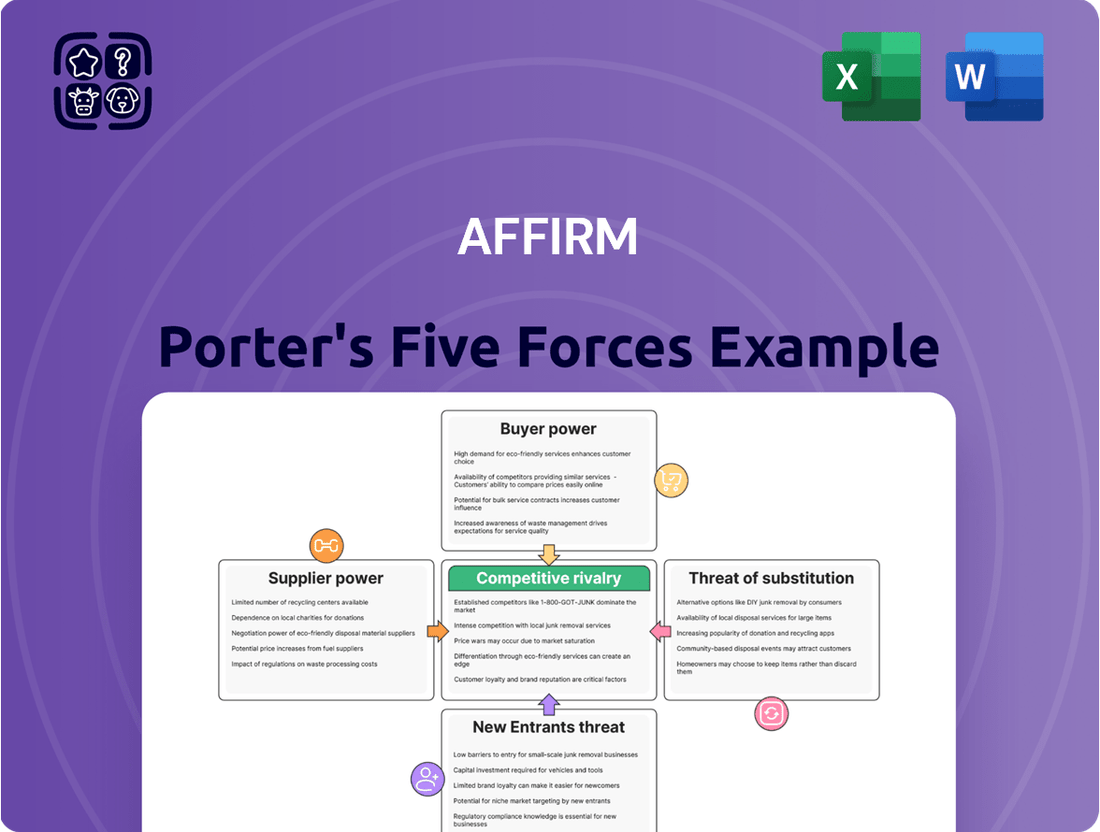

Affirm's competitive landscape is shaped by five key forces, each influencing its profitability and strategic options. Understanding the bargaining power of buyers, the threat of substitute products, and the intensity of rivalry among existing competitors is crucial for any stakeholder. Furthermore, the bargaining power of suppliers and the threat of new entrants present significant strategic considerations for Affirm.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Affirm’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Affirm's business model heavily depends on accessing capital to fund its consumer loans. These capital providers, including banks, insurance firms, and investors in asset-backed securities, possess significant bargaining power. The terms on which Affirm secures this funding directly impact its profitability and ability to grow. As of early 2024, Affirm leverages a diverse network of over 130 funding sources, which helps to mitigate some of this inherent power.

A substantial portion of Affirm's loans are funded and issued through originating bank partners like Cross River Bank, particularly for installment loans. This reliance gives these partner banks considerable leverage in negotiating terms, given their critical role in Affirm's business model. For instance, in fiscal year 2024, a significant percentage of loan originations continued to flow through these relationships. Any disruption in these key banking relationships could significantly impact Affirm's ability to originate new loans and scale its operations. This dependency is a crucial factor in the company's operational stability and financial performance.

Affirm significantly depends on technology infrastructure providers such as Amazon Web Services for cloud computing, Stripe for payment processing, and Plaid for financial data aggregation. The highly specialized nature of these services, coupled with the substantial costs and operational complexities involved in switching providers, grants these suppliers considerable bargaining power. For instance, AWS, a dominant cloud provider, reported a 2024 operating margin of around 30% from its cloud services, underscoring its market strength. Any service disruption from these critical partners could severely impede Affirm's operations and financial performance. This reliance necessitates stable and robust relationships with these key technology giants to ensure operational continuity.

Merchant Partners

Merchant partners, while customers of Affirm's payment solutions, also act as suppliers by subsidizing 0% APR financing, impacting Affirm's revenue streams. Major retailers, such as Amazon, which represented approximately 30% of Affirm's total Gross Merchandise Volume (GMV) in Q1 2024, wield significant bargaining power due to their transaction volume. This allows them to negotiate more favorable terms, directly influencing Affirm's margins on popular loan products. The potential loss of a large partner could severely impact GMV and overall financial performance.

- In Q1 2024, Amazon contributed roughly 30% to Affirm's total GMV.

- Large merchants negotiate lower merchant fees, directly affecting Affirm's profitability.

- Affirm's reliance on key partners creates leverage for these merchants.

- Losing a top merchant could significantly reduce Affirm's transaction volume.

Data Providers

Affirm's advanced risk modeling and underwriting processes critically depend on extensive data from various providers, including major credit bureaus like Experian, Equifax, and TransUnion. The quality and exclusivity of this data grant significant bargaining power to these suppliers, as it is indispensable for accurately assessing consumer credit risk and maintaining low delinquency rates. Without reliable, up-to-date data, Affirm's ability to offer competitive lending terms and manage its portfolio effectively would be severely hampered.

- Access to comprehensive data from providers is paramount for Affirm's real-time credit decisions.

- The proprietary nature or unique aggregation capabilities of certain data providers can increase their leverage.

- Affirm's ability to minimize loan losses, which stood at a net charge-off rate of 5.8% for the quarter ending March 31, 2024, is directly tied to data accuracy.

- Diversifying data sources and developing internal analytics capabilities can mitigate this supplier power.

Affirm faces significant supplier bargaining power from capital providers, especially originating banks like Cross River Bank, essential for loan funding. Technology providers such as AWS and Stripe also exert power due to specialized services and high switching costs. Additionally, major merchant partners, like Amazon which contributed 30% to Q1 2024 GMV, influence margins by negotiating fees. Data providers like credit bureaus hold leverage through exclusive data critical for risk modeling.

| Supplier Type | Key Examples | 2024 Impact |

|---|---|---|

| Capital Providers | Cross River Bank | Critical for loan origination |

| Tech Infrastructure | AWS, Stripe | AWS operating margin ~30% (2024) |

| Merchant Partners | Amazon | 30% of Q1 2024 GMV |

| Data Providers | Experian, Equifax | Supports 5.8% net charge-off rate (Mar 2024) |

What is included in the product

This analysis dissects Affirm's competitive environment by examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the buy-now-pay-later market.

Instantly identify and address competitive threats by visualizing the intensity of each Porter's Five Forces.

Customers Bargaining Power

Consumers face very low switching costs when choosing between various Buy Now, Pay Later (BNPL) providers. With numerous competitors like Klarna and Afterpay readily available at checkout, customers can easily select the most favorable terms for each individual purchase. This ease of switching gives consumers significant bargaining power, putting pressure on Affirm to offer competitive rates and a seamless user experience. The global BNPL market is projected to grow significantly by 2024, intensifying this competition.

High consumer sensitivity to interest rates significantly empowers customers in the Buy Now, Pay Later market. Many BNPL users, particularly younger demographics, are highly sensitive to financing costs and fees, often prioritizing affordability. The competitive landscape, with players like Klarna and Afterpay offering interest-free options, means consumers can easily demand transparent and low-cost financing solutions. Affirm's ability to offer attractive financing, including 0% APR deals, is crucial for acquiring and retaining these price-sensitive customers, especially as market interest rates fluctuate in 2024. This sensitivity drives intense competition among BNPL providers to offer the most consumer-friendly terms.

Merchants wield significant bargaining power over BNPL providers like Affirm, given the expanding selection of payment solutions available in 2024. This allows them to negotiate for more favorable merchant discount rates (MDRs) and enhanced integration support, directly impacting Affirm's revenue margins. A prime example of this leverage was Walmart's decision to shift its exclusive partnership away from Affirm, highlighting the formidable influence large retailers possess in the payments ecosystem. The competitive landscape forces providers to offer better terms to secure and retain valuable merchant relationships.

Access to Information

The digital framework of the Buy Now, Pay Later (BNPL) market empowers consumers to effortlessly compare Affirm with competing services such as Klarna and Afterpay. This inherent transparency significantly elevates customer bargaining power, as they are well-informed regarding diverse payment terms and merchant acceptance. Customers can leverage this readily available information to select the BNPL provider that aligns best with their specific financial needs or long-term retail relationships, impacting market share. In 2024, BNPL adoption continues to rise, with consumers actively seeking the most favorable terms.

- Consumers often compare 0% APR offers versus interest-bearing options across providers.

- Access to detailed repayment schedules and late fee policies is transparent.

- Online reviews and comparison sites further equip customers with decision-making data.

Growing Consumer Adoption and Choice

The rapid adoption of Buy Now, Pay Later (BNPL) services, with a projected global transaction value reaching $358.8 billion in 2024, empowers consumers to be more selective. As the user base expands, their collective preferences for features like flexible repayment terms and transparent fees significantly influence Affirm's product development. This demand for consumer-centric features strengthens the bargaining power of customers, pushing providers to innovate.

- Global BNPL transaction value anticipated at $358.8 billion in 2024, indicating broad adoption.

- Consumers increasingly prioritize flexible repayment options and clear fee structures.

- Growing user familiarity with BNPL drives demand for enhanced user experience.

- Affirm must respond to consumer preferences to maintain competitive advantage.

Customers hold significant bargaining power over Affirm due to very low switching costs among numerous Buy Now, Pay Later providers like Klarna and Afterpay. Their high sensitivity to interest rates and fees, coupled with digital transparency, allows easy comparison of financing terms. With the global BNPL market projected to reach $358.8 billion in 2024, consumers are empowered to demand competitive rates and flexible, transparent options, driving intense competition.

Same Document Delivered

Affirm Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details Affirm's competitive landscape using Porter's Five Forces, thoroughly analyzing the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, the threat of substitute products or services, and the intensity of rivalry within the buy now, pay later industry. This comprehensive evaluation equips you with a deep understanding of the external factors influencing Affirm's strategic position and profitability.

Rivalry Among Competitors

The Buy Now, Pay Later market is intensely competitive and fragmented, featuring pure-play BNPL firms, traditional financial institutions, and technology giants. Key fintech competitors for Affirm include Klarna and Afterpay, owned by Block, both actively vying for market share. This high number of players, with over 150 global BNPL providers by early 2024, leads to aggressive competition on fees, repayment terms, and product innovation to attract consumers and merchant partnerships. Such rivalry puts continuous pressure on Affirm's pricing and profitability.

Traditional financial powerhouses like JPMorgan Chase, Citi, and American Express are increasingly expanding into the Buy Now, Pay Later sector. These institutions leverage their immense customer bases, strong brand recognition, and significantly lower cost of capital, often below 5% for large banks in 2024, to directly compete with Affirm. Their entry heightens competitive rivalry, with reports indicating a 15% increase in traditional bank BNPL offerings by mid-2024. This intensified competition could lead to notable margin compression across the entire BNPL industry.

Large technology companies significantly intensify competitive rivalry for Affirm. Tech giants like Apple and PayPal have integrated their own buy now, pay later (BNPL) solutions directly into their vast ecosystems. While Affirm's partnership allows its service within Apple Pay, leveraging Apple's estimated 500 million active users, it also underscores the platform's power to introduce competing options like Apple Pay Later, which fully launched in late 2023. PayPal's 'Pay in 4' product, leveraging its 427 million active consumer accounts as of Q1 2024, stands as a direct and formidable competitor, using its extensive user and merchant network.

Price-Based Competition

Competitive rivalry in the Buy Now, Pay Later industry is intensely focused on pricing, specifically the interest rates and fees consumers face, alongside the discount rates charged to merchants. The widespread availability of 0% APR offerings, often subsidized by retailers, significantly challenges Affirm to differentiate on anything other than cost. This relentless emphasis on price puts continuous pressure on Affirm's profitability, especially as the company reported a net loss of $166.8 million in Q1 2024.

- BNPL competition heavily driven by interest rates and merchant discount fees.

- Prevalence of 0% APR offerings, often merchant-subsidized, limits non-price differentiation.

- This intense price focus pressures Affirm's profitability margins.

- Affirm reported a net loss of $166.8 million in Q1 2024, highlighting these pressures.

Low Differentiation and Low Switching Costs

The core Buy Now, Pay Later (BNPL) product remains largely similar across providers, resulting in low product differentiation. This, combined with low switching costs for both consumers and merchants, creates a highly rivalrous environment for Affirm. Companies are constantly innovating with new features and expanding into new sectors like travel and healthcare to create some level of differentiation in 2024.

- Affirm's active consumers reached 18.2 million in Q1 2024.

- Many competitors offer 0% APR plans, increasing price sensitivity.

- Merchant adoption of BNPL continues to grow, with over 200,000 active merchants on Affirm's platform as of Q1 2024.

- New partnerships in sectors like healthcare aim to diversify offerings.

Competitive rivalry for Affirm is intense, driven by numerous pure-play BNPL firms, traditional banks, and tech giants like Apple and PayPal. Low product differentiation and switching costs compel aggressive competition, particularly on pricing and 0% APR offers. This relentless pressure impacts profitability, as seen by Affirm's Q1 2024 net loss of $166.8 million.

| Metric | Affirm (Q1 2024) | Industry Context (2024) |

|---|---|---|

| Active Consumers | 18.2 million | PayPal: 427 million active accounts |

| Net Loss | $166.8 million | N/A |

| Active Merchants | 200,000+ | 150+ global BNPL providers |

SSubstitutes Threaten

Traditional credit cards remain Affirm's most significant substitute, boasting near-universal acceptance and high market penetration. While Affirm offers transparent, often interest-free installment plans, credit cards provide flexible revolving credit lines and are widely preferred for their convenience. In 2024, many consumers still favor the robust rewards programs and established familiarity of traditional credit cards over newer BNPL options. Data from early 2024 indicates that credit card debt in the U.S. continues to rise, highlighting their persistent usage.

Consumers considering larger purchases often look to traditional personal loans from banks or credit unions, which serve as a significant substitute for Affirm's financing. For individuals with strong credit, personal loan interest rates in mid-2024 could range from 6% to 10% APR, potentially offering more favorable terms than Affirm's interest-bearing plans, which can reach 30% APR. However, the application process for these loans is typically more involved, requiring detailed credit checks and longer approval times compared to Affirm's instant buy now, pay later decisions. This makes traditional personal loans a viable alternative for financing substantial one-time expenses, particularly for those prioritizing lower long-term costs over instant gratification.

Many retailers directly offer in-house financing programs, allowing customers to spread payments without third-party involvement. These traditional options, along with long-standing layaway plans, serve as direct substitutes for Affirm at the point of sale. While typically less flexible regarding payment terms or credit checks compared to Affirm's instant approval, they remain a significant alternative. For instance, major retailers like Walmart continue to offer layaway for certain items, particularly during holiday seasons, catering to a broad consumer base seeking payment flexibility without external credit lines in 2024.

Peer-to-Peer (P2P) Lending Platforms

Peer-to-peer (P2P) lending platforms present a notable substitute threat to Affirm by offering consumers alternative financing options outside the point-of-sale Buy Now, Pay Later (BNPL) model. These platforms directly connect individual borrowers with a pool of investors, often resulting in competitive interest rates that can challenge traditional credit products. While not integrated into merchant checkouts, P2P services like Prosper or LendingClub provide a viable avenue for consumers seeking personal loans to fund purchases, potentially diverting demand from BNPL providers. The global P2P lending market was valued at over $150 billion in 2023 and is projected to continue growing in 2024, indicating its increasing relevance as a financing channel.

- P2P platforms offer personal loans for various purposes, including large purchases.

- Interest rates can be competitive, sometimes lower than BNPL for longer terms.

- The global P2P lending market shows continued growth, reaching significant valuations.

- Consumers can access funds without merchant integration, directly impacting BNPL's market share.

Saving and Paying in Full

The most direct substitute for Affirm’s Buy Now, Pay Later (BNPL) service is simply saving money and paying for purchases in full using cash or a debit card. While this approach completely avoids debt, it inherently lacks the immediate gratification and financial flexibility that BNPL offers. For a significant segment of budget-conscious consumers, especially those wary of accumulating any form of debt, this remains the ultimate and preferred alternative to credit. In 2024, many consumers prioritize financial prudence, with data showing a continued preference for debit card usage over credit for everyday purchases for some demographics.

- Debit card transactions continue to be a dominant payment method, reflecting consumer preference for paying in full.

- A portion of consumers actively avoids credit to maintain financial independence and prevent interest accrual.

- The rise in interest rates in 2024 further incentivizes saving to avoid borrowing costs.

- Financial literacy initiatives often promote debt avoidance, reinforcing this substitute.

Affirm faces substantial threats from traditional credit cards, favored for widespread acceptance and rewards, with US credit card debt rising in early 2024 underscoring their persistent usage. Personal loans, including those from P2P platforms, offer competitive rates for larger purchases, while retailer-specific financing and layaway plans also serve as direct alternatives. Furthermore, consumers opting to save and pay with cash or debit cards represent a significant segment prioritizing debt avoidance, especially as interest rates influence borrowing decisions in 2024.

| Substitute Type | 2024 Trend/Data | Implication for Affirm | ||

|---|---|---|---|---|

| Traditional Credit Cards | U.S. credit card debt continues to rise in early 2024. | Strong preference for established, flexible revolving credit. | ||

| Personal Loans (Bank/P2P) | Mid-2024 rates 6-10% APR (good credit); P2P market over $150B (2023). | Lower long-term costs for large purchases. | ||

| Cash/Debit Payments | Continued preference for debit card usage over credit for everyday purchases. | Debt-averse consumers bypass all credit/BNPL options. |

Entrants Threaten

While building a sophisticated risk assessment model takes significant time and data, the basic technology for digital lending, especially Buy Now, Pay Later (BNPL) services, has become increasingly accessible. The core functionality of a BNPL offering can be readily replicated, which significantly lowers the barrier for new fintech startups to enter the market. This ease of entry makes the industry susceptible to new, innovative players. For instance, in 2024, numerous new BNPL solutions continue to emerge, including those from established banks and smaller fintechs, highlighting the ongoing threat of new entrants. These new players can quickly launch competing services, directly impacting Affirm's market share.

Regulatory scrutiny is intensifying across key markets for the Buy Now, Pay Later (BNPL) sector. In 2024, the U.S. Consumer Financial Protection Bureau (CFPB) continues its focus, alongside evolving frameworks in the U.K. and Australia. New rules around affordability checks, licensing, and detailed reporting will significantly increase compliance costs and operational complexity. This heightened regulatory burden acts as a substantial barrier, making it more challenging for new entrants to compete. Consequently, the market may consolidate around established players like Affirm, who possess the necessary resources to navigate this intricate legal landscape effectively.

Affirm, as an established player in the Buy Now, Pay Later (BNPL) market, benefits from significant brand recognition and consumer trust cultivated over years. New entrants face a substantial hurdle as they would need to invest heavily in marketing to build comparable brand awareness and a track record of reliability. For instance, Affirm reported over 18.5 million active consumers as of Q1 2024, demonstrating its strong user base and established trust. This brand loyalty acts as a considerable barrier, making it challenging for new competitors to quickly gain market share.

Access to Capital

Securing the substantial capital required to fund consumer loans presents a significant barrier for new entrants in the buy now, pay later sector. Established players like Affirm benefit from diverse and robust funding capacities, including warehouse facilities and securitizations. As of early 2024, Affirm maintained significant funding capacity, including over $11.0 billion in committed funding facilities, which is crucial for scaling operations. A new company would face the immense challenge of building these complex financial partnerships from the ground up.

- New entrants require immense capital to underwrite loans, facing high initial investment hurdles.

- Affirm leverages diverse funding channels, including securitization and credit facilities, totaling billions in capacity.

- Building trust with capital partners and securing competitive rates is a multi-year process for startups.

- The current economic climate, with higher interest rates, intensifies the difficulty of obtaining affordable capital.

Merchant Network and Integration

Building an extensive network of merchant partners and achieving seamless checkout integration presents a significant barrier for new entrants in the buy now, pay later sector. Affirm has cultivated deep relationships with major retailers, including its strategic partnership with Amazon, which became fully available to all eligible U.S. merchants in early 2024. This widespread adoption, further bolstered by its presence on platforms like Shopify, creates a powerful network effect that is incredibly challenging for new competitors to quickly replicate. Such established integration and a vast merchant base provide Affirm with a formidable competitive advantage.

- Affirm's network included approximately 292,000 active merchants as of Q1 2024.

- Its Amazon partnership expanded significantly throughout 2023 and into 2024, enabling broad merchant access.

- The company reported 18.1 million active consumers as of Q1 2024, leveraging this merchant ecosystem.

New entrants face varying barriers in the BNPL market; while core technology is accessible, significant capital, established brand trust, and extensive merchant networks are formidable hurdles. Regulatory scrutiny, increasing in 2024, further raises compliance costs, making it harder for startups to compete. Affirm's large active consumer base and funding capacity, including over $11.0 billion in committed facilities as of early 2024, reinforce its advantage.

| Factor | Affirm's Position (2024) | New Entrant Challenge |

|---|---|---|

| Technology | Mature, sophisticated models | Basic replication is easy |

| Funding Capacity | >$11.0B committed facilities | Securing competitive capital is immense |

| Brand/Trust | 18.5M active consumers (Q1) | Building recognition requires heavy investment |

| Merchant Network | ~292K active merchants (Q1) | Replicating widespread integration is difficult |

| Regulation | Resources for compliance | Higher compliance costs, complex navigation |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, incorporating information from Affirm's investor relations website, SEC filings, and financial statements. We also leverage industry-specific market research reports and competitor analysis to provide a comprehensive view of the competitive landscape.