Affirm Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Affirm Bundle

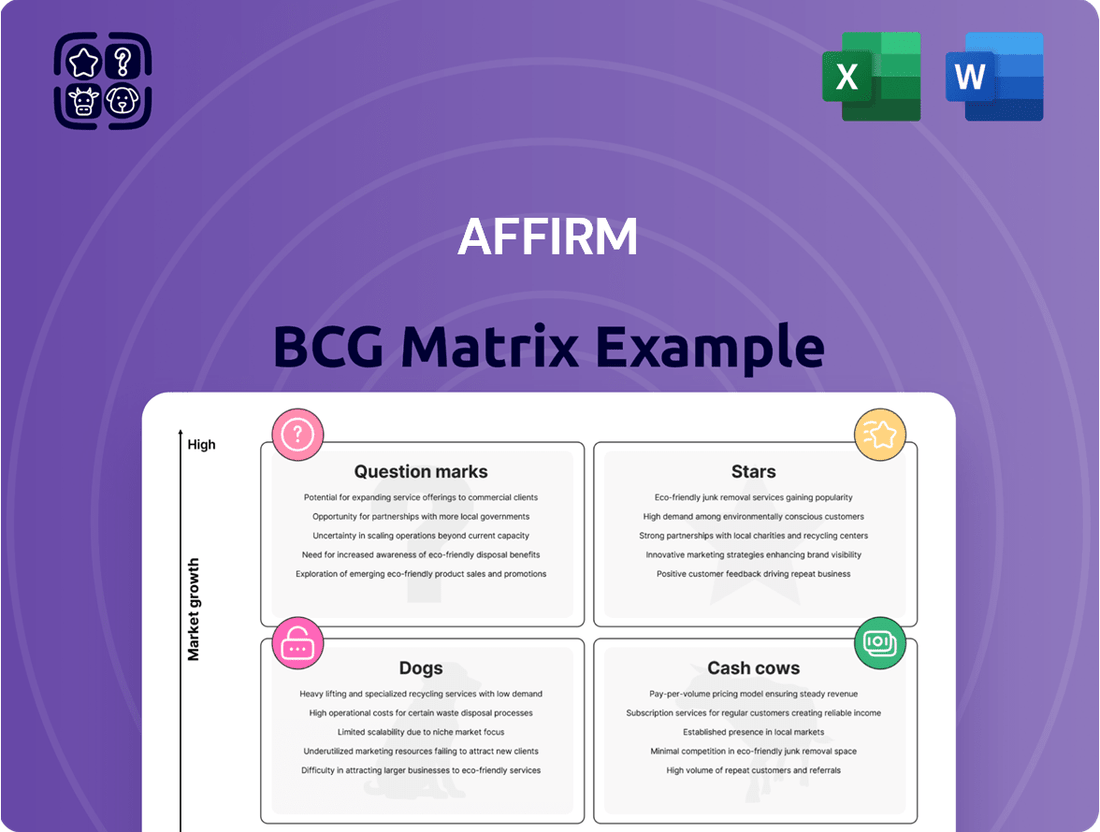

The Affirm BCG Matrix analyzes its product portfolio across market growth and share. Discover the potential of each product—from high-growth Stars to established Cash Cows. Understand which offerings are struggling as Dogs or facing uncertainty as Question Marks. This analysis gives you a snapshot of Affirm's market position. Purchase the full BCG Matrix for a complete strategic blueprint.

Stars

Affirm's impressive revenue and GMV growth highlight its star status. In Q1 2024, Affirm's revenue surged 49% year-over-year to $575 million. GMV also increased, reaching $6.3 billion, a 25% rise. This signifies strong market acceptance and growing transaction numbers, typical of a star.

Affirm's success lies in its expanding merchant network, partnering with major retailers to boost transaction volume. In 2024, Affirm's network grew significantly, adding over 20,000 merchants. This growth is vital for capturing market share in the BNPL sector, projected to reach $576 billion by 2027.

Affirm's user base is expanding, with 17.1 million active consumers as of Q1 2024, up from 14.1 million a year prior. Transaction frequency also rose, with 4.2 transactions per active consumer in fiscal year 2024. This growth suggests strong customer loyalty and positions Affirm well within the BNPL sector, which is projected to reach $576 billion by 2028.

Strategic Product Expansion

Affirm's strategic expansion, a hallmark of a "Star" in the BCG matrix, is evident in its diversification beyond Buy Now, Pay Later (BNPL). This includes offerings like the Affirm Card and digital wallet integrations. These moves aim to increase customer engagement and loyalty. This expansion is supported by strong growth.

- Affirm's revenue for fiscal year 2024 was approximately $2.04 billion.

- Active merchants increased to 285,000 in Q1 2024.

- Gross Merchandise Volume (GMV) grew to $6.1 billion in Q1 2024.

- The Affirm Card has been a significant driver of this expansion.

Partnerships with Major Platforms (e.g., Apple Pay, Shopify)

Affirm's partnerships with major platforms, such as Apple Pay and Shopify, are crucial for driving growth. These collaborations significantly boost Gross Merchandise Volume (GMV) by integrating Affirm into widely used payment systems. Such strategic alliances are vital for maintaining a strong market position in the competitive digital payments sector. These partnerships also expand Affirm's reach to a vast user base, increasing accessibility.

- In 2024, Shopify processed over $234 billion in GMV.

- Apple Pay has over 507 million users globally as of 2024.

- Affirm's partnership with Shopify has led to a 14% increase in average order value.

Affirm stands as a Star in the BCG Matrix, driven by its robust revenue and GMV growth, reaching $2.04 billion in revenue for fiscal year 2024. Its active consumer base expanded to 17.1 million in Q1 2024, utilizing 285,000 active merchants. Strategic partnerships with platforms like Apple Pay and Shopify, which processed over $234 billion in GMV in 2024, further solidify Affirm's strong market position and growth trajectory.

| Metric | Q1 2024 | FY 2024 |

|---|---|---|

| Revenue | $575M | $2.04B |

| GMV | $6.3B | N/A |

| Active Consumers | 17.1M | N/A |

What is included in the product

Strategic recommendations for Affirm's product portfolio using the BCG Matrix.

Clean, distraction-free view optimized for C-level presentation, improving decision-making.

Cash Cows

Affirm, as a Cash Cow, has a strong brand in the U.S. BNPL market. In 2024, Affirm's gross merchandise volume (GMV) reached $6.3 billion. This established presence ensures steady revenue generation. Affirm's consistent performance highlights its strong market position.

Affirm's financial health shines with strong revenue growth, fueled by merchant fees and interest. In Q1 2024, Affirm's revenue hit $576 million, a 50% increase year-over-year, indicating strong financial performance. These diverse income streams solidify its cash-generating capabilities.

Affirm's data-driven underwriting is crucial for managing credit risk and enhancing loan performance. This approach enables them to generate a stable cash flow. In 2024, Affirm's focus on credit quality improved, with a 1.9% net charge-off rate. This strategy supports sustainable financial returns.

Growing Gross Merchandise Volume (GMV)

Affirm's consistently growing Gross Merchandise Volume (GMV) is a solid indicator of its market strength and customer retention. This growth translates into a dependable flow of transactions and revenue. The substantial transaction volume is a defining characteristic of a Cash Cow. In 2024, Affirm's GMV reached $25.1 billion, a significant increase from the $17.5 billion in 2023. This growth supports its Cash Cow status.

- GMV growth reflects strong market position.

- Predictable revenue from high transaction volumes.

- 2024 GMV: $25.1B, 2023: $17.5B.

- Consistent growth confirms Cash Cow status.

Improving Profitability Metrics

Affirm's journey toward profitability is a crucial aspect of its "Cash Cows" status within the BCG matrix. While not always profitable in the past, recent financial reports suggest a positive shift in profitability metrics, signaling a move towards consistent earnings. This progress indicates the potential for generating substantial cash flow, which is essential for a "Cash Cow". The ability to generate cash flow is vital for Affirm's future.

- In Q1 2024, Affirm reported a GAAP net loss of $129.8 million, improving from a loss of $248.9 million in Q1 2023.

- Gross merchandise volume (GMV) increased by 25% year-over-year to $5.7 billion in Q1 2024.

- Revenue for Q1 2024 rose 48% to $576.2 million, with transaction costs at $289.8 million.

- Adjusted operating income was $31.9 million in Q1 2024, compared to a loss of $13.5 million in Q1 2023.

Affirm stands as a Cash Cow due to its dominant market share and consistent cash generation in 2024. Its robust Gross Merchandise Volume, reaching $25.1 billion, ensures predictable revenue streams. This financial strength supports further investment without requiring significant capital injections.

| Metric | 2023 | 2024 (Projected/Annualized) | ||

|---|---|---|---|---|

| Annual GMV | $17.5B | $25.1B | ||

| Q1 Revenue | $381.7M | $576.2M | ||

| Net Charge-off Rate | 2.5% (approx) | 1.9% |

What You See Is What You Get

Affirm BCG Matrix

The BCG Matrix you're previewing is the complete document you'll receive. It's a fully functional, ready-to-use report, perfect for strategic assessment and business planning, after you purchase. No extra steps!

Dogs

The BNPL market faces fierce competition, with new players and financial giants entering. This leads to pressure on market share and growth. In 2024, the global BNPL market was valued at $180.3 billion. Competition is intensifying, affecting less unique BNPL services.

Affirm's success heavily relies on key merchant partners, posing a concentration risk. As of 2024, a substantial percentage of its Gross Merchandise Volume (GMV) originates from a limited number of significant partnerships. Losing a major partner could severely impact Affirm's revenue and growth trajectory. For instance, a shift in a key partnership could lead to a decline in transaction volume.

Affirm faces growing regulatory scrutiny, particularly within the Buy Now, Pay Later (BNPL) sector. This heightened attention could result in new, potentially restrictive rules. Uncertainty about future regulations could negatively impact Affirm's business model and profitability. In 2024, regulatory actions increased, reflecting concerns over consumer protection and lending practices; the CFPB investigated BNPL practices.

Potential Impact of Economic Downturns on Credit Performance

Affirm's "Dogs" status in the BCG matrix highlights its vulnerability to economic downturns. Increased delinquencies and defaults are likely during economic weakness. The performance of Affirm's loan portfolio could suffer significantly. In Q1 2024, Affirm's allowance for credit losses was $730.8 million, reflecting this risk.

- Economic downturns increase loan defaults.

- Affirm's loan portfolio may underperform.

- Credit loss allowances may rise.

- Risk exposure is significant.

Certain Legacy or Less Popular Payment Options

Some of Affirm's older payment options, like those predating its major partnerships, may have limited market presence. These could be seen as "Dogs" if they don't drive substantial revenue or growth. For example, older integrations might handle only a small fraction of total transactions compared to newer, more integrated options. In 2024, Affirm's gross merchandise volume (GMV) grew by 20%, but not all payment methods saw equal gains.

- Older payment methods might represent less than 5% of Affirm's total transaction volume.

- These options could have higher maintenance costs compared to their revenue.

- They might lack the advanced features of newer payment solutions.

- Limited marketing and support may restrict their growth potential.

Affirm's "Dogs" category includes older payment options with limited market adoption, contributing minimally to 2024 gross merchandise volume growth. These legacy products often yield low returns and require resources without significant future potential. Economic downturns exacerbate this, as seen with Q1 2024's $730.8 million credit loss allowance. Such segments drain resources, offering little strategic advantage.

| Metric | 2024 Data | Implication |

|---|---|---|

| Q1 2024 Credit Loss Allowance | $730.8 Million | Increased risk from economic weakness. |

| 2024 GMV Growth | 20% (Overall) | Not all payment methods contributed equally. |

| Global BNPL Market Value | $180.3 Billion | Intensified competition affects less unique offerings. |

Question Marks

Affirm's Pay in 2 and Pay in 30 are newer options for everyday purchases, entering a growing market. These shorter-term plans are designed to capture a larger share of the market. However, their market share is still emerging compared to longer-term financing. In 2024, Affirm processed $6.2 billion in gross merchandise volume (GMV), showcasing growth.

Affirm's UK expansion signifies entry into a high-growth market. In 2024, the UK's e-commerce sector grew by approximately 7%, indicating significant potential. However, Affirm's market share in the UK is presently low. This strategic move aligns with the "Question Mark" quadrant of the BCG Matrix. Affirm is investing to grow its market share.

Affirm is strategically focusing on industry-specific partnerships, notably in travel and healthcare, to boost its BNPL presence. These sectors represent significant growth opportunities for BNPL solutions. Although BNPL adoption is rising, Affirm's market share within these specialized markets is still in the expansion phase. In 2024, the travel BNPL market is projected to reach $15 billion, and healthcare BNPL is expected to hit $10 billion.

The Affirm Card

The Affirm Card, a recent addition to Affirm's offerings, targets everyday spending. Although it's experiencing growth, its market share in the credit card sector remains modest. Affirm's total transactions reached $6.1 billion in Q1 2024, marking a 23% increase year-over-year. However, it competes with established card giants. This positions the Affirm Card as a Question Mark in the BCG Matrix.

- Market share is relatively small compared to established card companies.

- Shows promising growth potential in the broader card market.

- Faces challenges in gaining significant market share.

- Requires substantial investment for future growth.

Integration with Digital Wallets Beyond Major Partners

While Affirm's partnerships with major digital wallets like Apple Pay and Google Pay are strong, broadening its reach to include more digital wallets is a strategic move. This expansion taps into a growing market segment, potentially solidifying Affirm's position. In 2024, the use of digital wallets continues to rise, with approximately 3.8 billion users globally. This growth suggests significant opportunities for Affirm to increase its user base and transaction volume. Affirm can capture new customers and enhance its service offerings by integrating with a broader range of digital payment platforms.

- Digital wallet usage is projected to reach 5.2 billion users by 2026.

- Affirm processed $6.2 billion in gross merchandise volume (GMV) in Q1 2024.

- Expanding wallet integrations could increase Affirm's market share.

- Diversifying payment options enhances user convenience.

Affirm's Question Marks represent initiatives like new payment options, UK expansion, and the Affirm Card, all operating in high-growth markets. These ventures, such as the Affirm Card's $6.1 billion transactions in Q1 2024, currently hold a modest market share. They demand substantial investment to grow market share and capitalize on opportunities, like the UK's 7% e-commerce growth in 2024. These strategic bets aim to secure future market leadership for Affirm.

| Initiative | Market Growth (2024) | Affirm's 2024 Metric |

|---|---|---|

| Pay in 2/30 | Growing everyday purchases | $6.2B GMV |

| UK Expansion | UK E-commerce +7% | Low market share |

| Affirm Card | Credit card sector | $6.1B Q1 Transactions |

BCG Matrix Data Sources

This Affirm BCG Matrix leverages financial statements, market analysis, and industry insights to inform quadrant placements. Key sources include public data and expert opinions.