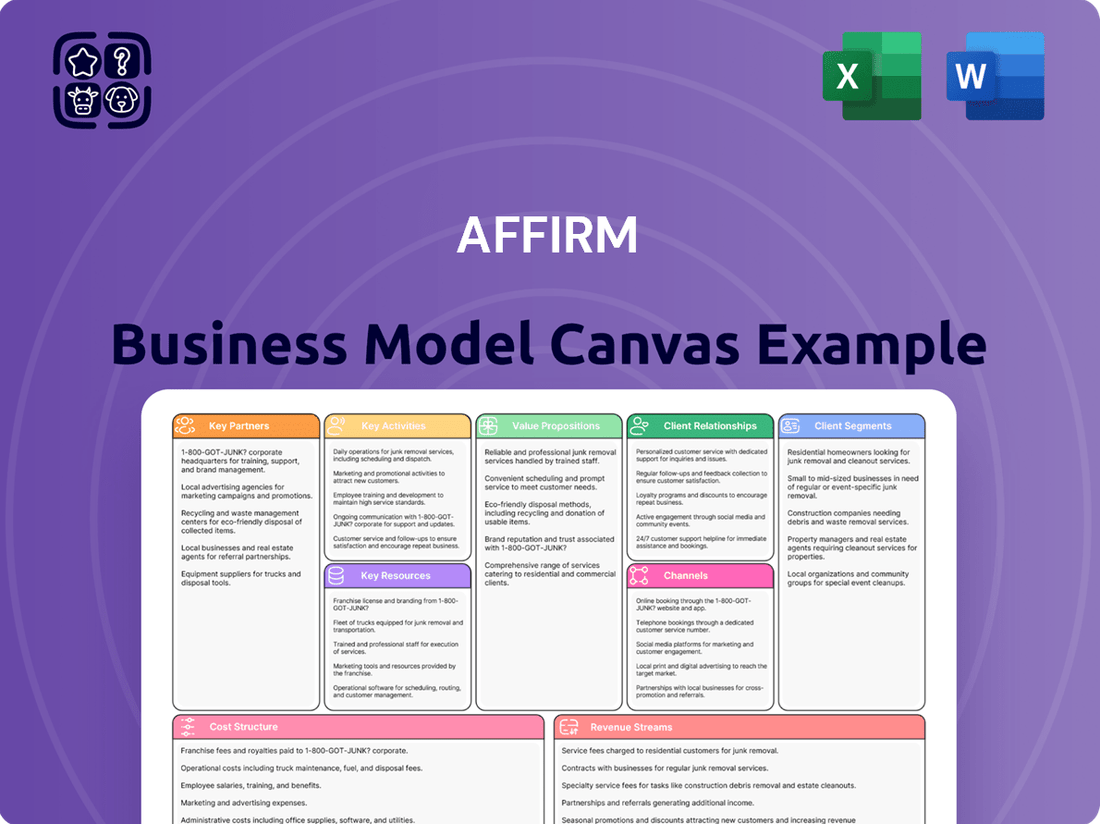

Affirm Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Affirm Bundle

Unlock the full strategic blueprint behind Affirm's innovative "buy now, pay later" model. This in-depth Business Model Canvas reveals how Affirm creates value for consumers and merchants, captures market share through seamless integration, and maintains a competitive edge in the rapidly evolving fintech landscape. Ideal for entrepreneurs, consultants, and investors seeking actionable insights into a disruptive financial service.

Dive deeper into Affirm’s real-world strategy with the complete Business Model Canvas. From its unique value propositions to its intricate cost structure and revenue streams, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its future opportunities lie.

Want to see exactly how Affirm operates and scales its disruptive financial services business? Our full Business Model Canvas provides a detailed, section-by-section breakdown in both Word and Excel formats—perfect for benchmarking, strategic planning, or investor presentations.

Gain exclusive access to the complete Business Model Canvas used to map out Affirm’s success in revolutionizing consumer credit. This professional, ready-to-use document is ideal for business students, financial analysts, or founders seeking to learn from proven industry strategies in the fintech space.

See how all the crucial pieces fit together in Affirm’s winning business model. This detailed, editable canvas highlights the company’s key customer segments, essential partnerships, innovative revenue strategies, and much more. Download the full version to accelerate your own business thinking and strategic development.

Partnerships

Affirm's core business relies heavily on its partnerships with retail and e-commerce merchants, which embed its financing directly into the checkout flow. This integration, seen with major platforms like Shopify and Amazon, gives Affirm direct access to a vast number of consumer transactions at the critical point of sale. By 2024, Affirm reported over 29 million active consumers and relationships with approximately 267,000 merchant partners. The goal is to become a ubiquitous payment solution, fostering a powerful network effect where both consumers and businesses expect Affirm as an available option, driving significant gross merchandise volume.

Affirm, as a non-bank lender, critically depends on state-chartered bank partners, primarily Cross River Bank and Celtic Bank, to legally originate the loans it facilitates. This partnership is essential for regulatory compliance, enabling Affirm to offer its buy now, pay later services across all U.S. states. The banks handle the formal loan origination, while Affirm manages the technology platform, underwriting decisions, and ongoing loan servicing. This collaborative model supports Affirm's significant growth, with gross merchandise volume reaching 6.3 billion USD in Q3 FY2024.

Strategic alliances with leading e-commerce platforms and payment processors are vital for Affirm's growth. Key partners like Shopify, Adyen, and Stripe enable thousands of merchants to integrate Affirm seamlessly, significantly reducing technical effort. This approach rapidly accelerates merchant acquisition, bolstering Affirm's market penetration. By mid-2024, Affirm continued to expand its network, leveraging these partnerships to solidify its position within the broader digital commerce ecosystem, enhancing its reach to over 150,000 active merchants.

Capital Markets & Funding Partners

Affirm's growth hinges on robust capital markets partnerships, which provide the essential funding for its loan originations. Investment banks play a crucial role, structuring and selling asset-backed securities (ABS) to institutional investors and asset managers. This diversified funding model ensures continuous access to capital, powering Affirm's ability to facilitate buy now, pay later options. For instance, Affirm maintained significant funding capacity through 2024, supported by its strong relationships.

- Diversified funding sources include securitization and whole loan sales.

- Investment banks facilitate ABS issuances, attracting institutional capital.

- Access to capital markets is critical for scaling loan volume.

- Affirm's funding capacity often exceeds loan originations, indicating strong partnerships.

Technology & Data Providers

Affirm significantly bolsters its core underwriting and platform capabilities through strategic alliances with technology and data providers. These partnerships are crucial for accessing alternative data sources, which are vital for enhancing risk assessment and fraud prevention, especially as online transactions grew by 15% in Q1 2024. This collaboration enables Affirm to continuously refine its proprietary risk models, maintaining a secure and highly scalable technology platform.

- Partnerships provide access to diverse alternative data.

- Utilizes advanced fraud prevention tools.

- Leverages cloud infrastructure for scalability.

- Supports continuous refinement of proprietary risk models.

Affirm secures its funding through diversified capital market partnerships, including securitization and whole loan sales. Investment banks are key, facilitating asset-backed securities issuances to attract institutional capital, ensuring ample funding for loan originations. This model is crucial for scaling loan volume, with Affirm maintaining significant funding capacity well into 2024.

| Funding Source | Purpose | Key Partner Type |

|---|---|---|

| Securitization | Access institutional capital | Investment Banks |

| Whole Loan Sales | Diversify funding base | Institutional Investors |

| Warehouse Lines | Short-term liquidity | Commercial Banks |

What is included in the product

A detailed breakdown of Affirm's strategy, outlining its customer segments, value propositions, and revenue streams for its buy now, pay later service.

This model examines Affirm's partnerships, cost structure, and key resources, offering insights into its operational efficiency and competitive positioning.

Provides a clear, structured framework for identifying and addressing key business challenges.

Helps teams quickly pinpoint and resolve operational inefficiencies and market gaps.

Activities

Affirm's core competency lies in its sophisticated risk assessment and underwriting, leveraging proprietary machine learning models for instantaneous credit decisions. These algorithms analyze thousands of data points beyond traditional FICO scores, assessing a borrower's ability and willingness to repay. This real-time process is crucial, allowing Affirm to maintain a strong credit performance with its net charge-off rate at 5.5% as of early 2024. This robust underwriting enables higher approval rates while effectively managing credit losses across its diverse consumer base.

Affirm continuously invests in developing and maintaining its core technology platform, a critical activity for its operations. This includes enhancing the consumer application for a seamless user experience and improving the merchant dashboard alongside integration APIs. Strengthening the back-end infrastructure for efficient loan servicing and robust data analytics is also paramount. These ongoing efforts ensure operational efficiency and support Affirm's growth, evidenced by their significant technology and data analytics investments reflected in their financial reporting for 2024.

Affirm’s core activities include the continuous expansion of its merchant network across diverse retail sectors, encompassing both online and in-store experiences. This involves a dedicated sales force targeting large enterprise clients, alongside user-friendly self-service tools tailored for smaller businesses. As of early 2024, Affirm reported over 292,000 active merchants, showcasing significant growth. The company provides robust support during the technical integration process, ensuring a smooth and efficient launch for new partners. This strategic focus drives Affirm’s market penetration and transaction volume.

Capital Sourcing & Management

Affirm constantly engages in complex financial activities to secure capital for its loan volume. This includes managing relationships with funding partners and negotiating warehouse lines of credit, essential for immediate liquidity. A critical aspect is executing securitization transactions, such as the $600 million of asset-backed securities issued in 2024. Effectively managing funding costs and liquidity is vital for the company's profitability and ability to scale its operations.

- Secured $1.5 billion in new funding capacity in 2024, enhancing loan origination capabilities.

- Maintained over $1.0 billion in unrestricted cash and cash equivalents by early 2024 for operational flexibility.

- Utilized securitization as a key funding strategy, with new deals executed in 2024.

- Focused on optimizing funding costs to improve net interest margin in a fluctuating rate environment.

Loan Servicing & Customer Support

Affirm’s loan servicing and customer support covers the entire post-origination lifecycle, from payment processing to collections, ensuring a smooth experience. The company prioritizes a transparent, user-friendly servicing experience via its intuitive app and website, crucial for building consumer trust and loyalty. This direct management of the customer relationship is a core differentiator from traditional financing methods, empowering users with clear payment schedules and no hidden fees. Affirm reported strong engagement with its platform, reflecting this customer-centric approach in 2024.

- Affirm handles all payment processing and collections directly.

- The company leverages its app and website for transparent customer interactions.

- Direct customer relationship management fosters trust and loyalty.

- This approach differentiates Affirm from conventional lenders by eliminating hidden fees.

Affirm's core activities center on sophisticated risk assessment through AI-driven underwriting, maintaining a 5.5% net charge-off rate in early 2024. They continuously expand their merchant network, reaching over 292,000 active partners by early 2024, and develop their technology platform. Crucially, Affirm manages complex funding, securing $1.5 billion in new capacity and executing $600 million in asset-backed securities in 2024, while also providing direct loan servicing and transparent customer support.

| Key Activity | 2024 Data Point | Impact |

|---|---|---|

| Risk Underwriting | 5.5% Net Charge-Off Rate | Manages credit losses effectively |

| Merchant Expansion | >292,000 Active Merchants | Drives market penetration and transaction volume |

| Capital Management | $1.5 Billion New Funding Capacity, $600 Million ABS | Ensures liquidity and scales loan volume |

Full Document Unlocks After Purchase

Business Model Canvas

This preview showcases the actual Affirm Business Model Canvas you will receive. It's a direct representation of the comprehensive document that will be delivered upon purchase, ensuring you know exactly what you're getting. You'll gain access to the same professionally structured and detailed canvas, ready for your strategic planning needs.

Resources

Affirm's most valuable asset is its advanced, data-driven underwriting technology, leveraging sophisticated machine learning models. These models, trained on a massive and proprietary dataset of loan performance, represent a significant competitive advantage. They allow Affirm to more accurately price risk, evident in their reported 3.8% 30-day+ delinquency rate as of March 2024. This capability enables them to extend credit to a broader range of consumers than traditional models typically allow.

Affirm’s core strength lies in its integrated technology platform, serving consumers, merchants, and internal operations seamlessly. This robust infrastructure encompasses its user-friendly mobile app, merchant APIs for easy integration, and sophisticated back-end systems powering real-time underwriting and efficient loan servicing. The platform’s scalability supports Affirm’s continued growth, which saw its active consumers reach 18.1 million as of Q1 2024. This frictionless digital experience is critical, processing billions in gross merchandise volume annually.

Affirm's extensive merchant network is a crucial asset, building a competitive moat through its widespread integration. This growing ecosystem provides a diversified, low-cost channel for acquiring consumers directly at the point of sale. By early 2024, Affirm continued to leverage key partnerships, including its integration with Amazon and its ongoing collaboration with Shopify, which significantly enhances brand credibility and visibility. This broad reach enables efficient customer acquisition, driving transaction volume across various retail sectors.

Brand Reputation & Consumer Trust

Affirm has built a strong brand identity emphasizing transparency, fairness, and simplicity, positioning itself as a consumer-friendly alternative to traditional credit. This reputation, highlighted by its no late fees or deferred interest policy, is a crucial intangible asset. It attracts consumers seeking honest financial products, fostering long-term loyalty and trust. This focus on clear terms resonates strongly with users, driving adoption among a large segment of online shoppers.

- Affirm’s brand trust helps attract repeat users, with a significant portion of transactions coming from existing customers.

- The absence of hidden fees enhances consumer confidence, differentiating Affirm in a competitive market.

- Transparency in lending terms fosters positive word-of-mouth and strengthens the brand’s market position.

- In 2024, Affirm continued to expand its merchant network, indicating strong partner trust in its consumer-centric model.

Access to Diversified Funding

Affirm’s robust access to diversified funding is a cornerstone resource, leveraging established relationships and a proven track record in capital markets. This enables consistent and efficient capital acquisition through channels like securitizations and warehouse facilities. Such a strategy ensures ample financial liquidity to fuel loan growth and mitigates funding risk, supporting significant scaling.

- Affirm actively utilizes securitization, successfully issuing over $1.1 billion in asset-backed securities (ABS) in the first half of 2024 to fund loan originations.

- The company maintains various warehouse facilities, providing flexible, short-term liquidity.

- Diversified funding sources reduce reliance on any single capital provider, enhancing financial stability.

- This funding infrastructure directly supports Affirm’s continued expansion into new merchant partnerships and consumer segments.

Affirm's key resources include its advanced AI underwriting, reflected in a 3.8% 30-day+ delinquency rate by March 2024, and a scalable tech platform supporting 18.1 million active consumers in Q1 2024. A vast merchant network, solidified by partnerships with Amazon and Shopify, drives significant transaction volume. Diversified funding, including over $1.1 billion in H1 2024 ABS issuances, ensures robust liquidity. This foundation supports its transparent brand identity.

| Resource Category | Key Asset | 2024 Data Point | ||

|---|---|---|---|---|

| Technology | AI Underwriting | 3.8% Delinquency (Mar 2024) | ||

| Platform | Integrated Platform | 18.1M Active Consumers (Q1 2024) | ||

| Funding | Diversified Capital | >$1.1B ABS Issued (H1 2024) |

Value Propositions

Affirm offers consumers a straightforward way to finance purchases with clear, simple terms and no hidden fees. The total cost of the loan, including any interest, is displayed upfront, eliminating the surprises common with traditional credit cards. This transparency empowers consumers to make responsible financial decisions, supporting a shift towards predictable payments. In 2024, Affirm continues to emphasize this clarity, attracting users seeking financial predictability.

Affirm empowers consumers by making higher-priced goods more accessible, allowing payments over time in fixed installments. This approach increases immediate purchasing power and offers crucial budgetary control. For example, Affirm reported over 18 million active consumers in early 2024, benefiting from flexible payment options. Many purchases also feature interest-free financing, further enhancing affordability and financial flexibility for everyday spending and larger ticket items alike.

For its retail partners, Affirm's primary value lies in its proven ability to significantly drive sales growth and boost conversion rates. By offering flexible payment options at checkout, merchants experience higher conversion rates, often seeing an increase of 20% or more. This also leads to a reduction in cart abandonment and a notable increase in average order value, with some merchants reporting up to an 85% rise. Affirm effectively removes price as a barrier, contributing to its Gross Merchandise Volume reaching $6.3 billion in Q3 2024.

For Merchants: New Customer Acquisition

Integrating Affirm allows merchants to tap into a substantial, expanding base of active consumers actively seeking flexible payment options. Many of Affirm's 18.1 million active consumers, reported as of Q3 2024, deliberately look for retailers offering buy now, pay later solutions. This direct consumer preference effectively transforms Affirm into a powerful customer acquisition channel, driving new, high-intent traffic directly to partnering businesses. Merchants benefit from increased discovery and engagement within Affirm's loyal user network.

- Access to over 18 million active Affirm consumers as of Q3 2024.

- Affirm acts as a direct referral source for new, high-intent customers.

- Consumers actively seek merchants offering Affirm, boosting traffic.

- Merchants gain exposure to a loyal and engaged user base.

A Modern Alternative to Traditional Credit

Affirm offers consumers and merchants a modern, digitally native alternative to the complexities of traditional credit cards and store cards. Its transparent, technology-first approach appeals strongly to a new generation of buyers, particularly Gen Z and Millennials, who prefer clear payment terms over revolving debt. In 2024, Affirm continued to expand its merchant network, providing a seamless buy-now-pay-later option at checkout for millions of users.

- Affirm's Gross Merchandise Volume (GMV) reached $5.7 billion in Q1 2024, reflecting strong consumer adoption.

- A 2024 survey showed over 60% of Gen Z consumers utilize BNPL services, highlighting the shift away from traditional credit.

- Affirm's active consumer count grew to 18.1 million as of March 2024, demonstrating its expanding user base.

- The platform's clear, interest-free or fixed-interest payment plans reduce the perceived pitfalls of hidden fees often associated with traditional credit.

Affirm offers consumers transparent financing with clear, upfront terms, eliminating hidden fees and providing predictable payments. For merchants, it significantly boosts sales and conversion rates, driving Gross Merchandise Volume to $6.3 billion in Q3 2024. Affirm also acts as a powerful customer acquisition channel, connecting merchants with over 18.1 million active consumers as of Q3 2024. This digital-first approach provides a modern alternative to traditional credit, appealing to a new generation of buyers.

| Stakeholder | Value Proposition | 2024 Data Point | ||

|---|---|---|---|---|

| Consumers | Transparent, predictable financing | 18.1 million active consumers (Q3 2024) | ||

| Merchants | Increased sales & conversion | GMV $6.3 billion (Q3 2024) | ||

| Merchants | Customer acquisition channel | Access to 18.1 million active users (Q3 2024) |

Customer Relationships

Affirm’s primary customer relationship is largely managed through a highly automated, self-service digital platform. Consumers engage with Affirm primarily via its mobile app and website for loan applications, payment management, and account inquiries. This model ensures significant operational efficiency and scalability, supporting a large user base that reached 18.2 million active consumers as of June 30, 2024. The automated approach provides 24/7 accessibility, allowing users to manage their finances seamlessly without direct human intervention, reflecting a core pillar of their 2024 operational strategy.

Affirm offers direct customer support through email, live chat, and phone to address issues not resolvable via self-service channels. This human-assisted approach is crucial for navigating complex inquiries, managing disputes, and ensuring high customer satisfaction. For 2024, Affirm continues to invest in responsive support, understanding its importance for maintaining customer trust and reinforcing its brand image as a reliable financial partner.

Affirm maintains robust, dedicated relationships with its merchant partners through specialized account management and partner support teams. These teams provide crucial assistance with platform integration, ensuring seamless setup and operation. They offer ongoing support, collaborating closely with merchants to optimize Affirm’s performance on their e-commerce platforms. This strong B2B relationship is fundamental for merchant retention and driving continued growth, supporting Affirm’s network of over 207,000 active merchants as of early 2024.

Transactional & Recurring

Affirm’s customer relationships are built on both transactional and recurring engagements. Initially, each new loan represents a transactional interaction at the point of sale. However, as consumers successfully repay their loans, they establish a positive credit history with Affirm, which can lead to increased credit limits and encourage repeat usage across Affirm’s extensive merchant network. The Affirm app further cultivates this recurring relationship by serving as an integrated shopping discovery platform, driving sustained engagement.

- Active consumers reached 18.2 million by Q2 2024, emphasizing growth in the user base.

- Repeat usage rates are critical, with successful repayments fostering higher credit limits.

- The Affirm app facilitates discovery, encouraging users to return for future purchases.

- This model aims to convert one-time borrowers into loyal, returning customers.

Community & Content Engagement

Affirm actively engages its user base through a robust content strategy, sharing financial literacy resources on its official blog and various social media channels. By offering educational materials on responsible spending and personal finance, Affirm aims to cultivate a supportive community around its brand. This content marketing approach helps to build trust and solidify Affirm's position as a reliable partner in consumers' financial wellness journeys. As of early 2024, Affirm continued to emphasize educational content, seeing sustained engagement across its platforms.

- Affirm leverages its blog and social media to disseminate financial literacy content.

- Educational resources cover responsible spending and personal finance topics.

- This strategy builds community and fosters trust with users.

- Affirm is positioned as a key partner in financial wellness through content engagement.

Affirm’s customer relationships are built on a highly automated digital platform, enabling self-service for 18.2 million active consumers as of Q2 2024. While largely self-service, human support channels address complex issues. Affirm fosters recurring engagement by encouraging repeat usage and leveraging its app for shopping discovery, aiming to convert one-time borrowers into loyal customers. Dedicated account management teams also maintain strong relationships with over 207,000 active merchant partners as of early 2024.

| Relationship Type | Key Channel | 2024 Data Point |

|---|---|---|

| Consumer | Digital Platform (App/Web) | 18.2M active consumers (Q2) |

| Merchant | Dedicated Account Management | 207K+ active merchants (early) |

| Engagement | Repeat Usage & App Discovery | High repeat usage rates |

Channels

Affirm's core channel involves direct integration into the checkout flows of its online and in-store merchant partners. This embedded presence is crucial, serving as the primary point for customer acquisition and facilitating transactions as consumers select Affirm as their payment option. By Q4 2023, Affirm reported over 250,000 active merchant partners, highlighting the widespread nature of these integrations. The ubiquity of these point-of-sale integrations remains fundamental to Affirm's business model, driving transaction volume and user adoption in 2024.

The Affirm consumer mobile app and website serve as essential multi-purpose channels, facilitating both account management and loan servicing for users. These platforms also function as dynamic shopping portals and discovery tools, allowing consumers to explore a vast network of merchant partners. Users can effortlessly get pre-qualified for loans and browse exclusive offers directly within the app, which effectively drives significant traffic back to Affirm’s retail partners. As of early 2024, Affirm reported over 18 million active consumers, many of whom engage directly through these digital channels to manage their payment plans and discover new purchasing opportunities.

Affirm’s Direct-to-Consumer Virtual Card significantly expands its reach, allowing consumers to utilize Affirm financing at nearly any online or in-store retailer, even those not directly integrated. This channel allows users to generate a one-time-use virtual card number for seamless purchase completion. It effectively decouples Affirm’s service from its direct merchant network, contributing to Affirm’s reported 29% year-over-year Gross Merchandise Volume growth to $6.3 billion in Q3 2024. This broadens consumer access and diversifies transaction sources.

Direct Sales & Partnerships Team

Affirm’s dedicated direct sales force and partnership team serves as a crucial channel for acquiring new enterprise-level and mid-market merchants. This team actively engages in B2B marketing and direct outreach, expanding the merchant network significantly. They are responsible for clearly communicating Affirm’s value proposition to potential retail partners and fostering long-term relationships, driving merchant adoption. As of early 2024, Affirm continued to grow its network, reaching over 207,000 active merchants by Q1 2024, a testament to these focused B2B efforts.

- Direct sales acquire enterprise and mid-market merchants.

- B2B outreach expands the merchant network.

- Team communicates Affirm's value proposition.

- Manages ongoing merchant relationships.

Marketing & Brand Communications

Affirm utilizes robust digital marketing, social media campaigns, and public relations to build strong brand awareness and attract both consumers and merchants. These channels effectively communicate Affirm's core message of transparency and financial empowerment, emphasizing its no-late-fees policy. By creating demand and a positive brand image, these efforts crucially support the growth and effectiveness of all other channels within their business model, driving merchant adoption and consumer engagement across diverse sectors, including travel and retail.

- Affirm's Q4 2023 active consumers reached 18.2 million, demonstrating successful channel engagement.

- The company reported gross merchandise volume (GMV) of $6.9 billion in Q4 2023, reflecting strong consumer adoption driven by marketing.

- Affirm's brand recognition continues to grow, as evidenced by its partnerships with over 267,000 merchant partners as of Q4 2023.

- Digital campaigns target specific demographics, contributing to a 2024 projected increase in user acquisition efficiency.

Affirm's primary channels include direct merchant integrations at checkout, its consumer mobile app, and a versatile virtual card, collectively driving transactions and user engagement. A dedicated direct sales force acquires new enterprise and mid-market merchants, expanding the network to over 207,000 active partners by Q1 2024. Digital marketing and PR efforts build brand awareness, supporting all channels and contributing to $6.9 billion in GMV in Q4 2023. These diverse channels ensure broad consumer access and robust merchant partnerships.

| Channel Type | Primary Function | 2024 Data Point |

|---|---|---|

| Merchant Integrations | Point-of-sale transactions | 250,000+ active partners (Q4 2023) |

| Consumer App & Virtual Card | User engagement & expanded access | 18.2 million active consumers (Q4 2023) |

| Direct Sales Force | Merchant acquisition | 207,000+ active merchants (Q1 2024) |

| Digital Marketing | Brand awareness & demand generation | $6.9 billion GMV (Q4 2023) |

Customer Segments

A core segment for Affirm comprises digitally-native Millennial and Gen Z consumers, many of whom are credit-averse or have thin credit histories. This demographic, accounting for over 70% of BNPL users as of early 2024, prioritizes transparency, digital convenience, and financial control. They often view traditional credit cards with skepticism due to revolving interest and complex fee structures. Affirm's straightforward, installment-based model resonates strongly, offering a clear payment schedule. This aligns with their preference for predictable financial commitments, driving significant adoption.

Affirm targets consumers making significant purchases, like furniture, electronics, and travel, who seek alternatives to upfront payment. This segment uses Affirm to manage cash flow effectively, making higher-ticket items more accessible by spreading costs over predictable payment schedules. For example, Affirm’s Gross Merchandise Volume (GMV) reached $6.9 billion in Q2 2024, reflecting strong demand for financing these larger acquisitions. These users prioritize budget management for specific, often substantial, expenditures.

A key customer segment for Affirm includes underbanked or thin-file borrowers often underserved by traditional financial institutions. These consumers, representing about 63 million adults in the U.S. as of 2023, may have limited credit history or FICO scores that do not fully reflect their creditworthiness. Affirm’s advanced underwriting model leverages alternative data points to assess risk beyond traditional metrics, allowing for broader credit access. This approach enables the approval of consumers who might otherwise be denied, expanding Affirm’s market reach and providing a crucial financial service. By focusing on this segment, Affirm taps into a significant portion of the population seeking flexible payment solutions.

E-commerce & In-Store Retail Merchants

E-commerce and in-store retail merchants represent Affirm's core B2B customer segment, encompassing a diverse array of industries from emerging online boutiques to established omnichannel enterprise retailers. These merchants partner with Affirm primarily to enhance sales, elevate average order value, and boost conversion rates by providing flexible, transparent payment solutions to their customers. They are indispensable to Affirm's two-sided network, driving demand for its financing options. As of early 2024, Affirm continued to expand its merchant network, reporting over 291,000 active merchants across various sectors, significantly impacting merchant growth.

- Primary B2B customer segment for Affirm.

- Range from small online shops to large omnichannel retailers.

- Seek to increase sales, average order value, and conversion rates.

- Critical part of Affirm's two-sided network, with over 291,000 active merchants in 2024.

Travel & Experience Providers

A growing segment for Affirm includes travel and experience providers, such as major airlines, online booking sites, and event platforms. Consumers increasingly utilize Affirm to book flights, vacations, and tickets, enabling them to spread the cost over time. This enhances travel accessibility for a broader audience and helps merchants secure bookings earlier, improving their cash flow. Affirm’s Gross Merchandise Volume (GMV) in the travel category has shown robust expansion, indicating strong adoption.

- Affirm’s travel and ticketing GMV significantly contributed to its overall GMV growth in 2024.

- The ability to pay over time makes higher-priced travel options more attainable for consumers.

- Merchants benefit from increased conversion rates and reduced booking friction.

- This segment is a key driver for Affirm's continued expansion in high-ticket purchases.

Affirm primarily serves digitally-native Millennials and Gen Z, many credit-averse, who value transparent payment plans for purchases. It also targets consumers making significant buys, like those contributing to its Q2 2024 GMV of $6.9 billion. Additionally, Affirm reaches underbanked individuals, leveraging alternative data for approvals. A crucial segment comprises over 291,000 active retail and e-commerce merchants as of early 2024, seeking to boost sales and average order value.

| Segment | Characteristic | 2024 Data Point | Benefit to Consumer | Benefit to Affirm |

|---|---|---|---|---|

| Millennials/Gen Z | Credit-averse, digital-first | 70%+ BNPL users (early 2024) | Transparent payments | High adoption rate |

| High-Ticket Buyers | Seek cash flow management | $6.9B GMV (Q2 2024) | Accessibility to large purchases | Increased transaction volume |

| Merchants | Retailers, e-commerce | 291,000+ active (early 2024) | Higher sales, AOV | Network expansion, revenue growth |

Cost Structure

The provision for credit losses stands as one of Affirm's most significant and variable costs, representing the funds set aside to cover anticipated loan defaults. This expense is directly tied to the volume of loans facilitated and the overall performance of their loan portfolio. For instance, in Q1 2024, Affirm reported a provision for credit losses of $143.6 million, reflecting their assessment of potential uncollectible balances. Effective risk management, including robust underwriting and collection strategies, is crucial for controlling this substantial cost and maintaining financial stability.

Funding costs represent the interest and fees Affirm pays on its diverse funding sources, including warehouse lines of credit and other debt instruments used to finance consumer loans before they are sold or securitized. Effectively managing these costs is critical for Affirm to maintain the profitability of its lending operations, especially given fluctuating interest rates. For instance, Affirm reported total interest expense of approximately $170.8 million for the nine months ended March 31, 2024, highlighting this significant cost component. This metric is closely scrutinized by financial analysts as a key indicator of the company's financial efficiency and leverage management.

A significant portion of Affirm's cost structure is dedicated to Technology & Data Analytics, encompassing substantial research and development expenses. This includes the salaries for numerous engineers and data scientists, crucial for advancing their proprietary AI models and platforms. Cloud infrastructure and software licenses also represent major outlays, vital for handling the massive transactional data and underwriting models. For instance, Affirm reported technology and data analytics expenses of approximately $309 million for the nine months ended March 31, 2024, highlighting this ongoing investment. This continuous investment is a key driver of Affirm's competitive advantage in the buy now, pay later market.

Sales & Marketing

Affirm's Sales & Marketing expenses are vital for expanding its two-sided network, covering costs to acquire both consumers and merchants. These include salaries for dedicated sales and marketing teams, significant advertising spend, and partner commissions. For instance, Affirm's total operating expenses, which include sales and marketing, were approximately $487 million in Q3 2024, reflecting substantial investments in growth initiatives. These strategic investments are crucial for driving top-line growth and market share expansion in the competitive fintech landscape, directly impacting their ability to onboard new users and businesses.

- Salaries for sales and marketing personnel are a primary component.

- Advertising and promotional activities represent a significant outlay.

- Commissions paid to partners for new user and merchant referrals are included.

- Brand-building efforts are essential for long-term market presence.

Personnel & General Administration

Personnel and General Administration for Affirm encompasses significant costs like employee salaries and benefits for roles across customer support, finance, legal, and human resources. This category also covers general overhead, including office space rent and professional services such as auditing and legal counsel. As Affirm scales its operations, effectively managing these general and administrative expenses is crucial for achieving operational leverage and improving profitability. For instance, Affirm reported $221.7 million in operating expenses for Q1 2024, a substantial portion attributable to G&A, emphasizing its impact on overall financial performance.

- Affirm's G&A expenses reflect costs for its extensive workforce and corporate infrastructure.

- Efficient management of these overheads directly impacts the company's path to profitability.

- Operational leverage is key, aiming for revenue growth to outpace G&A expense increases.

- Q1 2024 operating expenses highlight the scale of these administrative investments.

Affirm's cost structure is primarily driven by its provision for credit losses, which stood at $143.6 million in Q1 2024, and substantial funding costs, with interest expense reaching $170.8 million for the nine months ended March 31, 2024. Significant investment in technology and data analytics, totaling $309 million for the same period, underpins their platform. Additionally, sales, marketing, and general administrative expenses are key outlays for growth and operational support.

| Cost Category | Period | Amount (Millions) |

|---|---|---|

| Provision for Credit Losses | Q1 2024 | $143.6 |

| Interest Expense (Funding Costs) | 9M FY2024 (ended March 31) | $170.8 |

| Technology & Data Analytics | 9M FY2024 (ended March 31) | $309.0 |

Revenue Streams

Affirm's primary revenue stream from its Merchant Network comes from fees paid directly by businesses. When a customer chooses to pay using Affirm, the merchant pays a fee, typically a percentage of that transaction's total value. Merchants gladly pay this fee because offering Affirm often leads to higher sales volumes, significantly improved conversion rates, and larger average order values for their products. For example, in Q1 2024, Affirm reported strong growth in active merchants, underscoring the ongoing value proposition for businesses leveraging their platform.

Affirm generates significant interest income from the loans it facilitates for consumers. While some loans are offered at 0% APR, with merchants covering the cost, many carry a simple interest rate. This interest income is recognized over the life of each loan. For the quarter ending March 31, 2024, Affirm reported interest income of 301.2 million USD, making it a primary revenue driver. This consistent stream underpins Affirm's financial model and growth.

Affirm generates revenue by selling the loans it facilitates to a network of third-party investors and funding partners. The gain on these sales, a crucial revenue stream, is the difference between the sale price and the carrying value of the loans on Affirm's books. This strategy allows Affirm to recycle capital efficiently to fund new loans and transfer credit risk to external parties. For instance, in their fiscal third quarter of 2024, Affirm reported a gain on sale of loans of $146.4 million, demonstrating the significance of this revenue component to their financial model.

Servicing Income

Affirm generates servicing income by retaining the rights to manage loans after selling them to investors, earning a fee for this ongoing service. This involves handling all aspects of the loan lifecycle, from processing customer payments and addressing inquiries to managing collections. These servicing fees provide a consistent and predictable revenue stream, contributing significantly to Affirm's financial stability. For instance, in fiscal year 2024, Affirm continued to emphasize its servicing capabilities as a core part of its platform, reflecting steady operational efficiency.

- Affirm retains loan servicing rights post-sale.

- Earns fees for managing loan portfolios for investors.

- Covers customer payments, inquiries, and collections.

- Provides a recurring, predictable revenue stream.

Virtual Card Interchange Fees

When consumers utilize an Affirm Virtual Card for purchases at retailers not directly integrated into Affirm's primary merchant network, Affirm generates revenue through interchange fees. This fee is a small percentage of the transaction value, paid by the merchant's bank to the card issuer, which in this case is Affirm. While interchange fees represent a smaller portion of Affirm's overall revenue, they are crucial for monetizing transactions occurring outside its core partner ecosystem. This diversified approach supports broader consumer spending options, contributing to Affirm's total platform volume, which reached $6.3 billion in Q3 fiscal year 2024.

- Affirm's total platform volume reached $6.3 billion in Q3 fiscal year 2024, reflecting broad consumer engagement.

- Interchange fees help capture revenue from transactions at non-integrated merchants.

- These fees contribute to the diversification of Affirm's revenue streams beyond core interest and merchant fees.

Affirm's core revenue streams are diverse, anchored by merchant fees, interest income from consumer loans, and gains from selling loans to investors. Merchant fees drive sales for businesses, while interest income, totaling $301.2 million in Q1 2024, is a significant contributor. Furthermore, Affirm generates servicing income for managing sold loans and interchange fees from virtual card transactions, contributing to its $6.3 billion total platform volume in Q3 fiscal year 2024.

| Revenue Stream | Primary Source | 2024 Data Point |

|---|---|---|

| Merchant Network Fees | Fees from businesses | Q1 2024: Strong active merchant growth |

| Interest Income | Consumer loans | Q1 2024: $301.2 million |

| Gain on Sale of Loans | Selling loans to investors | Q3 Fiscal 2024: $146.4 million |

| Servicing & Interchange Fees | Loan management, virtual card use | Q3 Fiscal 2024: $6.3 billion (Total Platform Volume) |

Business Model Canvas Data Sources

The Affirm Business Model Canvas is constructed using a blend of internal financial data, customer transaction analysis, and extensive market research. This ensures each component, from value propositions to revenue streams, is grounded in empirical evidence and current market realities.