AerSale PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AerSale Bundle

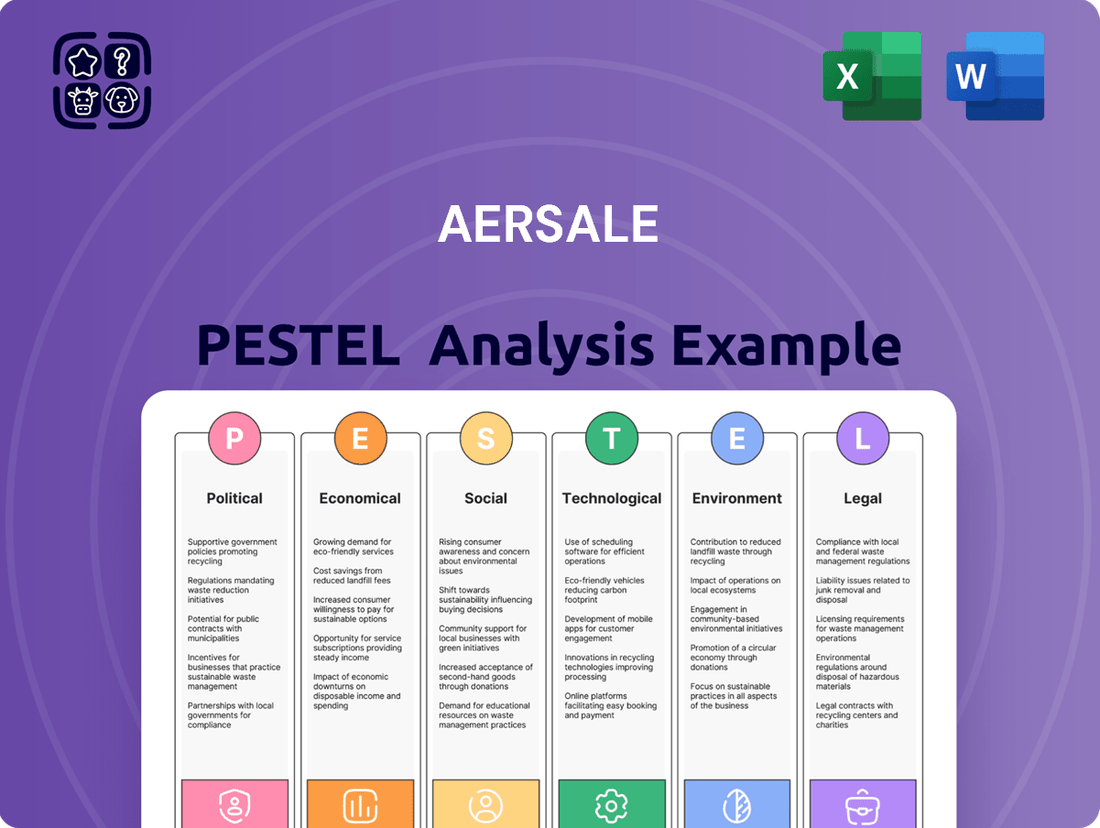

Unlock the hidden forces shaping AerSale's trajectory with our meticulously crafted PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are creating both opportunities and challenges for the company. Don't guess your next move; arm yourself with actionable intelligence. Purchase the full PESTLE analysis now and gain the strategic clarity you need to thrive.

Political factors

Government aviation policies, such as the FAA's evolving safety standards and the International Civil Aviation Organization's (ICAO) mandates on emissions, directly shape AerSale's operational landscape. For instance, stricter airworthiness directives can increase demand for aftermarket parts and MRO services, a core business for AerSale. In 2024, the global aviation industry continued to navigate complex regulatory environments, with a particular focus on sustainability initiatives that could influence the lifecycle management of aircraft.

Global geopolitical stability profoundly impacts the aviation aftermarket. For instance, ongoing conflicts in Eastern Europe and the Middle East, as of early 2024, have led to rerouted flights and increased operational costs for airlines, potentially dampening demand for MRO services and used aircraft parts. AerSale's international presence means it's directly exposed to these risks, affecting its supply chain and customer access.

International trade agreements and the imposition of tariffs on aviation components or aircraft directly influence AerSale's cost structure and pricing. For instance, the United States' trade policies, including tariffs on goods from certain countries, could increase the cost of acquiring or selling aircraft and parts. In 2024, ongoing adjustments to trade relationships, particularly with major aerospace manufacturing hubs, mean AerSale must remain agile in navigating potential import/export duties on used aircraft and engines.

Government Support and Subsidies for Airlines

Government financial support and subsidies for airlines, especially during challenging economic periods, can significantly stabilize AerSale's customer base. For instance, the CARES Act in the United States provided substantial aid to airlines during the COVID-19 pandemic, helping to prevent widespread fleet retirements and maintain operational capacity. This indirect support bolsters airlines' ability to invest in maintenance, repair, and overhaul (MRO) services and acquire used aircraft, which are core to AerSale's business model.

The availability of government aid directly impacts airline financial health, influencing their purchasing power for AerSale's offerings. A healthy airline sector, buoyed by supportive policies, translates to increased demand for aircraft parts, MRO services, and aircraft leasing. Conversely, a lack of government intervention could accelerate airline insolvencies, potentially flooding the market with used aircraft and parts, which might depress prices but also reduce the overall pool of active customers for AerSale's services.

- Government aid programs like the U.S. CARES Act provided over $50 billion in relief to the airline industry, supporting operational continuity and fleet management.

- European Union member states have also offered significant state aid to national carriers, crucial for maintaining fleet investments and MRO spending.

- The stability of airline finances, often influenced by government support, directly correlates with their capacity to engage in fleet modernization and maintenance, benefiting AerSale.

International Sanctions and Export Controls

International sanctions and export controls significantly impact AerSale's operational landscape. For instance, the evolving sanctions against Russia, which intensified in 2022 and continued to be a factor in 2023 and early 2024, could limit AerSale's access to certain aircraft or parts if they originate from or are destined for sanctioned entities. Similarly, stringent export controls on advanced aviation technologies, particularly those with dual-use capabilities, necessitate rigorous due diligence for every transaction. Failure to comply can result in substantial fines, potentially impacting AerSale's financial performance and market access.

The complexity of these regulations requires constant monitoring and adaptation. AerSale must navigate varying compliance requirements across different jurisdictions. For example, in 2023, the US Department of Commerce's Bureau of Industry and Security (BIS) continued to enforce export control regulations on advanced technologies, impacting the global aerospace supply chain. AerSale's ability to secure necessary licenses and approvals for its international sales and maintenance operations is crucial for its continued growth and profitability. Non-compliance could lead to penalties and reputational damage, restricting future business opportunities.

- Sanctions Impact: Restrictions on dealings with specific countries or entities due to international sanctions, as seen with ongoing geopolitical tensions impacting global trade routes and supply chains in 2023-2024.

- Export Controls: Stringent regulations governing the transfer of aviation technology and parts, requiring AerSale to maintain robust compliance programs for all international transactions.

- Compliance Risks: Potential for severe penalties and reputational damage for non-compliance, directly affecting market access and financial stability.

- Market Access: The necessity of adhering to evolving international trade policies to ensure continued access to global markets for aircraft sales, leasing, and maintenance services.

Government aviation policies, such as evolving safety standards and emissions mandates, directly shape AerSale's operational landscape, influencing demand for aftermarket parts and MRO services. Geopolitical stability and international trade agreements also profoundly impact AerSale's supply chain and market access, with tariffs and sanctions requiring constant vigilance. Government financial support for airlines, like the CARES Act, stabilizes AerSale's customer base by ensuring airlines can invest in maintenance and fleet management.

| Factor | Impact on AerSale | 2024/2025 Relevance |

|---|---|---|

| Regulatory Environment | Shapes demand for MRO and aftermarket parts. | Continued focus on sustainability and safety standards. |

| Geopolitical Stability | Affects supply chains and customer access. | Ongoing regional conflicts impacting air travel and logistics. |

| Trade Policies | Influences cost structure and pricing of parts/aircraft. | Adjustments to trade relationships affecting import/export duties. |

| Government Aid to Airlines | Stabilizes customer base and purchasing power. | Potential for continued support during economic fluctuations. |

What is included in the product

This AerSale PESTLE analysis thoroughly examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing the company's operations and strategic landscape.

It provides actionable insights for stakeholders by detailing how these external forces present both challenges and opportunities for AerSale's growth and market position.

AerSale's PESTLE analysis provides a clear, summarized version of external factors, acting as a pain point reliver by enabling quick referencing during meetings or presentations.

Economic factors

Global economic growth is a major driver for the aviation industry. When economies are strong, people and businesses travel more, boosting demand for flights and air cargo. This increased activity directly benefits airlines, encouraging them to grow their fleets and invest in essential services like maintenance, repair, and overhaul (MRO). For AerSale, a healthy global economy means more opportunities for its aircraft and MRO services.

In 2024, the International Monetary Fund (IMF) projected global growth to be around 3.2%, a slight slowdown from previous years but still indicating a generally positive economic environment. This level of growth supports continued demand for air travel. For instance, the International Air Transport Association (IATA) reported that global air cargo traffic increased by 10.4% in the first quarter of 2024 compared to the same period in 2023, signaling a healthy demand for logistics and, by extension, airline operations.

Conversely, economic downturns present challenges. A significant slowdown or recession can lead to reduced consumer spending on travel and decreased business activity, resulting in fewer passengers and less cargo. Airlines might then scale back operations, deferring fleet expansions and maintenance schedules. This would directly impact AerSale, as it could mean fewer aircraft sales, lower demand for MRO services, and a potential decrease in spare parts demand.

Global fuel prices are a major driver of airline operating expenses. For instance, in early 2024, jet fuel prices saw fluctuations, with some reports indicating averages around $2.80 per gallon, a notable increase from previous years. These price swings directly affect an airline's bottom line.

When fuel costs rise, airlines often face pressure to reduce spending elsewhere. This can lead to postponed investments in new aircraft, a greater reliance on more economical used planes, and a sharper focus on managing maintenance, repair, and overhaul (MRO) costs. This environment makes cost-saving solutions particularly valuable.

AerSale's business model, which centers on providing cost-effective used aircraft and MRO services, gains significant appeal when fuel prices are elevated. Airlines actively seek ways to optimize their fleet and maintenance expenditures, making AerSale's offerings a compelling proposition during these challenging economic periods.

Interest rates significantly impact AerSale's operating environment. For instance, the Federal Reserve's benchmark interest rate, which influences borrowing costs across the economy, saw increases throughout 2022 and 2023, reaching a range of 5.25%-5.50% by mid-2023. This rise in rates directly escalates the cost for airlines to finance new aircraft purchases or leases, potentially softening demand for AerSale's offerings.

Higher borrowing costs also affect AerSale's own capital expenditures, such as acquiring aircraft for its inventory or investing in maintenance and repair capabilities. For example, if AerSale needs to finance a $50 million aircraft acquisition, a 1% increase in interest rates could add $500,000 annually to its financing costs, impacting the profitability of its leasing and sales operations.

Furthermore, the cost of capital for leasing companies, AerSale's key customers, also rises with interest rates. This can lead to increased lease rates, making aircraft leasing less attractive for airlines and potentially reducing the demand for AerSale's aircraft and component services, particularly as the industry navigates economic uncertainties.

Supply Chain Dynamics and Component Pricing

The stability and cost of the global aviation supply chain significantly influence AerSale's Maintenance, Repair, and Overhaul (MRO) services and parts sales. For instance, in 2024, the aerospace industry continued to grapple with lingering supply chain bottlenecks, particularly affecting critical components like specialized alloys and advanced electronics. This directly translates to increased operational costs and extended lead times for AerSale.

Disruptions, such as geopolitical events or manufacturing delays, coupled with rising raw material prices, can directly impact AerSale's bottom line. In early 2025, reports indicated that the cost of titanium, a key material for aircraft components, saw a notable increase of approximately 8-10% compared to the previous year, adding pressure to MRO pricing.

- Component Shortages: Ongoing shortages of specific, high-demand aircraft parts, such as certain engine components or avionics units, can extend repair times and increase sourcing costs for AerSale.

- Raw Material Volatility: Fluctuations in the prices of essential materials like aluminum, titanium, and specialized composites directly affect the cost of parts and repair materials used by AerSale.

- Logistics Costs: Increased fuel prices and shipping container availability issues in 2024 and projected into 2025 continue to drive up the cost of transporting aircraft parts and materials globally.

Therefore, AerSale's ability to manage its supply chain effectively through strategic sourcing and inventory management is paramount to maintaining competitive pricing and ensuring timely service delivery to its clients.

Currency Exchange Rate Fluctuations

AerSale, operating globally, is inherently exposed to the volatility of currency exchange rates. These fluctuations can directly affect its bottom line by altering the cost of sourcing aircraft and components from overseas markets. For instance, a strengthening US dollar could make imports cheaper, while a weakening dollar would increase those costs.

The impact extends to revenue as well; international sales and lease agreements are priced in various currencies. When these foreign earnings are repatriated, their value in AerSale's reporting currency (likely USD) can significantly change based on prevailing exchange rates. This dynamic requires careful financial management to mitigate potential losses and capitalize on favorable movements.

For 2024 and into 2025, currency markets have shown considerable movement. For example, the Euro has experienced periods of weakness against the US dollar, which could benefit AerSale if it sources a significant portion of its inventory from the Eurozone. Conversely, if a substantial portion of its revenue comes from countries with depreciating currencies, this could negatively impact its reported profits.

- Impact on Costs: A stronger USD could lower the cost of acquiring aircraft and parts from countries using weaker currencies, such as those in the Eurozone or emerging markets.

- Revenue Translation: Fluctuations in exchange rates directly affect the USD value of revenue generated from international leases and sales, potentially reducing reported earnings if foreign currencies weaken.

- Profitability: The net effect of currency movements on AerSale's profitability depends on the balance between its foreign-denominated costs and revenues, with significant shifts impacting the conversion of foreign earnings back to its base currency.

- 2024/2025 Trends: Observing trends like the Euro's performance against the USD is crucial; for instance, if the Euro depreciated by 5% against the USD in a given period, AerSale's Euro-denominated expenses would become cheaper in USD terms.

Economic factors significantly shape AerSale's operational landscape. Global economic growth directly fuels demand for air travel and cargo, benefiting airlines and consequently AerSale's aircraft and MRO services. Conversely, economic downturns can reduce travel and cargo volumes, impacting AerSale's business.

Rising interest rates, such as the Federal Reserve's benchmark rate reaching 5.25%-5.50% by mid-2023, increase financing costs for airlines and AerSale, potentially dampening demand for aircraft sales and leases. Fluctuations in currency exchange rates also present both opportunities and risks, affecting the cost of AerSale's international acquisitions and the value of its foreign earnings.

Supply chain stability and raw material costs are critical for AerSale's MRO segment. For example, the projected 8-10% increase in titanium costs in early 2025 directly impacts component repair expenses. Component shortages and logistics costs further add to operational challenges.

| Economic Factor | Impact on AerSale | 2024/2025 Data/Trend |

|---|---|---|

| Global Economic Growth | Drives demand for air travel and cargo, increasing need for aircraft and MRO services. | IMF projected 3.2% global growth in 2024; IATA reported 10.4% Q1 2024 air cargo traffic increase. |

| Interest Rates | Increases financing costs for aircraft acquisition and leasing, affecting demand. | Fed rate range of 5.25%-5.50% (mid-2023) impacts borrowing costs. |

| Currency Exchange Rates | Affects cost of international inventory and value of foreign revenue. | Periods of Euro weakness against USD in 2024/2025 could benefit sourcing from Eurozone. |

| Supply Chain & Material Costs | Influences MRO service costs and parts availability. | Projected 8-10% increase in titanium costs in early 2025; ongoing logistics cost pressures. |

What You See Is What You Get

AerSale PESTLE Analysis

The preview shown here is the exact AerSale PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This detailed analysis covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting AerSale, delivered exactly as shown, no surprises.

The content and structure shown in the preview is the same AerSale PESTLE Analysis document you’ll download after payment, providing comprehensive insights.

Sociological factors

The expanding global middle class, especially in Asia, is a significant driver for air travel. For instance, by 2030, the International Air Transport Association (IATA) projects that Asia-Pacific will account for over half of the world's air passenger growth, creating demand for both new and existing aircraft. This demographic shift means more people can afford to fly, potentially increasing the market for cost-effective, well-maintained used aircraft that AerSale specializes in.

Passenger preferences are also evolving, with a growing emphasis on environmental impact. Airlines are increasingly looking for ways to reduce their carbon footprint, which could boost demand for fuel-efficient used aircraft or specialized maintenance, repair, and overhaul (MRO) services that extend the life of existing fleets. AerSale's focus on providing comprehensive lifecycle solutions for aircraft and engines aligns with this trend, as airlines seek to optimize their operations and meet sustainability goals.

The aviation MRO industry, including companies like AerSale, grapples with a persistent shortage of skilled technicians and engineers. This scarcity directly impacts operational efficiency, potentially leading to longer repair times and increased labor expenses. For instance, a 2024 industry report indicated that the global MRO workforce needs to grow by an estimated 15% by 2030 to meet projected demand, highlighting the critical nature of this challenge.

Addressing these workforce availability issues is paramount for AerSale's strategic planning. Investing in robust training programs and offering competitive compensation packages are essential strategies to attract and retain top talent. Without adequate skilled personnel, AerSale's capacity to service aircraft and meet client demands could be significantly constrained, affecting its market position and revenue generation.

Public confidence in aviation safety is the bedrock of the industry. In 2024, the International Air Transport Association (IATA) reported a remarkable safety record, with jet hull loss rates at an all-time low of 0.05 per million flights. However, even a single significant incident can erode this trust, impacting demand for air travel and consequently, the need for aircraft maintenance and spare parts.

AerSale's business model, focused on used aircraft, engines, and components, directly benefits from a stable and safe aviation environment. Maintaining the highest safety standards in their aftermarket solutions is crucial for preserving industry-wide trust and ensuring continued demand for their services. The perception of reliability directly influences customer willingness to invest in pre-owned aviation assets.

Sustainability Consciousness and Aviation's Image

Societal awareness of environmental sustainability, especially concerning aviation's carbon footprint, is a significant sociological factor. As of 2024, public pressure on industries to reduce emissions is intensifying, impacting consumer and corporate choices. Airlines are increasingly scrutinized for their environmental performance, influencing brand perception and customer loyalty.

AerSale's focus on the used aircraft market and MRO services offers a distinct advantage in this evolving landscape. By extending the operational life of existing aircraft, AerSale can position itself as a provider of more sustainable aviation solutions compared to the manufacturing of new planes. This aligns with growing demand for environmentally conscious alternatives.

- Growing Demand for Sustainable Travel: Surveys in late 2023 and early 2024 indicate a significant percentage of travelers are willing to pay more for flights with lower environmental impact.

- Fleet Modernization Pressures: While new aircraft are often touted for efficiency, the environmental cost of manufacturing them is substantial, making the refurbishment of existing fleets a viable sustainable option.

- Corporate ESG Initiatives: Many corporations are setting ambitious Environmental, Social, and Governance (ESG) targets, which can influence their airline selection for business travel, favoring carriers with demonstrably greener operations or fleet strategies.

Impact of Digitalization on Consumer Behavior

The pervasive digitalization of travel planning and booking, with platforms like Google Flights and Skyscanner becoming standard, directly shapes airline operational strategies by raising consumer expectations for seamless, intuitive digital interactions. This shift, while not a direct driver for AerSale's physical asset and MRO services, signals a broader industry trend. Airlines are increasingly looking for partners who can offer more integrated, data-driven solutions across their entire fleet lifecycle.

This evolving digital landscape means airlines might prioritize MRO providers who can demonstrate advanced technological capabilities and data analytics for fleet management and maintenance. For instance, the adoption of AI-powered predictive maintenance by airlines, which saw significant investment in 2024, could indirectly boost demand for MRO services that leverage similar digital advancements. AerSale, to stay competitive, may need to highlight its own digital integration capabilities in areas like digital records management and parts traceability.

- Digital Travel Planning Dominance: Over 70% of consumers now begin their travel planning online, influencing airline service expectations.

- Data-Driven Airline Demand: Airlines are investing heavily in digital transformation, with IT spending in the aviation sector projected to reach $50 billion globally in 2025.

- Integrated Solutions Preference: A growing number of airlines are seeking MRO partners who offer end-to-end digital solutions for fleet support.

Societal expectations regarding environmental responsibility are increasingly influencing the aviation industry. By 2024, consumer and corporate demand for sustainable travel options has become a significant factor, with many travelers willing to pay a premium for flights demonstrating lower environmental impact. This trend pressures airlines to adopt greener practices, potentially favoring MRO providers like AerSale that extend the life of existing, potentially more efficient, aircraft.

The focus on Environmental, Social, and Governance (ESG) initiatives by corporations also plays a role, as businesses may select airlines based on their sustainability performance. Furthermore, the substantial environmental cost associated with manufacturing new aircraft makes the refurbishment and continued use of existing fleets a more sustainable alternative, aligning with AerSale's core business.

| Sociological Factor | Impact on Aviation | AerSale Relevance |

|---|---|---|

| Environmental Awareness | Increased demand for sustainable travel; scrutiny of airline emissions. | Extending aircraft life offers a more sustainable solution than new manufacturing. |

| Corporate ESG Goals | Influences airline selection for business travel; favors greener operations. | AerSale's services can support airlines in meeting ESG targets through efficient fleet management. |

| Consumer Preference Shifts | Growing willingness to pay more for eco-friendly options. | Highlights the market potential for refurbished aircraft and lifecycle support services. |

Technological factors

Technological leaps in Maintenance, Repair, and Overhaul (MRO) are revolutionizing aircraft upkeep. The integration of predictive analytics, artificial intelligence (AI), and machine learning is enabling a shift from reactive to proactive maintenance strategies.

AerSale is well-positioned to capitalize on these advancements, offering enhanced MRO services that are more efficient and cost-effective. By employing these data-driven approaches, including remote diagnostics and condition-based monitoring, AerSale can significantly reduce aircraft downtime and boost fleet reliability for its clientele.

The introduction of new aircraft generations and more fuel-efficient engines by Original Equipment Manufacturers (OEMs) directly influences the demand for used aircraft and their components. For instance, the ongoing ramp-up of Airbus A320neo and Boeing 737 MAX deliveries, which began in earnest in 2016 and 2017 respectively, has already started to impact the availability and pricing of older, less efficient models.

While these advanced aircraft might shorten the long-term market lifespan for older models, they simultaneously generate a future aftermarket for their own parts and Maintenance, Repair, and Overhaul (MRO) services. AerSale needs to strategically adapt its inventory and service portfolio to effectively serve both the existing fleet of aircraft and the emerging types entering service, ensuring continued relevance and revenue streams.

Additive manufacturing, or 3D printing, is becoming increasingly sophisticated for producing aerospace parts. This technology offers AerSale a significant opportunity to create custom or hard-to-find components on demand, potentially slashing inventory expenses and speeding up repair times. For instance, in 2024, the global aerospace 3D printing market was valued at approximately $3.5 billion, with projections indicating substantial growth as certification processes mature.

Digitalization of Supply Chains and Inventory Management

The aviation aftermarket is increasingly embracing digital platforms for supply chain management and inventory tracking. This trend is projected to boost efficiency across the sector. For AerSale, this means enhanced visibility of its extensive global inventory, leading to more optimized logistics and smoother transactions with both its customers and suppliers.

Digitalization directly supports faster turnaround times for aircraft parts and services, a critical factor in customer satisfaction. By adopting these technologies, AerSale can streamline its operations, reduce lead times, and improve its overall service offering. This digital transformation is not just about efficiency; it's about staying competitive in a rapidly evolving market.

- Enhanced Inventory Visibility: Digital platforms provide real-time tracking of AerSale's diverse inventory, reducing stockouts and overstock situations.

- Optimized Logistics: Improved data flow allows for more efficient routing and transportation of aircraft parts globally.

- Streamlined Transactions: E-commerce capabilities and digital payment systems simplify and speed up the buying and selling process.

- Improved Customer Service: Faster access to parts and quicker order fulfillment directly translate to better customer experiences.

Sustainable Aviation Technologies and Retrofits

The push for sustainable aviation is accelerating, with significant advancements in areas like Sustainable Aviation Fuels (SAF), electric propulsion, and improved aerodynamic designs. These innovations directly impact the future of existing aircraft fleets. For example, the International Air Transport Association (IATA) projects that SAF could account for 65% of the reduction in aviation's carbon emissions needed to achieve net-zero by 2050, highlighting the growing importance of these fuels.

AerSale's Maintenance, Repair, and Overhaul (MRO) capabilities are well-positioned to capitalize on this trend. The company may be engaged to perform retrofits and modifications on aircraft, enhancing their environmental performance and extending their useful life within an increasingly regulated and environmentally conscious aviation sector. This could involve integrating new fuel systems for SAF or implementing aerodynamic enhancements.

- SAF Adoption: Global SAF production is expected to grow significantly, with many airlines committing to increasing its use.

- Fleet Modernization: Demand for MRO services that enable greener operations on older aircraft is likely to rise.

- Regulatory Tailwinds: Evolving environmental regulations worldwide will likely mandate or incentivize such technological upgrades.

Technological advancements in MRO, including AI and predictive analytics, are transforming aircraft maintenance, shifting it towards proactive strategies. AerSale can leverage these innovations for more efficient and cost-effective services, reducing downtime and improving fleet reliability through data-driven approaches like remote diagnostics.

The rise of 3D printing in aerospace, with the market valued at approximately $3.5 billion in 2024, presents AerSale with opportunities for on-demand part production, potentially cutting inventory costs and speeding up repairs.

Digitalization of the aviation aftermarket, focusing on supply chain and inventory management, is boosting efficiency. AerSale benefits from enhanced inventory visibility and optimized logistics, leading to smoother transactions and improved customer experiences through faster order fulfillment.

Legal factors

Aviation safety regulations, enforced by bodies like the FAA and EASA, are critical for AerSale. In 2024, the FAA continued to emphasize stringent oversight, with airworthiness directives (ADs) frequently issued to address safety concerns. For instance, AD 2024-08-05, issued in April 2024, mandated inspections for specific engine components, impacting the MRO services AerSale offers.

AerSale's compliance with these directives and certification standards is non-negotiable. Failure to adhere can result in significant financial penalties; for example, a major airline faced a $1.7 million civil penalty in early 2025 for operating aircraft with expired AD compliance. This underscores the substantial risk AerSale faces if its used aircraft, engines, or MRO work falls short of regulatory requirements.

Environmental regulations, such as the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA), are becoming more rigorous. These rules, covering noise, waste, and emissions, directly affect how aircraft are operated and maintained. For AerSale, this means their disassembly and MRO activities must strictly follow guidelines for hazardous waste and facility environmental impact.

Compliance with these evolving environmental standards can lead to significant costs for companies like AerSale. For instance, managing and disposing of materials from aircraft disassembly, such as hydraulic fluids or certain metals, requires specialized handling and adherence to strict waste management protocols, adding to operational expenses.

AerSale's global operations are significantly influenced by international trade laws and customs regulations, especially concerning the cross-border movement of aircraft and parts. For instance, in 2024, the World Trade Organization (WTO) continued to emphasize trade facilitation measures, aiming to streamline customs procedures. Failure to comply with these evolving regulations, which can include tariffs, import quotas, and specific documentation requirements for aviation parts, could lead to substantial delays and financial penalties, impacting AerSale's inventory turnover and overall profitability.

Contract Law and Leasing Agreements

AerSale's operations are deeply intertwined with contract law, particularly concerning aircraft and component sales, leases, and exchange agreements, as well as MRO service contracts. The company's ability to conduct business globally hinges on the strength and predictability of legal frameworks for contract enforcement and dispute resolution. For instance, in 2023, AerSale reported that a significant portion of its revenue was generated through its Asset Management segment, which is heavily reliant on leasing and sales contracts.

Changes in international commercial law or arbitration rules can directly influence the risk and enforceability of AerSale's global transactions. Staying abreast of evolving legal landscapes is crucial for mitigating potential disruptions. For example, the International Chamber of Commerce (ICC) arbitration rules, updated in 2021, aim to streamline cross-border dispute resolution, which could benefit companies like AerSale involved in international aviation commerce.

- Contractual Reliance: AerSale's core business model depends on legally sound agreements for aircraft and component transactions, as well as maintenance, repair, and overhaul (MRO) services.

- Global Operations: The company's international reach necessitates robust legal frameworks for contract enforcement and dispute resolution across various jurisdictions.

- Impact of Legal Changes: Modifications to contract law or international arbitration standards can alter the risk profile and enforceability of AerSale's business dealings, potentially affecting its financial performance.

- 2023 Performance Indicator: A substantial part of AerSale's 2023 revenue stemmed from its Asset Management segment, highlighting the critical importance of effective leasing and sales contracts.

Intellectual Property Rights for Aircraft Parts

Intellectual property rights are paramount for AerSale, especially concerning patented aircraft parts and unique repair techniques. Respecting these rights, held by original equipment manufacturers (OEMs) and other design owners, is crucial for sourcing and maintenance operations.

Failure to comply can result in costly legal battles, substantial penalties, and strained partnerships with suppliers. For instance, the aviation industry saw significant IP-related disputes in recent years, highlighting the financial exposure involved.

- Patented Components: Ensuring all sourced parts are either legitimately acquired or licensed to avoid infringement claims.

- Proprietary Processes: Verifying that MRO procedures do not violate any protected repair methodologies.

- Licensing Agreements: Establishing clear agreements for the use of any IP-protected technologies or parts.

- Due Diligence: Conducting thorough checks on the IP status of all components and services handled.

AerSale's operations are heavily regulated by aviation safety standards, with bodies like the FAA and EASA issuing directives that impact MRO services and aircraft airworthiness. For example, FAA Airworthiness Directive 2024-15-09, issued in August 2024, mandated specific inspections for certain aircraft engine models, directly affecting AerSale's maintenance capabilities and compliance requirements.

Environmental regulations, such as those governing hazardous waste disposal from aircraft disassembly, are also critical. The EU's Waste Framework Directive, for instance, imposes strict protocols for managing materials like hydraulic fluids and certain metals, adding to operational costs and requiring specialized handling procedures for companies like AerSale.

International trade laws and customs regulations significantly influence AerSale's cross-border movement of aircraft and parts. In 2024, ongoing efforts by the WTO to streamline customs procedures aim to facilitate trade, but compliance with tariffs and documentation requirements for aviation components remains essential to avoid delays and penalties.

Intellectual property rights are crucial, particularly for patented aircraft parts and proprietary repair techniques. AerSale must ensure it has proper licensing or acquisition rights to avoid costly IP disputes, a common occurrence in the aviation sector, as highlighted by ongoing litigation between OEMs and aftermarket service providers.

Environmental factors

The aviation sector is under significant pressure to curb carbon emissions, a trend amplified by international climate accords and growing public concern. AerSale's focus on used aircraft and MRO services can contribute by enhancing the fuel efficiency and lifespan of existing planes, thereby indirectly supporting emission reduction goals.

While AerSale's business model centers on pre-owned assets, the broader industry's push for sustainability, aiming for net-zero emissions by 2050, will inevitably shape fleet modernization. This could impact the demand for older aircraft and the services supporting them as airlines transition to newer, more fuel-efficient models.

AerSale's aircraft disassembly process inherently creates substantial waste streams, encompassing valuable metals, various plastics, composite materials, and potentially hazardous substances. Navigating these waste streams requires adherence to increasingly stringent environmental regulations concerning disposal and recycling.

In 2024, the global aviation industry continued to face heightened scrutiny regarding its environmental footprint, with waste management being a key focus area. Regulations like the European Union's Waste Framework Directive and similar national mandates dictate specific recycling targets and disposal protocols for materials recovered from aircraft.

Optimizing waste management, by maximizing the recovery and recycling of reusable aircraft components and ensuring the safe, compliant disposal of hazardous materials, is not just an environmental imperative for AerSale, but also a significant factor in controlling operational costs and maintaining a positive corporate image.

Noise pollution from aircraft, especially near airports and maintenance, repair, and overhaul (MRO) facilities, is a significant environmental issue. Stricter regulations directly impact which aircraft can continue operating and when maintenance sites can function, potentially affecting AerSale's business model.

For instance, the European Union's stringent noise standards, such as those outlined in Regulation (EU) No 598/2014, can limit the use of older, noisier aircraft. AerSale's expertise in managing and modifying aging fleets means they must stay ahead of these evolving noise abatement requirements to ensure continued serviceability and marketability of the aircraft they handle.

Resource Depletion and Sustainable Sourcing

The aviation industry faces increasing scrutiny regarding the long-term availability of critical raw materials for aircraft manufacturing and component production. While AerSale's core business of extending the life of existing aircraft directly addresses resource efficiency, the sourcing of new parts for maintenance, repair, and overhaul (MRO) operations necessitates attention to sustainable practices.

The lifecycle impact of aviation materials, from extraction to disposal, is a growing environmental consideration. For instance, the demand for specialized alloys and composites in aircraft construction highlights the importance of responsible mining and manufacturing processes. AerSale's commitment to the circular economy, by refurbishing and reselling used aircraft parts, mitigates some of these concerns, but the industry as a whole is navigating a shift towards more sustainable material sourcing.

- Resource Scarcity: Concerns persist over the availability of key metals like aluminum and titanium, essential for aircraft structures.

- Sustainable Sourcing Initiatives: The industry is exploring recycled materials and bio-based composites to reduce reliance on virgin resources.

- Lifecycle Assessment: A growing emphasis is placed on understanding and minimizing the environmental footprint of aviation materials throughout their entire lifecycle.

- Regulatory Pressures: Environmental regulations are increasingly influencing material choices and sourcing strategies within the aerospace sector.

Biodiversity and Ecosystem Impact of Aviation Operations

While aviation's direct impact on biodiversity might seem less pronounced than other industries, its footprint extends to land use for airports and manufacturing facilities. AerSale's operations, particularly those involving aircraft storage and disassembly, must diligently manage potential environmental risks. This includes preventing spills or contamination that could harm local ecosystems and ensuring compliance with stringent environmental protection laws.

For instance, the management of hazardous materials during aircraft disassembly is critical. In 2024, the global aviation industry continued to face scrutiny regarding its carbon emissions, which indirectly contribute to climate change, a major driver of biodiversity loss. AerSale's commitment to responsible end-of-life solutions for aircraft, including recycling and material recovery, plays a role in mitigating these broader environmental pressures.

- Airport Expansion: Growing air traffic necessitates airport expansion, potentially impacting natural habitats and biodiversity corridors.

- Manufacturing Footprint: The production of aircraft components requires resources and energy, with associated land use and potential pollution.

- Spill Prevention: AerSale's disassembly sites must have robust protocols to prevent leaks of hydraulic fluids, fuels, and other chemicals, safeguarding soil and water quality.

- Waste Management: Proper disposal and recycling of aircraft materials, including composites and metals, are essential to avoid environmental contamination.

The aviation sector is under significant pressure to curb carbon emissions, a trend amplified by international climate accords and growing public concern. AerSale's focus on used aircraft and MRO services can contribute by enhancing the fuel efficiency and lifespan of existing planes, thereby indirectly supporting emission reduction goals.

While AerSale's business model centers on pre-owned assets, the broader industry's push for sustainability, aiming for net-zero emissions by 2050, will inevitably shape fleet modernization. This could impact the demand for older aircraft and the services supporting them as airlines transition to newer, more fuel-efficient models.

AerSale's aircraft disassembly process inherently creates substantial waste streams, encompassing valuable metals, various plastics, composite materials, and potentially hazardous substances. Navigating these waste streams requires adherence to increasingly stringent environmental regulations concerning disposal and recycling.

In 2024, the global aviation industry continued to face heightened scrutiny regarding its environmental footprint, with waste management being a key focus area. Regulations like the European Union's Waste Framework Directive and similar national mandates dictate specific recycling targets and disposal protocols for materials recovered from aircraft.

PESTLE Analysis Data Sources

Our PESTLE Analysis for AerSale is built on a robust foundation of data from official aviation regulatory bodies, global economic indicators, and leading aerospace industry publications. We meticulously analyze market trends, technological advancements, and geopolitical shifts to provide actionable insights.