AerSale Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AerSale Bundle

Unlock the strategic potential of AerSale's product portfolio with our comprehensive BCG Matrix analysis. Understand which offerings are driving growth, which are stable cash generators, and which require careful consideration. This preview offers a glimpse into the powerful insights available.

Ready to transform your strategic planning? Purchase the full AerSale BCG Matrix report for detailed quadrant placements, actionable recommendations, and a clear roadmap to optimize your investments and product development. Don't miss out on the competitive edge.

Stars

AerSale's strategic expansion of its Maintenance, Repair, and Overhaul (MRO) services, notably with its new Millington, Tennessee facility operational in 2024, solidifies its leadership in a burgeoning market. The company anticipates continued growth in MRO revenues beyond 2024, fueled by robust demand for aircraft parts and associated services.

This significant expansion allows AerSale to more effectively address the increasing need for narrow-body aircraft maintenance, modifications, and heavy MRO tasks, thereby complementing its already strong MRO operations and positioning it for future success.

AerSale's Used Serviceable Material (USM) sales are showing impressive growth, highlighting its strength in a key part of the aviation aftermarket. This segment is experiencing a significant upswing, and AerSale is capitalizing on it.

Looking at the numbers, excluding volatile whole asset sales, AerSale's Asset Management revenue surged by 91.7% in the fourth quarter of 2024 compared to the same period in the previous year. This robust performance was primarily fueled by an increase in USM volume.

This positive momentum carried into the first quarter of 2025. USM sales continued to be a major driver, contributing to an 81.7% rise in Asset Management revenue when whole asset transactions are excluded.

AerSale's engineered solutions, specifically AerSafe™ and the emerging AerAware™, are positioned as stars within its business portfolio. These proprietary offerings are designed to boost aircraft performance and improve operating economics, directly addressing a significant demand in the aviation aftermarket for more cost-efficient solutions. The company's strategic push to promote AerAware™, coupled with a positive outlook for AerSafe™, underscores a commitment to capturing a larger share of this innovative market segment.

Expanding Lease Pool of High-Demand Assets

AerSale significantly bolstered its lease pool in 2024, a key move for its growth strategy. By the close of the year, the company had successfully placed 17 engines and one Boeing 757 freighter aircraft on lease agreements. This expansion directly fuels a recurring revenue stream, capitalizing on AerSale's established market share within the robust demand for essential aircraft components and engines.

The strategy of expanding the lease pool is designed to drive substantial revenue growth. As AerSale continues to add high-demand assets, this segment is poised for further expansion. The leasing market for critical aircraft parts remains strong, and AerSale is well-positioned to capture a larger share. This focus ensures consistent income, especially given the sustained demand for specific engine types.

- 2024 Lease Pool Growth: 17 engines and one 757 freighter aircraft on lease by year-end.

- Revenue Driver: Leasing provides a recurring revenue stream, enhancing financial stability.

- Market Position: High market share in a growing leasing market for crucial aircraft components.

- Strategic Focus: Capitalizes on strong demand for specific engine types.

Strategic Feedstock Acquisitions

AerSale's strategic focus on feedstock acquisitions underscores its commitment to maintaining a competitive edge. The company allocated $61.7 million to feedstock purchases in 2024, followed by an additional $43.4 million in the first quarter of 2025. This substantial investment reflects a proactive strategy to secure valuable aircraft assets amidst a challenging market environment.

This aggressive acquisition strategy has resulted in a robust inventory position, reaching $449.0 million as of March 31, 2025. Such a substantial asset base is crucial for meeting the escalating demand for aircraft parts and components, positioning AerSale to capitalize on anticipated market expansion.

AerSale's dedication to strategic feedstock acquisitions is a key differentiator, solidifying its market leadership in acquiring assets for future revenue generation.

- Significant 2024 Investment: $61.7 million dedicated to feedstock acquisitions.

- Early 2025 Commitment: $43.4 million invested in Q1 2025 for asset procurement.

- Robust Inventory Value: $449.0 million in assets as of March 31, 2025.

- Market Leadership: Proactive acquisition strategy secures high-demand assets.

AerSale's engineered solutions, AerSafe™ and AerAware™, are positioned as stars in its portfolio due to their innovative nature and strong market demand. These proprietary products enhance aircraft performance and operating economics, directly addressing the aviation aftermarket's need for cost-effective solutions.

The company's strategic promotion of AerAware™ and the positive outlook for AerSafe™ indicate a clear intention to capture significant market share in this high-growth segment. These offerings represent AerSale's commitment to developing value-added solutions that drive future revenue and profitability.

AerSale's engineered solutions are high-growth, high-market share products. Their proprietary nature and focus on improving aircraft efficiency position them as key revenue drivers for the company. The continuous development and promotion of these offerings underscore their star status within AerSale's business model.

What is included in the product

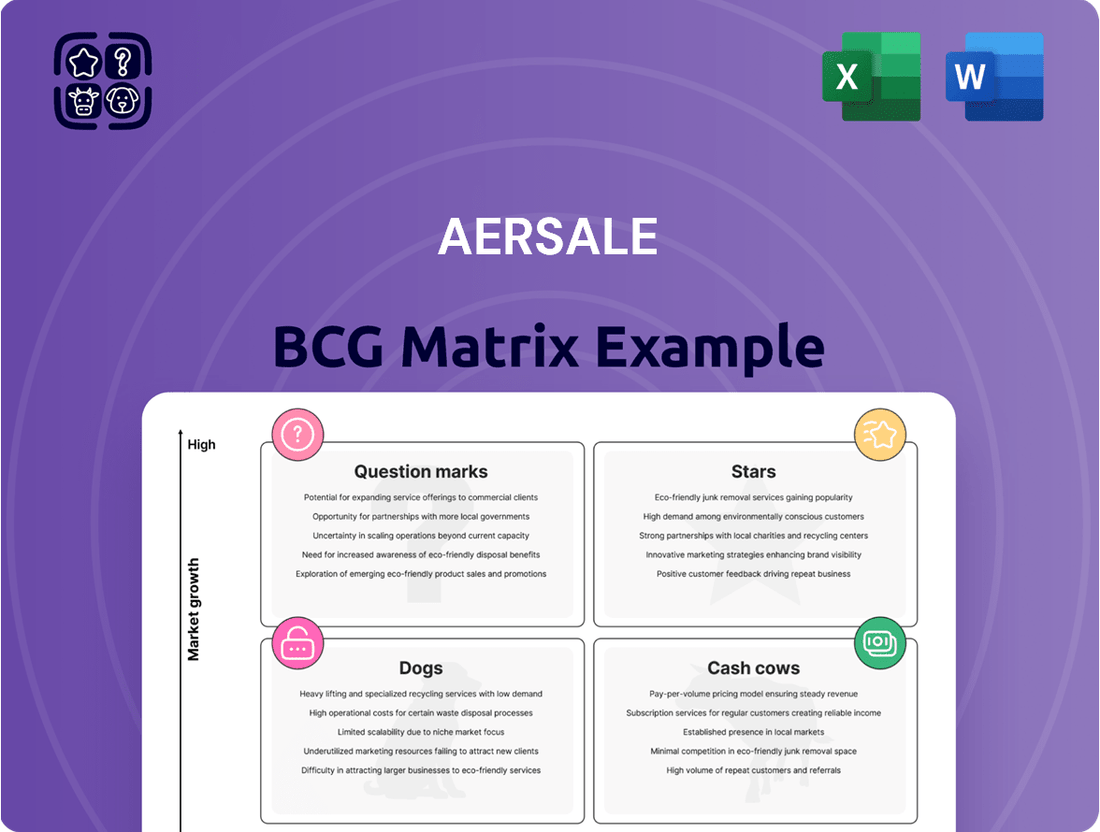

The AerSale BCG Matrix categorizes its business units into Stars, Cash Cows, Question Marks, and Dogs to guide strategic decisions.

It provides insights on which units to invest in, hold, or divest based on market growth and share.

The AerSale BCG Matrix provides a clear, one-page overview of each business unit's market position, alleviating the pain of complex strategic analysis.

Cash Cows

AerSale's Established Asset Management Solutions, including the sale and leasing of used aircraft and engines, along with asset disassembly for component parts, hold a significant market share within a mature industry segment. This division formed the bedrock of AerSale's financial performance in 2023, contributing the largest portion of its revenue and offering a stable revenue stream.

The company's expertise in market dynamics and technical intricacies allows it to optimize the value derived from flight equipment. In 2023, AerSale reported Asset Management Solutions revenue of $347.7 million, showcasing its dominance in this established market.

Beyond the unpredictable nature of selling entire aircraft, AerSale enjoys a steady and profitable income from selling individual used serviceable components. This reliable revenue stream is fueled by a robust market, where AerSale excels due to the increasing age of the global aircraft fleet and the persistent demand for dependable spare parts. The company's efficiency in turning these components into cash is a major contributor to its overall profitability.

While new aircraft and engine lease additions are considered Stars for AerSale, the company's established leasing portfolio acts as a reliable Cash Cow. These existing, long-term lease agreements generate a steady and predictable stream of income, demanding less intensive marketing efforts compared to newer, high-growth ventures.

This stable revenue base is a significant contributor to AerSale's financial health. Demonstrating this strength, leasing revenues experienced substantial growth, more than doubling to $7.9 million in the fourth quarter of 2024 when compared to the same period in the previous year.

Mature MRO Services for Common Aircraft Types

AerSale's mature Maintenance, Repair, and Overhaul (MRO) services for common aircraft types are a cornerstone of its business, functioning as a classic Cash Cow. These services are focused on aircraft models that have been in operation for a significant period and are widely used. This focus ensures a consistent and predictable demand for maintenance, repair, and parts.

The company's established expertise and efficient operations in servicing these mature fleets contribute to high profit margins. AerSale's MRO revenues reached $108 million in the full year 2024, underscoring the stability and profitability of this segment. This strong performance is a testament to their competitive advantage in a well-understood market.

- Stable Revenue Stream: AerSale's MRO services for common, long-serving aircraft provide a reliable source of income.

- High Profit Margins: Achieved through competitive advantage and operational efficiency in servicing mature fleets.

- Consistent Demand: Driven by the ongoing maintenance needs of a large, established aircraft population.

- 2024 Performance: MRO revenues totaled $108 million for the full year 2024.

Aircraft Storage and Disassembly Operations

Aircraft storage and disassembly are core to AerSale's operations, acting as a stable foundation for revenue. These services are crucial for handling aging aircraft and salvaging valuable parts, creating dependable income with steady, albeit not explosive, growth and strong profitability.

In 2024, AerSale continued to leverage its expertise in managing aircraft fleets transitioning out of service. The company's ability to provide secure, long-term storage solutions for aircraft, coupled with its environmentally compliant disassembly processes, ensures a consistent demand for its services. This segment is characterized by its operational efficiency and its role in the circular economy of aviation, where valuable used serviceable material (USM) is recovered and resold.

- Predictable Revenue: The ongoing need for aircraft storage and disassembly provides a reliable revenue stream, as airlines and leasing companies consistently cycle through their fleets.

- High Efficiency: AerSale's established infrastructure and expertise in disassembly allow for cost-effective operations, leading to high profit margins in this segment.

- USM Value Capture: The recovery and resale of used serviceable material from disassembled aircraft contribute significantly to the profitability of this business unit.

- Market Position: AerSale holds a strong position in the aircraft MRO (Maintenance, Repair, and Overhaul) market, particularly in the aftermarket services sector, which includes storage and disassembly.

AerSale's Asset Management Solutions, encompassing the sale and leasing of used aircraft and engines, along with component disassembly, represent its primary Cash Cow. This segment benefits from a mature market and consistent demand, driving stable revenue. In 2023, this division generated $347.7 million in revenue, highlighting its significant contribution to AerSale's financial stability.

The company's MRO services for common aircraft types also function as a Cash Cow, offering high profit margins due to operational efficiency and consistent demand from a large installed base of aircraft. For the full year 2024, AerSale's MRO revenues reached $108 million, demonstrating the segment's profitability and reliability.

Furthermore, AerSale's established leasing portfolio provides a predictable income stream from long-term agreements, requiring less intensive marketing. Leasing revenues saw substantial growth, more than doubling to $7.9 million in the fourth quarter of 2024 compared to the prior year's period.

Aircraft storage and disassembly services are another core Cash Cow, offering dependable income through efficient operations and the recovery of valuable used serviceable material. This segment is vital for managing aging aircraft fleets and contributes to AerSale's strong profitability.

| Segment | BCG Category | 2023 Revenue | 2024 MRO Revenue | Q4 2024 Leasing Revenue Growth |

| Asset Management Solutions | Cash Cow | $347.7 million | N/A | N/A |

| MRO Services | Cash Cow | N/A | $108 million | N/A |

| Existing Lease Portfolio | Cash Cow | N/A | N/A | More than doubled to $7.9 million |

| Aircraft Storage & Disassembly | Cash Cow | N/A | N/A | N/A |

Preview = Final Product

AerSale BCG Matrix

The AerSale BCG Matrix preview you see is the identical, final document you will receive upon purchase. This means no watermarks, no demo content, and no alterations—just the complete, professionally formatted strategic analysis ready for immediate application.

What you are previewing is the exact AerSale BCG Matrix report that will be delivered to you after completing your purchase. This comprehensive document is meticulously prepared and requires no further editing, ensuring you receive a polished, actionable tool for your business strategy.

Rest assured, the AerSale BCG Matrix document you are currently viewing is precisely what you will download once your purchase is confirmed. It's a fully realized, analysis-ready report designed for clarity and strategic decision-making, ready for your immediate use.

Dogs

Despite the overall growth in the Maintenance, Repair, and Overhaul (MRO) sector, certain AerSale facilities have faced headwinds. For instance, the Goodyear, Arizona location has seen reduced demand for its on-airport MRO services.

This underperformance suggests these specific facilities might hold a smaller market share and exhibit slower growth potential within AerSale's broader MRO operations. Such sites may necessitate strategic reviews to enhance their operational efficiency and financial contribution.

For example, in 2024, AerSale's MRO segment faced challenges in specific geographic areas, impacting overall facility utilization rates. While the company reported strong performance in other MRO hubs, the Goodyear facility's demand lagged, contributing to its classification as a potential 'Dog' in the BCG matrix.

AerSale identifies "Highly Volatile Whole Asset Sales" as a component with significant quarter-to-quarter revenue fluctuations. This unpredictability can directly affect the company's overall financial results.

For example, the decline in Q1 2025 revenue was largely attributed to a decrease in whole asset sales compared to the same period in the previous year. While these transactions can offer attractive profit margins, their inherent variability poses a challenge to consistent financial performance.

Inventory consisting of components for very old, uncommon, or retired aircraft models, often experiencing minimal demand, can be categorized as a 'Dog' in the AerSale BCG Matrix. These parts represent a significant drain on capital and incur ongoing storage expenses without contributing meaningfully to revenue or profit. For instance, as of early 2024, the aviation aftermarket continues to see a gradual phase-out of older wide-body aircraft like the Boeing 747-400, meaning spare parts for these models are increasingly moving towards 'Dog' status if not actively managed.

High-Cost, Low-Margin Service Lines

Within AerSale's portfolio, certain service lines are characterized by high operational expenses and slim profit margins. These are often areas where competition is fierce, or the service itself lacks unique selling points, leading to price pressures. For instance, in 2024, the company's aircraft maintenance, repair, and overhaul (MRO) services, particularly for older, less complex aircraft, often fall into this category. While essential for fleet operations, these services can consume significant resources without generating substantial returns.

These high-cost, low-margin segments can strain a company's financial health by diverting capital and management attention away from more lucrative opportunities. In 2024, AerSale's efforts to optimize these operations focused on improving efficiency and exploring ways to add value through bundled services or specialized expertise. The challenge lies in balancing the necessity of offering a comprehensive service suite with the imperative to ensure profitability across all business units.

- Aircraft Maintenance, Repair, and Overhaul (MRO) for older aircraft

- Intense competition in standard airframe checks

- Low differentiation in basic component repairs

- High labor and parts costs impacting margins

Inefficient Legacy Processes

Inefficient legacy processes at AerSale, which haven't been fully addressed by recent cost-saving initiatives, can be seen as a drain on internal resources. These older methods might be hindering overall efficiency and profitability, marking them for optimization or removal.

For instance, if AerSale's legacy inventory management system, which still relies on manual data entry for certain aircraft parts, experienced a 5% increase in processing time compared to its digital counterparts in 2024, this would represent an inefficient legacy process.

- Resource Consumption: Older, unoptimized processes consume more time and labor per unit of output.

- Profitability Impact: Inefficiencies directly reduce profit margins by increasing operating costs.

- Areas for Improvement: These processes are prime candidates for automation, standardization, or complete redesign.

AerSale's "Dogs" often encompass service lines with low market share and slow growth, such as MRO for older aircraft models where competition is intense. These segments, like standard airframe checks or basic component repairs, typically involve high operational costs and slim profit margins. For example, in 2024, the demand for MRO services on specific legacy aircraft types saw a decline, impacting facility utilization rates and contributing to these areas being classified as Dogs.

Inventory of parts for very old or retired aircraft also falls into this category. These components, experiencing minimal demand, tie up capital and incur storage costs without generating significant revenue. As of early 2024, the ongoing phase-out of aircraft like the Boeing 747-400 means spare parts for such models are increasingly becoming Dogs if not actively managed or repurposed.

Inefficient legacy processes, such as manual data entry in inventory management, also represent "Dogs" by draining resources and hindering overall efficiency. If these processes, like a legacy inventory system experiencing a 5% increase in processing time in 2024 compared to digital methods, are not optimized, they directly reduce profit margins.

| Category | Characteristics | Example (AerSale) | 2024 Impact |

| MRO for Older Aircraft | Low market share, slow growth, high costs, low margins | Standard airframe checks, basic component repairs | Reduced facility utilization in specific locations (e.g., Goodyear, AZ) |

| Legacy Inventory | Minimal demand, capital tie-up, storage costs | Parts for retired aircraft (e.g., Boeing 747-400 components) | Increased carrying costs, potential write-offs if not managed |

| Inefficient Processes | Resource drain, reduced efficiency, lower profitability | Manual data entry in inventory management | Increased processing time, higher operational expenses |

Question Marks

AerSale's new heavy Maintenance, Repair, and Overhaul (MRO) facility in Millington, Tennessee, became operational in 2024 and is currently in its ramp-up phase. This strategic expansion aims to capitalize on a growing market for MRO services.

During this initial ramp-up, the facility is expected to be a significant capital consumer, a common characteristic of new ventures. Its market share will naturally be lower as it establishes its operations, builds a client base, and refines its efficiency. For instance, similar facility startups often see initial operating losses before reaching profitability.

The full financial impact of this new MRO facility is projected to materialize in the latter half of 2025. This timeline reflects the typical period required for new aviation infrastructure to achieve optimal operational capacity and market penetration.

The AerAware™ Enhanced Flight Vision System represents a significant innovation for AerSale, positioning it as a potential star in the BCG matrix. Its technologically advanced nature caters to a market increasingly focused on safety and efficiency, a trend that accelerated in 2024 with ongoing advancements in aviation technology and regulatory pushes for enhanced situational awareness.

However, as a relatively new offering, AerAware™ likely requires substantial investment to achieve widespread market penetration. This includes costs associated with obtaining necessary certifications, marketing efforts to educate potential customers, and the integration process for airlines, mirroring the typical challenges faced by new entrants in a competitive aerospace landscape.

AerSale's Passenger-to-Freighter (P2F) conversion program for the Boeing 757 shows strong potential, with significant end-market interest and customer commitments already secured. This positions the program as a potential star within AerSale's portfolio, given the growing demand for dedicated cargo aircraft. For instance, the global air cargo market saw a substantial rebound in 2024, with demand for freighter capacity expected to continue its upward trajectory through 2025.

Despite the promising outlook, the 757 P2F conversion is a newer venture for AerSale. This means it currently commands a smaller market share compared to more established conversion programs. Significant capital investment is still required to ramp up operations and fully capitalize on the market opportunity, placing it in a position that demands strategic development to achieve its full growth potential.

Expansion into New Geographies/Market Niches

AerSale's expansion into new geographies or specialized market niches within the aviation aftermarket would be classified as question marks in the BCG matrix. These ventures offer high growth potential, but also demand significant upfront investment and dedicated efforts to establish market presence and capture share. For instance, entering emerging markets in Southeast Asia or focusing on the growing niche of electric Vertical Take-Off and Landing (eVTOL) aircraft support would fit this category.

- High Growth Potential: Emerging aviation markets and new technology niches present substantial long-term growth opportunities.

- Substantial Initial Investment: Significant capital is required for market research, regulatory compliance, infrastructure development, and building brand awareness.

- Market Penetration Challenges: Establishing a foothold against incumbent players and understanding local market dynamics are critical hurdles.

- Strategic Importance: Successful penetration can lead to future market leadership and diversification of revenue streams.

Investments in Advanced Manufacturing Technologies

Investments in advanced manufacturing technologies, such as additive manufacturing for aircraft parts, position AerSale's offerings in this category as Question Marks. These innovative processes promise substantial growth by shortening production cycles and allowing for tailored components. For instance, the global 3D printing market in aerospace was valued at approximately $2.5 billion in 2023 and is projected to reach over $6 billion by 2030, indicating significant potential.

However, the initial outlay for adopting and integrating these cutting-edge technologies is considerable. AerSale must strategically position itself to effectively capitalize on the market share available in this evolving sector. The benefits include potential cost savings and enhanced operational efficiency, but the path to widespread adoption and profitability requires careful planning and execution.

- High Growth Potential: Advanced manufacturing offers the prospect of significant market expansion.

- Capital Intensive: Initial investment in 3D printing and similar technologies requires substantial funding.

- Strategic Positioning: Success hinges on AerSale's ability to carve out market share in this developing area.

- Reduced Lead Times & Customization: Key advantages include faster part production and bespoke solutions.

AerSale's exploration into new geographic markets or specialized aviation niches, like eVTOL support, represents classic Question Marks. These ventures are characterized by high growth potential but require substantial investment to gain traction and market share. For example, entering the burgeoning Southeast Asian aviation aftermarket demands significant upfront capital for infrastructure and market development.

These new ventures, while promising, currently hold low market share due to their nascent stage. They necessitate considerable financial resources for market research, regulatory navigation, and building brand recognition, mirroring the typical investment profile of Question Marks.

The strategic importance of successfully penetrating these new areas cannot be overstated. It offers AerSale a pathway to future market leadership and crucial revenue stream diversification, especially as the global aviation landscape continues to evolve rapidly.

AerSale's investments in advanced manufacturing technologies, such as additive manufacturing for aircraft parts, also fall into the Question Mark category. These innovative processes offer significant growth potential by reducing production times and enabling customized components, a trend strongly supported by the aerospace 3D printing market, which was valued at approximately $2.5 billion in 2023.

However, the adoption of these cutting-edge technologies requires a substantial initial investment. AerSale must strategically position itself to capture market share in this evolving sector, balancing the potential for cost savings and enhanced efficiency against the considerable outlay needed for widespread adoption and profitability.

| Initiative | Market Growth Potential | Current Market Share | Investment Required | Strategic Focus |

|---|---|---|---|---|

| New Geographic Markets (e.g., Southeast Asia) | High | Low | High | Market Penetration, Infrastructure Development |

| Specialized Niches (e.g., eVTOL Support) | High | Low | High | Technology Integration, Regulatory Compliance |

| Advanced Manufacturing (e.g., Additive Manufacturing) | High | Low | High | Process Optimization, Part Customization |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including AerSale's financial reports, industry growth projections, and competitor performance analysis, to accurately position each business segment.