AerSale Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AerSale Bundle

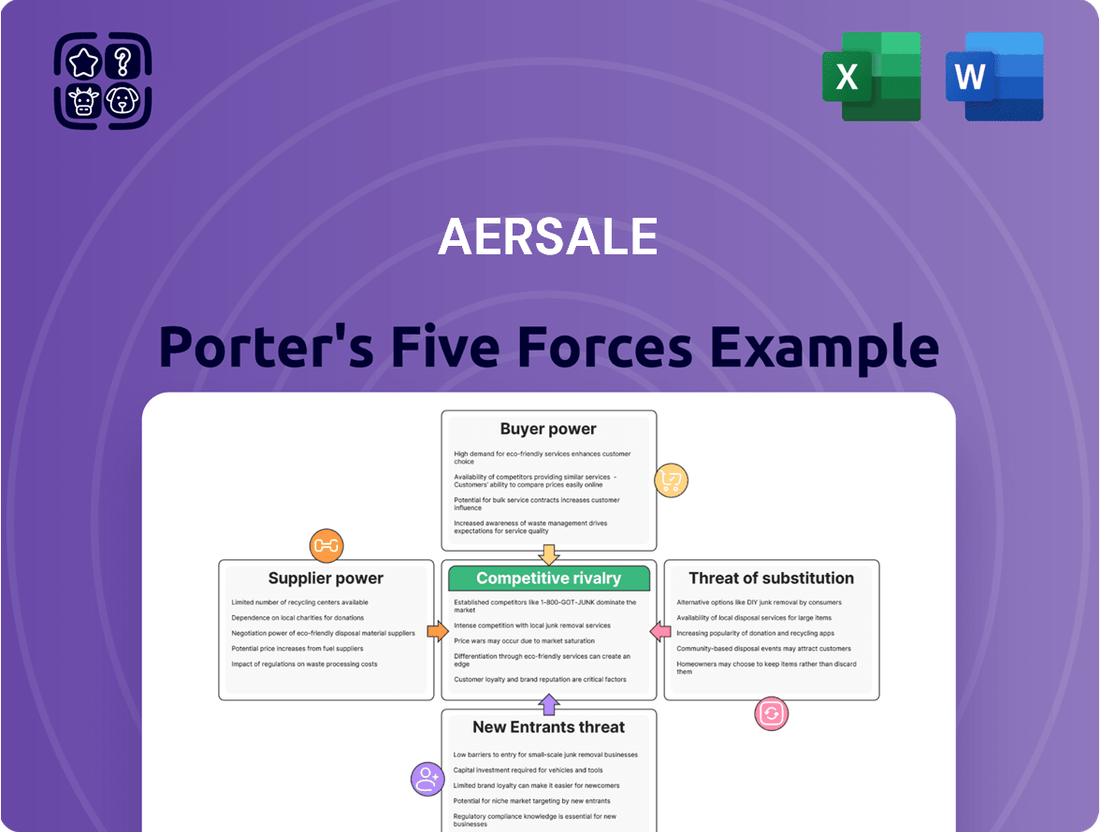

AerSale faces intense competition from established players and emerging threats, with supplier power significantly impacting their operational costs.

The threat of new entrants and the availability of substitutes are critical factors shaping AerSale's strategic landscape.

This brief overview only scratches the surface of AerSale's competitive dynamics. Unlock the full Porter's Five Forces Analysis to explore AerSale’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The market for used aircraft, engines, and components, often referred to as feedstock, is currently experiencing tightness. This scarcity stems from production challenges faced by original equipment manufacturers (OEMs), directly impacting the availability of these critical assets.

This limited supply significantly amplifies the bargaining power of suppliers who provide these essential materials to AerSale. For instance, in 2023, the global commercial aircraft MRO market, which relies heavily on feedstock, was valued at approximately $90 billion and is projected to grow, further highlighting the demand for these components.

AerSale's success in its Used Serviceable Material (USM) sales and leasing operations is fundamentally dependent on its capacity to secure this feedstock. The current tight market conditions therefore pose a direct challenge to AerSale's ability to maintain its inventory and fulfill customer orders efficiently.

Suppliers of highly specialized or proprietary aircraft parts and engines wield considerable bargaining power over AerSale. This is because AerSale may face limited alternative sources for these critical components, making it difficult to switch suppliers without incurring significant costs or operational disruptions.

AerSale's reliance on a select few suppliers for specific, high-demand items can directly translate into increased procurement costs. For instance, in 2024, the aerospace industry continued to experience supply chain constraints for certain advanced materials and engine components, driving up prices for manufacturers and MRO providers.

Original Equipment Manufacturers (OEMs) hold considerable sway over the availability of new, certified aircraft parts. This control, even for a company like AerSale that deals in used serviceable material, indirectly impacts the pricing and demand for aftermarket alternatives, thereby granting OEMs a degree of bargaining power.

Regulatory Compliance Costs

Suppliers of maintenance, repair, and overhaul (MRO) services or specialized aviation components face significant regulatory hurdles. For instance, obtaining and maintaining certifications from bodies like the Federal Aviation Administration (FAA) or the European Union Aviation Safety Agency (EASA) involves substantial investment in quality control, documentation, and personnel training. These compliance costs can be a barrier to entry, concentrating the market among fewer, highly qualified suppliers.

The financial burden of adhering to these rigorous aviation standards, which can include extensive audits and recertification processes, directly impacts the operational costs for MRO providers and component manufacturers. In 2024, the average cost for an MRO facility to maintain FAA Part 145 certification, for example, can range from tens of thousands to hundreds of thousands of dollars annually, depending on the scope of operations. This financial commitment naturally limits the pool of potential suppliers, giving those who can meet and sustain these requirements greater leverage in pricing and contract negotiations.

- High Compliance Investment: Suppliers must invest heavily in meeting stringent aviation safety regulations (e.g., FAA, EASA).

- Limited Supplier Pool: The cost and complexity of regulatory adherence restrict the number of qualified MRO and component providers.

- Increased Supplier Leverage: Fewer qualified suppliers translate to greater bargaining power over pricing and terms for AerSale.

Labor Shortages

Labor shortages are a significant factor impacting the aviation aftermarket, and AerSale is not immune. Skilled Maintenance, Repair, and Overhaul (MRO) technicians are in high demand across the industry. This scarcity can directly increase the cost of labor for AerSale's own MRO operations.

Furthermore, these widespread labor challenges can also affect AerSale's suppliers. When suppliers face their own staffing issues, it can lead to higher prices for outsourced services and the parts AerSale relies on. For instance, a report from Aviation Week in late 2023 highlighted that the global shortage of aviation mechanics could reach over 20,000 by 2025, a figure that directly translates to increased operational costs across the board.

- Increased Labor Costs: Shortages of skilled MRO technicians drive up wages and benefits for AerSale's direct workforce.

- Supplier Price Hikes: Suppliers facing their own labor crunches pass on increased costs for outsourced services and components.

- Potential for Service Delays: A lack of available skilled labor can also lead to longer turnaround times for MRO services, impacting AerSale's operational efficiency.

The bargaining power of suppliers for AerSale is elevated due to the current scarcity of used aircraft, engines, and components, often called feedstock. This tightness is exacerbated by production challenges faced by Original Equipment Manufacturers (OEMs), directly impacting the availability of these critical assets. For example, the global commercial aircraft MRO market, a key consumer of feedstock, was valued at roughly $90 billion in 2023 and is expected to grow, intensifying demand.

Suppliers of highly specialized or proprietary parts and engines hold significant leverage because AerSale may have few alternative sources, making supplier switching costly and disruptive. This reliance on a limited number of suppliers for specific, high-demand items can directly lead to increased procurement costs. In 2024, the aerospace sector continued to grapple with supply chain constraints for advanced materials and engine components, pushing prices upward for both manufacturers and MRO providers.

The stringent regulatory environment in aviation, requiring substantial investment in quality control and certifications from bodies like the FAA and EASA, limits the number of qualified suppliers. The annual cost for an MRO facility to maintain FAA Part 145 certification, for instance, can range from tens of thousands to hundreds of thousands of dollars in 2024, concentrating market power among fewer, highly compliant providers.

Labor shortages for skilled MRO technicians also amplify supplier bargaining power. This scarcity increases labor costs for suppliers, who then pass these higher expenses onto AerSale for outsourced services and components. Reports in late 2023 indicated a global shortage of aviation mechanics projected to exceed 20,000 by 2025, directly contributing to increased operational costs across the industry.

| Factor | Impact on AerSale | Supporting Data/Trend (2023-2024) |

|---|---|---|

| Feedstock Scarcity | Increased procurement costs and potential supply disruptions. | Global commercial aircraft MRO market valued at ~$90 billion (2023), with growing demand. |

| Supplier Specialization/Proprietary Parts | Limited alternatives, forcing reliance on specific suppliers and higher prices. | Continued supply chain constraints for advanced materials and engine components in 2024. |

| Regulatory Compliance Costs | Concentrates market among fewer, highly qualified suppliers, increasing their leverage. | Annual FAA Part 145 certification costs can range from $10k-$100k+ for MRO facilities (2024). |

| Skilled Labor Shortages | Suppliers pass on increased labor costs, raising prices for AerSale. | Projected shortage of over 20,000 aviation mechanics globally by 2025 (late 2023 report). |

What is included in the product

Analyzes the competitive intensity within the aviation aftermarket for AerSale by examining buyer and supplier power, new entrant threats, and the availability of substitutes.

Instantly identify competitive pressures and strategic vulnerabilities with a visually intuitive Porter's Five Forces analysis, streamlining complex market assessments.

Customers Bargaining Power

AerSale's core customers, airlines and leasing companies, are intensely focused on cost efficiency. This is particularly true in 2024, with ongoing global economic uncertainties impacting airline profitability. These buyers are actively looking for ways to lower their operating expenses.

Consequently, these customers are drawn to aftermarket solutions like used serviceable material (USM) and maintenance, repair, and overhaul (MRO) services offered by companies like AerSale. By extending the operational life of aircraft and their components, airlines can significantly reduce their capital expenditure and overall operational costs. This strong drive for cost savings naturally enhances their bargaining power when negotiating prices for these services and parts.

The bargaining power of customers is significantly influenced by the availability of aftermarket alternatives. For AerSale, this means customers can readily explore other Maintenance, Repair, and Overhaul (MRO) providers, independent parts suppliers, and aircraft leasing companies. This competitive landscape empowers customers to shop around, comparing pricing, service quality, and turnaround times. In 2024, the global MRO market was valued at approximately $90 billion, with a substantial portion driven by aftermarket services, highlighting the breadth of options available to customers.

Large airlines and major leasing companies, by their very nature, command substantial purchasing volumes for AerSale's aircraft, parts, and services. For instance, in 2024, major carriers like United Airlines and American Airlines continued to manage fleets well over 1,000 aircraft each, representing consistent demand for MRO (Maintenance, Repair, and Overhaul) services and parts. This sheer scale of their buying power allows them to negotiate aggressively for better pricing and tailored service agreements, directly impacting AerSale's margins.

Low Switching Costs for Standard Services

For standardized MRO services or common aircraft parts, customers often face low switching costs. This means they can readily move to another provider if AerSale's pricing or service quality doesn't meet their expectations. This dynamic directly impacts AerSale's ability to command premium pricing.

The ease with which customers can change providers for routine maintenance or widely available components puts pressure on AerSale. In 2024, the aftermarket aviation services sector continued to see intense competition, with many providers offering similar capabilities for standard repairs and parts. This environment reinforces the bargaining power of customers.

- Low Switching Costs: Customers can easily shift to competitors for standard MRO services and common parts.

- Price Sensitivity: This ease of switching makes customers more sensitive to AerSale's pricing compared to competitors.

- Competitive Pressure: The availability of alternative providers for common services intensifies competition, benefiting customers.

Integrated Solutions Demand

The aviation industry's intricate nature means customers often prefer integrated solutions rather than managing multiple vendors. This preference for one-stop shops, even with a focus on cost savings, can enhance AerSale's bargaining power. For instance, in 2024, the trend towards outsourcing complex maintenance, repair, and overhaul (MRO) services continued, with airlines seeking partners who can handle a wider scope of needs.

AerSale's ability to offer a comprehensive suite of services, encompassing MRO, parts supply, and aircraft leasing, directly addresses this demand for integrated solutions. By consolidating these services, AerSale can reduce the operational complexity for its customers. This integrated approach can diminish a customer's incentive to switch providers, especially if AerSale consistently delivers value and efficiency across its offerings.

- Demand for integrated aviation solutions is driven by operational complexity.

- AerSale’s comprehensive offerings (MRO, parts, leasing) cater to this demand.

- Consolidated services reduce customer complexity and switching incentives.

AerSale's customers, primarily airlines and leasing companies, possess significant bargaining power due to their intense focus on cost reduction, a trend amplified in 2024 by global economic pressures. The availability of numerous aftermarket alternatives, including various MRO providers and independent parts suppliers, further strengthens their negotiating position. In 2024, the global MRO market was estimated to be around $90 billion, underscoring the breadth of competitive options available to these buyers.

The sheer volume of business large customers bring to AerSale, exemplified by fleet sizes of over 1,000 aircraft for major carriers like United and American Airlines in 2024, enables them to demand favorable pricing and customized service agreements. This scale directly influences AerSale's profit margins.

Customers experience low switching costs for standard MRO services and common parts, making them highly sensitive to AerSale's pricing relative to competitors. This dynamic is prevalent in the competitive aviation aftermarket, where numerous providers offer similar capabilities, reinforcing customer leverage.

| Customer Segment | Key Bargaining Factors | Impact on AerSale | 2024 Market Context |

| Airlines & Leasing Companies | Cost efficiency focus, availability of alternatives, high volume purchases, low switching costs | Pressure on pricing and margins | Global MRO market ~$90B; Major airlines operate 1000+ aircraft fleets |

Same Document Delivered

AerSale Porter's Five Forces Analysis

This preview shows the exact AerSale Porter's Five Forces Analysis you'll receive immediately after purchase, detailing the competitive landscape, including threats of new entrants, bargaining power of buyers and suppliers, and the intensity of rivalry. You'll gain a comprehensive understanding of the industry's profitability drivers and strategic positioning. No surprises, no placeholders, just the complete, ready-to-use analysis.

Rivalry Among Competitors

The aviation aftermarket is a crowded space, with a multitude of companies competing for business. This includes specialized maintenance, repair, and overhaul (MRO) shops, larger integrated service providers, and even the original equipment manufacturers (OEMs) themselves, all looking to capture a piece of this expanding market. For instance, the global aviation MRO market was valued at approximately $84 billion in 2023 and is projected to reach over $100 billion by 2028, indicating significant growth but also intense competition as more entities enter or expand their offerings.

The aviation aftermarket is thriving, surpassing pre-COVID-19 levels and expected to see continued expansion until 2030. This surge is fueled by the increasing age of existing aircraft fleets and persistent delays in new aircraft deliveries, creating sustained demand for maintenance, repair, and overhaul (MRO) services.

While this robust growth offers ample opportunity for numerous players, it also intensifies competition. The expanding market naturally attracts new entrants and encourages existing companies to adopt more aggressive strategies to capture market share, potentially leading to price pressures and increased marketing efforts.

Competitive rivalry in the Used Serviceable Material (USM) and Maintenance, Repair, and Overhaul (MRO) sectors is intense, with pricing being a primary battleground. Customers, particularly airlines, are highly sensitive to costs and actively seek out the most economical solutions for their aircraft parts and maintenance needs. This focus on cost savings means that AerSale must consistently demonstrate its ability to provide competitive pricing to attract and retain business.

AerSale's success hinges on its capacity to offer attractive pricing while simultaneously ensuring healthy profit margins. This delicate balance is particularly challenging given the inherent volatility in the market for whole aircraft sales. Fluctuations in the value of these assets can directly impact the profitability of USM and MRO operations, making shrewd pricing strategies essential for sustained financial health.

Differentiation Through Engineered Solutions

AerSale differentiates itself by offering unique, internally developed engineered solutions such as AerSafe and AerAware. These proprietary products are crucial for moving beyond simple price competition and capturing more profitable business segments.

The success and market adoption of these specialized offerings directly impact AerSale's ability to mitigate intense rivalry. For instance, the company's focus on these engineered solutions aims to create a competitive moat, reducing reliance on commoditized services.

- AerSale's proprietary AerSafe and AerAware systems are designed to enhance aircraft safety and operational efficiency.

- The adoption of these engineered solutions allows AerSale to command premium pricing, thereby reducing direct price-based competition.

- In 2023, AerSale reported significant growth in its aftermarket segment, partly driven by the demand for its unique solutions.

OEMs Expanding Aftermarket Presence

Major Original Equipment Manufacturers (OEMs) such as Boeing and Airbus are significantly increasing their own aftermarket service offerings. This strategic shift brings larger, financially robust competitors directly into AerSale's established market segments, heightening competitive pressures, especially for lucrative services and parts.

This expansion means AerSale faces competition not just from independent MRO providers but also from the very companies that originally manufactured the aircraft and components. These OEMs possess deep technical knowledge, extensive parts inventories, and strong brand loyalty, making them formidable rivals.

For instance, Boeing's Global Services division, which includes aftermarket support, saw significant revenue growth. In 2023, Boeing reported commercial services revenue of approximately $15.5 billion, highlighting the scale of their aftermarket operations. Similarly, Airbus is actively growing its portfolio of aftermarket solutions, including parts, maintenance, and digital services, aiming to capture a larger share of this profitable sector.

- Increased Competition: OEMs like Boeing and Airbus are directly entering AerSale's aftermarket space.

- Resource Advantage: These OEMs have substantial financial backing and technical expertise.

- Market Impact: This intensifies rivalry for high-value services and critical aircraft parts.

- Boeing's Services Revenue: In 2023, Boeing's commercial services generated around $15.5 billion.

Competitive rivalry in the aviation aftermarket, particularly in Used Serviceable Material (USM) and Maintenance, Repair, and Overhaul (MRO), is intense, with pricing being a key battleground. AerSale must offer competitive pricing to attract cost-sensitive airlines, while also differentiating through proprietary solutions like AerSafe and AerAware to move beyond commoditized services. The increasing aftermarket focus from Original Equipment Manufacturers (OEMs) like Boeing and Airbus, who reported significant commercial services revenues in 2023 (Boeing at ~$15.5 billion), further intensifies this rivalry by bringing in financially robust competitors with deep technical expertise.

| Competitor Type | Key Characteristics | Impact on AerSale |

|---|---|---|

| Independent MROs/USM Suppliers | Price-sensitive, diverse offerings | Direct price competition, need for cost efficiency |

| Original Equipment Manufacturers (OEMs) | Strong brand, deep technical knowledge, extensive parts, growing service offerings | Increased competition for high-value services, potential for market share erosion |

| Proprietary Solutions Providers | Focus on innovation, specialized services | Opportunity for differentiation and premium pricing |

SSubstitutes Threaten

The long-term threat of substitutes for AerSale is the eventual increase in new aircraft deliveries from major manufacturers like Boeing and Airbus. While these deliveries are currently facing delays, a future surge could introduce more fuel-efficient and technologically advanced aircraft into the market.

This influx of new planes could diminish the demand for AerSale's core business, which involves MRO services and the sale of used aircraft parts for older models. For instance, if airlines can more readily acquire new, more efficient aircraft, their reliance on maintaining and sourcing parts for their existing, older fleets may decrease significantly, impacting AerSale's revenue streams.

Some major airlines, particularly those with extensive fleets and significant financial resources, operate their own in-house maintenance, repair, and overhaul (MRO) capabilities. This internal capacity directly competes with AerSale's MRO offerings, acting as a significant substitute. For example, Delta Air Lines has a substantial MRO operation, and United Airlines also maintains significant internal MRO infrastructure.

Beyond direct competitors, a multitude of smaller, specialized third-party Maintenance, Repair, and Overhaul (MRO) providers and parts brokers can offer specific services or components. These entities, while not direct substitutes for AerSale's integrated offering, can fulfill individual customer needs for particular parts or repair tasks, potentially fragmenting demand for AerSale's comprehensive solutions.

For instance, a customer needing only a specific, readily available aircraft part might source it from a specialized parts broker, bypassing the need for AerSale's broader MRO services. This dynamic can impact AerSale's market share for individual service offerings, even if its integrated model remains attractive for larger, more complex needs.

Component Repair vs. Replacement

The choice between repairing an aircraft component and replacing it with a new or used serviceable part presents a significant substitute threat. Customers constantly weigh the costs and benefits of each option.

Advancements in repair technologies are making repair an increasingly attractive alternative to purchasing new or used parts. For instance, specialized MRO (Maintenance, Repair, and Overhaul) providers are developing innovative techniques that can restore components to original specifications at a lower cost than outright replacement.

- Repair vs. New Part Cost: In 2024, the cost of repairing a complex aircraft engine component could be 30-50% less than purchasing a new one, depending on the extent of damage and the availability of specialized repair capabilities.

- Used Serviceable Parts (USPs) as Substitutes: The market for USPs provides another layer of substitution, offering a lower price point than new parts, though often with shorter remaining lifespans or different warranty structures.

- Technological Advancements in Repair: Innovations like advanced welding, composite repair, and additive manufacturing are expanding the range of components that can be economically repaired, directly challenging the demand for new parts.

- Regulatory Approvals for Repairs: As repair certifications become more robust and widely accepted by aviation authorities, the perceived risk associated with repaired components decreases, bolstering their viability as substitutes for new parts.

Technological Advancements in Aircraft Design

Technological advancements in aircraft design pose a significant threat of substitution for AerSale's core business. Newer aircraft models are increasingly incorporating more durable and reliable components, which naturally reduces the need for aftermarket services and spare parts. For instance, the widespread adoption of composite materials in modern aircraft, like those found in the Boeing 787 Dreamliner and Airbus A350 XWB, contributes to extended component lifespans and potentially lower maintenance requirements compared to older, traditional metal airframes.

Furthermore, innovations in areas such as advanced coatings and self-healing materials are designed to further extend the operational life of aircraft parts. This directly challenges the traditional model of repair and overhaul that AerSale relies on. As these technologies mature and become more prevalent, they could substitute the need for frequent part replacements or extensive refurbishments, thereby diminishing the demand for the very services AerSale provides. For example, advancements in engine coatings can significantly increase the time between overhauls, impacting the market for engine parts and repair services.

- Reduced Demand for Traditional MRO: New aircraft designs with longer-lasting components directly reduce the need for routine maintenance, repair, and overhaul (MRO) services.

- Extended Component Lifespans: Innovations like lightweight materials and advanced coatings aim to extend the operational life of parts, substituting traditional repair cycles.

- Impact on Spare Parts Market: As aircraft become more reliable, the demand for spare parts, a key revenue stream for companies like AerSale, could see a decline.

- Shift in Industry Focus: The industry trend towards greater aircraft efficiency and reduced lifecycle costs may accelerate the adoption of technologies that minimize the need for aftermarket support.

The threat of substitutes for AerSale is multifaceted, encompassing both technological advancements and alternative service providers. The increasing efficiency and durability of new aircraft models, such as those utilizing composite materials, directly reduce the demand for aftermarket MRO services and spare parts for older fleets. For instance, the Boeing 787 and Airbus A350 feature components with extended lifespans, potentially impacting AerSale's traditional revenue streams.

Furthermore, the ongoing development of advanced repair technologies, including additive manufacturing and specialized coatings, makes repairing existing components a more viable and cost-effective alternative to purchasing new or used parts. This trend is supported by the fact that in 2024, repairing certain complex engine components could be 30-50% cheaper than buying new ones.

The availability of Used Serviceable Parts (USPs) also presents a significant substitute, offering a lower price point than new parts, although often with different warranty structures and remaining lifespans. This dynamic means customers can often opt for less expensive, yet functional, alternatives to new components or extensive repair work.

Finally, the presence of in-house MRO capabilities within major airlines, such as Delta and United, and a broad network of smaller, specialized third-party MRO providers and parts brokers, fragment the market and offer customers alternative solutions for specific needs, thereby substituting AerSale's integrated offerings.

Entrants Threaten

The aviation aftermarket demands a significant upfront capital commitment. New players must invest heavily in acquiring aircraft for teardown, sourcing spare parts, and establishing or leasing Maintenance, Repair, and Overhaul (MRO) facilities. For example, a single wide-body aircraft can cost tens of millions of dollars, and building a capable MRO facility can run into hundreds of millions.

The aviation sector is intensely regulated, demanding extensive certifications like FAA, EASA, CAAC, and ISO for maintenance, repair, overhaul (MRO), parts manufacturing, and distribution. For instance, in 2024, obtaining initial FAA Part 145 certification alone can cost upwards of $50,000 and require months of preparation and audits. These stringent and costly approval processes create a substantial hurdle for potential new competitors seeking to enter the market.

New entrants face a significant hurdle in acquiring the specialized technical expertise and skilled labor crucial for aircraft maintenance and component solutions. Building or acquiring the necessary infrastructure, such as advanced hangars and repair facilities, also demands substantial capital investment, acting as a deterrent.

The ongoing labor shortages within the aviation sector, a trend particularly evident in 2024, further exacerbate the challenge for newcomers. For instance, the Federal Aviation Administration (FAA) reported a shortage of certified aviation maintenance technicians, impacting the availability of qualified personnel across the industry.

Established Relationships and Reputation

Established players like AerSale have cemented their position through years of cultivating strong relationships with airlines, leasing companies, and original equipment manufacturers (OEMs). This deep-rooted trust, built on a consistent track record of quality and reliability, presents a significant hurdle for any new competitor aiming to enter the market. For instance, in 2024, AerSale's ability to secure significant contracts with major carriers underscored the value of these existing partnerships.

New entrants must overcome the substantial challenge of building comparable credibility and fostering customer loyalty. This often requires substantial investment in demonstrating product quality, service responsiveness, and financial stability, which can be a lengthy and costly process. Without a proven history, newcomers struggle to attract the same level of business as established entities.

- Established Relationships: AerSale's long-standing ties with key industry players provide a competitive moat.

- Reputation for Quality: Decades of reliable service have built a strong brand image, difficult for new firms to replicate.

- Customer Loyalty: Existing clients are less likely to switch to unproven providers, even with competitive pricing.

- Barriers to Entry: The time and resources needed to build similar trust and a service network are considerable for new entrants.

Access to Feedstock and Supply Chains

Securing a consistent and high-quality supply of used aircraft and engines for disassembly, the essential feedstock for AerSale's business, presents a significant barrier for potential new entrants. Establishing reliable supply chains for these critical assets requires extensive industry relationships and logistical expertise that newcomers would find difficult to replicate quickly.

New entrants would face considerable challenges in competing with established companies like AerSale, which have already cultivated robust networks for sourcing these vital components. For instance, in 2024, the aviation MRO (Maintenance, Repair, and Overhaul) market, which includes parts and services derived from feedstock, was valued at approximately $85 billion, demonstrating the scale of operations required to be competitive.

- Feedstock Acquisition Difficulty: Newcomers struggle to access a steady stream of used aircraft and engines, a foundational requirement for AerSale's operations.

- Supply Chain Establishment Costs: Building reliable and efficient supply chains for parts sourcing involves substantial investment and time.

- Competitive Disadvantage: Existing players possess established relationships and networks, giving them a distinct advantage in feedstock procurement and parts distribution.

The threat of new entrants in the aviation aftermarket, particularly for companies like AerSale, is significantly mitigated by high capital requirements and extensive regulatory hurdles. For instance, in 2024, the cost of acquiring a single used wide-body aircraft for teardown can easily exceed $20 million, and obtaining necessary certifications like FAA Part 145 can cost tens of thousands of dollars and take months of compliance work. These substantial financial and regulatory barriers make it difficult and expensive for new players to establish a foothold.

Furthermore, the need for specialized technical expertise and the current labor shortages in the aviation sector, a challenge highlighted in 2024 with a reported deficit of certified aviation maintenance technicians, pose significant obstacles for newcomers. Building a reputation for quality and fostering customer loyalty, which takes years of consistent performance and strong relationships with airlines and OEMs, is another considerable barrier that established players like AerSale have already overcome.

| Barrier Type | Description | Example Impact (2024) |

|---|---|---|

| Capital Requirements | High investment needed for aircraft acquisition, MRO facilities, and inventory. | Acquiring a single wide-body aircraft can cost $20M+. |

| Regulatory Compliance | Strict certifications (FAA, EASA) required for operations. | FAA Part 145 certification can cost $50K+ and take months. |

| Technical Expertise & Labor | Need for skilled technicians and specialized knowledge. | Industry-wide shortage of certified aviation maintenance technicians. |

| Established Relationships & Reputation | Long-term trust with airlines, lessors, and OEMs. | AerSale's existing contracts underscore the value of established partnerships. |

| Supply Chain Access | Difficulty in sourcing reliable feedstock (used aircraft/engines). | The $85 billion aviation MRO market requires robust sourcing networks. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for AerSale is built upon a foundation of robust data, including AerSale's own SEC filings, investor relations materials, and industry-specific trade publications. We also incorporate market intelligence from leading aviation industry analysts and reports from reputable market research firms.